-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: China November PMI Rises Further Above 50

MNI US Macro Weekly: Politics To The Fore

MNI EUROPEAN MARKETS ANALYSIS: China Related Assets Outperform, Aust Q2 CPI In Focus For Asia Pac Tomorrow

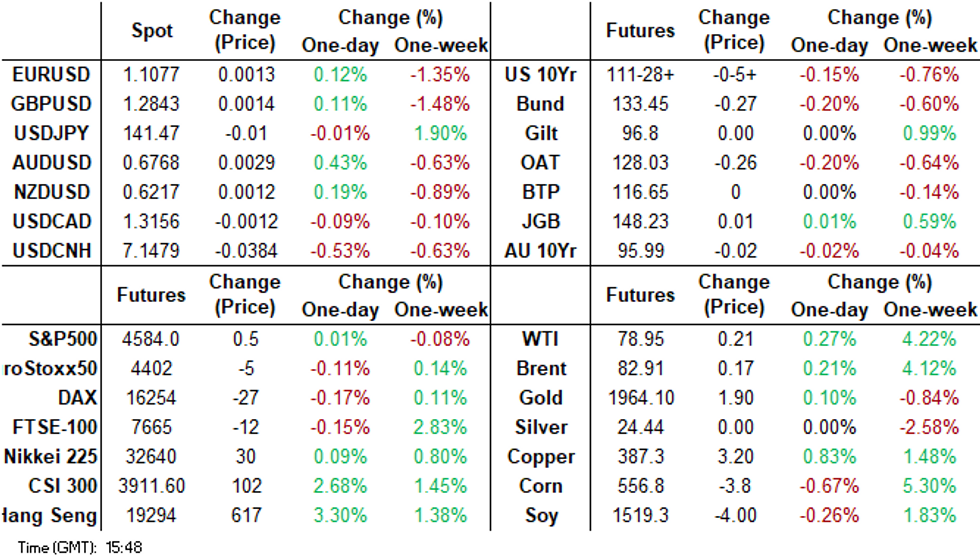

- Much of the focus today has been on China asset related performance post yesterday's Politburo meeting. Market sentiment has been buoyed as the authorities recognized the challenges facing the Chinese economy, particularly in terms of insufficient domestic demand. There is also scope for greater housing support, with the meeting dropping the line 'houses are for living in, not speculation'.

- China related equities have surged, led by China property developers in Hong Kong. The headline HSI is up +3.5%, onshore CSI 300 +2.6%. USD/CNH has dipped sub 7.1500, +0.50% firmer in CNH terms. There hasn't been that much positive spill over to other Asia FX though. AUD/USD is the best performer in the G10 space (+0.4%). Commodities are mostly higher, with Brent near $83/bbl, while iron ore is around $114/ton.

- Still the rough sell-side analyst consensus is caution around extrapolating positive sentiment too far post the Politburo meeting.

- Looking ahead, the July German Ifo survey prints. Later there is US May house price data, July consumer confidence and Richmond Fed. Tomorrow AU Q2 CPI is out.

MARKETS

US TSYS: Curve Steepens In Asia

TYU3 deals at 111-31, -0-03, a range of 0-05+ on volume of ~43k.

- Cash tsys sit flat to 2bps richer, light bull steepening is apparent.

- Tsys firmed as Chinese and HK equities rose in early dealing as China’s July Politburo statement buoyed risk appetite. However the move did not follow through and tsys marginally pared gains dealing in a narrow range for the remainder of the session.

- Earlier there had been a muted start to the days dealing, perhaps the proximity to tomorrow's FOMC rate decision kept participants on the sidelines.

- FOMC dated OIS price a 25bp hike into Wednesday's meeting, with a terminal rate of ~5.40% in November. There are ~60bps of cuts priced to March 2024.

- There is a thin docket in Europe today, further out we have House Prices, Consumer Confidence and Richmond Fed Mfg Index. The latest 5-Year Supply is also due.

