-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: China Equities Lower Post CEWC

MNI EUROPEAN OPEN: Sharp Fall In China Bond Yields Continues

MNI EUROPEAN MARKETS ANALYSIS: NZ Rates Reprice On Orr's Latest Warning

- The USD has been pressured in the Asian session, with a bid in U.S. equity futures on the back of Nvidia's earnings spilling over.

- NZ rates reprice as RBNZ higher for longer messaging hits home.

- Eurozone GDP headlines the regional docket this morning, with comments from BoE's Mann, ECB's de Cos Riksbank's Floden also due. Further out we have US GDP and Initial Jobless Claims. Atlanta Fed President Bostic and SF Fed President Daly will cross.

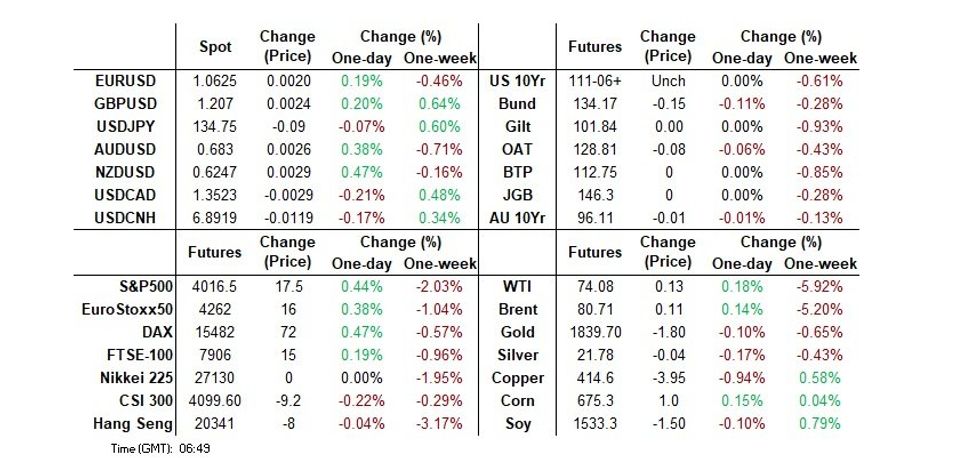

US TSYS: Narrow Ranges For Futures, Cash Re-opens In London

TYH3 deals at 111-07, +0-00+, operating in a narrow 0-03+ range on volume of ~83K.

- Cash Tsys remain closed due to the observance of a national holiday in Japan, re-opening in the London session.

- NY Fed President Williams was on the wires early in the session, he noted that the Fed is absolutely committed to a 2% inflation target, bringing little new to the policy debate as he cautioned that any moderation in inflationary pressure may not be as swift as hoped in the coming months.

- There was some very modest Asia-Pac pressure as cross-market flows from Antipodean rates spilled over, however there was little follow through, with liquidity hampered due to the cash closure.

- Ranges remained tight with little follow through on moves.

- This came after the minutes of the February FOMC meeting pressured Tsys off of best levels late Wednesday. The minutes noted that "a few" members supported hikes greater than 50bp. Rhetoric surrounding financial conditions provided a hawkish tinge.

- Eurozone GDP headlines the docket during the London morning. Further out we have U.S. GDP and Initial Jobless Claims. Comments from Atlanta Fed President Bostic and SF Fed President Daly will cross. We also have the latest 7-Year Tsy supply.

AUSSIE BONDS: Soft Wages Vs. Global Factors

A second-half reversal leaves YM -2.0 and XM -1.0 by the close after follow-up selling from the release of the FOMC minutes & weakness in NZGBs guided ACGBs lower early. Cash ACGBs close 1-2bp weaker with the 3/10 curve 1bp flatter.

- Swap rates are 2-3bp higher with 3-year underperforming.

- Bills close mid-range, 1-5bp weaker through the reds.

- RBA-dated OIS strip unwinds a part of yesterday’s soft WPI-induced move, firming 5-7bp for meetings beyond July with November leading. Terminal rate pricing pushes back to 4.27%. March meeting pricing remains at a 95% chance of a 25bp hike.

- On the local docket, Q4 Capex spending and investment intentions print stronger but fails to sustain an impact. Translation of this data into a market move tends to be more difficult during periods of high inflation because the price/volume split is unknown.

- Next week sees the local calendar deliver a batch of quarterly partials leading up to Q4 GDP on Wednesday. January reads on Retail Sales and Private Sector Credit are also due early in the week.

