-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Commodity FX The Winners In The Past Week

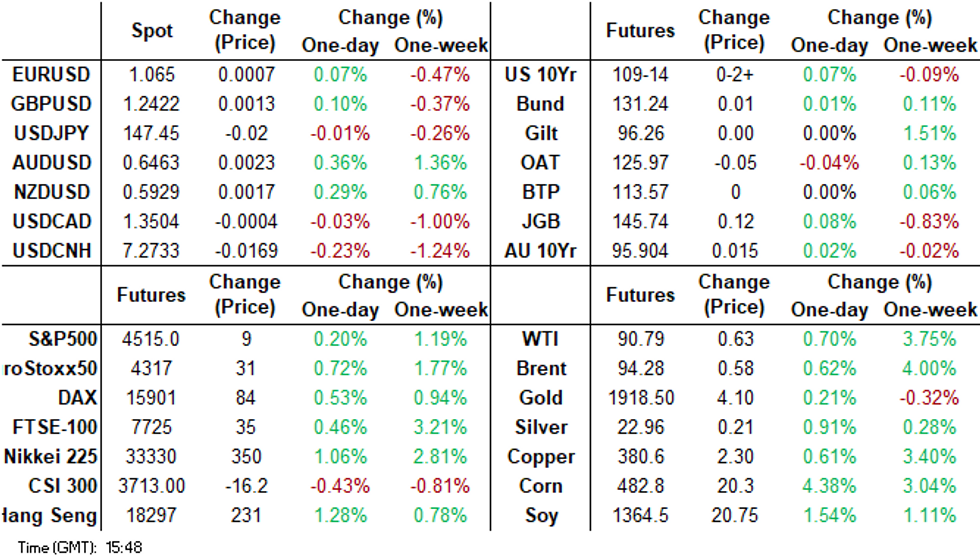

- AUD/USD has been the best performer in the G10 space today and over the past week. The currency benefiting from resurgent commodity prices, along with some signs of improvement in China activity data. CAD & NZD follow next. Oil prices remain on track for another healthy gain over the past week. USD/CNH is lower, but hasn't had much follow through as on-going property headwinds crimp equities.

- In the bond space, US cash tsys sit ~1bp richer across the major benchmarks. BOJ officials see a discrepancy between what Governor Kazuo Ueda said in a recent interview and how the remarks were interpreted by the market. JGB futures spiked to a Tokyo session high of 145.81 on the news but have pared those gains to be at 145.73, +11 compared to settlement levels.

- Looking ahead, there is a thin data docket in Europe today. Further out we have US industrial production, University of Michigan consumer sentiment and the Empire Manufacturing index.

MARKETS

US TSYS: Narrow Ranges In Asia

TYZ3 deals at 109-26, +0-02, a 0-05 range has been observed on volume of ~50k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- Tsys have observed narrow ranges with little follow through on moves, a move higher after stronger than forecast Chinese data didn't follow through and tsys pared gains through the session.

- FOMC dated OIS remain stable, a terminal rate of 4.45% is seen in December, there are ~50bps of cut by July 2024.

- There is a thin data docket in Europe today. Further out we have US industrial production, University of Michigan consumer sentiment and the Empire Manufacturing index.

JGBS: Futures In Positive Territory, Subdued Session Ahead Of BoJ Policy Decision Next Friday

JGB futures are firmer and just off Tokyo session highs, +9 compared to settlement levels.

- There hasn’t been much in the way of domestic drivers to flag. The tertiary industry index, just released, printed +0.9% m/m for July versus +0.3% est. and a revised -0.7% prior.

- The cash JGB curve has twist flattened, pivoting at the 3s, with yields 0.7bp higher to 1.2bp lower. The benchmark 10-year yield is 0.9bp lower at 0.707% versus the post-YCC tweak high of 0.723%.

- Swaps are dealing richer, with rates 0.6bp to 1.5bp lower. Swap spreads are tighter, apart from the 7-year.

- Next week the local calendar sees Trade Balance and Tokyo Condominiums for Sale data on Tuesday, ahead of National CPI and the BoJ Policy Decision on Friday.

- The MoF will conduct Liquidity Enhancement Auctions on Tuesday (1-5-years) and Thursday (5-15.5-years).

BOJ: Ueda's Remarks Not A New Policy Signal

BOJ officials see a discrepancy between what Governor Kazuo Ueda said in a recent interview and how the remarks were interpreted by the market. BOJ Officials noted that inflation remains strong, requiring them to closely look at upside risks for now. This indicates the possibility of an upward revision in a quarterly inflation outlook in October. More here.

