-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: PBOC Net Drains CNY216 Bln via OMO Monday

MNI EUROPEAN MARKETS ANALYSIS: Hong Kong Equity Bounce Helps Risk Appetite, Powell's Testimony Coming Up

- Hong Kong and China equities are higher today, with Hong Kong equities making up for their underperformance on Tuesday. Tech earnings optimism is fueling the move. This has helped curb earlier USD gains, particularly for higher beta plays. AUD is the best performer in the G10 FX space.

- Australia’s Q4 GDP printed in line with expectations at +0.2% q/q but annual growth slowed to 1.5% from 2.1% as higher rates, inflation and the unwind of pandemic-related pent-up demand weighed on growth.

- In terms of US TSYS Jun '24 10Y futures opened the day lower, touching a daily low of 111-03+. We have recovered the majority of that move to trade off -02 at 111-07+, well within Tuesday's ranges.

- Later the focus will be on Fed Chair Powell’s testimony before Congress. The Fed’s Daly and Kashkari also speak and the Beige Book is published. In terms of data, February ADP employment, January JOLTS job openings and euro area January retail sales print. The BoC meets and the ECB’s Buch appears.

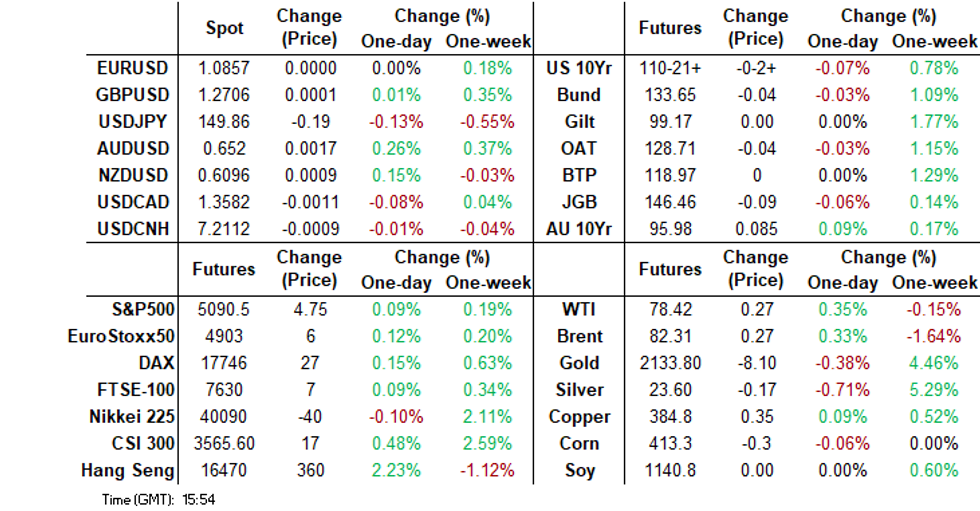

MARKETS

US TSYS: Treasury Futures Trade In Tight Ranges Off Earlier Lows

- Jun '24 10Y futures opened the day lower, touching a daily low of 111-03+. We have recovered the majority of that move to trade off -02 at 111-07+, well within Tuesday's ranges.

- Initial technical resistance at 111-11+ (38.2% retracement of the Feb 1 - 23 bear leg), a level we broke above on Tuesday but were unable to hold onto. A break above would open 111-24+ (High Feb 13), while to the downside, levels to include 110-05+/109-25+ (Low Mar 1 / Low Feb 23) and bear trigger.

- Treasury yields are largely unchanged on Wednesday, with the 2Y -0.4bps lower at 4.554%, the 10Y is -0.8bp lower at 4.145%, while the 2y10y is -0.168 at -40.918

- Trump has so far won 11 of 15 of the Republican Primary votes, with Haley winning Vermont.

