-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Colombia Central Bank Preview - July 2021: Hawkish Tweaks

Banco De La Republica

Executive Summary

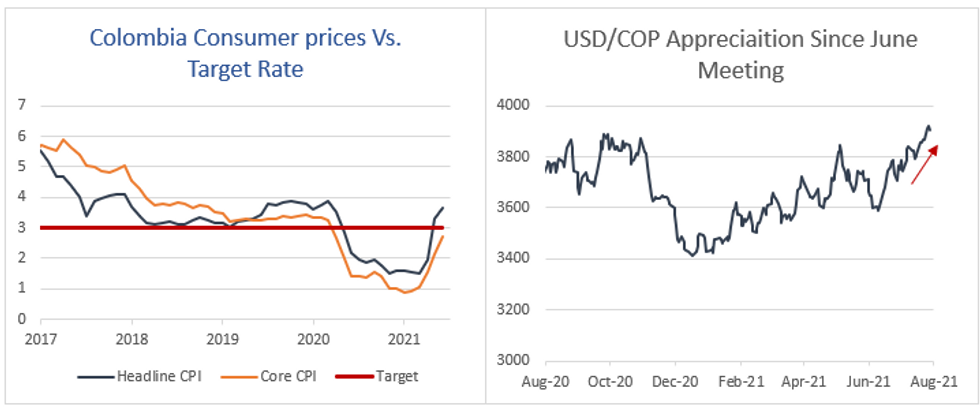

- The Monetary Policy Committee are likely to keep the overnight lending rate unchanged at 1.75%, with Inflation expectations remain well anchored.

- Despite a dip in June CPI, increases in core prices, a weakening Peso and base effects over the coming months may provide a more challenging inflation outlook for the MPC.

- The consensus among sell-side analyst appears to point to monetary tightening being initiated as early as September and therefore, to avoid any abrupt policy shift, the committee's communication may become marginally more hawkish.

Click to view the full preview: MNI BanRep Preview - July 2021.pdf

Further Evidence of Inflationary Pressure Needed

Monthly headline consumer price inflation actually fell 0.05% in June. While the annual headline print came in below expectations, 3.63% vs. 3.71%, this still signified an increase from the prior reading of 3.3% in May. While still within the central bank's tolerance band, this represented its fastest rate since the pandemic hit Colombia. Annual Core CPI rose to 2.7% from a prior 2.11%. Analysts point out that services inflation is likely to advance due to the loosening of restrictions as well as base effects contributing to further pressure for inflation dynamics over the coming months.

Markets May Also Place Pressure on Dovish Stance

Since the June meeting, USDCOP has risen just over 5%. With Fitch joining Standard & Poors in downgrading the long-term foreign-currency rating to junk, only Moody's still has the nation at investment grade. This, combined with lingering concerns related to social unrest from the most recent tax reform, has kept the local currency on the backfoot. With a weakening trend in place, this is likely to negatively effect the inflation outlook. Additionally, pre-emptive policy action being taken by other emerging market central banks as well as continued discussions surrounding Federal Reserve tapering could fast track the discussion regarding a potential path to normalisation.

Source MNI/Bloomberg

Source MNI/Bloomberg

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.