-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Ylds Receding, Hawkish FOMC Messaging Expected

- MNI Fed Preview - May 2024: Analyst Outlook: More Hawkish Message Expected As Cuts Get Pushed

- MNI BRIEF: Treasury Raises Q2 Borrowing Estimate By USD41B

- MNI US DATA: Regional Fed Mfg Surveys And PMI Move In Opposite Directions Before ISM

US

Fed Preview (MNI) May 2024 Analyst Outlook: More Hawkish Message Expected As Cuts Get Pushed Back: Analysts generally look for a more hawkish message from the FOMC in May compared with March, in light of strong inflation and economic activity data.

- None expect the Statement forward guidance to be changed, though a few see potential for tweaks. Several eye risks of the characterization of inflation to be changed in a hawkish fashion.

- Generally, Powell is expected to tilt more cautious on the inflation outlook than in previous appearances, with potential flashpoints for markets including whether he acknowledges that 3 cuts are less likely to be the base case for the FOMC in 2024, and/or whether June is too early for the first cut.

NEWS

TSY BRIEF (MNI): Treasury Raises Q2 Borrowing Estimate By USD41B: The U.S. Treasury Department on Monday announced it expects to borrow USD243 billion in privately held net marketable debt in the second quarter, USD41 billion more than previously announced in January due to lower cash receipts. Officials expect to borrow USD847 billion in the third quarter.

MIDEAST (MNI): Blinken Starts MENA Trip, Proposal To Hamas 'Extraordinarily Generous': US Secretary of State Antony Blinken has started another visit to the Middle East, holding talks with Saudi Foreign Minister Prince Faisal bin Farhan bin Abdullah in Riyadh. Blinken will hold talks with his counterparts from Qatar, Egypt, the UAE, Turkey and Jordan, as will French Foreign Minister Stephane Sejourne, who is also in Saudi Arabia. Blinken is then expected to visit Israel later in the week.

CHINA-EU (MNI): Xi Visit Confirmed 5-10 May As Trade Tensions Escalate: Wires reporting comments from the Chinese Foreign Ministry ahead of President Xi Jinping's upcoming trip to Europe, taking place 5-10 May. Says that the trip to France, Serbia, Hungary, and the EU institutions in Brussels "are vitally important for China's relations" with each partner, and will "provide new impetus for global peace and development".

US Tsys Briefly Trim Gains After Higher Than Expected Tsy borrow Estimates

- Treasury futures continued to climb off last Thursday's approximate 5-month lows Monday, completely recovering from a sell-off on lower than expected weekly claims and strong PCE data that saw 10Y yield climb to 4.7351% high.

- Tsys pared gains briefly after higher than expected Tsy borrow estimates to $243 billion in privately held net marketable debt in the second quarter, USD41 billion more than previously announced in January due to lower cash receipts. Officials expect to borrow $847 billion in the third quarter.

- Otherwise, generally subdued week opener with focus on Wednesday's FOMC policy announcement and April employment report on Friday.

- Generally, Powell is expected to tilt more cautious on the inflation outlook than in previous appearances, with potential flashpoints for markets including whether he acknowledges that 3 cuts are less likely to be the base case for the FOMC in 2024, and/or whether June is too early for the first cut.

- Projected rate cut pricing largely eased slightly: May 2024 -2.1% w/ cumulative -0.5bp at 5.324%; June 2024 at -10.6% w/ cumulative rate cut -3.2bp at 5.297%, July'24 cumulative at -8.1bp, Sep'24 cumulative -18.1bp.

OVERNIGHT DATA

US DATA (MNI): Regional Fed Mfg Surveys And PMI Move In Opposite Directions Before ISM:

- The Dallas Fed manufacturing survey (-14.5 after -14.4) completes the five regional Fed manufacturing surveys for April.

- The unweighted average bounced from -10.8 to -5.1, back closer to its -3.4 in Feb (highest since Apr 2022), after April gains from Empire, Richmond and especially Philly surveys.

- This improvement goes against the decline seen in the preliminary S&P Global US manufacturing PMI for April, which surprisingly fell from 51.9 to 49.9, although taken together they’re at relative levels similar to the ISM manufacturing’s 50.3 from March.

- Consensus sees ISM mfg dipping slightly to 50.0 on Wednesday although tomorrow’s MNI Chicago PMI can help add color here.