- Looking Ahead: MBA Mortgage Applications, ADP Employment Change, JOLTS Job Openings, Wholesale Inventories MoM, Federal Reserve Releases Beige Book, While Fed Chair Powell Testifies Before Congress

JGBS: Futures Weaker, BoJ Expected To Revise Consumption & Factory Orders Down

JGB futures are holding in negative territory, -10 compared to settlement levels, after shunting lower early in the session following a report that Japan’s biggest bank saw a BoJ exit from negative rates in two weeks.

- Mitsubishi UFJ Financial Group Inc.’s view is much more definitive than the swap market, which rates the chances of BoJ Governor Kazuo Ueda changing policy this month at about 50%. When he changes course, it will have major implications for the 1,096 trillion yen government bond market and the nation’s currency. (See Bloomberg linkICYMI)

- (Bloomberg) -- The BoJ is expected to revise down its assessment of consumption and factory output this month, Reuters reports, citing 3 unidentified people familiar with its thinking.

- The local data calendar was empty today, ahead of January labor cash earnings tomorrow.

- US tsys are largely unchanged in today’s Asia-Pac session ahead of Fed Chairman Powell's semi-annual policy testimony to Congress scheduled for later today and Thursday.

- Cash JGBs are slightly cheaper, with yields flat to 1bp higher. The benchmark 10-year yield is 0.8bp higher at 0.714% versus the Nov-Dec rally low of 0.555% and the February high of 0.772%.

- Swap rates are slightly higher out to the 5-year and slightly lower beyond. Swap spreads are mixed.

AUSSIE BONDS: Richer & At Session Highs Ahead Of Fed Powell’s Testimony & ADP Employment Data

ACGBs (YM +6.0 & XM +7.5) sit richer at Sydney session highs. ACGBs are also holding 2-3bps richer than pre-GDP levels despite Q4 data printing in line with expectations at +0.2% q/q.

- However, annual growth did slow to 1.5% from 2.1% as higher rates, inflation and the unwind of pandemic-related pent-up demand weighed on growth. 2023 slowed to 2.1% from 2022’s 3.8%.

- Growth was driven by government spending, non-dwelling construction and net exports. While GDP was in line with the RBA’s forecasts, domestic demand was weaker. This report is unlikely to change their on-hold stance.

- Cash ACGBs are 5-8bps richer on the day, with the AU-US 10-year yield differential 2bps lower at -13bps.

- Swap rates are 5-8bps lower, with the 3s10s curve flatter.

- The bills strip has bull-flattened, with pricing flat to +7.

- RBA-dated OIS pricing is flat to 5bps softer across meetings, with late-24 leading. A cumulative 42bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Trade Balance, Home Loans Value and Foreign Reserves data.

- Later today, MBA Mortgage Applications, ADP Employment Change, JOLTS Job Openings, Wholesale Inventories and Federal Reserve Releases Beige Book are due to be released. Fed Chair Powell will also testify before Congress.

AUSTRALIAN DATA: Growth Slowing As Expected, Unlikely To Shift RBA

Australia’s Q4 GDP printed in line with expectations at +0.2% q/q but annual growth slowed to 1.5% from 2.1% as higher rates, inflation and the unwind of pandemic-related pent-up demand weighed on growth. 2023 slowed to 2.1% from 2022’s 3.8%. Growth was driven by government spending, non-dwelling construction and net exports. While GDP was in line with the RBA’s forecasts, domestic demand was weaker. This report is unlikely to change their on hold stance.

Australia GDP %

Source: MNI - Market News/ABS

- Domestic demand rose only 0.1% q/q to be steady at 2.3% y/y, which was the slowest quarterly rates since Covid. Private consumption was weak rising only 0.1% q/q and 0.1% y/y, after falling 0.2% q/q in Q3, which was driven by spending on essentials. In contrast, government spending rose 0.6% q/q and 2.7% y/y contributing 0.1pp to growth, due to increased benefits, medical spending and employee expenses.

- The household savings ratio may have troughed as it rose to 3.2% in Q4 from 1.9%, its highest since Q1 2023, as compensation and government payments boosted total income and less tax was paid.

- Total private GFCF fell 0.2% q/q to be up 4.7% y/y but non-dwelling construction was strong while residential contracted. Public investment fell as infrastructure projects were completed.

