-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI US Inflation Insight: Softer Housing Helps Ensure Dec Cut

MNI DAILY TECHNICAL ANALYSIS - USDJPY Key Resistance Remains Exposed

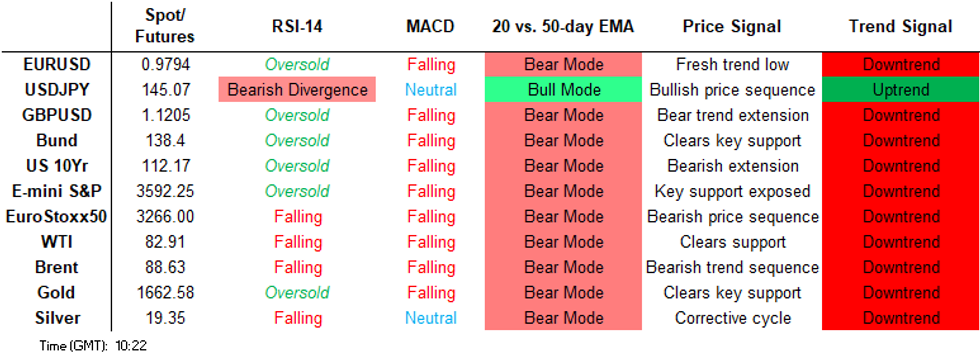

Price Signal Summary - USDJPY Approaches Its Key Short-Term Bull Trigger

- In the equity space, S&P E-Minis trend conditions remain bearish. Last week’s fresh trend lows strengthens bearish conditions and note that a key support at 3657.00, the Jun 17 low and an important medium-term bear trigger, has been pierced. The break would confirm a resumption of the broader downtrend. The focus is on 3558.97, 1.382 projection of the Aug 16 - Sep 7 - 13 price swing. EUROSTOXX 50 futures remain vulnerable following last week’s continuation lower and today’s bearish start to the week. Key short-term support at 3341.00, the Jul 5 low, has been breached. The focus is on 3229.00 next, the Nov 9 2020 low (cont).

- In FX, EURUSD short-term gains are considered corrective. The move higher last week, does suggest scope for an extension of the correction. Note too that the bounce from last Wednesday’s low of 0.9536 means the bear channel base, at 0.9477 today, remains intact. The 20-day EMA, at 0.9865 represents the next resistance, a break would be a positive development. The channel top intersects at 1.0004. A resumption of weakness would open 0.9536/9477. GBPUSD is holding onto its recent gains and a corrective cycle remains in play. The latest recovery reinforces the importance of the hammer reversal candle on Sep 26 and suggests scope for stronger corrective bounce. The next resistance is 1.1261, the 20-day EMA. A clear break would strengthen the current short-term bull cycle and potentially open the 50-day EMA at 1.1587. USDJPY key support is 140.36, the Sep 22 low. Attention is on the bull trigger at 145.90, the Sep 22 high. A break would confirm a resumption of the uptrend and open 146.03, 2.764 projection of the Aug 2 - 8 - 11 price swing. Initial support is 142.95, the 20-day EMA.

- On the commodity front, Gold remains in a downtrend and recent gains are considered corrective. Fresh trend lows last week confirm a resumption of the trend and this opens $1610.5, the 1.00 projection of the Jun 13 - Jul 21 - Aug 10 swing. The next resistance is at $1676.6, the 20-day EMA. In the Oil space, a bearish threat in WTI futures remains present and the recovery from last Monday’s low is considered corrective. First resistance is at $83.31, the 20-day EMA. A clear break would open the 50-day EMA, at $87.26. On the downside, a resumption of weakness would open $76.11, 1.618 projection of the Jul 29 - Aug 16 - 30 price swing.

- In the FI space, Bund futures remain in a clear downtrend and the extension lower last week, reinforces current conditions. The focus is on 135.27, the Mar 2012 low (cont). Gains are considered corrective. The primary trend direction in Gilts remains bearish. A resumption of weakness would refocus attention on 90.99, the Sep 28 low and the bear trigger. Note that last Wednesday’s price pattern was a bullish engulfing candle. However, additional bullish price evidence is required to validate this signal and confirm a short-term reversal.

