-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free Access*MNI EUROPEAN MARKETS ANALYSIS: Oil & The USD Weaken Ahead Of US Thanksgiving Holiday

*Correct title

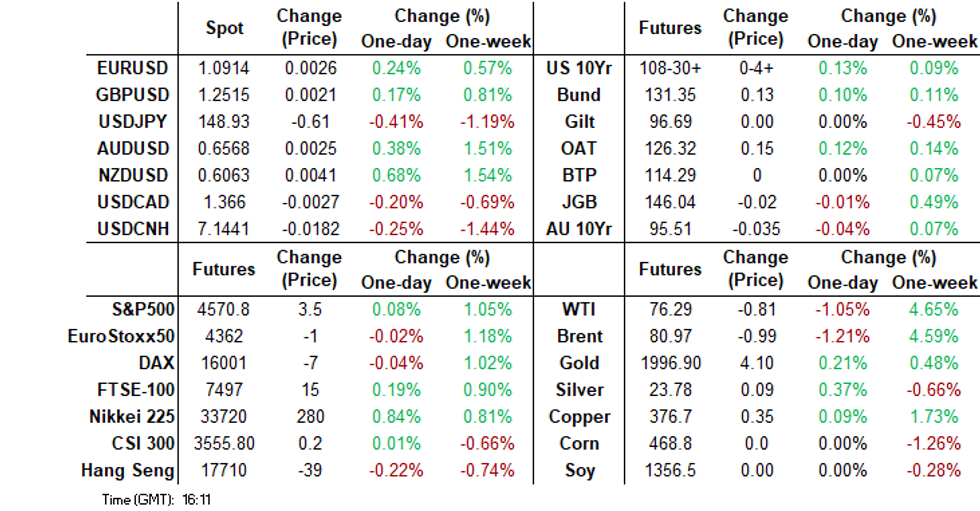

- There was no US cash Tsy trade today, due to the observance of the US Thanksgiving Holiday. Japan markets were also closed, but return tomorrow. TY ticked higher in early trade, the move was seen alongside a fall in Oil prices as Asian participants digested Wednesday's news of a delayed OPEC meeting.

- Brent and WTI are off 1%, although both benchmarks are above Wednesday session lows. Iron ore also fell, as verbal rhetoric came from the China authorities stepped up.

- This didn't impact AUD though, which has been on the front foot for most of the session. NZD has been the best performer though, up nearly 0.70%. JPY has also risen, +0.40%.

- Looking ahead, flash PMIs from Europe and the UK provide the highlight today.

MARKETS

US TSYS: TY Marginally Firmer In Light Trade, Cash Closed Today

TYZ3 deals at 108-29, +0-03, a 0-04 range was observed on volume of 22k.

- A reminder that cash tsys are closed today due to the observance of the US Thanksgiving Holiday.

- TY ticked higher in early trade, the move was seen alongside a fall in Oil prices as Asian participants digested Wednesday's news of a delayed OPEC meeting.

- The move higher didn't follow through and TY sat in a narrow range for the most part.

- Technically the bullish theme remains intact; resistance is at 108-08+ high from Nov 17, support comes in at 108-05 the 50-Day EMA.

- The docket is thin for the reminder of today's session.

AUSSIE BONDS: Cheaper, Narrow Ranges, AU-US10Y Spread Too Low

ACGBs (YM -6.0 & XM -4.0) are cheaper, but off the worst levels, after dealing in narrow ranges during the Sydney session ahead of the US Thanksgiving holiday. Japan was out today in observance of their Labour Thanksgiving holiday.

- The local calendar provided few domestic drivers, with the previously outlined flash Judo Bank PMI data as the sole release.

- Accordingly, today’s heavy price action can be largely attributed to RBA Governor Bullock’s relatively hawkish speech after-market yesterday. In summary, the Governor noted that the final stretch of reducing inflation to target will take longer than the initial leg. Additionally, she stated that “the remaining inflation challenge we are dealing with is increasingly homegrown and demand-driven”.

