-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS$ Credit Supply Pipeline

US Treasury Auction Calendar

MNI ASIA OPEN: Weaker CPI Won't Change FOMC Move Wednesday

EXECUTIVE SUMMARY

US

FED: The Federal Reserve is set to raise interest rates a half-point Wednesday to the highest since 2007 with investors focused on how much additional tightening will be needed early next year to get inflation back towards 2%.

- The slower pace of increase after four straight 75-bp hikes has been well telegraphed by Fed Chair Jerome Powell and will take the fed funds target range to 4.25%-4.5% from near-zero just nine months earlier. It comes as consumer inflation as measured by the CPI eased to 7.1% in November after peaking at 9.1% in June and core CPI slowed to 6% from a high of 6.6% in September.

- FOMC projections for the rates path are expected to be revised higher once more as data on economic activity and the labor market remained resilient. Former Fed officials told MNI the fed funds rate is likely to breach 5% in the first half of 2023 and stay higher for longer than markets now expect. Investors are also pricing in about 50 bps of rate cuts by the end of 2023. For more see MNI Policy main wire at 1046ET.

FED: The fairly broad-based slowing in inflation revealed in the November CPI report could prompt the Federal Reserve to pause its interest rate increases earlier than previously thought, former Fed staffer Riccardo Trezzi told MNI.

- While the November consumer price figures do not affect the expectation of a 50bp rate increase at tomorrow's FOMC meeting, the softening could mean the Fed pauses in March after one more hike in the cycle at the January/February meeting, said Trezzi, a former senior economist at the Fed Board.

- "I think they will be done raising rates by January basically and then they will pause there for five to six months," he said. "They will just deliver what they promised and then pause." For more see MNI Policy main wire at 1339ET.

UK

BOE: The MNI Markets team (along with 20/22 analyst previews we have read) expects a 50bp hike at this week’s MPC meeting. Assuming the 50bp hike is delivered, the breakdown of the vote and the forward guidance will arguably be the biggest drivers of markets moves.

- We expect a 4-way split in the vote with Tenreyro voting for rates on hold, Dhingra for a 25bp hike, Mann and Haskel a 75bp hike and the other 5 members of the MPC voting for 50bp.

- We expect the MPC's guidance of further "forceful, if necessary" hikes to be maintained and discuss options on how they could change their guidance around the markets' peak.

US TSYS: CPI Deflation

Tsys well bid but off post data highs after the bell - near middle of wide session range on decent volumes (TYH3>1.7M).

- FI markets gap bid after lower than expected Nov CPI (0.1% vs. 0.3% est, core 0.2%) spurred hopes of a continued slowdown in Fed hikes in 2023 (Fed voters have until this evening to revise projections).

- Still Expecting 50Bp Hike tomorrow while mid-'23 Terminal Dips - Fed funds implied hike for Dec'22 back to 51.2bp, while Feb'23 cumulative currently 84.9bp (91.5bp earlier) to 4.674%, Mar'23 98.7bp (108.0bp earlier) to 4.813%, while Fed terminal rate for May'23-Jun'23 falls to 4.845% vs. 4.97% pre-data.