FOREIGN EXCHANGE

EURUSD TECHS: Corrective Cycle Still In Play

- RES 4: 1.0051 High Sep 20

- RES 3: 1.0004 Bear channel top drawn from the Feb 10 high

- RES 2: 0.9907 High Sep 22

- RES 1: 0.9871 20-day EMA

- PRICE: 0.9787 @ 06:05 BST Oct 3

- SUP 1: 0.9636/9536 Low Sep 29 / 28

- SUP 2: 0.9501 1.382 projection of the Aug 10 - Sep 6 - 12 price swing

- SUP 3: 0.9477 Bear channel base drawn from the Feb 10 high

- SUP 4: 0.9442 1.50 projection of the Aug 10 - Sep 6 - 12 price swing

EURUSD is holding on to the bulk of its recent gains and the latest correction remains in play. Gains last week suggest scope for a continuation higher near-term and an extension of the correction. Note too that the bounce from last Wednesday’s low means the channel base, at 0.9477, has provided support. The 20-day EMA, at 0.9865 is first resistance. The channel top intersects at 1.0004. A resumption of weakness would open 0.9536/9477.

GBPUSD TECHS: Approaching The 20-Day EMA

- RES 4: 1.1587 50-day EMA

- RES 3: 1.1461 High Sep 20

- RES 2: 1.1364 High Sep 22

- RES 1: 1.1261/81 20-day EMA / Intraday high

- PRICE: 1.1222 @ 09:36 BST Oct 3

- SUP 1: 1.0763 Low Sep 29

- SUP 2: 1.0541/0350 Low Sep 28 / All Time Low

- SUP 3: 1.0203 3.236 proj of the Jun 16 - Jul 14 - Aug 1 price swing

- SUP 4: 1.0108 3.382 proj of the Jun 16 - Jul 14 - Aug 1 price swing

GBPUSD is trading closer to its recent highs and ahead of resistance at 1.1261, the 20-day EMA. The latest recovery follows a short-term reversal on Sep 26 - a hammer candle pattern highlighted a short-term base. This is allowing a recent oversold trend reading to unwind. A break of the 20-day EMA would strengthen the current bull cycle and open 1.1587, the 50-day EMA. 1.0350, the Sep 26 low, remains the bear trigger and key support.

EURGBP TECHS: Retracement Mode

- RES 4: 0.9501 High Mar 19 2020 and major resistance

- RES 3: 0.9388 High Mar 23 2020

- RES 2: 0.9292 High Sep 11 2020

- RES 1: 0.9066/9266 High Sep 28 / High Sep 26 and key resistance

- PRICE: 0.8749 @ 09:37 BST Oct 3

- SUP 1: 0.8713 Intraday low

- SUP 2: 0.8692 Low Sep 22

- SUP 3: 0.8649 50-day EMA

- SUP 4: 0.8626 Low Sep 14

EURGBP continues to retrace recent gains and remains well below 0.9266 - the Sep 26 high and the key short-term resistance. The latest pullback is considered corrective and this is allowing a recent overbought trend reading to unwind. The 20-day EMA at 0.8765, has been pierced. A clear break would signal scope for an extension, perhaps towards the 50-day EMA, at 0.8649. Initial firm resistance is seen at 0.9066, the Sep 28 high.

USDJPY TECHS: Approaching The Bull Trigger

- RES 4: 146.52 1.236 proj of the May 24 - Jul 14 - Aug 2 price swing

- RES 3: 146.03 2.764 proj of the Aug 2 - 8 - 11 price swing

- RES 2: 145.90 High Sep 22 and the bull trigger

- RES 1: 145.30 Intraday high

- PRICE: 144.93 @ 05:55 BST Oct 3

- SUP 1: 142.95/141.77 20-day EMA / Low Sep 23

- SUP 2: 140.36 Low Sep 22 and key short-term support

- SUP 3: 140.03 50-day EMA

- SUP 4: 139.39 High Jul 14 and a former key resistance

USDJPY has traded higher today. The pair is holding on to the recovery from 140.36, the Sep 22 low and key short-term support. The primary uptrend remains intact and attention is on the bull trigger at 145.90, the Sep 22 high. A break would confirm a resumption of the bull cycle and open 146.03, a Fibonacci projection. A break of 140.36 is required to highlight a top and the potential for a deeper retracement.

