-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Australian CPI Miss Lowers RBA Hike Odds, FOMC Coming Up Later

- RBA-dated OIS pricing is 5-9bp softer across meetings after the weaker than expected Q2 CPI data. The market now attaches a 33% chance of a hike by the RBA in August versus 58% pre-data. Economists are now split over whether we see an RBA pause in August. Not surprisingly, the AUD underperformed in the G10 FX space, although we sit comfortably above post data lows.

- There was no positive follow to yesterday's surge in Hong Kong/China equities, with major indices tracking lower currently. This aided USD sentiment at the margins.

- In terms of the global growth backdrop, CPB global trade fell 2.4% y/y in May after -1% the previous month driven by weakness in both advanced and emerging economies. But export momentum is recovering strongly in the latter and should drive positive growth from there in the months ahead.

- US Cash tsys sit little changed from opening levels across the major benchmarks, as the market awaits the FOMC rate decision. This is the main event risk for the Wednesday session, see our preview here.

MARKETS

GLOBAL: Trade Weak But Momentum Improving, IP Outlook Soft

CPB global trade fell 2.4% y/y in May after -1% the previous month driven by weakness in both advanced and emerging economies. But export momentum is recovering strongly in the latter and should drive positive growth from there in the months ahead. In line with weakening manufacturing PMIs, global IP fell for the third consecutive month but is still up 1% y/y.

- The Baltic Freight index is signalling that the correction in trade should have troughed but there is no sign yet that it is about to pick up. The IMF revised down its 2023 world trade forecast by 0.4pp to 2% but increased 2024 by 0.2pp to 3.7% in its July forecast update. EM trade was revised down to only 1.5% in 2023 and 4.5% in 2024 whereas OECD was 2.3% and 3.2% (+0.3pp).

Source: MNI - Market News/Refinitiv

- Global exports fell 1.6% y/y in May after -0.2% with advanced economies declining 2.2% and EM -0.7%. Asian exports were weak in May with China down 5.1% y/y, advanced Asia ex Japan -6.5% and emerging Asia ex China -1% y/y. Whereas the US’ rose 2.5% y/y, Latin America 5% and eastern Europe/CIS +9.9%.

- Global IP has been soft in recent months but remains positive in line with metal prices picking up and the global manufacturing PMI around 50. But the PMI fell to 48.8 in June and given the soft European surveys, it could fall again in July. Global IP 3-momentum turned negative in May and so along with subdued wool prices and the chance the global manufacturing PMI may decline again in July after falling to 48.8 in June, output could decline further.

Source: MNI - Market News/Refinitiv/Bloomberg

GLOBAL: IMF Revises Up 2023 Growth But Risks To Downside

The IMF revised up its 2023 global growth forecast to 3% from 2.8% in April after 3.5% in 2022. 2023 was always expected to see a slowdown but the global economy has proved more resilient than originally projected. In October 2022, the IMF forecast 2.7% for 2023. The upward revision was driven by both developed (+0.2pp) and emerging economies (+0.1pp). 2025 is also expected to grow by the below-average 3%.

- The IMF sees risks to growth skewed to the downside stemming from higher inflation (Ukraine, weather events) resulting in higher rates, financial stability and China’s troubled property market. Upside risks are from faster disinflation and resilient demand. It advises central banks to focus on sustained disinflation, and strengthening financial supervision & risk monitoring. Governments should build fiscal buffers.

- Developed country growth in 2023 is now expected to be 1.5% revised up from 1.3% with major countries seeing higher growth except Germany. The US was revised to 1.8% (+0.2pp), euro area 0.9% (+0.1pp), Japan 1.4% (+0.1pp) and the UK 0.4% (+0.7pp). Germany however is forecast to shrink by 0.3% (-0.2pp) but France grow by 0.8% (+0.1pp). 2024 OECD growth is forecast to be only 1.4%.

- The upward revision to EM growth was driven by emerging Europe and Latin America, as forecasts for China and developing Asia were left unchanged for 2023 at 5.2% and 5.3% respectively easing to 4.5% and 5% in 2024. India was revised up 0.2pp to 6.1% in 2023. Emerging Europe should grow by 1.8% (+0.6pp – driven by +0.8pp to Russian growth) and Latin America 1.9% (+0.3pp).

