-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI ASIA OPEN: Tsys Softer on Fed Williams 2% Target Comments

EXECUTIVE SUMMARY

MNI US FED: Williams-Cuts When Confident Prices Sustained Toward 2%

MNI INTERVIEW: Fed To Ease Modestly In '24 -Ex NY Fed's Benigno

MNI US-CHINA: Yellen: Trump Tariffs Proposals Would Raise Costs For Americans

MNI DATA: Realization Of Still Strong Core CPI Could Help Further Trim Rate Cut Expectations

US DATA PREVIEW

US DATA PREVIEW: Fed Funds futures point to 18bp of cumulative cuts with the March FOMC (from 25bp late last month), 64bp with June (from almost 80bps) and 141bp of cuts by year-end (from 160bps).

- Even without a beat, the realization of still relatively sticky core CPI inflation could help continue a trimming of Fed rate cut expectations compared to those extremes seen late last year, despite that move pausing in the past few sessions.

- That said we wouldn’t rule out a miss seeing a renewed push towards more fully pricing in a March cut even if that seems too early in our view, and with NY Fed’s Williams pushing back on such pricing after the reaction to the Dec FOMC.

- Reaction to Friday’s ISM Services miss demonstrates continued skittishness around data surprises.

- See more in the full MNI US CPI Preview, here: https://roar-assets-auto.rbl.ms/files/59430/USCPIPrevJan2024.pdf

NEWS

US FED (MNI): Williams-Cuts When Confident Prices Sustained Toward 2%

New York Fed President John Williams on Wednesday said he expects the central bank to keep a restrictive stance for some time and to begin rate cuts only when confident inflation is moving toward 2% on a sustained basis, also noting a slowing of QT does not seem to be close.

INTERVIEW (MNI): Fed To Ease Modestly In '24 -Ex NY Fed's Benigno

Federal Reserve officials will reduce interest rates several times this year – likely more than policymakers are letting on but not as many as the six cuts markets have priced in, former New York Fed economist Gianluca Benigno told MNI.

US-CHINA (MNI): Yellen: Trump Tariffs Proposals Would Raise Costs For Americans

Wires carrying remarks from US Treasury Secretary Janet Yellen, following a visit to Roxbury Community College in Boston, Massachusetts, stating that tariff proposals from former President Donald Trump would, "raise costs for American consumers."

SECURITY (MNI): WH NSC Kirby: Houthi Attacks In Red Sea Are Escalatory

White House National Security Council Spokesperson John Kirby has told reporters that the Biden administration is, "going to do everything we can to protect shipping in the Red Sea," and states that although the US, "does not seek conflict," the attacks are "escalatory," and the US, "will consult with partners about next steps if attacks continue."

MIDEAST (MNI): Walla News: Saudi Arabia-Israeli Normalisation On Track W/Conditions

Barak Ravid writes in Walla that US Secretary of State Antony Blinken yesterday delivered a message from Saudi Crown Prince Mohammad bin Salman to Israeli Prime Minister Netanyahu that, "Saudi Arabia will normalize relations with Israel and take part in the reconstruction of Gaza," but, "only if the Israeli government commits to accepting the two-state solution and what that entails."

MIDEAST (MNI): Blinken Warns Iran On Supporting Houthis On Bahrain Visit:

Wires carrying comments from US Secretary of State Anthony Blinken who delivered remarks to reporters following his visits to the Palestinian territories and Bahrain. On the attacks on commercial shipping by Houthi rebels in Yemen states that "Red Sea attacks have been aided an abetted by Iran.", says "There will be consequences for continued attacks in Red Sea by Houthis."

Tsys Recede Post-NY Fed Williams Comments on Achieving 2% Target

- Tsys are mixed to mildly weaker after the bell, curves steeper with the short end outperforming (2s10s +2.123 at -33.179). Limited data today, MBA mortgage applications bounced a seasonally adjusted 9.9% in the week to Jan 5, having fallen -10.7% in the prior, holiday-distorted week. Wholesale inventories in line at -0.2%, Wholesale trade lower than expected at 0.0% vs. 0.4%.