- As announced, net exports contributed 0.6pp to Q4 growth due to weak imports which also drove destocking (inventories detracted 0.3pp). The ABS observed that strong demand also drove down mining inventories.

- The statistical discrepancy weighed on growth detracting 0.2pp from the quarterly rate.

Source: MNI - Market News/ABS

AUSTRALIAN DATA: Productivity Rises, ULC Should Improve Over 2024

The RBA has continued to point out that productivity in Australia needs to improve for wages growth to be consistent with target. It rose 0.5% q/q in Q4 to be down 0.5% y/y, in line with RBA forecasts. It expects it to rise 3% y/y by mid-2024 and ease to 1.4% y/y by Q4. It has been improving due to hours worked contracting. The Q4 development is good news but unit labour costs, which the RBA has said are too high, remain a problem but they should improve over 2024.

- Unit labour costs rose 1.2% q/q to be up 6.6% y/y, up from Q3’s 6.3%. They rose by a lower 0.9% q/q in Q4 2022. While ULCs continue to rise at these rates, it is likely to remain a concern and keep the MPC cautious.

- Hours worked fell 0.3% q/q to be up 2.1% y/y, the lowest since Q1 2022. This trend is likely to continue given the easing in the labour market, which should help to increase productivity this year.

- Assuming hours worked fall over H1 2024 and then stabilise before returning to trend growth of 0.4% q/q by end 2025, annual productivity growth should be positive over that period and so ULC growth should return to more acceptable rates by mid-2024 assuming the RBA’s WPI forecasts. ULCs will also be helped by favourable base effects.

Source: MNI - Market News/ABS/RBA

NZGBS: Richer But Off Best Levels, Awaiting Fed Chair Powell’s Testimony Later Today

NZGBs closed 3-7bps richer, although short-end bonds retreated from the session's best levels. With US tsys largely unchanged in today’s Asia-Pac session ahead of Fed Chairman Powell's semi-annual policy testimony to Congress scheduled for later today and Thursday, the pullback from the day's highs could be attributed to position squaring, especially with the local economic calendar relatively light.

- At the margin, stronger-than-expected Q4 Construction Work Done data and remarks from RBNZ Chief Economist Conway might have exerted pressure on the market. Conway reiterated the importance of maintaining rates at restrictive levels for an extended period to ensure core inflation consistently aligns with the 1-3% band.

- Swap rates are 3-5bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing is flat to 6bps softer across meetings, with Feb-25 leading. A cumulative 50bps of easing is priced by year-end.

- Tomorrow, the local calendar sees 4Q Mfg Activity data.

- Tomorrow, the NZ Treasury plans to sell NZ$300mn of the 4.5% Apr-27 bond, NZ$150mn of the 2.0% May-32 bond and NZ$50mn of the 1.75% May-41 bond.

NZ DATA: Residential Building Needs To Recover To Meet Demand

Q4 building activity volumes fell 0.1% q/q to be down 0.9% y/y but the residential component fell 2.4% q/q to be down 5.3% y/y. This is a concern given that net migration rose over 161k in 2023 which is impacting the housing market with home prices rising for five consecutive months to February and rents up 4.5% y/y in Q4, which the RBNZ noted was an impact of higher population growth. If residential investment doesn’t improve soon, housing market inflation and affordability are likely to deteriorate.

NZ building volumes y/y%

Source: MNI - Market News/Refinitiv

- CoreLogic home prices rose 0.2% m/m in February to be down only 1.4% y/y and 2.8% above the September 2023 trough. Prices fell over 13% from their pandemic peak but housing affordability has still deteriorated due to the rise in mortgage rates. Rising prices even though rates are on hold are only going to make this situation worse.

- Demand is strong with REINZ dwelling transactions rising sharply over the year to January. Sales tend to lead prices.

- Housing affordability deteriorated significantly over the 18 months to Q4 2023 to stand 36% below trend. The pace has eased though with Q4 down 2.3% y/y after -9.9% in Q3 as the RBNZ has been on hold since May last year but the pickup in prices may stall any improvement.

