-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI BRIEF: China Passenger Car Sales Up In November Y/Y

MNI China Daily Summary: Monday, December 9

MNI EUROPEAN MARKETS ANALYSIS: China/HK Equity Bounce In Focus, Next Up FOMC Mins

- US yields are down a touch, although more at the front end, as the FOMC Minutes come into view.

- The main macro story today though has been the sharp bounce in China and Hong Kong equities, as the authorities targeted quant funds, contributing to recent measures to stabilize the market. While banks approved significant loans for property projects pushing property names higher.

- This helped drive NZD and AUD outperformance in the G10 space, particularly against yen. AU wages data and Japan trade figures didn't shift sentiment.

- Looking ahead, the Fed’s Bostic, Collins and Barkin speak plus the January Fed meeting minutes are published. The ECB’s Tuominen and Fernandez-Bollo, Bundesbank’s Nagel and BoE’s Dhingra make appearances.

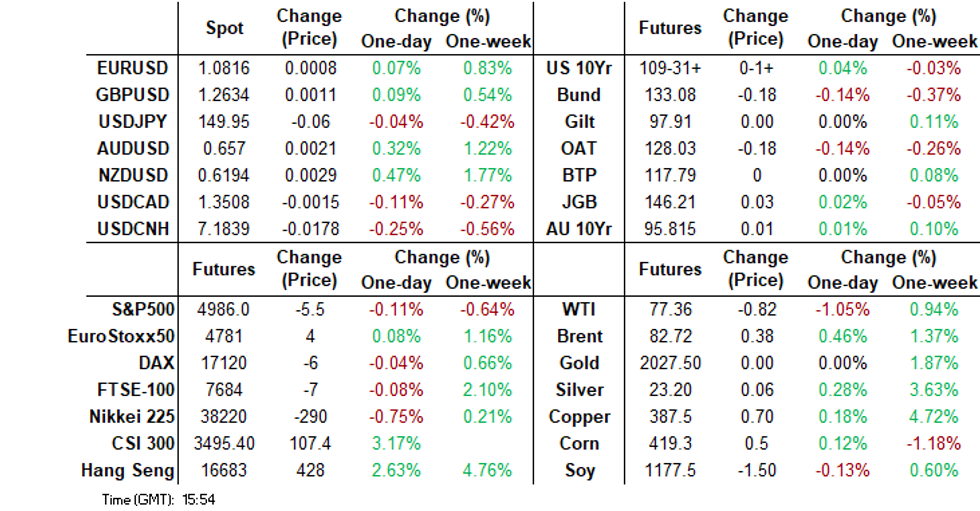

MARKETS

US TSYS: Treasuries Remain Rangebound Ahead of FOMC Minutes

TYH4 is currently trading at 109-31+, up - 01+ from New York closing levels

Treasury futures have opened slightly weaker in early trading, however have now recovered to trade slightly higher for the day and remain comfortably inside Tuesday's ranges. There has been very little in the way of market headlines, Hong Kong and Chinese equities have soared after further government and policy support.

- Mar'24 10Y Futures have been trading in tight ranges, lows of 109-27 and highs of 110. Initial resistance is 110-17 (Feb 15 high), while support holds at 109-17/15 (50.0% of Oct 19 - Dec 27 climb / Low Feb 16).

- Yield curves have continued the steepening trend from Tuesday with yields moving lower throughout Asia trading, with the 2Y yield -2.1bps lower to 4.591%, 10Y yield -0.6bp lower to 4.269%, while the 2y10y is +1.544 at -32.355

- Looking ahead later today Main focused will be on the FOMC minutes, while MBA Mortgage Applications, Chicago Fed Nat Activity Index, Jobless Claims, S&P Global US PMI, and New & Existing Home Sales will also be out.

GLOBAL: Container Shipping Rates Stabilising Despite Continued Attacks

Attacks by Iranian-backed Houthi rebels on shipping in the Red Sea have resulted in a sharp drop of 45% in traffic passing through the Suez Canal. These vessels have been rerouted around southern Africa which can add up to 2 weeks to journey times. This has resulted in a jump in shipping prices since the end of 2023 but they appear to have levelled off. But with a crew having to abandon ship on Sunday and contracts renewed in March, it may still be too early to say the threat to inflation has passed.

- Last week FBX global container rates fell 2.9% but are still 160% higher than the end of 2023 and the 2024 high was recorded last Wednesday. They are down around 2% since the end of January. They remain around 70% below the September 2021 peak that contributed to the world’s inflation problem, and so while current rates are up if they do stabilise here, they don’t look a problem.

