MNI EUROPEAN MARKETS ANALYSIS: China Equities Off Recent Highs

- The USD has recovered further ground in the first part of Friday trade, particularly against the yen. Japan's National CPI print for Feb was a touch above expectations, but still showed fairly steady core trends, while services y/y momentum edged down.

- JGB futures are weaker but off the session’s worst levels, -8 compared to the settlement levels, with Japan markets returning today. Cash US tsys are trading flat to 1bp cheaper following modest gains yesterday.

- Oil is firmer, while gold is down after recent strong gains. China and Hong Kong equities continue track lower, moving off recent highs.

- Looking ahead, it is a quiet end to the week with French manufacturing sentiment out. Canadian retail sales also print. In the US we have Fed speak from Williams and Goolsbee (on CNBC).

MARKETS

In today's Asia-Pac session, TYM5 is 111-01, -0-04+ from closing levels.

- Cash US tsys are trading flat to 1bp cheaper following modest gains yesterday. Activity remains subdued as markets continue to digest the FOMC's policy stance post-decision.

- The bulls were relieved by Fed Chair Powell's relatively dovish stance and the dots holding to two rate cuts this year, while bears noted the new 2025 SEP estimates reflecting slowing growth and rising inflation.

- Block Sell: 3800 of TUM5 traded at 103-16 3/8, post-time 03:20:06 GMT. The contract has traded lower since and is currently at 103-15 7/8.

- Fedspeak highlights of today's US calendar with Goolsbee on CNBC and Williams in the Bahamas

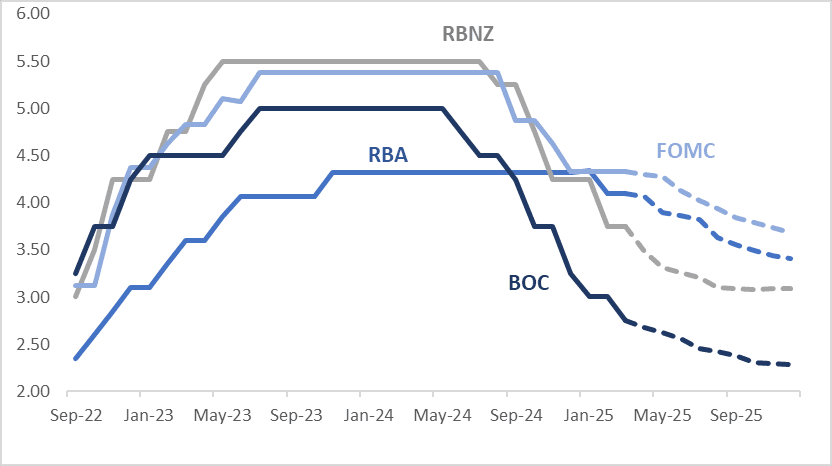

STIR: $-Bloc Markets Muted Over the Past Week Despite Key Data/Events

In the $-bloc, rate expectations through December 2025 remained largely stable over the past week. U.S. pricing firmed by 6bps, while Canada, Australia, and New Zealand experienced minimal net movement.

- On Tuesday, Canada's headline inflation quickened in February as a sales tax holiday ended but so did core measures excluding that policy change, suggesting the central bank faces a bigger trade-off in any further interest-rate cuts to help the economy adjust to the US trade war.

- On Wednesday, the Federal Reserve held rates steady at 4.25-4.5%. The bulls were relieved by Fed Chair Powell's relatively dovish stance and the dots holding to two rate cuts this year, while bears noted the new 2025 SEP estimates reflecting slowing growth and rising inflation. Chairman Powell said the Fed is well-positioned to sit tight and wait for policy uncertainty to subside before making any decisions on interest rates.

- On Thursday, Australia’s February employment was weaker-than-expected falling 52.8k due to fewer older workers returning, while January was revised down to +30.5k. The number of unemployed also fell and so the unemployment rate was unchanged at 4.1%, while underemployment continued to fall.