- In terms of house prices-to-rents though, NZ housing was undervalued in Q4 standing 4.8% below trend as home prices were still down 4.5% y/y while CPI rents rose 4.5% y/y.

Source: MNI - Market News/Refinitiv

FOREX: USD Off Earlier Highs, Equity Bounce in HK Helps Risk Appetite

G10 FX trends have been relatively contained today. Early USD strength wasn't sustained with the BBDXY unable to breach the 1242 level and we sit back near 1241 in recent dealings.

- A recovery in regional equity sentiment, led by a +2% gain in Hong Kong shares has seen AUD and NZD rebound from lows.

- US equity futures are higher, led by the tech but at +0.25% is only unwinding a modest part of yesterday's weakness. In the yield space, we are a touch lower in yield terms.

- USD/JPY sits just under 150.0, but ranges have been tight. Japan’s biggest bank sees a BoJ exit from negative rates in two weeks. Mitsubishi UFJ Financial Group Inc.’s view is much more definitive than the swap market, which rates the chances of BoJ Governor Kazuo Ueda changing policy this month at about 50%.

- AUD/USD is back to 0.6510/15, around 0.15% above end Tuesday levels in NY. The correlation with respect to HK equity moves has been evident today. Aussie looked through the on consensus Q4 GDP data. It rose 0.2% q/q and slowed to 1.5% y/y from 2.1%, but was in line with RBA forecasts. It showed a 0.5% q/q improvement in productivity.

- NZD/USD is lagging somewhat, but still up from earlier lows, last near 0.6090. NZD/JPY bounced off support at the 50-day EMA (near 91.06). AUD/NZD tried to push above 1.0700, but hasn't been able to do so convincingly. Earlier, Chief Economist for the RBNZ, Conway, noted that policy is likely to need to stay restrictive for some time and that household inflation expectations remain a watchpoint. He noted the RBNZ may be able to start easing sooner, but this would likely be contingent on the Fed easing in the second half of this year.

- Later, the UK budget release is in focus. UK construction PMI and Eurozone retail sales also cross. Then attention switches to the Bank of Canada decision and US Jolts, which will accompany the Fed Chair’s testimony.

ASIA STOCKS: Hong Kong Equities Surge Higher As Tech Leads The Way

Hong Kong and China equities are higher today, with Hong Kong equities making up for their underperformance on Tuesday. Tech names are leading the market higher, especially JD.com Inc, which is up 9.5% in anticipation of strong earnings due out during the US session later, while some short covering could be helping as well. While officials from the central bank, securities regulator and other ministries are scheduled to hold a press briefing this afternoon during the National People’s Congress, where more details on China’s economic policy plan for this year are expected

- Hong Kong Equities have surged higher today after lagging China Mainland stocks on Tuesday. Tech is the best-performing sector, with the HSTech Index up 3.79%, the HSI is up 2.33%, while the Mainland Property Index lags the move, although still trading 1.46% higher. In China, equity markets are higher, small-cap and growth names have led the way after underperforming on Tuesday, with the CSI1000 up 1.14%, ChiNext up 0.65%, while the CSI300 is 0.08% higher.

- China Northbound flows were -1.6b yuan on Tuesday, with the 5-day average to 1.42m, while the 20-day average sits at 2.76b yuan.

- Apple's iPhone sales plunge 24% over the first six weeks of this year, while the overall mobile markets shrank by 7% in the same period. The top share of the market went to Dongguan-based Vivo, who target the budget segment of the market. It was also reported that iPhone assembly partner Hon Hai Precision Industry Co, had reported a 18% slump in sales for the year.

- China has pledged to use the entire nations resources to speed up homegrown scientific breakthroughs. The government will increase spending on scientific and technology research by 10% to 370.8 billion yuan ($51.5 billion) in 2024, promote national champions and grant enterprises a central role in spearheading advances with particular focus on strategically critical areas from semiconductor manufacturing to quantum computing.