- The Suez canal is vital to European trade but container rates for the China/Asia to Mediterranean route fell 13.9% last week to be down almost 16% this month but are still up 155% this year. They appear to have peaked. The China/Asia to the east coast of north America rate is not as clear as it is still almost 4% higher than the end of January and almost 170% than the end of 2023.

- Supply chains don’t seem to be broadly impacted by the delay to vessel arrivals (see MNI: Ship Data Assuage Red Sea Inflation Fears - Researcher) with the NY Fed global supply chain pressure index still negative in January.

Source: MNI - Market News/Refinitiv

Global FBX shipping rates y/y%

Source: MNI - Market News/Refinitiv

JGBS: Twist-Flattener, Climate Transition Bond Included In BoJ’s Rinban Operations

JGB futures are flat in the Tokyo afternoon session and are sitting in the middle of today’s range, unchanged compared to the settlement level.

- There hasn’t been much in the way of domestic drivers to flag, outside of Trade Balance data. Machine Tool Orders data is due later.

- The results of today’s BoJ Rinban operations covering 1-10-year JGBs showed mixed results. The 1-3 and 3-5-year buckets saw positive spreads and higher offer cover ratios, but the 5-10-year bucket saw a small negative spread and a lower cover ratio versus the last outing.

- The BoJ included the nation’s first climate-transition government note in today's debt-purchase operation. Japan sold its first climate transition note on Feb. 14.

- The cash JGB curve has twist-flattened, pivoting at the 10s, with yields 2bps higher (1-year) to 4.5bps lower (40-year). The benchmark 20-year yield is 2.7bps lower at 1.462%, extending yesterday’s post-supply rally.

- The swaps curve has slightly bull-flattened, with rates flat to 2bps lower. Swap spreads are mostly wider.

- Tomorrow, the local calendar sees Weekly International Investment Flows, Jibun Bank PMIs (Preliminary) and Dept Store Sales. The MoF will also conduct a Liquidity Enhancement Auction for 5-15.5-year OTR JGBs.

AUSSIE BONDS: Slightly Richer, Limited Impact From Wages Data

ACGBs (YM +2.0 & XM +1.0) are sitting slightly stronger. The market’s focal point today was the release of the Wages Price Index (WPI) for Q4. The WPI was largely in line with expectations, printing a rise of 0.9% q/q (estimate +0.9%) in Q4 versus +1.3% in Q3. Wage price index rose 4.2% y/y in Q4 (estimate +4.1%) versus revised +4.1% in Q3. The annual rate was the fastest in almost 15 years and positive in real terms.

- The RBA is currently not concerned about wages but that depends on a productivity improvement. It stated that productivity not recovering “as assumed” was a “material risk”. Without that growth, current wage rates are too high to achieve the inflation target.

- Michelle Marquardt, ABS head of prices statistics, said: “For both the public and private sector, wage growth was driven by organisation-wide annual wage and salary reviews.”

- Cash ACGBs are 1-2bp richer on the day, with the AU-US 10-year yield differential +1bp at -10bps.

- Swap rates are 1-2bps lower on the day, with the 3s10s curve steeper.

- The bills strip is richer, with pricing flat to +3.

- RBA-dated OIS pricing is little changed on the day. A cumulative 40bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Judo Bank PMIs (Preliminary) for February.

AUSTRALIAN DATA: Strong Wage Growth, Is It Close To Its Peak?

Wages rose by 0.9% q/q in Q4 bringing the annual rate up 0.1pp to 4.2%, the fastest in almost 15 years and positive in real terms. The increase was driven by a 1.3% q/q increase in public sector wages to 4.3% y/y but the private sector also posted a 0.9% rise to be up 4.2%. The RBA is currently not concerned re wages but that depends on productivity improving. It stated that productivity not recovering “as assumed” was a “material risk”. Without that growth, current wage rates are too high to achieve the inflation target.

- The RBA is forecasting WPI growth to be steady at 4.1% y/y in Q2 but easing to 3.7% by year end as lower inflation and easier labour market conditions drive a decline in wage pressures. The July 1 increase in the minimum award wage is likely to be announced in June.

- The increase in private wages was in line with Q4 2022 and H1 2023 and is yet to show any material signs of slowing, excluding the minimum-wage impacted Q3 outcome. 16% of private sector workers received a pay rise in Q4, down from Q4 2022’s 21%, and the average increase was 4.4%, in line with H1 2023 but above Q4 2022.

