-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US MARKETS ANALYSIS - Tsys Through First Support

MNI US OPEN - RBA Holds, Communication Turns Slightly Dovish

MNI EUROPEAN MARKETS ANALYSIS: Recent Copper Correction May Be Signaling Softer Growth Outlook

- Yen gains have continued to dominate the G10 FX space, with notable outperformance against NZD and AUD. Risk off from equities, softer commodities and proximity to next week's BoJ meeting all in play.

- Elsewhere, JGB futures are weaker, -11 compared to settlement levels, but off session lows seen in the aftermath of today’s lacklustre 40-year auction. In US Tsys, it has been a subdued trading day in Asia today, yields are flat to 1bps lower.

- Asian markets are mostly lower today, following losses on Wall Street and disappointing earnings from major tech companies. We also look at the recent copper correction and whether it is signaling softer global growth ahead.

- Later the Fed’s Bowman and Logan give remarks and the ECB’s Buch, Lane and de Guindos appear. The Bank of Canada decision is also announced – a 25bp cut is forecast. In terms of data, US/European preliminary July PMIs and US June trade and new home sales are released.

MARKETS

GLOBAL: Recent Copper Correction May Be Signalling Softer Growth Outlook

LME copper prices are down 2.5% m/m in July to date after falling 4.6% in June and even though they are off their May peak they are still up 11% y/y. Copper is often a good indicator of global industrial production growth, as it is a common input across sectors, and this year’s rally is signalling that there could be a pick up in the data before IP slows again with trade flows following, which is important for Asia. Other indicators aren’t as positive though.

Global IP y/y% vs copper prices

Source: MNI - Market News/Refinitiv

- Copper prices may be overstating IP strength given supply disruptions contributed to prices rise. Uncertainty over China’s demand, given ongoing property woes, disappointing data and rate cuts, weighed on prices in June/July. But the overall demand outlook remains robust as the electricity sector accounts for almost 30% of global copper consumption, according to ANZ estimates. With continued rollouts of renewables, EVs and infrastructure that seems unlikely to change for now.

- The JP Morgan Global manufacturing PMI has indicated muted activity growth through 2024 with a slight pickup in Q2. The index is up almost 2 points since end 2023 though. The PMI as well as economic surprise indices are not as optimistic as copper prices about the outlook for IP growth. Preliminary US/European PMIs released today should give an indication before the global PMI is out August 1.

- Global IP growth as measured by the Dutch CPB improved to 2.3% y/y in April from 1.5% in January, close to the historical growth rate. But 3-month momentum has slowed since September last year and unlike copper prices is signalling that growth will be unlikely to improve further.

- There has been some improvement in global trade growth this year after a lacklustre 2023. In April, 3-month momentum at 4.8% annualised was its highest since August 2022 (May due July 25).