MARKETS SNAPSHOT

- Key market levels of markets in late NY trade:

- DJIA up 146.43 points (0.38%) at 38386.09

- S&P E-Mini Future up 15.75 points (0.31%) at 5147.25

- Nasdaq up 55.2 points (0.3%) at 15983.08

- US 10-Yr yield is down 5.8 bps at 4.6053%

- US Jun 10-Yr futures are up 13/32 at 107-31.5

- EURUSD up 0.0029 (0.27%) at 1.0722

- USDJPY down 2.2 (-1.39%) at 156.13

- WTI Crude Oil (front-month) down $1.12 (-1.34%) at $82.74

- Gold is down $1.79 (-0.08%) at $2336.17

- European bourses closing levels:

- EuroStoxx 50 down 25.76 points (-0.51%) at 4981.09

- FTSE 100 up 7.2 points (0.09%) at 8147.03

- French CAC 40 down 23.09 points (-0.29%) at 8065.15

US TREASURY FUTURES CLOSE

- 3M10Y -5.423, -80.257 (L: -86.376 / H: -76.654)

- 2Y10Y -3.268, -36.932 (L: -36.932 / H: -33.846)

- 2Y30Y -2.626, -25.042 (L: -25.042 / H: -22.11)

- 5Y30Y +0.016, 8.685 (L: 7.91 / H: 10.487)

- Current futures levels:

- Jun 2-Yr futures up 1.5/32 at 101-15 (L: 101-13.25 / H: 101-15.25)

- Jun 5-Yr futures up 7/32 at 105-3 (L: 104-27.75 / H: 105-03.5)

- Jun 10-Yr futures up 13/32 at 107-31.5 (L: 107-18.5 / H: 107-31.5)

- Jun 30-Yr futures up 28/32 at 114-23 (L: 113-30 / H: 114-24)

- Jun Ultra futures up 1-04/32 at 120-26 (L: 119-23 / H: 120-26)

US 10Y FUTURE TECHS: (M4) Gains Considered Corrective

- RES 4: 110-06 High Apr 4

- RES 3: 109-26+ High Apr 10

- RES 2: 109-17 50-day EMA

- RES 1: 108-15+ 20-day EMA

- PRICE: 107-30 @ 1415 ET Apr 29

- SUP 1: 107-04 Low Apr 25

- SUP 2: 106-27 2.764 proj of Dec 27 - Jan 19 - Feb 1 price swing

- SUP 3: 106-16 Base of a bear channel drawn from the Feb 1 low

- SUP 4: 106-08 3.00 proj of Dec 27 - Jan 19 - Feb 1 price swing

The trend outlook in Treasuries is unchanged and the direction remains down. The contract traded to a fresh cycle low last Thursday. MA studies are in a bear-mode set-up too, highlighting a clear downtrend. Note too that the recent consolidation appears to have been a flag formation - a bearish continuation pattern. Sights are on 106-27 next, a Fibonacci projection. Firm resistance is 108-15+, the 20-day EMA.

SOFR FUTURES CLOSE

- Jun 24 -0.005 at 94.705

- Sep 24 steady at 94.845

- Dec 24 +0.015 at 95.015

- Mar 25 +0.025 at 95.20

- Red Pack (Jun 25-Mar 26) +0.030 to +0.045

- Green Pack (Jun 26-Mar 27) +0.055 to +0.070

- Blue Pack (Jun 27-Mar 28) +0.070 to +0.080

- Gold Pack (Jun 28-Mar 29) +0.080 to +0.085

SOFR FIXES AND PRIOR SESSION REFERENCE RATES

SOFR Benchmark Settlements:

- 1M -0.00256 to 5.31317 (-0.00117 total last wk)

- 3M -0.00269 to 5.32681 (+0.00310 total last wk)

- 6M -0.00475 to 5.30909 (+0.01094 total last wk)

- 12M -0.00727 to 5.23653 (+0.02929 total last wk)

- Secured Overnight Financing Rate (SOFR): 5.32% (+0.01), volume: $1.795T

- Broad General Collateral Rate (BGCR): 5.31% (+0.01), volume: $688B

- Tri-Party General Collateral Rate (TGCR): 5.31% (+0.01), volume: $673B

- (rate, volume levels reflect prior session)

- Daily Effective Fed Funds Rate: 5.33% (+0.00), volume: $94B

- Daily Overnight Bank Funding Rate: 5.32% (+0.00), volume: $270B

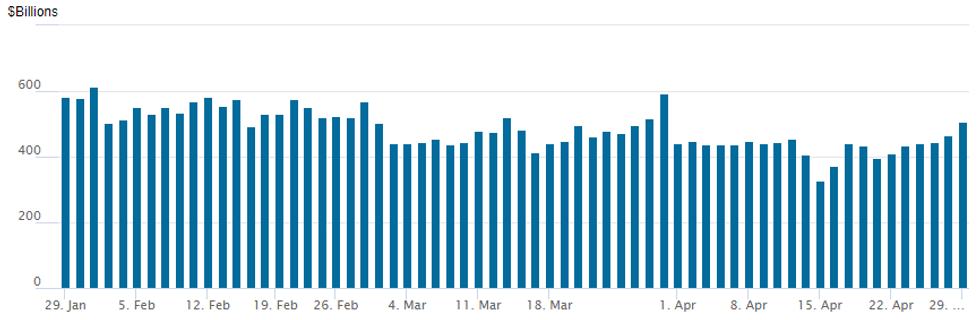

FED Reverse Repo Operation

NY Federal Reserve/MNI

- RRP usage climbs back over $500B to $505.530B vs. $464.912B last Friday. Compares to $327.066B on Monday, April 15 -- the lowest level since mid-May 2021.