- Cash ACGBs are 4-6bps cheaper, with the AU-US 10-year yield differential 5bps higher at +8bps. A simple regression of the AU-US cash 10-year yield differential and the AU-US 1Y3M swap differential over the current tightening cycle indicates that the 10-year yield differential is currently 12bps too low versus its fair value. (See link)

- Swap rates are 4-6bps higher, with the 3s10s curve flatter.

- The bills strip is cheaper, with pricing -4 to -8.

- Tomorrow, the local calendar is empty, with the next key release being Retail Sales on Tuesday.

AUSSIE BONDS: AU-US 10-Year Yield Differential Too Tight

Today, the AU-US 10-year cash yield differential is 4bps higher at +7bps following a relatively hawkish speech from RBA Governor Bullock after-market yesterday. The Governor noted that the final stretch of reducing inflation to target will take longer than the initial leg.

- Additionally, she noted that “the remaining inflation challenge we are dealing with is increasingly homegrown and demand-driven…a more substantial monetary policy tightening is the right response to inflation that results from aggregate demand exceeding the economy’s potential to meet that demand”.

- At +7bps, the cash AU-US 10-year yield differential currently sits near the middle of the range of +/-30bps which has been observed since November.

- The underperformance in the ACGB 10-year since early October can be attributed to a 55bp widening in the AU-US 3-month swap rate 1-year forward (1y3m) over that period. The 1y3m differential is a proxy for the expected relative policy path over the next 12 months.

- However, a simple regression of the AU-US cash 10-year yield differential and the AU-US 1Y3M swap differential over the current tightening cycle indicates that the 10-year yield differential is currently 12bps too low versus its fair value (i.e., +7bp versus +19bp).

Figure 1: AU-US Cash 10-Year Yield Differential (%) Vs. Regression Fair Value (%)

Source: MNI – Market News / Bloomberg

NZGBS: Closed With A Bear-Flattening Ahead Of US Thanksgiving

NZGBs closed 2-9bps cheaper, with the 2/10 curve at the session’s flattest level. Today’s move is consistent with developments in other $-Bloc markets ahead of the US Thanksgiving holiday.

- The US finished yesterday’s session with a bear flattening following stronger-than-expected initial jobless claims and higher-than-expected U of M inflationary expectations.

- The ACGB curve has bear-flattened today following a relatively hawkish speech from RBA Governor Bullock after-market yesterday. The Governor noted that “the remaining inflation challenge we are dealing with is increasingly homegrown and demand-driven…a more substantial monetary policy tightening is the right response to inflation that results from aggregate demand exceeding the economy’s potential to meet that demand”.

- The NZ 10-year underperformed its US counterpart by 3bps, but the NZ-AU 10-year yield differential closed 2bp tighter.

- Swap rates closed 3-8bps higher, with the 2s10s curve flatter and implied swap spreads little changed.

- RBNZ dated OIS pricing closed 2-7bps firmer for meetings beyond Feb’24. Terminal OCR expectations closed unchanged at 5.54%.

- Tomorrow, the local calendar sees Q3 Retail Sales Ex-Inflation.

- Bloomberg reported that negotiations to form NZ’s next government have concluded, with details to be announced tomorrow, Prime Minister-elect Christopher Luxon said. (See link)

EQUITIES: Mixed Trends, Better China Property Sentiment Doesn't Aid Aggregate Indices

Regional Asia Pac equities are mixed. There has been focus on China property related stocks, given announcements over the past 24 hours, but this hasn't done much for aggregate indices in China or Hong Kong into the break. US equity futures sit close to flat for both Eminis and the Nasdaq. Proximity to the Thanksgiving holiday coming up in the US may be keeping liquidity and interest lighter. Note Japan markets are also closed today.

- At the break, the CSI 300 real estate sub index sits +2.91% firmer, not too far off session highs. Late yesterday the authorities released a draft of property developers to be included in terms of funding support, with troubled names such as Country Garden included in the list, while Shenzhen has also eased second home buying rules (BBG).

- Still, the CSI aggregate index sits around flat at the break. More concerns in the shadow banking sector may be presenting a headwind (see this BBG link). The HSI is off 0.37% at the break, although the mainland properties index is outperforming at +4.26% higher.

- Elsewhere, South Korea (Kospi -0.10%) and Taiwan markets (Taiex -0.30%) are down modestly.

