-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI European Closing FI Analysis: Gilts Rise As QE Case Builds

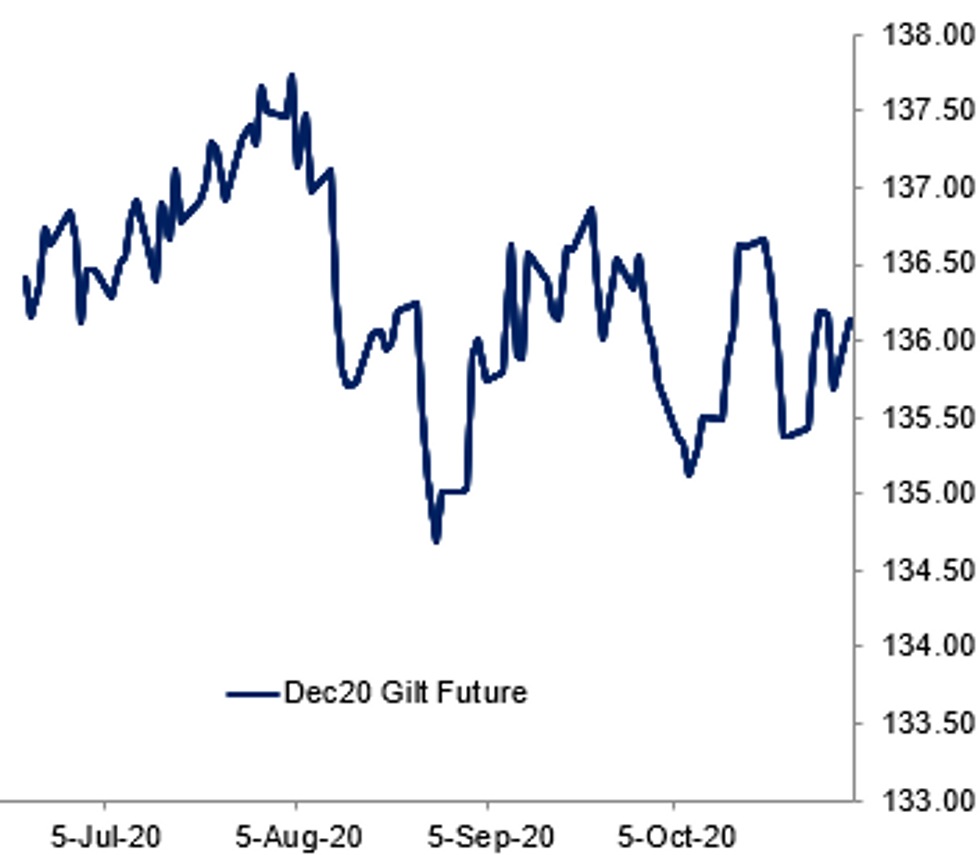

Fig. 1: Gilts Outperform

BBG, MNI

BBG, MNI

EGB SUMMARY: All eyes on US elections

EGBs have traded within the morning ranges, as investors and market participants prepare for a huge risk event week.

- German curve has reversed some of the bear flattening noted during the morning session, to trade flat at the time of typing.

- Peripheral have traded mixed, with Spain 0.4bp tighter versus the German 10yr, while Greece sits 1.4bp wider.

- Looking ahead, all eyes on the US election, with some of the results expected tomorrow night.

- Dec Bund futures (RX) up 8 ticks at 176.23 (L: 175.9 / H: 176.32)

- Germany: The 2-Yr yield is down 0.2bps at -0.796%, 5-Yr is up 0.2bps at -0.818%, 10-Yr is down 0.6bps at -0.633%, and 30-Yr is down 0.6bps at -0.224%.

- Dec BTP futures (IK) down 4 ticks at 149.55 (L: 148.97 / H: 149.63)

- Italy / German 10-Yr spread 0.7bps tighter at 138bps

- Dec OAT futures (OA) up 6 ticks at 170.17 (L: 169.85 / H: 170.23)

- Spanish bond spread down 0.4bps at 75.8bps

- Portuguese PGB spread down 0.3bps at 72.9bps

- Greek bond spread down 1.5bps at 156.1bps

GILT SUMMARY: Lockdown and QE expectations help gilts outperform

Gilts have been the outperformers in core fixed income space today following the weekend announcement that England would begin a nationwide lockdown beginning Thursday with the intention of it lasting four weeks.

