-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JPY Bid & JGBs Offered On BoJ Speculation

- JGBs were immune to the wider bid that has developed in core global FI markets since the start of Wednesday’s session, with domestic matters dominating the wider impulse. The latest Yomiuri source report suggested that the Bank will review the side-effects of its ultra-loose policy settings at next week's monetary policy meeting due to continued skew in market interest rates even after the surprise tweak to YCC in December.

- USD indices remain on the backfoot ahead of the US CPI print due later. The BBDXY index has tested sub 1235, fresh lows since the first half of June 2022, before finding some support. The DXY is near the 103.00 level. JPY gains have been the major driver of dollar underperformance, although AUD is also seeing some outperformance.

- U.S. CPI dominates the macro docket on Thursday, and will be supplemented by speakers from the Fed & BoE.

MNI US CPI Preview: Core Services Ex Shelter Keenly Watched

EXECUTIVE SUMMARY

- Core CPI inflation is seen nudging up to 0.3% M/M in December after surprising lower with 0.20% in November when the three main areas of core - shelter, services ex shelter and goods - all moderated.

- OER and tenants’ rents could see a modest dip but barring no surprises there, attention is likely most firmly on core services excluding shelter with its continued FOMC focus, and then any further goods deflation.

- Market expectations have tilted closer to another stepdown to a 25bp hike on Feb 1 (31bp priced) on softer than expected AHE growth within payrolls and a significant miss for ISM services as new orders slumped.

- We see high sensitivity to surprises in either direction, especially if in stickier, less idiosyncratic categories.

- The historically low u/e rate gives hawks something to build upon if an upside surprise, but might need to be followed by strong composition-adjusted wage growth in measures released later this month to lock in another 50bp hike, whilst a downside surprise could further cement a 25bp hike with a resulting relief rally.

- PLEASE FIND THE FULL REPORT HERE:USCPIPrevJan2023.pdf

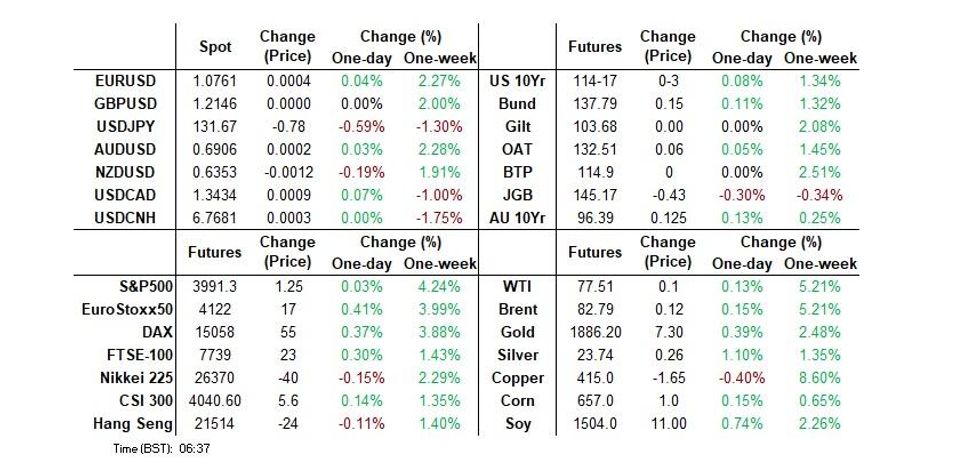

US TSYS: Richer, CPI In View

TYH3 deals at 114-18, +0-04, 0-04 off the top of its 0-11 range, on volume of ~97K.

- Cash Tsys have bull flattened, dealing 0.5-2.5bp firmer across the major benchmarks.

- Tsys were pressured in early Asia-Pac trade as speculation in the Japanese press re: a review of the side effects of the Bank's ultra-loose policy settings being conducted at next week's monetary policy meeting weighed.

- ACGBs then led a bid, allowing Tsys to turn richer on the day. There was no clear headline catalyst for the richening, with some pointing to softer than expected Chinese PPI data, but the nature of the move didn't back that idea up, in our view.

- TY dealt through Wednesday's high on the move.

- Tsys have ticked away from best levels as we approach the European session, as JGBs came under fresh pressure into the Tokyo close.

- The flow side was highlighted by a block buyer in UXY (908 lots).