EURJPY TECHS: Holding On To Recent Gains

- RES 4: 145.64 High Sep 12 and the bull trigger

- RES 3: 144.48 High High Sep 14

- RES 2: 143.70 76.4% retracement of the Sep 12 - 26 downleg

- RES 1: 142.49 61.8% retracement of the Sep 12 - 26 downleg

- PRICE: 142.24 @ 06:55 BST Nov 3

- SUP 1: 139.44/137.40 Low Sep 29 / 26 and key support

- SUP 2: 136.02 Low Aug 25

- SUP 3: 135.52 Low Aug 24

- SUP 4: 134.95 Low Aug 16 and a key support

EURJPY is holding on to its latest gains and has traded higher today, marking an extension of the recovery from 137.40, the Sep 26 low. Recent weakness between Sep 12 - 26 appears to have been a correction and if correct, the latest recovery signals the end of that cycle. The focus is on 143.70, a Fibonacci retracement and a continuation would open the key resistance at 145.64, Sep 12 high. Key support lies at 137.40.

AUDUSD TECHS: Trend Remains Down

- RES 4: 0.6770 50-day EMA

- RES 3: 0.6671 High Sep 22

- RES 2: 0.6632 20-day EMA

- RES 1: 0.6550 High Sep 26

- PRICE: 0.6433 @ 08:03 BST Oct 3

- SUP 1: 0.6363 Low Sep 28 and the bear trigger

- SUP 2: 0.6337 Low Apr 24 2020

- SUP 3: 0.6283 Low Apr 23 2020

- SUP 4: 0.6255 1.236 proj of the Apr 5 - May 12 - Jun 3 price swing

AUDUSD remains in a downtrend and short-term gains are considered corrective. The recent break of support at 0.6682, the Jul 14 low and a bear trigger, has strengthened bearish conditions and maintains the broader downward price sequence of lower lows and lower highs. The focus is on 0.6337 next, the Apr 24 2020 low. Initial firm resistance has been defined at 0.6632, the 20-day EMA.

USDCAD TECHS: Trend Needle Still Points North

- RES 4: 1.4000 Psychological round number

- RES 3: 1.3970 3.236 proj of the Aug 25 - Sep 7 - 13 price swing

- RES 2: 1.3896 3.00 proj of the Aug 25 - Sep 7 - 13 price swing

- RES 1: 1.3838 High Sep 30

- PRICE: 1.3749 @ 08:07 BST Oct 3

- SUP 1: 1.3603/3468 Low Sep 28 / 23

- SUP 2: 1.3424 20-day EMA

- SUP 3: 1.3195 50-day EMA

- SUP 4: 1.2954 Low Sep 13 and a key support

USDCAD traded higher last week and a bullish theme remains intact. The recent extension reinforces the uptrend and maintains the positive price sequence of higher highs and higher lows. Moving average studies are in a bull mode position, highlighting current market sentiment. Sights are set on 1.3896 next, a Fibonacci projection. On the downside, initial firm support is at 1.3424, the 20-day EMA.

FIXED INCOME

BUND TECHS: (Z2) Bearish Trend Direction Intact

- RES 4: 142.58 High Sep 20

- RES 3: 142.02 High Sep 22

- RES 2: 141.42 20-day EMA

- RES 1: 139.29/140.99 High Sep 27 / 23

- PRICE: 138.36 @ 05:17 BST Oct 3

- SUP 1: 135.41 4.236 proj of the Aug 2 - 12 - 15 price swing

- SUP 2: 135.27 Low Mar 2012 (cont)

- SUP 3: 134.76 4.382 proj of the Aug 2 - 12 - 15 price swing

- SUP 4: 134.24 4.50 proj of the Aug 2 - 12 - 15 price swing

Bund futures remain in a downtrend and moving average studies point south. Short-term gains are considered corrective. The extension lower last week confirmed a continuation of the bear cycle that started early August. 140.67, the Jun 16 low (cont), has been cleared. The break s confirms a resumption of the primary downtrend. Attention is on 135.27 next, the Mar 2012 low (cont). The 20-day EMA, at 141.42 remains a firm resistance.

