-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI UST Issuance Deep Dive: Dec 2024

MNI US Employment Insight: Soft Enough To Keep Fed Cutting

MNI ASIA MARKETS ANALYSIS: Jobs Data Green Lights Rate Cuts

MNI EUROPEAN MARKETS ANALYSIS: Debt Supply Takes Focus

- Bonds lose ground as recent risk aversion recedes; JGBs get some reprieve after 40-Year auction, 7-Year sale eyed in the U.S.

- Antipodeans catch light bid, touted Gotobi flows sap strength from JPY

- Speculation of intervention by China's "national team" emerges

BOND SUMMARY: Bonds Wounded By Risk Recovery, JGBs Take Breather After 40-Year Auction

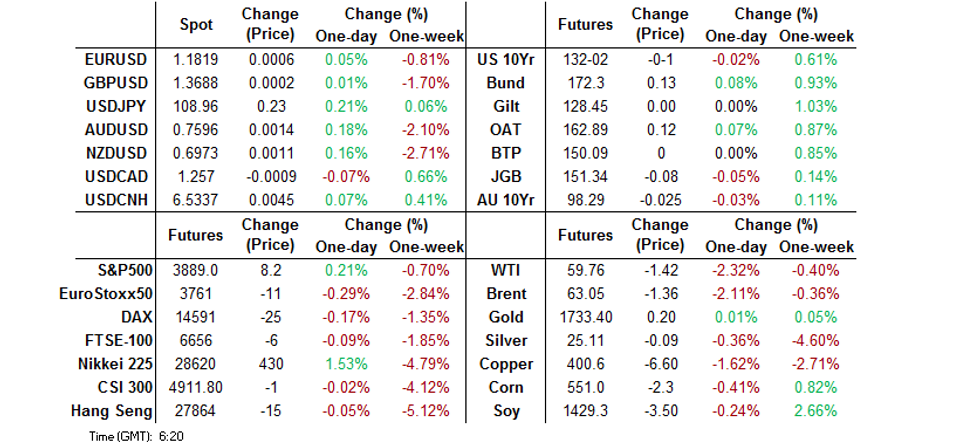

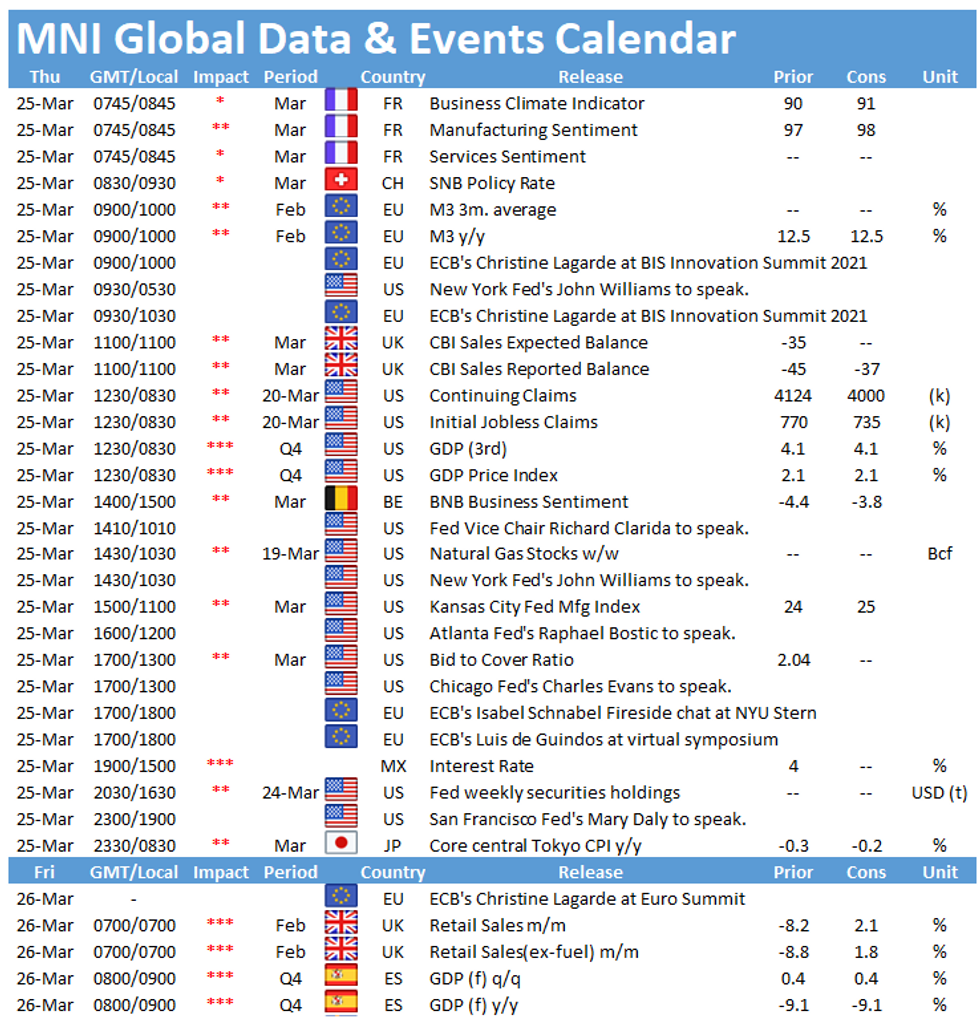

Risk appetite returned, despite the absence of any major headline catalysts in the Asia-Pac session, sapping strength from safe haven assets. T-Notes went offered, extending losses to the session low of 131-30 as the DXY had a look above the 200-DMA for the first time since May 2020. Subsequent recovery attempt proved shallow and T-Notes last sit -0-01+ at 132-01+. Cash Tsy curve runs steeper, yields are -0.2bp to +1.5bp. 7s underperformed in early trade but gradually caught up, with focus on today's seven-year auction. The previous offering of that maturity was particularly weak and triggered an immediate bond sell-off. Eurodollar futures run unch. to -1.0 tick through the reds. Today's U.S. docket features tertiary GDP report, initial jobless claims and plenty of Fedspeak.

- JGB futures softened as the broader market impetus outweighed the impact of a decent enough 40-Year JGB sale. The contract jumped after the auction as high yield (0.675%) missed BBG estimate of 0.690%, even as bid/cover ratio slipped to 2.800x from 2.865x seen previously. Futures then slid to a new session low of 151.24 but retraced the move and last trade at 151.31, -11 ticks vs. settlement. Meanwhile, 40-Year JGBs extended post-auction gains and comfortably outperform in the cash space.

- ACGBs tracked moves in U.S. Tsys, cash curve runs steeper with yields sitting -0.1bp to +3.5bp. YM wavered and sits -1.0 at typing, with XM last -3.0 & off earlier lows. Bills trade unch. to -2 ticks through the reds. The RBA offered to buy A$2.0bn of ACGBs with maturities of Nov '28 to Nov '31.

FOREX: Risk Appetite Recovers, JPY Dented By Gotobi Flows

