-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JPY Firms As Tokyo Eyes Regulatory Meeting On Banks

- A relatively sedate session for JGBs saw an uptick in activity in the last hour of trade on the back of wires running headlines covering a Nikkei piece which pointed to a trilateral (regular) meeting between the BoJ, MoF & FSA, which will in part cover the collapse of Silicon Valley Bank. Wires have suggested the meeting will take place at 16:45 Tokyo time (07:45 London), with chief financial diplomat Kanda set to brief the media afterwards. Finance Minister Suzuki continued to attempt to play down any local worry re: the headwinds for global banks, while affirming the need for vigilance and flagging ongoing communication with international regulatory bodies on those matters. JPY also strengthened on the headline flow from Nikkei.

- All major Asia-Pac equities indices are higher, with HK/China indices leading the way.

- In Europe today the final read of Eurozone CPI headlines an otherwise thin docket. Further out Industrial Production and UofMich consumer sentiment will cross. The aforementioned meeting of Japanese regulators will also draw attention, although it of course makes sense the relevant bodies to monitor and discuss such affairs.

US TSYS: Curve Flatter In Asia

TYM3 deals at 114-11, +0-05, a touch off the top of the 0-10+ range on volume of ~115k.

- Cash tsys sit 1bps cheaper to 2 bps richer across the major benchmarks. The curve has twist flattened pivoting on 3s.

- Tsys were marginally cheaper at the open as Asia-Pac participants digested yesterday's cheapening driven by the $30bn rescue package from First Republic and the associated Fed rate pricing adjustments in OIS markets.

- Losses extended as FOMC dated OIS saw the terminal rate tick higher and rate cut expectations for 2023 moderate.

- Tsys firmed off session lows as firmer regional equities boosted risk appetite and weighed on the USD.

- The bid marginally extended as news of a meeting of Japan's MOF, FSA and the BOJ which will in part cover the collapse of SVB.

- Fed dated OIS pricing now sees a terminal rate in May of ~5%, with ~75bps of cuts in 2023.

- In Europe today the final read of Eurozone CPI headlines an otherwise thin docket. Further out Industrial Production and UofMich consumer sentiment will cross.

US TSYS: MOVE-ing Back From Post-GFC Highs

Thursday saw the ICE-Bank of America MOVE index pull back from post-GFC highs, with the stabilising efforts surrounding Credit Suisse and First Republic Bank at the core of the move, after worry surrounding the banking sector, initially triggered by the meltdown of Silicon Valley Bank, allowed the index to surge higher over prior sessions. The index still remains relatively elevated when compared to some of the ‘worry’ indicators covering alternative major asset classes e.g. equities and FX.

Fig. 1: ICE-Bank of America MOVE Index

Source: MNI – Market News / Bloomberg

JGBS: Shunt Higher Into The Close On News Of Trilateral BoJ-MoF-FSA Meeting

A relatively sedate session for JGBs saw an uptick in activity in the last hour of trade on the back of wires running headlines covering a Nikkei piece which pointed to a trilateral (regular) meeting between the BoJ, MoF & FSA, which will in part cover the collapse of Silicon Valley Bank. Wires have suggested the meeting will take place at 16:45 Tokyo time (07:45 London), with chief financial diplomat Kanda set to brief the media afterwards. Finance Minister Suzuki continued to attempt to play down any local worry re: the headwinds for global banks, while affirming the need for vigilance and flagging ongoing communication with international regulatory bodies on those matters.

- Before then JGB futures had nudged away from their early Tokyo base alongside a similar move in U.S. Tsys, with Fed pricing in the STIR space front and centre.

- JGB futures shunted higher into the close, fully reversing overnight session losses (which came on the back of support efforts surrounding Credit Suisse & First Republic Bank, as well as the latest ECB decision) at one point, before closing -17. Cash JGBs are flat to 2.5bp richer as 10s outperform, printing at 0.29% into the close.

- Remarks from outgoing BoJ Governor re: the limits of NIRP not being reached failed to move the market.

