-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak Dalla Fed Mfg Data Buoys Rates

- MNI BRIEF: May Be More Hikes But Limited Size, Number-Villeroy

- MNI: Italy Pushes Back Date For Revamped Recovery Plan-Sources

- MNI US DATA: Dallas Fed Mfg Index Continues Mixed Month For April Surveys

Chart below - 2 surveys stronger, 2 surveys weaker on the month:

US

US DATA: Dallas Fed MFG Index It was close to its recent low of -23.7 from Jul’22, otherwise except for Mar-May’20 is the lowest since Jan 2016. It continues a run of mixed manufacturing readings for April, with Empire surging and Philly Fed falling more than expected for the regional Fed surveys whilst the flash PMI pushed back above 50 for the first time since October.

- From the details: “Labor market measures suggest moderate employment growth but a slight decline in work hours”… “The wages and benefits index moved up seven points to 37.6, a stubbornly elevated reading relative to its average of 21.0.”

- Price pressures: Raw materials prices index largely unchanged at 19.5 indicative of below-average increases in input costs and finished goods prices index little changed at 8.4.

EUROPE

EU: There may be more rate hikes to come from the ECB but said these would be limited in both size and in number, Bank of France Governor and ECB Governing Council Member Francois Villeroy said Monday.

- In an interview with Le Figaro newspaper, Villeroy said that the main impact on inflation to come would be from past hikes, adding most of the “journey” has now been done:

- “The main impact to come for the economy is linked to what is already in the pipe: we have done most of the journey. There may be need for some additional increases, but they must, in my view, be limited in their number and their size.”

ITALY: The Italian government is finding it harder than expected to revamp the National Recovery Plan required as a condition for EUR190 billion in NextGenerationEU aid, and will only send a proposal for approval by Brussels by some time close to the Aug. 31 deadline as opposed to in the spring as originally hoped, two governing coalition sources told MNI.

- Rome expressed its intention to modify its Plan in late 2022 in order to take account of the effect of higher energy and raw material prices on projects paid for by NextGenEU money. Recovery Plans throughout the EU are also being updated to take account of the RepowerEU plan for energy independence from Russia.

- While Brussels indicated it would not grant an Italian request to extend the 2026 time limit during which the money must be spent, it has given the green light for a reduction in the number of projects. (See MNI: Spain, Italy Discuss Joint Push For NGEU Extension-Source). Fore more see MNI Policy main wire at 0936ET.

US TSYS: Holding Near Early Friday Highs

- Front month Treasury futures extended early gains after April Dallas Fed manufacturing index comes out much weaker than expected -23.4 vs. -12.0 est. June 10Y futures marking a session high of 114-31 (+16), a tick away from Friday's early session high of 114-15.

- Despite the rebound today, 10Y futures remain vulnerable and recent activity appears to be a bear flag - a bearish continuation pattern that reinforces the current downtrend. The contract has recently traded through the 20- and 50-day EMAs and pierced 114-00. The move lower opens 113-23, a Fibonacci retracement.

- On the upside, initial firm resistance is at 115-00, Friday’s high. A break and close above this level would ease the current bearish threat.

- Otherwise, Monday was a quiet start to the week with the Federal Reserve in policy blackout through May 4.

- Focus on Tuesday's Data Calendar with House Price Index, New Home Sales, Consumer Confidence and US Tsy $42B 2Y Note auction (91282CGX3) in the afternoon.

OVERNIGHT DATA

- US APRIL DALLAS FED MANUFACTURING INDEX -23.4; EST. -12.0:

- Chicago Fed National Activity Index -0.19 vs. -0.20 est

- U.S. March Retail Sales Revised To -0.6% Vs Prev -1.0%; U.S. March Retail Sales Ex-Autos Revised To -0.4% Vs Prev -0.8%, Benzinga

MARKETS SNAPSHOT

Key late session market levels:

- DJIA up 49.86 points (0.15%) at 33858.4

- S&P E-Mini Future down 0.25 points (-0.01%) at 4156.25

- Nasdaq down 42.8 points (-0.4%) at 12029.66

- US 10-Yr yield is down 5.9 bps at 3.5128%

- US Jun 10-Yr futures are up 13/32 at 114-28

- EURUSD up 0.0059 (0.54%) at 1.1045

- USDJPY up 0.13 (0.1%) at 134.29

- WTI Crude Oil (front-month) up $0.86 (1.1%) at $78.74

- Gold is up $5.85 (0.3%) at $1988.87

- EuroStoxx 50 down 6.79 points (-0.15%) at 4401.8

- FTSE 100 down 1.93 points (-0.02%) at 7912.2

- German DAX down 17.71 points (-0.11%) at 15863.95

- French CAC 40 down 3.14 points (-0.04%) at 7573.86

US TREASURY FUTURES CLOSE

- 3M10Y +0.334, -154.001 (L: -167.731 / H: -152.773)