- The public sector saw its highest quarterly pay rise in 15 years driven by new enterprise agreements especially for essential workers. 38% of public sector employees received a pay rise with the average at 4.3%, up from 29% and 2.8% in Q4 2022.

- The ABS observes that the share of jobs receiving a wage increase over the last year of more than 3% continues to rise with it standing at 64% in Q4 2023 compared with 45% in Q2 2022. 29% received a rise of 4-6% up 6pp y/y and 14% above 6% (+4.7pp y/y).

Source: MNI - Market News/ABS/SEEK

Australia real wages y/y%

Source: MNI - Market News/ABS/SEEK/Refinitiv

NZGBS: Closed Little Changed, New May-54 Bond Issued

NZGBs closed flat to 2bps richer and in the middle of today’s ranges. There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined PPI data.

- Cash US tsys are dealing flat to 2bp richer in today’s Asia-Pac session, with a steepening bias present.

- Swap rates closed 1bp higher.

- RBNZ dated OIS pricing is 1-5bps softer for meetings beyond April. A cumulative 42bps of easing is priced by year-end.

- NZ Treasury issued NZ$4bn of new May 2054 NZGB via syndication today. The bonds, which carry a coupon of 5.00%, were issued at a spread of 1bp over the May 2051 nominal bond, at a yield to maturity of 5.0925%. It is noteworthy that the issue was launched with a guidance of -1 to +6 bps over 2051 bond, with an issuance cap of NZ$4b.

- Tomorrow, the local calendar will see Trade Balance data for January.

FOREX: NZD & AUD Outperform JPY On Firmer HK/China Equities

The BBDXY sits lower, last under 1242, with NZD and AUD outperforming amid a strong rally in Hong Kong and China equities.

- The equity rally was led by tech and property names in Hong Kong and China. The rest of the region has seen more mixed equity sentiment, while US futures sit down modestly.

- US yields sit down modestly, continuing the theme from Tuesday trade. Front end 2yr yields are down by 2bps to 4.59%, as the FOMC Minutes print later.

- NZD has had a slightly stronger beta to the HK/China equity risk on move. NZD/USD sits up 0.35%, last near 0.6190. This is very close to Tuesday highs, although we haven't been able to breach this level yet.

- AUD/USD has rallied 0.30% to 0.6565/70. At the margin, the weakness in iron ore prices may be curbing gains, although the Singapore benchmark is back to $122.5/ton today. The AUD/NZD cross is not too far from the 1.0600 level (last near 1.0615).

- Earlier data showed Q4 AU wages close to expectations. We were +4.2% in y/y terms, the fastest pace in almost 15 years. The RBA is currently not concerned re wages but that depends on productivity improving. It stated that productivity not recovering “as assumed” was a “material risk”. Without that growth, current wage rates are too high to achieve the inflation target.

- USD/JPY has tracked narrow ranges, last near 150.00, little changed for the session. We may be seeing some underperformance relative to AUD and NZD, given HK/China equity gains.

- Looking ahead, the Fed’s Bostic, Collins and Barkin speak plus the January Fed meeting minutes are published. The ECB’s Tuominen and Fernandez-Bollo, Bundesbank’s Nagel and BoE’s Dhingra make appearances.

CHINA/HONG KONG EQUITIES: Hong Kong and Chinese Stocks Surge on Market Stabilization Measures

Hong Kong & Chinese stocks surged today as authorities targeted quant funds, contributing to recent measures to stabilize the market. While banks approved significant loans for property projects pushing property names higher- As we head into Asia lunch, markets are higher across the board after a slow start on the open. Hong Kong equites outperform mainland equities, the HSI is up 3.00% after initially opening down 0.70% and bouncing off the 50-day SMA, HSTech index has brushed up broader market weakness on tech names to trade up 4.48%, while the Mainland property index is 4.00% higher.

- China mainland equities are higher today, although have underperformed vs Hong Kong, the CSI 300 is up 1.80%, while the ChiNext is up 1.28%

- Property names are being supported by the yesterday's announcement that Chinese banks had approved 123.6b yuan of loans for property projects since January and had started issuing the funds. While Hong Kong’s developer association and politicians are putting pressure on the government to remove extra property levies ahead of the budget planning announcement next week.

