-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: NZ Business Survey Shows Easing Activity & Inflation

- The USD has spent the first part of Tuesday trade on the front foot. NZD and AUD have faltered, although sit slightly up from session lows. RBNZ dated OIS pricing is flat to 4bps softer, with 2025 meetings leading. The key driver of today’s intra-session richening appears to have been the NZIER Survey results, which showed both activity and inflation easing.

- The June RBA meeting minutes suggest that the Board will hike rates if it determines that policy is “not sufficiently restrictive to return inflation to target within a reasonable timeframe”.

- US Tsys futures have edged higher ahead of speeches at Sintra from Fed officials later today. Cash JGBs are flat to 1bp cheaper across benchmarks after today’s 10-year supply.

- Looking ahead, the Fed’s Goolsbee appears and Fed’s Powell, ECB’s Lagarde and BCB’s Campos Neto speak in Sintra. Also, the ECB’s Schnabel, de Guindos and Elderson talk. In terms of data, there are May US JOLTS job openings and preliminary June euro area CPI.

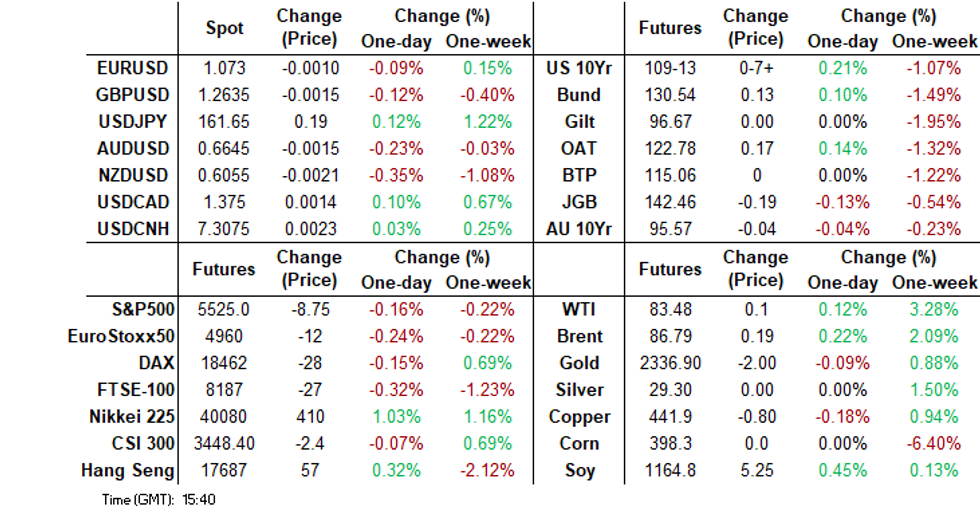

MARKETS

US Tsys: Futures Edge Higher Ahead Of Sintra, 2s10s Off Recent Highs

- Tsys futures have edged higher ahead of speeches at Sintra from Fed officials later today, TUU4 +0-01⅛ at 102-01⅛, while TYU4 +0-06 at 109-11+.

- Volumes are slightly above recent averages with TU 20k, FV 44k & TY 90k

- Tsys Flows: Post the US close/ prior to Asia open there was a large a large 15,988k FVU4 block trade, likely buyer at 106-05.25, while earlier there was likely block buyer of 5,839 UXY at sessions highs of 102-19.

- Cash treasury curve has seen slightly better buying through the 7-10yr part of the curve, yields are flat to 2bps lower, the 2s10s is off overnight highs of -28.679, and is now -1.357 at -31.207.

- A Trump presidency is looking likely based on currently polling (PredictIt now has odds at 59%, up 1% today), with investors believing this would lead to higher spending, tax cuts, and faster inflation. Furthermore, the US Supreme court ruled Trump has immunity from some criminal charges, which now shuts the small window for Trump to be put in front of a jury before the Election on Nov 5.

