-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Powell's Sintra Appearance, JOLTs Take Focus

MNI US OPEN - RN Majority Odds Dwindle as Opposition Begins to Cooperate

MNI ASIA OPEN: Yields Temper Gains as Crude Support Fades

- MNI INTERVIEW: Higher Rates Finally Begin To Bite US Firms

- MNI INTERVIEW: Fed 'Upside Surprise' To Drag On Housing - MBA

- MNI: Goolsbee Sees Risk Fed Overshoots As Supply Recovers

- MNI BRIEF: US GDP Revisions Boost Growth In Q1 And Back

- MNI Jobless Claims Better Than Expected, Below 2019 Averages

US

FED: Tighter monetary policy has finally made it to the top of U.S. corporate finance chiefs' list of worries, a sign that firms are at last feeling the effects of higher interest rates even if they still expect hiring and revenue growth to rebound next year, the CFO Survey director and Duke University economist John Graham told MNI.

- Difficulty hiring and retaining workers had dominated the list of most pressing concerns for a number of quarters but has finally been displaced by monetary policy, according to the latest survey of CFOs in late August and early September by Duke University’s Fuqua School of Business and the Federal Reserve banks of Atlanta and Richmond. Labor quality and availability remains a close second, followed by cost pressures and demand.

- About 40% of CFOs said high interest rates have already prompted their companies to pull back on capital and noncapital spending. If rates were to remain at their current level for another year, another 7% said they would curtail spending. FOMC projections last week showed the benchmark interest rate staying above 5% through the end of 2024, down slightly from the current 5.25%-5.5% range. For more see MNI Policy main wire at 1133ET.

FED: The Federal Reserve's higher-for-longer guidance last week and resulting impact on mortgage rates is another blow to the housing market that will drag down sales further, Mortgage Bankers Association deputy chief economist Joel Kan told MNI.

- The Fed's Summary of Economic Projections guidance "certainly added some upside risks to rates," Kan said, and that will be a blow to sales. "The reduction in cuts next year and the higher-for-longer message taken together is an upside surprise."

- The MBA's most recent forecast for existing home sales to bottom out in the third quarter at a seasonally adjusted annual rate of 4.14 million will likely be pushed back to the fourth quarter, but Kan is still anticipating mortgage rates to soften in early 2024. "The story is about what happens to rates and inventory." For more see MNI Policy main wire at 1311ET.

FED: The Federal Reserve can generate a rare soft landing but the risk is that policymakers overshoot by relying on misguided models suggesting a clampdown on demand when the real economic driver is a rebound in supply, Chicago President Austan Goolsbee said Thursday.

- Employment and GDP have been much stronger recently than economic models had suggested following the Fed’s recent tightening cycle, while core PCE inflation has been much slower, so much so that “the real data have not followed the historical patterns at all,” according to the text of remarks to the Peterson Institute for International Economics in Washington.

- "In today’s environment, believing too strongly in the inevitability of a large trade-off between inflation and unemployment comes with the serious risk of a near-term policy error," Goolsbee said. His remarks didn't give a specific view on where the fed funds rate should move in the near term. (See MNI INTERVIEW: Fed Likely Overtightened-Ex-Boston Fed's Fuhrer). For more see MNI Policy main wire at 0905ET.

US TSYS Markets Roundup: 10Y Yields Off New 16Y High of 4.6861%

- US rates finish at/near highs Thursday (TYZ3 at 107-31.5, +13) after a mildly volatile first half.

- Treasury 10Y yield climbed to new 16Y high of 4.6861% amid fast two-way trade on heavy volumes post data: Weekly claims came out lower than expected (204k vs 215k est) Continuing Claims near in-line (1.670M vs. 1.675M est), GDP Price Index lower than expected (1.7% vs. 2.0% est), Personal Consumption missed (0.8% vs. 1.7% est).

- Curves steepened broadly as bonds followed EGBs: Bunds, Gilts and JGBs joined the sovereign selloff, one desk noted. "Markets are either believing CBs higher for longer rhetoric or perhaps doubting the resolve to cause the pain needed to bring inflation down to target levels."