JGBS: Futures Pare Morning Weakness But 40Y Supply Goes Poorly

In the Tokyo afternoon, JGB futures pare morning weakness, unchanged versus settlement levels, despite the 40-year supply being poorly digested.

- There hasn’t been much in the way of domestic drivers to flag. Tomorrow the local calendar sees PPI Services (Jun) along with Coincident and Leading Indices (May F).

- Cash JGBs are dealing mixed with yield changes bounded by -0.5bp (5-year) and +1.1bp (40-year). The benchmark 10-year yield is 0.1bp higher at 0.464%, below BoJ's YCC limit of 0.50%.

- The market's response to the supply of 40-year bonds was disappointing, as the high yield exceeded dealer expectations, which had projected a yield of 1.445% based on the BBG poll. The cover ratio increased versus the previous outing but it is worth noting that the cover ratio observed in late May was the lowest seen at a 40-year auction since November 2022. The subdued demand seen today might be a reflection of uncertainty surrounding policy outcomes at the BoJ's policy meeting scheduled for Friday. The 40-year yield is dealing at 1.497%, around 3bp cheaper in post-auction trade.

- The swaps curve twist steepens, pivoting at the 3-year, with rates 0.3bp lower to 3.8bp higher. Swap spreads are wider across the curve.

- Tomorrow will see Rinban operations covering 3- to 25-Year+ JGBs.

AUSSIES BONDS: Slightly Cheaper, Narrow Range, Q2 CPI Tomorrow

ACGBs (YM -2.0 & XM -1.0) sit slightly weaker after trading in a narrow range in the Sydney session.

- Tomorrow the local calendar sees the release of Q2 CPI data. Bloomberg consensus expects headline CPI to print +1.0% q/q (5.5% y/y) versus +1.4% q/q (5.6% y/y) in Q1. Power rebates are holding down inflation while goods prices continue to rise. Trimmed Mean CPI is forecast to print +1.1% q/q (6.0% y/y) from +1.2% (6.6% y/y) in Q1, +1.7% in Q4 and +1.9% in Q3.

- Q2 and June CPI data will be an important input into the RBA’s August 1 decision on rates. Expectations are close to the RBA’s May June-23 forecasts of 6.3% and 6.0% respectively, which may be enough for another pause dependent on services inflation. (See MNI’s CPI Preview here).

- Cash ACGBs are 1-2bp cheaper with the 3/10 curve flatter and the AU-US 10-year yield differential -4bp at +14bp.

- Swap rates are 1bp higher with EFPs little changed.

- The bills strip bear steepens with pricing flat to -4.

- RBA-dated OIS pricing is flat to 3bp softer across meetings with a 54% chance of a 25bp hike priced for August.

- Later today, US House Prices, Consumer Confidence and Richmond Fed Mfg Index are due.

AUSTRALIAN DATA: Q2 Inflation Forecast To Moderate To Around RBA Forecast

Q2 and June CPI data are released on Wednesday and will be an important input into the RBA’s August 1 decision on rates. Both headline and the trimmed mean are expected to moderate further posting the lowest quarterly increases since H2 2021. Expectations are close to the RBA’s May June-23 forecasts of 6.3% and 6.0% respectively, which may be enough for another pause dependent on services inflation.

- NZ’s Q2 outcome suggests that Australia’s headline inflation should moderate towards the RBA’s Q2 forecast (see MNI NZ Q2 CPI Pointing To Sticky Australian Services Inflation) but economists expect it to go lower. Bloomberg consensus has the CPI rising 1% q/q to be 6.2% y/y, down from 7% in Q1. Expectations are between 0.6% and 1.4% q/q and 5.8% and 6.7% y/y with most around 0.9%-1.2% and 6.1%-6.4%. Both NAB & CBA expect 0.9% q/q and 6.1% y/y, ANZ 1.0%/6.2% and Westpac 1.1%/6.3%.

