-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak Retail Sales, Even Weaker PPI

EXECUTIVE SUMMARY

US

FED: The Federal Reserve should slow the pace of interest-rate hikes to 25 basis points starting at the Feb. 1 decision, Philadelphia Fed President Patrick Harker said Wednesday, echoing remarks he made last week and similar calls from many fellow FOMC members.

- “Hikes of 25 basis points will be appropriate going forward,” he said in prepared remarks. “I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed.” (See MNI: Fed Rates Likely Headed Above 5% Despite Cooling CPI)

- High inflation is a “scourge,” he said, adding the Fed is committed to bringing it back down to its 2% target. He sees a recession as unlikely given the strength of the labor market and a jobless rate around historic lows of 3.5%.

FED: Kansas City Fed President Esther George Wednesday said the central bank is fully committed to its 2% inflation mandate, emphasizing the lessons from the 70s and pushing back on questions the Fed would prematurely cut rates later this year.

- "One important difference for someone that participates in the dot plot forecasting is to be clear about what we see as the mandate and that is we must restore price stability," she said in Q&A when asked how she explains market pricing suggesting rate cuts later this year. "There is a commitment to being fully committed," she said about the Fed.

- Consumer spending increased slightly, with some retailers reporting more robust sales over the holidays. Other retailers noted that high inflation continued to reduce consumers' purchasing power, particularly among low- and moderate-income households. Auto sales were flat on average, but some dealers noted that increased vehicle availability had boosted sales.

- Housing markets continued to weaken, with sales and construction declining across Districts.

ASIA

JAPAN: The approval rating of Japanese Prime Minister Fumio Kishida remains at near records lows amid concerns over his administration's pledge to dramatically overhaul the Japanese military and play a more prominent global role in defense.

US TSYS: Yields Fall to Mid-Dec Levels

Tsy yields fell back to mid-December levels Wednesday (30YY 3.5185% low), futures back near first half highs after the bell.

- Initial support overnight, Tsys gap bid on BoJ policy annc: monetary policy settings steady, yield curve control unchanged.

- Tsys surged higher following weak Retail Sales (-1.0%, ex-motor -0.6%) and weaker PPI (-0.5%, ex food/energy +0.13%) - lowest since Nov'20.

- Short end well bid as markets price in policy pivot. Fed funds implied hike for Feb'23 -.7 to 27.2bp, Mar'23 cumulative 45.6bp (-1.8) to 4.788%, May'23 54.5bp (-2.8) to 4.876%, terminal at slips to 4.875% in Jun'23 from 4.905% earlier.

- From Philly Fed Harker: “Hikes of 25 basis points will be appropriate going forward,” he said in prepared remarks. “I expect that we will raise rates a few more times this year, though, to my mind, the days of us raising them 75 basis points at a time have surely passed.”

- Tsy futures bid accelerates after strong $12B 20Y bond auction re-open (912810TM0) trades through: 3.678% high yield vs. 3.702% WI; 2.83x bid-to-cover vs. prior month's 2.68x.