- Looking ahead, the NPC meeting will continue over the next few days although there is no set time frame, although expected to last about a week.

ASIA PAC EQUITIES: Asian Equities Rebound After A Slow Start

Regional Asian equities are mostly higher on Wednesday after a slow start to trading. Tech names are leading the market higher; JD.com Inc has earnings out during the US session but has surged almost 10% higher in anticipation, pulling other tech names up with it. Crypto has recovered some of Tuesday's losses, helping risk assets. There have been few market headlines today, while South Korea had CPI out earlier, coming in at 3.1% vs. 3.0% YoY. Australia also released 4Q GDP data, which came in line with expectations at 1.5% YoY.

- Japan equities are mixed today, with bank stocks again as top performers. The Topix Bank Index is up 0.81%, tech stocks weighed on the market earlier but have seen some rebound throughout the day, with the Nikkei 224 down just 0.10% after being down as much as 0.83%; the Topix is 0.30% higher.

- South Korean equities are slightly lower, although well off earlier lows as tech stocks rebound. There have been -$320 million of foreign equity outflows throughout today, after just $12 million of inflows on Tuesday. The Kospi is down 0.25%.

- Taiwan equities are higher today, after earlier reports that the Taiwanese Ministry of Economic Affairs opened a consultation on draft amendments to extend and enhance tax incentives for small and medium enterprises (SMEs). Semiconductor names opened lower this morning; however, they managed to grind higher throughout the day with TSMC up 1%, the Taiex now trading 0.65% higher for the day.

- Australian equities closed higher today; Financials were the top-performing sector offsetting weakness in the mining space. Australia had 4Q GDP data coming in line with expectations at 1.5% YoY. The ASX 200 closed up 0.12%.

- Elsewhere in SEA, NZ finished up 0.36%, Indonesia's JCI has managed to creep back above the support level of 7,250, to trade at 7,276 up 0.40% although foreign equity outflows have been negative for 7 of the past 8 days. Thailand SET is up above 1.00%, while India is off highs, down 0.30%.

Asian Equity Inflows Mixed On Tuesday As Markets Watch NPC Meeting

- China equities significantly out-performed HK equities on Tuesday, ETFs saw a surge in turnover with large cap out-performing smaller cap and growth stocks in a sign that the "National Team" was busy at work supporting the market, although it's important to note during day one of the NPC meeting it was mentioned that China will look to support growth in more stable and lower risk companies over higher risker companies, which could have helped the out-performance. China equities saw 1.53B Yuan of inflows, taking the 5-day average to 1.42m, while the 20-day average sits at 2.76b yuan.

- South Korean equities were lower on Tuesday, with inflows of just $12m. SK had GDP data out which was in line with expectations at 2.2%. Technology shares in the region were dragged lower after investors were worried about growth challenges in China after NPC meeting mentioned only modest fiscal support measures for the economy, while doubt has been raised around the breakthrough made by researchers behind LK-99 who have claimed to have synthesized a new material showing superconducting behaviour at room temperature. GDP data was out earlier and was in line with expectations, . The 5-day average is $285m, while the 20-day average sits at $299m.

- Taiwan equities edged higher following global semiconductor indices higher, while $238m of equity inflows hit the market, although this number was well down on the day prior. The 5-day average now sits at $242m, while the 20-day average sits at $270m.

- Indonesian equities continue to see outflows now marking 8 of the past 9 days of outflows. The JCI has been trading sideways since mid Feb and broke below resistance of 7250 on Tuesday to finish the day at 7247. The 5-day average now sits at -$27m vs the 20-day average at +$24m.