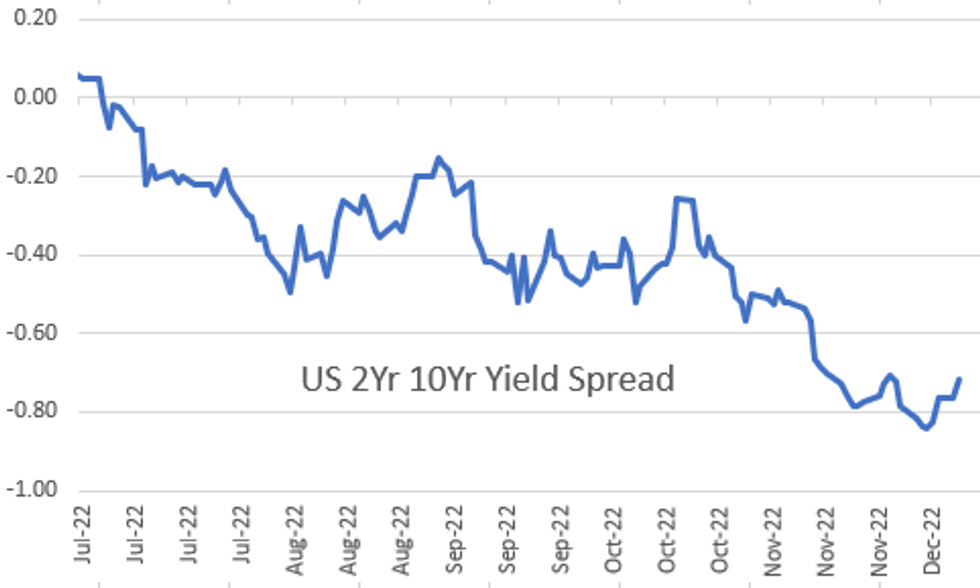

- Yield curves bull steepened (2s10s +4.943 at -72.493 late vs. -69.622 low) as core goods deflation accelerated, falling 0.5% in the month and its weakest since April 2020. Core services inflation also slowed to 0.4%, a still-robust print but one that's a four-month low.

- Heavy volumes in the well bid SOFR futures (far outpacing Eurodollar futures), w/ Reds (SFRZ3-SFRU4) trading +0.240-0.195 higher.

- Tys pare gains after $18B 30Y auction reopen (912810TL2) 3.1bp tails: 3.513% high yield vs. 3.482% WI; 2.25x bid-to-cover vs. 2.42x prior month.

OVERNIGHT DATA

- US NOV CPI 0.1%, CORE 0.2%; CPI Y/Y 7.1%, CORE Y/Y 6.0%

- US NOV CPI Unrounded:

- Unrounded % M/M (SA): Headline 0.096%; Core: 0.199% (from 0.272%)

- Unrounded % Y/Y (NSA): Headline 7.11%; Core: 5.958% (from 6.284%)

- Core goods CPI fell 0.52% M/M in Nov, the 2nd consecutive month of deflation on that front and the weakest monthly print since April 2020. Core services still robust at +0.44% M/M - but that's the 2nd consecutive deceleration and a 4-month low print.

- U.S. CPI inflation slowed more than analysts expected in November to 0.1% from a month earlier, with core CPI rising 0.2%, each a tenth weaker than Wall Street estimates, the Bureau of Labor Statistics reported Tuesday. That's good news for the FOMC as it begins a two-day meeting that is expected to culminate in a slower 50 bp interest rate increase Wednesday. (See: MNI: FOMC To Signal Path to 5% Next Year - Ex-Fed Officials)

- From a year ago, the headline index rose 7.1%, down from 7.7% a month earlier and June's 9.1% cycle peak. Core CPI inflation slowed to 6.0% from 6.3% a month earlier in 6.6% in September, even as the large shelter category advanced 7.1% in the year. Core goods deflation accelerated, falling 0.5% in the month and its weakest since April 2020. Core services inflation also slowed to 0.4%, a still-robust print but one that's a four-month low.

- US REDBOOK: DEC STORE SALES +5.8% V YR AGO MO

- US REDBOOK: STORE SALES +5.9% WK ENDED DEC 10 V YR AGO WK

Core CPI M/M Moderates Across All Three Main Components

- Strip core CPI into three categories of core goods, shelter and non-shelter services and each one of these saw moderation on the month.

- i) Core goods of -0.52% M/M hit a new low since Apr’20 but beyond that is the largest monthly decline since at least 2000. The unwinding of last year’s surge in used car prices is having a large impact but it’s not simply that: core goods ex used cars inflation was just 0.01% M/M, the lowest since Feb’21.

- ii) One of the few hot spots of the November report, key OER and rent of primary residence measures accelerated after October’s surprise dip but total rent of shelter eased to 0.65% M/M (lowest since July) courtesy of lower lodging away from home prices.

- iii) Finally, non-shelter service inflation, a measure that Chair Powell put increased weight on as an indicator of future inflation pressures, eased a tenth to 0.23% M/M on MNI calculations, its softest since July and before that Sep’21.

