-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Oil Recovers Further As Tight Supply Offsets Risk Jitters

- Regional equity sentiment has stabilized somewhat, as the PBoC pledged policy support to aid the recovery. HK/China equities are off highs though. USD/Asia pairs are mixed as official rhetoric to USD strength picks up across the region. The PBoC also pledged to keep CNY stable.

- Oil prices have recovered further, with recent YTD highs for Brent back within striking distance. Tight supply appears to be dominating recent risk jitters.

- The BoJ minutes and the as expected Australian CPI haven't impacted sentiment. US Cash tsys sit 1-2bps richer across the major benchmarks, light bull flattening has been observed. Still, the USD has been supported against the majors on dips.

- Europe's docket is thin today, further out we have Durable Goods in the US.

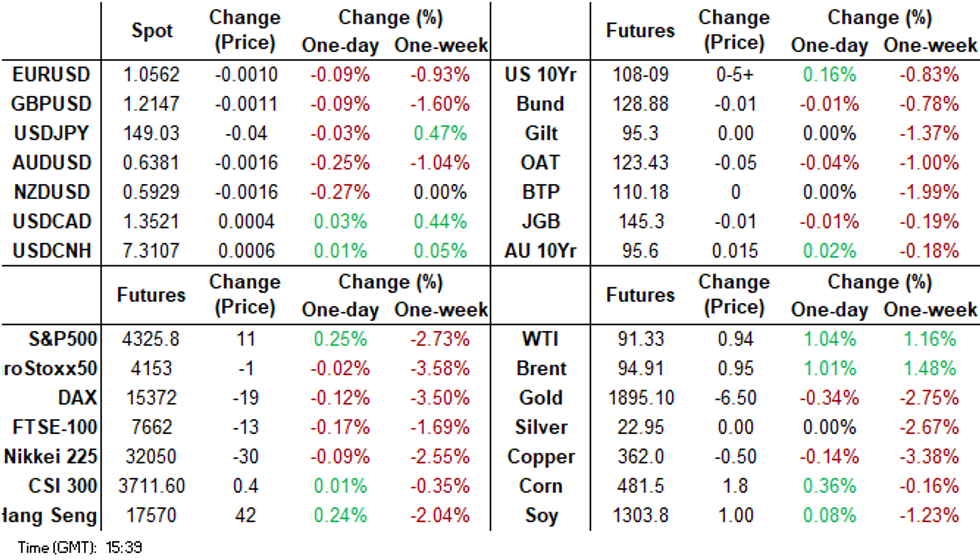

MARKETS

US TSYS: Marginally Richer In Asia

TYZ3 deals at 108-09+, +0-06, a 0-06 range has been observed on volume of ~63K.

- Cash tsys sit 1-2bps richer across the major benchmarks, light bull flattening has been observed.

- Tsys extended the move seen late in Tuesday's NY session as participants faded the recent cheapening, perhaps using the opportunity to close out short positions/add fresh longs.

- Gains were marginally extended as regional equities firmed after the PBOC noted that they will implement monetary policy in a precise and forceful manner, as well as focus on expanding domestic demand.

- Tsys pared gains and observed narrow ranges for the remainder of the session.

- Europe's docket is thin today, further out we have Durable Goods. Fedpseak from Gov Bowman and Minneapolis Fed President Kashkari will cross. We also have the latest 5-Year Supply

JGBS: Futures Are Holding Uptick, Mid-Range, 2Y Supply Tomorrow

JGB futures are holding in the middle of the Tokyo session range, +3 compared to the settlement levels.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined BOJ Minutes for the July meeting. Of note, many members said hitting the BOJ’s inflation target was not yet in sight.

- Leading and Coincident Indices and Machine Orders are due soon.

- The cash JGBs are dealing mixed, with yields 1.4bps higher to 0.4bp lower. The benchmark 10-year yield is 0.2bp lower at 0.739%, above BOJ's YCC soft limit of 0.50% but below its hard limit of 1.0%. It is also lower than the cycle high of 0.756%, set prior to the recent BOJ decision.

- The swaps curve has twist-steepened, pivoting at the 7s, with rates 0.5bp lower to 1.4bps higher. Swap spreads are wider beyond the 3-year.

- Tomorrow the local calendar sees International Investment Flow data, along with 2-year supply.

- Later today sees US Durable Goods. Fedspeak from Gov Bowman and Minneapolis Fed President Kashkari will cross. There is also 5-year US tsy supply.

BOJ: MNI BRIEF: Most Members Want More Flexibility - BOJ Minutes

Most Bank of Japan board members believe the Bank should allow greater flexibility in the conduct of yield curve control to sustain monetary easing amid high uncertainty for prices, according to the July 27-28 meeting minutes released Wednesday.

