-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Antipodean CB Repricing And BoJ Leadership Matters Still Dominate

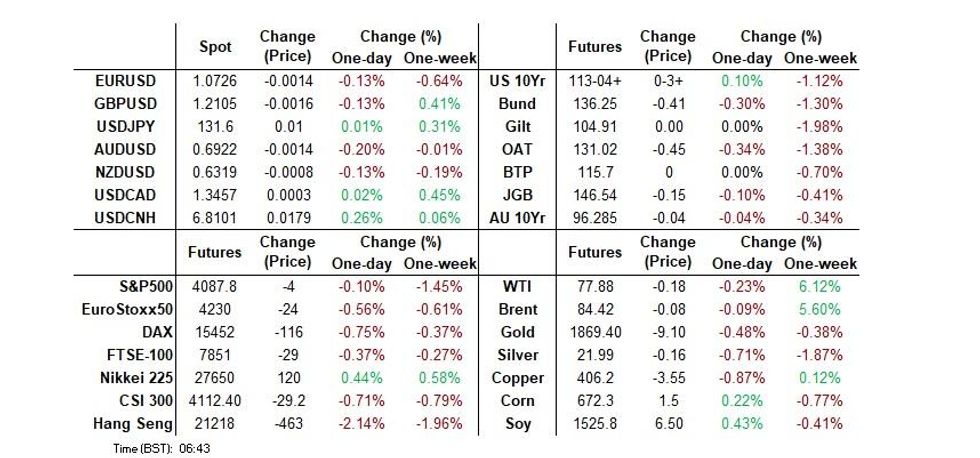

- The USD is on the front foot in Asia today. Equity sentiment is weaker, with U.S. futures lower and China and Hong Kong reversing some of yesterday's gain. The China CPI print, at the margins, is less supportive of easier policy settings, which may have trimmed risk appetite in the equity space. It was a supporting factor in yesterday's trading amid easing speculation.

- Japanese parliamentary officials confirmed that the government will announce its nominations for the BoJ Governor position on 14 February, at 11:00 Tokyo time (02:00 London), with the related parliamentary hearings slated for 24 February. BoJ Deputy Governor Amamiya reaffirmed his status as the continuity candidate in the race to succeed Kuroda, showing little want for any change re: the Bank’s inflation target, highlighting a need for continued easing under the current policy settings (“for now”), while underscoring the need for clear communication when it comes to the attainment of its inflation target, when the time comes.

- In Europe today we have UK GDP, further out there is the Canadian labour market report and U.S. UoM consumer sentiment survey. Elsewhere, Fedspeak from Gov Waller and Philadelphia Fed President Harker will cross, as will comments from BoE's Pill.

US TSYS: Marginally Cheaper In Asia

TYH3 deals at 113-04, +0-03, in the middle of its 0-05+ range on volume of ~86K.

- Cash Tsys sit 0.5-1bp cheaper across the major benchmarks.

- Tsys cheapened in early trade, as local participants reacted to yesterday's late NY weakness triggered by a soft 30-Year auction result and an early Sydney slide in ACGBs. 30-Year yields briefly dealt above Thursdays highs, although the rest of the major benchmarks failed to do the same.

- The space stabilized off session cheaps as ACGBs moved away from lows on the back of the RBA's SoMP.

- Softer than expected Chinese PPI data also facilitated Tsys recovery from session lows.

- In Europe today we have UK GDP, further out there is the Canadian labour market report and UoM consumer sentiment survey. Elsewhere, Fedspeak from Gov Waller and Philadelphia Fed President Harker will cross.

JGBS: BOJ Nominations Officially Scheduled, Amamiya Reaffirms Status As Continuity Candidate

JGB futures tracked wider core global FI, ticking lower, before correcting from worst levels, -16 ahead of close, sticking to the recent range. Cash JGBs run 1.5bp richer to 3bp cheaper, with the curve twist steepening and 10s bumping up near the upper limit of the BoJ’s permitted YCC trading band (the BoJ has announced another 5-Year funding round for Bank’s via its pooled collateral channel as a result). Swap rates are firmer across the curve, with steepening observed there, while swap spreads are mixed. Thursday’s wider FI dynamics likely weighed on the long end.

- Parliamentary officials confirmed that the government will announce its nominations for the BoJ Governor position on 14 February, at 11:00 Tokyo time (02:00 London), with the related parliamentary hearings slated for 24 February.

- BoJ Deputy Governor Amamiya reaffirmed his status as the continuity candidate in the race to succeed Kuroda, showing little want for any change re: the Bank’s inflation target, highlighting a need for continued easing under the current policy settings (“for now”), while underscoring the need for clear communication when it comes to the attainment of its inflation target, when the time comes.

