-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: JPY Hit & JGBs Bid As BoJ Stands Pat, Launched Review & Tweaks Guidance

- JGBs were bid and JPY went offered as the BoJ left its major policy settings unchanged, launched a review of its longer term monetary policy settings and tweaked its forward guidance.

- Regional equities are mostly tracking higher, following firm gains for US stocks through Thursday trade. US futures have drifted lower through the course of the session, but losses are modest, last around 0.10% for eminis, -0.20% for Nasdaq futures.

- In Europe today we have Eurozone, French and German GDP and Regional and National German CPI. Further out we have a slew of US data including PCE Deflator, MNI Chicago PMI and UofMich Consumer Sentiment.

US TSYS: Marginally Richer, BoJ Matters Dominate

TYM3 deals at 114-26+, +0-03, with a 0-11+ range observed on volume of ~133k.

- Cash tsys sit ~1bp richer across the major benchmarks.

- After a muted start tsys were briefly pressured after Nikkei reports surfaced noting the potential for policy change at today's meeting, however losses were pared as further headlines clarified that the change was in relation to the governments covid classification. TYM3 showed below Thursdays lows.

- Spillover from JGBs, as the BoJ left policy setting unchanged and announced a review of monetary policy which will take 1-1.5 years, saw tsys firm.

- FOMC dated OIS price ~22bp hike for next week's meeting with a terminal rate of 5.1% in June. There are ~60bps of cuts priced in 2023.

- In Europe today we have Eurozone, French and German GDP and Regional and National German CPI. Further out we have a slew of US data including PCE Deflator, MNI Chicago PMI and UofMich Consumer Sentiment.

JGBS: Futures Spike To Highest Level Since Late March After BoJ Decision

Following the BoJ’s monetary policy decision, JGB futures experienced a sudden surge, erasing the prior downtrend and climbing to +36 versus settlement levels. The JBM3 reached a peak of 148.49, marking the highest point since late March.

- The BoJ announced today that it would maintain its target yield for the 10-year bond at approximately 0% and keep the policy balance rate at -0.1%. As widely anticipated, the bank removed references to COVID-19 from its forward guidance. Furthermore, the BoJ called for a comprehensive review of its longer-term policies.

- Despite the significant increase in inflation forecasts for FY23 and FY24, the BoJ saw the price risks skewed to the downside for FY25, given the high levels of economic uncertainty. The bank expects the pace of growth to slow down towards the end of the projection period, and as such, it will patiently continue with monetary easing.

- Cash JGBs have richened across the curve after the BoJ decision with yields flat to 5.4bp lower with the 20-year zone and beyond the strongest performers. The benchmark 10-year yield is 3.9bp lower at 0.427%, well below the BoJ's YCC limit of 0.50%.

- The swaps curve bull flattened after the BoJ decision with swap spreads wider beyond the 3-year zone.

- BoJ Governor Ueda is scheduled to hold a news conference after the policy meeting at 0730 BST.

AUSSIE BONDS: Weaker, Supported By JGBs, Eyes US PCE Deflator

ACGBs sit weaker (YM -4.0 & XM -3.0) but well off session cheaps after JGBs rallied on the BoJ policy decision. US Tsys richened around 2bp after the BoJ decision versus +4-5bp for ACGBs. Before the post-BoJ spike the local market had appeared troubled by a firm Q1 PPI print. Private sector credit printed in line with expectations.

- Cash ACGBs are 2-3bp cheaper with the AU-US 10-year yield differential -3bp at -12bp.

- Swap rates are 1-2bp higher with EFPs 2bp tighter.

- Bills strip pricing is -3 to -7 with late whites the weakest.

- RBA dated OIS pricing is 1-7bp firmer with late ‘23/early ’24 leading.

- Q1 PPI data printed an increase of 1.0% Q/Q and +5.2% Y/Y versus 0.7% and +5.8% in Q4. According to the ABS, electricity and gas supply (+13.3% Q/Q) was the key upside driver, with fuel refining and manufacturing (-7.2% Q/Q) and furniture and other manufacturing (-5.8% Q/Q), as the weakest components.

- The local calendar highlight next week is the RBA policy decision on Tuesday.

- Until then, all eyes will be on the release late today of the March PCE Deflator.

- The AOFM announced today that it plans to sell A$800mn of the 4.50% 21 April 2033 on Wednesday May 3.

