-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weekly Claims Upside Miss, May Employ Up Next

- MNI US Payrolls Preview: Partial Rebound Amid Overall Slowdown

- MNI ECB BRIEF: Confidence in Projections Helped Rate Cut- Lagarde

- MNI US DATA: Initial Claims Tick Higher, But No Clear Signal Of Deterioration

US TSYS Tsys Near Late Highs Ahead Friday's Headline May Jobs Data

- Treasury futures have quietly pared losses in the second half, extending modest session highs after this morning's gap bid and quick reversal following the ECB rate cut and higher than expected weekly claims.

- No particular headline driver for the move, just renewed position squaring ahead of Friday's May employment data risk event (Bbg mean estimate +185k vs. +175k prior).

- Futures are mildly higher, Sep'24 10Y Treasury futures are currently +2.5 at 110-12 vs. 110-13 high, focus on technical resistance at 110-17 (High Apr 4).

- Cash yields mixed after the bell: 2s -.0024 at 4.7199%, 10s +.0019 at 4.2774%, 30s -.0028 at 4.4269%, while curves look mildly steeper: 2s10s +0.427 at -44.460, 5s30s +0.084 at 13.465.

- Today’s ECB decision provided little insight surrounding the future path for monetary policy, as Lagarde underscored the Bank’s data-dependent stance, albeit pointing to the likelihood that the ECB has started the “dialing back” of restriction phase.

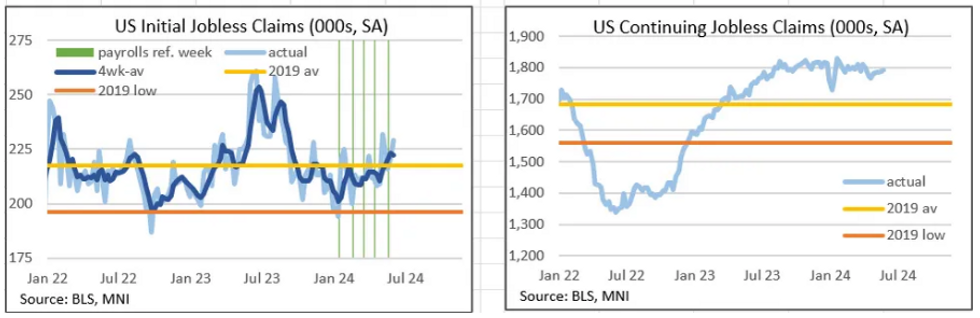

- Initial jobless claims in the Jun 1 week ticked up 8k to 229k, the highest in 4 weeks and exceeding consensus estimates of 220k (prior was 221k, rev up from 219k). Continuing claims for the preceding week edged 2k higher to 1,792k, non-impactful given a downward 1k revision to prior (to 1,790k).

NEWS

US (MNI): Senate Unlikely To Confirm New FDIC Chair This Year

Lawmakers are “sounding doubtful” there the Senate will confirm a successor to outgoing Federal Deposit Insurance Corp. Chair Martin Gruenberg this year, according to reporting from Punchbowl News.

ECB BRIEF (MNI): Confidence in Projections Helped Rate Cut- Lagarde

The European Central Bank’s decision to cut interest rates on Thursday came as the Governing Council's "overall confidence in the path ahead has increased over recent months," President Christine Lagarde told reporters. The Governing Council has increasing confidence in its projections, Lagarde said.

ECB (MNI): Project Slower GDP Deflator Moderation In 2024 Due To Higher Labour Costs and Profits

The ECB’s June macroeconomic forecasts record an upward revision to GDP deflator growth through 2024, with unit labour cost and unit profit growth revised higher. The higher unit labour cost projection comes as 2024 compensation per employee was revised higher and real productivity per employee was revised lower.

ISRAEL (MNI): International Statement Calls On Hamas To Accept US Ceasefire Deal:

The White House has released a joint statement with the leaders of 16 other nations calling for Hamas to accept the hostages-for-ceasefire deal outlined by President Joe Biden at the end of May.