Source: MNI - Market News/Refinitiv

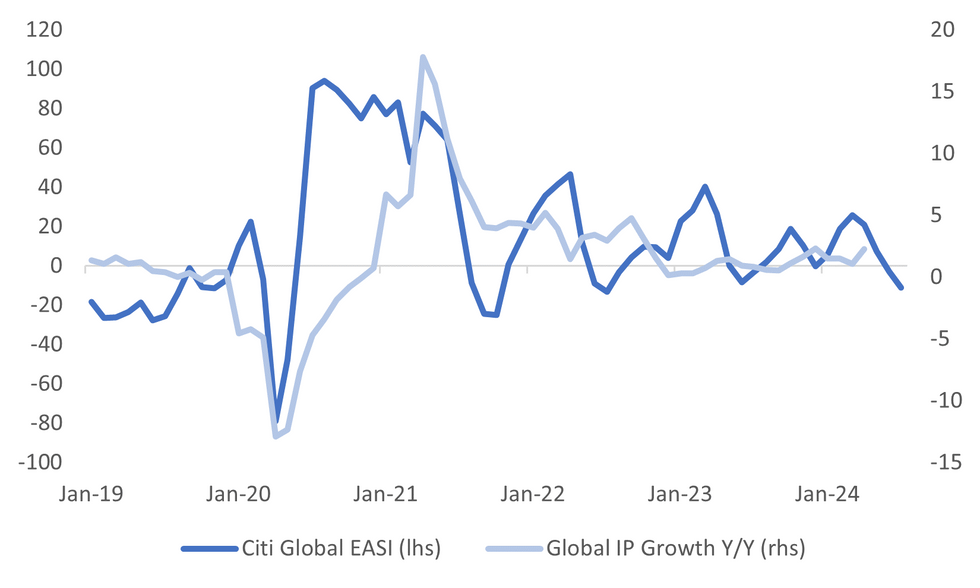

GLOBAL: Focus On Upcoming PMIs, With Data Surprises In Negative Territory For Major Economies

The upcoming preliminary PMI prints for the EU and US will present an important update in terms of the global macro backdrop. We had the preliminary Japan print earlier for July, which slipped back into contractionary territory, although it remains above recent lows.

- The broader backdrop of global data outcomes has generally been to surprise on the downside, as per the Citi global economic surprise index. This index is plotted below against global IP growth in y/y terms.

- All else equal the softness in global data outcomes is pointing to some downside risks. This is consistent with commodity price weakness as per the earlier bullet.

- This reinforces the importance of the upcoming flash PMIs, as the Citi surprise index measure is close to trough points from recent years (excluding the 2020 Covid episode). Such surprise indices have also had a tendency to lead market growth expectations.

Fig 1: Citi Global EASI Versus Global IP Growth Y/Y

Source: Citi/MNI - Market News/Bloomberg

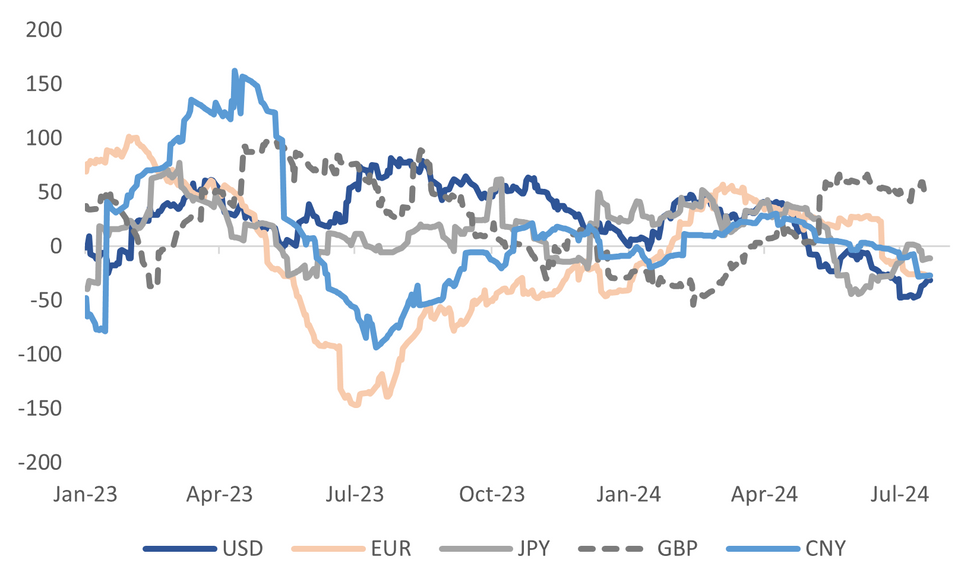

- By major economy/region, the Citi measures are all in negative territory except for the UK, see the second chart below.

- Note we get July PMIs for China in the early part of next week.

Fig 2: Citi EASI By Major Economy/Region

Source: Citi/MNI - Market News/Bloomberg

US TSYS: Tsys Futures Steady Ahead Of Flash PMIs & Corp Earnings

- It has been a subdued trading day in Asia today, yields are flat to 1bps lower, with the curve bull-steepening, the 10Y is -0.6bp at 4.245%.

- Treasury futures traded in very tight ranges today, while volumes were also muted. TYU4 trades at 110-26 after marking lows of 110-23+ in early morning trade.

- A Reuters poll released earlier shows Kamala Harris ahead of Trump for the Presidency 44% to 42%, while the betting odds at PredictIt have Trump at 55% down 4pts, while Kamala is trailing with a 46% chance up 2pts.