- Rates and equities dipped late after New York Fed President John Williams said he expects the central bank to keep a restrictive stance for some time and to begin rate cuts only when confident inflation is moving toward 2% on a sustained basis, also noting a slowing of QT does not seem to be close.

- Markets awaiting CPI/PPI on Thursday/Friday. Realization of still relatively sticky core CPI inflation could help continue a trimming of Fed rate cut expectations compared to those extremes seen late last year, despite that move pausing in the past few sessions.

- Projected rate cuts for early 2024 gaining slightly: January 2024 cumulative -1.1bp at 5.318%, March 2024 chance of rate cut -64.0% vs. -62.0% late Tuesday w/ cumulative of -17.1bp at 5.158%, May 2024 chance of cut 90.9% vs. 86.8% late Tuesday, cumulative -39.8bp at 4.930%. Fed terminal at 5.3275% in Jan'24.

- Treasury futures show little initial reaction to final 10Y sale re-open, TYH4 see-saws around 111-29.5 (+.5) after the $37B 10Y note auction re-open (91282CJJ1) tailed: 4.024% high yield vs. 4.017% WI; 2.56x bid-to-cover vs. 2.53x prior.

OVERNIGHT DATA: MBA Mortgage Applications Reverse Holiday Drop

- MBA mortgage applications bounced a seasonally adjusted 9.9% in the week to Jan 5, having fallen -10.7% in the prior, holiday-distorted week.

- The move was led by refis bouncing 18.8% after -18%, but purchases also increased 5.6% after -7.6%.

- The 30Y conforming mortgage rate increased another 5bps to 6.81%, off the recent low of 6.71% from Dec 22 but remains 109bps below late October highs.

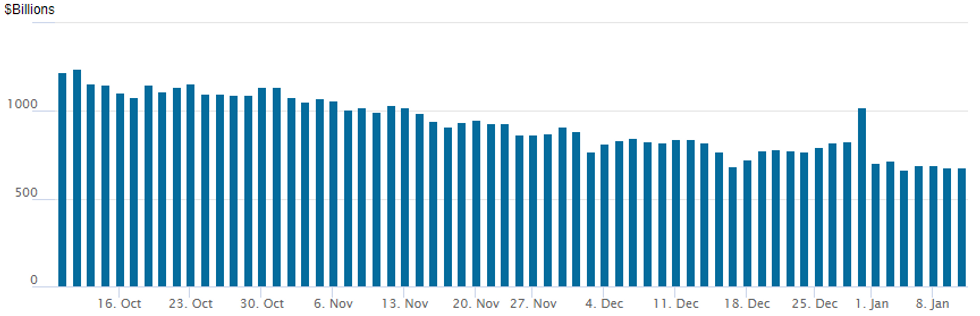

- Mortgage activity has lifted since that peaking in mortgage rates but remains unsurprisingly depressed historically - see chart.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 125.07 points (0.33%) at 37655.84

- S&P E-Mini Future up 19 points (0.4%) at 4812.5

- Nasdaq up 79.9 points (0.5%) at 14939.51

- US 10-Yr yield is up 2.5 bps at 4.0378%

- US Mar 10-Yr futures are down 3/32 at 111-26

- EURUSD up 0.0032 (0.29%) at 1.0963

- USDJPY up 1.32 (0.91%) at 145.8

- WTI Crude Oil (front-month) down $0.93 (-1.29%) at $71.31

- Gold is down $8.12 (-0.4%) at $2022.10

- European bourses closing levels:

- EuroStoxx 50 up 1.81 points (0.04%) at 4468.98

- FTSE 100 down 32.2 points (-0.42%) at 7651.76

- German DAX up 1.45 points (0.01%) at 16689.81

- French CAC 40 down 0.54 points (-0.01%) at 7426.08

US TREASURY FUTURES CLOSE

- 3M10Y +4.098, -135.059 (L: -143.546 / H: -134.94)

- 2Y10Y +2.443, -32.859 (L: -35.983 / H: -32.669)

- 2Y30Y +2.499, -15.571 (L: -18.764 / H: -15.31)