- Swap rates are higher on the day, with that curve steepening, which limited the bid in JGBs until the last hour or so, at least to some degree, as swap spreads widened.

AUSSIE BONDS: Weaker But Off Cheaps As U.S. Tsys Twist Flatten

ACGBs close weaker (YM -17.0 & XM -6.0) but off session cheaps as U.S. Tsys twist flatten in Asia-Pac trade. Cash ACGBs bear flatten with the 3-year and 10-year benchmarks respectivcely 16bp and 6bp weaker.

- The AU-US 10-year yield differential is unchanged on the day at -16bp, but as flagged earlier, too low versus developments at the short-end over the past week.

- Swaps close with the 3s10s curve 10bp flatter and rates 3-13bp higher. EFPs close 3-4bp tighter.

- Bills cheapen 12-25bp with the strip flattening.

- RBA dated OIS firms 27-30bp for meetings beyond May in sympathy with global STIR and a 50bp hike from the ECB yesterday. Nonetheless, April meeting pricing remains around flat with 14bp of easing priced by year-end.

- The local calendar is light next week with RBA Kent's speech at the KangaNews Summit and RBA Minutes the highlights. While RBA Governor Lowe provided further colour the day after the March policy meeting, the market will surely be looking for reasons why it makes sense to price in an end to the tightening cycle in the face of stronger economic data this week.

- Banking headline watching is the game plan ahead of Eurozone CPI, U.S. Industrial Production and University of Michigan Sentiment data tonight.

AUSSIE BONDS: AU/US 10-year Differential Too Narrow Given OIS Moves

There are many variables at play in a cross-market 10-year yield differential but the key driver tends to be short-end spreads. Given that, simple regressions of long-end versus short-end differentials can often highlight relative value opportunities on a curve.

- A simple regression of the AU/US 10-year yield differential versus the AU-US 12-month forward OIS differential over the current tightening cycle reveals that the 10-year differential is currently around 20bp too negative (i.e. -16bp Vs. fair value +4bp) after being around fair value on 8 March.

Fig. 1: AU/US 10-Year Yield Differential (%)

Source: MNI – Market News / Bloomber

- The catalyst for this development has been a massive realignment in 12-month forward OIS in the U.S. versus Australia on the back of recent global banking concerns. While the 10-year yield differential has widened around 16bp over the past week or so, the AU/US short-end differential has widened around 50bp after a sharp 110bp decline in 12-month forward OIS in the U.S.

Fig. 2: 12M Fwd. OIS: AU & U.S. (%)

Source: MNI – Market News / Bloomberg

NZGBS: Weaker With Firmer Tightening Expectations

NZGBs close 4-8bp weaker but well off session cheaps as U.S. Tsys twist flatten in Asia-Pac trade. The 2/10 curve was 3bp flatter with the NZ/US 10-year yield differential -4bp. NZ/AU 10-year yield differential was -2bp at +96bp, just below the multi-decade high set after the worse-than-expected Q4 current account deficit print earlier in the week.

- Swaps are 4-15bp weaker, implying a wider short-end swap spread, with the 2s10s curve 10bp flatter.

- RBNZ dated OIS pricing firms 12-13bp across meetings in sympathy with global STIR and the ECB’s 50bp hike yesterday. April pricing shows 27bp of tightening with terminal OCR expectations at 5.32%.

- The local calendar is light until February's Trade Balance data on Tuesday. After this week’s current account deficit print and the resultant comments from S&P about bond rating pressure, the release will likely be closely watched.

- RBNZ Chief Economist Conway is slated to give a keynote speech: “The path back to low inflation in NZ” at a capital markets forum on 23 March.

- Until then, the market will remain on banking headline watch ahead of Eurozone CPI (Feb) today, especially after ECB President Lagarde watered down tightening guidance. In the U.S., Industrial Production and University of Michigan Sentiment are the slated data highlights.

