-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Dems Riding The Wave

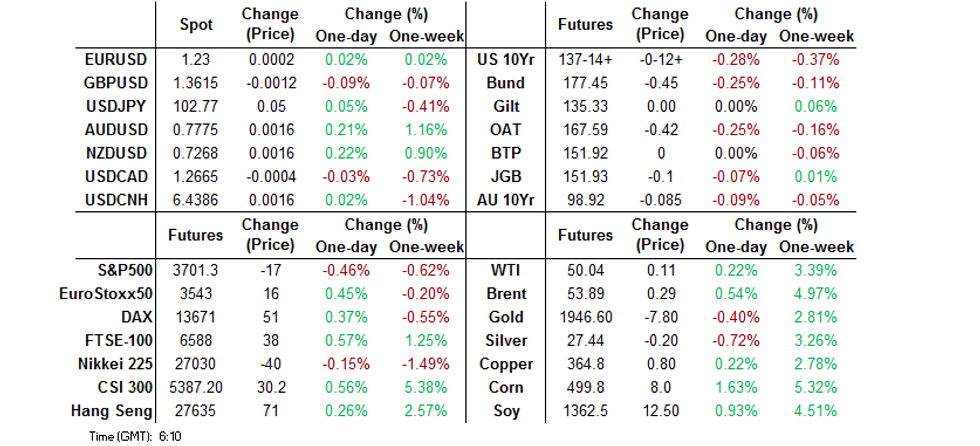

- U.S. Tsys steepen & 10-Year U.S. Yields test 1.00% as blue wave odds surge, weighing on equities.

- Sino-U.S. tensions continue to bubble.

- Crude holds on to Tuesday rally driven by Saudi surprise.

BOND SUMMARY: An Impending Blue Wave?

Increased chances of a 'Blue Wave' scenario in U.S. Congress drove price action overnight, with the U.S. Tsy curve bear steepening as a result of growing expectations re: deeper fiscal stimulus. U.S. 10-Year are yields threatening to break above the 1.00% psychological level for the first time since March at typing. T-Notes last -0-12+ at 137-14+, which represents lows of the day. While the Georgia Senate run-offs are still officially deemed too close to call by most news outlets, the composition of the votes yet to be counted has resulted in a couple of early calls for Democrat Warnock in one of the races, while the Cook Report has called victory for both Democratic Party candidates. As a reminder, a note released by Nomura's quantitative analysis team over the Christmas-New Year period suggested that CTAs would only start aggressively selling TY positions on a breach of the 1.02% yield level in U.S. 10-Year Tsys. Flow was mostly screen based, with some light downside interest in the TYG1 136.00 and TYH1 136.50 puts. There was also a 750 lot block buyer of WNH1 futures. Eurodollar futures sit unchanged to 2.0bp softer through the reds, with bear steepening seen across the broader strip.

- JGB futures were also softer, closing -10, with a bland 10-Year JGB auction doing little to add support, with cash JGBs up to ~1.0bp cheaper across the curve late in Tokyo. In terms of auction specifics, the aforementioned bland 10-Year JGB auction saw little meaningful movement in any of the major metrics, while the low price missed broader dealer expectations by the smallest of margins. Local focus continues to fall on the impending declaration of a state of emergency surrounding the COVID-19 situation, with expectations for an announcement to be made at some point on Thursday. N.B. Tokyo revealed another record new COVID case count on Wednesday.

- Aussie bonds traded in sympathy with U.S. Tsys, steepening, with -1.0 & XM -8.5 at the bell, against a limited backdrop of local catalysts. Swaps were mostly tighter vs. ACGBs across the curve. Domestically, the APRA revealed a A$46bn reduction size of the CLF, taking the total size of the CLF down to A$142bn, effective on or before 1 February 2021. The APRA reiterated language surrounding the potential for further reductions in the coming months and that "while APRA expects to ensure measured CLF reductions to avoid financial market disruptions, it would be reasonable to expect that if government securities outstanding continue to increase beyond 2021, the CLF may no longer be required in the foreseeable future."