Source: MNI - Market News/IMF/World Bank/OECD

US TSYS: Narrow Ranges In Asia, FOMC In View

TYU3 deals at 111-24, +0-04+, a 0-04+ range has been observed on volume of ~61k.

- Cash tsys sit little changed from opening levels across the major benchmarks.

- Tsys have observed narrow ranges in Asia with little follow through on moves, perhaps the proximity to today's FOMC rate decision limited activity.

- Flow-wise the highlight was a block seller in FV (2,177 lots).

- FOMC dated OIS remain stable, a 25bps hike is priced into today's meeting. A terminal rate of 5.44% is seen in November with ~60 cuts by June 2024.

- There is a thin docket in Europe today, before the FOMC rate decision is due further out. The MNI preview of the event is here. June Home Sales will also cross .

JGBS: Futures Reverse Higher In Afternoon Trading, Cash Curve Twist Flattens

JGB futures are firmer in afternoon trade, +13 compared to settlement levels, after trading in negative territory in the morning session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined June PPI data that surprised on the downside. While the data generated little initial market reaction, afternoon strength is consistent with the message embedded in the data. That being, the pace of gains in Japan’s service prices for businesses slowed in June by the most since October 2020. Service prices are seen by economists as an indication of how price gains are spreading in the wider economy. (See link)

- The leading and coincident indices (final for May) will print soon.

- The cash JGB curve has twist flattened in the Tokyo afternoon session, pivoting at the 3-year zone with yields ranging from 0.5bp higher (2-year) to 1.7bp lower (20-year). The benchmark 10-year yield is 0.7bp lower at 0.459%.

- The swap curve has swung from a bear steepening in the morning session to a bull flattening after the lunch break. Swap spreads are narrower across the curve after being wider in the morning.

- Tomorrow the local calendar sees International Investment flow data (Jul 21) ahead of Tokyo CPI and the BoJ Policy Meeting on Friday.

- Tomorrow also sees the MoF sell Y2.9tn 2-year JGBs.

AUSSIE BONDS: Richer After CPI Miss

ACGBs (YM +7.0 & XM +2.5) sit richer, but well off session bests, after Q2 headline and underlying inflation came in lower than RBA forecasts, thus it is on track to meet the target by mid-2025.

- Trimmed mean was lower at 0.9% and 5.9% after an upwardly revised 1.3% q/q and 6.6% y/y. Services inflation rose less than goods on the quarter up 0.8% q/q compared with goods at 0.9% but the annual rate rose 6.3% up from 6.1%.

- June inflation moderated to 5.4% from 5.5% in May. Importantly, 3-month momentum continues to ease towards the top of the RBA’s band and was 3.7% in June.

- Cash ACGBs are 6-7bp richer after the data with the AU-US 10-year yield differential -4bp at +11bp.

- Swap rates are 6-7bp lower after the data to be 3-8bp lower on the day with the 3s10s curve 5bp steeper.

- The bills strip bull steepens with pricing +4 to +10.

- RBA-dated OIS pricing is 5-9bp softer across meetings after the data. The market now attaches a 33% chance of a hike by the RBA in August versus 58% pre-data.

- Tomorrow the local calendar sees Terms of Trade data for Q2.

- Later today, the market’s focus will be firmly tuned to the FOMC meeting decision.

RBA VIEW: Economists Split Over Whether RBA Will Pause Now

Here is a selection of views on the implications of Q2 CPI on the monetary policy outlook from The Australian and other sources.

- ANZ thinks that the drop in quarterly CPI rates may mean that current policy is high enough to reduce inflation. 52% of prices were above 3% down from 60% in Q1.

- CBA still expects one more hike in August.

- Nomura has pushed out its August hike to November as unemployment remains below the NAIRU, other central banks are still tightening and policy isn’t particularly restrictive. Easing should begin in May 2024 bringing rates to neutral by year end.

- ING expects that the softer Q2 CPI should mean the RBA pauses in August, but base effects may mean that there’s a September hike.

- Citi still expects hikes in August and September, with an increased risk Sept is delayed to November, as it doesn’t expect the RBA’s core inflation forecast to be “materially revised” whereas its wages forecast may be revised up.

- AMP believes that Q2 CPI should be enough for the RBA to be on hold in August but that it will be a close call. It now expects only one more 25bp hike.

