-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Debt Ceiling Impasse Continues

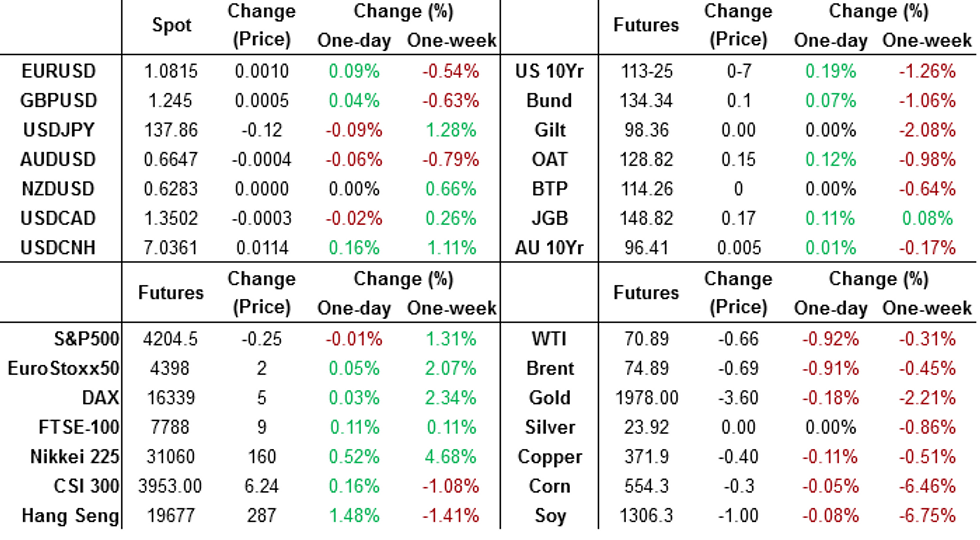

- Moves have been limited in G-10 FX and Fixed Income markets in Asia today as concerns of the US debt ceiling impasse continues.

- In the commodity space Oil is pressured, however Godl remained stable. Oil prices are down another 0.9% during APAC trading and close to intraday lows. WTI is currently around $71.09/bbl and Brent $74.95.

MARKETS

US TSYS: Richer In Asia, Debt Ceiling Talks Continue On Monday

TYM3 deals at 113-27, +0-09, a touch off the top of the 0-08 range on volume of ~95k.

- Cash tsys sit 2-3bps richer across the major benchmarks, light bull steepening is apparent.

- Tsys firmed in early dealing on the continued impasse regarding the US debt ceiling. There was no breakthrough in staff level talks on Sunday and President Biden and House Leader McCarthy are scheduled to meet today.

- Gains marginally extended as e-minis came off session lows, ranges were narrow with little follow through for the remainder of the Asian session.

- FOMC dated OIS price a terminal rate of 5.1% at the June meeting with ~50bps of cuts priced for 2023.

- There is a thin data calendar today. Fedpseak from St Louis Fed President Bullard, Richmond Fed President Barkin, Atlanta Fed President Bostic and SF Fed President Daly will cross.

JGBs: Futures At Session Highs In Afternoon Trade, Tracking US Tsys

JGB futures at 148.87 are at Tokyo session highs at the lunch break, +22 versus settlement levels, just below post-Tokyo trading highs ahead of the weekend.

- Apart from the previously mentioned core Machinery orders data, which fell short of expectations, there have been few notable domestic drivers worth highlighting.

- According to MNI’s technical team, the strong recovery in JGB futures from 147.27, the Apr 18 low confirms the corrective nature of the recent pullback, keeping medium-term attention on 149.53, the March 22 high and the bull trigger.

- Outside of the 1-year zone which is 1bp cheaper, cash JGBs are richer across the curve with yield changes ranging from -0.3bp to -1.7bp. The benchmark 10-year yield is 0.4bp lower at 0.394%, below the BoJ's YCC limit of 0.50%. The 40-year yield is 1.4bp lower at 1.428%, ahead of supply on Thursday.

- Swap rates are 0.2bp to 1.9bp lower across the curve with the 10-year leading. Swap spreads are generally tighter.

- The local calendar remains light tomorrow with Jibun Bank PMIs (preliminary) as the highlight ahead of 10-year index-linked supply.

AUSSIE BONDS: At Session Highs But Little Changed, Light Local Calendar

ACGBs sit slightly stronger (YM +1.0 & XM +0.5) at Sydney session highs as US tsys richen in Asia-Pac trade. A thin Asian docket today left local participants on headline watch. At the time of writing cash tsy yields were 2-4bp lower.