- Projected rate cut pricing into year end are steady to mildly higher vs. Tuesday morning levels (*): July'24 at -2.5% w/ cumulative at -0.6bp at 5.323%, Sep'24 cumulative -25.1bp (-24.3bp), Nov'24 cumulative -39.6bp (-38.5bp), Dec'24 -62.2bp (-61.1bp)

- Corporate earning expected today are: Tenet Healthcare, Evercore, AT&T, Amphenol, CME Group, Old Dominion Freight Line, Blackstone Mortgage Trust, International Paper, Boston Scientific, Applied Digital, Lennox International, Fiserv, General Dynamics, Thermo Fisher Scientific, NextEra Energy, Otis Worldwide, Stifel Financial and NextEra Energy.

- looking ahead, Wholesale/Retail Inventories, Flash PMIs and New Home Sales; Tsy supply includes $30B 2Y FRN Note and $70B 5Y Notes.

JGBS: Futures Recover From Weakness Seen Post-40Y Auction

JGB futures are weaker, -11 compared to settlement levels, but off session lows seen in the aftermath of today’s lacklustre 40-year auction.

- The issuance of 40-year bonds today encountered a tepid reception, with the actual high yield overshooting dealer expectations. As per the BBG poll, the anticipated yield was projected at 2.385% versus the realised yield of 2.42%. Given that today's auction followed solid demand metrics at July's 20- and 30-year JGB auctions, the result has been deemed poor.

- Outside of the previously outlined Preliminary Jibun Bank PMIs, there hasn't been much in the way of domestic data drivers to flag.

- Cash US tsys are slightly richer in today's Asia-Pac session, with equity weakness supporting the move.

- Cash JGBs are cheaper across benchmarks, with yields 1-4bps higher. The benchmark 10-year yield is 1.1bps higher at 1.076% versus the cycle high of 1.108%.

- The 40-year yield is 3.9bps higher at 2.467% following today’s supply results.

- Swap rates are little changed out to the 30-year, and 3bps higher beyond. Swap spreads are tighter.

- Tomorrow, the local calendar will see PPI Services, Weekly International Investment Flow and Department Store Sales data ahead of Tokyo CPI on Friday.

AUSSIE BONDS: Little Changed As Equity Market Weakness Moves Market Away From Cheaps

ACGBs (YM flat & XM +1.0) are lightly richer and well off the worst levels after another session of largely directionless dealings. With the domestic calendar light and cash US tsys little changed in today’s Asia-Pac session, the local market has seen relatively narrow ranges.

- Outside of the previously outlined Judo Bank PMIs, there hasn't been much in the way of domestic drivers to flag.

- Accordingly, the move away from session cheaps appears to be tied to equity weakness in today’s Asia-Pac session.

- The AOFM announced that the issue by syndication of the new 4.25% 21 December 2035 Treasury Bond has been priced at a yield to maturity of 4.425 per cent. The issue size is $11.5 billion in face value terms. There was a total of $56 billion of bids at the final clearing price.

- Cash ACGBs are flat to 1bp richer, with the AU-US 10-year yield differential at +9bps.

- Swap rates are 1bp higher, with EFPs wider.

- The bill strip pricing is flat to -1.

- RBA-dated OIS pricing is little changed. Terminal rate expectations sit at 4.42%.

- Tomorrow, the local calendar is empty.

AUSSIE BONDS: AU-CA 10-Year Yield Differential Slightly Above Fair Value Ahead Of BoC Policy Meeting

The RBA’s official rate is currently 40bps below that of the BoC, but this differential appears set to narrow to +15 bps later today if market pricing proves accurate.

- More interestingly, looking 12 months ahead using 3-month swap rates 1-year forward (1Y3M), the market now expects the RBA’s official rate to be 76bps higher than the BoC’s. (See link)

- A simple regression of the AU-CA cash 10-year yield differential, which is currently around its highest level since last December, against the AU-CA 1Y3M spread over the past 12 months suggests that the 10-year yield differential at its fair value of +94bps.