- In APAC markets, ACGB yields are 2-6bps higher, curve bear-steepening, NZGB yields 2.5bps lower to 4bps higher, curve bear-steepening. JGBs are flat to 2bps higher, better selling through the belly of the curve post the 10yr auction later

- Looking ahead, May JOLTS Job openings, Goolsbee to speak on BBG TV while Powell, Lagarde, Campos Neto Speak in Sintra

JGBS: Sell-Off Pared After 10Y Supply, BoJ Rinban Operations Tomorrow

JGB futures are holding near session lows, -16 compared to the settlement levels.

- Outside of the previously outlined Monetary Base data, there hasn't been much in the way of domestic drivers to flag.

- A Reuters survey conducted in late June/early July suggests the central bank's bond-buying program will be cut by roughly $100bn in the first year.

- This comes ahead of the BoJ's meeting with industry participants on July 9-10, where taper plans by the central bank will be discussed. The next BoJ meeting is at the end of July. See this piece from our Tokyo policy team on BoJ tapering plans.

- Cash US tsys are dealing flat to 2bps richer in today's Asia-Pac session after yesterday's bear-steepening.

- Cash JGBs are flat to 1bp cheaper across benchmarks after today’s 10-year supply. The auction saw the low price beat wider expectations. However, the cover ratio fell to 3.277x from 3.662x at June’s auction. The tail was unchanged at a relatively short length.

- The benchmark 10-year yield is 1.3bps higher at 1.074% versus the cycle high of 1.101%.

- Swaps are little changed, with rate movement bounded by +/- 1bp.

- Tomorrow, the local calendar will see Jibun Bank Composite & Services PMI data alongside BoJ Rinban Operations covering 1-5-year and 10-25-year JGBs.

AUSSIE BONDS: Slightly Richer After June RBA Minutes, Apr-37 Supply Tomorrow

ACGBs (YM -2.0 & XM -4.5) are holding cheaper, but slightly richer after the release of the June policy meeting minutes from the RBA.

- The minutes suggest that the Board will hike rates if it determines that policy is “not sufficiently restrictive to return inflation to target within a reasonable timeframe” because disinflation and closure of the output gap are slower than expected.

- At the August 6 meeting that assessment will depend on Q2 CPI on July 31 and the updated staff forecasts which will include not just the new CPI but also fiscal stimulus information. It will also “carefully review the extent of spare capacity” in this exercise.

- Cash ACGBs are 2-4bps cheaper, with the AU-US 10-year yield differential -2bps.

- Swap rates are higher, with the 3s10s curve steeper.

- Bills pricing is -1 to -2.

- RBA Dated OIS is slightly softer after the release of the RBA Minutes. Pricing is currently 6-26bps firmer across meetings than pre-CPI levels. The market gives a 25bp hike in August a 44% chance. Terminal rate expectations are also dramatically firmer at 4.49% versus 4.37% before the CPI data.

- Tomorrow, the local calendar will see Judo Bank Composite & Services PMIs, Building Approvals and Retail Sales data alongside the AOFM’s sale of A$600mn of 3.75% Apr-37 bond.

RBA: Is Monetary Policy Restrictive Enough?

The June meeting minutes suggest that the Board will hike rates if it determines that policy is “not sufficiently restrictive to return inflation to target within a reasonable timeframe” because disinflation and closure of the output gap are slower than expected. At the August 6 meeting that assessment will be dependent on Q2 CPI on July 31 and the updated staff forecasts which will include not just the new CPI but also fiscal stimulus information. It will also “carefully review the extent of spare capacity” in this exercise.

- If the RBA revises up its CPI profile which pushes out the timing of the return of inflation to target, accompanied by little change or an upward revision to growth, the August meeting is likely to be “live” for further monetary tightening.

- The minutes included a list of upside risks to the RBA’s forecasts including consumption, stronger global growth, easier financial conditions for businesses, pick up in market-implied inflation expectations, and recent domestic and overseas inflation data. In addition, if the supply-side is deemed to be “more constrained” than assumed in May, that would add to the case for a hike.

