MNI EUROPEAN MARKETS ANALYSIS: Risk Appetite Stabilizes, USD/JPY To Fresh Highs

- Tensions in the Middle East escalated over the weekend with Iran retaliating for Israel’s alleged attack on its embassy in Syria with a drone/missile attack on Israel using Jordanian and Iraqi airspace. The US has said that it will not support a strike against Iran and is looking for a diplomatic solution with the G7 to prevent escalation.

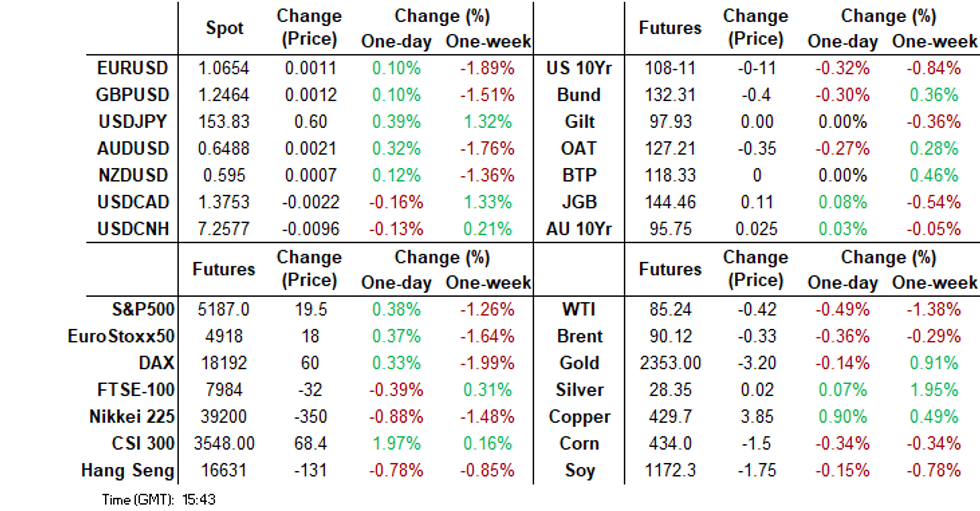

- Markets have reversed some of Friday's risk off moves, albeit to varying degrees. US equity futures are higher, US Tsy futures lower. Yen has weakened to a fresh low, while risk currencies have outperformed. Oil is modestly softer.

- Looking ahead, the Fed’s Logan and Williams appear and March retail sales and April Empire manufacturing are released. The ECB’s Lane and BoE’s Breeden speak, and euro area February IP is released.

MARKETS

GLOBAL: World Urges Restraint Following Iran Attack, Markets Watching

Tensions in the Middle East escalated over the weekend with Iran retaliating for Israel’s alleged attack on its embassy in Syria with a drone/missile attack on Israel using Jordanian and Iraqi airspace. Energy markets are likely to be under upward pressure at the start of the week as the world waits to see if Israel responds. The US has said that it will not support a strike against Iran and is looking for a diplomatic solution with the G7 to prevent escalation.

- Iran has said it has achieved its objective and also doesn’t want an escalation particularly with the US.

- Iran also seized an Israeli ship in the Strait of Hormuz over the weekend using troops from a helicopter. Given Qatar’s location just on the other side of the Strait, these events may also impact natural gas prices.

- IMF managing director Georgieva said that the conflict between Iran and Israel has so far had a “moderate” economic impact. This could change if the situation escalates and results in a sustained rise in oil prices.

- The G7 supported Israel in its defence against the attack, the first from Iranian territory, with the US intercepting four missiles and shooting down over 70 drones. The UK and France were also involved in ensuring most of the weapons didn’t strike. But the US has apparently warned Israel privately not to retaliate but war cabinet minister Gantz has said that it will “exact a price” when the time is right.

- Jordan also shot down several weapons in its airspace and has spoken to Iran in response to its comments that Jordan could be next and to avoid pushing the “whole region into abyss of war” according to foreign minister Safadi.

GLOBAL: Oil Inflationary Concern, Other Factors Mixed

Global factors are mixed in terms of the outlook for inflation. While oil prices are likely to add to headline pressures, supply-chains should continue to weigh on prices. Other commodities are mixed. Oil prices will be watched closely though, especially if higher fuel and transport prices feed into other prices, as they are up around 20% this year and have the potential to rise a lot further if the situation in the Middle East and Ukraine/Russia deteriorates. Most OECD countries are yet to return inflation to target.

- Brent crude is currently trading just above $90/bbl and has averaged $90.15 in April to date. The benchmark is now up over 17% this year rising each month. During 2022 it helped to put downward pressure on inflation but look sets to add to price pressures in 2024, but the key for central banks will be whether there are second round effects on core prices.

- Food prices have also helped reduce inflation recently. In March the FAO measure rose for the first time since July but the annual rate remains in deflation. Rice prices fell in March and are down so far in April too.

