-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: AUD & Local Yields Surge Post Q3 CPI

- In Australia, Q3 underlying CPI measures printed above expectations and posted quarterly increases greater than 1%. Also, the monthly data suggested that inflation may be easing at a slower rate than the RBA was forecasting and needs to meet its target by mid-2025. RBA Governor Bullock said recently the board will hike again “if there is a material upward revision to the outlook for inflation”.

- A 78% chance of a 25bp rate is priced for the November meeting. Terminal rate expectations firm to 4.47% (+40bps) from 4.34% pre-data. Australian bond yields are sharply higher, while AUD/USD has rallied, although stopped short of a break through the 0.6400 level.

- Elsewhere, US Cash Tsys sit 2bps richer to 2bps cheaper across the major benchmarks, the curve has twist steepened pivoting on 5s. China and Hong Kong equities are higher following fresh fiscal stimulus measures, although we are away from best levels.

- Later Fed Chair Powell gives welcoming remarks and ECB President Lagarde speaks. On the data front, US new home sales and the German Ifo for September print. The Bank of Canada meets and is expected to leave rates unchanged.

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 106-11+, unchanged from Tuesday's settlement level, a 0-07+ range has been observed on volume of ~100k

- Cash Tsys sit 2bps richer to 2bps cheaper across the major benchmarks, the curve has twist steepened pivoting on 5s.

- Tsys firmed in early trade, ticking higher alongside US Equity Futures paring early losses and marginal pressure on the USD. The space looked through the firmer than forecast CPI print from Australia.

- The move higher didn't follow through and Tsys ticked lower in narrow ranges for the remainder of the session.

- Flow wise the highlight was a block seller (two clips of 3k) in TY.

- The docket is thin in Europe today, further out we have New Home Sales and Fed Chair Powell provides welcome remarks at 2023 Moynihan Prize. We also have the latest 5-Year Supply.

JGBS: Futures Mid-Range, Belly Of Curve Underperforming

In the Tokyo afternoon session, JGB futures are sitting mid-range, -13 compared to the settlement levels.

- The local calendar has been light today, with Leading and Coincident Indices for August (final) due soon.

- Today’s weakness has been unexpected given it flew in the face of lower US tsy yields during Tuesday’s NY session. That said, afternoon weakness is consistent with the cheapening in longer-dated cash US tsys, which are dealing 1-2bps cheaper across benchmarks beyond the 5-year in Asia-Pac trade.

- One possible explanation for today’s move comes from Cranfield at Bloomberg. He believes the fact that JGBs are still biased lower despite an unscheduled buying operation and support for the belly of the curve via 5-year loans could be adding to bets for abandoning yield curve control at next week’s policy meeting. (See linkICYMI)

- Cash JGBs are dealing mixed, with the belly underperforming. Yield movements 1.6bps lower to 0.7bp higher. The benchmark 10-year yield is at 0.858% versus the cycle high of 0.882% set on Monday.

- The swap curve is also trading mixed, with rates 2bp lower to 0.6bp higher. Swap spreads are mixed.

- Tomorrow, the local calendar sees PPI Services, International Investment Flows and Machine Tool Orders data.

- The MOF will conduct a Liquidity Enhancement Auction for 15.5-39-year JGBs at 1700 JT.

AUSSIE BONDS: Sharply Cheaper After Q3 & September CPI Data Increases Chances Of A Nov Hike

ACGBs (YM -12.0 & XM -5.0) are 5-8bps cheaper after Q3 and September CPI printed higher than expected. Consequently, these outcomes have amplified concerns regarding the possibility of another interest rate hike in November, as it appears that inflation may be slowing less than the desired rate.

- RBA Governor Bullock said the board will hike again “if there is a material upward revision to the outlook for inflation”. This data is likely to result in an upward revision to near-term RBA CPI forecasts, but the key will be the outlook further out. Q2 2025 already stands at 3.1%, marginally above the top of the band.