- KPMG expects the RBA to pause in August, especially given the lags.

- VanEck is still forecasting the RBA to hike in August with the risk of further moves as inflation is still “stubbornly high”, the labour market is tight and there’s an upside risk to wages.

- Capital Economics is projecting at least another hike but sees the risk that the Q2 CPI data may be enough for the RBA to think it has done enough to contain inflation. But services inflation is likely to remain high due to elevated ULC and the tight labour market.

- Deloitte Access Economics believes the RBA is done tightening policy.

AUSTRALIAN DATA: Q2 Inflation Below RBA’s Forecasts, August Meeting Close Call

Q2 headline and underlying inflation came in lower than RBA forecasts, thus it is on track to meet target by mid-2025. But inflation remains well above target. Q2 CPI came in below expectations of a 1% q/q rise increasing 0.8% q/q to be up 6% y/y down from 7% y/y in Q1 and the Q4 7.8% peak. Trimmed mean was also lower at 0.9% and 5.9% after an upwardly revised 1.3% q/q and 6.6% y/y. These are the lowest quarterly rates since Q3 2021 and close to the historical average. June inflation moderated to 5.4% from 5.5% in May.

Australia CPI y/y%

Source: MNI - Market News/Refinitiv

- Services inflation rose less than goods on the quarter up 0.8% q/q (higher than average) compared with goods at 0.9% but the annual rate rose 6.3% up from 6.1% and higher than goods (5.8% y/y) for the first time since Q3 2021. This is likely to be the peak in services inflation, as the quarterly rates are moderating and base effects should help the annual rate ease in Q3. But higher wage rates from July 1 are likely to put upward pressure on prices in Q3 as signalled by the July services PMI.

Source: MNI - Market News/Refinitiv

- Domestically-driven non-tradeables eased to 6.9% y/y from 7.5% and tradeables to 4.4% from 6.1%.

- Most components of the CPI still rose but some declined. Lower fuel prices helped to bring the transport CPI down. The largest contributors to Q2 inflation were rents (+2.5% q/q & 6.7% y/y), overseas holiday travel, other financial services and new dwellings purchased. Food prices rose strongly up 1.6% q/q. On the downside electricity prices fell 1.8% q/q and domestic travel -7.2%.

- There will be a partial update of CPI weights in Q3, which the ABS says will increase the weight of international holiday travel. These weights will be published with the July CPI on August 30. This could result in upward revisions to CPI. The full update will now be in Q1 2024 rather than Q4 2023.

NZGBS: Closed On A Positive Note After AU CPI Sparks A Rally

NZGBs closed on a positive note with benchmark yields 3-5bp lower than session highs. The move away from session cheaps was assisted by a rally in ACGBs following lower-than-expected Q2 CPI data. By the close, the cash 2/10 curve had twist steepened with yields 1bp lower to 2bp higher. NZ/AU 10-year yield differential widened 4bp to +64bp.

- Swap rates closed mixed with rates -1bp to +1bp and the 2s10s curve steeper.

- RBNZ dated OIS pricing closed little changed. Terminal OCR expectations sit at 5.66% versus 5.70% late last week.

- Tomorrow the local calendar is empty. The next key release is ANZ Consumer Confidence (Jul) on Friday.

- Later today, the market’s focus will be firmly tuned to the FOMC meeting decision. While the market has already priced in a 25bp hike for the FOMC meeting today, there remains significant uncertainty about the Fed's outlook. Investors are keenly waiting for comments from Fed Chair Powell during the press conference following the rate decision. His statements may provide valuable insights into the central bank's plans for further interest rate increases.

- Tomorrow the NZ Treasury plans to sell NZ$225mn of the 0.5% May-26 bond, NZ$225mn of the 1.5% May-31 bond and NZ$50mn of the 2.75% May-51 bond.

FOREX: AUD Pares Post-CPI Losses, FOMC In View

The AUD has pared its post-CPI losses in Asia after Q2 headline and core CPI were below estimates. AUD/USD printed a low at $0.6731 before finding support and ticking away from session lows.

- The pair now sits at $0.6760/65, a touch below its pre-CPI levels. RBA-dated OIS sit 5-9bps softer across meetings and RBA-watcher McCrann noted that the CPI print may be enough to keep the RBA on hold in August.