- Looking ahead to December 2025, the projected official rates and cumulative easing across the $-bloc are as follows: US (FOMC): 3.68%, -65bps; Canada (BOC): 2.28%, -47bps; Australia (RBA): 3.42%, -68bps; and New Zealand (RBNZ): 3.09%, -66bps.

Figure 1: $-Bloc STIR (%)

Source: MNI – Market News / Bloomberg

JGBS: Cheaper After Holiday But Off Worst Levels

JGB futures are weaker but off the session’s worst levels, -8 compared to the settlement levels.

- Outside of the previously outlined slightly higher-than-expected National CPI, there hasn't been much by way of domestic drivers to flag.

- “Japan’s households reduced their collective stash of cash at the fastest pace on record last quarter as they sought to cope with rising costs of living, according to the latest data by the Bank of Japan. The decline mostly likely reflects the wider adoption of cashless consumption as well as a rise in nominal consumer spending due to inflation, a reversal after the pile of cash grew during the Covid pandemic, the BOJ said at a briefing.” (per BBG)

- Cash US tsys are trading flat to 1bp cheaper following modest gains yesterday. Activity remains subdued as markets continue to digest the FOMC's policy stance post-decision. Fedspeak highlights of today's US calendar with Goolsbee on CNBC and Williams in the Bahamas.

- Cash JGBs are 1bp lower to 2bps cheaper across benchmarks, with the futures-linked 7-year underperforming.

- Swap rates are flat to 2bps lower, with a flattening bias. Swap spreads are tighter.

- On Monday, the local calendar will see Jibun Bank PMIs alongside BoJ Rinban Operations covering 1-10-year and 25-year+ JGBs.

JAPAN DATA: CPI Slightly Firmer Than Forecast, But Food&Utility Inflation Eases

National CPI for February was slightly above market expectations. Headline CPI printed at 3.7%y/y (forecast was 3.5%, prior in Jan 4.0%), the ex fresh-food measure was 3.0%y/y against a 2.9% forecast and 3.2% prior. The ex fresh food, energy measure printed 2.6%y/y, in line with market forecasts but up from the 2.5% Jan outcome.

- In m/m terms, headline eased 0.1%, but the ex fresh food, energy measure was up 0.2%m/m. Goods prices fell 0.5%m/m, but service rose 0.1% (although these moves often get revised to flat).

- Drags came from a 0.5% m/m decline in food (with fresh food down 5.2%m/m). This will be welcomed by the authorities as it has been a source of concern and whether it could shift inflation expectations. Utilities also fell 4.2%m/m, as energy subsidies kicked back in.

- Most other categories saw either flat or modest m/m gains. Entertainment was up 0.4%m/m, while clothing and footwear rose 0.2%m/m (the first gain in two months).

- In y/y terms food and utilities inflation moderated but from high levels.

- The chart below plots the headline, ex fresh food and ex fresh food, energy inflation trends in y/y terms. Whilst we are off highs, all measures are comfortably above the BoJ's 2% inflation target.

- Note though, the measure of inflation which excludes all food and energy remained contain at 1.5% y/y in Feb. So today's data is unlikely to alarm the BOJ that it is falling behind the inflation curve.

Fig 1: Japan Inflation Trends - Y/Y, Off Recent Highs But Above 2%

Source: MNI - Market News/Bloomberg

JAPAN DATA: Offshore Investors Buy Local Bonds In Size, But Dump Equities

Recent trends in terms of offshore investment flows into Japan assets extended in the week ending March, albeit in larger aggregate size. Last week saw continued selling of local equities by offshore investors, with -¥1.8trln in outflows. This marked the 7th straight week of outflows from this space. It was also the largest weekly outflow since mid Sep last year. Global equity market sentiment, including in Japan has stabilized somewhat in the past week and a half. The recent trough for the NKY was on March 11. Next week's data will be eyed for any signs of stabilization in terms of such off outflow pressures

- Offshore investors bought close to ¥3.4trln of Japan bonds last week though. Again, this fits in with a more market risk averse theme, with JGBs and the yen seen as traditional safe havens. Last week's net buying of bonds was the largest since March 2023.