- Until then, the market is likely to be guided by abroad, with today's session throwing up a few questions about the longevity of yesterday's WPI-induced rally. ACGBs nonetheless delivered another 12bp outperformance versus NZGBs.

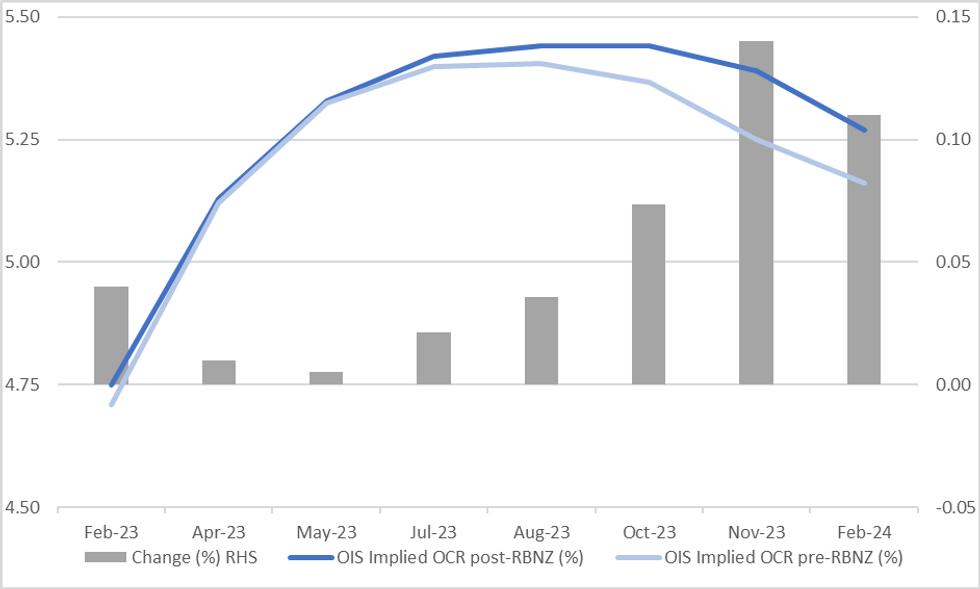

NZGBS: Upsized NZGB Supply & RBNZ Higher For Longer Talk Weighs

NZGBs weakened through Thursday's session, closing at cheaps, as the market comes to terms with the hawkish messaging from yesterday’s RBNZ policy decision and the bank’s subsequent communique. The overhang of potential supply resulting from the Government’s post-cyclone response also appears to have weighed on NZGBs with bonds underperforming swaps on the day.

- NZGBs close 13-14bp weaker across the curve versus a +5-9bp move in swaps.

- RBNZ-dated OIS's reaction to yesterday’s policy decision has centered on pricing for the late-23 meetings. With the RBNZ deciding to keep its peak OCR projection at 5.50% (albeit reached slightly later), highlighting the inflationary impact of Cyclone Gabrielle, alongside the chance of higher for longer rates (per comments from Governor Orr in a BBG interview). The market has lifted terminal OCR pricing to 5.45%, while scaling back easing expectations for later in the year. Pricing for the October and November meetings firmed 7bp and 13bp, respectively versus pre-RBNZ levels with the latter now only pricing in ~5bp of easing from 23bp a week ago and ~40bp at the start of February.

- With little on the local calendar until next week’s Q4 Retail Sales release, the market will have to find its direction from abroad, RBNZ communications and/or government announcements on its natural disaster recovery strategies.

FOREX: Greenback Pressured, US Equity Futures Boost Risk Sentiment

The USD has been pressured in the Asian session, a bid in US Equity futures driven by Nvidia issuing a strong revenue outlook for the current quarter spilled over into a wider risk appetite.

- Kiwi is the strongest performer in the G10 space at the margins, extending gains through the session. NZD/USD is ~0.5% firmer, last printing at $0.6245/50. RBNZ Gov Orr was on the wires this morning, he noted that it would take a significant inflation shock to return to 75bps and that he is confident of a return to low, stable inflation.

- AUD/USD is up ~0.4% and last dealt $0.6830/35. The pair has ticked away from lows seen late in yesterday's session having found support below $0.68. Q4 Private CapEx data printed at 2.2% above the 1.1% estimate, rising from -0.6% prior.

- USD/JPY is marginally softer, last printing at ¥134.75/85. Japanese markets are closed for the observance of a public holiday, which limited liquidity in JPY pairs.