- Cash ACGBs are 5-9bps cheaper after the data, with the AU-US 10-year yield differential 6bps higher on the day at -10bps.

- Swap rates are 4-8bps higher after the data and 4-12bps higher on the day. The 3s10s curve is flatter on the day.

- The bills strip is sharply weaker, with pricing -8 to -16.

- RBA-dated OIS pricing has shunted 10-15bps firmer on the day across meetings.

- A 78% chance of a 25bp rate is priced for the November meeting. Terminal rate expectations firm to 4.47% (+40bps) from 4.34% pre-data.

- Tomorrow, the local calendar sees an appearance by RBA Governor Bullock before the Senate Economics Legislation Committee, along with Terms of Trade data.

AUSTRALIAN DATA: Monthly Inflation Gaining Momentum

The monthly CPI for September showed that inflation had strong momentum going into Q4, which is likely to be another reason that the RBA’s Q4 CPI forecasts are likely to be revised up. The jump in headline to 5.6% from 5.2%, the second straight monthly rise, risks increasing inflation expectations too, which the RBA is wary of. Surveys show that cost-of-living remains the biggest concern for most households.

- Seasonally-adjusted headline CPI rose 0.3% m/m in September which annualised is 4%, which is well above the expectations the RBA has for 12 months’ time. 3-month momentum also picked up to 5.1% from 4.2% in August. Recent increases in headline have been driven by higher fuel prices. Rents also remain high at 7.6% y/y and electricity rose 18% y/y.

- Excluding volatile items and holiday travel, the CPI also rose 0.3% seasonally adjusted and 3-month momentum picked up to 5.2% from 4.5%. These robust numbers can’t be blamed on fuel prices. The annual rate was steady at 5.5% y/y while the trimmed mean eased to 5.4% from 5.6%.

- Child care fell 6% y/y due to a 13.1% m/m drop in September related to increased government subsidies.

Source: MNI - Market News/ABS

Australia CPI sa 3m/3m ave ann%

Source: MNI - Market News/ABS

AUSTRALIAN DATA: Services Inflation Elevated, Base Effects Drive It Lower

The October RBA meeting minutes cited core services as an upside inflation risk as they have “remained persistent internationally”. This is an area that they have been monitoring for some time as they are impacted by wages and domestic demand. While they eased in Q3 and appear to have peaked in Q2, the move was helped by very favourable base effects.

- In Q3 market services inflation eased to 6.2% y/y from 6.8%, but was helped by favourable base effects. It still rose 1.3% q/q. Total services increased 1% q/q and 5.8% y/y after 6.3% y/y in Q2. Goods rose +1.2% q/q and 4.9% y/y after 5.8% in Q2.

- Services inflation remains elevated and likely to remain a concern for the RBA. The ABS noted that for a number of services annual inflation remains high and rents, dental and insurance all rose in Q3. Rents increased 7.6% y/y up from 6.7%, the highest since 2009.

Source: MNI - Market News/Refinitiv

- Monthly headline services prices moderated to 5.3% y/y in September from 5.6% but remain in the range seen since February. Good news is that the 6-month annualised rate fell to 6.8% from 9.4%, the lowest since February 2022. Goods inflation rose to 5.7% y/y in September from 5.1%.

- Domestically-driven non-tradeables rose 1.3% q/q and 6.2% y/y in Q3 down from 6.9% also due to base effects but September was sticky at 6.2%. Q3 tradeables rose 0.7% and 3.7%, the lowest in two years, but September rose to 4.2% y/y from 3.4%, boosted by fuel.

Source: MNI - Market News/ABS

NZGBS: Closed Richer Despite Post-CPI ACGB Cheapening

NZGBs closed at the session's best levels, 1-5bps richer, despite a sharp cheapening in ACGBs following the release of higher-than-expected Q3 CPI data. NZGB yields were 2-3bps lower in post-AU CPI dealings. In contrast, ACGBs are 4-9bps cheaper.

