-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Fade Hawkish Fed Messaging

- MNI: Fed Gov Bowman Wants 'Further Rate Hikes'

- MNI: Boston Fed's Collins Says Further Tightening Not Off Table

- MNI SF Fed Daly On Sheer Momentum Of Economy Being Remarkable

- MNI: Canadian Retail Sales Pointing To Weak Third Quarter

- NY Fed Staff See Faster Core PCE Moderation Than FOMC Median

US

FED: Federal Reserve Governor Michelle Bowman on Friday called for "further rate hikes" to bring inflation back to target, citing too-high inflation and risk that rising energy prices could reverse past progress.

- A majority of FOMC members penciled in one more hike for the year in the Summary of Economic Projections released Wednesday, but opinions are split over where the fed funds rate will settle at the end of 2024. Next year's dots range from 4.4% to 6.1% with a median of 5.1%, compared to just below 5.5% now.

- "Given the mixed data releases — strong spending data but a decline in inflation and downward revisions to jobs created in previous months — I supported the FOMC’s decision to maintain the target range for the federal funds rate. But I continue to expect that further rate hikes will likely be needed to return inflation to 2% in a timely way," Bowman said in remarks prepared for the Independent Community Bankers of Colorado. For more see MNI Policy main wire at 1031ET.

FED: Boston Fed President Susan Collins said Friday further tightening is not off the table and emphasized that she expects rates to stay higher for longer.

- "I fully support the FOMC statement and agree with the policy guidance in the median SEP projections. I expect rates may have to stay higher, and for longer, than previous projections had suggested, and further tightening is certainly not off the table," she said in prepared remarks.

- Collins said although inflation is still too high, it is down from its earlier peak, and there is some evidence demand and supply are rebalancing. A labor market realignment is "needed to reduce the upward pressure on prices."

- "Importantly, the current policy phase requires patience, allowing time to better separate the signal from the noise in the data," Collins said. For more see MNI Policy main wire at 1002ET.

FED: Paraphrasing Daly's ('24 voter) first few comments in her fireside chat. In summary, momentum in economy has been remarkable, the labor market is moving closer to balance and not at a point where able to declare victory on inflation.

- On Wednesday's policy decision: Left rates where they are because, from my judgment, because recognize that have been really rapidly raising rates and want more time to receive information. It’s not a predictor for the next meeting but a sign we need to go at a slower pace. We’re looking at what’s been a very good set of data points in past couple months.

- The labor market shows us a gradual adjustment which is unequivocally good news. I do not get to a point where I’m ready to declare victory [on inflation]. There’s a lot of info to collect and we won’t be satisfied we’re where we need to be until we’re confident inflation is on its path back to stability, as gently as we can.

- The confounding strength of the labor market is a sign that there’s a lot of underlying strength in the economy – the sheer momentum has been remarkable. A lot is being driven by demand side but supply side also saw a lot of workers withdraw and we’re now just seeing them coming back. Those two factors, as demand starts to slow with higher rates, has started to close some of the gaps. We’re still not in balance (150k jobs added vs 100k coming in) but getting better.