- The Board decided to leave rates unchanged in June though since the data in aggregate didn’t suggest a shift in expectations that target would be achieved by 2026, “despite some elevated upside risk”. Also there hasn’t been “enough evidence” that the demand outlook has strengthened, while there remains significant uncertainty especially regarding consumption.

- The RBA is even more data dependent as the “’narrow path’ was becoming narrower” and it remains “vigilant” to upside inflation risks.

NZGBS: Twist-Steepening After Business Survey Shows An Easing In Activity & Inflation

After initially being pressured by US tsys’ overnight bear-steepening, NZGBs quickly moved away from the session’s worst levels, led by the short end. NZGB benchmarks twist-steepened, with yields closing 2bps lower to 3bps higher versus 7bps higher earlier in the session.

- The move away from session cheaps was aided by cash US tsys, which are flat to 2bps richer with a flattening bias in today's Asia-Pac session.

- Nevertheless, the key driver of today’s intra-session richening appears to have been the NZIER Survey results, which showed both activity and inflation easing.

- Westpac observed the “inflation indicators have continued to head in the direction that the RBNZ would have hoped. A net 41% of firms reported cost increases over the last three months, down from 52% last quarter and a peak of 80% at the end of 2022. There were similar falls in firms’ past and expected pricing.”

- The swaps curve has also twist-steepened, with rates 1bp lower to 3bps higher.

- RBNZ dated OIS pricing is flat to 4bps softer, with 2025 meetings leading. A cumulative 33bps of easing is priced by year-end.

- Tomorrow, the local calendar will see ANZ Commodity Price data.

FOREX: USD Gains Continue, NZD Falters Post Survey Data

The USD has spent the first part of Tuesday trade on the front foot, the BBDXY USD index firming back above 1272.0, although short of late June highs.

- Carry over USD strength from Monday's US session has been evident. US yields are lower, but losses of around 2bps are only giving up part of Monday's gain. US equity futures are lower, off 0.2-0.3%.

- NZD and AUD have faltered, although sit slightly up from session lows. NZD/USD got too fresh multi week lows of 0.6048 (last near 0.6055), around 0.30% weaker against the USD.

- Earlier NZ business sentiment data pointed to softer business conditions and easing inflation pressures. The NZ-US 2yr swap spread has rolled over modestly, back to +24.5bps, versus recent highs near +35bps. NZ OIS was also slightly weaker ahead of next week's RBNZ meeting.

- AUD/USD is back close to 0.6645, off 0.25%. The RBA minutes came and went, without shifting the sentiment needle.

- USD/JPY sits higher, last above 161.60, but hasn't been able to breach Monday intra-session highs at this stage (161.73). Verbal FX rhetoric has continued.

- Looking ahead, the Fed’s Goolsbee appears and Fed’s Powell, ECB’s Lagarde and BCB’s Campos Neto speak in Sintra. Also, the ECB’s Schnabel, de Guindos and Elderson talk. In terms of data, there are May US JOLTS job openings and preliminary June euro area CPI.