- 2Y10Y -1.885, -63.29 (L: -63.972 / H: -61.058)

- 2Y30Y -1.053, -41.976 (L: -42.797 / H: -40.147)

- 5Y30Y +1.041, 12.059 (L: 10.916 / H: 12.761)

- Current futures levels:

- Jun 2-Yr futures up 2.625/32 at 103-1.375 (L: 102-30.75 / H: 103-02.625)

- Jun 5-Yr futures up 8.25/32 at 109-15.5 (L: 109-06.5 / H: 109-17.75)

- Jun 10-Yr futures up 13/32 at 114-28 (L: 114-14.5 / H: 114-31)

- Jun 30-Yr futures up 27/32 at 130-24 (L: 129-26 / H: 130-30)

- Jun Ultra futures up 1-04/32 at 140-5 (L: 138-29 / H: 140-13)

US 10YR FUTURE TECHS: (M3) Bear Flag

- RES 4: 117-01+ High Mar 24 and bull trigger

- RES 3: 116-30 High Apr 5 / 6

- RES 2: 116-08 High Apr 12

- RES 1: 115-00/23 High Apr 21 / 14

- PRICE: 114-26+ @ 1230ET Apr 21

- SUP 1: 113-30+ Low Apr 19

- SUP 2: 113-23 50.0% retracement of the Mar 3 - 24 bull run

- SUP 3: 113-08+ Low Mar 15

- SUP 4: 112-30 61.8% retracement of the Mar 3 - 24 bull run

Treasury futures remain vulnerable and recent activity appears to be a bear flag - a bearish continuation pattern that reinforces the current downtrend. The contract has recently traded through the 20- and 50-day EMAs and pierced 114-00. The move lower opens 113-23, a Fibonacci retracement. On the upside, initial firm resistance is at 115-00, Friday’s high. A break and close above this level would ease the current bearish threat.

SOFR FUTURES CLOSE

- Jun 23 -0.005 at 94.90

- Sep 23 +0.020 at 95.140

- Dec 23 +0.040 at 95.520

- Mar 24 +0.050 at 95.995

- Red Pack (Jun 24-Mar 25) +0.065 to +0.065

- Green Pack (Jun 25-Mar 26) +0.060 to +0.065

- Blue Pack (Jun 26-Mar 27) +0.065 to +0.075

- Gold Pack (Jun 27-Mar 28) +0.060 to +0.070

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M +0.00692 to 4.97744 (+.07746 total last wk)

- 3M +0.00028 to 5.06803 (+.08487 total last wk)

- 6M +0.00003 to 5.08837 (+.14532 total last wk)

- 12M -0.00519 to 4.87728 (+.19820 total last wk)

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00100 to 4.80771%

- 1M -0.00429 to 5.01614%

- 3M +0.01300 to 5.26814% */**

- 6M -0.00057 to 5.43400%

- 12M +0.01871 to 5.42771%

- * Record Low 0.11413% on 9/12/21; ** New 16Y high: 5.26500% on 4/17/23

- Daily Effective Fed Funds Rate: 4.83% volume: $114B

- Daily Overnight Bank Funding Rate: 4.81% volume: $283B

- Secured Overnight Financing Rate (SOFR): 4.80%, $1.324T

- Broad General Collateral Rate (BGCR): 4.76%, $530B

- Tri-Party General Collateral Rate (TGCR): 4.76%, $523B

- (rate, volume levels reflect prior session)

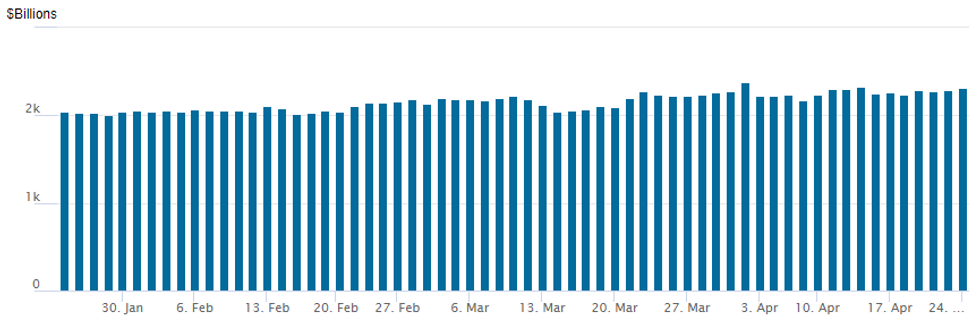

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,308.538B w/ 103 counterparties, compares to prior $2,290.023B. Compares to high usage for 2023: $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

