-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI CHINA LIQUIDITY INDEX: Conditions Ease, Economy A Concern

MNI Aug China Liquidity Conditions Index 32.7 Vs 46.0 Jul

Liquidity across China's interbank market picked up through August, helped by central bank money market operations, according to the latest MNI Liquidity Conditions survey, which also highlights concerns over the slowing economy.

The Liquidity Condition Index eased to 32.7 in August from 46.0 in July, the lowest reading in the last 5 months, with almost half of respondents reporting "loose" liquidity conditions after the bigger-than-expected MLF operation in mid-month.

The higher the index reading, the tighter liquidity appears to survey participants.

One trader at a state-owned bank in Shandong told MNI conditions were tight in the first part of the month, before easing significantly after the People's Bank of China's MLF injection, with another in Nanjing noting the decline in repo rates following the bank's operations.

The PBOC conducted a CNY600 billion MLF in mid-August against a maturing CNY700 billion MLF. The drain of net CNY100 was less than market expectations.

SLOWING ECONOMY

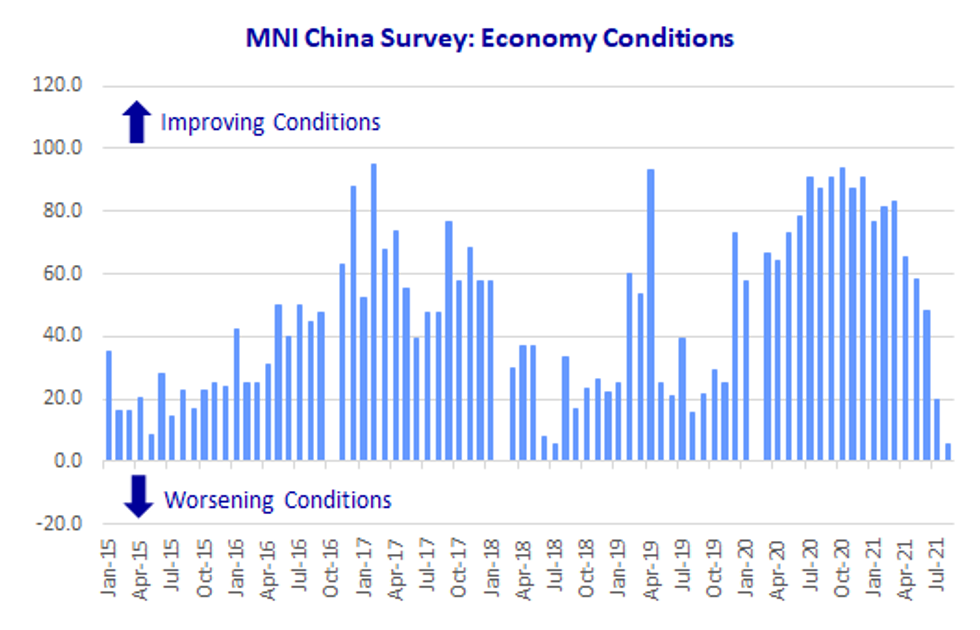

The Economy Condition Index fell again in August, dropping to 5.8 from the previous 20.0, the lowest level since February 2020. "Falling back" was mentioned by 9/10 survey participants who expressed concern over the economy. Respondents noted signs of the virus picking up, falling incomes, extreme weather conditions and supply-side issues for manufacturers as reasons for concern.

PRUDENT POLICY

The PBOC Policy Bias Index edged lower to 40.4 in August, down from July's 46. Most respondents saw policy unchanged, with the rest expecting 'looser policy' as the economy slows, although one Beijing-based trader pointed to the complications thrown up by the 'external situation'.

The Guidance Clarity Index, at 55.8 in August, was down slightly on July's 58.0, with almost 90% of traders seeing signals from the central bank as clear enough to guide the market.

In Q2 monetary policy report, released August 9, the PBOC said policy should be flexible and precise, reasonable and appropriate, with stability the top priority.

LONG-END YIELD SLIDE

The 7-Day Repo Rate Index fell to 57.7 from last 10-month peak 72.0, with 46.2% of the participants seeing a rise of the curve towards the end of month.

The 7-day weighted average interbank repo rate for depository institutions (DR007) closed at 2.2205% Tuesday, while the 10-year CGB Yield Index, fell for a second consecutive month to 30.8, down from 32.0, with nearly half of traders predicting lower yields in the next three months.

RATE CUT

Addressing recent market speculation that the PBOC could be considering a cut in benchmark lending rates, the special question in the August survey asked traders "Do you think it's possible to cut rate in the next three months?"

Only 1-in-5 respondents expected a cut over that period, with a further 20% not committing either way. The remaining 60% said a rate cut was 'not likely'.

China's one-year and five-year LPR have now been unchanged at 3.85% and 4.65% for 16 consecutive months.

The MNI survey collected the opinions of 26 traders with financial institutions operating in China's interbank market, the country's main platform for trading fixed income and currency instruments, and the main funding source for financial institutions. Interviews were conducted Aug 9 – Aug 20.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.