- For the ASX 200, we are off 0.61% at this stage, with miners underperforming. A sharp pull back has been evident in iron ore prices, as China's NDRC stated it would increase supervision in the sector.

- In SEA, trends are mixed. Indonesia stocks are outperforming, up +1.3%. Thailand's SET is underperforming, down -0.60%.

FOREX: Kiwi Standout Performer In Asia

The Kiwi is the strongest performer in the G-10 space at the margin today. The greenback has ticked lower amid thin holiday trade, US and Japanese cash markets are closed, BBDXY is down ~0.1%. Oil has ticked lower, as Asian participants digested Wednesday's news of a delayed OPEC meeting. US Equity futures are little changed. A firmer than expected Yuan fixing by the PBOC weighed on the USD with losses marginally extending through the session.

- NZD/USD prints at $0.6045/50, the pair is ~0.5% firmer today. Bulls remain focus on the 200-Day EMA ($0.6062). PM-Elect Luxon noted today taht he is aiming to be sworn in as PM on Monday as government formation talks have concluded.

- AUD/USD is up ~0.2% however a $0.6040/60 range has been observed for the most part. Judo Bank PMIs remain in contractionary territory, flash November prints were 47.7 (mfg) 46.3 (Services) and 46.4 (Composite) with all three ticking lower from the October reads.

- Yen is firmer and has ticked away from yesterday's session highs, however the ¥149 handle remains intact. Technically the recent weakness looks like a correction, resistance comes in at ¥149.75 high from Nov 22. Support comes in at ¥147.15, low from Nov 21.

- Elsewhere in G-10 SEK is ~0.3% higher however liquidity is generally poor in Asia.

- Flash PMIs from Europe and the UK provide the highlight today.

OIL: Biased Lower On OPEC Meeting Delay

Oil has spent the first part of the Thursday session under pressure, although much of the damage was done at the open, as Asia Pac markets digested Wednesday's news of a delayed OPEC meeting. Brent fell sharply to a low of $80.55/bbl after opening at $81.60/bbl. We have recovered some ground since then but have been unable to get back above $81/bbl (last near $80.85/bbl). We sit 1.35% weaker at this stage, with WTI off by 1.20% and last near $76.20/bbl.

- Focus will be on the delayed OPEC + meeting, now scheduled for November 30th (instead of November 26th). Analysts from Citi note this is unlikely to change the outcome around Saudi Arabia rolling its 1mln barrel cut into 2024 (see this BBG link).

- Other indicators suggest reduce tightness in the market though, the Brent prompt spread back close to flat, after being above $2 at the end of October. This is consistent with rising inventory levels in the US.

- Note subdued trading may be evident in the US session, given the Thanksgiving holiday.

- For WTI, moving average studies are in a bear-mode position, highlighting bearish sentiment. The focus is on $70.96, a Fibonacci retracement. Key resistance is at $79.65, the Nov 14 high.

- For Brent, it is a similar backdrop. Note the 20-day EMA is around $83.30/bbl, while on the downside Nov 16 lows rest at $76.60/bbl.

IRON ORE: Space Pressured On Thursday

SGX Iron Ore futures are down ~2.5% on Thursday, the NDRC in China have noted today that they would increase supervision, crack down on illegal activities, and maintain the normal order of the market (BBG).

- The December last prints at $131.60/tonne, a low of $130.15/tonne was printed before losses were pared.

- Technically support comes in at $130/tonne, then the 20-Day EMA ($126.55).

GOLD: Slightly Stronger After Wednesday’s Drop On The Back Of A Stronger USD & Higher Yields

Gold is +0.4% in the Asia-Pac session, after closing 0.4% lower at $1990.17 ahead of the US Thanksgiving holiday.

- The stronger greenback weighed on the precious metal at the margin, with spot gold consolidating back below the 2,000/oz mark for now.

- A bear-flattening of the US tsy curve, with yields flat to 3bps higher, also pressured bullion. US jobless claims and UofM inflation expectations data were not US Treasuries-friendly, sending yields higher led by the 5s.

- According to MNI’s technicals teams, the trend condition in gold remains bullish and this week’s gains reinforce this condition. The move higher signals scope for a test of key short-term resistance at $2009.4, the Nov 7 high. Clearance of this hurdle would confirm a resumption of the uptrend and pave the way for a climb towards $2022.2, the May 15 high.