- Rates climbed higher after midmorning Pending Home Sales data came out much lower than expected: MoM (-7.1% vs. -1.0% est), YoY (-18.8% vs. -13.0% est).

- Little react to Chicago Fed President Goolsbee said the Federal Reserve can generate a rare soft landing while a "China slowdown, higher oil prices, government shutdown" are all risks to the outlook.

- Fed Chairman Powell speaking at a teacher townhall event is not making any market moving policy statements.

- Friday Data Calendar: Inventories, PCE, Chicago PMI, UofM Sentiment.

OVERNIGHT DATA

- US JOBLESS CLAIMS +2K TO 204K IN SEP 23 WK

- US PREV JOBLESS CLAIMS REVISED TO 202K IN SEP 16 WK

- US CONTINUING CLAIMS +0.012M to 1.670M IN SEP 16 WK

US DATA: Initial jobless claims increased by less than expected to 204k (cons 215k) after a minimally upward revised 202k (initial 201k) vs 2019 av 218k.

- It sees another strong push lower for the four-week moving average to 211k (-6k) for its lowest since early February.

- The latest NSA change 175k after 177k makes the seasonally adjusted drop look on the favourable side again.

- Continuing claims also better than expected as they increased to 1670k (cons 1675k) after a downward revised 1658k (initial 1662k) vs 2019 av 1699k.

- US Q2 GDP +2.1%

US DATA: GDP was revised higher for the first quarter of 2023 and back through 2009, the Bureau of Economic Analysis said Thursday after issuing a comprehensive revision going back to 1979.

- Real GDP increased 2.2% in the first quarter, 0.2 percentage point faster than earlier published. In the 2017-2022 period, it grew at an average annual rate of 2.2%, 0.1 percentage point higher, and for 2009-2019, the rate was 2.4%, revised 0.1pp higher. Real GDI at 2.3% over 2017-2022 was also 0.2 pp higher than previously published.

- The BEA's third estimate of second-quarter growth was unchanged at 2.1%.

- Both PCE inflation and core PCE inflation in the first quarter were revised a tenth higher to 4.2% and 5.0%, respectively.

US DATA: The unrevised rounded core PCE print for Q2 at 3.7% annualized (3.66% after 3.69%) belied some notable upward revisions to past recent quarters, especially in 2022.

- Q1 was revised up to 4.96% (initially 4.88%), whilst 2022 is now seen to have averaged 5.09% annualized from an initial 4.84% - see chart below.

- US NAR AUG PENDING HOME SALES INDEX 71.8 V 77.3 IN JUL

- US NAR AUG PENDING HOME SALES -7.1% MOM; -18.7% YOY

MARKETS SNAPSHOT

- Key late session market levels

- DJIA up 81.56 points (0.24%) at 33635.29

- S&P E-Mini Future up 21.5 points (0.5%) at 4335.25

- Nasdaq up 101.6 points (0.8%) at 13195.17

- US 10-Yr yield is down 2.3 bps at 4.585%

- US Dec 10-Yr futures are up 10.5/32 at 107-29

- EURUSD up 0.0054 (0.51%) at 1.0557

- USDJPY down 0.38 (-0.25%) at 149.25

- WTI Crude Oil (front-month) down $1.86 (-1.99%) at $91.82

- Gold is down $8.9 (-0.47%) at $1866.22

- European bourses closing levels:

- EuroStoxx 50 up 29.88 points (0.72%) at 4161.56

- FTSE 100 up 8.63 points (0.11%) at 7601.85

- German DAX up 106.05 points (0.7%) at 15323.5

- French CAC 40 up 44.45 points (0.63%) at 7116.24

US TREASURY FUTURES CLOSE

- 3M10Y +1.017, -88.362 (L: -92.638 / H: -80.651)

- 2Y10Y +4.854, -48.353 (L: -53.194 / H: -43.248)