- NZ’s underlying inflation was steady at its peak of 5.8% in Q2 and given the high correlation suggests a risk that Australia’s trimmed mean proves sticky (see MNI Underlying Inflation Fails To Ease In Q2, Watch & Wait). Analysts forecast it to rise 1.1% q/q to be 6% y/y down from 6.6% in Q1. Estimates range from 0.8% to 1.3% q/q and 5.8% to 6.3% y/y. NAB and Westpac are in line with consensus but ANZ and CBA are slightly lower at 1.0% q/q and 5.9% y/y.

- June CPI inflation is expected to moderate further to 5.4% y/y from 5.6% with estimates between 5.2% and 6%. ANZ is at consensus whereas Westpac is looking for an increase to 5.8%.

AUSTRALIAN DATA: Services Focus Of Q2 CPI, Annual Rate Unlikely To Ease

Economists expect headline and trimmed mean Q2 CPI on Wednesday to moderate to around the RBA’s forecasts but this is unlikely to be enough on its own to stop the central bank hiking rates at its August 1 meeting (see MNI Q2 Inflation Forecast To Moderate To Around RBA Forecast). Developments in the domestically-driven services and non-tradeables components are likely to be the key to that decision.

- The quarterly CPI release includes the important services/goods and non-tradeables/tradeables breakdowns. Services inflation is on the RBA’s watch list given it has been sticky in other countries, is domestically driven and continued rising in Q1. A marked moderation in both quarterly and annual growth in Q2 services inflation would likely be needed to derail another RBA hike at the August 1 meeting.

- Q2 2022 services CPI rose only 0.6% q/q compared with 1.7% q/q in Q1 2023. It seems unlikely, that it will rise only 0.6% in Q2 which is required to keep the annual rate steady at 6.1%, given that the June Judo Bank services PMI release reported that charge inflation rose at its highest in four months. A 1% q/q rise would bring the annual rate up to 6.5%. Thus it is likely that it rose further in Q2.

- NZ Q2 services inflation was steady at 6.1% y/y, also implying that Australia’s is unlikely to moderate given that the correlation between the two is over 80%.

Source: MNI - Market News/Refinitiv

NZGBS: Subdued Trading, Narrow Range Ahead Of Tomorrow’s Events In AU & US

NZGBs closed slightly cheaper with benchmark yields 2bp higher after trading in a narrow range in the local session. Without domestic drivers, local participants have content to be guided by headlines, US tsys and ACGBs ahead of tomorrow’s Q2 CPI release in Australia and FOMC policy decision.

- US tsys are dealing flat to 2bp richer in the Asia-Pac session with the curve steeper.

- NZ/US and NZ/AU 10-year yield differentials are both 1bp wider on the day at respectively +75bp and +61bp.

- Swap rates are flat to 1bp lower with the 2s10s curve steeper.

- RBNZ dated OIS pricing is flat to 4bp softer across meetings with Jul’24 leading. Terminal OCR expectations sit at 5.67% versus 5.70% late last week.

- NZ’s heavy traffic index fell 1% m/m in June but rose 0.4% in Q2. This suggests low but positive GDP growth in Q2, according to ANZ Bank.

- Tomorrow the local calendar is empty. The next key release is ANZ Consumer Confidence (Jul) on Friday.

- Later today, US House Prices, Consumer Confidence and Richmond Fed Mfg Index are due. 5-Year supply is also scheduled.

EQUITIES: Hong Kong/China Shares Surge Post Politburo Meeting

The main focus today has been on the surge in China related equities following details of yesterday's Politburo meeting. The HSI is up over 3% at the break, the CSI 300 +2.6%. Most other markets in the region are in the green, although Japan stocks have lagged. US equity futures have been quiet, with Eminis sitting close to flat, last around 4583, likewise for Nasdaq futures.

- At the break, the HSI sits just below session highs above 19300 (last 19258.66). The simple 200-day MA is nearby (19272.67), so market participants may watch to see if we can close above this resistant point. The tech sub index is +4.61%, while the Mainland Properties Index is +11.31% (after falling 6.4% yesterday). Developer Country Garden also stated it had repaid all the bonds interest and principal on time (following recent volatility in the company's bonds).