“Some members were of the view that, if upward movements in prices continued, allowing to some extent a rise in long-term interest rates would enable the BOJ to maintain the positive effects of monetary easing through the channel of real interest rates, while alleviating, for example, a decline in the functioning of bond markets,” the minutes showed.

One member said keeping long-term interest rates stable at low levels to achieve the 2% price-stability target was important, the minutes showed. The same member noted, until the likelihood of achieving the target rose sufficiently, the BOJ should maintain YCC with greater flexibility.

Several members noted significant downside risks to Japan's economic activity and prices existed, especially with regard to the impact of overseas economies. However, some members stressed the BOJ must clearly explain allowing greater YCC flexibility was not a step toward an exit from monetary easing, "and there was no change in its stance of patiently continuing with such easing,” the minutes showed."

BOJ: MNI BRIEF: Members See High Chance of Wage Hikes - BOJ Minutes

Several Bank of Japan board members noted wages will likely rise next year, however, they stressed the Bank needed to clarify its wage-hike outlook, according to the July 27-28 meeting minutes released on Wednesday.

“Members shared the recognition that, in projecting future price developments, it was important to determine whether changes in firms' wage- and price-setting behaviour would progress and wage hikes would continue next year and beyond,” the minutes showed.

“One member – noting that the inflation rate was likely to fall below the 2% level in the second half of fiscal 2023 – expressed the view that, in order for this rate to then rise again to 2% and continue to stay at that level in a stable manner, it was important that a trend in which wage growth surpassed the rate agreed in the 2023 annual spring labor-management wage negotiations took hold.”

However, another member expressed the view that the profitability of small and medium-sized firms was weak, as evidenced by about 60% of them operating at a loss, and it was necessary to confirm whether wages would rise across a wider range of such firms in future.

AUSSIE BONDS: Slightly Richer, Post-CPI Rally Unwound, Retail Sales Tomorrow

ACGBs (YM +2.0 & XM +2.0) sit in the middle of the Sydney session range. While the CPI Monthly for August printed in line with expectations at 5.2% y/y, the domestic market managed to firm 2bps in the aftermath. That move was assisted by a strengthening in US tsys in early Asia-Pac trade. At the time of writing, the post-CPI strength in ACGBs has been unwound, despite US tsys holding 1-3bps richer across the major benchmarks.

- (AFR) Inflation has accelerated for the first time in four months, as expensive fuel and cost pressures in labour-intensive services pushed up annual consumer prices by 5.2 per cent to keep alive the chance of another interest rate rise. (See link)

- Cash ACGBs are 2bps richer on the day, with the AU-US 10-year yield differential at -14bps.

- Swap rates are 2-3bps lower on the day.

- The bills strip is richer, with pricing flat to +2.

- RBA-dated OIS pricing is flat to 3bp softer across meetings.

- Tomorrow the local calendar sees Job Vacancies (Q3) and Retail Sales (Aug).

AUSTRALIAN DATA: MNI BRIEF: Aussie Monthly CPI Rises To 5.2%

Australia’s monthly consumer price index (CPI) indicator rose 5.2% y/y in August, in line with market expectations and up from July’s 4.9%, according to Australian Bureau of Statistics data released Wednesday.

CPI excluding volatile items and holiday travel rose 5.5%, down from the rise of 5.8% in July, while annual trimmed mean inflation printed at 5.6%, flat against July. “The most significant price rises were housing (+6.6%), transport (+7.4%), food and non-alcoholic beverages (+4.4%) and insurance and financial services (+8.8%),” the ABS said.

NZGBS: Closed At Best Levels, Tracking Tsys, Business Confidence Tomorrow

NZGBs concluded the session on a positive note, witnessing a 4bp drop in benchmark yields. In the absence of domestic catalysts, recent shifts in the local market have been primarily influenced by developments in US tsys. Notably, the NZ-US and NZ-AU 10-year yield differentials were relatively stable throughout the day.

- US tsys are holding richer in Asia-Pac trade. Ranges remain narrow, with little meaningful macro news flow crossing. This leaves cash tsys 1-3bps richer across the major benchmarks.

- Swap rates are 4-5bps lower, with implied swap spreads slightly tighter.

- RBNZ dated OIS pricing is little changed across meetings, with terminal OCR expectations steady at 5.76%.

- Bloomberg reports that the RBNZ announced that it bought a net NZ$84m in August, after a net sale of NZ$3.96bn in July.

- Tomorrow the local calendar sees ANZ Business Confidence.

- Later today sees US Durable Goods. Fedspeak from Gov Bowman and Minneapolis Fed President Kashkari will cross. There is also 5-year US tsy supply.