- Kiwi was pressured on spillover from the post-CPI move lower in AUD before support was seen below $0.62. NZD/USD now sits ~0.1% lower on the day, and well within recent ranges.

- Yen is little changed, the pair is see-sawing around ¥141 handle in narrow ranges.

- Elsewhere in G-10 NOK is down ~0.3% however liquidity is generally poor in Asia. EUR and GBP are a touch lower however ranges remain narrow.

- Cross asset wise; BBDXY is up ~0.1% and US Tsy Yields are little changed across the curve. E-minis are flat and the Hang Seng is down ~0.8%.

- The highlight of todays session is the latest FOMC rate decision, the MNI preview is here.

EQUITIES: No Positive Follow Through To Yesterday's Hong Kong/China Equity Surge

Regional equities have been mixed ahead of the upcoming US Fed decision. US equity futures are close to flat paring early losses. Eminis were last near 4596.5, Nasdaq futures a touch weaker at 15657. We are down from late Tuesday session NY highs, amid a mixed earnings backdrop post the US close.

- Hong Kong and China equities haven't been able to rally further after posting strong gains yesterday. Losses are relatively modest at this stage, but the market may have been hopeful of further positive momentum in the wake of the recent Politburo meeting.

- At the break the HSI is down 0.79%, with the tech sub index down 1.38%, although we were 6.04% higher yesterday for this index. Jack Ma's backed Ant Group is planning a restructuring that will potentially pave the way for reviving the Hong Kong IPO.

- The CSI is off by 0.34% at the break, with the Shanghai Composite down by a similar amount. The properties sub index has continued to recover though, adding a further 0.87% so far, which follows yesterday's +8% gain.

- Japan stocks are close to flat at this stage. South Korean shares are among the weakest performers. The Kospi is down over 1%. Samsung has been weaker, along with motor vehicle companies. Offshore investors have net sellers of local stocks today (-$116.2mn).

- Australian stocks have outperformed, the ASX 200 +0.80%. The weaker than expected Q2 CPI print has aided sentiment around the RBA outlook.

- In SEA sentiment is mixed, with Thailand and Philippines bourses lower, but positive trends elsewhere.

CRUDE: Crude Down Slightly As Waits For Fed

Oil has been trading in a narrow range of less than 50c during the APAC session. The recent gains that brought crude to a three-month high have been sustained with prices down only 0.4% today, but the upcoming Fed decision and accompanying comments risk these gains. WTI hasn’t been able to break $80 and is currently around $79.28/bbl while Brent is $83.30. The USD index is up slightly.

- Crude has been trading sideways as it waits for the Fed decision. WTI reached a low of $79.17 followed by a high of $79.43. Brent’s intraday low was $83.12 and the high $83.42.

- Later the Fed is widely expected to hike rates 25bp and retain its tightening bias but the comments following will be key to the rate outlook and for oil developments. Despite the recent rally, crude markets remain concerned about demand from both the US and China. A hawkish Fed is likely to increase US recession fears (see MNI Fed Preview - July 2023 here).

- Bloomberg reported that API US crude inventories rose 1.319mn in the latest week, according to those familiar with the data. Official EIA data is released later today and expected to post a fall.

- In terms of data, there is only US June new home sales.

GOLD: Firmer On Tuesday, Awaiting The FOMC Decision

Gold is little changed in the Asia-Pac session, after closing higher (+0.5%) on Tuesday, recovering some of the losses experienced in recent days, which had pushed prices to their lowest level in a week. The market's focus was on the upcoming Federal Reserve interest rate decision scheduled for Wednesday, as well as monetary policy decisions from the ECB and BoJ later in the week.

- While the market has already priced in a 25bp hike for the FOMC meeting today, there remains significant uncertainty about the Fed's outlook. This uncertainty contributed to a rise in US Treasury yields over recent days, as there is a concern that the Fed's stance could turn out to be more hawkish than anticipated.

- Investors are keenly waiting for comments from Fed Chair Powell during the press conference following the rate decision. His statements may provide valuable insights into the central bank's plans for further interest rate increases. Any indication that the Fed is considering additional rate hikes beyond July, such as at its September meeting or later, might exert downward pressure on gold prices.

- Currently, gold has been buoyed by recent inflation data, which indicated that price pressures are easing more rapidly than initially expected.

