-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Japan FinMin - Ready To Intervene If Needed

- Macro moves were fairly steady through Asia Pac trade on Tuesday. Weakness in gold prices was the exception as we continued to see a correction from recent highs.

- Manufacturing PMIs were better for both Australia and Japan, as we await further prints for the EU and US later. Japan FinMin Suzuki stated tha the environment was in place for FX intervention if needed. The yen saw a small bounce, but no follow through. JGB futures are holding a downtick, -2 compared to the settlement levels.

- Later US preliminary April Global S&P PMIs, new home sales and Philly & Richmond Fed indices as well as European PMIs print. BoE’s Pill and Haskel speak.

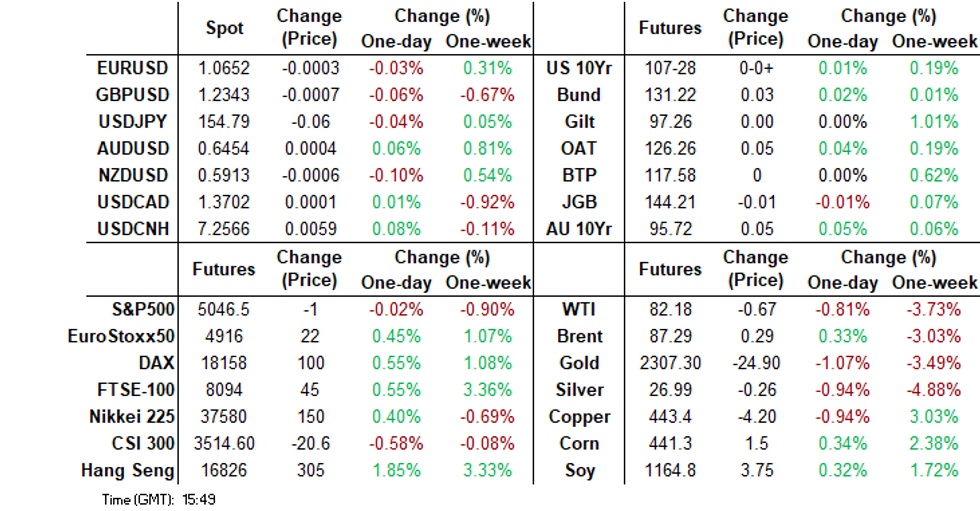

MARKETS

US TSYS: Treasury Futures Are Little Changed, Ranges Tight

- Treasury futures have done very little on Tuesday, ranges are tight (10Y - high 107-30+, low 107-27) and volumes are on the low side, following on from the US session when volumes were at about 60% verse the 20-day average, Jun'24 10Y contract is now unchanged from NY closing levels at 107-28, a downward trend remains and a bear cycle remains in play, initial support is at 107-13+ (Apr 16 low), while initial resistance is 108-22+ (Apr 19 high).

- Cash Treasury curve little changed Today, with the 2Y yield +0.5bps to 4.976%, 10Y +0.4bps to 4.613%, the 2y10y is unchanged at -35.879.

- Across local rate markets, NZGBs are 4-5bps lower, ACGBs are 1-4bps lower and JGBs are 1-5bps higher, in the EM space INDON & PHILIP yields are 1-4bps lower.

- Projected rate cut pricing running steady to mildly lower vs. late Friday lvls: May 2024 -2.6% w/ cumulative -0.6bp at 5.322%; June 2024 at -16.2% w/ cumulative rate cut -4.7bp at 5.282%. July'24 cumulative at 11.6bp, Sep'24 cumulative -22.3bp.

- Looking ahead: Philadelphia Fed Non-Manufacturing Activity, S&P Global US PMI, New Home Sales

JGBS: Futures Downtick, BoJ Gov. Ueda’s Comments Add Pressure, Mixed Results For 2Y Supply

JGB futures are holding a downtick, -2 compared to the settlement levels.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined Jibun Bank Flash PMIs.

- (MNI) BoJ Governor Ueda said the BoJ would tweak the degree of easy policy through adjustments to the unsecured overnight call loan rate if inflation rises to its 2% target as expected. (See linkICYMI)

- Cash US tsys are little changed in today’s Asia-Pacific session.