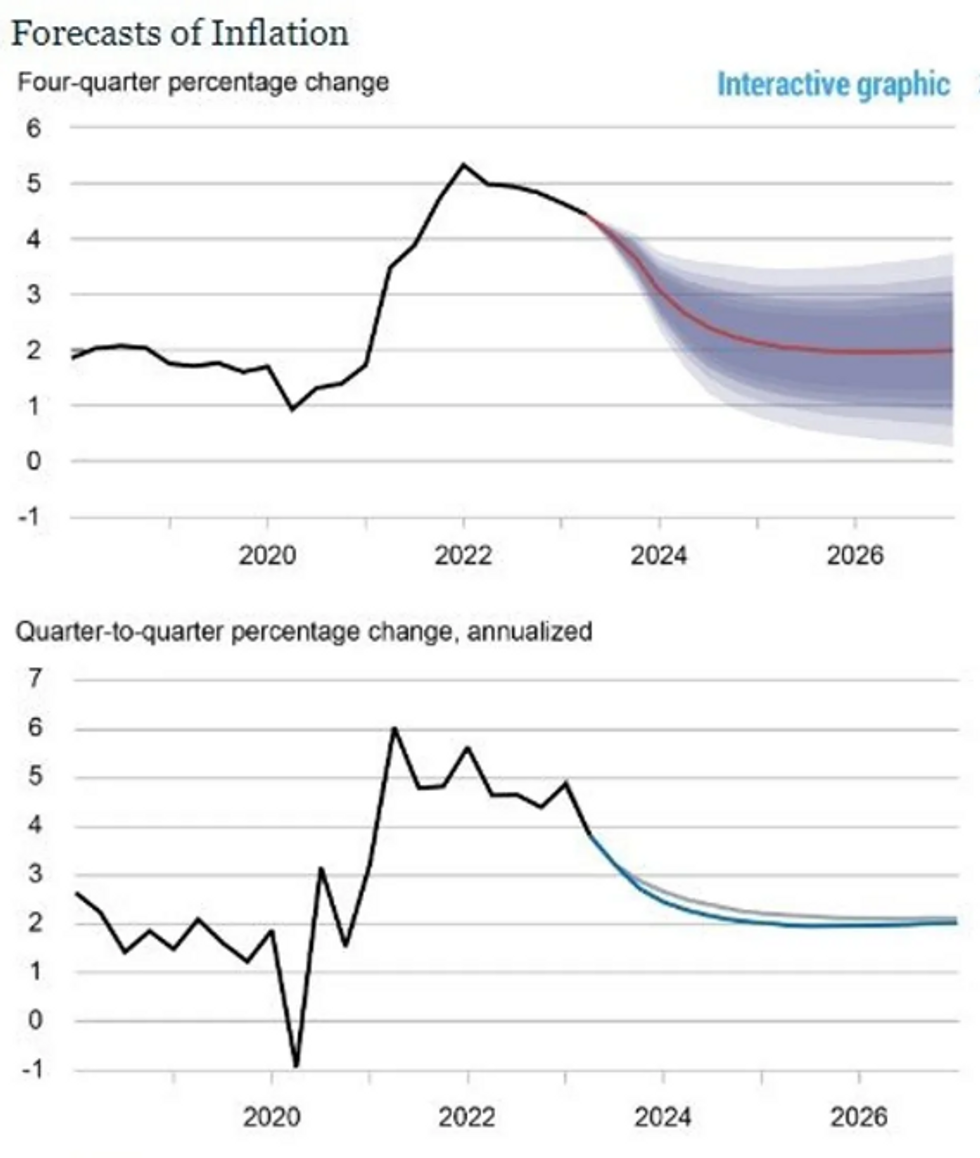

FED: One component of the FOMC’s economic projections that stood out on Wednesday was the core PCE forecast for 4Q23 only being revised down from 3.9% to 3.7% Y/Y, with most analysts looking for a drop to 3.6% or lower.

- It came with a central tendency of 3.6-3.9 after the 3.7-4.2 in the June SEP.

- Interestingly, the NY Fed has updated its DSGE model forecast today (see here) which was left at 3.7% from the same reading in its June release for 4Q23. Whilst these are staff estimates and clearly not the dot that is submitted, it nevertheless helps give an idea of what NY Fed’s Williams might have been going into the meeting with.

- The forecast does however now pencil in a sharper moderation in 2024, with 2.2% (from 2.5% in June) after that 3.7% in 4Q23. This is below the FOMC median of 2.6% in 4Q24 (central tendency 2.5-2.8) and also 2.3% in 4Q25 (CT 2.0-2.4)

- The faster moderation in core PCE comes despite a stronger growth outlook, with NY Fed estimates of GDP growth seen at 1.9% Y/Y (from 1.0) in 4Q23 and 1.1% Y/Y (from 0.7%) in 4Q24.

- It also comes with a higher perceived real natural rate of interest, at 2.5% (from 2.2) in 4Q23 and 2.2% (from 1.8) in 4Q24, declining to 1.6% by end-2026.

CANADA

BOC: Canada's retail sales fell in July after adjusting for price gains and a flash reading showed a decline in overall receipts for August, suggesting consumer spending is weakening again in the third quarter, a trend the central bank is relying on to justify avoiding further interest-rate hikes.