- EUR and GBP are both ~0.1% firmer, benefiting from the moderate pressure on the greenback.

- US Equity futures sit higher in Asia, NASDAQ futures are up ~0.9% and S&P500 futures are ~0.5% firmer. BBDXY is down ~0.2%.

- In Europe today Eurozone GDP headlines the docket. Further out we have US GDP and Initial Jobless Claims. Atlanta Fed President Bostic and SF Fed President Daly will cross.

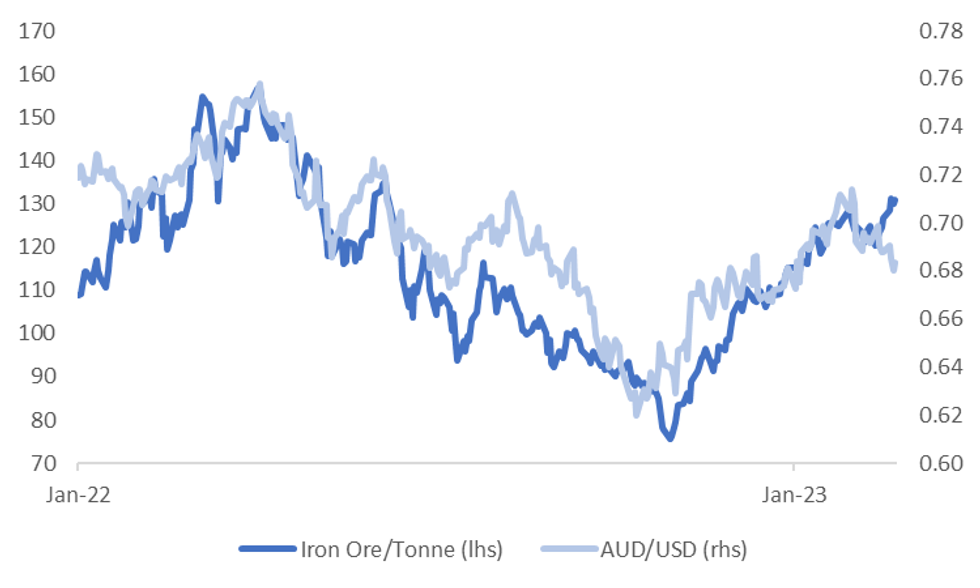

AUD: A$ Correlations Firm With Global Equities, Weakens With Iron Ore

AUD/USD correlations remain mixed with key macro drivers. The table below plots the levels correlation between the A$ and key macro drivers over the past week and month (note the yield spread variables are based off government bond yield differentials).

- For yield differentials, correlations are slightly lower over the past week. This is consistent with the recent RBA meeting now being behind us. Still, correlation levels remain positive, although more so for the past month.

- The trend in AU-US yield differentials has been broadly sideways the past week.

- Correlations with aggregate commodity indices is high, although much less so for base metals and iron ore. The correlation with iron ore over the past month is back to flat.

- The wedge between iron ore prices and AUD/USD has grown, see the Figure 1 below. As the chart suggests, the longer term correlation between the two series has been quite strong.

- A$ correlations with global equities remain quite firm, as signified by today's rebound in AUD, which is line with the firmer US equity futures tone.

Table 1: AUD/USD Correlations (Levels)

| 1wk | 1mth | |

| AU-US 2yr Spread | 0.15 | 0.70 |

| AU-US 5yr Spread | 0.44 | 0.82 |

| AU-US 10yr Spread | 0.26 | 0.76 |

| Global Commodities | 0.78 | 0.87 |

| Global Base Metals | -0.63 | 0.83 |

| Iron ore | -0.51 | -0.01 |

| Global equities | 0.85 | -0.04 |

| US VIX index | -0.59 | -0.64 |

Source: MNI - Market News/Bloomberg

Fig 1: AUD/USD & Iron Ore Prices

Source: MNI - Market News/Bloomberg

ASIA FX: Tech Sensitive Currencies Outperform

USD/Asia pairs are down for the session, although we are away from lows, as some modest USD support emerged this afternoon. KRW and TWD were the standouts, as tech equity sentiment rallied. Gains were more modest elsewhere. Taiwan IP figures for Jan are still due today, while Singapore IP prints tomorrow. Malaysia CPI is also due.

- USD/CNH was firmer in the early part of trade, holding close to Wednesday highs around 6.9080, which also coincides with the simple 200-day MA. We got to a low of 6.8840, but now sit back at 6.8920/30. Onshore equities are struggling for positive traction.