- Today’s 2-year supply demonstrated mixed demand metrics. The low price met dealer expectations and the auction tail was unchanged from last month. However, the cover ratio declined to 3.481x from 4.072x in March.

- This outcome is likely to be perceived as disappointing, especially considering the optimistic tone set by other JGB auctions in April.

- The cash JGB curve has maintained its bear-steepening, with yields flat to 4bps higher. The benchmark 10-year yield is little changed at 0.887%, just shy of the YTD high of 0.891%.

- The swaps curve has twist-steepened, pivoting at the 10s, with rates 1bp lower to 5bps higher. Swap spreads are tighter out to the 7-year and wider beyond.

- Tomorrow, the local calendar will see PPI Services data alongside BoJ Rinban Operations covering 3-25-year+ JGBs.

AUSSIE BONDS: Richer, Narrow Ranges, Awaiting Q1 CPI Tomorrow

ACGBs (YM +3.0 & XM +4.0) are slightly richer after dealing in narrow ranges so far in the Sydney session. With Q1 CPI data due for release tomorrow and US tsys showing no net movement in today’s Asia-Pac session, local participants have largely sat on the sidelines.

- Q1 CPI will be watched closely as it feeds into the RBA’s updated outlook published on May 7 and thus also its decision-making.

- Bloomberg consensus expects it to ease to 3.5% y/y from 4.1% but for the quarterly rise to pick up. Trimmed mean is forecast to drop to 3.8% from 4.2%, helped by favourable base effects.

- (MNI) Given the upward surprise to NZ’s domestic inflation in Q1, there is a risk the services component remains “sticky”, which the RBA is monitoring closely (See link).

- Cash ACGBs are 3-4bps richer, with the AU-US 10-year yield differential at -33bps, its cycle low.

- Swap rates are 3-5bps lower, with the 3s10s curve flatter.

- The bills strip has twist-flattened, pivoting at late-whites, with pricing -2 to +3.

- RBA-dated OIS pricing is little changed across meetings. A cumulative 17bps of easing is priced by year-end.

- Later today, the US calendar will see Philadelphia Fed Non-Manufacturing Activity, S&P Global US PMIs and New Home Sales.

AUSTRALIAN DATA PREVIEW: Q1 Inflation Forecast To Ease Substantially, Watch Services

Q1 CPI prints on Wednesday and will be watched closely as it feeds into the RBA’s updated outlook published on May 7 and thus also its decision making. Bloomberg consensus expects it to ease to 3.5% y/y from 4.1% but for the quarterly rise to pick up. Trimmed mean is forecast to drop to 3.8% from 4.2%, helped by favourable base effects. Given the upward surprise to NZ’s domestic inflation in Q1, there is a risk the services component remains “sticky”, which the RBA is monitoring closely (see MNI Strong NZ Domestic Inflation May Also Show In Australia’s Q1 Data).

- Q1 headline CPI is forecast to rise 0.8% q/q after 0.6% in Q4. It is worth noting that Q1 2023 posted a 1.4% increase. Forecasts range from 0.7 to 1.0% q/q and 3.2 to 3.7% y/y with ANZ, NAB and Westpac all at consensus and CBA slightly lower at 0.7%/3.4%.

- Trimmed mean is expected also to rise by 0.8% q/q in line with Q4. It rose 1.2% q/q in Q1 2023. Projections are in a narrow range of 0.7-0.9% and 3.7-3.9% with CBA and Westpac forecasting 0.8% but ANZ and NAB 0.9%.

- The services CPI will be important as it is domestically driven and elevated. Also the RBA is concerned re its persistence as seen overseas. It rose 4.6% y/y in Q4 and core 4.5% but while base effects should help the headline ease in Q1, the core needs a result below 0.9% q/q for a moderation in the annual rate. Non-tradeables will be another component to watch.

- March monthly CPI is forecast to be at 3.4% y/y for the fourth consecutive month with ANZ, CBA & NAB all at consensus but Westpac below at 3.2%. Forecasts range between 3.2% and 3.6%.

AUSTRALIAN DATA: PMI Points To Stronger H1 Growth

The pickup in private sector activity seen in Q1 was sustained into Q2 according to the Judo Bank preliminary PMIs for April. The composite PMI rose to 53.6 from 53.3, highest since April 2022, with the rise driven by a pickup in manufacturing to close to neutral at 49.9 from 47.3, but it is the strength of services that is driving overall activity growth. The services PMI remained positive but eased marginally to 54.2 from 54.4.

