-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Injects CNY28.8 Bln via OMO Thursday

MNI BRIEF: Ontario To Cut U.S. Energy Flows When Tariffs Hit

MNI EUROPEAN MARKETS ANALYSIS: China Still In Focus Into Year End

- USD FX indices are threatening to test lower but haven't done so yet in the final trading session for 2022. The bias in USD/JPY still appears to be skewed to the downside, with Japan markets likely to remain a strong focus point in the early parts of 2023, as the market looks for further potential BoJ shifts. Still, BoJ actions have continued to protect the current policy regime through the tail end of 2022.

- Elsewhere, regional equities have tracked higher in Asia Pac. There is hope 2023 will deliver outperformance relative to developed markets, led by China as covid waves subside and domestic demand rebounds. This backdrop will also be important for commodity markets in 2023.

- Coming up the Xi-Putin video conference is likely to be a focus point, with the MNI Chicago PMI providing the main data interest in the US session. Tomorrow, official China PMIs print for December, with market expectations fairly downbeat.

MARKETS

US TSY: Early Cheapening Marginally Extends

TYH3 deals at 112-14+,0-00+, a touch off the base of its narrow 0-03 range on light volume of ~22k.

- Cash tsys deal 1 to 2 bps cheaper across the major benchmarks today with the long end of the curve leading the move.

- The early cheapening marginally extended in the Asian afternoon, with no headline drivers, local participants have faded the move higher in tsys seen yesterday in the European and NY sessions.

- Cross asset flows show a mild risk-off tone developing, with the JPY and USD both firmer and US Equities futures softer. WTI is ~0.3% firmer.

- In Europe today we have a thin docket, further out MNI Chicago PMI provides the main point of interest on the last trading day of the year.

OIL: Down For December, But Dips Remain Supported

Brent crude is not too far off Thursday session highs, last tracking near $83.80/bbl. We currently sit little changed for the week, but down a little over 2% for the month. Dips towards $82/bbl were supported yesterday, but we remain comfortably below earlier weekly highs around $86/bbl. WTI sits close to $78.70/bbl currently.

- Looking ahead, official China PMI data prints tomorrow, but the market is likely to look through any downside surprises as optimism is still positive around the 2023 outlook on the shift away from CZS.

- Next week on Tuesday Bloomberg will publish its OPEC production survey. On Wednesday US API inventories are due, followed by EIA US inventories on Thursday.

- This weekly report, released yesterday saw a decent rise in US oil inventories, but as outlined above, dips in crude were supported through the session.

GOLD: Positive Momentum Maintained Into Year End

Gold has remained on a positive footing for the final trading session of the year. We last close to $1816.50, slightly down from session highs just above $1819. Gold is slightly outperforming a resilient USD backdrop this afternoon. For the week gold is up 1% at this stage.

- The precious metal continues to benefit from a softer USD backdrop, although major USD indices are yet to break down through recent support levels.

- The technical picture still appears encouraging for gold, with key MAs mostly trending higher. Through much of December we have found support ahead of the 20-day EMA (currently at $1794.26). Bulls will target a break of recent highs above $1833.

EQUITIES: A Positive End To The Year

(MNI Australia) Asia Pac equities are tracking higher, following the lead from US/EU markets through Thursday's session. Gains are more modest though, with major indices up less than 1% at this stage. US equity futures have stayed in negative territory for most of the session but are away from worst levels, last around -0.10% for the major indices. This may have trimmed risk appetite to some degree within the region.

- China/HK bourses are slightly outperforming the regional trend. The HSI up 0.80%, while the CSI 300 is +0.70% firmer at this stage.

- The domestic covid situation remains grim in China but case numbers looked to have peaked in some cities, including Beijing, which is seeing higher frequency indicators of economic activity recover.

- Elsewhere Thai equities are +0.70% higher as well. Optimism around the consumption backdrop likely aiding sentiment. Offshore investors were strong buyers of local equities yesterday, +$244.1mn.

FOREX: Yen Demand Persists, USD Index Still Threatening Test Lower

Yen demand has persisted as we approach the EU/London cross over. USD/JPY is back to 132.45/50, slightly above session lows near 132.40. Yen is the only G10 currency to move meaningfully higher against the USD, with some support emerging for the dollar ahead of key index levels. The BBDXY index last sits just above 1251, with dips towards the 1250 region supported over the past month.

- A modest risk-off tone has likely aided the USD at the margins, with US equity futures down slightly, while US cash Tsy yields are a touch higher as well, but overall moves are muted.

- AUD/USD was lower early, but dips have been supported, last at 0.6780, little change for the session (earlier lows came in at 0.6754). NZD/USD has underperformed, last down 0.30% to 0.6325/30. This has enabled the AUD/NZD to regain the 1.0700 handle.

- Other pairs have remained close to flat for the session.

- Looking ahead, we have a thin docket, with the MNI Chicago PMI providing the main point of interest on the last trading day of the year.