OVERNIGHT DATA

- US DEC FINAL DEMAND PPI -0.5%, EX FOOD, ENERGY +0.1%

- US DEC FINAL DEMAND PPI EX FOOD, ENERGY, TRADE SERVICES +0.1%

- US DEC FINAL DEMAND PPI Y/Y +6.2%, EX FOOD, ENERGY Y/Y +5.5%

- US DEC PPI: FOOD -1.2%; ENERGY -7.9%

- US DEC PPI: GOODS -1.6%; SERVICES +0.1%; TRADE SERVICES +0.3%

- US DEC RETAIL SALES -1.1%; EX-MOTOR VEH -1.1%

- US NOV RETAIL SALES REVISED -1.0%; EX-MV -0.6%

- US DEC RET SALES EX GAS & MTR VEH & PARTS DEALERS -0.7% V NOV -0.5%

- US DEC RET SALES EX MTR VEH & PARTS DEALERS -1.1% V US DEC -0.6%

- US DEC RET SALES EX AUTO, BLDG MATL & GAS -0.8% V NOV -0.2%

- US DEC INDUSTRIAL PROD -0.7%; CAP UTIL 78.8%

- US NOV IP REV TO -0.6%; CAP UTIL REV 79.4%

- US DEC MFG OUTPUT -1.3%

- US NAHB HOUSING MARKET INDEX 35 IN JAN

- US NAHB JAN SINGLE FAMILY SALES INDEX 40; NEXT 6-MO 37

- US NOV BUSINESS INVENTORIES +0.4%; SALES -0.8%

- US NOV RETAIL INVENTORIES +0.1%

- CANADA DEC INDUSTRIAL PRICES -1.1% MOM; EX-ENERGY +0.2%

- CANADA DEC RAW MATERIALS PRICES -3.1% MOM; EX-ENERGY +1.5%

MARKETS SNAPSHOT

Key late session market levels:

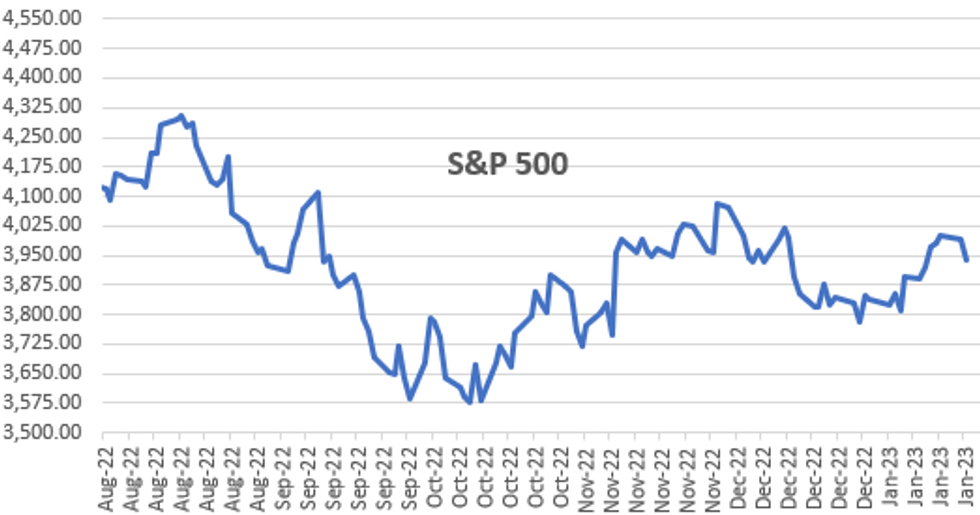

- DJIA down 498.52 points (-1.47%) at 33414.63

- S&P E-Mini Future down 51.5 points (-1.28%) at 3958.5

- Nasdaq down 104 points (-0.9%) at 10992.34

- US 10-Yr yield is down 17.4 bps at 3.3734%

- US Mar 10-Yr futures are up 39/32 at 115-28.5

- EURUSD up 0.0005 (0.05%) at 1.0793

- USDJPY up 0.67 (0.52%) at 128.79

- WTI Crude Oil (front-month) down $1.04 (-1.3%) at $79.14

- Gold is down $4.86 (-0.25%) at $1903.82

- EuroStoxx 50 up 0.01 points (0%) at 4174.34

- FTSE 100 down 20.33 points (-0.26%) at 7830.7

- German DAX down 5.27 points (-0.03%) at 15181.8

- French CAC 40 up 6.23 points (0.09%) at 7083.39

US TSY FUTURES CLOSE

- 3M10Y -22.432, -129.083 (L: -130.977 / H: -111.684)

- 2Y10Y -4.349, -70.692 (L: -72.267 / H: -64.813)

- 2Y30Y +0.336, -54.495 (L: -59.177 / H: -50.58)

- 5Y30Y +6.065, 9.861 (L: 2.413 / H: 13.505)

- Current futures levels:

- Mar 2-Yr futures up 6.875/32 at 103-5.875 (L: 102-29.625 / H: 103-06.375)

- Mar 5-Yr futures up 24.5/32 at 110-8.25 (L: 109-12.5 / H: 110-09.5)

- Mar 10-Yr futures up 1-07.5/32 at 115-29 (L: 114-16 / H: 115-29.5)

- Mar 30-Yr futures up 2-12/32 at 132-03 (L: 129-14 / H: 132-09)

- Mar Ultra futures up 3-04/32 at 144-26 (L: 141-03 / H: 145-01)