- Headline sales rose 0.3% in July but the volume of sales that strip out price increases declined 0.2% according to Statistics Canada's report Friday from Ottawa. The agency's flash estimate for August was a 0.3% decline, though the response rate of 49% was lower than the recent average of 89%.

- Excluding autos, sales climbed 1% led by food and beverage stores and nominal sales rose in seven of nine major categories. Gasoline sales declined 0.7% in July and volumes fell 1%. For more see MNI Policy main wire at 0847ET.

US TSYS Discounting Higher for Longer Policy Messaging

- Generally quiet end to a hectic week, 10Y Treasury yields off new 16Y high of 4.5064% tapped early overnight to 4.4377% after Friday's close as markets discounted the Fed and BOE "hawkish hold" or higher for longer messaging Friday.

- Federal Reserve Governor Michelle Bowman on Friday called for "further rate hikes" to bring inflation back to target, citing too-high inflation and risk that rising energy prices could reverse past progress.

- Boston Fed President Susan Collins said Friday further tightening is not off the table and emphasized that she expects rates to stay higher for longer. "I fully support the FOMC statement and agree with the policy guidance in the median SEP projections. I expect rates may have to stay higher, and for longer, than previous projections had suggested, and further tightening is certainly not off the table," she said in prepared remarks.

- Meanwhile, San Francisco Fed President Daly said it's "unlikely inflation will reach 2% goal in 2024.

- Treasury futures drew support after Flash PMI data comes out mixed: S&P Global US Manufacturing PMI (48.9 vs 48.2 est), Services PMI (50.2 vs. 50.7 est), Composite PMI (50.1 vs. 50.4 est).

- Cross asset summary: Greenback firmer (DXY +.195 at 105.558), Gold firmer (+4.92 at 1924.94), crude firmer (WTI +.77 at 90.40) and stocks marking modest gains again after retreating late: DJIA up 45.93 points (0.13%) at 34119.34, S&P E-Mini Futures up 12.25 points (0.28%) at 4384.5, Nasdaq up 62.1 points (0.5%) at 13287.28.

OVERNIGHT DATA

- US SEP FLASH S&P MANUF PMI 48.9 (FCST 48.2); AUG 47.9

- US SEP FLASH S&P SERVICES PMI 50.2 (FCST 50.7); AUG 50.5

US DATA: Mixed Details For Preliminary PMIs, With Softer Services More Notable Services missed, at 50.2 (cons 50.7) in Sept for a small dip from 50.5 Manufacturing beat, at 48.9 (cons 48.2) in Sept for a larger than expected climb from 47.9.

- The greater weight of services meant the composite missed, at 50.1 (cons 50.4) after 50.2. Highlights from the S&P Global press release (full here): cost pressures tick higher but limited ability to hike selling prices, whilst there is a quicker rise in employment growth but it may not be sustained.

- Inflation: “Cost pressures ticked higher again, as input prices rose at a marked pace. Nonetheless, the rate of cost inflation was much softer than those seen on average throughout the last three years. Firms continued to pass through higher costs to clients, but weak client interest stymied their ability to hike selling prices as the pace of increase matched that seen in August.”

- Labor market: “Subdued demand did not translate into overall job losses in September as a greater ability to find and retain employees led to a quicker rise in employment growth. That said, the boost to hiring from rising candidate availability may not be sustained amid evidence of burgeoning spare capacity and dwindling backlogs which have previously supported workloads.”

- CANADA JULY RETAIL +0.3% VS FORECAST 0%, PRIOR +0.1%

- CANADA AUGUST FLASH RETAIL SALES -0.3%

- CANADA RETAIL EX-AUTOS +1% VS FORECAST +0.3%, PRIOR -0.7%

- CANADIAN JULY RETAIL SALES VOLUMES -0.2%

- CANADA RETAIL EX-AUTOS & GAS +1.3% VS PRIOR -0.8%

MARKETS SNAPSHOT

- Key late session market levels:

- DJIA down 62.28 points (-0.18%) at 34006.62

- S&P E-Mini Future down 3.75 points (-0.09%) at 4368.75

- Nasdaq up 10 points (0.1%) at 13233.36

- US 10-Yr yield is down 6.1 bps at 4.4337%

- US Dec 10-Yr futures are up 9/32 at 108-22.5

- EURUSD down 0.0014 (-0.13%) at 1.0647

- USDJPY up 0.79 (0.54%) at 148.38

- Gold is up $5.01 (0.26%) at $1925.00

- European bourses closing levels:

- EuroStoxx 50 down 5.43 points (-0.13%) at 4207.16

- FTSE 100 up 5.29 points (0.07%) at 7683.91

- German DAX down 14.57 points (-0.09%) at 15557.29

- French CAC 40 down 29.08 points (-0.4%) at 7184.82

US TREASURY FUTURES CLOSE

- 3M10Y -4.231, -105.062 (L: -106.275 / H: -99.871)

- 2Y10Y -3.285, -68.679 (L: -68.894 / H: -63.316)

- 2Y30Y -2.894, -60.401 (L: -60.717 / H: -54.947)

- 5Y30Y -0.109, -5.088 (L: -5.368 / H: -1.19)

- Current futures levels:

- Dec 2-Yr futures up 1.5/32 at 101-9.75 (L: 101-08.25 / H: 101-12.25)

- Dec 5-Yr futures up 7/32 at 105-14.75 (L: 105-06.75 / H: 105-18.5)

- Dec 10-Yr futures up 9/32 at 108-22.5 (L: 108-09 / H: 108-26.5)

- Dec 30-Yr futures up 22/32 at 116-31 (L: 115-23 / H: 117-03)

- Dec Ultra futures up 22/32 at 122-21 (L: 121-07 / H: 122-25)

US 10Y FUTURE TECHS: (Z3) Bears Remain In The Driver’s Seat

- RES 4: 111-12+ High Sep 1 key resistance

- RES 3: 110-26 50-day EMA

- RES 2: 110-07+ High Sep14

- RES 1: 109-03/109-25+ Low Sep 13 / 20-day EMA

- PRICE: 108-14 @ 11:12 BST Sep 22

- SUP 1: 108-16 Low Sep 21

- SUP 2: 108-00 Round number support

- SUP 3: 107.23 1.236 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 4: 107-05+ 1.382 proj of the Jul 18 - Aug 4 - Aug 10 price swing

Treasuries traded lower Thursday. This week’s move down has resulted in a breach of support at 109-03, the Sep 13 / 19 low. The move below 109-03 cancels a recent reversal signal - a hammer candle on Sep 13, and this reinforces a bearish theme. A continuation lower would open 108-00 and 107-23, the 1.236 projection of the Jul 18 - Aug 4 - Aug 10 price swing. Key short-term resistance has been defined at 110-07+, the Sep 14 high.

SOFR FUTURES CLOSE

- Sep 23 +0.008 at 94.620

- Dec 23 +0.005 at 94.525

- Mar 24 +0.015 at 94.610

- Jun 24 +0.015 at 94.780

- Red Pack (Sep 24-Jun 25) +0.020 to +0.055

- Green Pack (Sep 25-Jun 26) +0.055 to +0.060

- Blue Pack (Sep 26-Jun 27) +0.055 to +0.060

- Gold Pack (Sep 27-Jun 28) +0.040 to +0.055

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00221 to 5.31751 (-0.00953/wk)

- 3M -0.00028 to 5.39981 (-0.00197/wk)

- 6M +0.00668 to 5.47951 (+0.01367/wk)

- 12M +0.01967 to 5.48563 (+0.06419/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $87B

- Daily Overnight Bank Funding Rate: 5.32% volume: $252B

- Secured Overnight Financing Rate (SOFR): 5.30%, $1.522T

- Broad General Collateral Rate (BGCR): 5.30%, $577B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $559B

- (rate, volume levels reflect prior session)