- Notably, the Australian CPI release stands out as it bucks the recent trend observed in the peripheral regions of the $-bloc, specifically New Zealand and Canada, where inflation prints have fallen below expectations. Additionally, the Australian monthly CPI data for September revealed a significant uptick in inflation, suggesting that it carries strong momentum into the fourth quarter. This newfound momentum is expected to play a role in the likely revision of the RBA's Q4 CPI forecasts, potentially pushing them upward.

- The NZ-AU 10-year yield differential closed a massive 9bps tighter at +68bps versus its mid-October high of +99bps.

- Swap rates closed 2-4bps lower, with the 2s10s curve unchanged.

- RBNZ dated OIS pricing closed 1-4bps softer across meetings, with terminal rate expectations at 5.60%.

- Tomorrow, the local calendar is empty again, ahead of ANZ Consumer Confidence on Friday.

- Tomorrow, the NZ Treasury plans to sell NZ$200mn of the 4.5% Apr-27 bond, NZ$200mn of the 3.5% Apr-33 bond and NZ$100mn of the 2.75% May-51 bond.

FOREX: AUD Firms After Q3 CPI Print

AUD is the strongest performer in the G-10 space at the margins. The move higher was seen after the Q3 CPI print which was firmer than expected with the headline rate at 1.2% Q/Q, RBA terminal rate expectations now sit at 4.47% and another 25bp rate hike is 78% priced in for the November meeting.

- AUD/USD sits ~0.4% firmer at $0.6375/80. Resistance is at $0.6393, high from Oct 18, the next level for bulls is $0.6445, high from Oct 11.

- Kiwi is a touch firmer, NZD/USD is up ~0.1%. The pair was up ~0.3% firmer after the bid in AUD spilled over however it has ticked away from session highs through the session.

- Yen is little changed and sits beneath the ¥150 handle. Technically bulls remain in the driver's seat, resistance is at ¥150.16, high from Oct 3 and bull trigger. Support comes in at ¥149.21, 20-Day EMA.

- Elsewhere in G-10 EUR and GBP are following the broader USD move and sit ~0.1% firmer.

- Cross asset wise; BBDXY is unchanged and the US Tsy curve is marginally steeper. The Hang Seng has pared an early gain of as much as 3% and now sits ~1.6% higher.

- On Wednesday the docket is thin in Europe with the IFO Survey from Germany providing the highlight.

EQUITIES: Hong Kong/China Markets Rise, But Are Away From Best Levels

Most regional equity markets are higher. Focus has been on gains in HK and China markets post additional fiscal stimulus measures. We are in positive territory, but indices are away from session highs. Elsewhere South Korean and Australian shares are lagging. US futures are down following mixed after late earning results from tech bellwethers. Eminis are off 0.2%, last tracking near 4262, which is just above the simple 200-day MA. Nasdaq futures are down by more, off 0.40% at this stage.

- In early trade Hong Kong's HSI was up comfortably over 2%. At the break though gains had been pared to +1.18%. We had a strong lead from the Golden Dragon Index in US trade on Tuesday, up nearly 4%, amid fiscal stimulus optimism (post the government's approval of an additional 1trln yuan in bond issuance).

- The properties sub index rose over 3% as Hong Kong Chief Executive John Lee delivered his annual address, which included cutting the home purchase tax on second homes to 7.5% from 15%. Again, though gains have been pared, the index last near +1%.

- Lee also stated that the stamp duty on stock trading would be cut to 0.1% (from 0.13%). This move may have a positive impetus post the lunchtime break.

- It has been a similar story for mainland shares, at the break, the CSI 300 is up 0.50%, we were +1.1% in earlier trade. Vice Finance Minister Zhu Zhongming stated that the extra fiscal stimulus will still leave the government's debt ratio manageable (see the Global Times link here).