SOUTH KOREA: Headline Consumer Sentiment Improves Further, Inflation Expectations Downtrend Continues

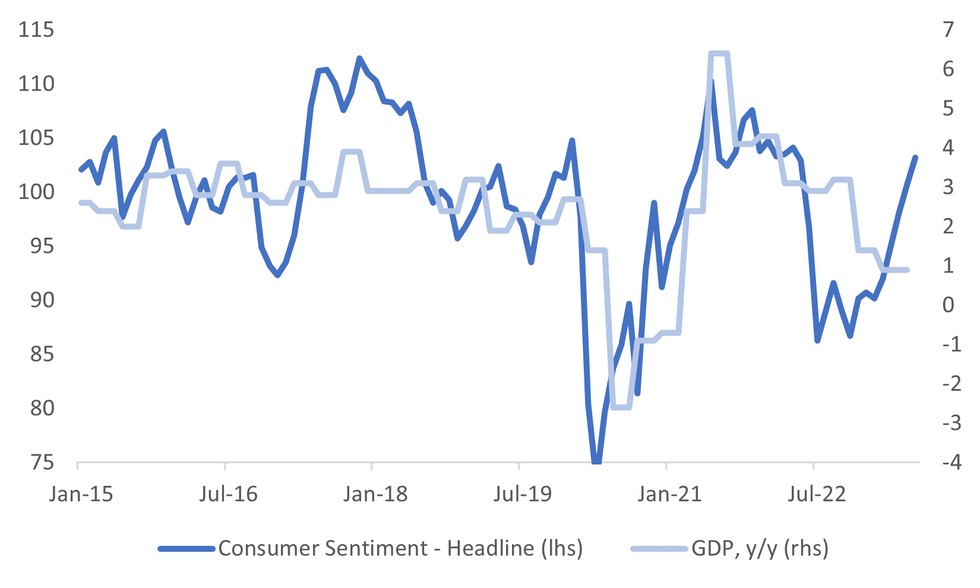

South Korean consumer sentiment for July continued to rebound, the headline index printing at 103.2, versus 100.7 in June. July's print is the strongest since April 2022. The first chart below overlays the headline consumer sentiment index against y/y GDP growth. Consumer sentiment tends to trough before GDP growth does and is suggesting, all else equal, better y/y growth momentum as we progress through H2.

- In terms of the detail, most subcomponents were higher, with decent pickups in the expectation for the domestic economy and employment. Spending plans were more muted though, particularly in discretionary areas.

Fig 1: South Korea Headline Consumer Sentiment & GDP Y/Y

Source: MNI - Market News/Bloomberg

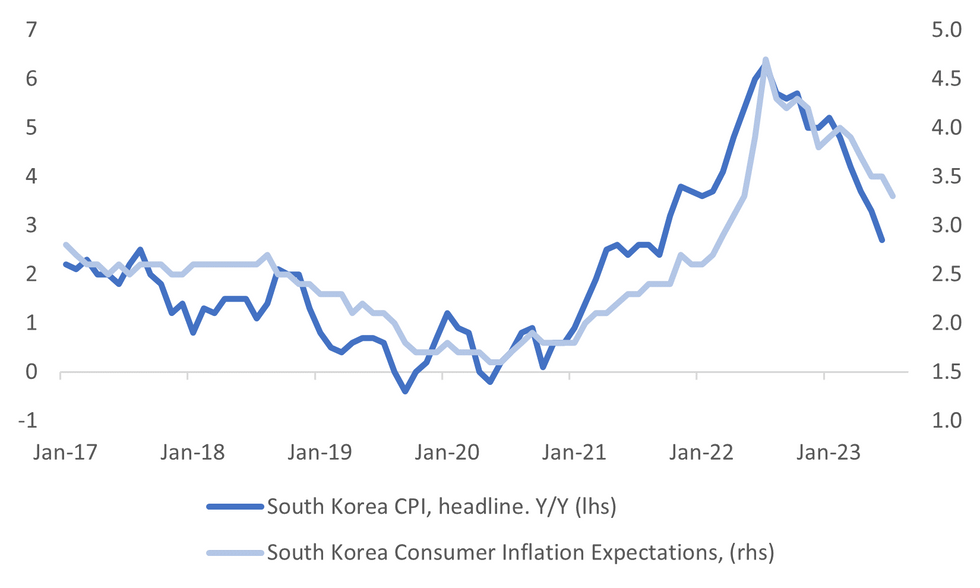

- On the inflation front, the expected rate for the next 12 months fell to 3.3%, although this indicator has been following headline inflation in recent years, with a slight lag, see the chart below. Still, the authorities will likely welcome a further downshift in expectations.