MARKETS SNAPSHOT

Key late session market levels:

- DJIA down 16.78 points (-0.05%) at 33986.37

- S&P E-Mini Future up 14.25 points (0.35%) at 4039.25

- Nasdaq up 65.4 points (0.6%) at 11209.52

- US 10-Yr yield is down 10.7 bps at 3.5048%

- US Mar 10Y are up 28.5/32 at 114-23

- EURUSD up 0.0094 (0.89%) at 1.0631

- USDJPY down 2.13 (-1.55%) at 135.54

- WTI Crude Oil (front-month) up $2.32 (3.17%) at $75.49

- Gold is up $28.9 (1.62%) at $1810.34

- EuroStoxx 50 up 65.01 points (1.66%) at 3986.83

- FTSE 100 up 56.92 points (0.76%) at 7502.89

- German DAX up 191.26 points (1.34%) at 14497.89

- French CAC 40 up 94.43 points (1.42%) at 6744.98

US TSY FUTURES CLOSE

- 3M10Y -14.129, -82.301 (L: -93.113 / H: -72.087)

- 2Y10Y +4.632, -72.804 (L: -84.838 / H: -69.622)

- 2Y30Y +10.731, -70.459 (L: -86.5 / H: -65.618)

- 5Y30Y +9.238, -12.769 (L: -29.332 / H: -7.412)

- Current futures levels:

- Mar 2Y up 11.5/32 at 103-0.375 (L: 102-21.625 / H: 103-06.375)

- Mar 5Y up 21.75/32 at 109-11 (L: 108-21.75 / H: 109-26.25)

- Mar 10Y up 28.5/32 at 114-23 (L: 113-25 / H: 115-11.5)

- Mar 30Y up 1-15/32 at 131-4 (L: 129-16 / H: 132-13)

- Mar Ultra 30Y up 1-16/32 at 143-28 (L: 142-08 / H: 145-27)

US 10YR FUTURE TECHS: (H3) Fresh Trend High Print

- RES 4: 116-12 2.0% 10-dma envelope

- RES 3: 115-26 2.00 proj of the Oct 21 - 27 - Nov 3 price swing

- RES 2: 115-14 50% Aug - Oct Downleg

- RES 1: 115-11 Intraday high

- PRICE: 114-30 @ 16:33 GMT Dec 13

- SUP 1: 113-22+/113-06+ Low Dec 122 / 50-day EMA

- SUP 2: 112-11+ Low Nov 21 and a key short-term support

- SUP 3: 112-05+ Low Nov 14

- SUP 4: 110-22 Low Nov 10

Treasury futures rallied following Tuesday’s CPI release. The move higher resulted in a print above resistance at 115-06+, the Dec 7 high and the bull trigger. A clear break of this resistance would confirm a resumption of the current uptrend and pave the way for a climb towards 115-26, a Fibonacci projection. On the downside, key short-term support has been defined at 113-22+, the Dec 12 low.

US EURODOLLAR FUTURES CLOSE

- Dec 22 +0.030 at 95.255

- Mar 23 +0.125 at 94.965

- Jun 23 +0.155 at 94.950

- Sep 23 +0.180 at 95.110

- Red Pack (Dec 23-Sep 24) +0.175 to +0.210

- Green Pack (Dec 24-Sep 25) +0.10 to +0.145

- Blue Pack (Dec 25-Sep 26) +0.090 to +0.095

- Gold Pack (Dec 26-Sep 27) +0.085 to +0.090

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00600 to 3.81786% (-0.00014/wk)

- 1M +0.02572 to 4.31786% (+0.04757/wk)

- 3M +0.01629 to 4.76900% (+0.03586/wk)*/**

- 6M +0.04471 to 5.20571% (+0.06600/wk)

- 12M +0.02572 to 5.55129% (+0.05186/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.77857% on 11/30/22

- Daily Effective Fed Funds Rate: 3.83% volume: $102B

- Daily Overnight Bank Funding Rate: 3.82% volume: $271B

- Secured Overnight Financing Rate (SOFR): 3.80%, $1.042T

- Broad General Collateral Rate (BGCR): 3.76%, $409B

- Tri-Party General Collateral Rate (TGCR): 3.76%, $392B

- (rate, volume levels reflect prior session)

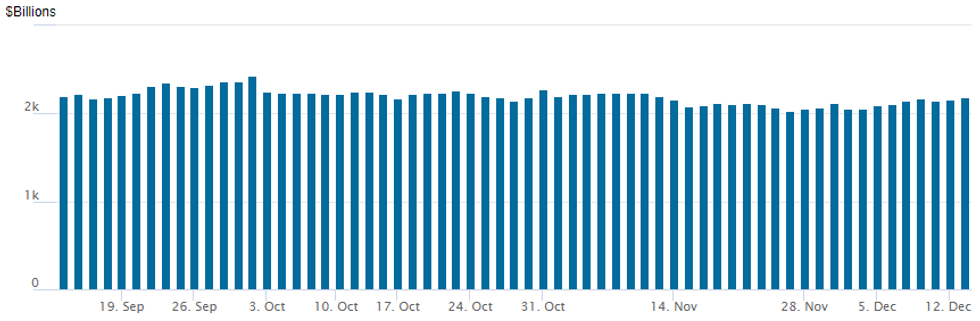

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage climbs to $2,180.676B w/ 98 counterparties vs. $2,158.517B in the prior session. Prior record high stands at $2,425.910B on Friday, September 30.

