-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Wind-Up to Fed Downshift

EXECUTIVE SUMMARY

- MNI Fed Preview - Feb 2023: Downshift, With “Ongoing” Concern

- MNI INTERVIEW: US Debt Feud Likely To Temper Sentiment - UMich

- MNI INTERVIEW: BOC Too Optimistic On CPI Slowdown-Ex Official

- MNI INTERVIEW: ECB Communications Errors Risk Market Selloff

- MNI INTERVIEW:EU State Aid Deal Possible In Q1-German Official

US

FOMC Preview executive summary: The Fed will downshift its rate hike pace in February for the second consecutive meeting, to 25bp from 50bp.

- The dovish risks to this meeting appear at least partly priced in, including some expectations of Statement language acknowledging decelerating inflation, or a clear signal that the end of the hiking cycle is near.

- However, there are many ways Powell could re-emphasize the FOMC’s view that the job is not nearly done yet.

- Powell will again steer attention away from the pace of hikes and toward the terminal level (which the FOMC envisages as higher than the market does), while pushing back against rate cut pricing for H2 2023. For more, see MNI Policy at 1100ET.

US: Consumer sentiment climbed to the highest since April but is likely to cool as Washington debates raising the debt ceiling and risking a crisis, says Joanne Hsu who leads the University of Michigan's Survey of Consumers.

- "While consumer sentiment has risen since December and has been lifting since it's all-time low in June, it still remains pretty low from a historical perspective, and consumers are still broadly expecting an economic downturn in the year ahead," she told MNI Friday.

- The Michigan index rose 8.7% in December to 64.9 reflecting improving assessments of personal finances and buying conditions for durables, she said. The one-year economic outlook jumped 4.7% to 62.7, the highest in a year.

- Sentiment will be affected by Washington's debt ceiling debate, Hsu said, noting debt ceiling crises in 2011 and 2013 prompted steep declines in confidence. For more, see MNI Policy at 1329ET.

CANADA

BOC: Inflation won't come down as easily as the Bank of Canada predicts, former top government economist Phil Cross told MNI, meaning investors should heed Governor Tiff Macklem's message that it's far too soon to consider a rate cut.

- “We probably are past peak inflation," said Cross, former chief economic analyst at Statistics Canada and now senior fellow at the Macdonald-Laurier Institute. "But whether we're on a good easy glide path to come back to the target of inflation, I’m certainly nowhere near as convinced as the Bank of Canada and I'm not sure how confident they are.”

- The Bank raised its overnight rate a quarter point to 4.5% Wednesday and said the eighth straight increase is likely the last if for example inflation remains on a path to reach 3% mid-year and its 2% target in 2024. Macklem said he can tighten again if needed and told reporters investor bets on a rate cut are premature. For more see MNI Policy main wire at 1020ET.

EUROPE

ECB: The European Central Bank must make its language clearer if it is to retain the confidence of markets, a former Governing Council member told MNI, warning that communication errors could prompt a blowout in peripheral bond spreads if rates continue to rise steeply.

- December’s guidance by President Christine Lagarde suggesting at least two half-point hikes to come after that month’s increase by the same amount was inconsistent with the Governing Council’s stated commitment to data-dependency, former Central Bank of Ireland deputy governor Stefan Gerlach said in an interview.

- “It’s contradictory to say that ECB will be driven by the data, but then say that it will raise rates three times by 50 basis points. There is, plainly, concern among financial market participants about the inconsistencies in [Lagarde's] communication,” Gerlach said. For more see MNI Policy main wire at 0902ET.

EU: The European Union could agree on a relaxation of state aid rules to fund investment in response to U.S. green subsidies by as early as March, but Germany would insist that this would only be temporary and targeted and would oppose fresh joint borrowing, a senior German official told MNI.

- State Secretary in the Federal Ministry of Finance Florian Toncar said Europe should not overplay its response to USD379 billion U.S. plans to drive investment in Washington’s Inflation Reduction Act.

- “My advice to Europe is not to exaggerate the effect of those subsidies and take it as a reason to further escalate any trade conflict with the United States. We need to jointly resolve the issue,” Toncar said in an interview in Berlin. “I would also hope that in America there will be some rethinking over whether one can indeed reduce some of the protectionist content and provisions in the IRA.” For more see MNI Policy main wire at 0849ET.