Figure 1: AU-CA Cash 10-Year Yield Diff. (%) vs. AU-CA 1Y3M Swap Diff. (%)

Source: MNI – Market News / Bloomberg

AU STIR: AU-CA Official Rate Differential Set To Narrow Later Today

The RBA’s official rate is currently 40bps below that of the BoC, but this differential appears set to narrow to +15 bps later today if market pricing proves accurate.

- The market is pricing in around a 90% chance of a rate cut today, up from less than 50% two weeks ago.

- A narrowing in the AU-CA official rate differential today aligns with market expectations that the official rate in Canada will fall below that of Australia by year-end. If this occurs, it would be the first time since 2018.

- Even more interestingly, looking 12 months ahead using 3-month swap rates 1-year forward (1Y3M), the market now expects the RBA’s official rate to be 75 bps higher than the BoC’s.

Figure 1: AU & CA 1Y3M Rates (%)

Source: MNI – Market News / Bloomberg

AUSTRALIAN DATA: Services Sector Passed Higher Costs On In July

The Judo Bank preliminary July PMIs suggest that the economy barely grew at the start of Q3 with services growth mildly positive but manufacturing continuing to contract. The composite and services PMIs were at 6-month lows of 50.2 and 50.8 respectively. The RBA has been concerned about services inflation and the PMI is likely to add to this as higher costs were passed on.

- The Q2 average PMI was slightly stronger on the quarter at 52.4 suggesting that growth should improve but the July reading is tentatively signalling that it will be short lived. But Judo Bank notes that July was too early to capture the positive effects from tax cuts and other fiscal stimulus.

Source: MNI - Market News/Refinitiv/Bloomberg

- The drop in the composite PMI was driven by new orders, which contracted for the second straight month. Exports orders were particularly weak, falling at their fastest pace in close to 4 years. Despite this employment growth remained positive, driven by services, but slowed.

- The services sector reported softer demand but cost inflation at its highest since November last year driven by the increase in the minimum wage (+4 points to 63.3). Businesses were still able to pass higher costs onto customers with Judo Bank recording a pickup in selling price inflation. It said that it is consistent with 4% CPI inflation.

- The manufacturing PMI improved only marginally to 47.4, with output shrinking faster at 46.3, down 0.5 points, driven by lower orders especially from overseas. Unlike services, weaker production meant job cuts and input inflation was below the series average and selling prices were moderate to attract demand.

- Confidence in the outlook deteriorated with services sentiment at its lowest since data began in May 2016, excluding the pandemic.

NZGBS: Short-End Rally Steepens Curve, Equity & USDJPY Weakness Supportive

NZGBs closed on a strong note, with benchmark yields 4bps lower to 1bp higher. The 2/10 curve steepened.

- Given the lack of domestic news flow, equity weakness in today’s Asia-Pac session looks to have assisted short-end outperformance.

- “The New Zealand economy will expand 0.8% in 2024, 2.2% in 2025 and 2.7% in 2026, according to a survey conducted by Bloomberg News. The chance of a recession happening over the next 12 months is 32 per cent, according to 8 respondents.”

- Andrew Vogel, an economist at S&P Global: “New Zealand saw a notable improvement in exports, and slightly better-than-expected growth in private consumption most recently, balanced by weakening fixed investment and still-high import spending. Still, the signs for the underlying strength of the economy are good, and the recession probability is gradually shrinking.” (See link)

- The swap curve has bull-steepened, with rates 1-8bps lower.

- RBNZ dated OIS pricing closed 3-7bps softer across meetings. A 53% chance of a cut in August is priced, with a cumulative 91% priced by October. A cumulative 74bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty again.

- Tomorrow, the NZ Treasury plans to sell NZ$300mn of the 3.0% Apr-29 bond and NZ$200mn of the 4.50% May-35 bond.

FOREX: Yen Surge Continues, As Risk Off Dominates, NZD/JPY Sub 200-day MA

Yen gains have continued to dominate the G10 FX space. USD/JPY tracks near 154.55/60 in latest dealings, close to session lows. We got to 155.99 in early trade, but that saw selling interest emerge in the pair. We are testing June 4 lows (154.55). The next downside target is 153.66, a retracement level. Elsewhere the USD has mostly been stronger, particularly against NZD and AUD, with both falling sharply against JPY. the USD BBDXY index is little changed, last near 1257.2.