- Dec's CPI print headlines the macro docket today (MNI’s preview is here), we also have weekly jobless claims as data as well as Dec real avg earnings. There is Fedspeak from Philadelphia Fed President Harker, St Louis Fed President Bullard and Richmond Fed President Barkin. On the supply side we have the latest 30-Year auction.

JGBS: BoJ Source Reports Weigh, More Than Negating Core Global FI Bid

JGBs were immune to the wider bid that has developed in core global FI markets since the start of Wednesday’s session, with domestic matters dominating the wider impulse.

- The latest Yomiuri source report suggested that the Bank will review the side-effects of its ultra-loose policy settings at next week's monetary policy meeting due to continued skew in market interest rates even after the surprise tweak to YCC in December.

- This continued to fan the flames re: the potential for another BoJ policy tweak, with Bank communication now changed and markets on alert for a wider review of the BoJ’s inflation targeting process in the coming months as BoJ Governor Kuroda’s term comes to an end.

- Futures managed to pull away from early Tokyo lows during the morning, as bears ran out of steam, before a drift lower restarted, leaving the contract just above late session lows into the bell -53, threatening a clean break of key technical support in the form of the mid-June cycle low.

- The early super-long end resilience quickly gave way in the afternoon, with the major benchmarks running flat to 7bp cheaper. The only flat point is 10s, which are capped by the upper boundary of the BoJ’s YCC parameters.

- Payside flows in 7+-Year swaps aided the cheapening.

- Note that the BoJ upped the size of 5- to 10-Year Rinban purchases to the maximum size permitted under its quarterly purchase plan (which met decent selling demand from the market).

- 5-Year JGB supply headlines Friday’s domestic calendar.

AUSSIE BONDS: Notably Firmer, With A Lack Of Meaningful Headline Observed

ACGBs firmed in Sydney dealing, adding to the bid derived from Tsys & EGBs on Wednesday.

- The initial bid came via a bull flattening motion, before the front end played catch up, leaving the major cash ACGB benchmarks 12-13bp richer across the curve, while YM was +13.0 & XM was +12.5 at the close.

- Note that 10-Year ACGBs have now reversed the notable cheapening witnessed since the start of trade on 20 Dec.

- There wasn’t a particular headline catalyst that promoted the two-step move seen in the Sydney session. Asofter than expected round of PPI data out of China was identified by some, but we aren’t necessarily in line with that train of thought, given the nature/timing of the two notable legs observed.

- The market appeared a little skittish ahead of the U.S. CPI release that will cross in NY hours.

- Bills were 5-14bp richer through the reds, bull flattening.

- Local news flow was limited, with a wider than expected monthly trade surplus flattering less than inspiring internals.

- Meanwhile, RBA dated OIS continues to price 20bp of tightening for the Feb ’23 meeting, while terminal cash rate pricing came in to just above 3.75%, in sympathy with moves in ECB pricing on Wednesday and the general bid core global FI (excluding JGBs).

- Looking ahead, housing finance data headlines the domestic docket on Friday, although adjustments to U.S. CPI will dominate any impulse from that data.

NZGBS: Firmer On Global Impetus

The benchmark NZGBs were 13bp richer across the curve come the close of Thursday’s session in what was a parallel shift, shifting firmer in lieu of Wednesday’s move in core global FI markets, before an ACGB-led bid provided fresh legs to the move as the day wore on.

- Swap rates were 10-13bp lower across the curve, moving in sympathy with NZGBs, leaving swap spreads a little wider to unchanged on the day, while the swap curve flattened.

- The major near-term RBNZ dated OIS pricing points were little changed to a touch softer, showing 65bp of tightening for the Feb ’23 meeting, alongside a terminal OCR of just below 5.50%.

- Local headline flow was particularly limited, with a continued pullback in the BNZ/SEEK job advertisements metric probably providing the highlight.

- Looking ahead, the local docket is empty for the remainder of the week, with focus squarely on the U.S. CPI release that will cross in Thursday’s NY session.

FOREX: USD Lagging Ahead Of CPI Print

USD indices remain on the backfoot ahead of the US CPI print due later. The BBDXY index has tested sub 1235, fresh lows since the first half of June 2022, before finding some support. The DXY is near the 103.00 level. JPY gains have been the major driver of dollar underperformance, although AUD is also seeing some outperformance.