US TSYS: Late Tsy Roundup: Implied Hike Steady at 25.9Bp Ahead Wed FOMC

- Tsys mildly weaker after the bell, well off late morning lows to near middle of range through early overnight trade. Tsy 30YY currently 3.6306 -.0091, vs. 3.6845% high)

- Higher than expected Japanese CPI data overnight (+4.4% Y/Y; MEDIAN 4.0%; Dec 3.9%) got the ball rolling overnight, Tsys extending lows ahead the NY open.

- Tsys see-sawed off lows drawing modest buying in intermediates to long end after largely in-line data: personal income +0.2%; NOM PCE -0.2%, modest lower revision to prior. Little react to midmorning Pending Home Sales (+2.5% MOM; -33.8% YOY) and UofM sentiment 64.9; est. 64.6.

- Fed funds implied hike for Feb'23 at 25.9bp (-0.7), Mar'23 cumulative at 46.4bp (-0.5) to 4.793%, May'23 56.9bp (+.1) to 4.898%, terminal at 4.905% in Jun'23.

- Focus on next week Wed's FOMC policy annc, dovish risks to this meeting appear at least partly priced in, including some expectations of Statement language acknowledging decelerating inflation, or a clear signal that the end of the hiking cycle is near.

- Next employment report covering January out next Friday as well, current median est at +175k vs. +223k prior..