- Yen gains appear to reflect a number of factors: unwinding of long trades against the likes of NZD and AUD (which has bene a position skew in recent months per CFTC). BoJ risks emerging (next week's meeting is Wednesday). Whilst no rate changes are expected, bond buying tweaks could be in focus.

- Broader market sentiment has had a distinct risk off tone today, with US equity futures slumping amid disappointment in terms of tech earnings (Nasdaq futures are off close to 1%). This backdrop, coupled with global growth concerns and softer metals prices, has added pressure to the likes of AUD.

- Regional equities are mostly tracking lower as well, with losses in Japan the largest amid sharp yen gains.

- NZD/JPY is sub the 200-day MA, last near 91.50, close to early May lows. AUD/JPY was last near 101.9, still above the 200-day (which is back close to 99.8). AUD/USD is under 0.6600, NZD/USD is at 0.5920, off 0.60%.

- US yields have ticked down a touch, but haven't been a theme today.

- Later the Fed’s Bowman and Logan give remarks and the ECB’s Buch, Lane and de Guindos appear. The Bank of Canada decision is also announced – a 25bp cut is forecast. In terms of data, US/European preliminary July PMIs and US June trade and new home sales are released.

ASIA STOCKS: HK & China Stocks Lower On Lack Of Policy Support & Soft Tech Prices

Hong Kong and China equity markets are lower today with disappointing tech earnings results weighing on the global markets as well as a lack of major policy support following the Third Plenum reinforcing bearish sentiment. There has been a bit of a bounce in some of the major China equity benchmark tracked by the large passive ETFs, which could be a sign the Nation Team is back in the market. Asia EV stocks and Tesla suppliers are lower after Tesla released disappointing earnings and delayed the Robotaxi unveiling to October from August.

- Hong Kong equities are weaker today, property stocks are the worst preforming with the Mainland Property Index down 1.16%, while the HS Property Index is down 1.26%, the HSTech Index has fallen 0.95% while the HSI is down 0.70%.

- China onshore equities have seen a bounce and now out-perform HK listed equities with the CSI 300 Real Estate Index down 1.70%, the CSI 1000 is 0.30% lower, while the CSI 2000 is 0.52% lower and the CSI 300 is 0.24% lower.

- China's new measures to curb short-selling, including increased margin requirements and the cessation of securities lending by state-owned China Securities Finance Corp, have reduced the outstanding balance of short trades to 27.9 billion yuan, the lowest in over four years, thereby increasing trading costs and reducing market volatility according to BBG.

- Apple's Jeff Williams and Micron's Sanjay Mehrotra visited Beijing to meet with senior Chinese officials amid potential new US tech curbs on China. The visit emphasized the need for US firms to stay engaged in China's reform and modernization, despite ongoing trade restrictions and the pressure on US companies to decouple from China.

- Calendar is empty today, with focus turning to Hong Kong's Trade Balance data tomorrow.

ASIA PAC STOCKS: Asian Equities Head Lower On Weak Tech Earnings

Asian markets are mostly lower today, following losses on Wall Street and disappointing earnings from major tech companies. US equity futures have seen a sudden drop with little in the way of headlines driving the move. Elsewhere the yen strengthened ahead of next week’s BoJ meeting, with speculation about a potential rate hike, weak business data from Japan and Australia, coupled with uncertainty around central bank policies is also affecting investor sentiment. In Taiwan, stock trading is suspended due to Typhoon Gaemi, while Philippines were also closed due to a Typhoon.

- Japanese equities are lower today following unimpressive earnings results from major US tech companies, particularly Alphabet and Tesla, set off a slump in electronics makers and telecom names. Equity prices were also affected by discussions around potential rate cuts although only about 30% of analysts predict that the BOJ will hike interest rates on July 31, while the yen edged higher. The Nikkei is 1.10% lower, while the Topix is down 1.20%.

- South Korean are mixed today, Pharma stocks are the top performers although weaker tech stocks particular Samsung are weighing on the market.. The Kospi is currently trading 0.60% lower, while the Kosdaq trades 0.30% higher.