- Cross-asset signals are fairly muted, with US equity futures slightly higher (+0.10%), while regional equities mixed. Commodities are mostly holding recent gains. US cash Tsy yields are down, again led at the back end (30y off -2.8bps, 10yr -1.5bps).

- These moves have likely helped yen, although fresh speculation ahead of next week's BoJ meeting is a bigger driver. Early headlines that the central bank would review the side effects of massive monetary policy stimulus aided yen. We currently sit just above lows for the pair, last around 131.45/50 (low was 131.37).

- AUD/USD is holding close to 0.6920, close to recent highs. The Nov trade figures were slightly better than expected from a surplus standpoint. The currency has largely shrugged off waning yield spreads, the 2yr AU-US back out to -106bps.

- NZD/USD is still lagging somewhat, last around 0.6375.

FX OPTIONS: Expiries for Jan12 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0650(E1.2bln), $1.0670-90(E3.9bln), $1.0750(E2.4bln), $1.0770-75(E1.5bln)

- USD/JPY: Y140.00($1.3bln)

- AUD/USD: $0.6825($511mln)

- USD/CAD: C$1.2900($1.8bln), C$1.3650($1.4bln), C$1.4000($1.3bln)

ASIA FX: IDR & PHP Fortunes Diverge

USD/Asia pairs are mixed, with much of the focus on South East Asia FX today. IDR has continued to recover, up more than 1.2% for the session. USD/PHP has rebounded though. USD/CNH made fresh lows before recovering. Still to come is Indian inflation data, while tomorrow the focus is on the BoK decision (+25bps expected) and China trade figures.

- USD/CNH hit a fresh low of 6.7545, but rebounded and spent much of the rest of the session between 6.76/6.77. Onshore spot is still weaker though, currently tracking at 6.7550. Inflation data hinted the worst of the downtrend in price momentum is now behind us. The CNY fixing was close to neutral.

- USD/KRW has tracked familiar ranges, lasty near 1245, unable to sustain early momentum sub 1240. The authorities will expand onshore FX trading form the second half of next year, with measures to be unveiled in February. This remains part of the Korean authorities attempts to gain inclusion into global bond indices.

- USD/SGD is dealing just off an 18th month low as the pair dealt at its lowest level since June 2021 on Monday, before moderating gains. We last sat just above 1.3300. The pair is consolidating ahead of tonight's US CPI print. The bearish technical trend continues to hold, after a brief test of the 20-day EMA early in the week. Much may depend on broader USD sentiment in terms of future USD/SGD direction, as the NEER hasn't made fresh highs (based off the Goldman Sachs index) since early November.

- IDR has continued to play catch up today. USD/IDR spot is down a further 1.2%, comfortably outperforming the rest of the USD/Asia bloc. This puts us back under 15300, which is fresh multi-month lows. It also puts us below the 100-day EMA (15413) for the first time since August last year. Reports from yesterday that the authorities will require more export earnings to be kept onshore continues to aid the rupiah. The scheme will be expanded from the mining/agricultural sector to include manufacturing. The term may also be expanded from 3 months to up to a year.

- USD/PHP has rebounded, the pair back above 55.00, last near 55.25. Note the 200-day MA comes in at 55.35. Chatter from officials around stepping down the pace of tightening and when the easing cycle might commence have likely weighed. BSP Governor Medalla also stated FX pressures have reduced from a rate differential standpoint and that the market will determine spot levels.

CHINA DATA: Inflation Close To Expectations, Worst Of Softer Price Trends May Be Behind Us

