-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI Credit Weekly: Le Vendredi Noir

MNI: Canada Apr-Sept Budget Deficit Widens On Spending

MNI EUROPEAN MARKETS ANALYSIS: China Data Surprises On The Downside Again, Will Growth Expectations Follow?

- Weaker than expected China data weighed on regional sentiment today. AUD/USD faltered, back to 0.6675 currently, while USD/CNH moved above 6.9700. China equities are modestly lower, while iron ore and oil have given back some of their recent gains. Further downside surprises in China data outcomes risks ending the run of positive growth upgrades we have seen this year.

- Elsewhere, NZGBs closed at session cheaps, 8-11bp weaker, as the market digests Westpac’s 6.0% OCR forecast and the prospect of a worse-than-expected deficit when the budget is handed down on Thursday.

- Japan equities remain a bright spot. A combination of positive earnings momentum, share buybacks and continued inflows (both domestically and from abroad) is aiding sentiment. The Topix is back to August 1990 levels.

- Looking ahead, US debt discussions resume on Tuesday afternoon US time. Ahead of that in Europe today preliminary Eurozone GDP is on the wires, further out Canadian CPI and US Retail Sales, Industrial Production and Business Inventories cross. Fed VC Barr testifies before Congress and Fedspeak from Cleveland Fed President Mester, NY Fed President Williams and Chicago Fed President Gooldsbee crosses.

MARKETS

US TSYS: Marginally Firmer In Asia

TYM3 deals at 115-11+, +0-04, a touch off the top of the 0-06 range on volume of ~50k.

- Cash tsys sit ~2bps richer across the major benchmarks.

- Tsys firmed through today's Asian session benefiting from spillover from ACGBs in lieu of falling Australian Consumer Confidence and the minutes of the May RBA meeting noted that the 25bp hike was finely balanced.

- Moves have had limited follow through as we remain well within recent ranges.

- A meeting between President Biden, House Leader McCarthy and other congressional leaders has been scheduled for Tuesday afternoon.

- In Europe today preliminary Eurozone GDP is on the wires, further out Canadian CPI and US Retail Sales, Industrial Production and Business Inventories cross. Fed VC Barr testifies before Congress and Fedspeak from Cleveland Fed President Mester, NY Fed President Williams and Chicago Fed President Gooldsbee crosses.

JGBS: Futures Holding Uptick, Narrow Range Ahead of Q1 GDP & 20-Year Supply

During the afternoon trading session in Tokyo, JGB futures have been trading within a narrow range and are slightly stronger at +7 compared to the settlement levels. Since there are no domestic data releases or supply-side factors affecting the market, local traders have been focused on monitoring US tsys as they await the release of the Euro Area's Q1 GDP and US Retail Sales later today.

- Cash US tsys are 2-3bp lower in early Asia-Pac trade, assisted by disappointing monthly economic data from China.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined news that the Japanese government will allow seven of the nation’s major power companies to raise household electricity prices by between 14% to 42%.

- Cash JGBs are slightly stronger across the curve apart from the 1-year and 3-year zones. Yields are 0.1-0.9bp lower with the 30-year the strongest The benchmark 10-year yield is 0.2bp lower at 0.405%, after yesterday’s 1.6bp increase.

- Swap rates are flat to 1.0p lower out to the 20-year zone, and slightly higher beyond. Swap spreads tighter out to the 10-year zone and wider beyond.

- The local calendar heats up tomorrow with the release of Q1 GDP and 20-year JGB supply.

AUSSIE BONDS: Weaker, Off Cheaps, Awaits WPI

ACGBs sit weaker (YM -3.0 & XM -2.0), off session cheaps, after the RBA Minutes signalled that the May decision to hike 25bp was a close call, with a no change outcome discussed. Members acknowledged the significant uncertainties surrounding the economic outlook, but on balance, they judged that a further increase in interest rates was warranted to bring inflation back to target.

- Richer US tsys in Asia-Pac trade also assisted the move off session lows.

- Cash ACGBs are 2bp richer after the Minutes release to be 2bp cheaper on the day with the AU-US 10-year yield differential +2bp at -4bp.

- Swap rates are 1-2bp higher on the day with the 3s10s curve flatter.

- Bills are 2bp stronger after the Minutes with pricing flat to -3.

- RBA-dated-OIS are slightly softer after the Minutes, sitting 1bp softer to 2bp firmer across meetings.

- Tomorrow sees the release of the Wage Price Index for Q1. After last quarter’s surprisingly soft print despite the minimum wage lift, the market will be watching to see if that result is reversed in Q1.