- 2Y30Y +6.676, -35.375 (L: -42.162 / H: -30.402)

- 5Y30Y +4.481, 7.72 (L: 2.591 / H: 9.218)

- Current futures levels:

- Dec 2-Yr futures up 5/32 at 101-10.25 (L: 101-04.25 / H: 101-10.375)

- Dec 5-Yr futures up 10/32 at 105-7.25 (L: 104-24 / H: 105-07.75)

- Dec 10-Yr futures up 10.5/32 at 107-29 (L: 107-07 / H: 107-30)

- Dec 30-Yr futures up 5/32 at 113-21 (L: 112-10 / H: 113-31)

- Dec Ultra futures up 9/32 at 118-19 (L: 116-25 / H: 118-29)

US 10Y FUTURE TECHS: (Z3) Bear Trend Firms Further

- RES 4: 111-12+ High Sep 1 key resistance

- RES 3: 110-13+ 50-day EMA

- RES 2: 109-20 High Sep19

- RES 1: 109-03/109-07+ Low Sep 13 / 20-day EMA

- PRICE: 107-11 @ 13:57 BST Sep 28

- SUP 1: 107-05+ 1.382 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 2: 106-23 1.50 proj of the Jul 18 - Aug 4 - Aug 10 price swing

- SUP 3: 106-13+ 2.0% Lower 10-dma envelope

- SUP 4: 106.00 Round number support

The bear trend in Treasuries remains intact and the contract is trading lower today. The extension this week confirms a resumption of the downtrend and maintains the bearish price sequence of lowers and lower highs - the definition of a downtrend. Sights are on 107-05, a Fibonacci projection. On the upside initial firm resistance is seen at 109-07+, the 20-day EMA. A break would signal a possible base.

SOFR FUTURES CLOSE

- Dec 23 +0.025 at 94.540

- Mar 24 +0.055 at 94.620

- Jun 24 +0.075 at 94.815

- Sep 24 +0.090 at 95.080

- Red Pack (Dec 24-Sep 25) +0.085 to +0.115

- Green Pack (Dec 25-Sep 26) +0.050 to +0.075

- Blue Pack (Dec 26-Sep 27) +0.030 to +0.045

- Gold Pack (Dec 27-Sep 28) +0.015 to +0.025

SHORT TERM RATES

SOFR Benchmark Settlements:

- 1M -0.00149 to 5.31459 (-0.00292/wk)

- 3M +0.00474 to 5.39482 (-0.00499/wk)

- 6M +0.00344 to 5.47093 (-0.00862/wk)

- 12M +0.00575 to 5.47484 (-0.01079/wk)

- Daily Effective Fed Funds Rate: 5.33% volume: $99B

- Daily Overnight Bank Funding Rate: 5.32% volume: $255B

- Secured Overnight Financing Rate (SOFR): 5.32%, $1.388T

- Broad General Collateral Rate (BGCR): 5.30%, $554B

- Tri-Party General Collateral Rate (TGCR): 5.30%, $544B

- (rate, volume levels reflect prior session)

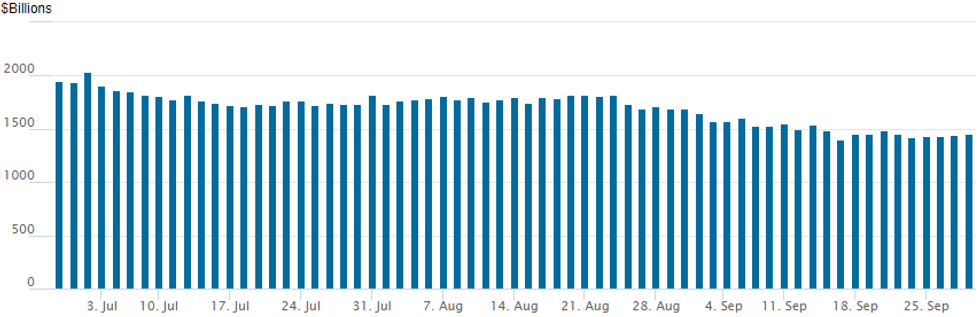

FED REVERSE REPO OPERATION

NY Federal Reserve/MNI

Repo operation up to 1,453.366B w/97 counterparties, compared to $1,442.805B in the prior session. The high for 2023 stands at $2,375.171B on Friday March 31, 2023; all-time record high of $2,553.716B reached December 30, 2022.