- Taiwan equity markets are closed today due to Typhoon Gaemi, Taiex futures are pointing to a 0.80% fall in the index with the Philadelphia SE Semiconductor Index falling 1.46%, and weak tech prices post the NY close contributing to the losses.

- Australian equities are a touch lower today, the ASX 200 is down 0.20% with gains in Consumer Discretionary and Health Care stocks offset by losses in Metals & Mining and Energy stocks. Earlier, Judo Bank preliminary July PMIs suggest that the economy barely grew at the start of Q3 with services growth mildly positive but manufacturing continuing to contract. In New Zealand equities are 0.50% led higher by Health care stocks.

- In EM Asia most markets are lower with Singapore's Straits Times down 0.10%, Malaysia's KLCI down 0.43% & Indonesia's JCI down 0.36%, while India's Nifty 50 is down 0.05%

ASIA EQUITY FLOWS: Foreign Investors Return After Sell-Off In Tech Stocks

- South Korea: South Korean equities saw inflows of $269m yesterday, although we still have a net outflow of $642m over the past five trading days. The inflows on Tuesdays were mainly into the Transport equipment sector. The 5-day average outflow is $128m, compared to the 20-day average inflow of $123m and the 100-day average inflow of $113m. Year-to-date, South Korea has experienced substantial inflows totaling $18.964b.

- Taiwan: Foreign investors ended their run of heavy selling on Taiwanese stocks on Tuesday with an inflow of $290m, although still a net outflow of $4.506b over the past five trading days. Taiwan equity markets will be closed today due to Typhoon Gaemi. The 5-day average outflow is $901m, higher than the 20-day average outflow of $380m and the 100-day average outflow of $77m. Year-to-date, Taiwan has experienced outflows totaling $2.855b.

- India: Indian equities saw inflows of $998m yesterday, contributing to a net inflow of $2.418b over the past five trading days. Since the election results were confirmed, we have seen 28 of 30 sessions of inflows, the Nifty 50 is up 4%$ over the past month. The 5-day average inflow is $484m, higher than the 20-day average inflow of $320m and significantly higher than the 100-day average outflow of $51m. Year-to-date, India has experienced inflows totaling $5.062b.

- Indonesia: Indonesian equities recorded outflows of $5m yesterday, resulting in a net inflow of $42m over the past five trading days, foreign investors flows have been mixed recently as the IDR continues to slip, the JCI is up 6.26% over the past month. The 5-day average outflow is $14m, below the 20-day average outflow of $8m and close to the 100-day average outflow of $9m. Year-to-date, Indonesia has experienced outflows totaling $127m.

- Thailand: Thailand saw a $2m inflow on Tuesday, after returning from a break on Monday and had a net inflow of $63m over the past five trading days. The SET is one of the worst performing markets in the region this year and trades just off yearly lows at 1.301.5, 1 only breaking below 1,300 once earlier this month, focus will be on if we can hold above it. The 5-day average inflow is $13m, better than the 20-day average outflow of $13m and the 100-day average outflow of $24m. Year-to-date, Thailand has seen significant outflows amounting to $3.289b.

- Malaysia: Malaysian equities experienced inflows of $32m yesterday, contributing to a 5-day net inflow of $76m. The 5-day average inflow is $15m, higher than the 20-day average inflow of $15m and the 100-day average outflow of $3m. Year-to-date, Malaysia has experienced inflows totaling $173m.

- Philippines: Philippine equities saw inflows of $8m yesterday with a 5-day net inflow of $68.5m. The 5-day average inflow is $14m, better than the 20-day average inflow of $4m and the 100-day average outflow of $6m. Year-to-date, the Philippines has seen outflows totaling $446m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| South Korea (USDmn) | 269 | -642 | 18964 |

| Taiwan (USDmn) | 290 | -4506 | -2855 |

| India (USDmn)* | 998 | 2418 | 5062 |

| Indonesia (USDmn) | -5 | 42 | -127 |

| Thailand (USDmn) | 2 | 63 | -3289 |

| Malaysia (USDmn) | 32 | 76 | 173 |

| Philippines (USDmn) | 8 | 68.5 | -446 |

| Total | 1593 | -2480 | 17482 |

| * Up to 22nd July |

OIL: Oil Prices Stabilise, EIA US Inventory Data Due Later

Oil prices are off their intraday highs but are still up moderately during APAC trading after initially rallying following data that showed another US crude inventory drawdown. Oil has fallen sharply and is now down around 5% since last Wednesday on increased demand concerns, especially from China, and subsequent algorithmic selling. The USD index is little changed.

