MNI EUROPEAN MARKETS ANALYSIS: Equities Rally, Market Awaits BoJ's Ueda

- Equities have continued their rally with the S&P 500 hitting new all time highs overnight, while the ASX200 hit highs today. Tsys yields were slightly lower with curves bull-steepening, AGCBs & NZGBs have tracked those moves, while JGBs yields rose.

- Chinese equities continue to struggle with multiple companies reporting weak demand for their products in the region. However there were pockets of green, with China considering removing home purchase restrictions which boasted property stocks while electric vehicles names were also higher following reports the European Union and China agreed to intensify discussions in a bid to avert looming tariffs ahead of a nearing deadline

- Focus in the region today has been on the BoJ where as expected they kept rates on hold at 0.25%, there was little reaction in the markets to headlines coming out with investors now awaiting comment from Ueda.

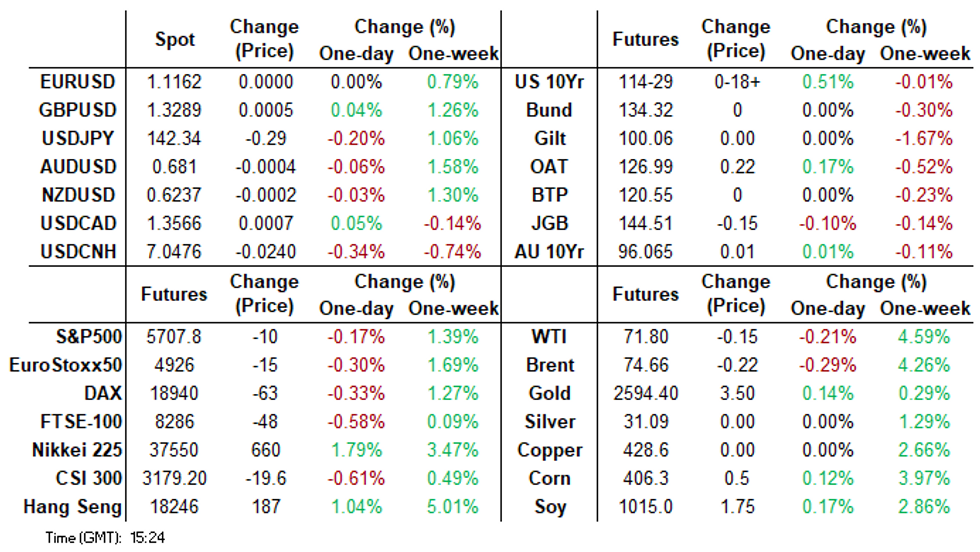

MARKETS

US TSYS: Tsys Futures Edge Higher, Curve Bull-Steepens, BoJ Holds

- Tsys futures have edged slightly higher today with the short-end outperforming, continuing moves made overnight, although ranges have been reasonably tight while volumes are below averages. TU is trading just above Thursday's highs at 104-11+, while TY is +05 at 114-29.

- Focus in the region has been on the BoJ, as expected they kept rates on hold at 0.25%, there was very little reaction to the announcement. Attention has turned to the press conference which is expected shortly.

- Cash tsys curve has bull-steepened, yields are trading flat to 2bps lower. The 2yr continues to outperform trading -1.8bps at 3.564%, while the 10yr is -0.2bps at 3.711%. The 2s10s is testing overnight & cycle highs up 1.694 at 14.456.

- Projected rates from an assumed 4.83% effective, latest vs. this morning's pre-data () as follows: Nov'24 cumulative -35.9bp (-33.3bp), Dec'24 -72.4bp (-70.8bp), Jan'25 -106.5bp (-1.050bp).

- Looking ahead: no US data Friday but the return of Fed speakers. Data to resume Monday with flash PMIs.

JGBS: Futures Weaker & Near Session Lows After BoJ Policy Decision

JGB futures are weaker and near Tokyo session lows, -11 compared to the settlement levels.

- The BoJ largely maintained its assessment of the overall economy and major economic components, although it slightly upgraded its assessment of private consumption, following the Board's decision to hold the policy rate steady at 0.25% today.

- The bank said private consumption has been on a "moderate increasing trend despite the impact of price rises and other factors.” The previous view held that private consumption "has been resilient.”

- “Inflation expectations have risen moderately,” the BoJ added.

- The bank also maintained its view on future inflation, saying that in the second half of the projection period to March 2027, the medium- to long-term inflation expectations are likely to be at a level that is generally consistent with the price stability target.

- Cash US tsys are 1-2bps richer, with a steepening bias, in today’s Asia-Pac session after yesterday’s modest twist-steepening. There is no US data today, but Fed speakers return. Data will resume on Monday with flash PMIs.