US 10YR FUTURE TECHS: (H3) Outlook Firms as Key Resistance Gives Way

- RES 4: 116-21+ 2.0% 10-dma env

- RES 3: 116-02 200-dma

- RES 2: 116-00 Round number resistance

- RES 1: 115-28 High Jan 18

- PRICE: 115-23 @ 16:26 GMT Jan 18

- SUP 1: 113-29/18+ 20- and 50-day EMA values

- SUP 2: 112-18+/111-28 Low Jan 5 / Low Dec 30 and the bear trigger

- SUP 3: 111-27+ 61.8% retracement of the Nov 3 - Dec 13 rally

- SUP 4: 111-01 76.4% retracement of the Nov 3 - Dec 13 rally

Treasury futures maintain a bullish tone and the recent pullback is considered corrective. Price has now solidly breached resistance at 115-11+, the Dec 13 high, to put prices at their best level since September. The clear breach of this hurdle as well as 115-26 Fibonacci projection, strengthens bullish conditions and opens the 200-dma of 116-02. On the downside, initial support lies at 113-29, the 20-day EMA.

US EURODOLLAR FUTURES CLOSE

- Mar 23 +0.020 at 94.990

- Jun 23 +0.045 at 94.950

- Sep 23 +0.060 at 95.095

- Dec 23 +0.090 at 95.490

- Red Pack (Mar 24-Dec 24) +0.140 to +0.175

- Green Pack (Mar 25-Dec 25) +0.175 to +0.175

- Blue Pack (Mar 26-Dec 26) +0.165 to +0.170

- Gold Pack (Mar 27-Dec 27) +0.155 to +0.165

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N -0.00614 to 4.31043% (-0.000328/wk)

- 1M +0.01571 to 4.48571% (+0.03128/wk)

- 3M +0.01014 to 4.80771% (+0.01528/wk)*/**

- 6M -0.01271 to 5.10800% (+0.00686/wk)

- 12M -0.03086 to 5.36414% (+0.00714/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $94B

- Daily Overnight Bank Funding Rate: 4.32% volume: $276B

- Secured Overnight Financing Rate (SOFR): 4.31%, $1.248T

- Broad General Collateral Rate (BGCR): 4.28%, $449B

- Tri-Party General Collateral Rate (TGCR): 4.28%, $429B

- (rate, volume levels reflect prior session)

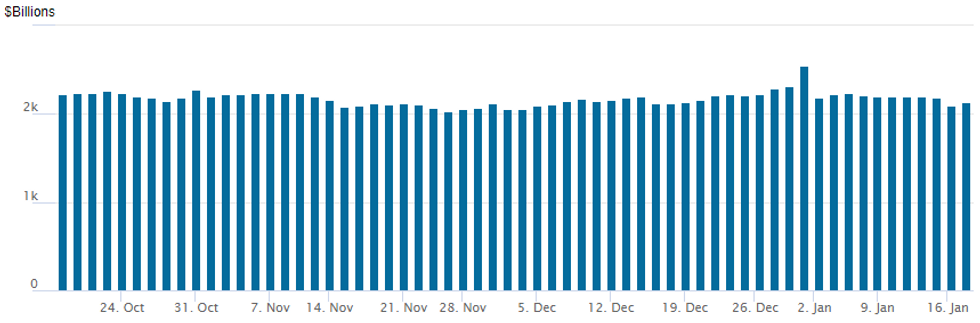

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage rebounds to $2,131.678B w/ 103 counterparties vs. prior session's $2.093.328B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE: $4B CADES 3Y SOFR, $2.5B JBIC 3Y SOFR Priced

Total $8.1B issuance on the day, mostly 3Y SOFR

- Date $MM Issuer (Priced *, Launch #)

- 01/18 $4B *CADES 3Y SOFR+39

- 01/18 $2.5B *JBIC 3Y SOFR+62

- 01/18 $1B *OPEC Fund 3Y SOFR+90

- 01/18 $600M *First Abu Dhabi Bank (FAB) 5.25Y +105

- 01/18 $Benchmark Serbia +5Y, 10Y investor calls

- Expected Thursday

- 01/19 $Benchmark CAF +3Y SOFR+130a

- 01/19 $1B Council of Europe Dev Bank (CoE) WNG 5Y SOFR+41a

EGBs-GILTS CASH CLOSE: Weak US Data And BoJ Decision Boost Long End

The UK and German curves twist flattened Wednesday after the Bank of Japan decision maintained downside pressure on long-end yields with their decision to maintain their 10Y JGB yield-capping regime.