- Thailand equities also continue to see outflows with another -$81m leaving, Top Thai Government Aid has called for a rate cut to help spur growth, the SET is one of the worst performing equity markets in the region as struggles with growth. the 5-day average is -44m, vs the 20-day average of -$8m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | 1.6 | 7.1 | 35.4 |

| South Korea (USDmn) | 12 | 1427 | 9128 |

| Taiwan (USDmn) | 238 | 1213 | 6461 |

| India (USDmn)** | -1 | 848 | -2397 |

| Indonesia (USDmn) | -49 | -136 | 1083 |

| Thailand (USDmn) | -82 | -221 | -909 |

| Malaysia (USDmn) ** | -67 | -160 | 313 |

| Philippines (USDmn) | 6 | 40.1 | 240 |

| Total (Ex China USDmn) | 57 | 3011 | 13920 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To March 4 |

OIL: Crude Little Changed, Looking For Direction From Fed’s Powell

Oil prices are little changed during APAC trading ahead of Fed Chair Powell’s testimony later today. Crude markets are concerned that easing will be delayed thus weighing on energy demand and adding upward pressure to the greenback. So, they will be monitoring Powell’s comments closely. The USD index is flat.

- Benchmarks have held the losses of the last two days. WTI is up 0.2% today to $78.34/bbl, close to the intraday high. It fell briefly below $78 to a low of $77.99. Brent is up 0.2% to $82.22, also close to the day’s high, and back above $82 after falling early in the session to $81.85.

- Bloomberg reported that US crude stocks rose 423k barrels last week according to people familiar with the API data. The trend of crude builds and product drawdowns continued with gasoline falling 2.8mn and distillate -1.8mn barrels. The official EIA data is out today.

- OPEC+ cuts have been extended to the end of June and Saudi Arabia has now surprisingly raised prices for its main grade shipped to Asia.

- Later the focus will be on Fed Chair Powell’s testimony before Congress. The Fed’s Daly and Kashkari also speak and the Beige Book is published. In terms of data, February ADP employment, January JOLTS job openings and euro area January retail sales print. The BoC meets and the ECB’s Buch appears.

GOLD: Slightly Weaker After Hitting A New All-Time High On Tuesday

Gold is slightly weaker in the Asia-Pac session, after closing 0.6% higher at $2128.04 on Tuesday after hitting a new all-time high of $2141.79.

- According to MNI’s technicals team, the break of the prior high at $2135.4 (Dec 4) reinforced a bullish condition and signalled scope for a climb towards $2177.6 (Fibonacci projection).

- Tuesday’s gains were driven by lower Treasury yields along with some mild net USD weakness.

- Geopolitical tensions and a pullback for equity markets added support for bullion.

- The market's focus now turns to Fed Chairman Powell's semi-annual policy testimony to Congress today and Thursday as well as NFP on Friday.

- TD Securities point to macro funds and momentum buying by commodity trading advisors further contributing.

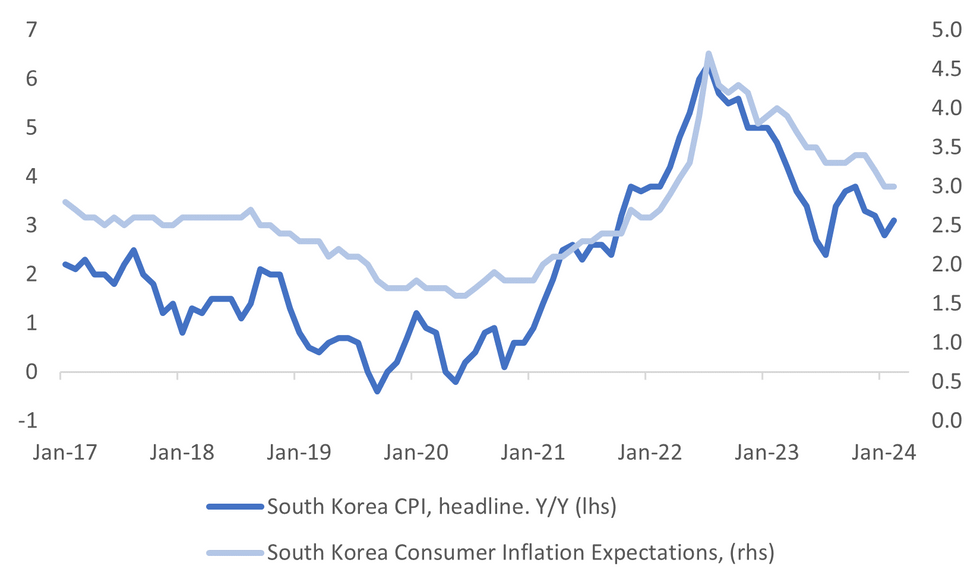

SOUTH KOREA DATA: Headline CPI Firms, LNY A Possible Driver, Core Inflation Steady