FOREX: Greenback Pressured, Antipodeans Outperform

The USD is pressured in Asia, AUD and NZD are the best performers in the G-10 space at the margins. Regional Equities are firmer boosting risk appetite weighing on the USD, BBDXY is down ~0.3%. US Treasury Yields have ticked away from session highs and now sit marginally lower.

- AUD/USD prints at $0.6705/15, up ~0.8%. The pair has broken through the $0.67 handle on the improving risk appetite, the next upside target is the 20-Day EMA at $0.6723. Stronger metals, Iron Ore futures are up 0.8% and Copper which is up ~1.5%, are aiding the bid in AUD at the margins.

- Kiwi is ~0.7% firmer, NZD/USD last prints at $0.6235/45. The 20-Day EMA ($0.6211) was breached in early dealing and the pair extended gains through the session.

- USD/JPY is ~0.5% softer, the pair prints at ¥133.05/155. The move away from session highs in US Yields have aided the strength in JPY. The bid extended on headlines that the BOJ and Japanese Govt will meet on markets after SVB.

- Elsewhere NOK and SEK are both firmer, both up ~0.7%.

- Cross asset wise; 10-Year US Treasury Yields are ~2bps lower. The Hang Seng is up ~2%, S&P500 e-minis are lagging the bid in Asian equities up ~0.1%.

- In Europe today the final read of Eurozone CPI headlines an otherwise thin docket. Further out US Industrial Production and UofMich consumer sentiment will cross.

AUD/NZD: Resistance Seen At $1.08, Rate Differentials Widest Since 2015

AUD/NZD was firmer yesterday, rising ~0.4% in yesterday's trading after a softer than expected Q4 GDP print from New Zealand.

- $1.08 has now emerged as a key resistance level, since breaking below the handle earlier this month the cross has struggled to sustain a break of the handle.

- From a technical perspective bulls look to firstly break 20-Day EMA which sits a touch above $1.08 at $1.0812 from here they can target $1.0902 (200-Day EMA).

- Bears now target the 76.4% retracement of the Dec-Feb bull leg ($1.0617), a break through there opens 2022 lows at $1.0471.

- Rate differentials continue to widen, 2-Year Swap Rates now at -161bps the widest level since 2015. The widening in rate differentials is helping cap rallies in the cross.

Fig 1: AUD/NZD Spot

Source: MNI/Bloomberg

FX OPTIONS: Expiries for Mar17 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0500(E1.2bln), $1.0660-80(E1.7bln), $1.0690-10(E5.1bln), $1.0775(E1.4bln)

- USD/JPY: Y130.00($3.3bln), Y130.92-00($937mln), Y132.00($1.7bln), Y133.00-10($2.0bln), Y133.60-68($698mln), Y134.00-20($1.2bln), Y134.90-00($1.5bln)

- EUR/JPY: Y131.00(E1.0bln)

- AUD/USD: $0.6580(A$831mln), $0.6650(A$1.1bln), $0.6700(A$611mln)

- USD/CNY: Cny6.8500($1.5bln)

ASIA FX: Firmer, But Some SEA Currencies Outperforming NEA

USD/Asia pairs are lower across the board. The firmer equity backdrop, weaker USD, particularly against high beta AUD and NZD, have been clear supports. Relative to recent ranges we have seen some outperformance from currencies in SEA, such as PHP and THB. USD/CNH and USD/KRW remain above lows from earlier in the week. Looking ahead, Monday sees the China 1yr and 5yr LPRs, although no change is expected. Taiwan export orders are out, along with Malaysian trade figures as well.

- USD/CNH is down around 0.40% for the session so far, last near 6.8700, slightly up from session lows sub 6.8600. CNH bulls will target lows from earlier int he week near 6.8300. Onshore equities have rebounded, albeit are down from intra-day highs, while north bound stock connect flows are tracking for the best inflow day since end Jan.