- Cash ACGBs are 1-2bp richer with the 3/10 curve steeper and the AU-US 10-year yield differential -3bp at -7bp.

- Swap rates are 1-2bp lower with EFPs slightly tighter.

- Bills strip bull steepens with pricing flat to +3.

- RBA dated OIS pricing is 1-5bp softer across meetings with a 15% chance of a 25bp hike priced for the June meeting. The expected terminal rate dips to 3.97% from 4.01% on Friday, the highest level since March 9.

- Australian Employment Minister Tony Burke strongly backed an increase in the minimum wage that matches inflation. (link)

- The local calendar has been light today with the next scheduled highlight being RBA Jacobs, Head of Domestic Markets, speaking at a Fixed Income Forum in Tokyo tomorrow.

- The AOFM plans to sell A$150mn of the 1.25% 21 August 2040 Indexed bond tomorrow.

NZGBS: Pare Post-Budget Sell-Off, US Tsys Assist

NZGBs closed 2-5bp richer, paring the post-budget sell-off. Richer US tsys in Asia-Pac have assisted the move.

- Swap rates closed with rate 1-6bp lower with the 2s10s curve 5bp flatter.

- The local calendar is light until Wednesday’s release of Retail Sales Ex-Inflation ahead of the RBNZ policy decision on the same day. BBG consensus expects a 25bp hike to 5.50%, although ASB expects a 50bp hike.

- RBNZ dated OIS closed 3-6bp softer across meetings with October leading. 33bp of tightening is priced for this week’s RBNZ meeting. Terminal rate expectations sit at 5.86%.

- NZ households expect CPI inflation to be 7.4% in a year’s time, according to the RBNZ’s 2Q household expectations survey. Expectations rise from 7% in 1Q, according to Bloomberg.

- The orderly fall in property prices over the past 18 months has reduced the risk of a significant rise in credit losses for New Zealand banks, S&P said in a statement.

- A Bloomberg article reports, a majority of nine members of the RBNZ Shadow Board recommend a 25bp increase in the OCR at the May 24 decision given domestic inflation pressures remain high and the upside risk to inflation due to the weather events, according to NZIER. (link)

FOREX: Yen Firms In Asia

The Yen is firmer in Asia today, US Treasury Yields have ticked lower on the continued impasse regarding the US debt ceiling. There was no breakthrough in staff level talks on Sunday and President Biden and House Leader McCarthy are scheduled to meet today.

- Yen is ~0.2% firmer, USD/JPY prints at ¥137.60/70 as the pair holds below ¥138 after finding support below ¥137.50. Core Machine Orders for March were weaker than expected printing -3.5% Y/Y vs exp 1.3%.

- Kiwi is little changed from opening levels, the pair was pressured in thin liquidity this morning before paring losses. AUD/NZD has printed a fresh YTD and is down ~0.1%.

- AUD/USD is little changed from Friday's closing levels, the pair has observed a narrow range with little follow through on moves.

- Elsewhere in G-10 SEK is ~0.3% firmer however liquidity is generally poor in Asia. GBP and EUR are both ~0.1% firmer.

- Cross asset wise; e-minis are flat having been down as much as 0.3% this morning. BBDXY is 0.1% lower and US Treasury Yields are marginally softer.

- There is a thin data docket today, participants are focused on the US debt ceiling situation which may evolve through the session.

GOLD: Rebounds From Six Week Lows As Fed Chair Powell Suggests Pause

Gold remained stable during Asia-Pacific trading, maintaining its firmness from trading ahead of the weekend when traders assessed comments made by US Fed Chair Powell. Powell's suggestion of a potential pause in interest rate increases next month provided support to the precious metal.

- Furthermore, Minneapolis Fed Kashkari expressed his inclination to support maintaining interest rates at their current levels during the June meeting. He emphasised the importance of allowing officials more time to evaluate the impact of previous rate hikes and assess the outlook for inflation.

- The recent stronger closing came after a three-day decline that pushed gold to its lowest level in over six weeks. The main drivers of gold's weaker performance earlier in the week were a stronger dollar and higher yields.

- Additionally, concerns about the risk of debt default in Washington increased the demand for safe-haven assets like gold. Treasury Secretary Janet Yellen expressed scepticism about the US's ability to pay all of its bills by mid-June, further bolstering interest in gold as a safe-haven investment.