- Until then, all eyes will be on global bonds as they navigate Q1 GDP in the Euro Area and April Retail Sales in the US.

AUSTRALIAN DATA: Confidence Falls Sharply But Housing Optimism Rising

Westpac’s measure of consumer confidence fell 7.9% m/m in May after rising 9.4% in April and is now only slightly above the February/March low. All components were lower. Given the RBA’s surprise May rate hike, this development is unsurprising. Westpac also notes that the Budget weighed on sentiment too, as it seems people were hoping for more relief.

- Almost 70% of those surveyed expect rates to rise again over the next year with just over 40% expecting it to be by more than 1pp. This is up from 61% and 34% respectively in April following the RBA’s pause but down from November’s peak of 81.5% and 60%.

- The survey had been delayed a week to assess the impact of the Budget. Confidence before the May 9 Budget was 81.3 (-5.3% m/m) whereas afterwards it was down another 7.4% to 75.3. The largest post-Budget drops were in the groups most dependent on cost-of-living relief and mortgage holders. Westpac attributes around 60% of the total May drop to the Budget and the rest to the rate hike and other factors.

- 15.5% of those surveyed expect to be better off from the Budget and 27% worse off, which is a usual pattern.

- Renters, mortgage holders, low income consumers and women saw the sharpest falls in confidence. The news recently has been uniformly negative regarding the prospects for renters.

- The housing market bucked the trend with the “time to buy” rising 7.3% after 8.2% last month, despite house price expectations rising 10.7% and rates expected to rise further.

- Both past and future finances fell around 10%. The economic outlook fell over 9%. “Time to buy a household item” remains more depressed than the early 1990s recession.

- Consumers are still optimistic regarding the labour market but are gradually losing some confidence.

- See Westpac report here.

Source: MNI - Market News/Refinitiv/Westpac

NZGBS: Weaker Fuelled By Hike & Budget Deficits Fears

NZGBs closed at session cheaps, 8-11bp weaker, as the market digests Westpac’s 6.0% OCR forecast and the prospect of a worse-than-expected deficit when the budget is handed down on Thursday. NZGBs underperformed the $-Bloc with NZ/US and NZ/AU 10-year yield differentials closing respectively 6bp and 3bp higher.

- Swap rates closed 5-9bp higher with the 2s10s curve 4bp flatter.

- RBNZ dated OIS closed 6-11bp firmer for meetings beyond May. The May meeting has 25bp of tightening priced.

- Non-Resident Bond Holdings data showed an increase from 60.3% in March to 62.1% in April, its highest level since 2017.

- The local calendar is light again tomorrow ahead of the Budget on Thursday. The government has signalled that Budget 2023 will focus on alleviating cost-of-living pressures, fast-tracking recovery from Cyclone Gabrielle, and maintaining public services, but not much else. The operating balance is expected to reach surplus in 2025/26, one year later than previously flagged.

- In Australia, the Wage Price Index is scheduled for release tomorrow with the market closely watching to see if last quarter’s soft outcome is reversed.

- Until then, all eyes will be on global bonds as they navigate Q1 GDP in the Euro Area and April Retail Sales in the US.

NZ: Budget To Focus On Post-Cyclone Repair & Cost-Of-Living Relief

PM Hipkins has said that the May 18 budget will be focussed on cost-of-living relief and recovery from Cyclone Gabrielle but will be “no frills”. There also won’t be any new taxes or tax cuts. The recovery cost of recent weather events are to be funded from both within the existing budget and debt issuance.

- Finance minister Robertson said "We've had some big Budgets over the last few years to support people through Covid so we've got to look carefully at the way we're funding everything." He has said that the Budget will show fiscal responsibility.

- There will be a $1bn flood and cyclone recovery package, on top of the $800mn of support already announced. The fund will cover the “basics”, i.e. repair roads, school, rail and includes flood protection and mental health support. Treasury estimated that fixing the damage will cost $9-$14bn with $5-$7.5bn for public infrastructure repair but the cost will be spread over several years.

- Another $400mn in the budget will be spent on schools and $73.5mn for family violence prevention over four years.

- The government has found $4bn in savings and reprioritisations over the coming 4 years and most of it will go to funding agencies’ existing expenditures. Covid programmes, the cancelled public media merger and affordable water reforms will have their funding reallocated. There will also be reduced funding for the clean car upgrade and social leasing schemes.