South Korean Feb CPI was a touch above expectations in terms of headline pressures. We rose 3.1% in y/y terms, versus 3.0% forecast and 2.8% prior. The m/m outcome was in line at 0.5%, while core (ex food and energy) also met expectations at 2.5%y/y (which was also the Jan reading).

- The chart below plots y/y headline CPI against consumer inflation expectations. We are well off 2022 highs, but not yet back to the 2% BoK inflation target, particularly for expectations.

- In terms of the detail, the biggest m/m gains in Feb were for food, +1.4% and transport, +1.5%. Recreation also rose 1.0% m/m. These moves may have been driven by the LNY.

- Only two categories saw falls in m/m terms, while other categories saw only modest rises or flat outcomes in the month.

- In y/y terms, food +6.9% and clothing at 5.7%, are recording the strongest gains.

- For the BOK, they are likely to remain in watch and wait mode, to see if pressures, particularly those potentially related to LNY tick down in March.

Fig 1: South Korea CPI Y/Y & Consumer Inflation Expectations

Source: MNI - Market News/Bloomberg

MALAYSIA: MNI BNM Preview - March 2024: On Hold, Ringgit Stability In Focus

- The consensus is for no change tomorrow at the BNM policy meeting. This is also our strong bias.

- Recent MYR weakness has taken center stage from a policy standpoint. This has raised prospects that the BNM may sound more hawkish this week, or potentially even hike rates to curb MYR weakness. A hike is a low probability outcome in our view though. Given still wide rate differentials with the US, a 25bps hike is unlikely to provide lasting FX support.

- Equally, FX weakness is likely to prevent BNM from sounding too dovish, even with a patchy growth backdrop of late.

- Click to view the full preview:

ASIA FX: South East Asia Currencies Firm, Low CNH Volatility Continues

USD/Asia pairs are mostly lower in the first part of Wednesday trade. NEA currencies are underperforming at the margin though. CNH is steady, continuing to show very low volatility. USD/KRW 1 month climbed in early trade, but has reversed lower as equity sentiment has improved. In SEA, IDR, THB and PHP are higher, but we are yet to see key ranges broken. Looking ahead to tomorrow, China Feb trade data is out. Thailand consumer confidence is also out, then later on we have the BNM decision (no change expected), along with Taiwan CPI.

- USD/CNH sits unchanged, once again maintaining tight ranges. We were last near 7.2120. Onshore equities are marginally higher. We haven't seen much positive spill over from HK gains (amid tech earnings optimism). Onshore government bond yields are weaker, down -1 to -2.5bps, which is likely weighing at the margins. Reuters reported earlier that domestic capital outflows are very strong, which is bumping up against official limits (see this link). This may be a factor that keeps spot USD/CNY supported on dips, although we haven't breached 7.2000 yet.

- 1 month USD/KRW got above 1335 in early trade, but we now sit back lower, close to 1333, which is keeping us within recent ranges. Earlier we have Feb CPI print slightly stronger than expected, but core trends were steady. Onshore equities are weaker, but away from session lows, as broader equity sentiment has mostly improved throughout the region today.

- USD/IDR has tracked lower in recent dealings, last near 15720, around 0.30% stronger in IDR terms for the session. Recent highs from yesterday came in close to 15780. The 1 month NDF is also slightly lower versus end NY closing levels from Tuesday, near 15740. For spot we are still some distance above the 20-day EMA, near 15680, which is showing a modest uptrend. A better regional equity tone, led a HK rebound, has aided broader risk appetite in the FX space. Portfolio flows remain a net negative for the FX though. We saw nearly $50mn in equity outflows at the start of the week, while bond outflows on Monday were -$118mn.