- In terms of Japan outbound flows to offshore assets, aggregate shifts were more modest last week. We did see local investors retreat from global equities, although this on partially unwound the prior week's net positive flows into this space.

Table 1: Japan Weekly Offshore Investment Flows

| Billion Yen | Week ending Mar 14 | Prior Week |

| Foreign Buying Japan Stocks | -1806.2 | -219.6 |

| Foreign Buying Japan Bonds | 3396.7 | 686.3 |

| Japan Buying Foreign Bonds | -87.6 | -353.7 |

| Japan Buying Foreign Stocks | -752.5 | 1177.6 |

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Subdued Session, CPI Monthly Highlights Next Week

ACGBs (YM -1.0 & XM -2.0) are weaker, sitting mid-range on a data-light day.

- "Australian Treasurer Jim Chalmers will deliver a pre-election budget on Tuesday, aiming to balance voter appeasement with spending control to avoid rekindling inflation." (see link)

- Cash US tsys are trading flat to 1bp cheaper following modest gains yesterday. Activity remains subdued as markets continue to digest the FOMC's policy stance post-decision. Fedspeak highlights of today's US calendar with Goolsbee on CNBC and Williams in the Bahamas.

- Cash ACGBs are 1-2bps cheaper with the AU-US 10-year yield differential at +15bps.

- Swap rates are flat to 1bp higher.

- The bills strip is flat to -2 across contracts, with a steepening bias.

- RBA-dated OIS pricing is little changed across meetings today. A 25bp rate cut in April is given a 6% probability, with a cumulative 66bps of easing priced by year-end (based on an effective cash rate of 4.09%).

- On Monday, the local calendar will see S&P Global PMIs. Next week’s highlight, however, is likely to be February’s CPI data.

- Next week, the AOFM plans to sell A$300mn of the 4.75% 21 June 2054 bond on Monday, A$800mn of the 3.50% 21 December 2034 bond on Wednesday and A$700mn of the 1.25% 21 May 2032 bond on Friday.

BONDS: NZGBS: Slightly Cheaper, Subdued Session, Light Calendar Next Week

NZGBs closed mid-range, 1-2bps cheaper, with the 2/10 curve flatter.

- Outside of the previously outlined trade balance data, there hasn't been much by way of domestic drivers to flag.

- (AFR) “Adrian Orr was able to “finish on a high”. That was one way for his deputy to describe the controversial Reserve Bank of New Zealand governor’s shock and unexplained exit at 1.30 pm on Wednesday last week, three years ahead of finishing his second term.” (See BBG link)

- Cash US tsys are trading flat to 1bp cheaper in today’s Asia-Pacific session, following modest gains yesterday. Activity remains subdued as markets continue to digest the FOMC’s policy stance post-decision.

- Swaps closed showing a twist-flattener, with rates 1bp lower to 1bp higher.

- RBNZ dated OIS pricing closed little changed across meetings. 24bps of easing is priced for April, with a cumulative 65bps by November 2025.

- The local calendar will be empty until ANZ Consumer Confidence and Filled Jobs data next Friday.

FOREX: USD Index Tracking Up For The Week, Yen Unwinding Thurs Outperformance

The USD index has tracked modestly higher as the Asia Pac session has unfolded. We were last near 1269.85%, up around 0.15%. This is short of recent highs (1271.26) but the index is still set to end the week higher.

- Losses in the G10 space have been fairly uniform, although yen is slightly underperforming. USD/JPY was last near 149.40, up around 0.40%. Yen outperformed on Thursday as EU equities weakened, but this trend hasn't been sustained today.

- Earlier we had Feb national CPI data, which was a touch above expectations in terms of the headline, core ex fresh food measure. Markets didn't react much though, a core measure which excludes all food and energy was fairly benign at 1.5%, while services y/y inflation also moderated.

