-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Tsys Reverse Support Despite Soft Data

- MNI INTERVIEW: US Manufacturing Set For 4Q Rebound - ISM Chief

- MNI UST Issuance Deep Dive: Aug 2023 - Refunding Preview

- MNI BOE WATCH: Data-Dependent Stance Ups Chances Of 25BP Hike

- MNI INTERVIEW: Trudeau Pushes BOC To High-For-Long Rate-Asselin

- MNI Atlanta Fed GDPNow Increases To 3.9% For Q3

- MNI ISM Mfg: Tepid Prices Paid, Employment Falls But New Orders Firm

US

US: U.S. manufacturing activity contracted for the ninth consecutive month in July but there are finally signs emerging that suggest the sector could be on a slow path to eke out some growth near the end of the year, Timothy Fiore of the Institute for Supply Management told MNI.

- "We're probably in the manufacturing contraction trough, and from here we'll probably start to build out," the ISM manufacturing survey chief said in an interview. "I don't see a spike, but I do see a slow recovery here back towards the 50 number" in the PMI. "We could be in a trough period here below 50 for two or three more months."

- Fiore said it is a positive sign manufacturers increased layoffs in July. "Up to July we had a lack of demand and now we are seeing revenue and output adjusting to a new reality. We had been burning off backlog and we are now de-staffing. We are rightsizing factories to future demand," he said. "I don't see any reason to think the PMI will go below 46," he added. "We're getting much more into a normal supply-demand environment." For more see MNI Policy main wire at 1323ET.

US: Treasury’s August 2 quarterly refunding announcement (0830ET/1330 UK) is very likely to bring an increase in coupon auction sizes, more or less across the board, for the coming quarter. We go through our expectations in August's Deep Dive, along with several sell-side analysts' projections.

- MNI’s current expectations include $2B raises to 2s/3s/5s and $1B to 7s in each month, with 10Y sizes $3B higher, 20Y up $1B, and 30Y up $2B. If anything this is conservatively low for 7s, 20s, and 30s. Overall this means nominal sales will total $249B in Oct, vs $222B equivalent in the prior quarter.

- We should also note that while we only forecast the quarter ahead, we expect further increases of a similar magnitude at the Nov refunding. For more see MNI Policy main wire at 1140ET.

UK

BOE: The Bank of England looks certain to hike again in August, with analysts split over the size of the move but with a 25-basis-point rise in Bank Rate apparently more consistent with its data- dependent guidance than a larger 50bp move as inflation and activity come in roughly in line with May forecasts.

- While the Monetary Policy Committee’s previous statement indicated only that “further tightening in monetary policy would be required” in the case of more inflationary pressures and provided no steer as to the potential size of the next move, a second consecutive 50bp hike following June’s surprise increase to 5% would risk driving peak rate expectations back up above 6%. This would also risk pushing mortgage rates higher again, adding to pressures on consumption.

- June’s headline CPI inflation of 7.9% was bang in line with the MPC’s May forecast while labour market data were mixed, with strong wage growth accompanied by signs of weakening employment. For more see MNI Policy main wire at 0722ET.

Canada

BOC: The Bank of Canada is being pushed into higher-for-longer interest rates by loose fiscal policy as Justin Trudeau prepares for the next election, a former adviser to the prime minister told MNI.

- “The government, although they are taking credit for inflation getting down, everything they’ve done on the fiscal side has made it worse,” said Robert Asselin, who assisted Trudeau during his first term and now advises the Business Council of Canada. “Essentially they said to the Bank of Canada, you’re the only player on the ice for this, and you have to basically go hard and control this beast,” Asselin said on MNI's FedSpeak podcast.

- Bank Governor Tiff Macklem raised rates for the 10th time in this cycle on July 12, taking the benchmark to the highest since 2001 at 5%, and says he's prepared to do more if needed. Officials also said that while they want to avoid overtightening, inflation will remain above the 2% target until mid-2025. For more see MNI Policy main wire at 1028ET.

US TSYS: Rates Reject Soft Data

- Treasury futures remain weaker - trading in a narrow range after quickly rejecting soft set of data this morning: Construction Spending MoM (0.5% vs 0.6% est); JOLTS Job Openings (9.528M vs. 9.600M est); ISM Mfg (46.4 vs. 46.9 est), Prices Paid (42.6 vs 44.0 est).

- Employment saw another heavy decline, falling -3.7pts to 44.4 after June’s -3.3pts to 44.4 for its lowest since Jul’20 and pre-pandemic the lowest since 2009 having come very close in 2016. The latest decline mirrors the particularly sharp decline in yesterday’s Chicago PMI.