- Cash JGBs are weaker across benchmarks with yields 0.3bp higher (20-year) to 3.1bps higher (1-year).

- Swap rates are 1-2bps higher. Swap spreads are mixed.

NZGBS: Yesterday’s Rally Extends, Tracking US Tsys

NZGBs closed 1-2bps richer on a data-light session. NZGB yields are now 8-10bps lower than the mid-session high set following yesterday’s better-than-expected Q2 GDP.

- NZ PM Christopher Luxon expects fewer citizens will leave the country as interest rates fall and the economy begins to recover from a prolonged slump. “We have to build an opportunity economy,” Luxon said in a fireside chat at a Bloomberg Address in Auckland on Friday. “Where young people you can see that actually if you stay here and you work hard you can get ahead.”

- With the local calendar light, NZGBs have largely tracked US tsys and ACGBs, with the NZ-US and NZ-AU yield differentials little changed on the day.

- Cash US tsys are 1-2bps richer, with a steepening bias, in today’s Asia-Pac session after yesterday’s modest twist-steepening.

- There is no US data today, but Fed speakers return. Data will resume on Monday with flash PMIs.

- Swap rates closed 2bps lower to 1bp higher, with the 2s10s curve steeper.

- RBNZ dated OIS pricing closed 1-2bps softer across meetings. A cumulative 82bps of easing is priced by year-end.

- The local calendar sees Trade Balance data on Monday.

ACGBS: Richer, Narrow Ranges, RBA Policy Decision Next Tuesday

ACGBs (YM +2.0 & XM +0.5) are slightly stronger and near Sydney session highs. However, dealings have been light with ranges narrow on a data-light day.

- Today’s key regional event was a non-event, with the BoJ leaving the overnight call rate at 0.25% and signaling no need to hurry with interest rate hikes.

- Cash US tsys are 1-2bps richer, with a steepening bias, in today’s Asia-Pac session. There is no US data today, but Fed speakers return. Data will resume on Monday with flash PMIs.

- Cash ACGBs are 1-2bps richer with the AU-US 10-year yield differential at +22bps.

- Swap rates are flat to 2bps lower.

- The bills strip is holding a bull-flattener, with pricing +1 to +3.

- RBA-dated OIS pricing is 1-5bps softer across 2025 meetings. A cumulative 17bps of easing is priced by year-end.

- The local calendar will see Judo Bank PMIs on Monday ahead of the RBA Policy Decision on Tuesday and the CPI Monthly for August on Wednesday.

- Next week, the AOFM plans to sell A$1.0bn of the 3.75% 21 May 2034 bond on Wednesday and A$500mn of the 2.25% 21 May 2028 bond on Friday.

STIR: RBNZ Dated OIS End-24 Expectations Approach Cyclical Low

RBNZ dated OIS pricing closed 1-2bps softer across meetings. A cumulative 82bps of easing is priced by year-end.

- Year-end OCR expectations, currently at 4.43%, are just 9bps above the cyclical low of 4.34% set in late December last year.

Figure 1: RBNZ OCR & End-24 Expectations (%)

Source: MNI – Market News / Bloomberg

OIL: Stronger on the Week Post FED - Focus Back on Middle East.

- As markets now digest what is viewed as a ‘Dovish’ fed rate rise, a positive tone has swept across risk markets into year end.

- WTI rose in Thursday US trading, touching US$72.50 before settling at US$71.92.

- Brent futures too rose trading above US$75 briefly before settling at US$74.75.

- For the week, WTI was up 4.71% and Brent 4.37%.

- Equity markets were strong across the broad as the expectation that the Federal Reserve seems confident of engineering a soft landing for the US economy.

- As always, the possibility of a further escalation of tensions in the Middle East hangs over the oil market following comments from the Israeli Defense Minister suggested a ‘new phase’ in the war is imminent.

- In the US, this time of year sees US refiners undertaking maintenance ahead of winter. This maintenance usually results in an interruption of supply. US refiners release how many barrels of daily processing are not processed due to maintenance and this year the impact is the lightest seen in three years.

- Also in the US, data on US inventories show that the decline in inventories by US storage hubs sees their levels at near five-year lows. This points to potential upside in the demand cycle as and when these inventories begin to get replenished.

GOLD: Sitting Just Below $2600

Gold is 0.2% higher in today’s Asia-Pac session, after closing 1.1% higher at $2586.74 yesterday. That leaves bullion just below the $2600 mark, which was briefly touched in the aftermath of the 50bp rate cut decision by the FOMC on Wednesday. Lower rates are typically positive for gold, which doesn’t pay interest.

- The yellow metal's move yesterday came despite a report on Thursday showing jobless claims at the lowest level since May.