- USD/JPY spiked higher printing a high of ¥147.69, gains have been unwound and the pair sits unchanged from opening levels. The uptrend remains intact for the pair, resistance comes in at ¥147.87 the 7 Sep high and bull trigger. Support is at ¥145.91 low from Sep 11.

- JGB futures spiked to a Tokyo session high of 145.81 on the news but have pared those gains to be at 145.73, +11 compared to settlement levels.

AUSSIE BONDS: Richer, At Sydney Session Highs But Small Ranges, RBA Minutes On Tuesday

ACGBs (YMZ3 +1.8 & XMZ3 +2.2) are dealing at or near Sydney session highs, although the range has been modest. In the absence of domestic drivers, the local market has drifted with US tsys in the Asia-Pac session. US tsys are ~1bp richer across benchmarks.

- Cash ACGBs are 2bp richer, with the AU-US 10-year yield differential 4bp lower at -18bp.

- Swap rates are 1-3bp lower, with EFPs tighter.

- The bills strip has twist flattened, with pricing -1 to +3.

- RBA-dated OIS pricing is flat across meetings.

- (AFR Joye) I was asked to tender our strongest convictions at a conference this week. The first was that we would experience the worst corporate default cycle since the global financial crisis in the US and since the 1990-91 recession in Australia. The second was that cash and liquid, high-grade bonds should outperform stocks and risky debt over the next few years. (See link)

- Next week the local calendar is empty on Monday, ahead of the RBA Minutes for the September meeting on Tuesday.

- Next Wednesday the AOFM plans to sell A$800mn of the 2.75% 21 June 2035.

AU-US RATES: AU-US 10-Year Yield Differential Is Too Tight

Today, the AU-US 10-year cash yield differential is 4bp lower at -19bp after 10-year cash tsys finished 4bp cheaper on Thursday.

- At -19bp, the cash AU-US 10-year yield differential is currently in the lower part of the range of -30bp to +25bp which has been observed since November.

- The narrowing in the 10-year yield differential from +25bp in mid-June can be attributed to a 70bp narrowing in the AU-US 3-month swap rate 1-year forward (1y3m) over that period. The 1y3m differential is a proxy for the expected relative policy path over the next 12 months.

- A simple regression of the AU-US cash 10-year yield differential and the AU-US 1Y3M swap differential over the current tightening cycle indicates that the 10-year yield differential is currently 9bp too negative versus its fair value (i.e., -19bp versus -10bp).

Figure 1: AU-US Cash 10-Year Yield Differential (%) Vs. Model Fair Value (%)

Source: MNI – Market News / Bloomberg

NZGBS: Slightly Cheaper, Narrow Ranges, Q2 GDP Next Thursday

NZGBs closed flat to 1bp cheaper after dealing a narrow range after the BusinessNZ manufacturing PMI failed to be a market mover.

- NZ’s Performance of Manufacturing Index contracted further in August, sliding to 46.1 from 46.6 in July on a seasonally adjusted basis, according to trade organization BusinessNZ. "While the key sub-index components of New Orders (46.6) and Production (43.9) improved slightly from July, the trend since March has seen them all but entrenched in contraction" said Catherine Beard, BusinessNZ’s Director of Advocacy.

- Given the absence of significant domestic catalysts, local market participants appeared to turn their attention overseas for guidance. US tsys, JGBs and ACGBs all displayed modest strength during the Asia-Pac session.

- Swap rates are flat to 1bp higher.

- RBNZ dated OIS pricing is flat to 2bp firmer across meetings, with terminal OCR expectations lifting 2bp to 2.64%.

- Next week the local calendar sees the Performance Services Index (Aug) and Non-Resident Bond Holdings (Aug) data on Monday, BoP Current Account Balance (Q2) on Tuesday, GDP (Q2) on Thursday and Trade Balance (Aug) on Friday.

- Next Thursday, the NZ Treasury plans to sell NZ$200mn of the 0.25% May-28 bond, NZ$225mn of the 2.0% May-32 bond and NZ$75mn of the 2.75% May-51 bond.

FOREX: Antipodeans Firm In Asia

The Antipodeans are firmer in Asia after China's August Monthly Economic Activity Data was firmer than forecast. Industrial Production and Retail Sales were the stand out beats.

- AUD is the strongest performer in the G-10 space at the margins. AUD/USD is up ~0.4%, last printing at $0.6465/70. The pair sits a touch above resistance at $0.6460, high from Sep 14.

