-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessUS Treasury Auction Calendar Through April 2025

MNI European Closing FI Analysis: Brexit Tensions Intensifying

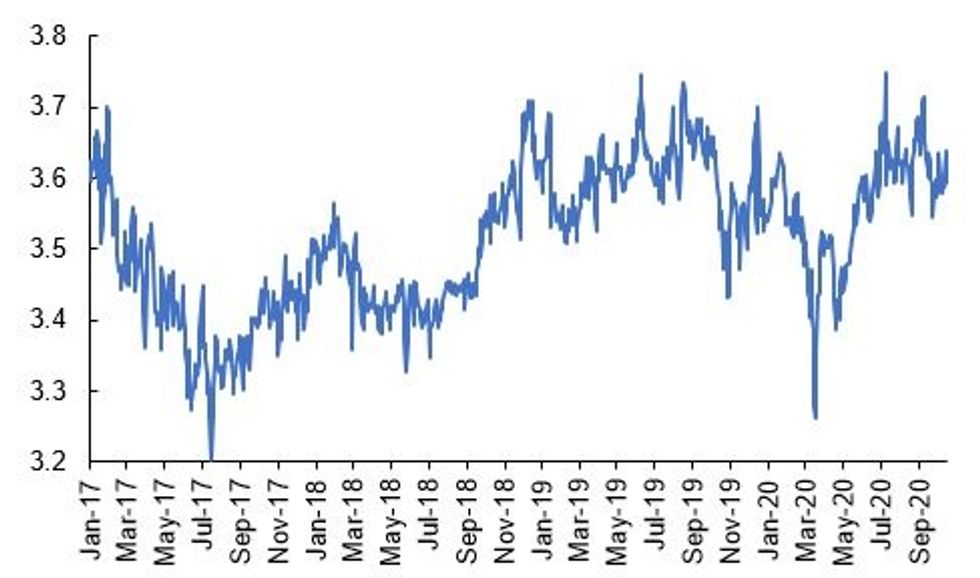

Fig 1: GBP 5y5y Forward Inflation Swap

Source: MNI/Bloomberg

EGB SUMMARY: Brexit talks dominate EGB markets

Brexit headlines have been the major focus for the market today. UK Prime Minister Boris Johnson's statement that the UK is preparing for an Australia-style deal (which is little more than WTO rules) pushed core fixed income higher, but much of the knee jerk move was retraced as the market took the view that the talk was little move than posturing and hard talk. Macron later continued the hard talk saying that the UK needed a deal more than the EU but Merkel struck a more conciliatory tone stating that compromises would be needed from both sides. Johnson later said that unless the EU was willing to compromise talks would stop now, despite EU diplomats already on their way to the UK to continue talks and EU sources stating that talks would continue next week.

- Elsewhere, a better than expected US retail sales print pushed fixed income lower globally.

- Bund futures are up 0.24 today at 176.14 with 10y Bund yields down -1.8bp at -0.630% and Schatz yields down -0.8bp at -0.781%.

- BTP futures are up 0.67 today at 150.27 with 10y yields down -5.2bp at 0.644% and 2y yields down -4.6bp at -0.367%.

- OAT futures are up 0.29 today at 170.21 with 10y yields down -2.3bp at -0.355% and 2y yields down -1.1bp at -0.716%.

GILT SUMMARY: UK PM Again Raises Prospect of No-Deal Brexit

Focus today has been on the EU summit and the lingering stalemate in trade discussions between the UK and EU. In a bid to add fresh momentum to struggling Brexit negotiations, UK Prime Minister Boris Johnson has argued that preparations must be made for a no-deal scenario. Johnson further stressed that Brussels would need a fundamental change of approach to secure a deal.

- The market has so far largely shrugged off today's developments with equities inching higher and cable flat on the day.

- It is a similar story for gilts, which have lack convincing direction today and now trade around yesterday's close. Last yields: 2-year -0.0657%, 5-year -0.0833%, 10-year 0.1736%, 30-year 0.7234%.

- The Dec-20 gilt future trades at 136.64, near the middle of the day's range (L: 136.47 / H: 136.97).

- Short sterling futures are 0.5 ticks higher in whites/reds and broadly flat in greens/blues.

OPTIONS

EURIBOR OPTIONS: Upside call fly

ERZ0 100.50/100.62/100.75c fly, bought for 2.75 in 2k

EURIBOR OPTIONS: Dec upside buyer

ERZ0 101c, bought for 0.15 synth in 7.5k

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.