FOREX: Greenback Has Georgia On Its Mind

DXY bounced off a fresh 33-month low and swung from losses to a gains in sync with U.S. Tsy yields as tight races for Georgia Senate seats grabbed attention. The greenback briefly showed atop the G10 pile as betting market odds flipped to favour the Dems, amid a growing perception that we may witness a "red mirage," with absentee ballots expected to play a key role after early results pointed to razor-thin leads for GOP candidates. The Cook Report and Decision Desk called the Warnock (D) - Loeffler (R) race for Warnock. Election matters overshadowed Sino-U.S. frictions, keeping most G10 crosses trapped within relatively tight ranges. USD corrected its earlier move ahead of the London morning, with DXY pulling back from highs.

- JPY was among the worst G10 performers, limited by Japanese MoF's jawboning. A ministry off'l stressed the importance of FX market stability, adding that the Ministry will monitor financial markets and remain in touch with the BoJ & FSA.

- The Antipodeans outperformed their G10 peers, but although AUD/USD and NZD/USD peeked above fresh cycle highs printed yesterday, they failed to make much headway beyond there.

- The yuan was happy to hug a tight range, leaving the prior day's extremes intact, as Caixin Services PMI released out of China was ignored.

- Per the minutes from the BoT's Dec MonPol meeting, Thai policymakers judged that the new coronavirus outbreak in Thailand may inspire some FX volatility, while warning that the baht will encounter challenges going forward.

- Flash German and French CPIs, U.S. ADP employment report & final durable goods orders, comments from BoE Gov Bailey & FOMC Dec MonPol meeting minutes, as well as further updates on Georgia runoff polls take focus from here.

FOREX OPTIONS: Expiries for Jan06 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.2035-50(E664mln-EUR puts), $1.2255-70(E670mln-EUR puts), $1.2300(E1.1bln-EUR puts), $1.2465-70(E507mln-EUR puts)

- USD/JPY: Y101.00($501mln), Y103.25-35($890mln-USD puts), Y104.00($1.1bln)

- AUD/USD: $0.7500(A$659mln)

- USD/MXN: Mxn20.85 $800mln-USD puts)

EQUITIES: Larger Fiscal Stimulus Vs. Higher Yields

Higher U.S. Tsy yields, which were a result of developments surrounding the U.S. Senate run-offs in Georgia (and increased chances of a 'Blue Wave' scenario in Congress), and to a lesser extent, worry re: Sino-U.S. tensions surrounding President Trump's banning of 8 Chinese payment apps, NYSE flip-flopping re: the delisting of 3 major Chinese telecoms firms & the arrest of a U.S. lawyer in Hong Kong weighed on sentiment in Asia-Pac hours, although broader ranges were largely contained. Still, e-minis are off worst levels as participants continue to balance the outlook for enhanced U.S. fiscal stimulus under a 'Blue Wave' scenario in the Senate vs. higher U.S. Tsy yields.

- Russell index e-minis were the exception to the rule, with that particular contract edging higher on the back of the reflation trade mantra that would surround Democrats securing control of the U.S. Senate.

- Nikkei 225 -0.4%, Hang Seng -0.1%, CSI 300 +0.3%, ASX 200 -1.1%.

- S&P 500 futures -15, DJIA futures -4, NASDAQ 100 futures -136.

GOLD: Tight Range In Asia

The U.S. Senate situation has provided little impetus for bullion during Asia-Pac hours, with U.S. real yields continuing to hover around recent lows. Spot gold last deals $5/oz or so softer around the $1,945/oz mark, with initial support and resistance levels as previously outlined.

- Known ETF gold holdings have nudged up in recent days, after flatlining in the month of December

OIL: Crude Little Changed After Tuesday's Rally

WTI & Brent sit a little above their respective settlement levels, after a surprise, unilateral 1.0mn bpd crude production cut from Saudi Arabia (which will go into play during the months of February & March) put a bid into oil on Tuesday, allowing the metrics to add over $2.00 come settlement.