- Front month Sep'23 10Y futures bounced to 111-07 from 111-00 pre-data, traded down to a session low of 110-26.5 (above technical support of 110-25.5 (Low Jul 28). Curves on the other hand bear steepened with short end rates outperforming: 3M10Y +6.344 at -140.915, 2s10s +5.335 at -86.861.

- There were no substantive headline drivers for the post-data reversal in rates, however. Similar to last Friday's sharp rally and reversal, it appears algos reacted too strongly to the data with prop and fast money selling into the move ahead upcoming data.

- Focus turns to ADP private employ data early Wednesday (+188k est vs. 497k prior), and July employment data on Friday, current estimate of +200k job gains vs. +209k in June.

- Late unscheduled Fed speak after Tuesday's close: Atlanta Fed Pres Bostic said "THERE IS SOME RISK NOW OF OVERTIGHTENING" while "SUPPORTING FURTHER HIKES 'HARDER ON SOME LEVEL'"; DOESN'T SEE CUTS UNTIL H2 '24 AT EARLIEST"

OVERNIGHT DATA

- US S&P FINAL JUL MANUF PMI 49.0 (FLASH 49.0); JUN 46.3

- US BLS: JOLTS OPENINGS RATE 9.582M IN JUN

- US BLS: JOLTS QUITS RATE 2.4% IN JUN

- US JUN CONSTRUCT SPENDING +0.5%

- US JUN PRIVATE CONSTRUCT SPENDING +0.5%

- US JUN PUBLIC CONSTRUCT SPENDING +0.3%

- US ISM JUL MANUF PURCHASING MANAGERS INDEX 46.4

- US ISM JUL MANUF PRICES PAID INDEX 42.6

- US ISM JUL MANUF NEW ORDERS INDEX 47.3

- US ISM JUL MANUF EMPLOYMENT INDEX 44.4

US DATA: The ISM mfg index increased by slightly less than expected in July to 46.4 (cons 46.9) after 46.0.

- Prices paid caught attention as they bounced by less than expected to 42.6 (cons 44.0) after 41.8, rather than climbing back near May’s 44.3 although that too was down heavily on prior levels.

- Employment saw another heavy decline, falling -3.7pts to 44.4 after June’s -3.3pts to 44.4 for its lowest since Jul’20 and pre-pandemic the lowest since 2009 having come very close in 2016. The latest decline mirrors the particularly sharp decline in yesterday’s Chicago PMI. Of course though, services have a much heavier weight in overall employment when it comes to indications for Friday's payrolls.

- The new orders index meanwhile saw another solid increase to 47.3 (+1.7pts) for its highest since Oct’22, even if that remains firmly in contraction territory. An increase in inventories meant no further progress in the NO-inventory measure as a forward-looking indicator of manufacturing activity after its recent improvement back into positive territory.

US DATA: The Atlanta Fed GDPNow sees a further boost for the still very early days of its Q3 tracker, revised up from 3.55% to 3.87%.

- Still clearly a long way to go but if accurate it would mark an acceleration from the 2.4% correctly predicted for Q2 and 2.0% for Q1, and continue to run contrary to notable weakness in Gross Domestic Income in Q4/Q1.

MARKETS SNAPSHOT

Key late session market levels:- DJIA up 60.19 points (0.17%) at 35623.09

- S&P E-Mini Future down 11.5 points (-0.25%) at 4603.25

- Nasdaq down 51.7 points (-0.4%) at 14294.69

- US 10-Yr yield is up 8.8 bps at 4.0471%

- US Sep 10-Yr futures are down 16.5/32 at 110-28.5

- EURUSD down 0.0024 (-0.22%) at 1.0973

- USDJPY up 1.13 (0.79%) at 143.42

- WTI Crude Oil (front-month) down $0.5 (-0.61%) at $81.29

- Gold is down $20.59 (-1.05%) at $1944.58

- EuroStoxx 50 down 63.77 points (-1.43%) at 4407.54

- FTSE 100 down 33.14 points (-0.43%) at 7666.27

- German DAX down 206.43 points (-1.26%) at 16240.4

- French CAC 40 down 91.7 points (-1.22%) at 7406.08

US TREASURY FUTURES CLOSE

- 3M10Y +9.315, -137.944 (L: -154.015 / H: -137.339)

- 2Y10Y +6.118, -86.078 (L: -92.196 / H: -84.62)

- 2Y30Y +6.48, -80.635 (L: -87.417 / H: -78.303)

- 5Y30Y +2.528, -14.431 (L: -18.735 / H: -13.031)