PIPELINE: $2.5B RBC 2Pt Launched

$6.6B to price Monday:

- Date $MM Issuer (Priced *, Launch #)

- 04/24 $2.5B #RBC $1.6B 2Y +85, $900M 10Y +152

- 04/24 $2.25B #CIBC $1.25B 2Y +103, $1B 5Y +142

- 04/24 $1.35B #Crown Castle +5Y +125, 10Y +160

- 04/24 $500M #Nvent Finance 10Y +218

- 04/24 $Benchmark Sasol Financing 6Y investor calls

EGBs-GILTS CASH CLOSE: Bear Flattening With Euro CPI Awaited

Short-end UK and German yields rose modestly Monday with limited movement further down the curves.

- The bear flattening came as ECB and BoE hike expectations ticked higher (ECB terminal +5bp, BoE +3bp), carrying over from last week's hawkish moves.

- But there were few macro or headline drivers to start the week (German IFO was a little better than expected), keeping Bunds and Gilts trading in tight ranges.

- ECB's Schnabel said (in an April 20 interview published today) that a 50bp May hike was "not off the table", but this would be data-dependent. This had little impact on implied rates, which had already been edging higher all session.

- German yields closed the session at the highs, with the Schnabel comments helping catalyse a bit of weakness focused on the short end.

- Villeroy's comments (may be a need for more rate hikes; hikes should be limited in size and number), came on the cash close and judging from futures don't appear to have made much of an impact.

- The undoubted focus of the week is on Friday's Euro CPI readings, which will make or break the case for 25bp vs 50bp at next week's ECB meeting.

- In the meantime, Tuesday sees an MNI event with ECB's Enria.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany:

- Germany: The 2-Yr yield is up 5.6bps at 2.977%, 5-Yr is up 3.9bps at 2.56%, 10-Yr is up 2.7bps at 2.508%, and 30-Yr is up 0.9bps at 2.559%.

- UK: The 2-Yr yield is up 5.8bps at 3.804%, 5-Yr is up 3.3bps at 3.654%, 10-Yr is up 2.3bps at 3.781%, and 30-Yr is up 2.3bps at 4.12%.

- Italian BTP spread up 0.1bps at 187.2bps / Spanish down 0.5bps at 103.4bps

FOREX: Greenback Grinding Lower In Late Session, EURUSD Eyes 1.1076 High

- As we approach the APAC crossover, the USD index is fading to its worst levels of the session, now comfortably below last week’s lows. Corresponding G10 gains are being led by the Euro, which after recapturing the 1.10 handle has not looked back.

- Despite the uninspiring price action, both EURUSD and GBPUSD are pressing session highs amid the moderate bounce off the lows for equities. EURUSD now tracks 0.53% higher, keeping trend signals bullish for now. Recent weakness appears to be a correction, with price well supported above 1.0913, the 20-day EMA as well as the Apr 17 high.

- Moving average studies are in a bull mode position, highlighting an uptrend. The bull trigger is unchanged at 1.1076, Apr 14 high, a break would open 1.1127, a Fibonacci projection and 1.1185, Mar 31 2022 high.

- Furthermore, today EURJPY has broken the 2022 highs at 148.40 and the pair’s high of 148.47 represents the highest print since late 2014. With the Bank of Japan widely expected to not tweak its easy policy settings at the April 27-28 meeting, the path of least resistance for XXX/JPY looks set to remain higher.

- For EURJPY, the next topside level resides at 149.39, the 1.00 projection of the Mar 20 - 21 - Apr 6 price swing.

Tuesday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/04/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 25/04/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/04/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/04/2023 | 0800/1000 |  | EU | ECB Supervisory Board Chair Andrea Enria and MNI event | |

| 25/04/2023 | 0900/1000 |  | UK | BOE Broadbent Speech at NIESR | |

| 25/04/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/04/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/04/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/04/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/04/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/04/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 25/04/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/04/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/04/2023 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 25/04/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.