- Judo Bank says that the Q1 composite PMI is in line with GDP rising around 0.6% q/q, significantly stronger than Q4’s 0.2% and a result that would keep the RBA on hold.

- The private sector saw an increase in new business in April, which drove activity and employment. Services new business rose to its highest in almost 2 years, while manufacturing declined at a slower rate.

- In line with recent strong employment gains, the survey showed that the services sector saw “growth in headcounts” while in the manufacturing sector they “near-stabilised”.

- Cost inflation continued to pick up in April due to the softer AUD and higher raw materials prices, but selling price inflation eased again in order to encourage new business. While costs remain a concern, the RBA will be pleased to see that demand is not strong enough for them to be fully passed on.

- Confidence re the outlook remained positive but eased in April.

- See Judo Bank report here.

Source: MNI - Market News/Refinitiv/Bloomberg

*Services PMI uses April data for Q2

NZGBS: Richer & Just Off Best Levels, NZ-US 10Y Differential Unchanged

NZGBs closed 5bps richer across benchmarks, just off session bests. In the absence of domestic data, local participants have used US tsys for directional guidance.

- The NZ-US 10-year yield differential is unchanged versus yesterday’s local close. At +22bps, the differential sits around its tightest level since mid-2021. Before this narrowing started in March, the differential had oscillated between +30 and +80bps since late 2022.

- Swap rates closed 5-6bps lower.

- RBNZ dated OIS pricing closed is 2-5bps softer for meetings beyond August, with November leading. A cumulative 54bps of easing is priced by year-end.

- Tomorrow, the local calendar will see Trade Balance data.

- Also tomorrow, Australia will release Q1 CPI data. Bloomberg consensus expects it to ease to 3.5% y/y from 4.1% but for the quarterly rise to pick up. Trimmed mean is forecast to drop to 3.8% from 4.2%, helped by favourable base effects.

- (MNI) Given the upward surprise to NZ’s domestic inflation in Q1, there is a risk the services component remains “sticky”, which the RBA is monitoring closely (See link)

FOREX: A$ Posts Modest Gains, Suzuki States Ready To Intervene If Needed

The BBDXY sits down a touch, last just under 1264.0 in the first part of Tuesday trade. Outside of some modest AUD gains, overall moves have been muted though.

- Cross asset sentiment has been steady, with US equity futures close to flat after opening in the red. US yields sit close to unchanged as well, amid light news flow (the Fed is in the blackout period).

- After rising 0.5% on Monday, AUDUSD is up 0.15% so far today to 0.6460, breaking above initial resistance at 0.6457, April 18 high, opening up 0.6498, 20-day EMA. The pickup in private sector activity seen in Q1 was sustained into Q2 according to the Judo Bank preliminary PMIs for April.

- Equities are generally stronger in the region, although once again China markets are underperforming.

- The Kiwi is the worst performing G10 currency today although only slightly lower while ranges remain tight. NZD/USD was last near 0.5915. AUD/NZD is up 0.10% and back above 1.0900 at 1.0912. The pair now eyes a test of the 1.0920 area that it failed to break above back on the 15 & 16th April. Note we have Q1 AU CPI tomorrow.

- USD/JPY sits just under 154.75 in recent dealing. Earlier comments from FinMin Suzuki provided some support for the yen. He noted the environment was in place for intervention if needed. There was little follow through to yen gains though. Earlier we had a pick in Japan's manufacturing PMI for April (preliminary) but this didn't impact FX sentiment.

- Looking ahead, US preliminary April Global S&P PMIs are due, new home sales and Philly & Richmond Fed indices as well as European PMIs print. BoE’s Pill and Haskel speak.

ASIA EQUITIES: China & HK Equities Mixed, CSRC Announcement Helping HK Equities

Hong Kong and China equity are mixed today, with Hong Kong equities outperforming again today after the CSRC announced five measures to promote Chinese companies listing in Hong Kong with companies expected to shift their fundraising plans to Hong Kong following recent tightening of domestic listing rules. China’s CB to further lower its MLF rates to help reduce financing cost for the economy, according to analysts.