- Current futures levels:

- Sep 2-Yr futures down 2.125/32 at 101-14.375 (L: 101-14 / H: 101-18.125)

- Sep 5-Yr futures down 9/32 at 106-17.25 (L: 106-16.25 / H: 106-29)

- Sep 10-Yr futures down 17/32 at 110-28 (L: 110-26.5 / H: 111-16)

- Sep 30-Yr futures down 47/32 at 122-31 (L: 122-26 / H: 124-20)

- Sep Ultra futures down 62/32 at 130-9 (L: 130-03 / H: 132-17)

US 10Y FUTURE TECHS: (U3) Watching Support

- RES 4: 113-08 High Jul 18 and a bull trigger

- RES 3: 112-27 50-day EMA

- RES 2: 112-17+ High Jul 24

- RES 1: 112-07 High Jul 27

- PRICE: 110-30+ @ 1215 ET Aug 1

- SUP 1: 110-25+ Low Jul 28

- SUP 2: 110-13 Low Jul 7

- SUP 3: 110-05 Low Jul 6 and the bear trigger

- SUP 4: 109-14 Low Nov 8 2022 (cont)

Treasuries are unchanged and the contract is trading closer to its recent lows. The latest bear leg appears to be a correction, however, price has breached all relevant short-term retracement points. A resumption of weakness would expose the key support at 110-05, the Jul 6 low. Clearance of this level would confirm a continuation of the medium-term downtrend. Key resistance has been defined at 113-08, the Jul 18 high.

SOFR FUTURES CLOSE

- Sep 23 steady00 at 94.590

- Dec 23 steady00 at 94.625

- Mar 24 -0.005 at 94.835

- Jun 24 -0.015 at 95.145

- Red Pack (Sep 24-Jun 25) -0.06 to -0.025

- Green Pack (Sep 25-Jun 26) -0.09 to -0.075

- Blue Pack (Sep 26-Jun 27) -0.095 to -0.09

- Gold Pack (Sep 27-Jun 28) -0.095 to -0.09

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00011 to 5.31795 (-.00015/wk)

- 3M +0.00103 to 5.36635 (-0.00556/wk)

- 6M +0.00001 to 5.43314 (-0.01486/wk)

- 12M -0.00924 to 5.37388 (-0.03400/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $103B

- Daily Overnight Bank Funding Rate: 5.32% volume: $237B

- Secured Overnight Financing Rate (SOFR): 5.31%, $1.551T

- Broad General Collateral Rate (BGCR): 5.29%, $583B

- Tri-Party General Collateral Rate (TGCR): 5.28%, $574B

- (rate, volume levels reflect prior session)

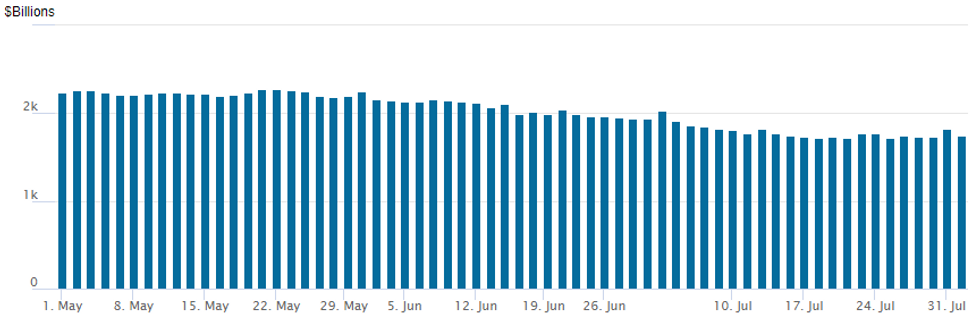

FED Reverse Repo Operation

NY Federal Reserve/MNI

The latest operation recedes to $1,739.554B, w/96 counterparties, compared to $1,821.124B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: August Kicks-Off With Booz; July Total Corporate Issuance Crests $104B

- Date $MM Issuer (Priced *, Launch #)

- 08/01 $Benchmark Booz Allen Hamilton 10Y +220a

- 08/01 $500M TriNet Group 8NC3 investor call

- $19.2B Priced Monday, total $104.075B high-grade issuance for July

- 07/31 $5B *BAT $1B 5.5Y +175, $1B 7Y +225, $1.25B 10Y +245, $750M 20Y +285, $1B 30Y +305

- 07/31 $3.5B *Mercedes Benz $700M 2Y +52, $400M 2Y SOFR+57, $750M 3Y +72, $900M 5Y +95, $750M 10Y +115