- 1 month USD/KRW sank to a low of 1292.70, but we are now back closer to 1296. A hawkish BoK hold helped from a rate perspective, although the +1% rise in the Kospi amid renewed tech optimism post the Nvidia result was arguably the bigger driver.

- USD/TWD is also 0.50% lower in spot terms for the session, with the pair last at 30.36. The Taeix has performed slightly better +1.30%.

- INR has dealt in narrow ranges this week, following the broader USD trend seen in recent dealing. USD/INR prints at 82.75/80 ~0.1% softer in early dealing, in line with lower USD indices but lagging higher beta FX. There still appears to be resistance above the 82.90 level. Local equities are firmer today, but still close to month to date lows (Nifty around 17570). Offshore investors continued to move back into local equities in the first part of the week ($181.2mn).

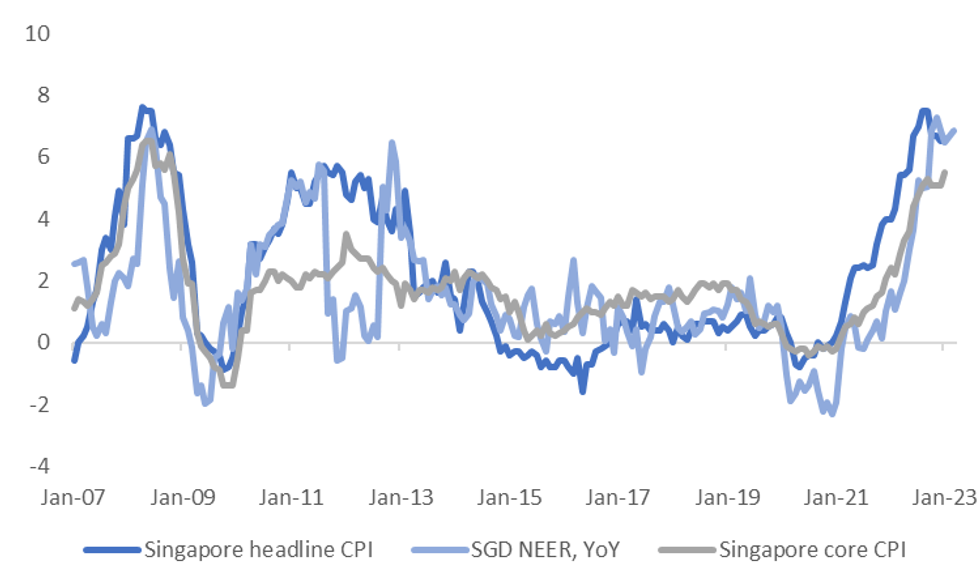

- Singapore headline CPI came in noticeably weaker than expected. Still, core printed at 5.5% y/y, which was less of a downside miss (5.7% forecast). Also, the m/m core number rose by 0.82%, the strongest for this cycle. The m/m sequence has been picking up since the Oct 0.10% outcome last year. This result may not be enough to tip the MAS to further tightening in April, but the result was not as weak as the headline implied. USD/SGD is higher post the result, up from 1.3380 level to 1.3400, although the USD is firmer, so that has likely played a role. The SGD NEER is also off earlier highs.

SGD: CPI Detail Firmer Than Headline Miss Suggests

The headline CPI came in noticeably weaker than expected, +6.6% y/y, versus +7.1% forecast. The Jan outcome was also only a modest step up from the 6.5% Dec pace. M/M the rise was 0.2% the same as Dec, which is a soft result given the GST hike. Still, core printed at 5.5% y/y, which was less of a downside miss (5.7% forecast).

- This measure also showed a pick up from the prior month (5.1%). Also, the m/m core number rose by 0.82%, the strongest for this cycle. The m/m sequence has been picking up since the Oct 0.10% outcome last year.

- The biggest downside surprise was in recreation and culture relative to recent trends (-1.6% m/m for Jan, +1.8% in Dec). Most other sub-categories recorded firmer m/m momentum.

- This result may not be enough to tip the MAS to further tightening in April, but the result was not as weak as the headline implied.

- The chart below overlays SGD NEER Y/Y against headline and core Y/Y outcomes.

- USD/SGD is higher post the result, up from 1.3380 level to 1.3400, although the USD is firmer, so that has likely played a role.