- Market sentiment has been buoyed by the Politburo meeting outcome, which recognized the challenges facing the Chinese economy, particularly in terms of insufficient domestic demand. There is also scope for greater housing support, with the meeting dropping the line 'houses are for living in, not speculation'.

- The Mainland CSI 300 is +2.6% at the break (moving back above 3900 in index terms), while the Shanghai Composite is +1.89% higher.

- Japan stocks have lagged, with the major indices tracking lower at this stage. The Taiex is up by over 1.2%, aided by TSMC pans for fresh investment in an advanced chip plant in Taiwan. The Kospi is +0.15% firmer at this stage.

- Most SEA markets are higher, although gains are less than 1% at this stage. Thai stocks are only slightly higher, as on-going political uncertainty weighs at the margins. Indian stocks are close to flat in early trade.

FOREX: USD Pressured In Asia

The greenback has been pressured in Asia on Tuesday as firmer risk sentiment has seen after Chinese and Hong Kong shares rallied on optimism that more economic support will come from Beijing.

- AUD is the strongest performer in the G-10 space at the margins. AUD/USD is up ~0.4% and last prints at $0.6760/65. Resistance is at the high from July 21 ($0.6788), a break through here opens $0.69 the high from June 16.

- Kiwi is also firmer however the NZD is lagging the AUD. NZD/USD prints at $0.6210/15 ~0.2% firmer thus far today.

- USD/JPY is ~0.1% lower however ranges remain tight for the Yen. Support is at the low from Jul 21 ¥139.75. Resistance comes in at ¥142.08, 61.8% retracement of the Jun 30 to Jul 14 downleg.

- Elsewhere in G-10 the Scandies are firmer with NOK up ~0.3% and SEK ~0.2% firmer, however liquidity is generally poor in Asia. EUR and GBP are up ~0.1%.

- Cross asset wise; BBDXY is down ~0.2% and 2 Year US Tsy Yields are ~2bps lower. Hang Seng is up ~3% and the CSI300 is up ~2.5%.

- There is a thin docket today, rate decisions from the Fed, ECB and BOJ later in the week are coming into view and provide the highlight this week.

OIL: Crude Higher Again Today, Gains Vulnerable To Fed Comments

Oil has made further gains during the APAC session rising around 0.2% after Monday’s +2% rise, as China’s July Politburo statement buoyed risk appetite. It has been trading in narrow ranges though. Brent is around $82.93/bbl, close to the intraday high of $82.99, and off the earlier low of $82.68. WTI is $78.96 but hasn’t been able to hold breaks above $79. The USD index is 0.2% lower.

- The news from China that there would be increased support for the property market and plans to resolve local government debt issues has supported oil prices at a time when evidence is emerging of reduced OPEC+ supply. China is the world’s largest crude importer.

- Oil’s recent gains could be vulnerable to hawkish comments from Fed Chairman Powell on Wednesday (see MNI Fed Preview - July 2023 here). A 25bp hike is widely expected and so the tone of remarks re future policy will be key to oil markets. MNI expects the tightening bias and options to hike at subsequent meetings to be retained.

- Later there is US May house price data, July consumer confidence and Richmond Fed. There is also the July German Ifo survey.

GOLD: Lower Again As Risk-On Sentiment And Higher US Tsy Yields Weigh

Gold is 0.4% higher in the Asia-Pac session, after closing -0.4% at $1954.73 on Monday. Bullion’s haven status weighed as risk-on sentiment drove equities and US bond yields higher ahead of Wednesday’s FOMC policy meeting. USD strength also pressured the precious metal.

- A 25 bp hike is fully priced for Wednesday's FOMC meeting, but there is considerable uncertainty over the outlook. The risk that the Fed's stance is more hawkish than feared weighed on US tsys.

- The latest US PMIs showed continued services price pressure along with softer expected business activity.

- From a technical standpoint, gold pushed closer to support at $1949.6 (50-day EMA). Resistance remains at the early Thursday high of $1987.5.