EQUITIES: China/HK Equities Higher On PBoC Policy Pledge

Regional equities are mixed in the first part of Wednesday Asia Pac trade. There have been pockets of strength, most notably in HK and China markets. Losses elsewhere haven't been as large as implied by US weakness in Tuesday trade. US equity futures are a touch higher at this stage. Eminis near 4323, +0.18%, while Nasdaq futures are up by close to the same amount. Eminis are only a touch above fresh lows going back to mid June.

- In the cross-asset space, US nominal yields are touch lower, which is potentially aiding US equity futures, but overall moves are modest. USD dips are being supported though.

- HK and China equities enjoyed early positive momentum, but we sit off session highs for major indices. At the break the HSI is +0.64%, the CSI 300 +0.31%.

- Early positive momentum reflected PBoC headlines, where the central bank stated it will use 'precise, forceful policy' to boost the recovery. August profit data also showed some improvement, with profits up 17.2% y/y (prior -6.7%), although base effects played a role.

- Real estate jitters persist, following reports that the Evergrande Chair was under police watch. The CSI 300 real estate sub index is down slightly in the first part of trade.

- Japan markets are down modestly, the Nikkei 225 off 0.35%. The Taiex is off 0.12%, despite a sharp dip in the SOX during US Tuesday trade. The Kospi is down further, off 0.30%. Local news wire Yonhap reported that key chipmakers (including Samsung) may get an indefinite waiver over chip export controls to China.

- In SEA, Indonesian and Philippine stocks are higher, while modest losses are evident elsewhere.

FOREX: USD Marginally Firmer In Asia

The greenback has marginally extended recent gains in Asia on Tuesday, BBDXY is up ~0.1% and sits above yesterdays highs. The advance in the USD was seen alongside Tsys and US Equity Futures retreating from session highs.

- Kiwi is the weakest performer in the G-10 space at the margins, NZD/USD is down ~0.3% last printing at $0.5925/30. The pair now sits below the 20-day EMA, bears target low from Sep 21 ($0.5896) and $0.5859 (6 Sep low).

- AUD is also pressured, AUD/USD was unable to hold early gains above the $0.64 handle and sits at $0.6380/85. The trend condition remains bearish, support comes in at $0.6357, low from Sep 6 and bear trigger.

- Yen sits a touch above the ¥149 handle, there has been no follow through on moves today thus far. The trend continues to be bullish, resistance comes in at ¥149.10, High from Oct 25 2022, and ¥147.71, high from Oct 24 2022. Support is at ¥147.29, the 20-Day EMA.

- Elsewhere in G-10, EUR and GBP are following the broader USD trend and are down ~0.1%.

- There is a thin docket in Europe today.

OIL: Recovery Extends Further, As Supply Fears Dominate, US Inventories Eyed Later

Oil has continued to recover, building on Tuesday's gains. Brent sits near $94.90/bbl, comfortably above late Asia Pac Tuesday lows sub $92/bbl. The benchmark contract is up a further ~1%, following Tuesday's +0.72% gain. WTI was last near $91.35/bbl, up by a similar magnitude in Tuesday trade to date.

- Supply side concerns appear to be trumping broader risk jitters/USD strength.

- Official data on inventories, due later in US trade may see another draw in crude inventories. This follows API data suggesting as much, which were released on Tuesday, per Bloomberg reports.

- Near term spreads in WTI contracts also continue to highlight a very tight supply backdrop.

- The recent recovery in Brent is bringing recent YTD highs back into play. Resistance is seen at $95.96 (Sep 19 high) and support at $91.12 (20-day EMA).

GOLD: Steady After Being Down Sharply On Tuesday

Gold is little changed in the Asia-Pac session, after closing -0.8% at $1900.65 on Tuesday, off a low of $1899.24. Bullion’s decline appeared attributable to the combination of a stronger USD and yields hovering at cycle highs.

- US tsys gave up early gains to finish slightly mixed. The fear of a higher-for-longer policy stance by global central banks continued to weigh and was exacerbated after JPMorgan's Dimon noted the potential for a 7% rate as a worst-case scenario. Additionally, the threat of a government shutdown this weekend and Moody's ratings warning probably left bond buyers sidelined.

- The US Treasury 10-year yield finished at 4.54%, just below its highest level since 2007, after being 8bps lower in early trade.

- From a technical standpoint, Tuesday’s low for gold tested $1901.1 (Sep 14 low) after which lies the bear trigger at $1884.9 (Aug 21 low).

- The market for bullion in China has surged this month, at times commanding a record premium over international prices of more than $100 an ounce, compared with an average over the past decade of less than $6. (See link)

SOUTH KOREA DATA: Manufacturing Sentiment Softens, Export Expectations Dip

The October BoK manufacturing and service business sentiment readings were mixed. On the manufacturing side the headline index slipped to 67, from 69 in September. We are above earlier 2023 lows of 65, but only at the margin.