NZGBS: Cheaper, Boosted By JGBs, Awaits US PCE Deflator

NZGBs closed cheaper with the 2-year and 10-year benchmark yields 6bp and 3bp higher. With domestic data and headlines light, the local market had been content to track US Tsys ahead of US PCE Deflator data later today. The local market however received a boost from JGBs late in the session following the BoJ policy decision.

- Swap rates are 5-9bp higher with implied swap spreads slightly wider.

- RBNZ dated OIS closed 2-10bp firmer across meetings with early ’24 leading. May meeting closed 2bp firmer with 22bp of tightening priced.

- While ANZ Consumer Confidence unexpectedly increased by 2.1% M/M in April, the overall level of confidence remains low, reflecting the impact of rising costs and worsening household balance sheets.

- Next week’s local calendar highlight is the release of the March Quarter Labour Market Report on Wednesday. BBG consensus expects some cooling in tight labour market conditions with the unemployment rate forecast to increase to 3.6% from 3.4% in Q4. Slowing demand for labour and increasing supply, due to an inflow of migrant workers, should dampen wage pressures and core inflation, in time.

- Ahead of that data, the RBA will hand down its policy decision on Tuesday.

- Until then, all eyes will be on the release late today of the March PCE Deflator after yesterday’s stagflation-like Q1 GDP report.

FOREX: Yen Pressured After BOJ Meeting

Yen is the weakest performer in the G-10 space at the margins on Friday after the latest BoJ Monetary Policy decision. The BoJ removed reference to Covid in its forward guidance. It also removed reference to rates in terms of the guidance (expecting rates to remain at low or present levels was left out), but the Bank left in that is prepared to take further easing measures if necessary. The BOJ will also conduct a review, which is expected to take 1 to 1.5 yrs.

- USD/JPY prints at ¥134.65/75, the pair is ~0.5% firmer, gains have been marginally pared after printing a post BOJ high at ¥134.94. Bulls target the high from Apr 19 at ¥135.13, break through here opens ¥135.96 76.4% retracement of the Mar 8-24 bear leg.

- AUD/USD is ~0.2% as spillover from the USD/JPY has helped the USD firm, support is seen at $0.6591 low Apr 26. Westpac noted that it expects the RBA to pause again at its May meeting and that 3.6% is the likely cash rate peak.

- Kiwi is a touch softer, however a narrow $0.6140/60 range has prevailed thus far today.

- Elsewhere in G-10, GBP and EUR are both ~0.1% softer.

- Cross asset wise; e-minis are ~0.1% softer and BBDXY is ~0.2% firmer. US Treasury Yields are ~1bp lower across the curve.

- In Europe today we have Eurozone, French and German GDP and Regional and National German CPI. Further out we have a slew of US data including PCE Deflator, MNI Chicago PMI and UofMich Consumer Sentiment.

FX OPTIONS: Expiries for Apr28 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.0950-70(E711mln), $1.1000(E2.9bln), $1.1040-50(E1.2bln)

- USD/JPY: Y130.00-20($1.4bln), Y134.00($537mln)

- AUD/USD: $0.6600(A$1.2bln), $0.6900(A$2.1bln)

- GBP/USD: $1.2600(Gbp615mln)

- USD/CAD: C$1.3600($747mln)

ASIA FX: Fresh YTD Lows For USD/IDR, Holiday For Most In The Region On Monday

Asian FX has been mixed, with KRW and TWD underperforming, with some spill over from higher USD/JPY levels post BoJ. CNH has been more resilient as equities continue to recover. In SEA, PHP and IDR have outperformed. USD/IDR printing fresh YTD lows. Still to come is Taiwan Q1 GDP, which is expected to be negative send the economy into a technical recession. On Sunday Apr PMIs print for China. In South Korea Apr trade figures are out on Monday.

- Note though China markets are closed for the May day holidays Mon-Wed. South Korea, Singapore and Hong Kong are also shut on Monday, along with the other major countries in the region.

- USD/CNH is back to 6.9200, slightly firmer in CNH terms for the session and outperforming the stronger USD tone post the BoJ in terms of the majors. Onshore equities are higher for the second straight session, with the CSI 300 back above its 200-day MA.

- KRW has underperformed, although spot USD/KRW did find selling interest above 1340 post the BoJ decision (which saw USD/JPY spike towards 135.00). Onshore South Korean equities have also underperformed. Earlier IP momentum in March, but from low levels.

- USD/TWD is holding close to recent highs, above 30.70. We are very close tot eh 200-day MA (30.725). Q1 GDP is expected to have contracted -1.25%, based off the consensus, putting Taiwan in a technical recession (Q4 growth was -0.41%).