- Finance Minister Suzuki stressed that it is too soon to discuss a potential revision to the BoJ-government accord, pointing to such discussions taking place with Kuroda’s successor.

- Japanese PPI data was a touch softer than expected in January, although remained elevated.

AUSSIE BONDS: Curve Bear Flattens, SoMP Digested

Aussie bonds finished off cheapest levels, with YM -8.0 & XM -4.0, while wider cash ACGBs are 4-8bp cheaper as the curve bear flattens.

- Early Friday trade saw Aussie bond futures pull lower, extending on their overnight weakness, as RBA cash rate pricing extended higher and some pre-RBA SoMP hedging took hold.

- The space then pulled away from session cheaps, assumingly on the back of the RBA’s SoMP pointing to underlying inflation returning to the upper end of the target band by the end of next year (albeit a product of a mark higher in this year’s forecast points).

- Softer than expected Chinese PPI data may have also provided some modest support.

- Bills were 4-10 bp cheaper through the reds, with the backend of the whites leading the weakness. RBA-dated OIS now shows a terminal rate of just under 4.15% after pushing closer to 4.20% earlier in the session.

- EFPs were little changed on the day.

- Next week’s domestic data docket sees the release of the monthly labour market report, business and consumer confidence surveys, household spending data from CBA and consumer inflation expectations. We will also hear from RBA Governor Lowe who will appear before the Senate Economics Legislation Committee.

NZGBS: Bear Flattening Again

The NZGB curve bear flattened ahead of the weekend, with the major benchmarks benchmarks going out 2.0-7.5bp cheaper.

- The post-30-Year auction pull lower in Tsys applied some early pressure, with payside flow in swaps and RBNZ-dated OIS then weighing on the front end of the curve, even as long dated paper corrected from cheaps alongside wider core global FI markets, with some focus on softer than expected PPI data out of China and the tweaks made to the RBA’s inflation forecast profile.

- Swap rates were little changed to 8bp higher, with that curve also flattening, leaving swap spreads little changed to a touch tighter. The 2-/10-Year swap spread has generally consolidated in February, after the pull away from cycle extremes (deepest inversion since the GFC) in late ’22.

- RBNZ-dated OIS firmed again today, leaving just over 60bp of tightening priced for this month’s meeting, alongside pricing of a terminal OCR of ~5.40%.

- Local headline flow was dominated by focus on a cyclone that is making its way towards the country (after the recent floods in Auckland, which will impact inflation in the coming months)

- Looking ahead, inflation expectations and REINZ house price data headline next week’s local docket.

FOREX: USD Firms, Softer Equities Weigh On Risk Appetite

The USD is on the front foot in Asia today. Equity sentiment is weaker, with US futures lower and China and Hong Kong reversing some of yesterday's gain. The China CPI print, at the margins, is less supportive of easier policy settings, which may have trimmed risk appetite in the equity space. It was a supporting factor in yesterday's trading amid easing speculation.

- USD/JPY is up ~0.1%, last printing ¥131.65/70. Jan PPI printed below expectations, YoY 9.5% vs 9.7% exp and the MoM read was flat. Parliamentary officials confirmed the government will announce its nominations for BOJ Governor on 14 Feb at 11am Tokyo time (0200 London time).

- AUD/USD is ~0.2% softer, there was little reaction to the RBA's SoMP. The bank noted whilst inflation will rise next year, CPI will return to the target band in 2025. AUD was pressured through the session, before finding support below $0.69. Copper and Iron Ore are both lower today weighing on AUD at the margins.

- NZD/USD is down ~0.3% last printing $0.6310/0.6315. There was little support from improving domestic data; Jan Business NZ Manf PMIs were on the wires, the measure is back in expansionary territory at 50.8 rising from the prior of 47.2. Jan Card Spending rose 3.3% from -1.2% prior.

- EUR and GBP are both down ~0.2% as the greenback strength weighs.

- Cross asset flows are showing a risk-off tone. E-minis are down ~0.2%, the Hang Seng is ~2% softer. DDBXY is up ~0.2%.

- In Europe today we have UK GDP, further out there is the Canadian labour market report and UoM consumer sentiment survey. Elsewhere, Fedspeak from Gov Waller and Philadelphia Fed President Harker will cross.

MNI Insight: AUD/NZD FX: Most Roads Point North, But Risks Remain

EXECUTIVE SUMMARY

- AUD/NZD risks still appear biased to the topside. The cross has recovered strongly in recent months and yield momentum is pointing to further gains in the period ahead. Measures of Australian core inflation have now surpassed NZ’s, which suggests the RBA has more work to do in coming months. We may well now be past the peak in terms of relative rate pricing in the 1yr ahead period.