- Spot USD/PHP is lower, last tracking close to 55.86, around 0.20% stronger in PHP terms. We are still above late Feb lows near 55.70. Earlier comments by BSP Governor Remolona suggested a rate cut was unlikely in the near term, as the central bank is unsure inflation is sustainably within its 2-4% target band. This follows yesterday's upside surprise for the Feb data.

- USD/THB has tracked lower as well, we were last near 35.75, up by the same amount as PHP. This is close to fresh lows in the pair back to the first half of Feb. Comments from the Thailand Business Group were marginally positive. The group is keeping its growth forecast for the year at 2.8-3.3%. The second half is expected to be firmer, amid more government support and tourism inflows (34-35mln visitors are expected this year).

INDONESIA: Indonesian Sovereign Curves Flatten, Reverse Tuesday's Move

Indonesian USD sovereign debt yields have reversed their move higher from Tuesday, with yields 1-3 bps lower on today, although still underperforming the overnight movement by US Treasuries.

- The 2Y yield is unchanged at 4.88%, the 10Y yield is 2 bps lower at 5.00%, while the 5-year CDS is up 0.25 bps to 71.75 bps.

- The spread difference between USD Indonesian and US Treasury yields has been closing over the past month, although it lagged the move from US Treasuries overnight. The 2Y spread is now 32 bps (+3 bps overnight), still considerably tighter than a month prior when the spread was 48 bps, while the 10Y spread is now 85 bps, unchanged from a month prior.

- In cross-market moves, the USD/IDR is 0.24% lower, the JCI is 0.20% higher, while US Tsys yields are 0-1 bp lower.

- Foreign investors sold Indonesian debt on Monday and Tuesday, with -$120 million exiting the market. Short-term, investors have largely been sellers, with a 20-day average daily flow currently at -$29 million, while longer-term trends still remain positive with the 100-day average at +$6.2 million.

- On Tuesday, Bank Indonesia Governor Perry Warjiyo expressed confidence that the economy would grow by over 5 percent this year, anticipating a swift conclusion to the presidential election, expected to alleviate pressure and minimize disruptions. With Defense Minister Prabowo Subianto projected to secure an outright win, Perry urged businesses to invest actively, emphasizing the favorable conditions for profit generation.

- Looking Ahead: Feb Foreign Reserves are Due out on Thursday

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 06/03/2024 | 0700/0800 | ** |  | DE | Trade Balance |

| 06/03/2024 | 0830/0930 | ** |  | EU | IHS Markit Final Eurozone Construction PMI |

| 06/03/2024 | 0930/0930 | ** |  | UK | IHS Markit/CIPS Construction PMI |

| 06/03/2024 | 1000/1100 | ** |  | EU | Retail Sales |

| 06/03/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 06/03/2024 | 1230/1230 |  | UK | Budget Statement | |

| 06/03/2024 | 1315/0815 | *** |  | US | ADP Employment Report |

| 06/03/2024 | 1445/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 06/03/2024 | 1500/1000 | * |  | CA | Ivey PMI |

| 06/03/2024 | 1500/1000 | ** |  | US | Wholesale Trade |

| 06/03/2024 | 1500/1000 | *** |  | US | JOLTS jobs opening level |

| 06/03/2024 | 1500/1000 | *** |  | US | JOLTS quits Rate |

| 06/03/2024 | 1500/1000 |  | US | Fed Chair Jay Powell | |

| 06/03/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 06/03/2024 | 1530/1030 |  | CA | BOC Press Conference | |

| 06/03/2024 | 1700/1200 |  | US | San Francisco Fed's Mary Daly | |

| 06/03/2024 | 1900/1400 |  | US | Fed Beige Book | |

| 06/03/2024 | 2115/1615 |  | US | Minneapolis Fed's Neel Kashkari |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.