- The SGD NEER (per Goldman Sachs estimates) is a touch firmer this morning however we remain well within post MAS ranges. We currently sit ~1% below the top of the band. USD/SGD prints at $1.3340/50, the pair has been dealing in a narrow range this week as $1.34 has capped rallies and the 20-Day EMA ($1.3334) has provided support. The March Unemployment rate printed at 1.8% ticking lower from 2.0% in December. This is the lowest Unemployment rate since March 2015.

- Spot USD/IDR sits slightly above session lows. The pair last at 14640/45. We touched 14638 earlier, which was a fresh YTD low. The market may now target round figure support at 14600. Note that lows in the pair from early June last year came in just ahead of 14400. Late yesterday it was reported that exporters placed $156.5mn into FX term deposits with the central bank. This is the largest amount since the policy was introduced a few months ago.

- USD/PHP is back close to mid-Mar lows, last in the 55.50/55 region. The pair has unwound nearly half of the rally we saw in the first 3 weeks of Apr (54.30/35 to 56.35/40). For today, spot is +0.35% firmer in PHP terms, with some gains pared due to higher USD/JPY levels. Mid-April lows came in close to 55.00, which could be the next level watched on the downside.

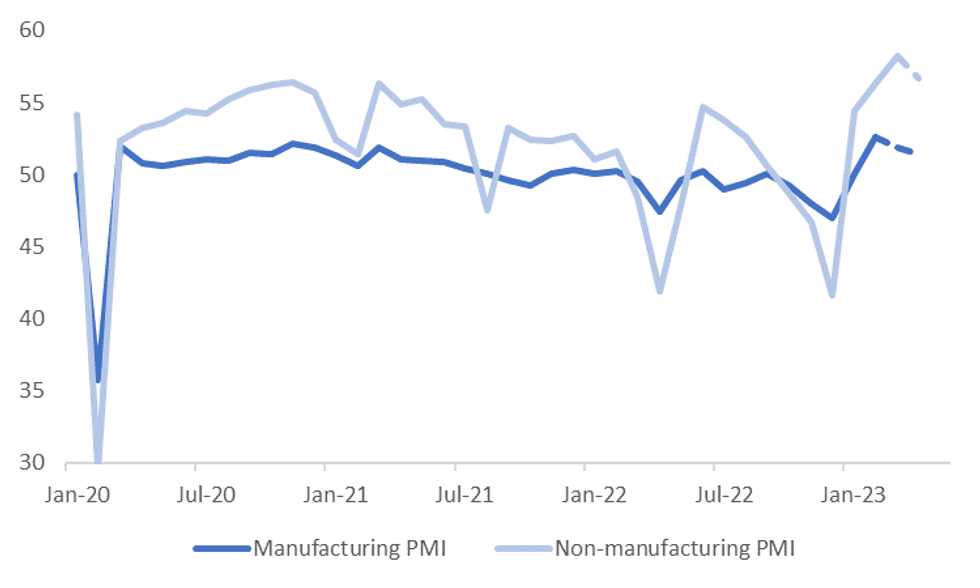

CHINA: Official PMIs Out Sunday, Consensus Looks For Manufacturing & Services To Pullback

A reminder that the official PMIs for Apr print on Sunday. The market expects a pullback in both the manufacturing and services side. The manufacturing PMI is expected at 51.4, prior was 51.9, while forecast range is 50.9-51.7. On the non-manufacturing/services side, the forecast is 56.7, prior was 58.2, while forecast range is 55.0-55.90. The composite PMI will also be released, the prior was 57.0 (with no consensus for this print).

- If the consensus is realized for both prints, it will still leave us comfortably in expansion territory, particularly on the services side, see the chart below.

- Mobility/travel related indicators have remained firm through April, with planned bookings ahead of the 5-day May holiday period above 2019 levels per the Nikkei (see this link). Obviously, this may show up more so in May data.

- Housing sentiment faltered to some degree, with housing sales slowing in the first part of April.

- On the manufacturing side, partial indicators are also mixed, although this sector has been less buoyant compared with the services side as the re-opening theme gained traction. Activity data across March for IP, investments and profits still showed headwinds in some segments of manufacturing, particularly parts of tech.

Fig 1: China Manufacturing & Services PMIs

Source: MNI - Market News/Bloomberg

EQUITES: Japan Stocks Gain Post BoJ, China/HK Bourses Gain

Regional equities are mostly tracking higher, following firm gains for US stocks through Thursday trade. US futures have drifted lower through the course of the session, but losses are modest, last around 0.10% for eminis, -0.20% for Nasdaq futures.