- 1 month USD/KRW hasn't seen much downside. The pair last tracked near 1300, still above earlier lows from the week around the 1293/94 region. Onshore equities are higher, with the Kospi +0.65%, but offshore investors haven't been buyers today (-$64mn). South Korea and Japan relations are on the improve, with yesterday's meeting between the two leaders likely to bring down trade barriers.

- USD/SGD is eyeing fresh lows towards 1.3400 (last near 1.3420). Export figures for Feb were mixed, but still generally showing a softer backdrop for external demand. The SGD NEER (per Goldman Sach estimates) slumped as global tightening expectations unwound late last week/early this week, but has been steadily improving since then. We were last near -0.90% from the top end of the band (we were -1.3% at the start of the week).

- USD/PHP is back to fresh lows going back to mid Feb. The pair was last around 54.50. This puts us under the simple 50-day MA, which is around the 54.84 level. Dips below this support point have not been sustained over the past month. A sustained break sub this level will have the market targeting a move towards the 54.30/40 region. Incremental news flow has been positive for PHP today, with BSP Governor Medalla stating that Philippine Banks have no reported exposure to Credit Suisse.

- USD/THB is off by slightly more, last near 34.20, around 0.6% below closing levels from yesterday. Both currencies have been the best performers since the beginning of the week, although baht is +1.2% higher, more than double PHP gains (+0.60%). Less exposure to global banking turmoil and a likely slowing in global tightening are benefits for both currencies.

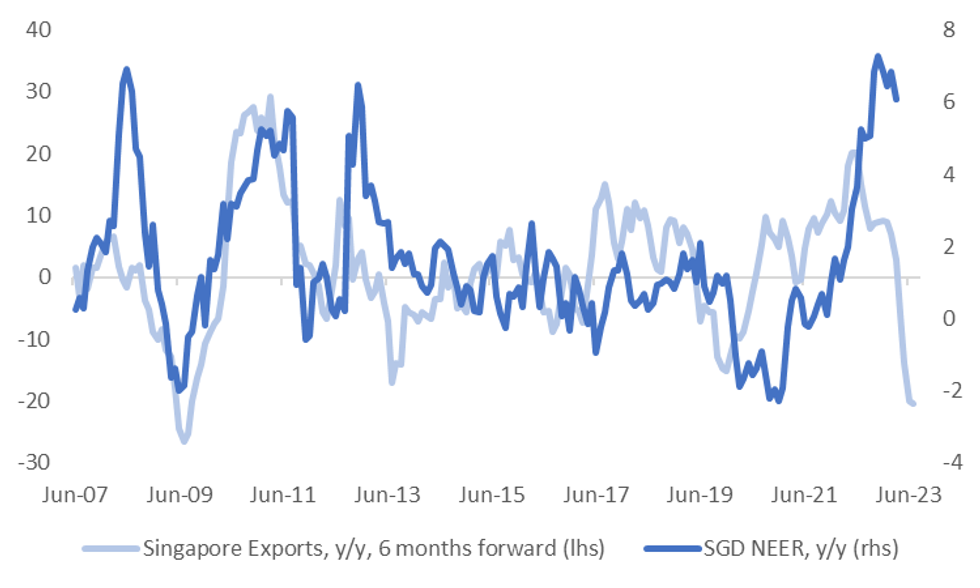

SINGAPORE: Weaker Export Growth Trend Still Evident

Singapore Feb exports showed a sharp -8.0% m/m fall (versus -0.5% forecast). Still, y/y momentum was close to expectations at -15.6% (-15.8% forecast and -25.0% prior). Electronic exports remained near recent lows at -26.5% y/y, -26.8% prior (there is no consensus estimate for this print).

- The m/m decrease was driven in part by a plunge in ship related exports, which may reverse somewhat next month. Still underlying trends don't appear to have changed.

- The level of tech related exports continued to trend lower as well.

- The chart below takes the 3 month moving average of headline exports in y/y terms. We are still running around -20% y/y, with the SGD NEER (the other line on the chart) looking too elevated still, albeit edging down off recent highs.