- For USD/JPY earlier highs this week were at 150.15, so we are still some distance from those levels.

- AUD/USD has ticked down to 0.6290/95, which is still above intra-session lows from Thursday (0.6271). The March 11 low was at 0.6259. NZD/USD is also slightly weaker, back close to 0.5750.

- Weakness in Hong Kong and China equities has likely weighed on AUD and NZD at the margins. There doesn't appear to be a direct fresh catalyst for these equity losses, but markets continue to move off recent highs. Analysts have cited lack of fresh upside catalysts for markets post recent earnings reports.

- EUR/USD is back to 1.0835, but also above recent lows.

- US yields are a touch higher today, but the 10yr near 4.25% is still close to recent lows. US equity futures sit off earlier highs, but remain a touch in positive territory.

- Looking ahead, it is a quiet end to the week with French manufacturing sentiment out. Canadian retail sales also print. In the US we have Fed speak from Williams and Goolsbee (on CNBC).

ASIA STOCKS: Regional Stocks Mixed Despite China Moving Lower

Hong Kong and China equity markets are continuing to correct lower. the HSI off over 2% at this stage, which the tech sub index has lost over 3%. The CSI 300 is down close to 1%.

- Both markets continue to lose momentum from recent highs. Lack of fresh catalysts for further upside momentum is being cited by some analysts as a factor behind the correction.

- BBG noted that "BYD Shares Fall After Report of EU Probing Hungary EV Plant", although this was out on Thursday (reported by the FT, see this link).

- The Hang Seng lead China’s bourses lower down -2.01% today, to be -0.9% lower for the week. The CSI 300 is lower too by -1.11%, capping off a tough week declining -1.8%. The Shanghai Comp is lower by -0.94% whilst Shenzhen is down -1.44%

- One of the regional standouts this week, the KOSPI, is up again today by +0.28% marking it’s fifth day of gains and on track to finish +3.00% higher for the week.

- Following a disjointed week due to a public holiday Malaysia’s FTSE Bursa KLCI Index is up today by +0.35%, but likely to finish lower for the week following Wednesday and Thursday’s losses.

- All eyes on Indonesia this week with the Jakarta Composite volatility rising to such a level it required a trading halt Tuesday. It has not faired better today falling by -2.10% and on track to finish over -4% down for the week.

- Singapore’s Straits Times is having a lackluster finish to the week, up just +0.05% whilst the Philippines is down -0.63% and set to finish marginally down for the week.

- India is opening positive with the NIFTY 50 +0.28%, but is on track for one of its best weeks of the year up +3.7%

ASIA STOCKS: Taiwan Sees Huge Inflow on Back of TSMC News.

Following positive news coming out of Taiwan’s best known stock TSMC, Taiwan enjoyed one of the larger inflows it has had for some time, with South Korean following suit.

- South Korea: Recorded inflows of +$355m yesterday, bringing the 5-day total to +$1,007m. 2025 to date flows are -$4,481m. The 5-day average is +$201m, the 20-day average is -$160m and the 100-day average of -$106m.

- Taiwan: Had inflows of +$910m yesterday, with total outflows of -$876m over the past 5 days. YTD flows are negative at -$14,298. The 5-day average is -$175m, the 20-day average of -$613m and the 100-day average of -$200m.

- India: Saw outflows of -$119m as of the 19th, with a total outflow of -$724m over the previous 5 days. YTD outflows stand at -$16,396m. The 5-day average is -$145m, the 20-day average of -$248m and the 100-day average of -$204m.

- Indonesia: Posted outflows of -$30m yesterday, bringing the 5-day total to -$398m. YTD flows are negative at -$1,883m. The 5-day average is -$80m, the 20-day average is -$60m the 100-day average of -$37m.

- Thailand: Recorded outflows of -$84m yesterday, totaling -$121m over the past 5 days. YTD flows are negative at -$1,021m. The 5-day average is -$24m, the 20-day average of -$41m the 100-day average of -$19m.