- According to MNI’s technicals team, a bullish structure in gold remains intact, and moving average studies are in a bull-mode set-up, highlighting a clear uptrend and positive market sentiment. The focus is on $2613.3 next. Firm support lies at $2530.6, the 20-day EMA.

- Meanwhile, silver outperformed, up ~3% on Thursday, bringing the gold-silver cross down to its lowest level since July 25.

ASIA STOCKS: Asian Equities Mostly Higher, Buoyed By Fed Cut, BoJ Holds

Asian stocks are set for their best week in a month, buoyed by the Fed's larger-than-expected rate cut and hopes for China’s stimulus. The MSCI Asia Pacific Index rose 1.3%, with a weekly gain of 2.6%, as markets rallied across the region. The HS China Enterprises Index advanced for a sixth session, while Japanese shares gained as the BoJ maintained its steady policy.

- China equities are mostly lower, property names are higher after reports that China is considering the of removing home purchase restrictions which boasted property stocks, electric vehicles names were also higher following reports the European Union and China agreed to intensify discussions in a bid to avert looming tariffs ahead of a nearing deadline. HK equities are performing much better with major benchmarks all higher, the HSI is +1.20% led by tech after a rallying in semiconductor stocks overnight.

- Japanese equities have surged higher to be the top performing market, tech stocks are the top performing sector with Tokyo Electron up 5.60%. The BOJ kept interest rates unchanged, maintaining steady monetary policy and signaling no rush for hikes as it monitors financial markets following July's increase. Meanwhile, Japan's key inflation gauge accelerated for a fourth consecutive month in August.

- Taiwan & South Korea equities are higher today after the Philadelphia Stock Exchange Semiconductor Index rose 4.27% overnight. TSMC is 1.77% higher, Samsung +1%, while Hon Hai has recovered some of yesterday's plunge to trade 1.45% higher today

- Elsewhere, Australia's ASX200 is +0.25%, New Zealand's NZX 50 -0.87%, while Indonesia's JCI dropped 2% on the open after hitting ATH on Thursday.

ASIA STOCKS: Foreign Investors Continue Buying Indonesian Equities

There is a strong trend emerging with the likes of Indonesia, Philippines, Thailand & Malaysia seeing consistent inflows on the back of the Fed rate cutting cycle, while tech stocks continue to struggle with volatile flows.

- South Korea: Saw outflows of $751m yesterday, with the past 5 sessions reaching -$2.58b, while YTD flows are +$11.81b. The 5-day average is -$517m, below both the 20-day average of -$302m and the 100-day average of -$14m.

- Taiwan: Saw inflows of $1.00b yesterday, with the past 5 sessions netting +$1.81b, while YTD flows are -$14.33b. The 5-day average is +$362m, above the 20-day average of -$319m but below the 100-day average of -$125m.

- India: Saw inflows of $284m Tuesday, with the past 5 sessions netting +$2.29b, while YTD flows are +$21.88b. The 5-day average is +$485m, above both the 20-day average of +$366m and the 100-day average of +$87m.

- Indonesia: Saw inflows of $137m yesterday, with the past 5 sessions netting +$1.54b, while YTD flows are +$3.64b. The 5-day average is +$308m, above both the 20-day average of +$153m and the 100-day average of +$29m.

- Thailand: Saw inflows of $31m yesterday, with the past 5 sessions totaling +$188m, while YTD flows are -$2.57b. The 5-day average is +$38m, below the 20-day average of +$50m and the 100-day average of -$7m.

- Malaysia: Saw inflows of $29m yesterday, with the past 5 sessions netting +$47m, while YTD flows are +$981m. The 5-day average is +$9m, below the 20-day average of +$35m but above the 100-day average of +$16m.

- Philippines: Saw inflows of $30m yesterday, with the past 5 sessions totaling +$65m, while YTD flows are -$193m. The 5-day average is +$13m, above both the 20-day average of +$11m and the 100-day average of -$2m.

Table 1: EM Asia Equity Flows

G10 FX: BOJ on Hold, Equities Strong End to the Week.

- Key event that FX market was watching today was whether the BOJ would move on monetary policy.

- BOJ did not hike and appeared satisfied with the current setting, indicating it is not hurrying to alter policy.

- Yen was slightly stronger post the BOJ announcement trading at 142.18 having touched 142 briefly.

- The YEN has had another strong week, rising 0.94% against the USD.

- Elsewhere currencies were quiet with AUD, EUR, GBP and KWD relatively unchanged on the day.

- Having had time to digest the week’s change in policy from the Federal Reserve, market movements post the event had been mostly confined to Thursday’s price action with Friday seeing relatively benign movement into the weekend.

- This evening’s key data events out of Europe include Retail Sales from the UK, PPI out of Germany and Manufacturing Confidence from France.

