-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Wednesday, December 11

MNI EUROPEAN MARKETS ANALYSIS: JGB Futures Spike On Weaker Tokyo CPI, US PCE Later

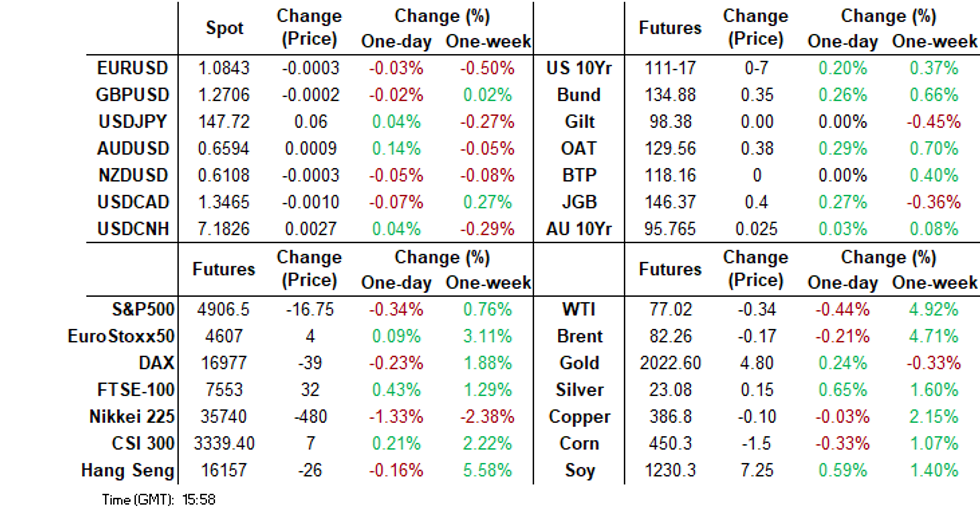

- The main macro move in Friday Asia Pac trade has been weaker equity sentiment in the tech space. Nasdaq futures sit lower, with weaker Intel results weighing. This has weighed on regional tech plays, albeit to varying degrees. There hasn't been much spill over to other asset classes though. The USD is relatively steady against the majors, while US yields are down modestly.

- Elsewhere, JGB futures remain sharply higher in Tokyo afternoon session, +37 compared to settlement levels, but are off the session high set during early dealings following the release of lower-than-expected Tokyo CPI.

- Oil has trimmed its weekly advance, but only modestly. Headlines crossed earlier that China is pressing Iran to curb Houthi attacks on Red Sea shipping (RTRS).

- Looking ahead, the main focus will be in the US session, with the PCE Core Deflator and personal spending data on tap.

MARKETS

US TSYS: Rally Extends After Q4 GDP’s Goldilocks-Style Print

TYH4 is trading at 111-17+, +0-07+ from NY closing levels.

- Cash bonds are dealing 1-3bps richer in today’s Asia-Pac session. News flow has been light, with local participants extending yesterday's rally sparked by a Goldilocks-style print for Q4 GDP.

- Early next week, we have the next quarterly refunding announcement (QRA) from the Treasury, which will set out its plans for debt issuance over the next three months. The question of how much debt the US government needs to issue, and the strength of demand for that debt, has become increasingly important in the last year, and these QRAs have taken on extra significance.

- Later today the US calendar shows Personal Income & Spending, PCE Deflator for December, Pending Home Sales and Dallas Fed Manf. Activity data.

- The FOMC’s policy decision is due to be handed down next Wednesday.

STIR: $-Bloc Easing Expectations Little Changed Over The Past Two Weeks

STIR markets within the $-bloc remain poised for a significant easing cycle in 2024 ahead of next Tuesday’s FOMC meeting.

- There has been little change in pricing over the past two weeks, with December 2024 expectations and the cumulative easing across the $-bloc stand at: 3.88%, -145bps (FOMC); 3.98%, -103bps (BOC); 3.94%, -40bps (RBA); and 4.60%, -92bps (RBNZ).