- Robertson has said that spending is easing toward the low-30% of GDP rate but he doesn’t want to get it there sooner, as that would require significant cuts. Tax revenue is expected to fall to 29.9% of GDP from 30.2%.

- NZ debt is forecast to rise to 19.9% of GDP from 17.2%, but still below the 30% debt ceiling. The deficit in the FY to date has been larger than expected due to Cyclone Gabrielle and lower-than-expected tax revenues.

- RNZ, Stuff.co.nz

EQUITIES: Japan Stocks Hit Multi-Decade Highs, China Markets Struggle Amid Data Misses

Regional equities are once again trading mixed. Japan stocks remain solid performers, with the Topix printing multi decade highs. Weaker April activity data has weighed on China equity bourses, although losses haven't been large. Hong Kong equities are also still higher at this stage. US futures are in the red with Eminis down ~0.20%, last near4142.

- Japan's Topix is around +0.50% at this stage, which is fresh highs back to August 1990 (last near 2125.00 in index terms). A combination of positive earnings momentum, share buybacks and continued inflows (both domestically and from abroad) is aiding sentiment.

- The CSI 300 is down slightly, while the Shanghai Composite is flat. Weaker April activity figures have weighed at the margin. We have seen Northbound stock connect outflows today (-3.92bn yuan), the first daily outflow since the 4th of May (if sustained for the rest of the session).

- The HSI is +0.39% at this stage, we did see a surge in the Golden Dragon index in US trade on Monday (+4.07%). Famed money manager Michael Burry increased holdings in Alibaba and JD.com, which aided sentiment in the tech space.

- The ASX 200 is down -0.30%, with the softer Westpac/ANZ consumer sentiment readings weighing on consumer related stocks. Miners have also been indifferent with commodity prices struggling somewhat post the China data.

- The Kospi is up +0.10%, but the Taiex has outperformed +1.35%, following a strong gain for the SOX index in US trade on Monday.

FOREX: USD Little Changed In Asia

The greenback is little changed from Mondays closing levels in Asia, BBDXY is flat. Ranges across G-10 have been mostly narrow with little follow through.

- Kiwi is the strongest performer in the G-10 space at the margins, NZD/USD prints at $0.6250/55 ~0.1% firmer today. The pair sits a touch off session highs and has moved above its 20-Day EMA today.

- AUD is marginally pressured, AUD/USD prints at $0.6690/95 down ~0.1%. The RBA minutes of the May meeting noted that the decision to hike 25bps was finely balanced. AUD briefly extended losses as Chinese data was softer than expected before recovering to current levels.

- Yen is little changed dealing in a narrow range around the ¥136 handle.

- Elsewhere in G-10 ranges have been narrow in Asia, EUR is a touch firmer.

- Cross asset wise; e-minis are down ~0.2% and US Treasury Yields are ~2bps softer across the curve.

- In Europe today preliminary Eurozone GDP is on the wires, further out Canadian CPI and US Retail Sales, Industrial Production and Business Inventories cross.

OIL: Crude Holds Onto Gains But Off Highs Following Disappointing China Data

Oil prices have extended Monday’s gains during today’s APAC session, despite April China data coming in on the downside. They are up another 0.4% with WTI around $71.40/bbl following an earlier intraday high of $71.79 and Brent about $75.56 after a high of $75.95. Both are approaching resistance levels of $73.93 and $77.61 respectively. The USD index is flat.

- While the hoped for surge in demand from China is looking less likely, the US announced that it will buy up to 3mn barrels of sour crude in August for the Strategic Petroleum Reserve (SPR), helping to support oil prices.

- Despite the weaker-than-expected China data, processing of crude remained near a record high. China’s disappointing post-pandemic recovery plus expectations of a US recession have weighed on oil prices this year. The market also continues to be nervous about the US debt ceiling talks.

- Supply issues persist though with Canadian wildfires disrupting around 300kbd of crude and issues with shipments from Iraqi Kurdistan persisting. However, Russian shipments continue to indicate that output isn’t being reduced there.

- Later the IEA publishes its monthly outlook report and industry data on US fuel stocks is also released.

- The Fed’s Mester, Barr, Williams, Goolsbee and Logan are all scheduled to speak today. US April retail sales will be watched closely. NY Fed services business activity for May, April IP and March business inventories print as well. UK and euro area employment data, euro area Q1 GDP and Canadian April CPI are released.

GOLD: Unchanged In Asia-Pac, Weaker Dollar & Debt Ceiling Talks Supporting

In Asia-Pacific trading, gold is little changed at 2016.61, after closing +0.3% to $2016.49 having gyrated its way higher with the USD index steadily unwinding Friday’s sizeable gain.