- Malaysia: Experienced outflows of -$65m yesterday, contributing to a 5-day outflow of -$304m. YTD flows stand at -$1,908m. The 5-day average is -$61m, the 20-day average of -$51m the 100-day average of -$35m.

- Philippines: Saw inflows of +$3m yesterday, with net inflows of +$28m over the past 5 days. YTD flows are negative at -$198m. The 5-day average is +$6m, the 20-day average of -$1m the 100-day average of -$7m.

OIL: Oil Prices Consolidate, Set to Deliver Strong Week.

- News from the US on further sanctions on a Chinese refinery drove oil higher into the close of US trading overnight.

- Oil Refiner Shandong Shouguang Luqing Petrochemicals are subject to sanctions for buying up to US$500m of Iranian oil according to the US Treasury Department.

- The Treasury is also sanctioning eight oil ships for carrying Iranian oil.

- WTI opened in Asian trading at $68.35 and failed to make much ground all day remaining at that level.

- For the week, WTI has gained +1.75%, its strongest gain in eight weeks.

- Brent opened at $72.39 and traded marginally lower throughout to $72.20.

- For the week, Brent is up +2.2% marking its best gain in eight weeks.

- OPEC+ nations that have exceeded their quotas have provided updates on their plans to reduce production Kazakhstan, Iraq and Russia have consistently failed to cut to the pre-agreed levels from 1 year ago but recent data shows that they are beginning to reduce production, albeit moderately.

- The Trump administration is giving Chevron a further 30 days to halt production in Venezuela following lobbying by the company.

- Global oil forecasters are expecting a surge in new oil projects globally to come online providing a huge supply increase of new crude production, challenging OPEC+ plans to increase production.

GOLD: Profit Takers Evident as Gold Softens into the Weekend.

- As the Federal Reserve left rates on hold and cautioned on inflation gold’s recent good performance continued, reaching new highs.

- But after a strong week, gold lost ground in Asia trading today to fall from its opening level of US3,044.90, to be $3,030.44 into the close.

- Despite the loss, gold is still on track to deliver yet another positive week, up over 1.5%.

- Gold is up over 16% year to date and touched a new high of US$3,057.44 this week.

- Gold activity globally is heating up as the Swiss Federal Customs Administration released details of their exports to the US remaining elevated at 147.4 tonnes, over US$14bn in value whilst shipments to India and Hong Kong fell.

- Yesterday in China, the China Securities Journal ran an article warning retail investors on investing in gold as they expect prices to be volatile going forward.

SOUTH KOREA: First 20 days Exports Rise in March.

- According to the Korea Customs, South Korea's first 20 days exports expanded at +4.5% y/y in March, First 20 days imports fell 1.4% y/y

- Chip exports were a highlight rising +8.2% y/y

- Exports to the US rose +2.5% y/y whilst exports to China fell +3.8% y/y, likely still feeling the impact of the Lunar New Year holidays.

- The trade surplus for the first 20 days was $1.148b

- When adjusting for working day differences (i.e. taking into account holidays) exports rose over 8%.

- South Korea is intrinsically linked to the global supply chain and the semi conductor industry is key to the economy.

- As the US threaten tariffs threaten global trade, the evolution of export data will be a key driver in the input for decision making for the BOK

CHINA: Country Wrap: China Supports Free Trade

- Chinese Foreign Ministry spokesperson Mao Ning said on Thursday China will adhere to opening up, and firmly support the principle of free trade and the multilateral trading system no matter how the external environment may evolve at a regular press conference when responding to a question about the Organization for Economic Cooperation and Development (OECD)'s cutting of the global economic growth forecast due to certain countries' trade barriers. (source: Global Times)

- China’s steel industry is considering paying firms to close outdated plants as the central governments tried to slow output. (source: BBG).