SOUTH AFRICA (MNI): BBG-Main Trade Union Federation Urges ANC Agreement w/DA:

Bloomberg is reporting that the Congress of South African Trade Unions (COSATU), the country's largest labour federation, is encouraging the governing African National Congress (ANC) to seek a deal with the liberal Democratic Alliance (DA) in order to remain in power.

OVERNIGHT DATA

US DATA (MNI): Initial Claims Tick Higher, But No Clear Signal Of Deterioration

Initial jobless claims in the Jun 1 week ticked up 8k to 229k, the highest in 4 weeks and exceeding consensus estimates of 220k (prior was 221k, rev up from 219k). Continuing claims for the preceding week edged 2k higher to 1,792k, non-impactful given a downward 1k revision to prior (to 1,790k).

- Even with the move higher, the 4-week moving average for initial claims fell 1k to 222k, with the jump to 232k at the start of May dropping out of the calculation. This leaves the average a little above readings between 210-220k earlier in the year.

- Non-seasonally adjusted initial claims were a touch below past years and in line with general steadiness at this time of year (down 2k to 195k), while NSA continuing claims showing a similar story (up 6k to 1,672k), though both appear to be bottoming out out ahead of what is usually a pickup in mid-summer.

- With both initial and continuing claims well within recent ranges, there is little here to suggest that there is much movement away from the steadily weakening though reasonably solid labor market signals seen in the past couple of months of claims reports, even as some other employment signals show clearer signs of deterioration.

US Payrolls Preview (MNI): Partial Rebound Amid Overall Slowdown: Nonfarm payrolls are expected to partially rebound in May from April’s surprisingly low 175k, with 188k in headline gains per MNI’s sell-side analyst median.

- While still an acceleration from the prior month, the consensus outcome if realized would be seen as reinforcing the view that the labor market has shifted into a softer but still-solid phase of growth.

- The rebound is seen being led by a recovery in government job gains. Private payrolls are seen posting a fairly flat rise of roughly 160k, vs 167k in April, with health and social assistance sector payrolls still providing the biggest boost

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 89.63 points (0.23%) at 38896.29

- S&P E-Mini Future down 2.5 points (-0.05%) at 5363.75

- Nasdaq down 20 points (-0.1%) at 17166.97

- US 10-Yr yield is up 0.4 bps at 4.2793%

- US Sep 10-Yr futures are up 2/32 at 110-11.5

- EURUSD up 0.0023 (0.21%) at 1.0892

- USDJPY down 0.45 (-0.29%) at 155.65

- WTI Crude Oil (front-month) up $1.53 (2.07%) at $75.60

- Gold is up $18.25 (0.77%) at $2373.55

- European bourses closing levels:

- EuroStoxx 50 up 33.43 points (0.66%) at 5069.09

- FTSE 100 up 38.39 points (0.47%) at 8285.34

- German DAX up 76.73 points (0.41%) at 18652.67

- French CAC 40 up 33.55 points (0.42%) at 8040.12

US TREASURY FUTURES CLOSE

- 3M10Y +1.248, -112.397 (L: -115.484 / H: -109.425)

- 2Y10Y +0.62, -44.267 (L: -45.159 / H: -43.01)

- 2Y30Y +0.142, -29.32 (L: -30.291 / H: -27.647)

- 5Y30Y +0.094, 13.475 (L: 12.447 / H: 14.937)

- Current futures levels:

- Sep 2-Yr futures up 0.625/32 at 102-6.625 (L: 102-04.375 / H: 102-06.875)

- Sep 5-Yr futures up 1.75/32 at 106-25.5 (L: 106-20 / H: 106-26.5)

- Sep 10-Yr futures up 2/32 at 110-11.5 (L: 110-03 / H: 110-13)

- Sep 30-Yr futures up 5/32 at 119-13 (L: 118-26 / H: 119-17)

- Sep Ultra futures up 6/32 at 127-0 (L: 126-04 / H: 127-05)