BOBL TECHS: (Z2) Trend Needle Is Still Pointing South

- RES 4: 121.570 High Sep 19

- RES 3: 120.940 High Sep 21

- RES 2: 120.752 20-day EMA

- RES 1: 120.150 High 23

- PRICE: 119.590 @ 05:23 BST Oct 3

- SUP 1: 118.020 Low Sep 28 and the bear trigger

- SUP 2: 117.918 2.382 proj of the Aug 25 - Sep 1 - Sep 6 price swing

- SUP 3: 117.630 2.50 proj of the Aug 25 - Sep 1 - Sep 6 price swing

- SUP 4: 117.342 2.618 proj of the Aug 25 - Sep 1 - Sep 6 price swing

The trend needle in Bobl futures is unchanged and still points south and recent gains are considered corrective. Last week’s fresh cycle lows reinforce bearish conditions. A key support at 119.940, the Jun 16 low (cont) and the bear trigger, has recently been cleared. The break confirms a resumption of the broader downtrend and opens 117.918 next, a Fibonacci projection. Firm resistance is seen at 120.752, the 20-day EMA.

SCHATZ TECHS: (Z2) Corrective Bounce

- RES 4: 107.585 High Sep 19

- RES 3: 107.392 20-day EMA

- RES 2: 107.380 High Sep 20

- RES 1: 107.265 High Sep 30

- PRICE: 107.075 @ 05:29 BST Oct 3

- SUP 1: 106.513 2.236 proj of the Aug 25 - Sep 1 - Sep 6 price swing

- SUP 2: 106.379 2.382 proj of the Aug 25 - Sep 1 - Sep 6 price swing

- SUP 3: 106.000 Round number support

- SUP 4: 105.800 Low Nov 2008 (cont)

The Schatz futures trend direction remains down and the latest recovery is considered corrective. Recent fresh trend lows confirm once again an extension of the bear cycle. This also maintains the current bearish price sequence of lower lows and lower highs and moving average studies remain in a bear mode position. The focus is on 106.513 next, a Fibonacci projection. On the upside, initial firm resistance is seen at 107.392, the 20-day EMA.

GILT TECHS: (Z2) Monitoring The Bullish Engulfing Candle

- RES 4: 101.80 20-day EMA

- RES 3: 100.00/102.45 Round number resistance / High Sep 23

- RES 2: 98.68 Low Sep 23 and gap high on the daily chart

- RES 1: 98.01 Intraday high

- PRICE: 96.93 @ Close Nov 3

- SUP 1: 90.99 Low Sep 28 and the bear trigger

- SUP 2: 90.57 2.618 proj of the May 12 - Jun 16 - Aug 2 swing (cont)

- SUP 3: 90.00 Psychological round number

- SUP 4: 88.94 2.764 proj of the May 12 - Jun 16 - Aug 2 swing (cont)

A strong rally last Wednesday in Gilt futures led to a short-term reversal. In pattern terms, Wednesday’s session was a bullish engulfing candle. However, additional reinforcing price evidence is required to validate this signal and confirm a short-term shift in market sentiment. An extension higher would be positive and signal potential for a climb towards the 100.00 handle initially. Key support and the bear trigger is at 90.99, the Sep 28 low.