SOUTH KOREA: Headline GDP Firmer Than Expected, But Details Don't Suggest Firm Underlying Spending

Headline GDP growth was slightly firmer than expected for South Korea in Q2. The q/q outcome came in at +0.6%, against a +0.5% forecast (+0.3% prior), which saw a slightly firmer than expected y/y pace at 0.9% (0.8% forecast and 0.9% prior).

- Some resilience in y/y growth momentum is consistent with business and consumer sentiment surveys stabilizing since the start of the year. The chart below overlays manufacturing sentiment against y/y GDP growth.

- Still the detail wasn't all that positive, with q/q contractions for major expenditure components:

- Private consumption -0.1%, construction investment -0.3%, facilities investment -0.2% and exports -1.8%, although imports recorded a larger q/q fall of -4.2%. Government spending was also softer at -1.9%.

- By industry, the trends were more mixed, manufacturing up 2.8% q/q, and services +0.2% (after being flat in Q1). This offset construction and utilities weakness.

- Overall, while the headline result will be welcome, the detail showed the domestic economy is not on strong footing in terms of the expenditure components. Export growth also looks uncertain, with the first 20-days of July data showing renewed headwinds.

Fig 1: South Korean Y/Y GDP & Manufacturing Sentiment

Source: MNI - Market News/Bloomberg/BOK

ASIA: Not All Of APAC Seeing Shrinking Exports To China

MNI (Australia) – In the July Politburo meeting statement some more measures to support China’s economy were announced but it also recognised that domestic demand was insufficient. China’s disappointing post-pandemic economic recovery impacts some countries more than others (see MNI APAC Countries To Be Concerned By Softer China Outlook) but particularly those in the APAC region with the US and Europe a lot less exposed. So, any policy measures that support demand in China will be welcome to the region as a whole. However, not all countries have seen recent weak shipments to China.

- Australia, NZ, the Philippines, UK and India have all seen stronger export growth to China in May this year compared with May 2022, ie since China’s reopening. These countries ex the UK benefit from commodity exports, including food.

- Australian exports to China rose 22.1% y/y% 3mma in May which is a significant improvement from May 2022’s -10.7%. NZ’s rose 6.5% y/y 3mma in June compared to 0.3% last year.

Source: MNI - Market News/Refinitiv

- Korean exports to China are important to its economy as they are worth over 9% of GDP but in June they shrank 22.2% y/y 3mma. Malaysia’s are worth 11.8% of GDP and fell 9% y/y 3mma in June. Both countries saw stronger export growth to China in June last year.

- China is very important to Taiwan’s economy with 25% of exports going to its neighbour worth 15.8% of GDP in 2022. Given this dependence, the 20.6% y/y 3mma drop in June is unwelcome.

Source: MNI - Market News/Refinitiv

ASIA FX: USD/CNH Dips On Growth Hopes Post Politburo Meeting

Much of the focus today has been on China related asset performance, with CNH surging post yesterday's Politburo meeting. We have not gone beyond 7.1450 in terms of USD/CNH at this stage though. Spill over to other Asia FX has been evident but not strong at this stage. THB and MYR have lagged broader USD/Asia moves. Still to come is the BI decision, no change is expected. Tomorrow South Korean consumer confidence and Singapore IP are on tap. Thailand customs trade data is out also.

- USD/CNH got to lows of 7.1467 not long after the HK and local equity opening, where sentiment surged post yesterday's Politburo meeting. The CNY fixing was also much stronger than expected. USD/CNH did stabilize somewhat, but upticks above 7.1600 have been sold. Headlines have also crossed from Reuters that large State-Owned banks have been selling USDs in both the onshore and offshore markets.

- 1 month USD/KRW sits slightly down on NY closing levels from Monday, last near 1278. The won has underperformed firmer CNH levels. Local equities are close to flat, while earlier Q2 GDP printed better than expected, although the detail showed domestic expenditure was far from on a firm footing.