- Hong Kong equities are surging higher today with the HSTech Index up 2.85% and now testing both the 20 & 50-day EMAs, while the 14-day RSI has ticked into positive territory at 50, the Mainland Property Index up 1.17% however still remains below all EMA's and 14-day RSI is below 50 although it's ticking higher, while the HSI is up 1.64% and has now broken back above 100-day EMA with a potential move to the 200-day EMA at 17,266. China Mainland equities are underperforming this morning, with the CSI300 down 0.56% and now testing the 50 & 100-day EMA, levels we have remained above since mid Feb, a break below here could signal a further leg down and a test of the 3,400 level. Small-cap indices are mixed with the CSI1000 down 0.50% while the CSI2000 is up 0.60%.

- China Northbound had an inflow of 1.4b yuan on Thursday, momentum has been decreasing over the past week with the 5-day average at -2.68billion, while the 20-day average sits at -1.28billion yuan.

- Analysts suggest that China's central bank may lower its medium-term lending facility (MLF) rates in the third quarter to reduce financing costs for the economy. This move could also lead to a decrease in banks' loan prime rates and help address local debt risks, according to experts cited by the China Securities Journal. However, there are concerns about the shrinking room for further reduction in loan prime rates due to pressure on banks' net interest margins caused by declining lending rates

- Recent measures by China's securities regulator to support IPOs in Hong Kong are expected to lead mainland firms to shift their fundraising plans to the city, bolstering its status as a premier listing destination. The move follows tightening regulations on domestic listings and aims to enhance connectivity between Hong Kong and mainland capital markets, although the impact may not be immediate due to ongoing global uncertainties.

- Looking ahead, HK CPI Composite later today & Trade Balance on Thursday, while the calendar for China remains quiet.

ASIA PAC EQUITIES: Asian Equities Head Higher Ahead Of Busy Earnings Week

Regional Asian equities are higher today, benchmark indexes in Japan, South Korea and Australia are up, while US equity futures are unchanged after US markets ended a run of down days led higher by Nvidia. Concerns remain around rising interest rates, stubborn inflation, and geopolitical risks although these tensions look to be cooling with focus for the moment turning to corporate earnings as about 40% of the S&P are set to report this week. Economic data from Australia and South Korea suggests some inflationary pressures but remains relatively subdued.

- Japanese equities are higher today recovering further from the sell-off on Friday. The Nikkei 225 index is up 0.31% to 37,555 and has now consolidated back above the 100-day EMA, while the broader Topix has outperformed recently and is now testing the 20-day EMA, up 0.21% to 2,668. Investors will be closely monitoring the earnings report of Nidec, a Kyoto-based manufacturer of precision and automotive motors. Many investors are cautious, waiting to see if the company's financial performance will differ from previous disappointing results in the EV sector. Additionally, attention is on the yen, which is trading close to a 34-year low against the dollar at 154.75, prompting investors to watch for any indications of potential verbal intervention or concrete measures by Japanese authorities to bolster the currency.

- South Korean equities are higher today, with PPI for March indicating a cooling of domestic inflationary pressure, with a smaller month-on-month rise compared to February, signaling progress in the broader disinflation process, while agricultural prices saw a notable increase, contributing to a modest year-on-year rise of 1.6%. The Kospi has traded back above the 100-day EMA, up 0.14% to 2,633.53. Focus now turns to GDP tomorrow.

- Taiwan equities are higher today ending a run of down days up 1.10%, the Taiex has just broken back above the 50-day EMA and now trades down 5.90% from recent highs after being down as much as 7.62% on Friday. Late Monday Taiwan's unemployment rate was unchanged in March at 3.4% as expected, looking ahead Industrial Production for march is expected out with consensus of 7.25% up from -1.10% in Feb.

- Australian equities are following wider markets higher today the ASX200 is up 0.46% and now up 2.70% from lows made on Friday, the index is now testing the 50-day EMA levels at 7,684. Industrials are the only sector in the red today, as Health Care stocks lead the way. Earlier Judo Bank PMIs showed an increased from the March, while focus will turn to CPI due out tomorrow.