- Relative growth momentum is also expected to trend in AUD/NZD’s favor, particularly given NZ recession risks. Still, relative data surprises haven’t evolved rapidly in AUD’s favor, while recent NZ survey outcomes have moved up from recent lows.

- The relative commodity price backdrop has also turned less favorable for AUD/NZD. Correlations have been much lower with the cross though in recent months. There is also optimism a China recovery this year will drive AU’s commodity basket higher. The nature of China growth is likely to be important, with a focus on services/consumption outcomes relative to housing/infrastructure.

- Finally on the technical backdrop, the outlook looks constructive. We are below early February highs, but MA studies remain bullish. Upside targets are at 1.1045, the Nov 11 high, then 1.1101, the 61.8% retracement of the Sep 28 - Dec 16 down leg. Key support rests at 1.0881 the Jan 31 low. Our sense is the market will maintain a buy on dips mentality, given the above macro backdrop.

- See the full note for more details:AUDNZD (Feb 10 2023).pdf

FX OPTIONS: Expiries for Feb10 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0700(E1.0bln), $1.0750(E1.2bln), $1.0775-80(E615mln), $1.0800(E921mln), $1.0850-60(E636mln)

- USD/JPY: Y130.00($1.6bln)

- GBP/USD: $1.2150(Gbp529mln)

- EUR/GBP: Gbp0.8800(E506mln)

- AUD/USD: $0.7000(A$505mln)

- USD/CAD: C$1.3400-20($1.4bln)

ASIA FX: USD/Asia Pairs Higher, THB Continues TO Unwind Earlier Outperformance

USD/Asia pairs are higher across the board today, in line with USD strength against the majors and equity market weakness throughout the region. KRW and THB are the weakest performers over the past week. Still to come is Indian IP figures for Dec. We also still waiting for China aggregate financing figures for Jan.

- USD/CNH has generally traded on the front foot. The pair got close to 6.8200 this afternoon, we now sit slightly lower at 6.8100. Equity sentiment has softened, while northbound outflows have resumed. CPI data was close to expectations, but suggests underlying momentum is improving. The CNY fixing was close to neutral.

- 1 month USD/KRW is still finding selling resistance around the 1265 level. Onshore equities have softened. Officials expect CPI pressures to moderate as we progress further into 2023.

- USD/THB was already on the front foot in the first part of trade, but comments from the Finance Minister (reported by Reuters) that the strong baht is a risk to the economy have fueled further gains in the pair. We now sit at 33.71, down slightly from session highs just above 33.735. Still, this is around 0.70% weaker in baht terms for the session. Offshore investors remain net sellers of local equities though, -$367mn week to date, with -$100.9mn yesterday.

- USD/INR has opened at 82.60/70, ~0.2% firmer from yesterday's closing levels. We sit slightly lower now, last around 82.55. The INR NEER is off early Feb lows, albeit modestly. We are close to 66.40 (J.P. Morgan Index), versus 65.91 on Feb 2. USD/INR has dealt in a narrow range this week, reflecting broader moves seen in the USD which has been relatively rangebound in recent sessions. Equity outflows continue, with ~$446mn of equities sold by foreign investors in the first half of the week.

- USD/MYR is continuing to press higher, the pair moving above 4.3300, which is fresh highs back to mid Jan for the pair. The Jan 18th high around 4.3400 could be the next upside target, while note the 20-day EMA has bottomed and is drifting higher (last just under 4.3100). Earlier Q4 GDP came in weaker than expected at -2.6% q/q, (-1.9% forecast), which took y/y growth to 7.0%, which still firmer than the 6.7% forecast. We were at +14% in Q3 though, so growth momentum clearly slowed. BNM doesn't expect a recession this year, but is mindful of external risks. Inflation pressures are expected to ease further this year but stay at an elevated level.

CHINA: China Inflation Close To Expectations, But Underlying Pressures Firmer

China headline inflation came in as expected, 2.1% y/y. There was a decent 0.8% rise in m/m terms. The core measures improved, albeit from depressed levels. Non-food rose 1.2% y/y, only a slight uptick from Dec (1.1%). Core (ex food & energy) saw a bigger lift to 1.0% y/y (from 0.7%). This core measure is now back to highs from mid last year, but still down from pre Covid levels (1.50-2.00%).

- The first chart below plots the core inflation metric against the 2yr China government bond yield. There was also other evidence that the worst of the disinflation pulse was behind us. 7 out of 8 sub-categories saw firmer prints in Jan relative to Dec in y/y terms.

- One month doesn't make a trend, but at the margin this may complicate calls for more monetary policy easing.