Recent risk aversion evaporated and the Antipodeans got some reprieve after a poor showing in the first half of the week. BBG trader source cited demand for AUD/USD from exporters and fast money funds, while the kiwi crept higher alongside its cousin from across the Tasman. The Asia-Pac session provided little to rock the boat in the way of headline catalysts.

- JPY was the main laggard overnight amid speculation that Gotobi flows amplified pressure on the Japanese currency. However, USD/JPY struggled to push through the Y109.00 mark on both swings towards the level. Worth flagging today's expiry of $1.5bn worth of options with strikes at Y109.25-30.

- The PBOC fixed its USD/CNY mid-point at 6.5282, just 3 pips above sell side estimates. USD/CNH edged higher, extending its recent winning streak. 21st Century Business Herald reported that the PBoC could conduct the annual review of RRRs today or on Apr 6.

- Coming up today we have U.S. tertiary Q4 GDP and weekly initial jobless claims, while the central bank speaker slate is tightly packed with Fed, ECB, BoE & Riksbank members.

FOREX OPTIONS: Expiries for Mar25 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1700-10(E1.2bln), $1.1800(E1.56bln), $1.1900(E610mln), $1.2000(E587mln)

- USD/JPY: Y108.00($615mln), Y108.80($560mln), Y109.25-30($1.5bln), Y109.40-50($688mln), Y110.00($691mln)

- EUR/GBP: Gbp0.8525(E525mln), Gbp0.8550(E800mln), Gbp0.8600(E1.1bln), Gbp0.8615(E589mln-EUR puts), Gbp0.8625-30(E816mln-EUR puts)

- AUD/USD: $0.7400(A$555mln)

- AUD/NZD: N$1.0745(A$576mln)

- USD/CAD: C$1.2505($700mln), C$1.2550($500mln)

- USD/MXN: Mxn20.83($480mln-USD puts)

ASIA FX: Greenback Continues To Rise

Most USD/Asia crosses rose as the greenback continues its recent rally, stocks struggled for direction and an initial wave of risk on gave way to an uncertain tone.

- CNH: Offshore yuan is weaker, taking another leg higher post fix as the DXY rises above its 200-day moving average. The rate is now above its 100-day moving average, but below 2021 highs just below 6.58 hit on March 9.

- SGD: Singapore dollar weakened slightly, USD/SGD last up 9 pips at 1.3470, sources note SGD liquidity is tight as swap rates rise to the highest since May.

- TWD: Taiwan dollar is weaker, USD/TWD consolidating further above 28.50. The pair is now above its 100-day moving average for the first time in 11 months. Taiwan has declared a red alert for the first time in six years as drought takes hold.