Figure 1: $-Bloc STIR

Source: MNI – Market News / Bloomberg

JGBS: Futures Sharply Richer, US Monthly PCE Deflator Due Later Today

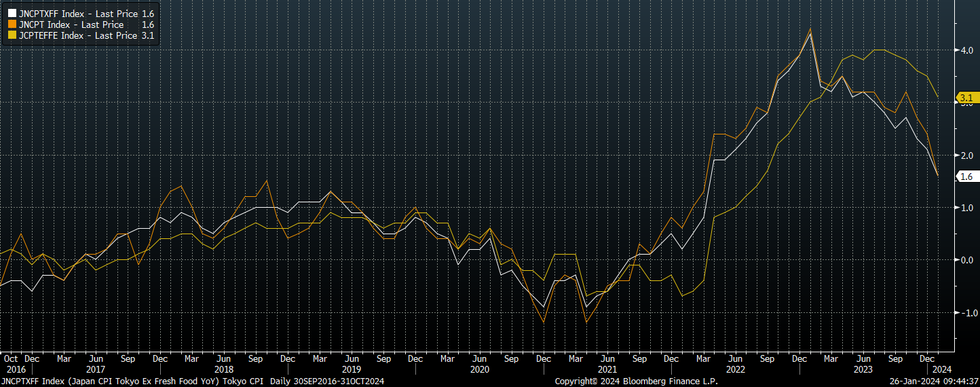

JGB futures remain sharply higher in Tokyo afternoon session, +37 compared to settlement levels, but are off the session high set during early dealings following the release of lower-than-expected Tokyo CPI. As previously outlined, Tokyo CPI printed weaker across the board relative to expectations in January.

- The other noteworthy news flow was the release of the BoJ Minutes from the December meeting. In short, BoJ board members had a big debate on the timing of liftoff and the pace of subsequent rate hikes. That said, not everyone was convinced of the need to move at all quickly, with some members saying that it was likely that the BoJ was likely to keep substantial easing for the time being.

- Coincident & Leading Indices data is due later today.

- (Bloomberg Economics) The surprisingly sharp slowdown in Tokyo’s inflation in January will give the Bank of Japan pause. (See link)

- Elsewhere, cash US tsys are dealing 1-2bps richer in today’s Asia-Pac session, as local participants digest yesterday’s Goldilocks Q4 GDP print. Later today sees the PCE Deflator for December.

- Cash JGBs are richer, with the futures-linked 7-year leading (3.6bps lower).

- Swaps curve has bull flattened, with rates 1-3bps lower.

- The local calendar is empty on Monday apart from BoJ Rinban Operations covering 3-10-year and 25-year+ JGBS.

JAPAN DATA: Tokyo CPI Delivers Downside Surprise, Core Slowed In M/M Terms

The Tokyo Jan CPI print was weaker across the board relative to expectations. The headline was 1.6% y/y (versus 2.0% forecast and 2.4% prior). Ex fresh food was 1.6%y/y (versus 1.9% forecast and 2.1% prior). Ex fresh food and energy printed at 3.1% y/y, (versus 3.4% forecast and 3.5% prior).

- Sequential y/y momentum continues to moderate, see the chart below, albeit at a quicker pace than what the market had anticipated in terms of the Jan print.

- It's important to note Jan 2023 marked the peak in y/y momentum for the headline CPI measures, so base effects will be less favorable going forward.

- In terms of the detail, headline and the core measures were down 0.1% m/m (seasonally adjusted). The index that excludes all food and energy fell sharply down 0.4% m/m (although this is not seasonally adjusted).

- Outside of food rises, +0.5%m/m, the result would have been weaker. Household goods (-0.3%m/m), clothing (-1.8% m/m), transport (-0.3% m/m) and entertainment (-1.9% m/m) were all drags.

- In y/y terms, we saw slower y/y momentum in 9 out of the 11 sub categories. Utilities at -18.4% y/y remains the biggest drag.

Fig 1: Tokyo CPI Y/Y Momentum Eases Further In January

NZGBS: Drifted Richer With US Tsys, Aussie Market Closed

NZGBs closed 4-5bps richer, with the 2/10 curve flatter. With the domestic calendar empty and the Australian market closed for Australia Day, the local market has drifted richer with US tsys during today’s Asia-Pac session.

- US tsy yields are dealing 1-2bps richer, with a slight flattening bias present ahead of Friday’s US data drop of Personal Income & Spending, PCE Deflator, Pending Home Sales and Dallas Fed Manf. Activity data. The monthly PCE Deflator for December is the standout ahead of Next week’s FOMC policy meeting.

- ICYMI, RBNZ Chief Economist Conway will deliver a keynote speech on 30 January. The speech will focus on the significant changes to the global economy since the COVID-19 pandemic. He will also make brief comments on domestic data developments since the November Monetary Policy Statement.

- Bloomberg reported that ANZ sees slack emerging across the NZ economy, which will take the wind out of domestic inflation. They see CPI inflation slowing to 2.5% in Q3 from 4.7% in Q4 2023. (See link)

- Swap rates are 5-6bps lower.

- RBNZ dated OIS pricing is flat to 4bps softer across meetings, with August-November leading.

- Next week, the local calendar sees Trade Balance data on Monday, ANZ Business Confidence on Wednesday, CoreLogic House Prices on Thursday and ANZ Consumer Confidence and Building Permits on Friday.