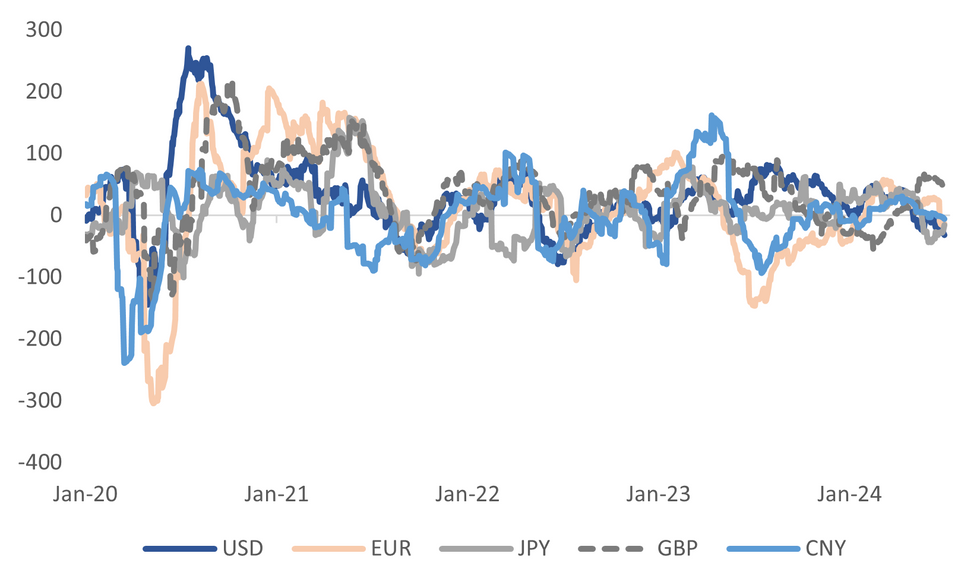

USD: US Data Surprises Negative, But Similar Trends In Other Major Economies

USD FX indices look too elevated relative to recent downside momentum in data surprises for the economy (EASIs). The Citi data surprise index for the US sits back at -32.4, which is fresh lows since early August 2022. However, an important caveat is that outside of the UK, other major economy EASIs are in negative territory as well.

- The first chart below plots the Citi EASIs for the US, EU, Japan, China and the UK. The US is the weakest but only marginally (excluding the UK).

- Arguably we would need to see greater divergence in terms of downside US surprises relative to other major economies for this to present a more material USD headwind.

Fig 1: Major Economy Citi EASIs

Source: Citi/MNI - Market News/Bloomberg

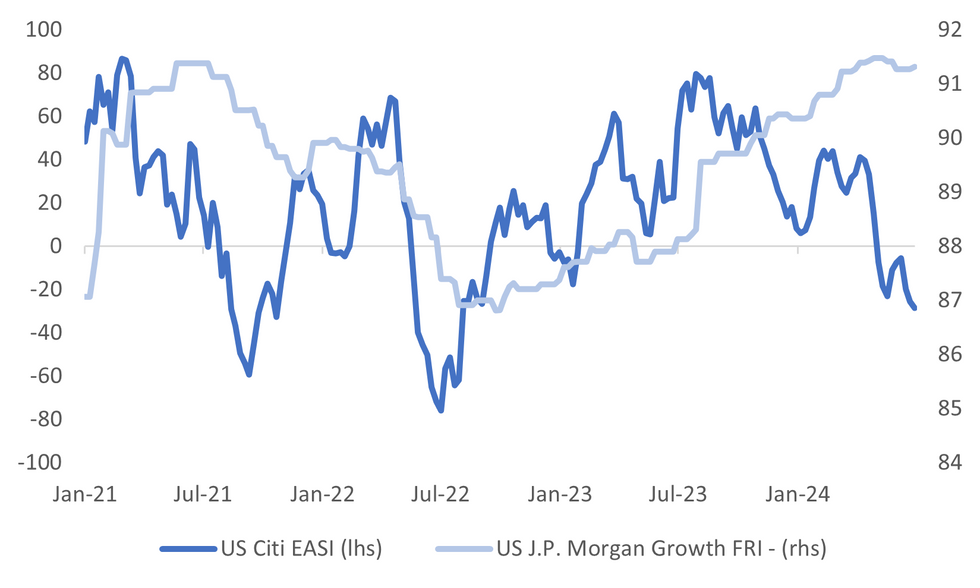

- The other factor is that actual US growth forecast revisions have been only very modest to the downside. The second chart below plots the J.P. Morgan growth forecast revision index (FRI), which measures the extent to which JPM economists are revising up or down their US growth outlook, against the Citi EASI for the US.

- The run of downside data surprises has not led to material downside revisions by US economists at JPM yet. Again, if we were seeing more downside in terms of US growth expectations, we might have expected more USD headwinds to emerge.