EGBs-GILTS CASH CLOSE: Bund Yields Near 3% As Core FI Rout Continues

European yields rose sharply again Thursday as the core FI rout continued, amid heavy futures trading volumes.

- Bunds and Gilts sold off relentlessly through almost the entire session, shrugging off marginally softer-than-expected German/Spanish inflation prints, only finding a footing about an hour before the cash close.

- The German and UK curves ended bear steeper. Though yields finished off the highs, we still saw multiple multi-year highs set. 10Y Bund notably came within 1.7bp of the 3.00% mark but finished at a post-2011 high of 2.93%.

- 10Y Gilt yields meanwhile had risen over 20bp at one point before settling "just" 12bp higher.

- Once again it was difficult to pinpoint a trigger for the violent selloff, which could best be pinned on "higher-for-longer" bearish price action.

- 10Y BTP spreads widened to 200bp for the first time since 1Q, but ended up lower on the day as risk assets rallied after the US cash equity open.

- Friday's main focus is Eurozone inflation, which after today's prints looks likely to come in below expectations coming into the week. We also get UK GDP, German jobs data, and appearances by ECB's Lagarde, Vasle, Vujcic, Kazaks, and Visco.

Closing Yields / 10-Yr Periphery EGB Spreads To Germany

- Germany: The 2-Yr yield is up 4.2bps at 3.286%, 5-Yr is up 7.8bps at 2.89%, 10-Yr is up 8.7bps at 2.93%, and 30-Yr is up 5.6bps at 3.089%.

- UK: The 2-Yr yield is up 6.5bps at 4.939%, 5-Yr is up 11.1bps at 4.583%, 10-Yr is up 12.6bps at 4.484%, and 30-Yr is up 11bps at 4.903%.

- Italian BTP spread down 0.8bps at 193.8bps / Spanish down 0.7bps at 109.2bps

FOREX

- EURUSD up 0.0054 (0.51%) at 1.0557

- USDJPY down 0.38 (-0.25%) at 149.25

FRIDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/09/2023 | 2300/1900 |  | US | Richmond Fed's Tom Barkin | |

| 29/09/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 29/09/2023 | 0600/0700 | *** |  | UK | GDP Second Estimate |

| 29/09/2023 | 0600/0700 | * |  | UK | Quarterly current account balance |

| 29/09/2023 | 0600/0800 | ** |  | DE | Retail Sales |

| 29/09/2023 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 29/09/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 29/09/2023 | 0645/0845 | ** |  | FR | PPI |

| 29/09/2023 | 0645/0845 | ** |  | FR | Consumer Spending |

| 29/09/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 29/09/2023 | 0740/0940 |  | EU | ECB's Lagarde speaks at IEA-ECB-EIB Conference | |

| 29/09/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 29/09/2023 | 0830/0930 | ** |  | UK | BOE M4 |

| 29/09/2023 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 29/09/2023 | 0900/1100 | *** |  | EU | HICP (p) |

| 29/09/2023 | 0900/1100 | *** |  | IT | HICP (p) |

| 29/09/2023 | - |  | UK | Publication of the Treasury bill calendar for October-December 2023. | |

| 29/09/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 29/09/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 29/09/2023 | 1230/0830 | ** |  | US | Advance Trade, Advance Business Inventories |

| 29/09/2023 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 29/09/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

| 29/09/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 29/09/2023 | 1600/1200 | ** |  | US | USDA GrainStock - NASS |

| 29/09/2023 | 1645/1245 |  | US | New York Fed's John Williams |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.