- Some analysts have changed their calls ahead of Thursday's Monetary Policy Report and the consensus is now even more firmly looking for a GBP100bln extension to QE. Cementing this expectation into market pricing has helped the gilt rally today.

- Gilts have broken above Friday's high of 136.08 (the first resistance level noted by our technical analyst). Attention now shifts to 136.38, the Oct 20 low, to close the gap on the chat.

- 2y yields down -3.3bp today at -0.71%

- 5y yields down -3.1bp today at -0.71%

- 10y yields down -3.8bp today at 0.222%

- 30y yields down -4.1bp today at 0.787%

- 2s10s down -0.5bp today at 29.3bp

- 10s30s down -0.3bp today at 56.5bp

DEBT FUTURES/OPTIONS:

- RXZ0 172.50p, bought for 3.5 and 4 in 4k total

- DUZ0 112.40p, bought for 3.5 in 6kDUZ0 112.40p, bought for 3.5 in 6k

- L M1 100.00/100.125/100.25/100.375 c condor, bought for 3 in 4k

- 0LU1 100.00/99.87ps 1x2, bought the 2 for 1.5 in 1.5k

- LF1 100^, bought for 7.5 in 500

- LH1 99.87/100/100.12c 1x3x2, bought for 2.5 in 5k

- LH1 100/100.12/100.25c fly, bought for 2 in 1.5k

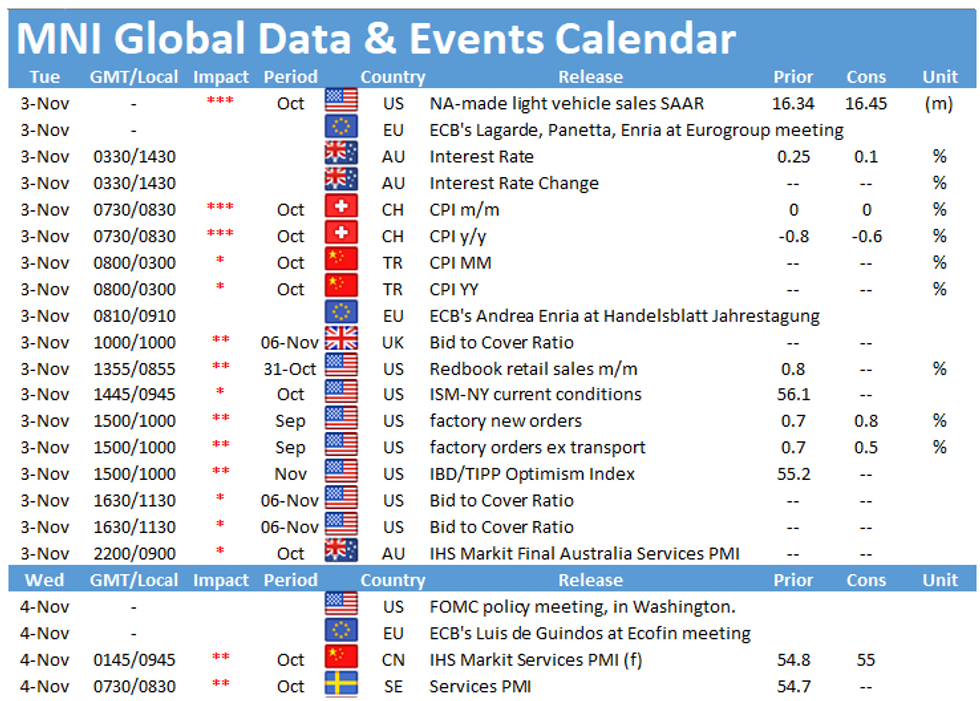

LOOK AHEAD:

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.