- Meanwhile, the latest number of counterparties slips to 75 vs. 78 prior.

PIPELINE $10B Boeing 6Pt Priced, $850M DTE Energy Launched

- Date $MM Issuer (Priced *, Launch #)

- 4/29 $10B *Boeing $1B 3Y +145, $1.5B 5Y +165, $1B 7Y +175, $2.5B 10Y +190, $2.5B 30Y +210, $1.5B 40Y +225 (well below the $25B issued on April 30, 2020 over 7 tranches)

- 4/29 $850M #DTE Energy 10Y +125

- 4/29 $750M #Antofagasta 10Y +170

- 4/29 $600M *Kookmin Bank $300M 3Y +60, $300M 5Y +65

- 4/29 $Benchmark ADQ (Abu Dhabi Development Co) 5Y, 10Y investor calls

FOREX JPY Volatility In Focus To Start The Week

- USDJPY posted an impressive 563-pip range on Monday as fresh cycle highs above 160.00 likely prompted Japanese officials to intervene and stabilise the yen. In early Europe, USDJPY printed as low as 154.54 with holiday-thinned trade potentially exacerbating the price swings.

- USDJPY spent a lot of the US session edging back to the high 156’s, however, renewed weakness saw a quick late dip to 155.10, as markets remain wary over any sudden moves. As a reminder, initial key technical support to watch lies at 154.01, the 20-day EMA.

- There has been no official confirmation on intervention from Japanese authorities, with top currency official Kanda stating he has ‘no comment for now’ and that the market will find out of possible intervention when data is posted in late May.

- As a result, the USD index resides 0.40% lower, in fitting with modestly lower US yields. Stock markets trade marginally in the green, which assists the likes AUD (+0.55%) and NZD (+0.65%) which outperform in G10 and is bolstering the performance of EM FX.

- With Aussie retail sales and China PMIs due overnight, attention will be on a developing bullish phase for AUDUSD. Resistance at 0.6526, the 50-day EMA, has been breached and the clear break highlights a stronger reversal that signals scope for a climb towards 0.6644, the Apr 9 high.

- GBPUSD is also now up over half a percent on the session, trading above 1.2550. Despite the trend condition in GBPUSD remaining bearish, a corrective cycle continues to play out, which is allowing an oversold condition to unwind. Price action has narrowed the gap to resistance at 1.2580, the 50-day EMA.

- Key attention this week will rest on Wednesday’s Fed meeting and press conference, as well as Friday’s release of NFP.

TUESDAY DATA CALENDAR

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/04/2024 | 2301/0001 | * |  | UK | BRC Monthly Shop Price Index |

| 30/04/2024 | 2330/0830 | * |  | JP | Labor Force Survey |

| 30/04/2024 | 2330/0830 | ** |  | JP | Industrial Production |

| 30/04/2024 | 2330/0830 | * |  | JP | Retail Sales (p) |

| 30/04/2024 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 30/04/2024 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

| 30/04/2024 | 0130/1130 | ** |  | AU | Retail Trade |

| 30/04/2024 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 30/04/2024 | 0530/0730 | *** |  | FR | GDP (p) |

| 30/04/2024 | 0530/0730 | ** |  | FR | Consumer Spending |

| 30/04/2024 | 0600/0800 | ** |  | DE | Retail Sales |

| 30/04/2024 | 0600/0800 | ** |  | DE | Import/Export Prices |

| 30/04/2024 | 0645/0845 | *** |  | FR | HICP (p) |

| 30/04/2024 | 0645/0845 | ** |  | FR | PPI |

| 30/04/2024 | 0700/0900 | *** |  | ES | GDP (p) |

| 30/04/2024 | 0700/0900 | ** |  | CH | KOF Economic Barometer |

| 30/04/2024 | 0755/0955 | ** |  | DE | Unemployment |

| 30/04/2024 | 0800/1000 | *** |  | IT | GDP (p) |

| 30/04/2024 | 0800/1000 | *** |  | DE | GDP (p) |

| 30/04/2024 | 0830/0930 | ** |  | UK | BOE M4 |

| 30/04/2024 | 0830/0930 | ** |  | UK | BOE Lending to Individuals |

| 30/04/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 30/04/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 30/04/2024 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 30/04/2024 | 0900/1100 | *** |  | IT | HICP (p) |

| 30/04/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 30/04/2024 | 1100/1200 |  | UK | Asset Purchase Facility Quarterly Report 2024 Q1 | |

| 30/04/2024 | 1230/0830 | *** |  | US | Employment Cost Index |

| 30/04/2024 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 30/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 30/04/2024 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 30/04/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/04/2024 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 30/04/2024 | 1345/0945 | *** |  | US | MNI Chicago PMI |

| 30/04/2024 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 30/04/2024 | 1400/1000 | ** |  | US | housing vacancies |

| 30/04/2024 | 1430/1030 | ** |  | US | Dallas Fed Services Survey |

| 30/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 01/05/2024 | 2245/1045 | *** |  | NZ | Quarterly Labor market data |

| 01/05/2024 | 2300/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.