- Japan stocks have posted healthy gains, up over 1% for the major benchmarks. South Korean shares are struggling though, the Kospi off 0.60%, foreign and institutional selling not helping.

- The ASX 200 is down slightly, the Q3 upside surprise on CPI weighing. Philippine stocks are around flat, as the market awaits whether an off-cycle hike is delivered tomorrow.

- Thailand and Indonesian indices are doing better though.

OIL: Crude Range Trading, Conflict Fears Ease & Hope China Increases Demand

Oil hasn’t made up any of Tuesday’s losses during APAC trading today. Yesterday crude fell around 2% driven by a stronger greenback from better PMIs and stabilisation in the Middle East. Brent has been range trading and is up slightly to $88.11/bbl but off the intraday low of $87.92. WTI is flat at $83.75 after an intraday low of $83.45. The USD index is also little changed.

- The war risk premium has been reduced following US diplomatic efforts to stabilise the situation in the Middle East and increasing pressure on Israel to abandon a ground offensive. Crude markets were also reassured that the US and Saudi Arabia have been talking to ensure the conflict doesn’t escalate.

- On the demand side, China has increased the deficit ratio and issued more government bonds in an effort to stimulate the economy. There is hope that this will increase demand for oil given that China is the world’s largest importer.

- Bloomberg reported that US crude inventories fell another 2.67mn barrels after -4.38mn the previous week, according to people familiar with the API data. There was a 4.17mn barrel drawdown of gasoline stocks and -2.31mn of distillate. The official EIA data is released later today.

- Later Fed Chair Powell gives welcoming remarks and ECB President Lagarde speaks. On the data front, US new home sales and the German Ifo for September print. The Bank of Canada meets and is expected to leave rates unchanged.

GOLD: Slightly Stronger After A Solid Intraday Recovery On Tuesday

Gold is 0.1% higher in the Asia-Pac session. This comes after it closed near unchanged at $1970.97 on Tuesday after a strong recovery off a low of $1953.71. The recovery moved bullion away from support at $1943 (Oct 19 low), according to MNI’s technical team.

- A stronger dollar driven by the higher-than-expected US S&P global October manufacturing PMI at 50 vs 49.8 prior failed to negatively impact the yellow metal.

- Lower longer-dated US Treasury yields possibly supported gold, although short-dated yields did move higher following the US PMI data release.

- Gold remains below the five-month high reached last week on the back of the conflict in the Middle East. Tensions have eased this week as ongoing diplomatic measures and the freeing of some hostages have delayed the much-feared Israeli ground assault on Gaza.

SOUTH KOREA DATA: Consumer Sentiment Dips Further, Inflation Expectations Firm A Touch