OIL: Crude Down On US Debt-Ceiling Concerns, Signs Of Lower Supply

Oil markets have been rattled today by the ongoing US debt ceiling impasse with the June 1 deadline approaching. Prices are down another 0.8% during APAC trading and close to intraday lows. WTI is currently around $71.09/bbl and Brent $74.95. The USD index is 0.1% lower.

- Brent reached an intraday low today of $74.88 but moves below $75 haven’t been maintained and the level appears to be providing some support. WTI is finding support at $71. Its low was $71.01, the lowest since last Wednesday.

- President Biden and House Speaker McCarthy are scheduled to meet again on Monday after having had a “productive” phone conversation on Sunday, according to Reuters. There is significant concern in oil markets that there will be a default which will produce a US recession. See Negotiations Closer On How To Solve Impasse, Biden/McCarthy Meet Monday

- China’s oil imports from Russia eased in April to 7.12mn tonnes after posting a record in March of 9.61mn. All major suppliers to China saw a drop in shipments over the month, adding to market demand concerns.

- Reuters is reporting that JP Morgan has estimated that crude and oil product shipments from OPEC+ fell 1.7mbd to mid-May. The G7 announced that it is going to improve enforcement of price caps on Russian oil exports while “maintaining global energy supply”. Also on the supply side, the number of US oil rigs fell to its lowest since September 2021 according to Baker Hughes.

- The focus later on Monday will be the talks between President Biden and House Speaker McCarthy. There is little in terms of data but the Fed’s Bullard speaks on the US economy and monetary policy. Bostic, Barkin and Daly are all scheduled to talk too.

BONDS: AU-NZ 10-Year Yield Differential Only Slightly Below Fair Value

The AU-NZ 10-year yield differential at -81bp sits only 5bp below fair value despite the 18bp narrowing sparked by the more stimulatory than expected NZ budget last week.

- A simple regression of the AU/NZ 10-year yield differential versus the AU-NZ 1Y3M swap differential suggests fair value is around -76bp versus the 10-year differential’s current level of around -81bp. The 10-year was at fair value at -62bp the day before the budget.

- The failure to open a wider gap with fair value reflects the 30bp narrowing in the AU-NZ 1Y3M swap differential. NZ STIR firmed post-budget on fears that the RBNZ would need to be more aggressive in lieu of the budget.

Figure 1: AU/NZ 10-Year Yield Differential Vs. 1Y3M Swap Differential

Source: MNI – Market News / Bloomberg

STIR: $-Bloc STIR Softer, RBNZ Meeting On Wednesday

North American STIR markets were softer in trading ahead of the weekend after the combination of a debt ceiling impasse, Fed Chair Powell’s failure to use a panel discussion to tow a more hawkish line and Tsy Secretary Yellen's comments on potential further bank mergers.

- FOMC dated OIS pricing for the June meeting softened to 5.11% from 5.16% on Thursday.

- BoC dated OIS shifted to a cumulative 11bp of tightening priced by September from 24bp on Thursday.

- RBA dated OIS is flat to 3bp softer across meetings in early trade with an 18% chance of a 25bp hike priced for the June meeting.

- RBNZ dated OIS is 1-5bp softer across meetings currently after shunting firmer following a more stimulatory than expected budget last week. Pricing is 7-25bp firmer post-budget with early ’24 leading. 35bp of tightening is priced for this week’s RBNZ meeting. Terminal rate expectations are at 5.87% after lifting to a new cycle high of 5.92% on Friday.

Figure 1: $-Bloc STIR: Terminal Rate Expectations & Year-End Pricing

Source: MNI – Market News / Bloomberg

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/05/2023 | 0900/1100 | ** |  | EU | Construction Production |

| 22/05/2023 | 0900/1100 |  | EU | ECB de Guindos Opens ECB/EIOPA Workshop | |

| 22/05/2023 | 0900/1100 |  | EU | ECB Elderson Guest Lecture Utrecht University | |

| 22/05/2023 | 1230/0830 |  | US | St. Louis Fed's James Bullard | |

| 22/05/2023 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 22/05/2023 | 1415/1615 |  | EU | ECB Lane Panels OeNB Economics SUERF Conference | |

| 22/05/2023 | 1430/1530 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 22/05/2023 | 1500/1100 |  | US | Fed's Tom Barkin, Raphael Bostic | |

| 22/05/2023 | 1505/1105 |  | US | San Francisco Fed's Mary Daly | |

| 22/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 22/05/2023 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 22/05/2023 | 1600/1700 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 23/05/2023 | 2300/0900 | *** |  | AU | Judo Bank Flash Australia PMI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.