EQUITIES: Weaker Tech Weighs On Sentiment, But Chian/HK Markets Still Up For The Week

Weaker US equity futures, particularly in the tech space, has weighed on Asia Pac sentiment today. Nasdaq futures sit close to session lows, last off around 0.70%, while Eminis are down around -0.30%. Disappointing revenue forecasts from tech names Intel and KLA weighed on sentiment late in US trade.

- The Topix is off around 1.1%, the Nikkei 225 slightly more in Japan. The electric appliances sector the weakest performer. Toyota was also down, while month end rebalancing was a factor also cited in contributing to weakness (BBG).

- Weakness hasn't been uniform though. In Taiwan the Taiex is around flat, while in South Korea the Kospi has climbed nearly 1%. An IPO launch for a shipbuilder has helped the aggregate index.

- Hong Kong and China mainland shares sit lower at the break. The HSI is off by around 1%, with the tech sub index off by ~2.7%. Both indices are higher for the week though, following early China stimulus efforts/rescue headlines.

- China's CSI 300 is down 0.68% at the break, but like the Hong Kong indices is still up for the week. The real estate sub index is also rallying further, up 2.4%. The authorities pledged stable credit to the sector yesterday. While gaming stocks are also higher on fresh approvals made in January (see this BBG link for more details).

- Australia and India markets are closed today for public holidays.

- In SEA, Indonesian markets are down around 0.75% at this stage. The index is back mid Dec levels, with some carry over from political uncertainty yesterday a potential headwind.

FOREX: G10/Dollar Trends Steady, US PCE In Focus Later

G10 FX trends have been relatively muted in Friday trade to date. The BBDXY sits marginally lower versus end Thursday levels in NY, last near 1237.2.

- Cross asset sentiment has been softer in the equity space, led by tech plays (Nasdaq futures off around 0.7% on late earnings disappointment, led by Intel). This hasn't impacted sentiment a great deal in the FX space though.

- Likewise, a modestly softer US yield backdrop (nearly -2bps lower for some benchmarks). US Treasury Secretary Yellen said on Thursday (US time) that surprisingly strong economic growth in the fourth quarter was a "good thing" that signals continued healthy consumer spending without increases in inflationary pressures.

- USD/JPY has seen a low of 147.48, against a high of 147.85 (we currently track at 147.70/75). the Tokyo Jan CPI print was much weaker than expected. Lower entertainment prices (weighed by the Jan earthquake) a factor.

- Still, the data suggests no rush for the BoJ to move away from easy policy settings. The BoJ Dec minutes also came out. In short, BoJ board members had a big debate on the timing of liftoff and the pace of subsequent rate hikes. That said, not everyone was convinced of the need to move at all quickly, with some members saying that it wasn’t too late to make a decision post-spring wages and others stating that it was likely that the BoJ was likely to keep substantial easing for the time being.

- AUD/USD has drifted a little higher but remains sub 0.6600, with local markets closed today for a public holiday. NZD/USD has traded tight ranges, the pair last in the 0.6105/10 region.

- Looking ahead, the main focus will be in the US session, with the PCE Core Deflator and personal spending data on tap.

OIL: China's Reported Efforts To Stem Houthi Attacks Help Trim Oil's Weekly Advance

In the first part of Friday trade front end benchmarks for oil are tracking moderately softer. Brent is just under $82.10/bbl, off around 0.40%/ WTI is under $77/bbl, off by around 0.6% at this stage. This is reversing part of Thursday's ~3% gains for the benchmarks. We are comfortably higher for the week though, with WTI up ~4.75%, Brent +4.5%.

- A Reuters piece crossed in earlier trade, with reports that the China authorities have asked Iran to curb Houthi attacks on Red Sea, with the news wire reporting that if China's interests are harmed it could impact commercial relations with Iran.

- This has likely weighed on sentiment at the margins. Equity risk off, albeit in the tech space, has likely been another headwind.

- Still, broader concerns around supply through the Red Sea, coupled with Ukrainian drone strikes on Russia energy infrastructure, have added geopolitical risk premiums to prices in recent sessions. Lower US stocks has been another support point.

- In terms of upside targets, $84.22 (Nov 30 high) is in focus for Brent, while for WTI, $77.48 (Fibo retrace of Sep 19 – Dec 13 bear leg) after which lies $79.56 (Nov 30 high) are areas to watch.

GOLD: Supported By A Goldilocks-Style GDP Print

Gold is slightly higher in the Asia-Pac session, after closing +0.3% higher at $2020.84 on Thursday.