- Further debt ceiling talks between the White House and Congressional leaders are set for Tuesday and are expected to hit roadblocks. A key Republican Congressional leader signalled Monday they're far apart from President Joe Biden on debt limit negotiations, lending support to gold.

- With the Federal Reserve coming to the end of its hiking cycle, market analysts are looking for a supportive medium-term outlook for gold.

- MNI's technical team reports that gold is still on an uptrend, marked by a series of higher highs and higher lows. Moving average studies are also indicating a bullish setup. Investors are closely monitoring the March 8 high of $2070.4, which is the immediate target before the all-time high of $2075.5. Meanwhile, the key support level remains at $1969.3, which was the low point recorded on April 19th.

CHINA DATA: Data Surprises On The Downside Again, Will Growth Expectations Follow?

China April activity data was weaker than expected, particularly in the industrial space. IP y/y printed at 5.6%, versus 10.9% expected and 3.9% prior. Fixed asset investment (FAI) also showed a decent downside miss at 4.7% ytd y/y/ versus 5.7% expected.

- The drag from property investment remained, -6.2% ytd y/y, -5.7% expected. Property sales were better at 11.8% ytd y/y, versus 7.1% prior. Other details showed new construction starts at -21.2% ytd y/y, while funds raised by developers were -6.4% y/y.

- The retail segment performed better, +18.4% y/y for retail sales, but this was still below expectations of +21.9%. This has been the trend during this recovery in terms of retail spending outperforming the industrial side.

- The jobless rate ticked down to 5.2%, versus 5.3% expected, although the China stats bureau noted that youth unemployment rose to the highest on record at 20.4%.

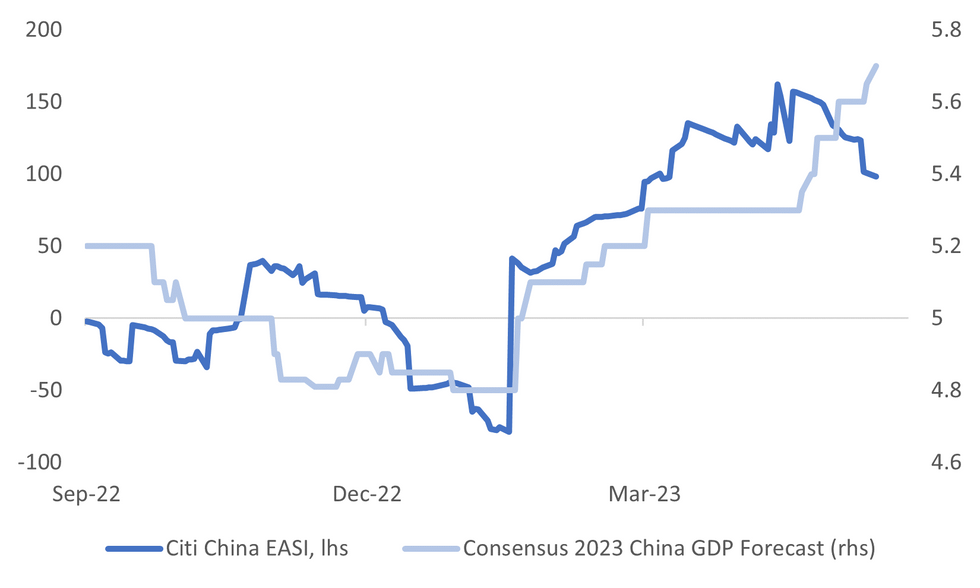

- Overall, the data suggests we will see further downside in indicators like the Citi China EASI (note the latest reading on the chart doesn't incorporate today's data outcomes). The index is moving down from elevated levels, see the chart below. The other line on the chart is China 2023 consensus GDP growth expectations (taken from Bloomberg).

- In recent months the two series have had a solid relationship, but further downside surprises in data outcomes may temper the upward trajectory to growth expectations seen this year.