ASIA FX: USD/Asia Pairs Move Lower, BI Decision Still To Come

USD/Asia pairs have mostly moved lower as today's session has progressed. A weaker USD tone against the majors has helped, while equity sentiment has been mixed within the region. Still to come is the BI decision, with no change expected. Taiwan IP also prints later. Tomorrow, we have Malaysian CPI and Singapore IP on tap.

- USD/CNH is close to session lows, last near 7.1475. This is 0.20% stronger in CNH terms but still comfortably above Wednesday lows near 7.1320. The USD/CNY fixing dipped further despite USD stability, although the initial reaction in CNH was muted. Property related stocks are much firmer, although overall equity trends are only marginally positive. Broader USD weakness, (BBDXY off 0.20%) has not doubt helped the yuan today.

- USD/IDR is a touch firmer as we head towards the BI decision later. The pair last just under 15590. An earlier move above 15615 drew selling interest, while on the downside we haven't been sub 15585 so far today. These moves follow yesterday's sharp IDR sell off (down nearly 0.90% in spot terms), which BI stated related to temporary corporate USD demand. The BI is expected to remain on hold later. As we noted in our preview, while the central bank has a number of existing and new instruments to ensure FX stability, given recent currency depreciation it is unlikely to want to risk destabilising the IDR by easing monetary policy ahead of the Fed.

- The Rupee is little changed from opening levels, ranges have been narrow today and the drop in Oil prices has not yet weighed on USD/INR. Oil prices as Asian participants digested Wednesday's news of a delayed OPEC meeting, WTI is down ~1%. USD/INR prints at 83.3300/75.

- Ringgit is marginally pressured in early trade on Thursday as Thursday's uptick in US Tsy Yields weighs in early dealing. USD/MYR is ~0.2% firmer this morning, last printing at 4.6830/80. The local docket is empty today, tomorrow October CPI is due and is expected to print at 1.9% Y/Y.

- The SGD NEER (per Goldman Sachs estimates) is little changed this morning, we remain a touch off recent cycle highs. The measure sits ~0.3% below the top of the band. USD/SGD firmed above the $1.34 handle yesterday trimmed some of the losses since in November thus far. USD/SGD deals at $1.3405/10 a touch below opening levels. CPI in October was firmer than expectations, headline CPI printed at 4.7% Y/Y (exp 4.5%) and Core CPI printed at 3.3% Y/Y (exp 3.1).

- USD/PHP sits just below 55.45 in recent dealings, a touch lower for the session (we closed yesterday at 55.48). Earlier session highs were at 55.54. Recent lows from Tuesday rest in the 55.30/35 region. The pair is comfortably sub all key EMAs. PHP has been mid-range for the past week in terms of relative EM Asia FX performance, trailing CNH & CNY but outperforming KRW and IDR. Offshore developments/broader USD trends are likely to be key for PHP. USD/PHP finding a near term trough has coincided with stability in broader dollar trends.

- USD/THB sits near 35.24 in recent dealings, not far from session highs for the week. This puts the baht around 0.10% weaker since yesterday's close. Recent lows rest close to the 35.00 figure level. October tourism arrivals were 2.2million. A slight uptick on the September number but still down on July highs around 2.5 million. The authorities will be hoping for firmer momentum through NOv/Dec, which is typically stronger from a seasonal standpoint. Earlier the BoT Governor spoke and stated that the economy needs fiscal and monetary space, while PM Srettha stressed the need for cash handouts to boost the economy.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 23/11/2023 | 0700/0800 | ** |  | NO | Norway GDP |

| 23/11/2023 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 23/11/2023 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 23/11/2023 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 23/11/2023 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 23/11/2023 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 23/11/2023 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 23/11/2023 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 23/11/2023 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 23/11/2023 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 23/11/2023 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 23/11/2023 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 23/11/2023 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 23/11/2023 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 23/11/2023 | 1330/0830 | * |  | CA | Quarterly financial statistics for enterprises |

| 24/11/2023 | 2330/0830 | *** |  | JP | CPI |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.