- 5Y30Y +1.269, 22.666 (L: 20.876 / H: 23.217)

- Current futures levels:

- Mar 2-Yr futures up 0.25/32 at 102-22.125 (L: 102-21.375 / H: 102-24.75)

- Mar 5-Yr futures down 0.75/32 at 108-2.75 (L: 108-01.75 / H: 108-09.5)

- Mar 10-Yr futures down 3/32 at 111-26 (L: 111-25.5 / H: 112-07)

- Mar 30-Yr futures down 12/32 at 122-1 (L: 121-30 / H: 122-30)

- Mar Ultra futures down 21/32 at 129-7 (L: 129-04 / H: 130-18)

US 10Y FUTURE TECHS: (H4) Corrective Cycle Still In Play

- RES 4: 114-06+ 2.00 proj of the Oct 19 - Nov 3 - Nov 13 price swing

- RES 3: 114-00 Round number resistance

- RES 2: 113-12 High Dec 27 and the bull trigger

- RES 1: 112-19 High Jan 4

- PRICE: 111-28 @ 1500 ET Jan 10

- SUP 1: 111-06+ Low Jan 05

- SUP 2: 110-28 50-day EMA

- SUP 3: 110-16 Low Dec 13

- SUP 4: 109-31+ Low Dec 11 and a key short-term support

Treasuries remain in a short-term bearish corrective cycle. The print below the 20-day EMA does suggest scope for a continuation lower near-term. The next key pivot support lies at 110-28, the 50-day EMA. Moving average studies continue to suggest the medium-term trend direction is up. A recovery would refocus attention on the bull trigger at 113-12, the Dec 27 high. Clearance of this level resumes the uptrend.

SOFR FUTURES CLOSE

- Mar 24 +0.015 at 94.930

- Jun 24 +0.025 at 95.360

- Sep 24 +0.025 at 95.750

- Dec 24 +0.020 at 96.090

- Red Pack (Mar 25-Dec 25) steadysteady0 to +0.015

- Green Pack (Mar 26-Dec 26) -0.01 to steadysteady0

- Blue Pack (Mar 27-Dec 27) -0.01 to -0.005

- Gold Pack (Mar 28-Dec 28) -0.015 to -0.01

FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00134 to 5.33419 (-0.00505/wk)

- 3M +0.00302 to 5.32646 (-0.00280/wk)

- 6M +0.01157 to 5.18474 (-0.00810/wk)

- 12M +0.02258 to 4.84310 (-0.01140/wk)

- Secured Overnight Financing Rate (SOFR): 5.31% (+0.00), volume: $1.693T

- Broad General Collateral Rate (BGCR): 5.30% (+0.00), volume: $677B

- Tri-Party General Collateral Rate (TGCR): 5.30% (+0.00), volume: $664B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $91B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $251B

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

- RRP usage inches up to $679.961B vs. $676.050B Tuesday, compares to $664.899B on Thursday, January 4 -- the lowest level since mid-June 2021.

- Meanwhile, the number of counterparties bounces to 79 from 72 yesterday, the lowest since January 5, 2022.

PIPELINE: RBC 4Pt Debt Issuance Leads Wed's $19B Corporate Supply

Just over $19B high-grade corporate debt issued Wednesday, $58.59 total on the week

- Date $MM Issuer (Priced *, Launch #)

- 1/10 $4B #Royal Bank of Canada $1.25B 3Y +77, $500M 3Y SOFR+95, $1B 5Y +100, $1.25B 10Y +115

- 1/10 $3B *Province of Ontario 5Y SOFR+55

- 1/10 $3B *Asian Infrastructure Investment Bank (AIIB) 5Y SOFR+53

- 1/10 $3B #Energy Transfer $1.25B +10Y +155, $1.75B 30Y +175

- 1/10 $1.5B *OKB 5Y SOFR+45

- 1/10 $1.25B #Daimler Truck $750M 3Y +93, $500M 10Y +137

- 1/10 $1.04B #Sumitomo Life PerpNC10 5.875%

- 1/10 $1B #Micron 7Y +130

- 1/10 $800M #Berry Global 10Y +165

- 1/10 $500M *Met Tower Global Funding 3Y +75

EGBs-GILTS CASH CLOSE: Peripheries Outperform Amid Supply Deluge

Core EGB yields continued to rise Wednesday amid a deluge of supply, with UK yields also ticking higher.