- China's major stock exchanges froze the accounts of quantitative hedge fund Ningbo Lingjun Investment Management for three days after it rapidly sold 2.57 billion yuan ($360 million) in shares, disrupting normal trading order. Chinese regulators are increasing scrutiny on quant funds amid concerns about market volatility, prompting the exchanges to tighten supervision and extend reporting scope to include northbound investors via the mainland to Hong Kong stock connect.

- Finally Market participants are reportedly discussing the potential suspension of Chinese onshore stock listings as authorities further look to stabilize the domestic market. There is division among participants on whether to halt IPOs, however consensus remains for regulators to maintain stringent thresholds and boost oversight in the listing process

- Looking ahead to Thursday and China has Swift Global Payments data out, while Hong Kong will have CPI data.

ASIA PAC EQUITIES: Regional Asian Equities Lower Amid Tech Slide, Eyes on Nvidia Earnings

Regional Asian Equities are lower today after technology stocks led Wall Street broadly lower on Tuesday, with investors waiting for chipmaker Nvidia's quarter-earning report. There was little in the way of economic data or market headlines today.

- Japan equities are lower today as tech stocks; the semiconductor index slipped 1.6% during the US session on Tuesday. Softbank, down 2.00%, has contributed to most of the decline in the Topix, which is off 0.30%, while the Nikkei 225 trades 0.28% lower. Japan's January export data surprised to the upside, hitting 11.9% vs. the expected 9.5%, led mostly by demand from chip-making machinery in China.

- Taiwan equities are lower today, weighed down by tech, especially semiconductor stocks. TMSC, down 0.87%, has contributed the most to the fall in the Taiex, which is down 0.37%.

- South Korean equities are also lower today as tech names pull the market down; foreign equity outflows have also increased today, totaling -173.7 million in outflows so far today, marking the highest outflow day since Jan 17th. The KOSPI currently trades 0.13% lower.

- In Australia today, wage growth data was out, beating expectations, coming in at 4.2% vs. 4.1%. Equities were lower today, with miners contributing to the bulk of the weakness as the price of iron ore declines on the back of China's outlook demand. The ASX200 finished down 0.77%.

- Elsewhere in SEA, New Zealand Equities finished the day higher, up 0.17%, while Thailand equities are higher, up 1% after the PM called for rate cuts.

ASIA: Asian Equity Flows

- China Equities have seen little in the way of inflows post the LNY, the 5yr LPR was cut yesterday which did little to spur flows

- Foreign Buying of South Korea Equities has decreased in the past week, with the 5-day moving average of falling to $133.8m, well below the 20-day average of $297.7m.

- Indonesian stocks have seen an increase of Foreign inflows to equities post the Presidential election

- Taiwan inflows have largely been due to their exposure to the semiconductor sector

- Thailand's saw decent equity outflows last week, and turned negative again post weaker GDP Data, while the PM now calls for rate cuts

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -0.1 | 8.4 | 0.2 |

| South Korea (USDmn) | 143 | 859 | 7519 |

| Taiwan (USDmn) | 101 | 1190 | 4137 |

| India (USDmn)** | 21 | -103 | -3784 |

| Indonesia (USDmn) | 90 | 502 | 1427 |

| Thailand (USDmn) | -2 | -57 | -841 |

| Malaysia (USDmn) *** | 13 | 87 | 334 |

| Philippines (USDmn) | 12 | 46.1 | 186 |

| Total (Ex China USDmn) | 377 | 2524 | 8978 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Feb 16 | |||

| *** Data Up To Feb 19 |

OIL: Crude Higher As Commodities Rally On China Optimism

Oil prices are moderately higher today during APAC trading after falling over a percent on Tuesday as commodities have benefited from stronger HK/China equities and a weaker greenback (USD index -0.1%). Geopolitical issues also persist. WTI is up 0.3% to $77.28/bbl and Brent +0.3% to $82.62, both close to their intraday highs.

- Higher oil prices and shipping costs from conflict in the Middle East and attacks on shipping in the Red Sea have resulted in an increase in petrol prices with the UK’s RAC reporting fuel prices rising by at least 2% in the first half of February. Australian petrol prices are almost 4% higher since the end of January.

- There were reports today from the UK navy of increased drone activity just north of the Bab al-Mandab Strait.

- The bullish Brent prompt spread has expanded, according to Bloomberg.

- US inventory data has been volatile since a cold snap disrupted oil output and refining. Data for the latest week is released by API later today.