- Saudi's surprise move more than offsets marginal increases for Russia & Kazakhstan over the same period, while the remainder of the OPEC+ cohort agreed to leave their respective production quotas unchanged during those two months.

- Elsewhere, post-settlement trade saw the latest API inventory estimates reveal a roughly in-line with exp. drawdown in headline crude stocks, a small build in stocks at the Cushing hub and much larger than expected builds in both distillate and gasoline stocks.

- DoE inventory data will hit on Wednesday.

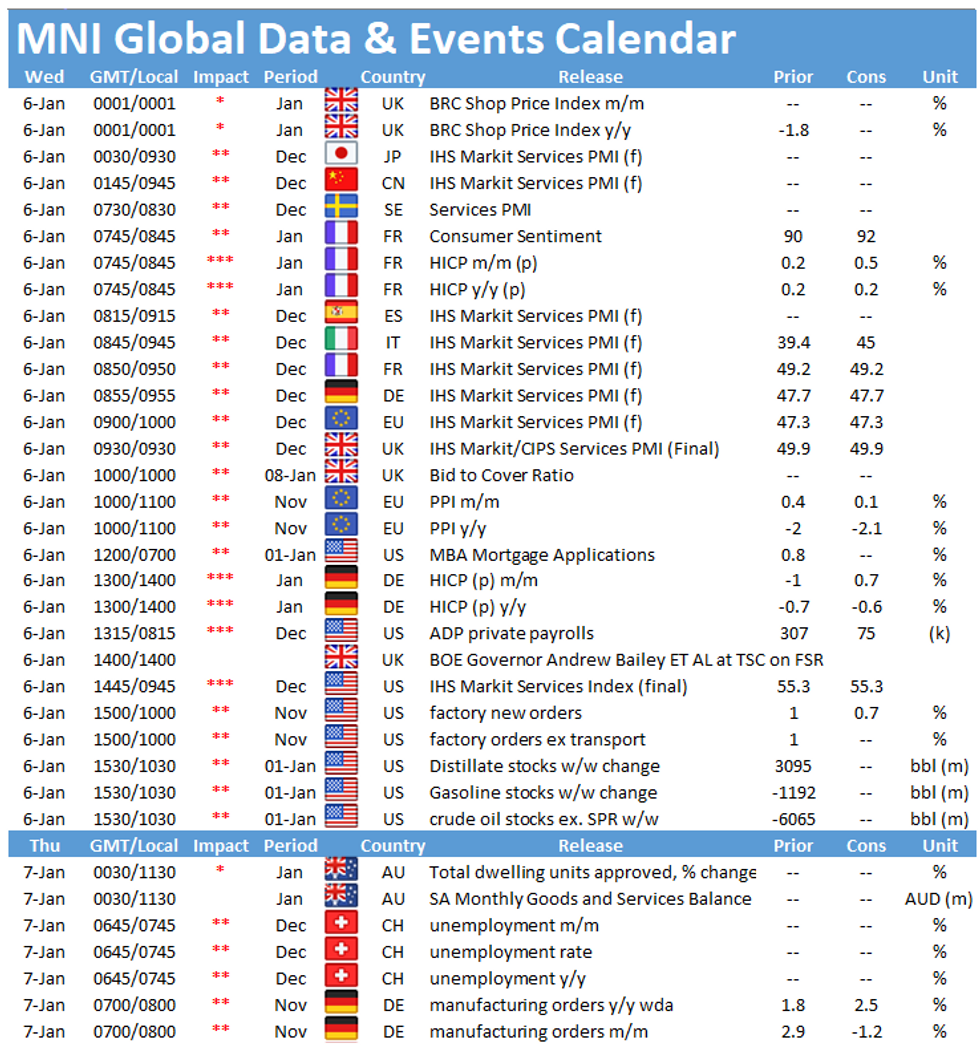

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.