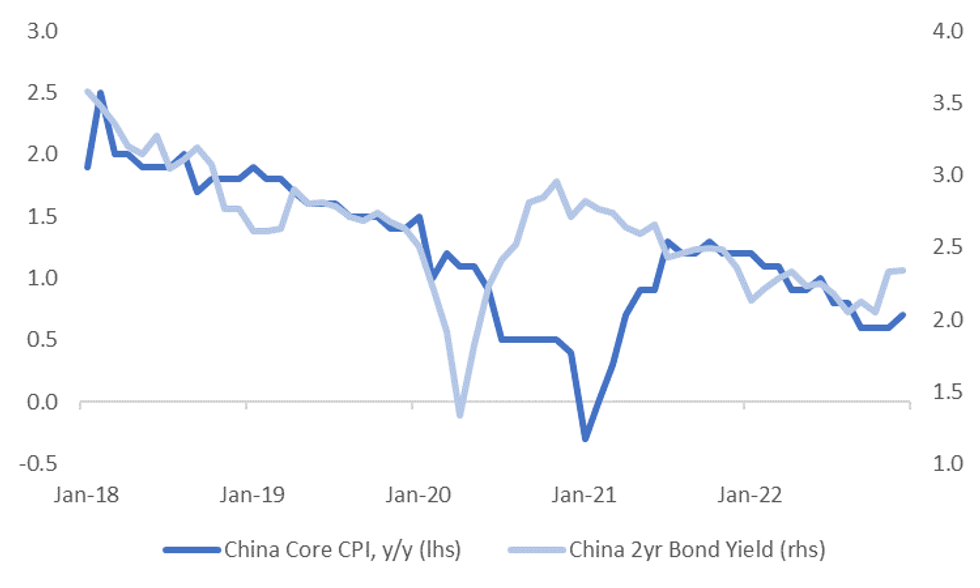

(MNI Australia) Headline inflation was at expectations, +1.8% y/y, with a flat outcome for the month (-0.2% m/m was recorded in Nov). Core inflation ticked higher to 0.7% y/y, from 0.6% prior for the past 3 months. The chart below overlays the 2yr government bond yield against core inflation.

- Food inflation pushed back to 4.8% y/y, from 3.7% prior. Interestingly of the 8 sub-components, only one (transport and communication), recorded a lower y/y pace. The rest either saw a step up in y/y momentum, or were unchanged from Nov. Non-food inflation was unchanged at 1.1% y/y though.

- The bias from some sell-side analysts is to pay China rates amid the recovery trend, although as we noted yesterday, some onshore analysts are still calling for easier monetary policy settings this year.

Fig 1: China Core Inflation & 2yr Government Bond Yield

Source: MNI - Market News/Bloomberg

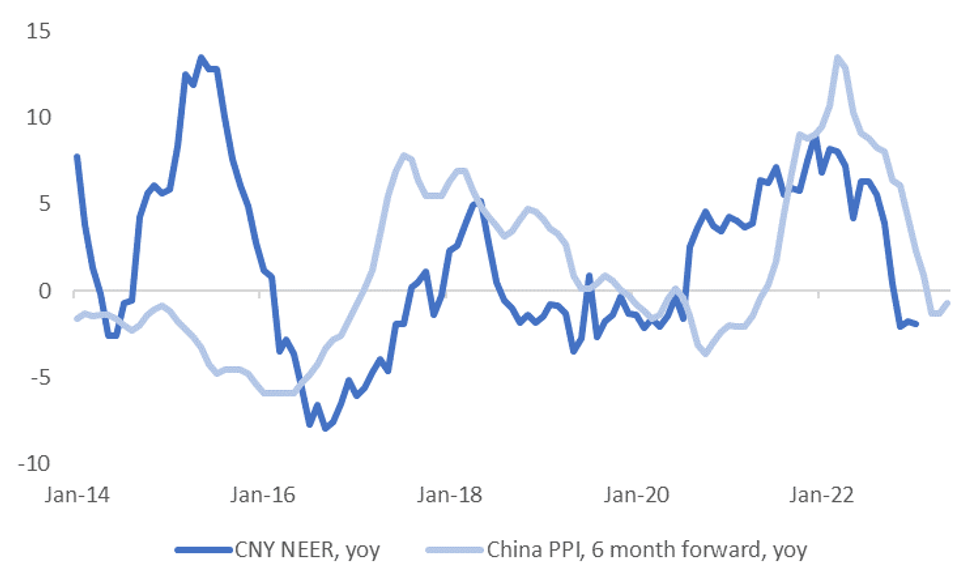

- In terms of the PPI, it was slightly weaker than expected, -0.7% y/y, versus -0.1% expected. Weakness remains in manufactured producer goods (-2.7% y/y), whilst most other segments showed improvement.

- The expectation is for a firmer upstream pulse as we progress further into 2023, aided by the shift away from CZS. This should be supportive of CNY in NEER terms (J.P. Morgan Index), see the second chart below. The NEER is already +2.8% up from late November lows.