- Japan stocks have firmed, the Topix around +0.70%, aided by an unchanged BoJ, with arguably some dovish rhetoric in terms of the review stance. USD/JPY got close to 135.00 but is now lower. Not surprisingly, Japan bank stocks have suffered post the BoJ, the Topix bank index off 2.4% at one stage.

- China and HK shares are higher, the HSI by nearly 0.90%m while the CSI 300 up around 0.75%. The Golden Dragon index firmed in US trade for the second session. Reports of potential efforts to lower US-China tensions may be helping at the margins. The Cyberspace regulators is also launching a 3 month campaign to protect Internet companies legal interests.

- South Korean shares are underperforming, the Kospi down 0.20%, the Kosdaq off 1.10%. The FSS is meeting with heads of local brokerages to increase oversight of retail investors.

- In SEA, markets are more mixed, with Indonesian stocks down slightly, unwinding a touch of Wed/Thur gains. Philippines stocks are doing better, +0.70% of talk of rate pauses and RRR cuts by mid year.

- The ASX 200 is close to flat.

GOLD: Slips But Still Within Recent Ranges

Gold is tracking lower, albeit with recent ranges. We currently sit close to mid-point of the last week's range, currently around $1987.00. The last part of trading has seen the precious metal slip, as the USD has seen support post the BoJ decision (led by yen weakness). We remain above session lows of $1985 though.

- For the past week, dips towards $1975 have been support, while moves above $2000 have ultimately drawn selling interest. For the week, gold is tracking modestly higher +0.20%.

- US yield/USD moves will likely continue to dominate as we progress into next week.

- Gold ETF holdings are holding near recent highs.

OIL: Recovers Further On China Demand Outlook, But Still Tracking Lower For THe Week

Brent crude has firmed through the Asia Pac session today, up another 0.90%, to be back above the $79/bbl handle. This follows Thursday's 0.88% gain as well. Sentiment has been buoyed today after China's top fuel producer, Sinopec, stated demand growth should be more than 10% in 2023. Demand growth was 6.7% in Q1 and is expected to be stronger in Q2. Note we also get China PMIs on Sunday which will provide a further economic update.

- Still these gains need to be seen in the context of broader trends. Brent is still tracking 3.20% lower for the week and is down modestly for April as a whole.

- In terms of levels recent lows towards $77/bbl have been supported. On the topside we are comfortably off resistance at $83.06/$85.15 (Apr 25/19 highs).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 28/04/2023 | 0600/0800 | ** |  | SE | Retail Sales |

| 28/04/2023 | 0630/0830 | ** |  | CH | retail sales |

| 28/04/2023 | 0645/0845 | *** |  | FR | HICP (p) |

| 28/04/2023 | 0645/0845 | ** |  | FR | PPI |

| 28/04/2023 | 0700/0900 | * |  | CH | KOF Economic Barometer |

| 28/04/2023 | 0700/0900 | *** |  | ES | GDP (p) |

| 28/04/2023 | 0700/0900 | *** |  | ES | HICP (p) |

| 28/04/2023 | 0755/0955 | ** |  | DE | Unemployment |

| 28/04/2023 | 0800/1000 | *** |  | IT | GDP (p) |

| 28/04/2023 | 0800/1000 | *** |  | DE | GDP (p) |

| 28/04/2023 | 0800/1000 | *** |  | DE | Bavaria CPI |

| 28/04/2023 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Q/Q |

| 28/04/2023 | 0900/1100 | *** |  | EU | EMU Preliminary Flash GDP Y/Y |

| 28/04/2023 | 0900/1100 | *** |  | DE | Saxony CPI |

| 28/04/2023 | 1200/1400 | *** |  | DE | HICP (p) |

| 28/04/2023 | - |  | EU | ECB Lagarde at Post-Eurogroup Meeting Press Conference | |

| 28/04/2023 | - |  | EU | ECB Lagarde, Panetta, de Guindos at Eurogroup / ECOFIN Meeting | |

| 28/04/2023 | 1230/0830 | ** |  | US | Personal Income and Consumption |

| 28/04/2023 | 1230/0830 | ** |  | US | Employment Cost Index |

| 28/04/2023 | 1230/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 28/04/2023 | 1342/0942 | ** |  | US | MNI Chicago PMI |

| 28/04/2023 | 1400/1000 | *** |  | US | Final Michigan Sentiment Index |

| 28/04/2023 | 1500/1100 |  | CA | Finance Dept monthly Fiscal Monitor (expected) |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.