Fig 2: Citi US EASI & J.P. Morgan Growth FRI

Source: Citi/J.P. Morgan/MNI - market News/Bloomberg

ASIA STOCKS: China & HK Equities Mixed, Property & EVs Higher On Strong Sales

Hong Kong and China equity markets are mixed today. The MSCI AC Asia Pacific Index hit its highest since late May amid a rally in Hong Kong-listed property on better-than-expected June home sales and electric vehicle maker shares also high following positive sales and deliveries data for June, with analysts predicting a short-term rally before the mid-July low season.

- Hong Kong equities are higher today, as they return from a break Monday. Property is the best performing sector after yesterday the top 100 developers returned a 36% m/m increase in sales, however it should be noted that sales are still down y/y, the Mainland Property Index is up 2.99%, while the HS Property Index is up 0.68%. In the tech space, HSTech Index is now down 0.70% underperforming the wider markets largely due to slightly softer prices in the US overnight, while the wider HSI is up 0.39%.

- China equity markets are mixed today with the CSI300 is down 0.10%, while small-cap indices the CSI 1000 down 0.70% and the CSI 2000 up 0.16% while the growth focused ChiNext is 0.70% lower, and finally after surging 5.75% yesterday the CSI 300 Real Estate Index is down 0.85%.

- The property market in China shows signs of recovery, with sales of existing residential properties in Shanghai reaching 26,374 units in June, marking a 41% increase from the previous month and the highest monthly transaction in three years. This surge follows the city's measures to lower downpayments and offer cheaper mortgages in late May. Beijing also saw a rise in existing-home sales, with nearly 15,000 units sold in June, the highest in 15 months, representing a 12% month-on-month increase and a 29% year-on-year rise. However, in the new-home market, while homebuyer visits have increased in Shanghai, actual transaction volumes have not yet picked up noticeably.

- Looking to next week, Tuesday we have Hong Kong Retail Sales, Wednesday we have Caixin China PMI composite & Services.

ASIA PAC STOCKS: Asian Equities Mixed, Global Political Concerns, Softer Tech Prices

Asian markets are trading mixed today as traders weigh the potential implications of another Trump presidency following his recent debate with Biden and the earlier announcement that he will be given immunity from some charges, PredictIt now has Trump at a 59% change of winning, up 1%. US equity futures are lower today giving back some of the gains made in the US session as tech again led the market higher. In local markets, Japanese equities initially opened lower due to concerns over a contraction in US factory activity and potential currency intervention, although we have pared loses and now trade higher for the session, South Korean & Taiwan shares are lower amid global political uncertainty.

- Japanese stocks are higher today after higher oil prices boosted resource-related shares, and expectations of a potential interest rate hike by the BoJ supported gains in bank and insurance stocks which boosted the Topix closer to record highs. However, the possibility of government intervention in the currency market limited the upside potential for Japan's exporters. The Nikkei 225 is 0.93% higher, while the Topix rose by 1.09%.

- South Korean stocks are lower today as investors weigh global economic uncertainties and the latest inflation data. Geopolitical tensions involving China and upcoming US elections have left traders cautious this morning, with the likes of Samsung selling off a touch. Banking stocks are higher after media reports said the nation will soon announce tax incentives to encourage listed companies to enhance shareholder returns, with the government announcing more around the “Corporate Value-up” tax incentives soon, according to government officials. The Kospi is 0.85% lower, while the small-cap Kosdaq is down 2.10%

- Taiwanese equities are lower this morning, as TSMC trades off. Later this week we have local CPI data which is expected to show a slightly increase from the prior month. This morning the Taiex is trading 0.73% lower.

- Australian equities are lower today after RBA minutes stated the RBA considered a rate hike but judged that keeping the rate unchanged was the stronger option although chances of future rate hikes were not ruled out. The ASX200 is down 0.38%

- Elsewhere, New Zealand equities are 0.17% lower, Thai equities are 0.50% lower, Philippine equities are 0.15% lower, Indian equities little changed, Indonesian equities are 0.15% higher, Singapore equities are up 0.50%, and Malaysian equities are up 0.10%.