Fig 1: Citi China EASI Versus 2023 China GDP Growth Expectations

Source: Citi/MNI - Market News/Bloomberg

ASIA: Empire Tech Spending Intentions Slump, But Equities Are Painting A more Resilient Picture

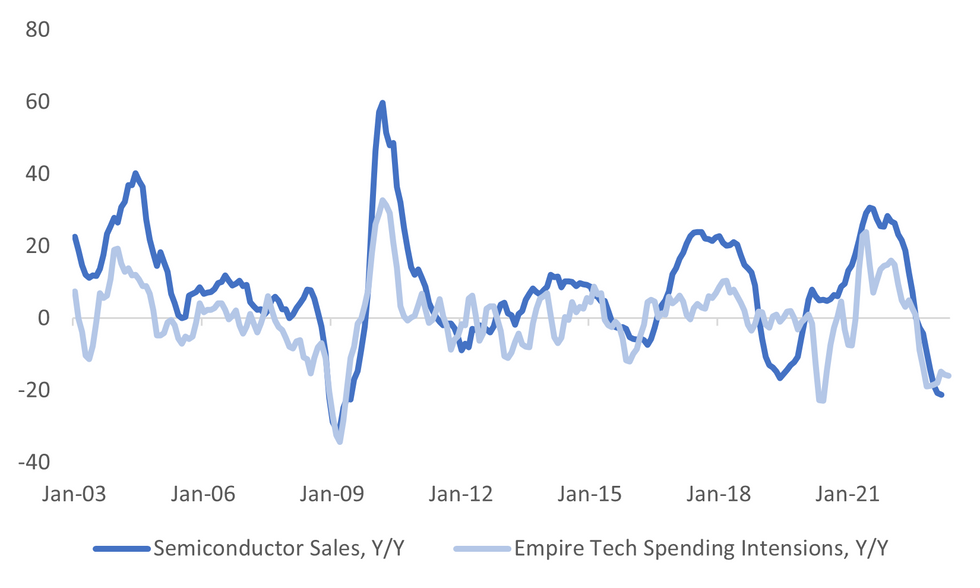

The US Empire manufacturing reading for May slumped, printing at -31.8, versus -3.9 expected (prior was 10.8). The market impact following the release wasn't large, as it tends to be quite a volatile series, particularly relative to other business surveys. Still, we did see fresh lows back to the first half of 2020 in terms of the sub-component related to 6 month ahead technology spending intentions (+1.9 from +10.3).

- The chart below plots the y/y change in such intentions (smoothed as a 3 month moving average) against y/y global semiconductor sales.

- Waning tech spending intentions suggests fairly limited prospects for a sharp turnaround in global semi conductor sales, in the near term at least. Up to March, sales to the US were -16.43% y/y, to China -34.05%, rest of Asia Pac -22.2% y/y, while sales to the EU and Japan also slipped into negative y/y territory.

- Next Monday we also get the first 20-days export data for May in South Korea, which will provide an update on semiconductor exports, which have remained depressed in the first 4 months of this year.

Fig 1: US Empire Tech Spending Intentions Versus Global Semiconductor Sales

Source: MNI - Market News/Bloomberg

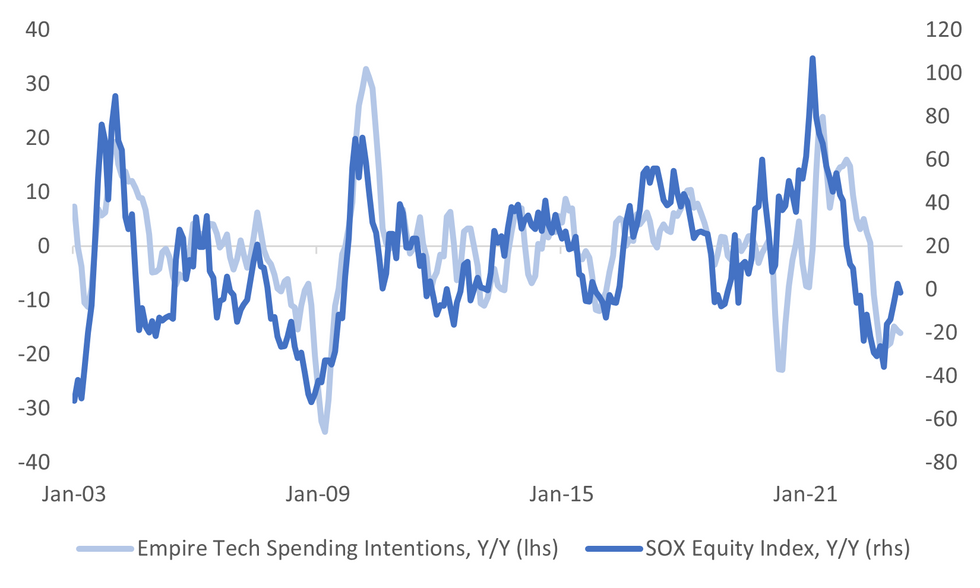

- Still, the SOX semiconductor equity index is painting a slightly less bearish picture. Whilst the equity index is still down in y/y terms, we are well past the trough point from late last year near -36% y/y.