BTP TECHS: (Z2) Bearish Outlook And Gains Are Considered Corrective

- RES 4: 118.51 High Sep 13

- RES 3: 117.05 High Sep 22

- RES 2: 114.85 20-day EMA

- RES 1: 113.46/114.67 High Sep 26 / Low Sep 20

- PRICE: 111.98 @ Close Sep 30

- SUP 1: 107.99 2.236 proj of the Aug 25 - Sep 1 - 8 price swing

- SUP 2: 107.27 2.382 proj of the Aug 25 - Sep 1 - 8 price swing

- SUP 3: 107.00 round number support

- SUP 4: 106.68 2.618 proj of the Aug 25 - Sep 1 - 8 price swing

BTP futures trend conditions remain bearish and short-term gains are considered corrective. Fresh trend lows last week confirmed a resumption of the bear cycle. Moving averages are in a bear mode condition, highlighting the current market sentiment. A resumption of weakness would open 107.27, a Fibonacci projection. On the upside, initial firm resistance is seen at 114.85, the 20-day EMA.

US 10YR FUTURE TECHS: (Z2) Corrective Bounce Still In Play

- RES 4: 115-06+ High Sep 14

- RES 3: 114-17 High Sep 20

- RES 2: 114-04 20-day EMA

- RES 1: 112-30+/114-00 High Sep 23 / 22

- PRICE: 112-26 @ 11:40 BST Sep 30

- SUP 1: 110-19 Low Sep 28

- SUP 2: 110-00 Psychological Support

- SUP 3: 109 20 3.0% 10-dma envelope

- SUP 4: 109-23+ Low Nov 30 20074 (cont)

Treasuries remain vulnerable and short-term gains are considered corrective. Recent weakness has reinforced current bearish trend conditions. A price sequence of lower lows and lower highs and bearish moving average studies clearly highlight the market's sentiment. The focus is on 109-20, a lower moving average band value. Initial resistance is 112-30+, the Sep 23 high.

EQUITIES

EUROSTOXX50 TECHS: (Z2) Heading South

- RES 4: 3753.00 High Aug 19

- RES 3: 3692.00 High Aug 26

- RES 2: 3678.00 High Sep 13 and bull trigger

- RES 1: 3435.40/3518.60 20-day EMA / 50-day EMA

- PRICE: 3267.00 @ 05:57 BST Oct 3

- SUP 1: 3229.00 Low Nov 9 2020 (cont)

- SUP 2: 3163.00 Low Nov 6 2020

- SUP 3: 3143.20 1.382 proj of the Aug 17 - Sep 5 - 13 price swing

- SUP 4: 3100.00 Round number support

EUROSTOXX 50 futures trend conditions remain bearish and the contract has traded to a fresh trend low today. Last week's bearish extension confirms a continuation of the reversal on Sep 13 from 3678.00. Key short-term support at 3341.00, the Jul 5 low, has been cleared. The break strengthens bearish conditions and the focus is on 3229.00 next, the Nov 9 2020 low (cont). Resistance is at 3435.40, the 20-day EMA.

E-MINI S&P (Z2): Bear Trend Remains Intact

- RES 4: 4234.25 High Aug 26

- RES 3: 3946.63/4175.00 50-day EMA / High Sep 13

- RES 2: 3829.83 20-day EMA

- RES 1: 3751.25 High Sep 28

- PRICE: 3609.75 @ 06:55 BST Oct 3

- SUP 1: 3571.75 Round number support

- SUP 2: 3558.97 1.382 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 3: 3506.38 1.50 proj of the Aug 16 - Sep 7 - 13 price swing

- SUP 4: 3453.78 1.618 proj of the Aug 16 - Sep 7 - 13 price swing

S&P E-Minis trend conditions remain bearish and the contrast has traded to a fresh cycle low today. Moving average studies are in a bear mode position, highlighting the current trend direction. Attention is on key support at 3657.00, Jun 17 low, that has been breached. This strengthens bearish conditions and confirms a resumption of the broader downtrend. The focus is on 3558.97, a Fibonacci projection. Initial firm resistance is 3751.25, the Sep 28 high.