Asian Equity Flows Subdued As Investors Take Profit On Tech

- South Korea: South Korean equities saw outflows of $39m yesterday, contributing to a net inflow of $691m over the past five trading days. Markets were higher with the small cap Kosdaq out-performing, up 0.80% vs the Kospi which was up 0.23%. The 5-day average inflow is $138m, slightly lower than the 20-day average of $189m and higher than the 100-day average of $148m. Year-to-date, South Korea has experienced substantial inflows totaling $17.1b.

- Taiwan: Taiwanese equities had outflows of $320m yesterday, contributing to a net outflow of $906m over the past five trading days. The Taiex was up just 0.11% yesterday, and trades just off all-time highs. The 5-day average outflow is $181m, contrasting with the 20-day average inflow of $73m and the 100-day average inflow of $30m. Year-to-date, Taiwan has accumulated inflows of $4.1b.

- India: Indian equities experienced strong inflows of $186m yesterday, contributing to a 5-day total inflow of $1.7b. The nifty 50 has continued it's stellar run post elections and has been making new highs. The 5-day average inflow is $339m, higher than the 20-day average of $169m. The 100-day average shows a slight outflow of $25m. Year-to-date, India has seen inflows of $349m.

- Indonesia: Indonesian equities recorded inflows of $11m yesterday, with a net inflow of $44m over the past five trading days. The JCI is now up 6.58% from its lows made on June 19th. The 5-day average outflow is $9m, similar to the 20-day and 100-day averages of $4m and $9m, respectively. Year-to-date, Indonesia has experienced outflows totaling $416m.

- Thailand: Thai equities saw inflows of $9m yesterday, bringing the 5-day total to a net outflow of $200m. The local market ended a run of 27 straight sessions of selling from foreign investors on Monday, although the SET is looking under pressure again, after closing below 1,300 with the ytd lows now back in sight. The 5-day average outflow is $40m, close to the 20-day average of $47m and higher than the 100-day average outflow of $24m. Year-to-date, Thailand has seen significant outflows amounting to $3.2b.

- Malaysia: Malaysian equities experienced inflows of $28m Friday, contributing to a 5-day net outflow of $76m. The FTSE Malay was up 0.50% on Monday and is now testing the 20-day EMA, after breaking below it mid June. The 5-day average outflow is $28m, higher than the 20-day average outflow of $11m and the 100-day average outflow of $3m. Year-to-date, Malaysia has experienced outflows totaling $173m.

- Philippines: Philippine equities saw modest inflows of $2m yesterday, with a 5-day net inflow of $8.5m. The PSEi was lower on Monday, although is up about 4% from recent lows, we currently trade just on the 20-day EMA, with a break here opening up a retest of 6,200 and potentially the recent cycle lows. is The 5-day average is $2m, less than the 20-day average outflow of $10m and the 100-day average outflow of $6m. Year-to-date, the Philippines has seen outflows totaling $526m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 62 | 352 | 17089 |

| Taiwan (USDmn) | 432 | -2193 | 4062 |

| India (USDmn)* | 929 | 1724 | 349 |

| Indonesia (USDmn) | -106 | 30 | -416 |

| Thailand (USDmn) | -71 | -238 | -3222 |

| Malaysia (USDmn) | -56 | -141 | -173 |

| Philippines (USDmn)* | 7 | 0.2 | -526 |

| Total | 1197 | -466 | 17165 |

| * Up to 28th June |

OIL: Crude Slightly Higher On Geopolitical & Hurricane Concerns

Oil prices are moderately higher during APAC trading today with WTI up 0.2% to $83.56/bbl after an intraday high of $83.61 and Brent is 0.3% higher at $86.84/bbl after rising to $86.89. Crude continues to be supported by geopolitical uncertainties and the early start of the hurricane season in the Atlantic. Benchmarks broke resistance levels on Monday. The USD index is 0.1% higher.