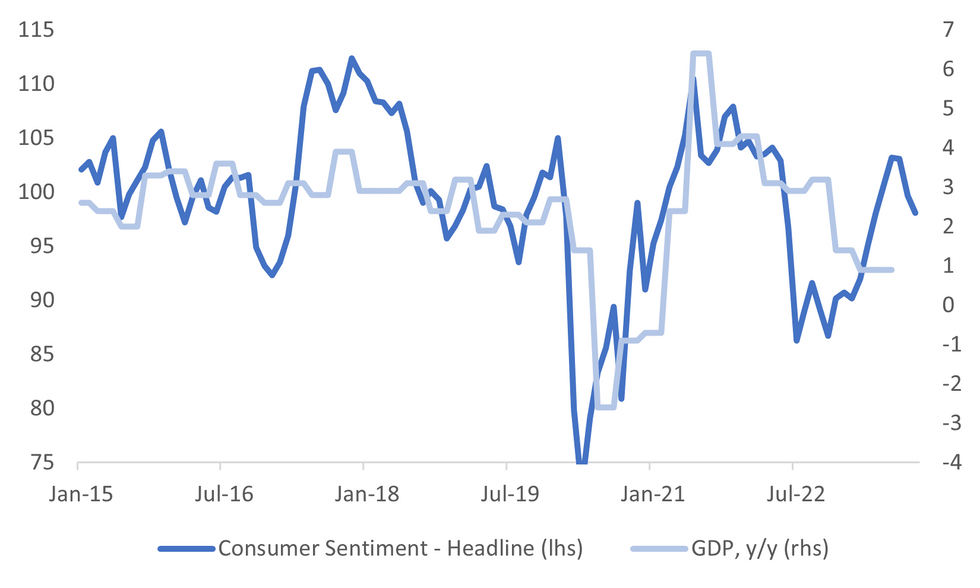

Headline South Korean consumer sentiment continued to lose momentum in October. The index dipped to 98.1 from 99.7 prior. We are now comfortably off mid year highs for the index, although mid -2022 lows are still some distance away. The first chart below overlays the index against y/y GDP growth.

- In terms of the detail, the domestic economy situation slipped, whilst the change in interest rates sub index also rose. Spending plans were relatively unchanged though compared with September.

- Note we get Q3 GDP tomorrow in South Korea.

Fig 1: South Korean Consumer Sentiment & GDP Y/Y

Source: MNI - Market News/Bloomberg

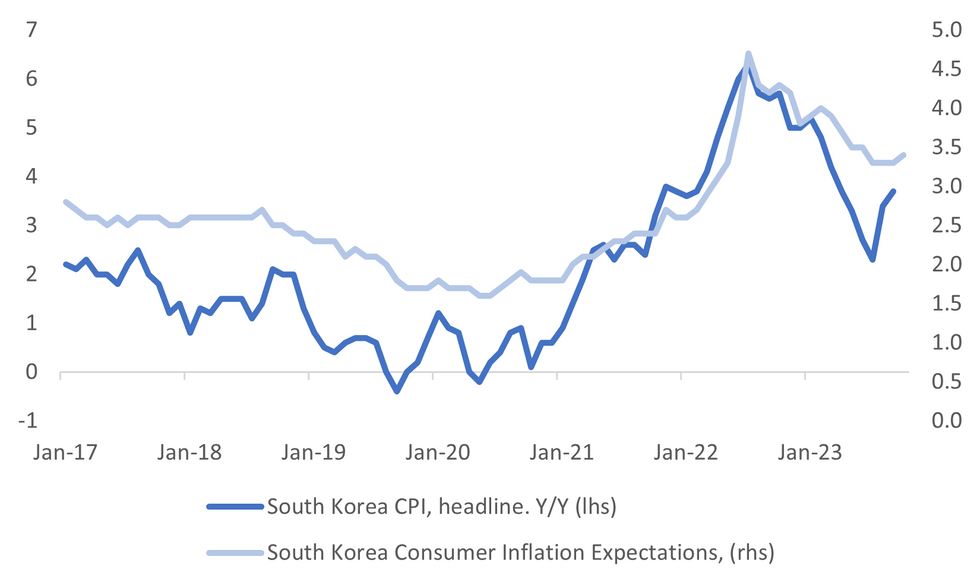

- In terms of prices, the expected inflation level ticked higher to 3.4%, after holding steady at 3.3% for the past 3 months. The second chart below overlays this expectation index against headline inflation in y/y terms.

- Expected wages and house prices ticked down in October though.

Fig 2: South Korean Consumer Inflation Expectations & CPI Y/Y

Source: MNI - Market News/Bloomberg

ASIA FX: CNH Not Seeing Positive Spill Over From Higher Equities

USD/Asia pairs are mixed. CNH is not seeing positive spill over from better equity sentiment, while USD/KRW has risen amid on-going offshore equity outflows. USD/THB is up from earlier lows, and USD/IDR tracks recent ranges, with the market like mindful of BI intervention risks. Tomorrow's calendar is headlined by Q3 South Korean GDP. Also out is Singapore unemployment figures and IP data.