US 10Y FUTURE TECHS: (U4) Bull Cycle Extends

- RES 4: 111-09 High Apr 1

- RES 3: 110-27+ 1.00 proj of the Apr 25 - May 16 - 29 price swing

- RES 2: 110-17 High Apr 4

- RES 1: 110-12+ High Jun 5/6

- PRICE: 110-11+ @ 1500 ET Jun 6

- SUP 1: 109-14 50-day EMA

- SUP 2: 109-07 20-day EMA

- SUP 3: 108-27+ Low Jun 3

- SUP 4: 107-31 Low May 29 and a key support

Treasuries maintain a firmer short-term tone and this week’s move higher has reinforced the current bullish theme. The contract has traded through resistance and a bull trigger at 110-09, the May 16 high. The break higher opens 110-17, the Apr 4 high, and 110-27+, a Fibonacci projection. On the downside, initial support to watch lies at 109-14+, the 50-day EMA. The 20-day EMA, lies at 109-07.

SOFR FUTURES CLOSE

- Jun 24 +0.005 at 94.678

- Sep 24 -0.005 at 94.890

- Dec 24 +0.015 at 95.185

- Mar 25 +0.015 at 95.455

- Red Pack (Jun 25-Mar 26) +0.010 to +0.015

- Green Pack (Jun 26-Mar 27) +0.015 to +0.020

- Blue Pack (Jun 27-Mar 28) +0.015 to +0.015

- Gold Pack (Jun 28-Mar 29) +0.010 to +0.015

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOSOFR Benchmark Settlements:

- 1M -0.00161 to 5.32630 (-0.00351/wk)

- 3M -0.00307 to 5.33444 (-0.00840/wk)

- 6M -0.00956 to 5.27509 (-0.03910/wk)

- 12M -0.02095 to 5.09229 (-0.10968/wk)

- Secured Overnight Financing Rate (SOFR): 5.33% (+0.00), volume: $1.989T

- Broad General Collateral Rate (BGCR): 5.32% (+0.00), volume: $762B

- Tri-Party General Collateral Rate (TGCR): 5.32% (+0.00), volume: $745B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $100B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $280B

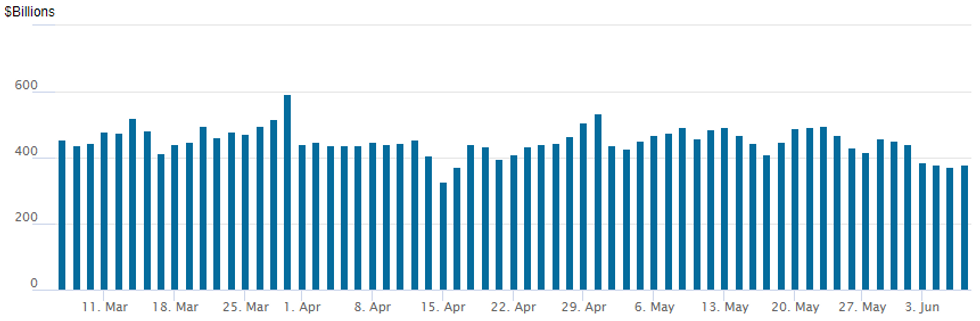

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs to $378.125B from $371.841B prior; number of counterparties slips to 72 from 76. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

PIPELINE $2.7B John Deere 4Pt Debt Launched

John Deere 4-part issuance pushes session total to $7.4B

- Date $MM Issuer (Priced *, Launch #)

- 6/6 $2.7B #John Deere $700M 3Y +45, $350M 3Y SOFR+60, $850M 5Y +60, $800M 10Y +80

- 6/6 $3.5B #Energy Transfer $1B 5Y +100, $1.25B 10Y +135, $1.25B 30Y +165

- 6/6 $500M #Harley Davidson 5Y +170

- 6/6 $700M *Applied Materials 5Y +55

EGBs-GILTS CASH CLOSE: Bunds Weaken With ECB Cut Path Left Unclear

EGB curves bear flattened Thursday, as the ECB delivered a slightly hawkishly-perceived message alongside its well-anticipated 25bp rate cut.