OVERNIGHT DATA

- US DEC PERSONAL INCOME +0.2%; NOM PCE -0.2%

- US DEC PCE PRICE INDEX +0.1%; +5.0% Y/Y

- US DEC CORE PCE PRICE INDEX +0.3%; +4.4% Y/Y

- US DEC UNROUNDED PCE PRICE INDEX +0.052%; CORE +0.296%

- US NAR DEC PENDING HOME SALES INDEX 76.9 V 75 IN NOV

- US NAR DEC PENDING HOME SALES +2.5% MOM; -33.8% YOY

- MICHIGAN FINAL JAN. CONSUMER SENTIMENT AT 64.9; EST. 64.6

- MICHIGAN JAN. CURRENT CONDITIONS AT 68.4 FROM 59.4

- MICHIGAN JAN. EXPECTATIONS INDEX AT 62.7 FROM 59.9

- MICHIGAN JAN. 1-YR EXPECTED INFLATION AT 3.9% FROM 4.4%

- MICHIGAN JAN. 5-YR EXPECTED INFLATION UNCHANGED AT 2.9%

MARKETS SNAPSHOT

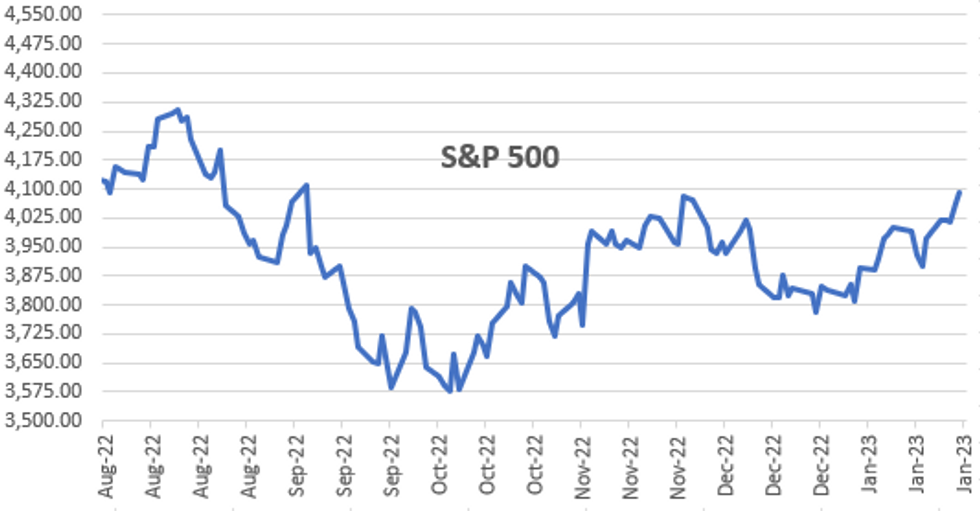

Key late session market- DJIA up 178.79 points (0.53%) at 34127.41

- S&P E-Mini Future up 28.75 points (0.71%) at 4104

- Nasdaq up 162.4 points (1.4%) at 11674.29

- US 10-Yr yield is up 2 bps at 3.5145%

- US Mar 10-Yr futures are down 8/32 at 114-19.5

- EURUSD down 0.0022 (-0.2%) at 1.087

- USDJPY down 0.31 (-0.24%) at 129.91

- WTI Crude Oil (front-month) down $1.52 (-1.88%) at $79.49

- Gold is up $1.01 (0.05%) at $1930.17

- EuroStoxx 50 up 4.03 points (0.1%) at 4178.01

- FTSE 100 up 4.04 points (0.05%) at 7765.15

- German DAX up 17.18 points (0.11%) at 15150.03

- French CAC 40 up 1.22 points (0.02%) at 7097.21

US TSY FUTURES CLOSE

- 3M10Y +2.274, -116.366 (L: -121.836 / H: -111.852)

- 2Y10Y -0.095, -69.481 (L: -69.588 / H: -65.927)

- 2Y30Y -3.55, -58.043 (L: -58.66 / H: -52.917)

- 5Y30Y -3.414, 0.835 (L: -0.284 / H: 5.083)

- Current futures levels:

- Mar 2-Yr futures down 2/32 at 102-26.625 (L: 102-25.625 / H: 102-28.5)

- Mar 5-Yr futures down 4.75/32 at 109-10 (L: 109-05.75 / H: 109-15)

- Mar 10-Yr futures down 8/32 at 114-19.5 (L: 114-12 / H: 114-28)

- Mar 30-Yr futures down 8/32 at 130-5 (L: 129-10 / H: 130-13)

- Mar Ultra futures up 1/32 at 142-17 (L: 141-03 / H: 142-17)

US 10YR FUTURE TECHS: (H3) Approaching Support

- RES 4: 117-00 High Sep 8 2022

- RES 3: 116-08 High Jan 19 and the bull trigger

- RES 2: 115-21 High Jan 20

- RES 1: 114-28/115-13 Intraday high / High Jan 25

- PRICE: 114-19 @ 1420ET Jan 27

- SUP 1: 114-14 Low Jan 24

- SUP 2: 114-09+ Low Jan 17 and a key support

- SUP 3: 113-31 50-day EMA

- SUP 4: 113-17+ 61.8% retracement of the Dec 30 - Jan 19 bull leg

Treasury futures are trading lower today and attention turns to support at 114-09+, the Jan 17 low. A break of this level would undermine the recent bull theme and signal scope for a deeper retracement and expose the 50-day EMA, at 113-31. The average represents an important short-term support. On the upside a key short-term resistance has been defined at 115-13, the Jan 25 high. A break would ease any developing bearish threat.

US EURODOLLAR FUTURES CLOSE

- Mar 23 steady00 at 95.005

- Jun 23 steady00 at 94.925

- Sep 23 -0.020 at 95.005

- Dec 23 -0.035 at 95.325

- Red Pack (Mar 24-Dec 24) -0.06 to -0.045

- Green Pack (Mar 25-Dec 25) -0.045 to -0.04

- Blue Pack (Mar 26-Dec 26) -0.055 to -0.05

- Gold Pack (Mar 27-Dec 27) -0.055 to -0.05

SHORT TERM RATES

US DOLLAR LIBOR: Latest settlements:

- O/N +0.00014 to 4.30471% (-0.000043/wk)

- 1M +0.02242 to 4.56971% (+0.04643/wk)

- 3M +0.02286 to 4.82529% (+0.00972/wk)*/**

- 6M +0.00000 to 5.10229% (+0.00029/wk)

- 12M +0.01529 to 5.31614% (-0.03114/wk)

- * Record Low 0.11413% on 9/12/21; ** New 14Y high: 4.82971% on 1/12/23

- Daily Effective Fed Funds Rate: 4.33% volume: $113B

- Daily Overnight Bank Funding Rate: 4.32% volume: $302B

- Secured Overnight Financing Rate (SOFR): 4.30%, $1.165T

- Broad General Collateral Rate (BGCR): 4.27%, $473B

- Tri-Party General Collateral Rate (TGCR): 4.27%, $455B

- (rate, volume levels reflect prior session)