- This week has seen a new record of E108bln in primary issuance in Europe (Bloomberg), including sovereigns as well as corporates/SSA, with more yet to come over the next two days (including an Ireland syndication Thursday). Today Spain sold E15bln of 10Y paper on orderbooks of E138bln, while Estonia sold E1bln in 10Y.

- Bund yields reversed higher in the afternoon after a constructive start, with 10Y German yields closing at their highest level since Dec 12.

- The high evident demand for Spanish debt, and Bund weakness, helped EGB periphery spreads tighten, with BTP/Bund narrowing to the lowest levels of the year.

- The German curve leaned bear flatter, with the UK's bear steepening slightly.

- There was only 2nd tier European data on the docket (Italian retail sales beat, French industrial production disappointed), and speakers including ECB's Schnabel (who noted that it was still too early to discuss rate cuts) and BoE's Bailey didn't have much of a market impact.

- Thursday's main event is US CPI.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.9bps at 2.649%, 5-Yr is up 3.4bps at 2.17%, 10-Yr is up 2.4bps at 2.212%, and 30-Yr is up 0.2bps at 2.418%.

- UK: The 2-Yr yield is up 2.4bps at 4.235%, 5-Yr is up 2.8bps at 3.755%, 10-Yr is up 3.7bps at 3.819%, and 30-Yr is up 2.4bps at 4.415%.

- Italian BTP spread down 3.1bps at 163.1bps / Spanish down 0.9bps at 96.3bps

FOREX JPY Weakness Persisting As US CPI Data Approaches

- With market participants likely focused on US inflation data on Thursday, the USD index has continued to trade in a narrow range this week, moderately dipping during today’s session. However, JPY volatility remains notable with another 150 -pip range for USDJPY, maintaining an upward bias that ahs been present since the turn of the year.

- The persistent JPY weakness through the Wednesday session, twinned with EUR/USD demand into the WMR fix has resulted in a substantial 1.15% rally for EUR/JPY, a move that's prompted new YTD highs and a crack above the 50-dma of 159.32 in the process. Retracement levels are next up, with 160.07 and 161.69 marking the 61.8% and 76.4% retracement of the Nov 16 - Dec 7 bear leg. Today's rally puts the cross well clear of Y156.00, which marks the surveyed analyst consensus for Q1 for EUR/JPY.

- Near-term vols for EUR/JPY remain supported, but have drifted through the turn of the year. 3m implied trades either side of 9.5 points, keeping implied just below the rolling 12m average. The slight fade in vols has worked in favour of EUR/JPY call vol, as 3m risk reversals inch to the best level since the mid-Dec pullback, at 1.4 points in favour of puts.

- Elsewhere, GBP also marginally outperforms, and continues to be the strongest G10 currency against the greenback in 2024. With the trend outlook remaining bullish, attention is on resistance at 1.2827, the Dec 28 high and bull trigger. Clearance of this level would confirm a resumption of the uptrend and open 1.2881, a Fibonacci retracement point. Initial firm support lies at 1.2611, Jan 2 low.

- All focus on tomorrow’s US CPI report where consensus puts core CPI inflation at 0.3% M/M in December, with risk seen to the downside.

THURSDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 11/01/2024 | 0030/1130 | ** |  | AU | Trade Balance |

| 11/01/2024 | 0800/0900 | ** |  | ES | Industrial Production |

| 11/01/2024 | 0900/1000 | * |  | IT | Industrial Production |

| 11/01/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 11/01/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 11/01/2024 | 1330/0830 | *** |  | US | CPI |

| 11/01/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 11/01/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 11/01/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 11/01/2024 | 1740/1240 |  | US | Richmond Fed's Tom Barkin | |

| 11/01/2024 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 11/01/2024 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.