- Other commodities are mixed with LME metal prices up in March and April and 3-momentum almost 20%, but iron ore and wool have fallen over the last three months.

Source: MNI - Market News/FAO/Refinitiv

GLOBAL: Supply Chain Index Not Yet Impacted By Threats To Shipping

Oil prices have a geopolitical risk premium priced in but remain vulnerable to an escalation of the situation in the Middle East or Ukrainian attacks on Russian refining facilities. The tensions in the former in particular impact more than just oil and gas with merchant shipping targeted by both Houthi rebels in Yemen and now Iran in the Strait of Hormuz. While unlikely, the closure of the Strait remains a key risk.

- The resolution of supply-chain issues since the pandemic has helped to reduce inflation. There was some concern that attacks on merchant shipping off Yemen would create supply pressures but that doesn’t seem to be the case with the NY Fed’s supply chain pressure index at -0.27 in March. While it has risen from its -1.6 trough in May 2023, a negative implies that supply issues continue to ease.

- Risks to shipping and the cost of rerouting has added to rates with the FBX global container index up 87% this year, it is off its 2024 peak though, but the Baltic dry index is down 17.4%. Even though rates are up sharply they remain significantly below pandemic peaks but the decline from those peaks contributed to the disinflation seen in recent years and that doesn’t look likely to continue for now.

Source: MNI - Market News/Refinitiv

US TSYS: Treasury Futures Erase Friday Moves As Geopol Tensions Simmer

- Treasury futures have continued their move lower, after briefly seeing some strength during the morning session. Jun 24' 10Y futures reached a post open high of 108-18+, before reversing those moves to trade at intraday lows of 108-08+, we trade just off those levels as Europe logs in down - 11+ at 108-10+.

- Earlier there was a 10Y block trade in 2.95k size at 108-14+, likely seller.

- Cash Treasury curve has bear-steepened, and erased earlier gains the 2Y yield +2.2bps at 4.918%, 10Y +3.1bp to 4.552%, while the 2y10y is +0.681 at 36.827

- Looking ahead: Retail Sales and Fed Speak with Dallas Fed Logan, NY Fed Williams Bbg TV interview, SF Fed Daly keynote remarks.

JGBS: Futures Stronger But At Session Lows, Light Local Calendar Again Tomorrow

JGB futures are stronger, +8 compared to settlement levels, but dealing at the bottom of today’s trading range.

- Outside of the previously outlined Machinery Orders, domestic drivers have been light on the ground. Accordingly, today’s price action has tracked fluctuations in US tsys in today’s Asia-Pac session.

- US tsys are dealing 3-4bps cheaper despite Iran’s military launching drones and missiles against Israel over the weekend, in a significant escalation of hostilities.

- Later today, the US data calendar includes Retail Sales and Fed Speak: Dallas Fed Logan, IMF/BoJ conf, Tokyo (no text, Q&A), NY Fed Williams Bbg TV interview, SF Fed Daly keynote remarks, Stanford (text, Q&A).

- Cash JGBs are dealing slightly mixed across the curve. The benchmark 10-year yield is 0.3bp higher at 0.858% versus the YTD high of 0.871%, set last week.

- The swaps curve has twist-steepened, with rate moves bounded by +/- 3bps. Swap spreads are mixed, but wider beyond the 10-year.

- Tomorrow, the local calendar is empty apart from an auction for Enhanced-Liquidity of 5-15.5-year JGBs.

AUSSIE BONDS: Slightly Richer, Tracking US Tsys, Local Calendar Light Until Jobs Data On Thursday

ACGBs (YM +3.0 & XM +2.5) are stronger but at or near session lows after US tsys open the week cheaper.- After closing 4-8bps richer across benchmarks last week, cash US tsys are dealing ~3bps cheaper in today’s Asia-Pac session. This comes despite Iran’s military launching drones and missiles against Israel over the weekend, in a significant escalation of hostilities.

- Cash ACGBs are 2-3bps richer, with the AU-US 10-year yield differential at -30bps. At -30bps, the cash differential currently sits at the bottom of the range of +/-30bps which has been observed since November 2022.

- A simple regression of the AU-US cash 10-year yield differential against the AU-US 1Y3M swap differential over the current tightening cycle indicates that the 10-year yield differential is 9bps too low versus its fair value.

- Swap rates are flat to 1bp lower.

- The bills strip is richer, with pricing +1 to +4.

- RBA-dated OIS pricing is slightly softer across meetings. A cumulative 22bps of easing is priced by year-end.

- The highlight of this week’s local calendar is the Employment Report for March on Thursday. The calendar is light until then.

AUSSIE BONDS: AU-US 10-Year Yield Differential At The Bottom Of Range

Today, the AU-US 10-year cash yield differential has decreased by 6bps to -30bps.