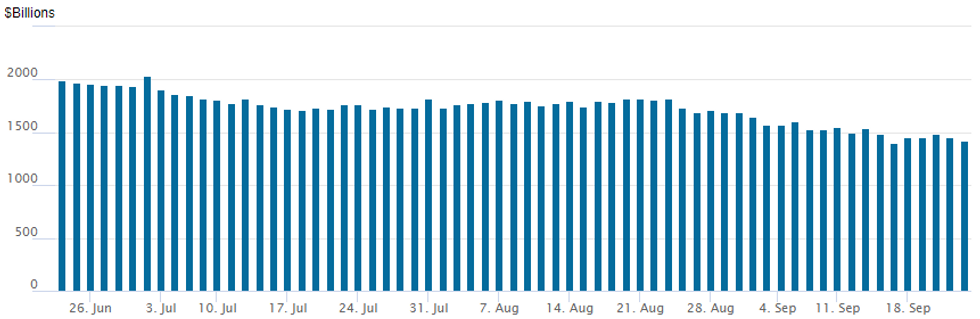

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation recedes to 1,427.575B w/96 counterparties, compared to $1,454.115B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

EGBs-GILTS CASH CLOSE: Gilts Outperform Amid Weak PMIs

Gilts easily outperformed Bunds Friday, with core FI recovering some ground after Thursday's sell-off.

- The European session opened on the front foot following a "dovish hold" by the BoJ overnight. Weak French September flash PMI data accelerated the rally, but a stronger-than-expected German composite reading reversed gains. UK data was poor but was seen largely priced in with the BoE having seen the data before deciding to pause at yesterday's meeting.

- Apart from PMIs and in-line UK retail sales, little else was on the docket. Comments by ECB officials had little impact, including from Lane (underscoring need to keep rates at 4% for a sufficiently long period, alongside data dependence), while de Cos said it was too soon to start talking about rate cuts.

- The UK curve ended bull steeper, with 2Y yields benefiting from a continued pullback in BoE hiking expectations; Germany's curve was a little steeper, with the belly outperforming.

- BTPs underperformed overall, with spreads widening into the weekly close on a Reuters report that the 2023-24 fiscal deficit forecasts would be upwardly revised.

- Ratings reviews after hours include S&P on Germany. Next week's highlight will be the September round of preliminary Eurozone inflation data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.1bps at 3.258%, 5-Yr is down 0.6bps at 2.75%, 10-Yr is up 0.2bps at 2.739%, and 30-Yr is up 2.3bps at 2.893%.

- UK: The 2-Yr yield is down 7bps at 4.803%, 5-Yr is down 6.2bps at 4.364%, 10-Yr is down 5.6bps at 4.249%, and 30-Yr is down 2.6bps at 4.683%.

- Italian BTP spread up 5.1bps at 185.5bps / Greek bond up 4.4bps at 146.4bps

FOREX USD Index Edges Higher, USDJPY Set To Close Above 148.00

- Following this week’s hawkish hold from the Fed, the USD index edged higher on Friday, trading within ten pips of the 2023 highs, printed earlier in March at 105.88. A 0.25% increase for the index this week extends the streak of consecutive weekly advances to ten.

- USDJPY led the advance on Friday as Bank of Japan Governor Ueda stuck to a dovish script in his post-meeting address. USDJPY looks set to close above 148.00, the highest weekly close since late 2022. The focus is on a climb towards 148.60 next, a Fibonacci projection, with scope seen for a climb towards the 150.00 handle.

- GBPUSD (-0.46%) has also underperformed following a softer-than-expected UK services PMI, pointing to increased recession worry and continued loosening in the labour market. Support at 1.2308, the May 25 low, has been breached this week. The move down confirms a resumption of the bear trend and maintains the bearish price sequence of lower lows and lower highs.

- The Euro trades closer to unchanged as mixed flash PMI data across France and Germany kept downside momentum in check for the single currency. The Antipodeans outperform G10 FX peers, probably looking to firmer Chinese equities as a source of support. The likes of NZDJPY and AUDJPY have risen around 1% to close the week.

- Highlights on the global calendar next week include Eurozone inflation releases and US Core PCE. Additionally, there are a number of emerging market rate decisions to look out for.

MONDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/09/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/09/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/09/2023 | 1000/1100 | ** |  | UK | CBI Distributive Trades |

| 25/09/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Lagarde speaks at ECON Hearing | |

| 25/09/2023 | 1300/1500 |  | EU | ECB's Schnabel speaks at JHvT Lecture | |

| 25/09/2023 | 1430/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 25/09/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 25/09/2023 | 2200/1800 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.