- Prompt spreads are indicating that the oil market is tight but the demand outlook remains uncertain with a US refinery reducing output due to soft demand while China’s Caixin manufacturing PMI came in more optimistic than the official PMI. The industry-based US API inventory data is released today. Travel developments for this week’s Independence Day holiday will be monitored closely.

- Venezuelan president Maduro said today that talks with the US will resume on Wednesday after the latter reintroduced sanctions on the country’s oil and gas in April as it didn’t meet fair election criteria. Elections will be held this month.

- Later the Fed’s Goolsbee appears and Fed’s Powell, ECB’s Lagarde and BCB’s Campos Neto speak in Sintra. Also the ECB’s Schnabel, de Guindos and Elderson talk. In terms of data, there are May US JOLTS job openings and preliminary June euro area CPI.

GOLD: Buoyed By Weaker ISM, Focus On Labour Market Data

Gold is steady in the Asia-Pac session, after closing 0.2% higher at $2331.90 on Monday.

- Bullion found support from lower-than-expected ISM Manufacturing and Prices Paid data on Monday.

- The US calendar is light today ahead of US ADP private employment, ISM Services, and Weekly Claims on Wednesday, the 4th of July holiday on Thursday and June US Payrolls data on Friday.

- Traders will look to upcoming US economic data to help clarify when the Federal Reserve could pivot to monetary easing.

- Lower rates are typically positive for gold, which doesn’t pay interest.

- According to MNI’s technicals team, a clear break of the 50-day EMA, at $2,318.7, would open $2,277.4, the May 3 low. Initial firm resistance is $2,387.8, the Jun 7 high.

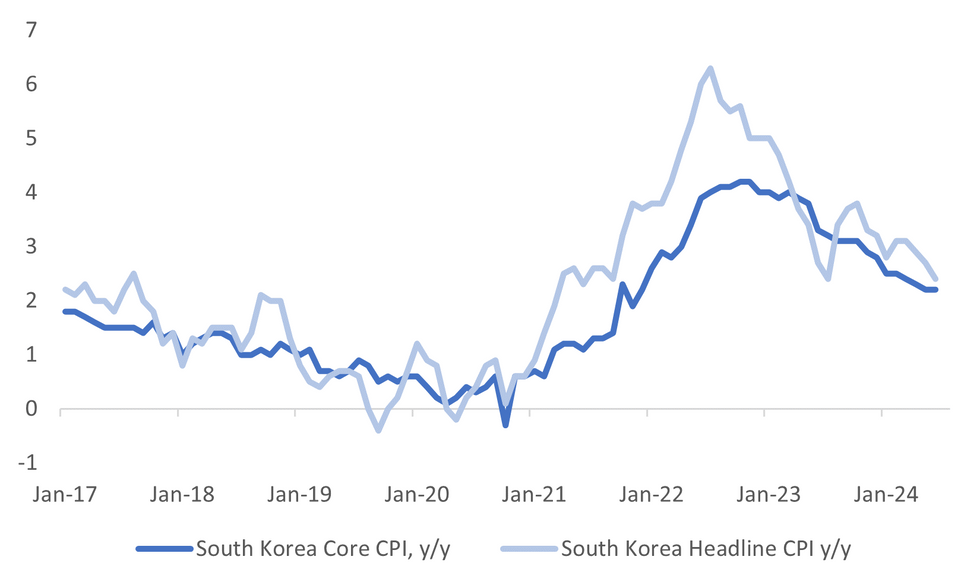

SOUTH KOREA DATA: June CPI Below Market Expectations, Headline Y/Y At 2.4%

South Korea June CPI was below expectations. The m/m print fell 0.2%, against a +0.1% expectation, which was also the same as the prior outcome. As a result, the headline y/y print was also below forecasts, coming in at 2.4% y/y (2.6% forecast and 2.7% prior0. The core, ex food and energy, measure rose 2.2% y/y in line with the prior outcome and market forecasts. The chart below plots the headline and core CPI trends in y/y terms.