EGBs-GILTS CASH CLOSE: Gilts Lag As US And UK Data Set The Tone

US and UK data dominated price action in European FI Tuesday, as key central bank decisions loomed large Wednesday and Thursday.

- Global yields dropped sharply after US CPI surprised to the downside for the 2nd consecutive month.

- Gilts underperformed, lagging the post-CPI rally and then more than reversing the drop as the afternoon progressed. Bunds also faded the initial move but yields finished the session lower.

- Some of the Gilt underperformance was attributed to strong nominal UK wage growth data this morning and BoE's Bailey noting potential second-round inflation risks, ahead of Thursday's BoE decision (MNI's Preview here).

- Periphery EGB spreads finished mostly tighter, but well off the session's narrowest levels posted amid a broad post-CPI risk rally.

- UK CPI data features first thing Weds, with the Fed decision later in the day.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 5.1bps at 2.146%, 5-Yr is down 3.4bps at 1.944%, 10-Yr is down 1.4bps at 1.925%, and 30-Yr is up 3.5bps at 1.752%.

- UK: The 2-Yr yield is up 5.4bps at 3.519%, 5-Yr is up 6.5bps at 3.344%, 10-Yr is up 10bps at 3.301%, and 30-Yr is up 10.5bps at 3.716%.

- Italian BTP spread down 1.3bps at 187.6bps / Spanish down 1.6bps at 101bps

FOREX: Softer US CPI Sparks Broad Greenback Selloff

- Another weaker-than-expected US inflation print prompted a significant adjustment lower for the US dollar. The kneejerk reaction was roughly a 1% gap lower for the USD index with the initial surge higher for equities exacerbating the greenback weakness. Despite equities reversing substantially, the DXY has held onto the majority of the session’s fall, registering a 1.10% decline approaching the APAC crossover.

- With the front-end of the US yield curve shifting around 15 basis points lower, the Japanese Yen was one of the biggest beneficiaries following the data, with USDJPY down around 2.2% at its worst point before recovering a portion of the losses to close around 135.50. On the downside, the bear trigger is unchanged at 133.63. A break would resume the technical downtrend.

- A very resilient profile across the commodity complex (Bloomberg commodity index +2.00%), is helping the likes of AUD and NZD hold on to gains in the region of 1.5% on the session, while EUR and GBP are modestly underperforming G10 peers.

- EURUSD has however breached resistance at 1.0595, the Dec 5 high and the bull trigger. The break higher confirms a resumption of the uptrend and also cancels the recent bearish candle pattern - a shooting star. The climb sets the scene for 1.0736 next, a Fibonacci projection. On the downside, key short-term support has now been defined at 1.0443, Dec 7 low, of which a break would signal a short-term top.

- Focus turns swiftly to tomorrow’s release of UK CPI before the December FOMC meeting and summary of economic projections. A packed calendar continues Thursday, with CB decisions from the Norges Bank, the SNB, the BOE and the ECB.

Wednesday Economic Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 14/12/2022 | 0001/0001 | * |  | UK | XpertHR pay deals for whole economy |

| 14/12/2022 | 0700/0700 | *** |  | UK | Consumer inflation report |

| 14/12/2022 | 0700/0800 | *** |  | SE | Inflation report |

| 14/12/2022 | 0800/0900 | *** |  | ES | HICP (f) |

| 14/12/2022 | 0930/0930 | * |  | UK | Halifax House Price Index |

| 14/12/2022 | 1000/1100 | ** |  | EU | Industrial Production |

| 14/12/2022 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 14/12/2022 | 1330/0830 | ** |  | US | Import/Export Price Index |

| 14/12/2022 | 1530/1030 | ** |  | US | DOE weekly crude oil stocks |

| 14/12/2022 | 1900/1400 | *** |  | US | FOMC Statement |

| 15/12/2022 | 2145/1045 | *** |  | NZ | GDP |

| 14/12/2022 | 2230/2330 |  | EU | ECB Elderson Pre-recorded Speech at COP15 |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.