- 07/31 $3.5B *Santander $1.5B 5Y +140, $2B 10Y +295

- 07/31 $2B *Lloyds $1.5B 4NC3 +148, $500M 4NC3 SOFR+156

- 07/31 $1.6B *Norfolk Southern $600M 7Y +102, $1B 30Y +137

- 07/31 $1.5B *State St $1.2B 3Y +75, $300M +3Y SOFR+84.5

- 07/31 $800M *Invitation Homes $450M 7Y +158, $350M 10Y +173

- 07/31 $800M *Xcel Energy 10Y +153

- 07/31 $500M *Consumers Energy +5Y +75

EGBs-GILTS CASH CLOSE: Afternoon Retreat

Gilts and Bunds retreated Tuesday, with sideways-to-lower trading in the morning giving way to a more pronounced selloff in the afternoon.

- The weakness in core FI (led in the afternoon by US Treasuries) seemed to defy the data, with Italian and Spanish PMIs in the morning mostly reaffirming the weaker growth and inflation narrative (French / UK upward PMI revision and solid Eurozone jobs data were exceptions), and US JOLTS and ISM prices/employment data looking soft.

- Both the UK and German curves bear steepened, with Gilts underperforming.

- Periphery EGB spreads widened, reflecting a risk-off tone (Eurostoxx futures dropped 1.6% on the day).

- With most focus on risk events later in the week, including the BoE decision Thursday and the US employment report Friday, attention in a relatively quiet Wednesday schedule will be on the US Treasury's quarterly issuance announcement with potential for large supply increases.

- We published our Eurozone July inflation review today, and our BoE preview will be out tomorrow.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 2.6bps at 3.064%, 5-Yr is up 5bps at 2.586%, 10-Yr is up 6.5bps at 2.557%, and 30-Yr is up 7.1bps at 2.641%.

- UK: The 2-Yr yield is up 5.8bps at 5.058%, 5-Yr is up 8.4bps at 4.478%, 10-Yr is up 9bps at 4.399%, and 30-Yr is up 6.7bps at 4.529%.

- Italian BTP spread up 2.2bps at 163.2bps / Greek up 4.1bps at 131bps

FOREX: AUD Extends Intra-Day Decline To 1.6%, USD Index Testing Resistance

- The US dollar advance has settled in late Tuesday trade with the USD index (+0.45%) around 10 pips off session highs as we approach the APAC crossover with the 100- and 50-dma resistance levels in close proximity, intersecting at 102.39 and 102.49 respectively. Alongside higher US yields and a steeper curve, there greenback strength has been broad based, rising against all others in G10 and showing a particular outperformance against the emerging market basket.

- The Australian dollar remains the weakest of the majors, declining 1.6% following the August RBA meeting. Importantly it appears that the RBA’s forecasts were broadly unchanged from May, suggesting that there will need to be an increase in upside inflation risks from here for rates to rise further. Combining this with the negative sentiment across equity markets on Tuesday has resulted in a sharp reversal lower for the AUDUSD. Attention is firmly on the next key support at 0.6596, the Jun 29 low.

- Despite a very brief dip on the US ISM data, USDJPY has maintained a steady trajectory higher on Tuesday and continues to eat into the sharp decline from 145.00 seen in early July. Today’s price action strengthens current bullish conditions and signals scope for a continuation higher. This has opened 144.20, the Jul 7 high, and key resistance at 145.07, the Jun 30 high.

- CNH slipped overnight on the poorer-than-expected Caixin PMI release, which unexpectedly signalled contraction of 49.2 against 50.1 forecast. New home sales data were also a soft spot, with the value of new home sales down over 33% on the year. USDCNH is still hugging daily highs, with spot having earlier broke above horizontal congestion resistance around 7.1774-78. Today's move higher has also topped the 50-dma of 7.1714 and a close above this mark today would be a bullish development.

- Negative sentiment also weighed heavily on some emerging market currencies with ZAR (-2.4%), PLN (-1.2%), BRL (-1.4%) and COP (-1.6%) all feeling the pinch.

- Wednesday will bring New Zealand employment figures as well as US ADP with the market now focusing on Thursday’s BOE decision and Friday’s release of US non-farm payrolls.

WEDNESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/08/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 02/08/2023 | 1215/0815 | *** |  | US | ADP Employment Report |

| 02/08/2023 | 1230/0830 | ** |  | US | Treasury Quarterly Refunding |

| 02/08/2023 | 1400/1000 | ** |  | US | housing vacancies |

| 02/08/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 03/08/2023 | 2300/0900 | * |  | AU | IHS Markit Final Australia Services PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.