- Elsewhere in SEA, New Zealand Equities are down 0.41%, Singapore equities are 1.22% higher ahead of March CPI due out later today, Malaysian equities up 0.40%, Philippines equities are up 0.93%, while Indonesian equities are up 0.67%

ASIA EQUITY FLOWS: Equity Flow Momentum Remains Negative As Rates & USD Head Higher

- China equities saw an inflow on Monday, while equities markets were lower, the CSI300 remains within recent ranges after testing 3,600 and the 200-day EMA on Thursday. Flow momentum remains negative with the 5-day average now -2.68b, 20-day average at -1.28b and the longer term 100-day average now 0.33B yuan.

- Taiwan equities have marked the eighth straight day as foreign investors sell a total of $6.89b for that period, while equity markets were unable to rebound after they plummeted on Friday closing down 0.59% on Monday. Equity flow momentum has quickly changed in Taiwan, with the market seemingly fallen out of love with tech stocks recently as higher rates and inflated values hurt sentiment in the sector, the 5-day average is now -$1.07b, vs the 20-day at -$432m, while the 100-day average is now just $59.5m.

- South Korea equities saw their largest outflow in a month as $597m left the market and marked six of the past seven trading days of net outflows. The Kospi was off 8.13% at its worst on Friday, testing the 200-day EMA and hitting an 14-day RSI of 30, before rebounding about 3% and trading back through the 100-day EMA. The 5-day average is now -$190m, the 20-day average to $125m and the 100-day average to $171m.

- Philippines equities continue to see outflows with $13.8m leaving the market on Friday making it 12 straight days of outflows for a total of $132m. The PSEi was unchanged on Monday, and has now consolidated below the 200-day EMA. The 5-day average is -$13.5m, the 20-day average is -$7.40m, while the 100-day average continues to edge lower now at $1m.

- Indonesia had a $56m outflow on Friday taking it to a 14-day streak of net selling by foreign investors for a total of $1.04b. The JCI was 0.19% lower on Monday and has consolidated below the 200-day EMA and now off 5.11% from recent cycle highs. The 5-day average is now -$66m, the 20-day average is -$50m, while the longer term 100-day average is still positive at $14.2m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | 1.4 | -13.4 | 47.6 |

| South Korea (USDmn) | -598 | -950 | 13165 |

| Taiwan (USDmn) | -480 | -5383 | -2202 |

| India (USDmn)** | 93 | -2137 | 542 |

| Indonesia (USDmn) | -57 | -334 | 768 |

| Thailand (USDmn) | 10 | -325 | -1941 |

| Malaysia (USDmn) ** | -61 | -333 | -669 |

| Philippines (USDmn) | -14 | -65.9 | 52 |

| Total (Ex China USDmn) | -1107 | -9528 | 9714 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 19th |

OIL: Crude Stabilising As Geopolitics Settle, Supply In Focus

Oil prices are up moderately during today’s APAC session after falling 0.1% on Monday. While fighting in Gaza continues and there is no further escalation of tensions between Israel and Iran, crude may range trade again. WTI is up 0.5% to $82.29/bbl after falling to $81.86 and Brent is 0.4% higher at $87.39 but tested $87 earlier. The USD index is down slightly.

- The US extended sanctions on Iran’s oil to include financing but analysts don’t expect the new measures to have a material impact on Iran’s crude exports, according to Bloomberg.

- Derivatives markets are easing with the premium Brent calls had over puts disappearing but the spread between the two nearest futures contracts continues to signal a tight market, as stated by Bloomberg.

- With geopolitical developments not currently driving energy prices, attention returns to fundamentals. US API inventory data is released later today. There has been sizeable crude stock builds in recent weeks while product inventories continue to decline.

- Later US preliminary April Global S&P PMIs, new home sales and Philly & Richmond Fed indices as well as European PMIs print. BoE’s Pill and Haskel speak.

GOLD: Biggest Decline In Almost Two Years

Gold is 1% lower in the Asia-Pacific session, after tumbling 2.7% to $2327.30 on Monday. This was the largest decline in almost two years.

- The yellow metal is now at its lowest level in a week, as geopolitical tensions in the Middle East ease.

- The move was not isolated to gold, with silver off by around 5% on the day, leaving it approximately 9% lower than the April high. As a result, the gold/silver ratio is back above the 200-dma, after dipping below earlier in the month.

- Bloomberg reports that bullion’s 16% YTD gain through last Friday could spur some reserve managers to consider slowing down their purchases should gold struggle to retain its mojo. The same mindset could affect Chinese savers who have been a notable source of demand.