- Bond markets are finishing the week on a stronger note with yields across most major markets moving lower.

ASIA FX: Caught Watching the BOJ as China Keeps Policy on Hold.

- Asian currencies slipped quietly into the weekend after the excitement from the FED and all eyes on the BOJ in the region.

- Lost in the expectation around the BOJ was China’s policy decision on LPR.

- In line with market expectations banks in China maintained key loan prime rates unchanged for September.

- The CNY has had a very strong year and following on from the decision by the Federal Reserve, likely gives the PBOC time to further measures to support the struggling economy.

- In Thailand, the ongoing surge by the BAHT has seen it up 8% since June. Whilst more of a USD story with the FED, the rise in the currency is enough to worry the tourism sector as the Deputy Finance Minister urged the Central Bank to intervene.

- THB was quiet today up just 0.02% but for the week rose 0.74%.

- INR was strong today up 0.16% to finish up over 0.40% for the week.

- The Indian economy is in a very strong position in this phase of the global economy with growth strong, inflation moderating, and FX reserves large. The RBI does not seem to be in any hurry to move on rates at this stage.

- In Korea, the WON had a quiet end to the week after a weaker day yesterday. Korean equity markets finished the week very strongly and could possibly finish at their highest level for a fortnight.

CHINA : Companies Concerned Over Weak China Demand

Mercedes, Skechers & Swiss Watches have all raised concerned on China demand over the past 24hrs.

- Swiss Watches has seen a drop in August exports to China by 5.9% y/y, while HK saw 11.1% drop y/y

- Skechers Skechers shares fell 9.6% after the company's CFO warned that China sales would face continued pressure for the rest of the year.

- Mercedes has cut its financial forecast for 2024 due to a rapid deterioration in its business in China. The company now expects its adjusted return on sales to be between 7.5% and 8.5%, down from a prior forecast of up to 11%, and earnings are expected to be "significantly below" last year's level.

- The slowdown is attributed to China's weakening GDP growth, reduced consumer spending, and a continued downturn in the real estate sector, which has affected overall sales, particularly in the luxury segment.

JAPAN DATA: Local Investors Buy Foreign Bonds, Sell Equities

- Japan weekly investment flows showed strong outflows from foreign investors who sold the most Japanese stocks since Sept'23, foreign investors did seem to rotate into Japanese bonds. Local investors were strong buyers of foreign bonds with inflows near yearly highs.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending Sept 13 | Prior Week |

| Foreign Buying Japan Stocks | ¥-3005.8b | -¥902.3b |

| Foreign Buying Japan Bonds | ¥1383.9b | ¥451.2b |

| Japan Buying Foreign Bonds | ¥2100.1b | ¥-216.5b |

| Japan Buying Foreign Stocks | ¥-87.2b | ¥490.9b |

Source: MNI - Market News/Bloomberg

UK DATA: GfK Consumer Confidence Weaker Than Expected

UK GfK Consumer Confidence deteriorated below expectations to -20 (vs -13 consensus and prior) in September - returning it to the weakest since March 2024.

- All 5 subcomponents deteriorated this month, although they all remained above levels seen in September 2023. In particular, the 'Personal Financial Situation over next 12 months' score fell 9 points to -3, and Major Purchase Index also fell 10 points to -23.

- Meanwhile, the 'General economic situation over next 12 months' score fell 12 points to -37.

- These sharp falls in the forward looking indicators may be indicating lower consumption and retail sales and in turn softer GDP growth in the second half of this year.

- September's survey was conducted among a sample of 2,003 individuals from August 30 to September 13.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/09/2024 | 0600/0700 | *** |  | UK | Retail Sales |

| 20/09/2024 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 20/09/2024 | 0600/0800 | ** |  | DE | PPI |

| 20/09/2024 | 0645/0845 | ** |  | FR | Manufacturing Sentiment |

| 20/09/2024 | 0830/0930 |  | UK | BOE's Mann Speech at Central Bank Research Association | |

| 20/09/2024 | 1215/0815 |  | CA | BOC Governor Macklem speech at AI conference | |

| 20/09/2024 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 20/09/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 20/09/2024 | 1230/0830 | ** |  | CA | Retail Trade |

| 20/09/2024 | 1400/1600 | ** |  | EU | Consumer Confidence Indicator (p) |

| 20/09/2024 | 1500/1700 |  | EU | ECB's Lagarde Banking Lecture Organised by the IMF | |

| 20/09/2024 | 1530/1730 |  | EU | ECB's Lagarde converses with IMF Georgieva | |

| 20/09/2024 | 1700/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

| 20/09/2024 | 1800/1400 |  | US | Philly Fed's Pat Harker |