- WTI is up 0.2% to $77.11/bbl, off the intraday high of $77.49 and close to the low of $77.08. Brent is also 0.2% higher at $81.17/bbl after a high of $81.48 and low of $81.12.

- Bloomberg reported that US crude inventories fell 3.86mn barrels last week, according to people familiar with the API data. Gasoline fell 2.77mn and distillate 1.5mn. The official EIA data is released later today and another drawdown would be the fourth in a row.

- Later the Fed’s Bowman and Logan give remarks and the ECB’s Buch, Lane and de Guindos appear. The Bank of Canada decision is also announced – a 25bp cut is forecast. In terms of data, US/European preliminary July PMIs and US June trade and new home sales are released.

GOLD: Medium Trend Remains Up

Gold is 0.3% higher in today’s Asia-Pac session, after closing 0.5% higher at $2409.64 on Tuesday.

- It was an uneventful summer trading session yesterday, with little newsflow to drive markets. US Treasuries finished with yields slightly lower but off their earlier lows. Lower rates are typically positive for gold, which doesn’t pay interest.

- The front end outperformed after cooler existing home sales. US existing home sales were weaker than expected, down 5.4% m/m in June, the fourth successive monthly decline.

- The market is now waiting for Friday’s update on the Fed’s preferred underlying inflation measure, which is expected to show the PCE deflator retreated to an annual pace of 2.5% from 2.6% in the year to May.

- According to MNI’s technicals team, the medium-term trend for gold still points higher despite the pullback across the second half of last week and on Monday.

- The previous breach of key resistance at $2,450.1, the May 20 high, opens the $2,500.00 handle next. Initial support is at $2,391.7, the 20-day EMA.

ASIA FX: Asia FX Mostly Steady, Outperforming Higher Beta G10 FX

Compared to the major G10 currencies, Asia FX has been very subdued so far in Wednesday dealings. Higher beta plays like KRW and IDR are outperforming the continued weakness for AUD and NZD etc. A softer commodity price backdrop is also generally a terms of trade positive for most Asia currencies, given net energy importing status for most economies. The weaker USD/JPY trend will also be aiding some regional FX from a competitiveness standpoint. These factors have helped offset a generally softer equity tone, with disappointing US tech results weighing on tech futures.

- USD/CNH sits little changed, last near 7.2870, down slightly on on the day. The pair is likely enjoying some benefit from firmer yen levels, although weaker onshore asset sentiment is an offset. Local equities are mixed today, but the CSI 300 is holding the bulk of yesterday's 2.1% fall. The USD/CNY fixing got to a fresh high since Nov 2023 but didn't impact sentiment.

- Spot USD/KRW is slightly firmer in won terms, last near 1385. Similar factors are in play to CNH. We have stronger yen levels helping to offset the weaker equity tone. The Kospi sits 0.50% lower so far today.

- USD/THB has seen decent pull back, the pair off around 0.40%, last in the 36.05/10 region. Some of this reflects catch up to lower USD/JPY levels. Thailand's constitutional court will decide on August 14 on whether PM Srettha should be removed from office. This follows a cabinet appointment back in April, which some Thai senators said was ethical breach (see this BBG link). Meanwhile digital wallet handouts, designed to boost the economy will be in Q4 of this year.

- USD/IDR is a touch higher, last around 16230. This is only around 0.10% weaker in IDR terms, with the softer global equity backdrop a likely headwind.

- USD/MYR is up a touch as well to 4.6750. Earlier data showed weaker than forecast June CPI pressures. The headline print was 2.0%y/y versus 2.2% projected.

- Note Philippine markets have been closed today due to adverse weather conditions.