- The short end of European curves weakened early as UK CPI came in above expectations, and ECB speakers Villeroy and Rehn pushed back against Tuesday's Bloomberg story that pointed to a downshift in rate hikes after Feb.

- But global yields headed lower in the European afternoon as a slew of weak US data spurred recession speculation and pushed Fed terminal rate pricing down.

- Periphery spreads tightened against this backdrop, with 10Y BTP/Bund spreads touching a fresh post-April 2022 low of 170bp.

- Attention turns to an appearance by ECB's Lagarde and the Norges Bank decision early Thursday.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 0.6bps at 2.463%, 5-Yr is down 4.7bps at 2.061%, 10-Yr is down 6.8bps at 2.023%, and 30-Yr is down 10.2bps at 1.989%.

- UK: The 2-Yr yield is up 3.3bps at 3.495%, 5-Yr is down 1.3bps at 3.263%, 10-Yr is down 1bps at 3.314%, and 30-Yr is up 0.6bps at 3.673%.

- Italian BTP spread down 6.3bps at 173.8bps / Spanish down 3.7bps at 94bps

FOREX: AUD & CAD Bearing The Brunt of Late Equity Weakness, JPY Spin Cycle

- Wednesday has been highlighted by the impressive 400 pip intra-day range for USDJPY. Following the Bank of Japan standing pat, hawkish pre-positioning was aggressively unwound to reach highs of 131.58 before the start of European trade. However, with topside momentum unable to be sustained, the pair saw a swift and powerful reversal throughout the session, culminating in the pair printing fresh daily lows of 127.57.

- The US session was a real tale of two halves. With the early JPY action heavily weighing on the broad USD index, the ensuing substantial weakness across major equity indices underpinned the greenback recovery.

- AUD was one of the notable laggards, sinking around 1.7% from intra-day highs, with both AUD and CAD leading G10 losses approaching the APAC crossover. AUDUSD overall maintains a bullish technical theme and supports to watch reside at 0.6930/6860 (lows Jan 17 / 9) and 0.6854, the 20-day EMA.

- In the same vein, the weaker risk sentiment prompted declines across emerging market FX, with specific weakness in the LatAm region. In particular USDMXN failed just shy of the 2020 lows around 18.52 and has since bounced over 1% to 18.85. Initial firm resistance is at 19.0401, the recent breakout point.

- Aussie employment data kicks off Thursday’s docket, before US Philly Fed, Jobless Claims and Housing Starts highlight the US calendar.

- On the speaker slate, ECB President Lagarde is due to participate in a panel discussion titled "Finding Europe's New Growth" at the World Economic Forum, in Davos before potential comments from Fed’s Collins, Brainard and Williams in the US session.

Thursday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 19/01/2023 | 0030/1130 | *** |  | AU | Labor force survey |

| 19/01/2023 | 0900/1000 | *** |  | NO | Norges Bank Rate Decision |

| 19/01/2023 | 1000/1000 | * |  | UK | Index Linked Gilt Outright Auction Result |

| 19/01/2023 | 1000/1100 | ** |  | EU | EZ Current Account |

| 19/01/2023 | 1030/1130 |  | EU | ECB Lagarde Panellist at World Economic Forum | |

| 19/01/2023 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 19/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 19/01/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 19/01/2023 | 1330/0830 | ** |  | US | Philadelphia Fed Manufacturing Index |

| 19/01/2023 | 1400/0900 |  | US | Boston Fed's Susan Collins | |

| 19/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 19/01/2023 | 1600/1100 | ** |  | US | DOE weekly crude oil stocks |

| 19/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 19/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 19/01/2023 | 1700/1800 |  | EU | ECB Schnabel in Finanzwende Webinar | |

| 19/01/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 10 Year Note |

| 19/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 19/01/2023 | 1815/1315 |  | US | Fed Vice Chair Lael Brainard | |

| 19/01/2023 | 2335/1835 |  | US | New York Fed's John Williams | |

| 20/01/2023 | 2350/0850 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.