- KRW: Won is weaker, touching a one week low. Virus cases in South Korea are back above 400, while markets were sanguine over reports of a North Korea missile test.

- INR: Rupee opened weaker but has gained as the session goes on. Finance Minister Sitharaman reassured markets yesterday India was not at risk of a ratings downgrade.

- IDR: Rupiah is lower for a second day, FinMin Indrawati said yesterday the BI would be vigilant of any spillover from US policy.

- MYR: Ringgit is weaker, Malaysian CPI missed the +0.2% Y/Y consensus forecast in Feb. The headline metric improved to +0.1% from -0.2% seen in Jan. Core inflation printed at +0.7% Y/Y.

- PHP: Peso is slightly stronger, the presidential spokesman insisted that restrictions implemented within the NCR+ bubble are not a form of lockdown as "the economy is open." Markets await the BSP policy announcement later today.

- THB: Baht is weaker, Thailand saw 6,110 tourist arrivals last month, a decline of 99.7% Y/Y due to the pandemic, elsewhere the trade surplus narrowed more than expected as exports dropped and imports rose.

ASIA RATES: Bonds Track UST's Lower

Bonds sold off in the main, reversing moves from the start of this week as regional bonds tracked a sell off in US treasuries.

- INDIA: Yields mixed across the curve, space proving more resilient than regional counterparts. Participants look ahead to today's operation twist, the RBI will purchase INR 100bn of longer dated bonds and will sell the same amount in shorter tenors. The bank has reduced the size of purchases from INR 150bn last week.

- SOUTH KOREA: Futures are lower in South Korea, giving back after four days of gains. Bonds pressured after South Korea passed a budget that entails KRW 9.9tn extra issuance. Curve steepens, the short end still benefitting from the BoK's decision to reduce MSB auctions by 50%, and the implied bias towards a steeper yield curve.

- INDONESIA: Yields higher across the curve, some bear steepening seen after a weak greenshoe option yesterday, which itself followed a weak auction. FinMin Indrawati said yesterday the BI would be vigilant of any spillover from US policy.

- CHINA: The PBOC matched maturities with injections again today, the fourteenth straight day of matching maturities, while the bank hasn't injected funds since February 25. The overnight repo rate is 17bps lower after jumping into the close yesterday, still above yesterday's intraday lows of 1.80% , but below last week's peak, last at 2.793%. 7-day repo rate has risen 30bps to 2.2069% after jumping as high at 2.75% on Monday. Futures are lower amid risk on trade, giving back after four days of gains, moves are muted compared to regional peers though. 21st Century Business Herald reported that the PBoC could conduct the annual review of RRRs today or on Apr 6.

EQUITIES: Volatile

Markets are mixed in Asia. Chinese markets opened lower on concerns that Chinese companies they will be de-listed from US bourses after the SEC took initial steps to impose stricter regulation, while worries about a semiconductor shortage also engendered some caution. Mainland China did see indices moving into positive territory though, amid rumours that China's "national team" were again active in buying stocks. BOJ Governor Kuroda is putting wind in the sails of Japan stocks, saying the central bank will continue to buy ETFs as needed. In South Korea the KOSPI has eked out some gains after the National Pension Service's fund management committee announced it was to discuss increasing its target for local stock holdings.

- In Europe and the US have fluctuated between gains and losses. At the time of writing US futures are slightly higher, tech shares are the laggard after being hit hard yesterday in a rotation to cyclicals.

GOLD: Struggling To Break Higher

The yellow metal is flat on the session, last trading at $1734.67/oz, retreating from session highs at $1739.27. There has been little in the way of macro catalysts during the Asia session, markets have shrugged off reports that North Korea conducted a missile test for the first time in a year. As such markets continue to digest comments from Fed speakers and consider US auctions. Demand at the 5-year auction yesterday was solid, markets await results of the 7-year auction today; a poor 7-year auction last month catalysed an initial sell off in US treasuries.

OIL: Recedes After Spike Higher

Oil has slipped slightly in Asia-Pac trade, retracing some of the rally yesterday. WTI is down $1.03 from settlement levels at $60.14/bbl, while Brent is down $0.89 at $63.51/bbl.

There is still a container ship blocking the Suez Canal, though a team of Dutch specialists will attempt to move the blockage today.

- Data yesterday showed crude inventory builds extended as refinery runs continued to see lingering effects from the mid-February polar vortex. Headline crude stocks climbed 1.91m bbls, taking stocks 6.4% above the five-year average. The build was concentrated on the US Gulf Coast, which saw inventories rise 5.39m bbls, while Cushing, OK saw a 1.94m bbl draw, the largest one-week slide since mid-February. It was the fifth consecutive week of crude inventory builds fueled in large part by a refiners struggling to reach full capacity after February's deep freeze.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.