- Spot USD/THB sits above 34.50 in last dealings, around 0.15% weaker in baht versus terms versus closing levels yesterday. A cluster of EMAs remain higher between 34.60 and 34.70. Recent lows rest under 34.00. The Pheu Thai Party cancelled a scheduled meeting of coalition partners that had been set for today around forming a new government and nominating a new PM candidate. However, uncertainty rests over whether Thursday's PM vote will now go ahead.

- USD/INR has fallen ~0.4% this week breaking out of its recent range, last printing at 81.73/75. Broader USD trends are dominating in early dealing which has seen the Rupee print its strongest level since early May. Corporate inflows, which may be connected to a deal by Bain Capital to buy Adani Capital, may also be boosting the rupee at the margins. More on the deal here. A reminder that the domestic data calendar is empty this week.

- The ringgit is little changed in early dealing on Tuesday, with narrow ranges observed thus far in today's session. USD/MYR prints at 4.5635/65, in line with yesterday's closing levels. On Monday the pair was marginally firmer rising ~0.1%. Foreign investors have bought a net of $110.7 of local equities month to date, this puts July on track to be the first monthly inflow in 2023. The local data calendar is empty for the remainder of the week.

- The SGD NEER (per Goldman Sachs estimates) is little changed in early dealing, the measure sits a touch off cycle highs and is ~0.2% below the top of the band. USD/SGD is following broader USD trends, and is down ~0.2% thus far today. The pair sits a touch below the $1.33 handle. CPI ticked lower in June, the headline number printed at 4.5% Y/Y ticking lower from the prior read of 5.1%. The Core measure ticked lower to 4.2% Y/Y from 4.7%.

- PHP remains around 0.25% firmer versus closing levels from last Friday (FX markets were closed yesterday). We last tracked at 54.61, slightly above earlier session lows of 54.52. The pair remains sub all key EMAs, and wedged between recent lows at ~54.30 and 54.94 (a break down level from earlier in July). Finance Secretary Diokno stated the FX rate was in a comfortable place now in earlier comments. In terms of monetary policy, Governor Remolona stated inflation will be back within target by Q4 this year (2-4% band). Deputy Governor Dakila also stated the central bank is ready to resume rate hikes if the data warrants it.

SOUTH KOREA: Highlights From Local News Wires

Below is a collection of news wires reports from English versions of South Korean Newspapers and some other major news outlets over the past day or so.

BOK: BOK to keep key rate intact in 2023: economists (link)

INFLATION: Gasoline Prices on the Rise Again (link)

INFLATION: Vegetable prices soar following heavy rains in Korea (link)

INFLATION: Gap widens between perceived inflation and official figure (link)

HOUSEHOLDS: Household excess savings up over $77.7 bil. during pandemic: BOK data (link)

BANKS: Top 5 banks offload bad debt amid rising concerns over soundness (link)

PROPERTY: Korea’s land value increases at its lowest in 12.5 years, Seoul sees decline (link)

FX: Korean Investors Snap up Cheap Yen (link)

TECH: Samsung SDI, Stellantis to build 2nd joint battery plant in US (link)

TECH: Samsung Lowering Dependence on China for LCD Panels (link)

GEOPOLITICS: North invites Chinese delegation as first post-Covid guests to armistice anniversary (link)

GEOPOLITICS: North fires two missiles after U.S. nuclear sub docks in South (link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 25/07/2023 | 0600/0800 | ** |  | SE | PPI |

| 25/07/2023 | 0800/1000 | *** |  | DE | IFO Business Climate Index |

| 25/07/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 25/07/2023 | 1000/1100 | ** |  | UK | CBI Industrial Trends |

| 25/07/2023 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 25/07/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 25/07/2023 | 1300/0900 | ** |  | US | S&P Case-Shiller Home Price Index |

| 25/07/2023 | 1300/0900 | ** |  | US | FHFA Home Price Index |

| 25/07/2023 | 1300/1500 | ** |  | BE | BNB Business Sentiment |

| 25/07/2023 | 1400/1000 | *** |  | US | Conference Board Consumer Confidence |

| 25/07/2023 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 25/07/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 25/07/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.