- According to MNI’s technicals team, the trend condition in gold is unchanged and the outlook remains bullish, with sights on $2452.5, a Fibonacci projection, on the upside. Initial firm support is at $2310.2, the 20-day EMA.

ASIA FX: Spot USD/CNY Drift Higher Continues, Mixed USD/Asia Trends Elsewhere

USD/Asia pairs are mixed, albeit largely tracking recent ranges. Spot USD/CNY continues to firm, remaining close to the top end of the daily trading band. The WSJ is reporting that the US is drafting sanctions that could cut off some China banks from the global financial system in order to curb the country's commercial support for Russia's war with Ukraine. Elsewhere KRW and PHP are modestly firmer, while other pairs are close to flat. Tomorrow, we get South Korean consumer confidence, followed by the BI decision in Indonesia later on.

- Spot USD/CNY has firmed towards 7.2450, while USD/CNH is also a little higher, last near 7.2575. Local equities are weaker, underperforming the broader trend of positive gains seen in the region. The CSI 300 is back near 3500. The WSJ article may be weighing on sentiment at the margins and comes ahead of US Secretary of State Blinken's trip to Beijing.

- 1 month USD/KRW has tracked recent ranges, the pair last near 1376, slightly below NY closing levels from Monday. Equity sentiment has been flat today, modestly unperforming the better tech led trend see elsewhere.

- Spot USD/HKD is back close to April highs. the pair last near 7.8365. Earlier April highs were just under 7.8390 (back on the 11th). This month has seen dips in the pair back under the 20-day EMA as buying opportunities. This support point is trending higher and last around 7.8310. Interestingly, there hasn't been much yield sponsorship on this recent rebound in spot USD/HKD. The US-HK 3 month rate differential sits off recent highs, last near +86bps. The divergence between the two series is modest, but most of the time we see both series moving in the same direction. On the data front, we have the March CPI out later. The market expects 2.1% y/y, unchanged from Feb. On Thursday we get March trade figures.

- USD/IDR spot appears to be consolidating near recent highs the pair last near 16240, little changed for Tuesday so far. The 1 month NDF is near 16260, comfortably off recent highs, but also not showing signs of dramatic mean reversion. Note for this pair the 20-day EMA continues to trend higher and was last near 16071.5. Recent highs were marked at 16366. Near term focus rests with tomorrow's BI outcome. No change is expected by the consensus although several sell-side forecasters are expecting a 25bps hike to curb rupiah depreciation pressures.

- Elsewhere, USD/INR sits slightly lower, last near 83.35. PMI prints for April (preliminary) were unchanged for manufacturing (59.1) and slightly higher for services (61.7). They continue to paint a growth outperformance picture from India.

- Singapore CPI for March was weaker than expected, falling 0.1% m/m. This dragged the headline down to 2.7% from 3.4% prior and 3.1% forecast. USD/SGD sits a touch higher, last near 1.3625.