- Later the Fed’s Bostic, Collins and Barkin speak plus the January Fed meeting minutes are published, which oil markets will monitor closely for signs of a willingness to ease. The ECB’s Tuominen and Fernandez-Bollo, Bundesbank’s Nagel and BoE’s Dhingra make appearances.

GOLD: Fourth Day Of Gains Ahead Of FOMC Minutes

Gold is 0.2% higher in the Asia-Pac session, after closing 0.4% higher at $2024.41 on Tuesday.

- Tuesday’s move was the fourth consecutive day of gains as traders awaited the release of Federal Reserve minutes and remarks from policymakersthat may shed light on the path of interest rates.

- The market’s focus is now tuned to the release of the Federal Reserve minutes of its recent meeting on Wednesday.

- A handful of Fed speakers are also scheduled to speak this week. Among them, Minneapolis Fed chief Neel Kashkari will address economic trends and the outlook on Thursday. Fed Governor Christopher Waller is also due to speak on Thursday.

- Technically significant levels on the topside remain much further out. The yellow metal needs to clear resistance at $2065.5, the Feb 1 high, to reinstate a bullish theme.

INDONESIA: Domestic Demand Growth Robust, BI On Hold

Bank Indonesia announces its monetary policy decision later today and is widely expected to leave rates unchanged at 6.0% and is not yet likely to move to an easing bias as growth remains robust, inflation is at the mid-point of the band and the IDR is still at weak levels (see MNI BI Preview). BI expects growth this year to be between 4.7% and 5.5% supported by domestic demand. Leading indicators from the start of 2024 support this view.

- Q4 domestic demand growth rose to 6.1% y/y from 4.8%, the highest in five years, supported by strong consumption and investment, which has been boosted by infrastructure projects, and there was also a pickup in government expenditure. President-elect Prabowo has said he will continue the economic policies of the outgoing President Jokowi.

- January consumer confidence rose 1% to its highest level since August and is in line with consumption growth continuing in the 4.5-5% range it been in since the end of 2022.

- The S&P Global manufacturing PMI rose 0.7pp to 52.9 in January, well above the aggregate ASEAN PMI of 50.3. The outlook is also positive with new orders growth picking up including slight growth in new export orders. Business confidence also stayed positive with businesses hoping sales would rise as the economy improved, but sentiment is below the series average.

Source: MNI - Market News/Refinitiv

ASEANS&P Global manufacturing PMIs

Source: MNI - Market News/Bloomberg

SOUTH KOREA: MNI BoK Preview - Feb 2024: On Hold, No Rush To Easing Bias

- The strong consensus for tomorrow’s BOK meeting is no change in rates. All of the economists surveyed by Bloomberg look for the policy rate to remain at 3.50%. This is also our firm bias.

- Whilst inflation has continued to track lower since the last policy meeting, the BoK is likely to want more time to assess the likelihood of a return to the 2% target.

- Growth dynamics have improved, particularly in terms of survey measures, which also argues for not rushing towards a dovish pivot.

- Full preview here:

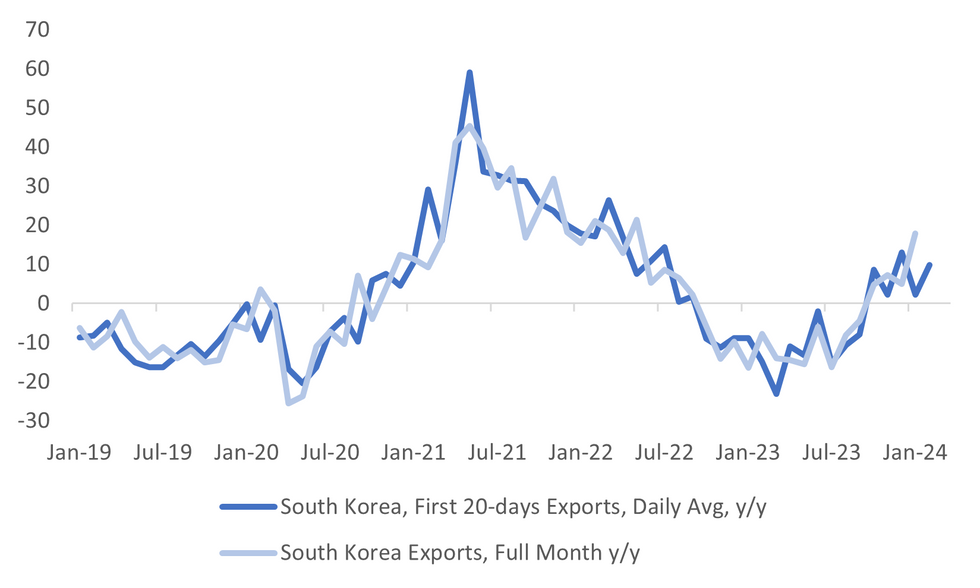

SOUTH KOREA: First 20-days Export Headline Dips, But Detail Paints Resilient Picture