Fig 1: China Core Inflation Versus 2yr Government Bond Yield

Source: MNI - Market News/Bloomberg

- On the PPI side, we saw a slight downside miss (-0.8% y/y, versus -0.7% expected). Raw materials slipped back into disinflation -0.1% y/y (from 1.2%), while consumer goods inflation eased slightly to 1.5% y/y, from 1.8% prior.

- The second chart below overlays the PPI y/y, 6 months forward, versus y/y changes in the CNY NEER.

Fig 2: CNY NEER Y/Y Versus China PPI Y/Y

Source: MNI - Market News/Bloomberg

EQUITIES: China/HK Reversing Thursday Gains

(MNI Australia) Regional equities are mostly on the back foot to end the week. Much of the focus has been on weakness in HK/China stocks, reversing yesterday's gain, albeit to varying degrees. US futures are lower, but are away from worst levels (Eminis -0.20%, Nasdaq -0.30% at this stage).

- The weakness in China/HK stocks doesn't appear to reflect a specific factor. Some firming in underlying inflation (from a low base) may lower odds of easier policy settings, which may have weighed at the margin. The prospect of further US tech curbs, post the balloon incident is another potential headwind.

- At this stage, the HSI is off around 2%, with the tech sub-index off -4.22%, fully unwinding yesterday's rise. The CSI 300 is down 0.80%, while northbound flows have been negative, -4.1bn yuan so far.

- The Kospi (-0.65%) and Taiex (-0.20%) are tracking lower, while Japan stocks are outperforming modestly (Nikkei 225 +0.20%).

- Indian stocks are lower, off by 0.25% at this stage, with stocks linked to the Adani group still included in MSCI Indexes, although their respective weightings could still be impacted.

GOLD: Testing 50-Day EMA On The Downside

Gold is off a further 0.40% so far today. The precious metal last around the $1854/55 level. For the week we are tracking lower, -0.55% at this stage, after last week's -3.27% fall. Today's move is line with a stronger USD tone, with the dollar indices tracking +0.15% at this stage.

- Gold looks a little too low relative to USD strength, but the divergence isn't excessively large at this stage.

- Still, we currently sit close to the 50-day EMA (1855.5 based of Feb 9 closing levels), which a close below in NY trade later would be a bearish signal from a technical standpoint.

- ETF gold holdings continue to drift lower.

OIL: Weekly Gains Trimmed

Brent crude is slightly below NY closing levels currently, last around $84.35. Ranges have been tight today, and we remain comfortably above the Thursday session low of $83/bbl. Beyond that is lows at the start of the week close to $79/bbl. The 20-day and 50-day EMAs are nearby, but a move above the 100-day ($87.42/bbl) is likely required to re-energize the bulls. For WTI, we currently sit near $77.80/bbl.

- A more cautious tone in the equity space has weighed on broader risk appetite, but oil is still tracking higher for week, Brent +5.5% at this stage. This has arguably been more supply than demand driven though.

- Goldman Sachs has lowered its brent crude forecasts, $6 lower for Q1 ($92/bbl, versus $98/bbl prior), while the bank expects brent to end the year at $100/bbl (-$5 revision). The forecast changes reflect softening supply-demand fundamentals (more supply from US & Russia, less demand from US & EU).

- Looking ahead, next Tuesday delivers the OPEC monthly oil report (along with US CPI). On Wednesday an IEA-IEF-OPEC symposium will take place in Riyadh. The IEA monthly oil report will also print.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/02/2023 | 0700/0700 | *** |  | UK | GDP First Estimate |

| 10/02/2023 | 0700/0700 | ** |  | UK | Index of Services |

| 10/02/2023 | 0700/0700 | *** |  | UK | Index of Production |

| 10/02/2023 | 0700/0700 | ** |  | UK | Output in the Construction Industry |

| 10/02/2023 | 0700/0700 | ** |  | UK | Trade Balance |

| 10/02/2023 | 0700/0700 | ** |  | UK | UK Monthly GDP |

| 10/02/2023 | 0700/0800 | * |  | NO | CPI Norway |

| 10/02/2023 | 0900/1000 | * |  | IT | Industrial Production |

| 10/02/2023 | 1330/0830 | *** |  | CA | Labour Force Survey |

| 10/02/2023 | 1400/1400 |  | UK | BOE Pill Panellist at BIS SUERF Workshop | |

| 10/02/2023 | 1400/1500 |  | EU | ECB Schnabel Twitter Q&A | |

| 10/02/2023 | 1500/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 10/02/2023 | 1730/1230 |  | US | Fed Governor Christopher Waller | |

| 10/02/2023 | 1900/1400 | ** |  | US | Treasury Budget |

| 10/02/2023 | 2100/1600 |  | US | Philadelphia Fed's Pat Harker |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.