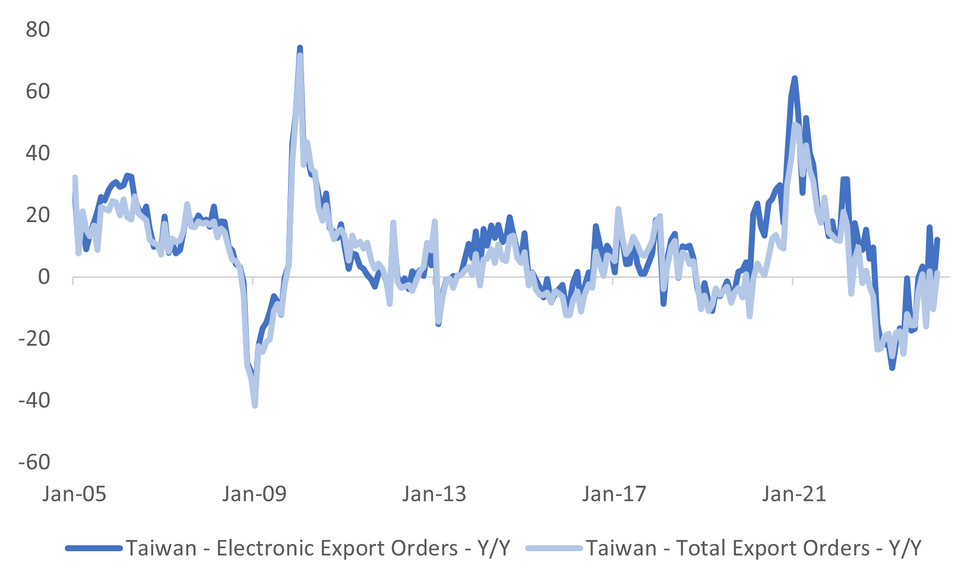

TAIWAN DATA: Export Orders Rise, Led By Tech, But Outlook Less Certain

Taiwan export orders out late yesterday, rose to +1.20% y/y, up from Feb's -10.4% reading. This was still below consensus expectations of +4.0% y/y though. This maintains somewhat of a see-saw pattern for export orders, albeit on a modestly improving trend. Y/Y growth may struggle somewhat as we progress through Q2/Q3, as export order levels peaked in Oct last year.

- Still, the detail showed positive y/y gains in March for the two biggest sub-indices, with electronics up 12%, while telecommunications rose 4.27%. Both these categories were up versus Feb outcomes. Together they represent around 63% of Taiwan's total export order base. The chart below overlays electronic export orders versus total export orders for Taiwan.

- Other segments were less positive though, still generally in negative y/y terms. By country, we saw improving y/y momentum for the US, albeit still in negative territory (-2.17%), while to China & HK we rose to 7.67% y/y (from -5.46% prior).

- Overall, an improved export trend is consistent with better reads from other strongly export orientated economies in the region like South Korea.

- Still, some uncertainty remains over the outlook. Global semiconductor sales eased in the first few months of this year. While in the US the Empire survey of 6 month ahead tech spending intentions is close to 2023 lows. There will also be focus on key earnings updates from US tech companies over the coming period.

Fig 1: Taiwan Export Trend Volatile But Improving

Source: MNI - Market News/Bloomberg

Philippines: PHILIP Sovs Curve Flattens, Budget Balance Tomorrow

- The PHILIP curve is slightly flatter today, yields are 1-3bps lower, the 2Y yield is unchanged at 5.175%, 5Y yield is 2bps lower at 5.31%, 10Y yield is 3bps lower 5.45%, while 5yr CDS is down 1bp at 66.5bps.

- The Philip to US Treasury spread difference is a touch wider in the front-end with the 2y is 20bps (+4bps), the 5yr is 69.5bps (+0.5bp), while the 10yr is 84bps (+1bp).

- Cross-asset moves: The USD/PHP is down 0.11% at 57.48, the PHP trades just off mulit-year lows, PSEi Index is up 0.96%, while US Tsys yields are unchanged

- Looking Ahead, Budget Balance on Wednesday

INDONESIA: MNI BI Preview - April 2024: Decision Focus On FX Stability

- Bank Indonesia’s (BI) April 24 meeting is going to be all about FX stability and how they address that remains a significant unknown. 11 of the 39 analysts on Bloomberg are forecasting a 25bp rate hike, which BI did in October to support the rupiah.

- We expect it to be on hold in April as unlike October the next Fed move is expected to be a cut, the rupiah has weakened this year despite October's hike and BI has stated it sees an opportunity to ease in H2 this year. While we don't expect material changes to most of the statement, BI is likely to voice its concern regarding recent IDR weakness and reiterate that it will use its other tools to stabilise the currency.

- USDIDR has weakened 3.6% since the 20 March BI meeting and reached its highest level this week in around 4 years, the height of pandemic uncertainty. In addition, it has lost value versus its main trading partners with the JP Morgan NEER falling 1.8%.

- See full preview here.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/04/2024 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 23/04/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/04/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/04/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/04/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/04/2024 | 0800/0900 |  | UK | BOE's Haskel Panelist at Econometric Seminar | |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/04/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/04/2024 | 1115/1215 |  | UK | BOE's Pill Speech at University of Chicago | |

| 23/04/2024 | 1230/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 23/04/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 23/04/2024 | 1345/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 23/04/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 23/04/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 23/04/2024 | 1400/1000 | ** |  | US | Richmond Fed Survey |

| 23/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/04/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 2 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.