- Most of the detail was softer relative to the September read. New orders fell to 73 from 75, while inventories climbed to 106 from 102. Domestic sale expectations also slipped.

- The export outlook fell noticeably, back to 62 from 66 in September. This puts the export index back to March lows.

- The chart below overlays this index against South Korea y/y export growth. It is not suggesting much of a rebound at this stage.

Fig 1: South Korean Manufacturers Export Expectations & Exports Y/Y

Source: MNI - Market News/Bloomberg/BOK

- Sentiment was better in the services or non-manufacturing side. We ticked up to 77 in October from 76 in September. Most of the sub-indices improved, although we are comfortably below 2022 highs.

ASIA FX: Official Rhetoric Steps Up To USD Strength

Rhetoric from a number of central banks rose again today around USD strength. The PBoC pledged to keep CNY stable, the South Korean FinMin stated it will act on FX if needed, while BI said it will be in the market to ensure supply/demand balance. The BoT decision is still to come, it remains a close call between no change and a +25bps move. Outside of Thailand industrial production, the data calendar is light tomorrow.

- USD/CNH dipped in early trade, as we had another much stronger than expected CNY fixing, while the PBoC pledged policy support to bolster the recovery. It also stated it will keep CNY stable and curb excessive moves. Onshore and HK equities opened higher, but are away from best levels. USD/CNH couldn't get sub 7.3000. The pair last tracks near 7.3120. Spot USD/CNY is back above 7.3050.

- 1 month USD/KRW sits lower, last near 1347. Earlier highs were at 1353.40. Onshore equities are lower, but only modestly at -0.20%. Local news wire Yonhap reported that key chipmakers (including Samsung) may get an indefinite waiver over chip export controls to China. The FinMin also stated that the country will take steps on FX if needed.

- Spot USD/HKD sits above recent lows. The pair last near 7.8210. Earlier highs were seen close to 7.8240, while Monday's low was just under 7.8140. Broader USD gains have likely slowed HKD appreciation to some extent, with the BBDXY pushing to fresh YTD highs in recent sessions. Yield differentials have nudged back in favor of the USD but only at the margin. The 3-month US-HK spread sits back at +17bps, we were +13.5bps yesterday.

- The Rupee has opened dealing in line with yesterday's closing levels, USD/INR last prints at 83.21/24. On Tuesday firmer Oil prices and broader USD flows saw USD/INR firm ~0.3% to sit a touch off YTD highs and within sight of all time highs for the pair. Equity outflows continued on Monday with ~$167mn in net outflows, this brings the total in September to ~$1.67bn in total outflows on track be to the highest on record.

- USD/MYR has printed a fresh YTD high breaking above the 4.70 handle for the first time since November 2022 as the higher for longer Fed mantra boosts the USD. The data docket is empty this week, the next data of note is next Monday's S&P Global MFG PMI for September.

- The SGD NEER (per Goldman Sachs estimates) sits a touch off yesterdays cycle highs, holding a narrow range this morning. We now sit ~0.5% below the top of the band. Broader USD trends continue to dominate flows for USD/SGD, the pair printed a fresh cycle high as the USD continues to strength as the higher for longer rates narrative continues to be the main driver in USD/Asia. The pair is up ~0.1% last printing at $1.3705/10.

- The path of least resistance for USD/IDR still appears skewed higher. The pair is making fresh highs above 15500 in the first part of trading today (last at 15543), off 0.34% in IDR terms. The combination of weaker global equity market sentiment, higher US real yields and broader USD gains all appear to be weighing on the rupiah. BI reiterated that it remains in the market to maintain supply/demand balance.

- USD/PHP sits at 56.935, which is down from earlier highs near 56.98. Lows for the session sit just under 56.90. The near-term focus remains on whether we can test above the 57.00 level, which has been a resistance point in recent months and a likely BSP intervention zone (something hinted at in terms of recent official rhetoric).

- USD/THB has risen to fresh highs of 36.565, a loss of 0.55% in baht terms. We still have the BoT decision to come. We sit in the +25bps hike camp, but it is likely to be a very close call.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 27/09/2023 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 27/09/2023 | 0645/0845 | ** |  | FR | Consumer Sentiment |

| 27/09/2023 | 0700/0900 | ** |  | SE | Economic Tendency Indicator |

| 27/09/2023 | 0800/1000 | ** |  | EU | M3 |

| 27/09/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 27/09/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 27/09/2023 | 1230/0830 | ** |  | US | Durable Goods New Orders |

| 27/09/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 27/09/2023 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 27/09/2023 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.