COMMODITIES

BRENT TECHS: (Z2) Bounce Considered Corrective

- RES 4: $101.88 - High Jul 29 and key resistance

- RES 3: 95.54 - High Sep 5

- RES 2: $92.24 - 50-day EMA

- RES 1: $88.93/89.00 - 20-day EMA / Intraday high

- PRICE: $88.75 @ 09:42 BST Oct 3

- SUP 1: $82.44 - Low Sep 26 and the bear trigger

- SUP 2: $81.97 - 1.618 proj of the Jul 29 - Aug 5 - 30 price swing

- SUP 3: $80.22 - 1.764 proj of the Jul 29 - Aug 17 - 30 price swing

- SUP 4: $78.52 - Low Jan 24

Brent futures continue to trade closer to recent highs. Short-term gains are considered corrective. The contract traded to a fresh trend low early last week before recovering. The move lower confirms a resumption of the broader downtrend and strengthens bearish conditions plus maintains the price sequence of lower lows and lower highs. The focus is on $81.97 next, a Fibonacci projection. Firm trend resistance is at the 50-day EMA, at $92.24.

WTI TECHS: (X2) Remains Above Last Week’s Lows

- RES 4: $97.91 - High Jul 29 and a reversal trigger

- RES 3: $92.26/96.82 - High Aug 30 / 31 and key resistance

- RES 2: $87.26 - 50-day EMA

- RES 1: $83.31 - 20-day EMA

- PRICE: $81.86 @ 07:13 BST Oct 3

- SUP 1: $76.11 - 1.618 proj of the Jul 29 - Aug 16 - 30 price swing

- SUP 2: $75.70 - Low Jan 24

- SUP 3: $71.22 - 2.00 proj of the Jul 29 - Aug 16 - 30 price swing

- SUP 4: $68.20 - 2.236 proj of the Jul 29 - Aug 16 - 30 price swing

WTI futures are trading closer to recent highs. Bearish conditions remain intact though and the climb from last Monday’s low is considered corrective. The contract has recently cleared support at $80.89, Sep 8 low. This marks a resumption of the downtrend and maintains the bearish price sequence of lower lows and lower highs. The move lower opens $76.11 next, a Fibonacci projection. Key short-term resistance is at $87.26, the 50-day EMA.

GOLD TECHS: Short-Term Corrective Cycle Still In Play

- RES 4: $1765.5 - High Aug 25 and a key resistance

- RES 3: $1714.3/35.1 - 50-day EMA / High Sep 12

- RES 2: $1688.0/1707.1 - High Sep 21 / High Sep 14

- RES 1: $1676.6 - 20-day EMA

- PRICE: $1666.4 @ 07:20 BST Nov 3

- SUP 1: $1615.0 - Low Sep 28 and the bear trigger

- SUP 2: $1610.5 - 1.00 proj of the Jun 13 - Jul 21 - Aug 10 swing

- SUP 3: $1569.1 - Low Apr 1 2020

- SUP 4: $1563.9 - 1.236 proj of the Jun 13 - Jul 21 - Aug 10 swing

Gold has recovered from last Wednesday's low of $1615.0. Short-term gains are considered corrective and the downtrend remains intact. The next resistance is at $1676.6, the 20-day EMA. A break of this level would signal scope for an extension higher. On the downside, $1615.0 is the bear trigger. A breach would confirm a resumption of the bear cycle and this would open $1610.5, a Fibonacci projection.

SILVER TECHS: Key Short-Term Resistance Remains Intact

- RES 4: $21.967 - High Jun 17

- RES 3: $21.540 - High Jun 27

- RES 2: $20.876 - High Aug 15 and the bull trigger

- RES 1: $20.014 - High Sep 12

- PRICE: $19.354 @ 07:26 BST Oct 3

- SUP 1: $17.562 - Low Sep 1 and bear trigger

- SUP 2: $16.955 - Low Jun 15 2020

- SUP 3: $16.473 - 1.00 proj of the Jun 6 - Jul 14 - Aug 10 price swing

- SUP 4: $15.998 - 76.4% retracement of the 2020 - 2021 bull leg

Silver maintains a bearish tone despite its most recent gains. The recent break of $18.845, Sep 12 low, confirmed the end of a corrective recovery between Sep 1 - 12. A continuation lower would pave the way for a move towards the key support and bear trigger at $17.562, the Sep 1 low. Clearance of this level would confirm a resumption of the broader downtrend. Key resistance is at $20.014, Sep 12 high. A break would alter the picture.

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.