- USD/CNH saw brief downside in the first part of trade, onshore equities surged at the open amid fresh fiscal stimulus. However, we couldn't get beyond 7.3069 and we last tracked near 7.3140. Local equities are away from earlier highs, which has weighed at the margin. Speculation that monetary easing will be needed to in conjunction with fresh fiscal stimulus (particularly from a liquidity standpoint), may also be curbing CNH.

- The won is underperforming in the first part of Wednesday trade. The 1 month NDF is back to 1346, which is above Tuesday highs and around 0.30% weaker versus NY closing levels. It is also back above the 20-day EMA. Highs from Monday in the pair came in close to 1353. Local equities are generally underperforming broader regional trends. The Kospi sits -0.35% weaker at this stage. Headwinds have come from weaker US Nasdaq futures, while offshore equity outflows have been -$335.4mn so far today.

- The Rupee has opened marginally firmer after being closed for the observance of a national holiday on Tuesday. In early trade on Wednesday we sit at 83.11/12 ~0.1% below Monday's closing levels. A reminder that the data docket is empty this week. Looking ahead the next release of note is on 31 Oct which is Sep Fiscal Deficit and Eight Infrastructure Industry Survey.

- The SGD NEER (per Goldman Sachs estimates) sits little changed from opening levels and well within recent ranges after firming earlier this week. The measure sits ~0.5% below the top of the band. USD/SGD sits a touch below the 20-Day EMA ($1.3680) on Wednesday, the pair firmed yesterday as broader USD flows dominated. The local data docket is empty today, looking ahead tomorrow September Industrial Production crosses. On Fridays Q3 Home Prices are due as is September Unemployment.

- The Ringgit has ticked higher in early dealing today, USD/MYR faced resistance ahead of the 4.80 handle and has fallen ~0.3%. The pair sits at 4.7685/4.7725, recent gains have only been trimmed and USD/MYR is ~6% above August's opening levels. A reminder that the data calendar is empty this week. Looking ahead the next release of note is next Wednesdays S&P Global October Mfg PMI.

- USD/THB sits near 36.14 in recent trade, modestly firmer in baht terms for the session. Earlier lows in the pair were at 36.055. This was fresh lows for October, but we couldn't test the 36.00 figure level. Note as well, the 50-day EMA comes in at 35.99. On the topside, the 20-day EMA is near 36.37.

Baht is the top performing EM Asia currency in October to date, up nearly 0.80%. Fundamentally, not a lot appears to have changed for the currency, although in early October the NEER (J.P. Morgan Index) got to fresh YTD lows. Hence part of the baht rebound may have reflected some market participants seeing fresh value in the currency. - USD/IDR sits a little higher in the first part of Wednesday dealings. We last tracked just near 15865, around 0.10% weaker in IDR terms. This came after closing yesterday at 15850, which also marked lows for the session. The 1 month USD/IDR NDF has followed a similar trajectory, with the pair unable to sustain breaches sub 15850.

- USD/PHP sits within recent ranges, last near 56.80. Focus is whether the BSP delivers an out of cycle hike tomorrow, with Governor Remolona stating this was possible in an interview yesterday.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/10/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Survey |

| 25/10/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/10/2023 | 0700/0900 | ** |  | ES | PPI |

| 25/10/2023 | 0800/1000 | ** |  | EU | M3 |

| 25/10/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/10/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/10/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 25/10/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/10/2023 | 1400/1000 | *** |  | CA | Bank of Canada Policy Decision |

| 25/10/2023 | 1400/1000 |  | CA | Bank of Canada Monetary Policy Report | |

| 25/10/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 25/10/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 25/10/2023 | 1500/1100 |  | CA | Bank of Canada Governor press conference | |

| 25/10/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 25/10/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

| 25/10/2023 | 2035/1635 |  | US | Fed Chair Jerome Powell |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.