- Expected wages continued to tick higher, as did the house price outlook.

Fig 2: South Korean Consumer Inflation Expectations & Headline CPI Y/Y

Source: MNI - Market News/Bloomberg

ASIA FX: Most USD/Asia Pairs Higher As USD/CNH Rebounds

Most USD/Asia pairs have seen a modest drift higher, led by a rebound in USD/CNH. Weaker equities in parts of the region have also weighed, while the USD is modestly higher against the majors (ahead of the FOMC). THB has outperformed, while MYR has been steady in the face of the USD/CNH turn higher. Still to come today is Thailand trade data. Tomorrow, we get China Industrial profits, along with South Korea business sentiment. Thailand IP and Singapore unemployment figures are also due.

- USD/CNH sits around +0.30% higher versus NY closing levels from Tuesday. We were last just under 7.1580, with the pair having found some selling interest on the earlier move up to 7.1640. There hasn't been any positive follow up momentum to Hong Kong or mainland stocks so far today, which has likely tempered bullish CNH sentiment. The CNY fixing error was also narrower.

- 1 month USD/KRW spiked higher in early trade, but found selling interest above 1280. We last tracked close to 1276.50, still 0.15% weaker in won terms versus NY closing levels. The won has outperformed a fairly sharp pull back in onshore equities (the Kospi off 1.4%, while the Kosdaq is off 2.7% as momentum into EV stocks wanes). Earlier we had a further rise in July consumer sentiment and a pull back in inflation expectations.

- The Ringgit is little changed in early dealing on Thursday, operating in a narrow range with little follow through on moves. USD/MYR prints at 4.5590/4.5630, the pair is marginally below opening levels and has been consolidating below 4.60 handle in recent dealing. The KLCI index has risen ~0.5% and is set for its highest close since March 10. Global investors bought a net $30.8 million of Malaysian stocks on Tuesday, according to exchange data, adding to the strong inflows seen in July. A reminder that the local data docket is empty for the reminder of July, the next data due is July Mfg PMI next Tuesday.

- The SGD NEER (per Goldman Sachs estimates) is marginally firmer in early dealing, the measure sits a touch off cycle highs and is ~0.2% below the top of the band. USD/SGD fell ~0.4% as broader USD trends dominated flows amid, the pair remains well within recent ranges and sits a touch below the $1.33 handle. Industrial Production rose 5.0% M/M in June stronger than the forecasted 4.1%. Looking ahead on the wires early in tomorrow's session we have the June Unemployment Rate, the rate is expected to tick high to 1.9% from 1.8%.

- Rupee has weakened today, USD/INR is ~0.2% higher and sits above the 82 handle. Reuters noted, link here, that the RBI has been selling the Rupee to halt the downward momentum of USD/INR which had fallen 1.4% off July 10 highs. A reminder that the domestic data calendar is empty this week.

- USD/THB sits lower for the session, last at 34.41, which is around 0.30% firmer in baht terms for the session to date. Earlier highs were near 34.55, with baht modestly outperforming the stronger USD/Asia trend elsewhere (most notably USD/CNH) and higher USD levels against the majors (albeit away from best levels). There doesn't appear a fundamental catalyst for this modest outperformance, but it does threaten a break to the downside in terms of ranges for the week, although we remain comfortably above lows from last Thursday close to the 33.76 level. As we noted earlier, focus is likely to remain on the domestic political front, although prospects for meaningful headway in the near term appear low.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/07/2023 | 0600/1400 | ** |  | CN | MNI China Liquidity Survey |

| 26/07/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 26/07/2023 | 0800/1000 | ** |  | EU | M3 |

| 26/07/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 26/07/2023 | 1400/1000 | *** |  | US | New Home Sales |

| 26/07/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 26/07/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 26/07/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting | |

| 26/07/2023 | 1800/1400 | *** |  | US | FOMC Statement |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.