- The SGD NEER (per Goldman Sach estimates) slumped as global tightening expectations unwound late last week/early this week, but has been steadily improving since then. We were last near -0.90% from the top end of the band (we were -1.3% at the start of the week).

Fig 1: SGD NEER Y/Y & Export Y/Y Trend

Source: MNI - Market News/Bloomberg

EQUITIES: HK/China Tech Plays Lead The Region Higher

All major regional indices are higher, with HK/China indices leading the way, although other major markets aren't too far behind. The combination of the dovish ECB 50bps hike and efforts to boost troubled US regional banks (First Republic), has been enough to drive positive sentiment heading into the weekend. Signals from other asset classes are supportive, with US yield edging down from session highs, commodities mostly higher and the USD softer. US equity futures are only up modestly though (~0.05/0.10% for Eminis).

- The HSI is up ~1.7% at this stage, with tech stocks leading the way. This sub index is up over 4.0%, with the China internet company Baidu surging amid positive analyst reviews for its AI chatbot.

- The CSI 300 is up ~1.2%, bouncing off support at the 100-day MA. Northbound stock connect flows have rebounded, +11.6bn yuan, slightly off session highs, but still the best inflow since the end of Jan this year.

- The Topix is around ~1.20% firmer at this point, although the underlying bank index is only up 0.4%, still comfortably down versus closing levels from last Friday. The Kospi is +0.75%, although the Taiex is outperforming at +1.4%.

- The ASX 200 is up a modest 0.42%, while bourses in SEA are higher, led by commodity sensitive plays Malaysia (~1.50%) and Indonesia (~1.40%).

GOLD: Third Straight Week Of Gains, ETF Holdings Trending Higher Again

Gold is closing in on previous resistance points, with the precious metals last near $1930. Moves above this level were not sustained through Wednesday and Thursday of this week (highs near $1937.50). Still, we are still up close to 0.50% for today's session, slightly outperforming the broad USD indices (BBDXY -0.30%). For the week, gold is up just over 3.2%, which is the third straight week of gains.

- Gold has run ahead of USD weakness in this latest surge higher. This is likely to reflect renewed safe haven demand for the metal given the jitters in global banking stocks this week.

- Note that gold ETF holdings are trending higher again after reaching a trough point last Friday.

- A clean break above the $1933/37 region will likely have bulls targeting earlier YTD highs above $1950. Note the simple 50-day MA sits back at $1877.

OIL: Stabilizes Further, But Still Tracking For Large Weekly Loss

Oil sentiment has continued to stabilize/improve through today's session. For Brent we are back around the $75.50/bbl level, which is +1% higher for the session. This builds on Thursday's +1.37% gain, although only unwinds a portion of losses from earlier in the week. Brent is still tracking nearly 9% weaker for the week. WTI is off by slightly more, last down by around 10% for the week, just above the $69/bbl level.

- In terms of Brent levels, support is clearly evident around the $72/bbl or a touch below this level, which we bottomed out on two occasions in recent sessions. On the topside though, the 20-day EMA is still some distance away at $81.25/bbl.

- Outside of broader risk sentiment shifts, which have turned more positive heading into the weekend, supply developments will also be eyed. Oil sentiment stabilized post reports of OPEC+ chiefs from Saudi Arabia and Russia meeting in Riyadh yesterday. Note that the next scheduled meeting for the OPEC+ group is April 3.

- Elsewhere, an advisor to US President Biden stated the US won't rush to refill the SPR.

- Next week outside of the usual weekly inventory numbers we have the FT Commodities Global summit (which runs from Mon-Wed), but most focus is likely to rest on the Fed's decision, out on Wed.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/03/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 17/03/2023 | 0930/0930 | ** |  | UK | Bank of England/Ipsos Inflation Attitudes Survey |

| 17/03/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 17/03/2023 | 1230/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/03/2023 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/03/2023 | 1315/0915 | *** |  | US | Industrial Production |

| 17/03/2023 | 1400/1000 | *** |  | US | University of Michigan Sentiment Index (p) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.