- The Hang Seng lead China’s bourses lower down -2.01% today, to be -0.9% lower for the week. The CSI 300 is lower too by -1.11%, capping off a tough week declining -1.8%. The Shanghai Comp is lower by -0.94% whilst Shenzhen is down -1.44%

- CNY: Yuan Reference Rate at 7.1760 Per USD; Estimate 7.2433

- The 10YR CGB is moving in the opposite direction with yields 1bp lower at 1.83%. Having sold off to 1.90% on Monday, three consecutive days of liquidity injection has turned the fortunes of the bond market around leading to lower yields.

MALAYSIA: Country Wrap: US Now Malaysia’s Top Export Market.

- The US has overtaken China to become Malaysia’s largest export market on a volume basis though on total trade (exports and imports) China still leads (source : Bernama)

- According to data from the Securities Commission, Malaysia’s capital market industry grew 10% last year to MYR4.2tn driven by stock market capitalization, bond issuance and IPOs. Trading volumes increase, assets under management breached MYR1tn for the first time with the commission drafting recommendations for a 5-year master plan (source: BBG).

- Following a disjointed week due to a public holiday Malaysia’s FTSE Bursa KLCI Index is up today by +0.35%, but likely to finish lower for the week following Wednesday and Thursday’s losses.

- MYR: a slow end to the week for the ringgit broadly unchanged yet still on track to deliver a positive week, up +.44% at 4.4235.

- Bonds: a strong week for MGS bonds with the MGS 10YR -5bps for the week at 3.75%

ASIA FX: KRW & IDR Underperform Tis Week, USD/CNH Edging Higher

The two worst performing Asian currencies so far this week have been KRW and IDR, with domestic factors in play for both currencies. They have weakened around 1% each versus the USD. Other currencies have mostly tracked lower in line with higher USD indices this week. INR and MYR have been outperformers though.

- USD/CNH is tracking towards 7.2600 in latest dealings. The USD/CNY fixing has crept up to fresh highs since Jan 20 this week, allowing slightly more yuan depreciation. The local equity backdrop has also faltered after strong recent gains. There hasn't bene a direct catalyst for this move, but broader concerns around trade tensions, along with mixed earnings results have been cited. A move above 7.2650 would put USD/CNH back above all key EMAs.

- Spot USD/KRW is close to 1470, which may see intervention risks from the South Korean authorities rise. Onshore equities have recovered ground this week, so too have offshore inflows. Still, moves by the opposition to impeach the acting President may be weighing, while trade concerns linger in the background. The first 20-days of March data did suggest improving export growth though.

- USD/IDR has risen back above 16500 today, so within striking distance of recent cycle highs near 16600. Onshore equities have fallen back 2% so far today, but the JCI is still above the 6000 level. An Indonesian lawmaker stated they want a bolder central bank to help drive Indonesian economic growth. The lawmaker added that BI is independent but not independent of statehood (per RTRS).

- USD/THB is back above 33.80, so still within recent ranges but unable to break to fresh lows. The customs trade data was better than expected, which included a bumper trade surplus (close to $2bn). Still, gold prices are lower today, while this week has seen BoT easing expectations firm, as the central bank shifts focus to growth risks.

- USD/MYR is back to the low 4.4200 region, largely flying under the radar this past week. Higher oil prices may be helping at the margin.

- USD/INR has continued to correct lower, last back in the 86.25/30 region, after earlier highs in March around 87.50. The rebound in local equities is helping, with inflows also related to FTSE rebalancing another positive.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 21/03/2025 | 0700/0700 | *** | Public Sector Finances | |

| 21/03/2025 | 0745/0845 | ** | Manufacturing Sentiment | |

| 21/03/2025 | 0900/1000 | ** | EZ Current Account | |

| 21/03/2025 | 1100/1100 | ** | CBI Industrial Trends | |

| 21/03/2025 | 1230/0830 | ** | Retail Trade | |

| 21/03/2025 | 1305/0905 | New York Fed's John Williams | ||

| 21/03/2025 | 1500/1600 | ** | Consumer Confidence Indicator (p) | |

| 21/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 21/03/2025 | 1700/1300 | ** | Baker Hughes Rig Count Overview - Weekly |