ASIA RATES: INDON Curve Out-Performs As Investors See Rate Hikes Ending

Asia sov curves are mixed today, with the INDON curve is outperforming after strong demand for local currency debt on Tuesday. FX & Equity trading has been close in Philippines today due to Typhoon Carina.

- INDON curve has bull-steepened, while the PHILIP curve has bear-steepened. INDON front-end has out-performed the PHILIP curve by about 10bps over the past week, as investors view the BI ending it's rate hiking cycle.

- Demand for IDR Indonesian debt at a recent auction surged to its highest level since January, with the bid-to-target ratio reaching 2.6, the highest since January, with increased investor demand attributed to the attractive pricing of the bonds and expectations, plus the expected end of the rate hiking cycle.

- Foreign investors have been buyers of Indonesian debt this month for a total inflow of $198m, following an inflow of $117m in June, although this is well down on May's inflow of $1.2b.

- The Philippines recorded a budget deficit of PHP209.1b ($3.58 billion) in June, a decrease from 225.4B a year earlier. For the first half of the year, the budget deficit reached 613.9b, up from 551.7b in the same period last year. Revenues rose by 10.93% y/y to 296.5b, while spending increased by 2.62% y/yr to 505.6b.

- Cross-asset: Indonesian equities are 0.40%, while the IDR trades 0.10% lower in commodities space palm oil is 0.33% while nickel closed 0.40%.

INDIA: India Budget - Focus on Attracting Foreign Capital/Reducing FinMkt Volatility

Initial thoughts on the Indian budget:

- Increase in capital gains tax for investments in financial assets held over one year from 12.5% from 10%

- Increase in capital gains tax for investments held less than one year to 20% from 15%.These measures are aimed at dampening speculation in financial assets.

- A $2tn rupee jobs program providing financial support for first time job seekers

- Employment related incentives for employers and employees in manufacturing sector

- The government pledged to maintain strong fiscal support for India’s infrastructure sector, with spending seen at 11.1 trillion rupees, or 3.4% of India’s gross domestic product.

- Abolishment of tax on capital raising for start ups

- Small reduction in personal income tax rates

- Corporate tax on foreign companies reduced from 40% to 35% to support Foreign Direct Investments

- Reduced fiscal deficit target to 4.9% from 5.1%

- All in all, a fairly neutral budget. With the potential Trump administration becoming more protectionist and focusing on China, the reduction in Foreign Companies Tax could be aimed to positioning India as an alternative destination for foreign capital, whilst the changes to the tax structure for investments is seen to dampen speculation and hence volatility in financial markets.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 24/07/2024 | 0600/0800 | * |  | DE | GFK Consumer Climate |

| 24/07/2024 | 0645/0845 |  | EU | ECB's de Guindos at ECB/IMF conference | |

| 24/07/2024 | 0700/0900 | ** |  | ES | PPI |

| 24/07/2024 | 0715/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 24/07/2024 | 0715/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 24/07/2024 | 0730/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 24/07/2024 | 0730/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 24/07/2024 | 0800/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 24/07/2024 | 0800/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 24/07/2024 | 0800/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 24/07/2024 | 0830/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 24/07/2024 | 0830/0930 | *** |  | UK | S&P Global Services PMI flash |

| 24/07/2024 | 0830/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 24/07/2024 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 24/07/2024 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 24/07/2024 | 1200/1400 |  | EU | ECB's Lane at ECB/IMF conference | |

| 24/07/2024 | 1345/0945 |  | CA | BOC Monetary Policy Report | |

| 24/07/2024 | 1345/0945 | *** |  | CA | Bank of Canada Policy Decision |

| 24/07/2024 | 1345/0945 | *** |  | US | S&P Global Manufacturing Index (Flash) |

| 24/07/2024 | 1345/0945 | *** |  | US | S&P Global Services Index (flash) |

| 24/07/2024 | 1400/1000 | *** |  | US | New Home Sales |

| 24/07/2024 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 24/07/2024 | 1430/1030 |  | CA | BOC Governor Press Conference | |

| 24/07/2024 | 1530/1130 | ** |  | US | US Treasury Auction Result for 2 Year Floating Rate Note |

| 24/07/2024 | 1700/1300 | * |  | US | US Treasury Auction Result for 5 Year Note |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.