- NZD/USD is up ~0.3%, the pair sits a touch below the 20-Day EMA ($0.5933). BusinessNZ Mfg PMI ticked lower in August, printing at 46.1 the prior read was revised higher to 46.6.

- Yen is little changed from opening levels, USD/JPY prints at ¥147.35/40. The uptrend remains intact for the pair, resistance comes in at ¥147.87 the 7 Sep high and bull trigger. Support is at ¥145.91 low from Sep 11.

- Elsewhere in G-10; EUR and GBP are a touch firmer.

- Cross asset wise; US Tsy Yields are ~1bp lower across the curve and BBDXY is down ~0.1%. E-minis are up ~0.2% and Hang Seng is up ~1.5%.

- There is a thin data docket in Europe today.

EQUITIES: Australian Stocks Surge On Commodity Prices, Better China Data

Regional equities are a sea of green in Asia Pac for Friday trade. Positive leads from US/EU markets on Thursday is helping, while US futures are a touch higher at this stage. Eminis were last near 4565, +0.20%, while Nasdaq futures were around 0.25% higher at 15714. We sit slightly down on best levels for the session. Announced strikes by the UAW at a number of US car manufacturers hasn't dented equity futures sentiment materially at this stage.

- Australian stocks are among the best performers, the ASX 200 up a little over 1.5% at this stage. Firmer commodity prices, particularly in terms of iron ore and oil, is seeing the materials sub sector outperform.

- Better than expected China IP and retail sales data for August is adding positive momentum to this theme.

- Hong Kong stocks are also up strongly at the break, +1.66% for the HSI. China's 1yr MLF rate was held steady at 2.50%, but the rollover amount larger than expected, leaving a net cash yuan injection of 191bn. This coupled with yesterday's RRR cut announcement is driving optimism around the growth recovery.

- Still, on the mainland, China shares are barely in positive territory at the break, the CSI 300 up 0.06%. The Shanghai Composite is doing better, at +0.28%.

- Property developer concerns remain though, with Sino-Ocean suspending all offshore debt payments, while Country Garden has further delayed a bond extension vote to Monday.

- Japan (Topix +1.25%) and South Korean (Kospi +1.3%) have outperformed the Taiex (+0.20%).

- In SEA, most markets are firmer, although Philippine and Thailand market are struggling for positive traction.

OIL: Tracking Firmly Higher For The Week

Brent crude has continued to build on Thursday's gain of close to 2%. We were last near $94.60/bbl, up nearly a further 1% for the first part of Friday trade. At this stage we are tracking +4.35% firmer for the week, which would be the third straight week of gains. WTI is above $91/bbl, also tracking +4% higher for the week.

- Outside of the well documented tighter supply backdrop, crude, along with other commodity prices, have benefited from modest upside surprises to China IP and retail sales activity prints today.

- Better than expected China data should, all else equal, curb further growth downgrades, which in turn should be supportive for the commodity price outlook more broadly.

- For Brent, mid Nov 2022 highs near $97/bbl could be the next upside target, although a test of the $100/bbl level is being spoken about by some analysts.

- On the downside, the 20-day EMA is back near ~$89/bbl,

GOLD: Steady Despite A Firmer USD & Higher US Treasury Yields

Gold is 0.3% higher in the Asia-Pac session, after closing +0.1% on Thursday. Bullion held up well considering a solidly higher DXY index and higher Treasury yields. Nonetheless, gold is headed for a second straight weekly decline.

- US Treasury yields were pressured on Thursday by stronger than expected PPI and retail sales data. That followed the release of the hotter-than-forecast CPI data on Wednesday.

- One possible explanation for the relatively steady performance on Thursday could be the dovish hike from the ECB. The ECB raised interest rates to a record high of 4% but sent a clear message it was probably done with raising rates as economic growth slows. The statement said “…the Governing Council considers that the key ECB interest rates have reached levels that, maintained for a sufficiently long duration, will make a substantial contribution to the timely return of inflation to the target.” Lagarde did however add the caveat that she “can’t say that now we are at peak”.

CHINA DATA: Better IP & Retail Sales Prints Encouraging, Property Headwinds Still Evident

China August activity data was better than expected in terms of IP growth and retail sales. IP printed at 4.5% y/y (3.9% forecast and 3.7% prior) This owed to a recovery in manufacturing activity to 5.4% y/y (from 3.9% in July). Mini also rebounded somewhat, which helped offset weakness in utilities. Auto manufacturing was +9.9% y/y, versus 6.2% in July.