ASIA FX: USD/Asia Pairs Mostly Biased Lower, IDR Outperforms

The bias for most USD/Asia pairs has been skewed to the downside. Outside of USD/IDR, moves have been fairly modest though. The weekend focus will be on tomorrow's official China PMI prints, where expectations are mostly downbeat, while on Sunday December trade figures for South Korea print.

- USD/CNH has been supported sub 6.9700, but is attempting a move below this level. The CNY fixing was neutral. We expect the market to mostly look through tomorrow's PMI prints. An upside surprise would likely generate more of a market reaction than fresh downside momentum.

- 1 month USD/KRW has been range bound around the 1260 level, with onshore markets closed today. December CPI showed sticky core inflation pressures (4.8% y/y, versus 4.6% expected), which is likely to see the BoK raise rates (25bps) at the next policy meeting in mid January.

- USD/IDR is down a further 0.50% today in spot terms. The pair ended yesterday's session at 15658, but dipped as low as 15548 in early trade today before USD support emerged. We last tracked close to 15580. These moves follow BI intervention yesterday, which came after the pair rose to fresh 2yr highs. This puts USD/IDR back below its simple 50-day MA (15626), but not yet on an EMA basis (15559). The break below these support levels couldn't be sustained in early December.

- USD/THB is tracking to fresh lows, to levels last seen in the first half of June. The pair was last around 34.53. Signs of firmer domestic consumption is aiding the growth outlook (7.2% y/y for Nov), while net equity inflows were $244mn yesterday. A clean break sub 34.50 is likely to have the market targeting May lows around the 34.00 figure level.

CHINA DATA: Official PMIs On Tap Tomorrow, Market May Continue To Look Through Softer Outcomes

China official PMIs print tomorrow. Not surprisingly, the market looks for weaker outcomes, particularly for the non-manufacturing print. The market consensus for this outcome is 45.0 (range of 38-47.5), with November coming in at 46.7. The consensus for the manufacturing PMI is 47.8 (range of 42 to 50.2), with the prior outcome at 48.0.

- Activity was likely weighed on surging domestic covid case numbers in the month. Although as has been the case since China shifted away from CZS, market sentiment hasn't been impacted by disappointing data outcomes.

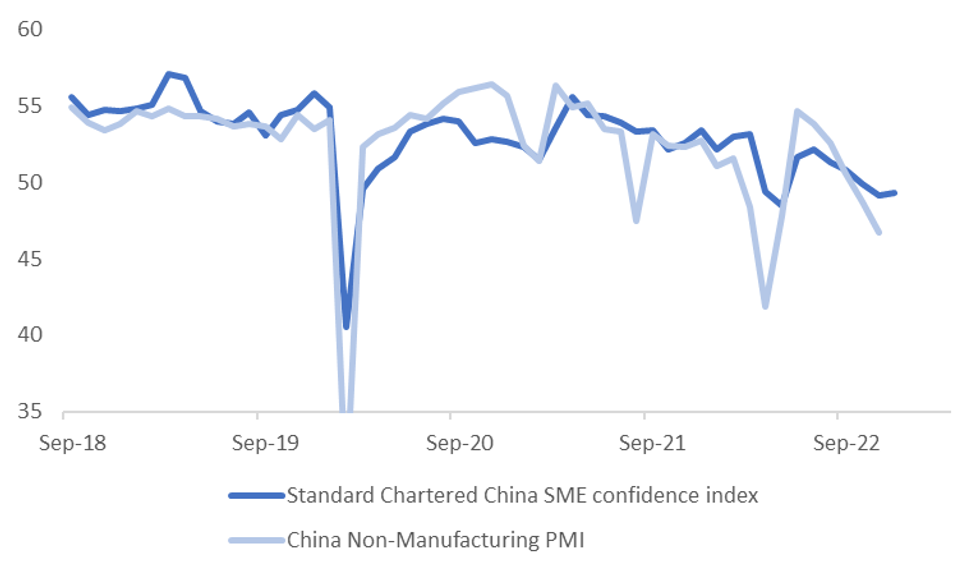

- Also, the Standard Chartered China SME survey saw a slight improvement in the headline outcome for December, nudging up to 49.31 from 49.16 in November, see the chart below.

- There are also signs of improving high frequency data in cities where covid cases have peaked, so the market may keep its focus on the 2023 outlook, rather than any disappointment from tomorrow's data.

Fig 1: Standard Chartered China SME Index Versus The Non-Manufacturing PMI

Source: Standard Chartered/MNI - Market News/Bloomberg

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 30/12/2022 | 0800/0900 | *** |  | ES | HICP (p) |

| 30/12/2022 | 0800/0900 | * |  | CH | KOF Economic Barometer |

| 30/12/2022 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 30/12/2022 | 1445/0945 | ** |  | US | MNI Chicago PMI |

| 30/12/2022 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 31/12/2022 | 0130/0930 | *** |  | CN | CFLP Manufacturing PMI |

| 31/12/2022 | 0130/0930 | ** |  | CN | CFLP Non-Manufacturing PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.