Fig 2: China PPI & CNY NEER Y/Y (J.P. Morgan Index)

Source: MNI - Market News/Bloomberg

MNI BoK Preview - January 2023: 25bps Hike; Then Pause

EXECUTIVE SUMMARY

- Tomorrow the BoK is expected to deliver a 25bps hike, which would take the policy rate to 3.50%. This isn’t a uniform expectation with 5 out of 16 economists surveyed by Bloomberg forecasting no change, while the remainder are forecasting a 25bps hike. Our base case is for a 25bps hike and then a pause by the BoK.

- Tightening that has already taken place since 2021, along with signs of softer growth conditions across the domestic and external sectors, coupled with peaking headline inflation, are all factors arguing for a pause. Much stronger won FX levels compared to last early Q4 lows also argues, at the margins, for less aggressive monetary policy action.

- Sticky core inflation, which remains well above the target, is a powerful offset though and BoK's clear focus remains on bringing inflation back down. If the BoK hikes we expect the Governor will give hints of a pause to assess the impact of previous tightenings and success in bringing inflation back to target.

- See the full preview here:

BoK Preview - Janaury 2023.pdf

EQUITIES: Major Indices Consolidate, Resource Plays Outperform

Major indices have to a large extent consolidated today, ahead of key event risk in the US session with the CPI print. US futures are slightly higher, eminis last near 3995, but unable to crack the 4000 level.

- HK and China mainland stocks are down slightly. The HSI off 0.30%, with tech names underperforming in what looks like profit taking flows after the recent rally.

- The CSI 300 is off by less than -0.10%. Inflation data suggests we may be past the downtrend in price indicators.

- The Kospi is +0.50%, back to mid-Dec highs, with offshore investors continuing to add to local shares. The Taiex is down slightly at -0.20%, despite a TSMC profit beat.

- The ASX 200 is +1.20%, again buoyed by mining related stocks.

- The Philippines bourse is +1.2%, with the BSP Governor hinting of a RRR cut in the first half, which has aided financial names. JCI in Indonesia is also 1% higher, unwinding some of the recent underperformance trend. Higher commodity prices likely helping at the margin.

GOLD: Eyeing Higher Levels

Gold is tracking higher, last near $1884, for a +0.40% gain for the session. We remain below Wednesday session highs near $1887, but dips sub $1870 remain supported. Since the start of the year gold has only had 2 down sessions. Focus remains on upside targets, with $1896.5 (61.8% retrace of the Mar-Sep bear leg) potentially in play if we see a weaker than expected US CPI outcome later.

- Positioning may already be somewhat skewed for a softer outcome though given recent gold trends and USD indices sitting close to recent lows.

OIL: Largely Holding Wednesday's Impressive Gains

Brent crude is not too far away from Wednesday session highs, holding close to $83/bbl currently. We found early selling interest on the move above $83/bbl but oil has largely held onto impressive gains from yesterday's session. Having cleared the 20-day EMA of $81.59, the next upside target is $83.68 (50-day EMA). WTI is just near $77.50 currently.

- The sharp rise in oil inventories, reported in the US session, did little to dampen sentiment. The API data from Tuesday already hinted at the outcome, while weather related disruptions were also reportedly a factor, which may have limited the impact of release.

- Oil may also be playing some catch up to other commodities in terms of renewed optimism around the China demand outlook. Goldman's stated Brent could reach $110/bbl by Q3 if China fully moves away from Covid related restrictions.

- Focus shifts to the US CPI print due later.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 12/01/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 12/01/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 12/01/2023 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 12/01/2023 | 1330/0830 | *** |  | US | CPI |

| 12/01/2023 | 1345/0845 |  | US | Philadelphia Fed's Patrick Harker | |

| 12/01/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 12/01/2023 | 1630/1130 |  | US | St. Louis Fed's James Bullard | |

| 12/01/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 12/01/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 12/01/2023 | 1700/1200 | *** |  | US | USDA Crop Estimates - WASDE |

| 12/01/2023 | 1700/1200 | ** |  | US | USDA GrainStock - NASS |

| 12/01/2023 | 1700/1200 | *** |  | US | USDA Winter Wheat |

| 12/01/2023 | 1700/1700 |  | UK | BOE Mann Lecture at University of Manchester | |

| 12/01/2023 | 1740/1240 |  | US | Richmond Fed President Tom Barkin | |

| 12/01/2023 | 1800/1300 | *** |  | US | US Treasury Auction Result for 30 Year Bond |

| 12/01/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 12/01/2023 | 1900/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.