- An upgrade in core inflation projections drove an initial sell-off in Euro rates, after which Pres Lagarde warned of a "bumpy" inflation path ahead and wouldn't fully endorse that the ECB had entered a "dialing back" phase of rate decisions, stressing data dependence.

- Bunds would bounce from mid-press conference lows, but the German curve saw belly underperformance as 2024 ECB cuts (beyond today's expected 25bp reduction) were pared to 36bp from 40bp pre-decision.

- Periphery EGBs largely took the relatively hawkish communications in stride, with spreads closing only slightly wider of Bunds.

- Gilts easily outperformed EGBs, with bull steepening in the UK curve.

- Friday brings German industrial production and Eurozone final Q1 GDP data, after which the session's focus will be US nonfarm payrolls.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 3.7bps at 3.017%, 5-Yr is up 4.4bps at 2.604%, 10-Yr is up 3.7bps at 2.549%, and 30-Yr is up 2.2bps at 2.674%.

- UK: The 2-Yr yield is down 4bps at 4.331%, 5-Yr is down 2.8bps at 4.067%, 10-Yr is down 1bps at 4.174%, and 30-Yr is unchanged at 4.611%.

- Italian BTP spread up 1.2bps at 132.1bps / Spanish up 0.2bps at 73.2bps

FOREX EURUSD Holds Narrow Range Post ECB, NFP Awaits

- There was a modest uptick for the single currency as the ECB’s well telegraphed 25bp cut was offset by higher-than-expected revisions to both growth and inflation for 2024 and for inflation in 2025.

- Additionally, by not committing to any particular rate path, and the confirmation of a meeting-by-meeting approach, this leaves markets unclear on the immediate next steps for the ECB’s Governing council.

- Overall, EURUSD held a narrow 40-pip range on Thursday. The brief move back above the 1.09 handle failed to garner any momentum as markets remain on the sidelines ahead of tomorrow’s key employment data from the US. Above here, the week’s high of 1.0916 precedes the more significant Fibonacci retracement at 1.0933, before 1.0964/81, the March highs.

- Separately, EURGBP continues to flirt with the key 0.8500 level, of which the pair has failed to close below since August 2022.

- The USD index sits moderately in the red as US yields continue to hover at the lowest levels of the week and major equity indices remain buoyant.

- AUD has outperformed, rising 0.35% against the dollar, which further underpins the bull cycle that started Apr 19 for AUDUSD. Short-term pull backs appear to be corrective in nature, and a continuation higher signals scope for the bull trigger to be tested at 0.6714, May 16 high.

- Friday’s release of nonfarm payrolls is expected to partially rebound in May from April’s surprisingly low 175k, with 188k in headline gains per MNI’s sell-side analyst median. While still an acceleration from the prior month, the consensus outcome if realized would be seen as reinforcing the view that the labor market has shifted into a softer but still-solid phase of growth.

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/06/2024 | 0600/0800 | ** |  | DE | Trade Balance |

| 07/06/2024 | 0600/0800 | ** |  | DE | Industrial Production |

| 07/06/2024 | 0645/0845 | * |  | FR | Foreign Trade |

| 07/06/2024 | 0800/1000 |  | EU | ECB's Schnabel participates in panel discussion at the Federal Ministry of Finance | |

| 07/06/2024 | 0900/1100 | *** |  | EU | GDP (final) |

| 07/06/2024 | 0900/1100 | * |  | EU | Employment |

| 07/06/2024 | - | *** |  | CN | Trade |

| 07/06/2024 | 1230/0830 | *** |  | US | Employment Report |

| 07/06/2024 | 1230/0830 | *** |  | CA | Labour Force Survey |

| 07/06/2024 | 1400/1000 | ** |  | US | Wholesale Trade |

| 07/06/2024 | 1415/1615 |  | EU | ECB's Lagarde in Atelier Maurice Allais | |

| 07/06/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 07/06/2024 | 1900/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.