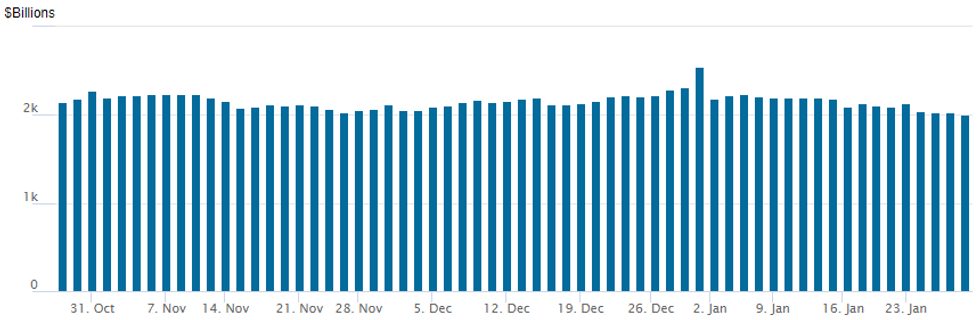

FED Reverse Repo Operation

NY Federal Reserve/MNI

NY Fed reverse repo usage recedes to $2,003.634B w/ 96 counterparties vs. prior session's $2,024.069B. Compares to Friday, Dec 30 record/year-end high of $2,553.716B (prior record high was $2,425.910B on Friday, September 30.

PIPELINE

No new high-grade corporate bond issuance Friday, $30.65B total on week.

EGBs-GILTS CASH CLOSE: Modest Steepening Ahead Of A Big Week

European curves steepened modestly to end the week, with periphery EGB spreads widening in anticipation of next week's data- and central bank-heavy schedule.

- 10s outperformed on the UK curve, though 30s underperformance meant the curve bear steepened overall; the German curve twist steepened with 2Y yields dipping.

- BTPs underperformed alongside a tick higher in terminal ECB hike expectations +2bp to 143bp), in preparation for next Thursday's decision.

- With limited data on the European docket, attention was on the US personal income/spending release which was in line with expectations and not a market mover. Likewise, no central bank speakers of note ahead of next week's key decisions, including the Federal Reserve, BoE and ECB.

- Next week we also get heavy EGB supply and flash January eurozone inflation data.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is down 0.4bps at 2.58%, 5-Yr is up 2bps at 2.258%, 10-Yr is up 2.3bps at 2.239%, and 30-Yr is up 1.4bps at 2.195%.

- UK: The 2-Yr yield is up 1bps at 3.474%, 5-Yr is up 0.9bps at 3.201%, 10-Yr is up 0.6bps at 3.323%, and 30-Yr is up 1.9bps at 3.681%.

- Italian BTP spread up 3.9bps at 185.8bps / Spanish up 1.8bps at 98.7bps

FOREX: G10 FX Little Changed Ahead of Busy Central Bank Week

- Major currencies remain close to unchanged for Friday, as markets digest the end of the Lunar New Year holiday in China and contemplate the Federal Reserve’s first monetary policy decision next week.

- The greenback spent the day trading in moderately firmer territory with a noted uptick approaching the WMR fix for value-date month end. However, the USD gradually faded approaching the close, leaving the USD index very close to last Friday’s close but still within close proximity to most recent trend lows.

- G10 majors were mixed with the Euro moderately lower and the JPY slightly firmer on the session. For now, EUR/USD remains in a broader uptrend, with Thursday's 1.0929 print highlighting the upside bias. Key short-term support levels remain intact and note that moving average studies continue to highlight positive market sentiment. The next objective is 1.0954, the Apr 11, 2022 high.

- Focus clearly on the FOMC next week where the Fed are expected to downshift its rate hike pace in February for the second consecutive meeting, to 25bp from 50bp. The dovish risks to this meeting appear at least partly priced in, including some expectations of statement language acknowledging decelerating inflation, or a clear signal that the end of the hiking cycle is near.

- As well as the Fed, we have the BOE and ECB rate decisions next week which will be followed up by Friday’s release of US non-farm payrolls.

Monday Data Calendar

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/01/2023 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/01/2023 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/01/2023 | 0900/1000 | *** |  | DE | GDP (p) |

| 30/01/2023 | 1000/1100 | ** |  | IT | PPI |

| 30/01/2023 | 1000/1100 |  | EU | Consumer / Economic Confidence Indicators | |

| 30/01/2023 | 1500/1000 |  | US | Treasury Quarterly Financing Estimates | |

| 30/01/2023 | 1530/1030 | ** |  | US | Dallas Fed manufacturing survey |

| 30/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 30/01/2023 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 31/01/2023 | 2350/0850 | ** |  | JP | Industrial production |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.