- If the equity index can sustain current levels, we will move back into positive y/y territory for June. This would present a less adverse tech spending backdrop, at least if historical correlations hold.

Fig 2: US Empire Tech Spending Intentions Versus SOX Equity Index

Source: MNI - Market News/Bloomberg

ASIA FX: Weaker China April Activity Data Aids USD Sentiment

USD/Asia pairs are mostly higher, with weaker than expected China activity data for April the main headwind today. THB has also unwound a good part of yesterday's early bounce as election outcome uncertainty continues. Tomorrow, China new homes prices data is out for April, while Singapore exports are also due.

- USD/CNH couldn't sustain early downside, with weaker than expected April activity figures weighed. IP and property related sentiment was quite soft, while retail sales, while much higher in y/y terms, still came in below market expectations. Onshore equities are softer, with Northbound stock connect flows negative. USD/CNH was last around 6.9730, we saw earlier lows at 6.9555.

- 1 month USD/KRW was weaker in early trade but couldn't see further downside beyond the low 1331 region. We now sit back at 1335/36, slightly above NY closing levels. Equities has lost momentum as the session progressed, while offshore investors have been small net buyers today (+$32.4mn). Higher USD/CNH levels post the China data outcomes has weighed on the won.

- USD/THB sits just below session highs. The pair last 33.85/90 (33.935 was the earlier high). Yesterday lows came in between the 33.70/75 region. Recent highs rest near 34.00. Sell-side analysts were mostly positive in the aftermath of the result, albeit waiting to see how government is formed and who is the new Prime Minister. A contested election result and or significant delay in announcing the new PM will be seen as negative for Thailand related assets. Local newswires reported that some senators oppose Move Forward PM candidate Pita due to question mark around his loyalty (see this link).

- USD/PHP has continued to climb this afternoon, heading back towards earlier highs at 56.20. We were last 56.16. We are now threatening highs from back in mid-April, which came in at 56.385. At this stage we are through the simple 200-day MA around 56.10. Earlier comments from BSP Governor Medalla were noteworthy, with the governor noting that there are other ways to loosen policy besides cutting rates. One such option is a RRR cut. Market speculation has risen around a potential RRR cut around the middle of this year. These comments come after the Governor stated yesterday the central bank may pause at Thursday's policy meeting.

- USD/MYR prints at 4.4980/5020, pair rose ~0.4% yesterday printing its highest level since 17 March. MYR was pressured yesterday as concerns over the slowing global economy weighed. Palm Oil futures fell ~1% on Monday and are down a further ~1% today. Bulls now target the high from Mar 9 at 4.5317. Bears first look to break the 20-Day EMA (4.4471) to turn the tide. Looking ahead, Friday's April Trade Balance provides the only data of note this week. A surplus of MYR21.20bn is expected.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 16/05/2023 | 0600/0700 | *** |  | UK | Labour Market Survey |

| 16/05/2023 | 0900/1100 | *** |  | EU | GDP (p) |

| 16/05/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 16/05/2023 | 0900/1100 | * |  | EU | Employment |

| 16/05/2023 | 0900/1100 | ** |  | IT | Italy Final HICP |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Conditions Index |

| 16/05/2023 | 0900/1100 | *** |  | DE | ZEW Current Expectations Index |

| 16/05/2023 | - |  | EU | ECB de Guindos in ECOFIN Meeting | |

| 16/05/2023 | 1215/0815 |  | US | Cleveland Fed's Loretta Mester | |

| 16/05/2023 | 1230/0830 | *** |  | CA | CPI |

| 16/05/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 16/05/2023 | 1230/0830 | *** |  | US | Retail Sales |

| 16/05/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 16/05/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 16/05/2023 | 1400/1000 | * |  | US | Business Inventories |

| 16/05/2023 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 16/05/2023 | 1400/1000 |  | US | Fed Vice Chair Michael Barr | |

| 16/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 16/05/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 16/05/2023 | 1615/1215 |  | US | New York Fed's John Williams | |

| 16/05/2023 | 1915/1515 |  | US | Dallas Fed's Lorie Logan | |

| 16/05/2023 | 2300/1900 |  | US | Atlanta Fed's Raphael Bostic | |

| 16/05/2023 | 2300/1900 |  | US | Chicago Fed's Austan Goolsbee |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.