- In terms of the detail we had 5 out of 12 sub indices record m/m falls. The largest came from food, -1.0% (now down in m/m terms for 3 straight months). Transport fell 1.5%, while health and recreation fell modestly. Restaurants (+0.3% m/m) and the other category (+0.4%m/m) were the main positives.

- In y/y terms 8 out of the 12 sub indices saw either lower momentum compared with May or the same. Despite m/m falls, food and transport still have the highest y/y pace (after the other category).

- Today's result brings headline closer towards the 2% BoK target. This adds to the case for the BoK easing at some stage in H2 of this year, although next week's meeting is likely to see an unchanged outcome.

Fig 1: South Korea CPI Y/Y Trends

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Higher Across The Board, Fresh YTD Highs For USD/CNY

USD/Asia pairs are higher across the board, albeit to varying degrees. In spot terms, KRW, PHP and IDR have been the weakest performers. Spot USD/CNY continues to move higher in line with the higher USD/CNY fixing outcomes. Regional equity sentiment has been mixed, while the USD is firmer against the majors, leading to positive spillover for USD/Asia pairs. Tomorrow, we have the Caixin services PMI on tap in China, while the Indian services PMI prints later on.

- USD/CNH sits around recent highs, the pair last near 7.3078. USD/CNY spot is above 7.2700, close to its upper daily trading limit. The onshore CY fixing was close to 7.1300, fresh highs back to Nov last year. Follow through equity gains have been limited so far, likewise for onshore bond yields following yesterday's PBoC announcement. Broader USD gains have been evident against the majors, a likely yuan headwind, albeit with a much lower beta with respect to such moves.

- Spot USD/KRW got to 1390 in earlier trade, but couldn't extend gains beyond this level. Earlier data showed weaker than forecast June CPI figures, which if continued is likely to pave the way for a BoK easing in H2. Note the central bank meets next week, although a change at that meeting is unlikely. the authorities may be on guard against a sharp rally in USD/KRW through the 1390/1400 region.

- Spot USD/PHP sits near 58.80/85 in latest dealings, down a little over 0.3% in PHP terms for the session so far. We aren't too far away from recent highs (58.93) see towards the end of June. The 20-day EMA is close by (58.63), while the 50-day sits further south (close to 58.12). Upside focus is likely to rest around the 59.00 level, which marked 2022 highs. Whilst BSP Governor Remolona stated they don't intervene in FX markets every day, a sharp move through 59.00 may prompt a response from the authorities. Like elsewhere in the region, the PHP is seeing headwinds from broader USD gains, amid a firmer yield backdrop. The recent rebound in USD/PHP has coincided with a rise in US real yields (the 10yr back to 2.16%). Locally, the main focus will rest on Friday's June CPI print.

- USD/IDR spot has also gravitated higher, with similar factors in play, the pair last near 16380. Spot USD/THB is also higher by around 0.25%, last near 36.80. We remain sub recent highs near 37.00. Earlier headlines crossed that foreign tourism arrivals are up 35% y/y for the first 6 months of 2024.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 02/07/2024 | 0730/0930 |  | EU | ECB's De Guindos chairing session on inflation | |

| 02/07/2024 | 0830/1030 |  | EU | ECB's Elderson chairs session on biodiversity | |

| 02/07/2024 | 0900/1100 | *** |  | EU | HICP (p) |

| 02/07/2024 | 0900/1100 | ** |  | EU | Unemployment |

| 02/07/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 02/07/2024 | 1030/1230 |  | EU | ECB's Schnabel chairing panel on Geopolitical shock and inflation | |

| 02/07/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 02/07/2024 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 02/07/2024 | 1330/1530 |  | EU | ECB's Lagarde in policy panel at ECB forum | |

| 02/07/2024 | 1330/0930 |  | US | Fed Chair Jerome Powell | |

| 02/07/2024 | 1400/1000 | *** |  | US | JOLTS jobs opening level |

| 02/07/2024 | 1400/1000 | *** |  | US | JOLTS quits Rate |

| 02/07/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for Cash Management Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.