- The NEER (per Goldman Sachs estimates) has also edged lower, albeit at the margins. Now back to -0.60% from the top end of the band, we were closer to -0.50% earlier.

Fig 1: SGD NEER Y/Y Versus CPI (Headline & Core Y/Y)

Source: MNI - Market News/Bloomberg

EQUITIES: Tech Firms, Mixed Trends Elsewhere

Tech related plays in terms of the Kospi and Taiex have been the standout performers today. This followed strong earnings guidance from Nvidia in the US, which has also boosted US futures. Not surprisingly, the Nasdaq is leading the way, just off session highs currently, last +0.86%, while Eminis are +0.45%. Elsewhere the trends are more mixed, although note Japan markets are closed today.

- The HSI is up around 0.50% at this stage, with some positive spill over from tech moves elsewhere. The underlying tech index is +2%.

- China shares are close to flat. The CSI 300 last just above 4100. There wasn't much market impact from the headline that the authorities will push faster SOE profit growth this year, relative to GDP growth. Also note a number of schools halted classes due to covid clusters at the start of this week. This story was flagged at the beginning of the week.

- The Kospi is currently +1.1%, with offshore investors still modest sellers so far today (-$37.6mn), while the Taiex is +1.33%. Nvidia's upbeat outlook, particularly in the AI space is giving hope for the tech space amid weak chip demand elsewhere.

- India equities are struggling to stay in positive territory, while the ASX 200 fell by 0.37%.

GOLD: Bullion Close to 2023 Lows On US Rate Tightening Prospects

Gold prices fell by a moderate 0.5% on Wednesday. They were already falling in the lead up to the FOMC minutes which revealed that “a few” members called for a 50bp hike and the USD strengthened as a result. During APAC trading, bullion has been range bound and is up 0.1% to $1827.90/oz, close to the intraday high. The USD index is down 0.2%.

- Gold prices remain above support at $1819.00, the February 17 low, but are close to this 2023 low. They are trading between the 50-day and 100-day simple moving averages.

- Later the Fed’s Bostic and Daly speak. The Kansas and Chicago Fed indices and initial jobless claims print. There is also a revised estimate of Q4 US GDP.

OIL: Crude Higher As Increased China Demand Hopes Resurface

Oil prices have been gradually trending up during APAC trading after falling by around 3% on Wednesday after FOMC minutes revealed that “a few” members called for a 50bp hike and tightening fears grew. WTI is up 0.5% to around $74.35/bbl and Brent 0.5% to $81.00, both close to their intraday highs. The USD index is down 0.2%.

- Brent has been outperforming WTI on the back of growing US crude stockpiles and hawkish Fed repricing. WTI cleared support of $75.32, the February 17 low, on Wednesday and the next level to watch is $72.25, the February 6 low. Brent also broke through its support of $81.80 and the next level is at $79.10, the February 6 low.

- API reported a further build in US crude inventories of 9.895mn barrels after 10.507mn the previous week. Gasoline stocks rose 0.89mn and distillate 1.37mn. The official EIA data is out later today. Refining maintenance is resulting in crude being stockpiled.

- The market continues to hope for prices to rise on increased demand from China but forecasts are being revised down, as it appears that Russia is meeting much of additional Chinese consumption and a more hawkish Fed is being priced in.

- Later the Fed’s Bostic and Daly speak. The Kansas and Chicago Fed indices and initial jobless claims print. There is also a revised estimate of Q4 US GDP.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/02/2023 | 0930/0930 |  | UK | BOE Mann Speech at Resolution Foundation | |

| 23/02/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 23/02/2023 | 1100/0600 | * |  | TR | Turkey Benchmark Rate |

| 23/02/2023 | 1100/1100 | ** |  | UK | CBI Distributive Trades |

| 23/02/2023 | 1330/0830 | * |  | CA | Payroll employment |

| 23/02/2023 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 23/02/2023 | 1330/0830 | ** |  | US | Jobless Claims |

| 23/02/2023 | 1330/0830 | *** |  | US | GDP (2nd) |

| 23/02/2023 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 23/02/2023 | 1550/1050 |  | US | Atlanta Fed's Raphael Bostic | |

| 23/02/2023 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 23/02/2023 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 23/02/2023 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 23/02/2023 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 23/02/2023 | 1800/1300 | ** |  | US | US Treasury Auction Result for 7 Year Note |

| 23/02/2023 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 23/02/2023 | 1900/1400 |  | US | San Francisco Fed's Mary Daly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.