South Korea's first 20-days trade data for Feb was distorted by the timing of the China LNY. Headline exports fell -7.8% in y/y terms, versus -1.0% for the same reference period in Jan. Imports were -19.2% y/y, against -18.2% for the first 20-days in Jan. The trade deficit for the first 20-days was -$1.23bn. Note the full month trade surplus for Jan was a modest $300mn.

- The detail still showed resilience though. Daily average exports were still +9.9% y/y for the first 20-days of the month. The chart below plots this series against full month export growth.

- Whilst full month export growth is likely to step down in Feb, with the timing of LNY this year versus last year having an impact, the daily average export trend looks to remain in positive territory.

- This points to a better global trade volumes path, up from 2023 lows, but not a sharp v shaped recovery.

- The details were mixed, chip exports rose 39.1% y/y, base effects playing a role, but still showing positive momentum in early parts of 2024.

- By country, exports were down -10.8% y/y, to the US we fell -22.8% y/y.

Fig 1: South Korea First 20-day Exports Versus Full-Month

Source: MNI - Market News/Bloomberg

ASIA FX: CNH Aided By Equity Bounce, THB Rebounds, BI Still To Come

USD/Asia pairs are mostly lower, with only a few pockets of USD strength. USD/CNH has broken to fresh lows going back to the end of last month, the pair last near 7.1850, with surging HK and China equities helping sentiment. Gains elsewhere have been more muted, although THB has rallied close to 0.55%. Still to come today is the BI decision with no change expected. The BoK decision headlines Thursday's session, with a steady hand also expected. India PMIs are also due tomorrow.

- USD/CNH got to a low of 7.1811 before support emerged. The pair last near 7.1870. After an indifferent start, both HK and China bourses have rallied stronger. Property and tech names have led the move higher, amid efforts to support the housing market onshore. Note that Northbound Stock Connect flows have total 12.6bn yuan so far today. For USD/CNH downside focus will be the 200-day EMA, which comes in near 7.1740.

- 1 month USD/KRW is close to unchanged, last near 1332.5. There has been little spill over from lower USD/CNH levels. Onshore equities are modestly weaker, last down around 0.30%, while offshore investors have sold -$153.2mn of local shares so far today. Earlier data showed positive business manufacturing sentiment and resilient detail for the first 20-days of trade data in Feb. Still, this hasn't shifted won sentiment, the pair remaining comfortably within recent ranges.

- USD/IDR spot and the 1 month NDF are little changed, as the BI decision comes into view. Spot USD/IDR was last near 15660/65. BI is widely expected to leave rates unchanged at 6.0% and is not yet likely to move to an easing bias as growth remains robust, inflation is at the mid-point of the band and the IDR is still at weak levels.

- Spot USD/THB is back sub 35.90, around 0.55% stronger in baht terms for the session so far. Some of this reflects catch post yesterday's onshore spot close (as the USD generally weakened). BBG also notes some analysts stating that the BoT is likely to resist the PM's call for easier policy settings. Onshore equities have also rallied today, last around +0.80% higher, while gold has risen for the fourth straight session. For USD/THB we aren't too far away from the 20-day EMA at 35.77. Yesterday's highs were at 36.185.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/02/2024 | 0700/0700 | *** |  | UK | Public Sector Finances |

| 21/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 21/02/2024 | 1100/1100 | ** |  | UK | CBI Industrial Trends |

| 21/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/02/2024 | 1300/0800 |  | US | Atlanta Fed's Raphael Bostic | |

| 21/02/2024 | 1355/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/02/2024 | 1400/1400 |  | UK | BOE's Dhingra MNI Connect Event on BoE projections | |

| 21/02/2024 | 1500/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 21/02/2024 | 1630/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 21/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 21/02/2024 | 1800/1300 |  | US | Fed Governor Michelle Bowman | |

| 21/02/2024 | 1900/1400 | *** |  | US | FOMC Minutes |

| 22/02/2024 | 2200/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.