- The precious metal was supported by lower US Treasury yields on Thursday after a Goldilocks-style print for Q4 GDP. Q4 GDP printed 3.3% annualised growth, well above the consensus of 2.0%, but the Core PCE Price Index showed 2.0%, in line with consensus and prior.

- Despite Thursday’s gain, bullion looks set for its second weekly decline ahead of Friday’s US data drop: Personal Income & Spending, PCE Deflator, Pending Home Sales and Dallas Fed Manf. Activity data. The monthly PCE Deflator for December is the standout ahead of next week’s FOMC policy meeting.

- According to MNI’s technicals team, the bear threat remains present, with support at $2001.9 (Jan 17 low).

SINGAPORE MNI MAS Preview - Jan 2024: No Change Amidst Resilient Inflation/Growth Backdrop

- For the January MAS policy meeting the consensus looks for no change, which also fits with our firm bias. Developments since the last policy meeting in October don’t warrant a shift in MAS’s policy stance. Core inflation pressures have based somewhat, while offshore developments (supply chains etc) are likely to leave the MAS's cautious around the broader price backdrop.

- Reasonable growth momentum into end 2023 also doesn't suggest a need for an imminent policy change/bias in a dovish direction either.

- The general sell-side view point is for easier MAS policy settings eventually, but like elsewhere in the region, at the start of 2024 is likely too early for such a shift.

- Full preview here:

ASIA FX: IDR Worst Performer The Past Week, TWD Outperforms

Asian FX is mostly higher, although gains are fairly limited at this stage. USD/CNH has edged a little higher, to be the exception, but is tracking recent ranges. USD/IDR tried to go higher in earlier trade but there was no follow through. The rupiah is the worst performer week to date in the EM Asia FX space, TWD the best. THB and PHP are higher, aided by better than expected trade balance figures. Tomorrow, China industrial profits data prints. Then on Monday we have the Singapore MAS decision, no change is expected.

- USD/CNH has held above 7.1800 for much of the session, holding close to late NY levels form Thursday trade, although we haven't tested close to the 7.1900 level. Onshore and HK equities are weaker, but still up for the week and are paring losses in the afternoon session. Liquidity is easier in the CNH space, the 1 month implied yield back to +2.7%, versus recent highs around 3.7%. US and China officials (including the China Foreign Minister) will also meet in Thailand.

- 1 month USD/KRW sits a little lower, last near 1333, but hasn't been able to test sub 1330 so far today. Onshore equities are outperforming the weaker led tech trend seen elsewhere in the region. The Kospi was last +0.70%, away from best levels though.

- Spot USD/TWD is trying to test lower, but lows around 31.25 remain intact so far. Local equities are around flat for the session, with weaker Intel results from late in the US session weighing on broader sentiment in the tech space. Still, we have seen nearly $2.9bn in offshore inflows so far this week. TWD has been the best EM Asia FX currency over the past week.

- USD/IDR opened above 15840, but sits back under 15820 in recent dealings. The 1 month NDF is 15830, also off earlier highs. Thursday highs were close to 15900, with the market likely to be mindful of BI intervention and any further domestic news re potential political resignations. Onshore equities are down around 0.90% at this stage.

- Spot USD/PHP is lower, back under 56.35, around 0.35% stronger in PHP terms. Dec trade figures for the Philippines showed a slightly better than expected trade deficit (-$4bn, versus -$4.5bn forecast), largely thanks to slowly import growth. Yesterday's highs in the pair (56.56), were the firmest levels since early Nov last year.

- Spot USD/THB has ticked down from recent highs, last close to 35.65, around 0.20% firmer in baht terms. Dec customs trade showed a surprise trade surplus of nearly $1bn (-$1430mn expected), but this owed to a sharp fall in imports, -3.1%y/y (+7.4% forecast), which indicate softer domestic demand. Comments from late yesterday suggested the BoT bias may be shifting towards a more easier stance.

- USD/SGD has drifted lower, but remains within recent ranges. We were last near 1.3400. While the NEER has also been steady. Monday delivers the MAS policy meeting, with a steady outcome expected.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 26/01/2024 | 0001/0001 | ** |  | UK | Gfk Monthly Consumer Confidence |

| 26/01/2024 | 0700/0800 | * |  | DE | GFK Consumer Climate |

| 26/01/2024 | 0700/0800 | ** |  | SE | Unemployment |

| 26/01/2024 | 0745/0845 | ** |  | FR | Consumer Sentiment |

| 26/01/2024 | 0900/1000 | ** |  | EU | M3 |

| 26/01/2024 | 1330/0830 | ** |  | US | Personal Income and Consumption |

| 26/01/2024 | 1500/1000 | ** |  | US | NAR Pending Home Sales |

| 26/01/2024 | 1600/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) | |

| 26/01/2024 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.