- In the retail space, headline sales were +4.6% y/y (+3.0% forecast and 2.5% prior). Consumer goods spending rose 3.7% y/y (versus 1.0% prior). Restaurant spending was +12.4% y/y, but this cooled further from July's 15.8% pace. Automobiles and parts of consumer spending were firmer.

- Fixed asset investment printed slightly below expectations, 3.2% ytd y/y (3.3% forecast and 3.4% prior). Private sector enterprises were -0.7% ytd y/y, losing a little further momentum from July.

- Property investment was close to forecasts (-8.8% ytd y/y versus -8.9% projected). Property sales edged down to -1.5% ytd y/y from +0.7% prior. New property construction was -24.4% ytd y/y.

- Earlier data showed house prices falling by slightly more in August (-0.29%) compared with July.

- Still, given recent policy initiatives around easing home buying restrictions and lower mortgage rates, better sentiment may emerge in the space.

- Finally, the jobless rate edged down to 5.2% (versus 5.3% prior and 5.3% forecast).

ASIA FX: USD/CNH Dips, Mixed Trends Elsewhere

USD/Asia pairs are mixed today. USD/CNH has slipped amid some better data and a fresh cash injection via the 1yr MLF, but we are away from lows as onshore equities still struggle amid property headwinds. Other pairs are modestly lower but there is little follow through on weaker USD trends at this stage. USD/IDR is down from fresh multi month highs, owing to better August trade surplus data.

- USD/CNH sits above earlier lows of just under 7.2600. We got last tracked near 7.2700. We had better than expected China data for August, while a fresh 1yr MLF cash injection is also seen as supportive for growth. Still, onshore equities are weaker after the break, with property developers struggling. CNH is 0.30% firmer versus NY closing levels on Thursday.

- Spot USD/HKD sits near 7.8250. The pair unable to sustain breaks below this level in the past few sessions. Equally, moves back towards 7.8300 have drawn selling interest, leaving us in a reasonably tight range. HIBOR rates continue to track higher, albeit at a slowed pace compared to earlier in the week. The 1 month is just above 5.00%, the 3 month also above 5%, only slightly above Wednesday's fixing of 4.98%. US-HK 3 month rate differentials are still tracking lower, but the downtrend has slowed, last at +44bps. This may have helped slow the descent in USD/HKD.

- The Rupee has opened dealing little changed from Thursday's closing levels in a muted start to today's trade. On Thursday USD/INR firmed above the 83 handle as broader USD trends dominated flows closing at its highest level of the week. On the wires today we have August Trade Balance, a deficit of $21bn is expected.

- USD/MYR continues to tick higher in narrow ranges, the pair printed a fresh 3-month high before marginally paring gains. We now sit ~4% above levels seen in early August. On Friday the pair is stable, dealing a touch above the 4.68 handle. Looking ahead, the next data of note is August Export data on Monday.

- The SGD NEER (per Goldman Sachs estimates) is little changed in early dealing on Friday, the measure sits well within recent ranges and is ~0.6% below the top of the band. USD/SGD has ticked lower today, following as broader USD trends are dominating flows. The pair was supported below $1.36 yesterday and finished dealing ~0.2% higher. A reminder that the local docket is empty today. The next data of note is Monday's August Export data.

- USD/IDR sits off earlier session highs, aided by the trade surplus beat. We opened around highs of 15390, which was fresh highs back to mid-March of this year, but now sit back near 15365. Session lows were at 15355. It's a similar backdrop or the 1 month NDF. Earlier highs were above 15400, but we now sit back close to 15380. The August trade data saw the trade surplus print double expectations at $3.12bn, versus $1.5bn projected.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/09/2023 | 0645/0845 | *** |  | FR | HICP (f) |

| 15/09/2023 | 0800/1000 | ** |  | IT | Italy Final HICP |

| 15/09/2023 | 0830/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 15/09/2023 | 0900/1100 | * |  | EU | Trade Balance |

| 15/09/2023 | 0900/1100 |  | EU | Labour Force Survey (Q2) | |

| 15/09/2023 | 0945/1145 |  | EU | ECB's Lagarde & Panetta speak in Spain | |

| 15/09/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 15/09/2023 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/09/2023 | 1230/0830 | ** |  | US | Import/Export Price Index |

| 15/09/2023 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/09/2023 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 15/09/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 15/09/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

| 15/09/2023 | 1400/1000 | ** |  | US | U. Mich. Survey of Consumers |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.