- At -30bps, the cash AU-US 10-year yield differential currently sits at the bottom of the range of +/-30bps which has been observed since November 2022.

- A simple regression of the AU-US cash 10-year yield differential against the AU-US 1Y3M swap differential over the current tightening cycle indicates that the 10-year yield differential is currently 9bps too low versus its fair value (i.e., -30bps versus -21bps).

- The 1y3m differential is a proxy for the expected relative policy path over the next 12 months.

Figure 1: AU-US Cash 10-Year Yield Differential (%)

Source: MNI – Market News / Bloomberg

NZGBS: Richer, Closed On Strong Note, Neutral OCR About 3.9% (RBNZ)

NZGBs closed on a strong note, with benchmark yields 7bps lower. While the local market opened stronger on the back of US tsys’ positive close on Friday, weak domestic data aided today’s strong close.

- As previously noted, the NZ Performance of Services Index fell to 47.5 in March from a revised 52.6 in February.

- Indeed, the local market strengthening through the session countered the ~2bps cheapening in US tsys during today’s Asia-Pac session.

- (Bloomberg) The RBNZ commented on neutral interest rates in an article on Monday. “Due to New Zealanders’ high inflation expectations, the OCR would currently need to be about 3.9% to neither tap the brakes nor push on the accelerator of the economy”. The OCR is 5.5% “which is therefore clearly contractionary”. (See link)

- Swap rates closed 5-6bps lower, with implied swap spreads wider.

- RBNZ dated OIS pricing closed flat to 2bps softer across meetings. A cumulative 39bps of easing is priced by year-end.

- The local calendar sees NZ REINZ House Sales tomorrow, ahead of Q1 CPI on Wednesday.

FOREX: Risk Currencies Outperform Yen, As Restraint Called For In Israel/Iran Conflict

The BBDXY sits little changed for Monday's session to date, last near 1259. This masks divergent trends within the G10 space though, with early yen and CHF gains giving way to a risk on feel for FX markets.

- USD/JPY has climbed to fresh cyclical highs, last at 153.80/85, around 0.40% weaker in yen terms versus end Friday levels in NY. Earlier lows were just under 153.00, as the market opened cautiously after the weekend Iranian missile/drone attacks on Israel.

- However, with the UN/G7 calling for restraint and US President Biden reportedly telling the Israeli leader the US would not participate in retaliatory attacks, has aided risk appetite as the session has progressed.

- Macro markets have reversed some of Friday's trends, with US equity futures up close to 0.30%, while US yields are higher across the benchmarks. USD/CHF is a touch higher, last near 0.9145.

- AUD is among the stronger G10 performers, up around 0.25%, last above 0.6480. Two other sources of support have been evident for the A$, with firmer China equities helping, along with a bounce in metal prices following US and UK sanctions on Russia.

- The Kiwi is mixed today, up only against the JPY, CHF and unchanged against the USD. NZD/USD was last near 0.5945. The RBNZ released a piece earlier where they suggest the OCR is "Contractionary" above the neutral cash rate of 3.9%, while NZ PSI saw its biggest contraction in two years falling from 53 to 47.5.

- Looking ahead, the Fed’s Logan and Williams appear and March retail sales and April Empire manufacturing are released. The ECB’s Lane and BoE’s Breeden speak, and euro area February IP is released.

ASIA EQUITIES: China Equities Outperform As Tighter Market Supervision Is Expected

Hong Kong and China equity markets are mixed today, with China mainland equities rallying. The move higher could be linked to China vowing to tighten stock market supervision after the rebound in equities has stalled, which was announced late Friday afternoon while the CSI300 have now broken back above the 20, 50 & 100-day EMA. Earlier the 1yr MLF was kept on hold at 2.50%.

- Hong Kong equities are lower today with HSTech down 0.88% after being down as much as 2.34% at one stage, Mainland Property Index is down 0.95%, the HSI is down 0.56%, the HS China Enterprise which tracks China owned companies is faring slightly better down just 0.23%. In China, equity markets are higher, with the CSI300 up about 2.10%, while the CSI1000 is down 0.53%

- China Northbound saw -7.4b of inflows on Friday, with the 5-day average at -2.29billion, while the 20-day average sits at 0.24billion yuan.

- (Bloomberg) China Vows to Tighten Stock Market Supervision as Rebound Stalls - (See link)

- In the property space, China Vanke is reassuring investors by outlining plans to address liquidity pressure and operational challenges, emphasizing the use of its own resources and existing financing facilities to stabilize operations and reduce debt. Despite recent stock and bond declines following credit rating downgrades, Vanke's executives deny rumors and controversies, affirming their commitment to timely project completion and normal overseas business activities, while facing pressures from China's real estate crisis and upcoming debt maturities.

- China's steel exports surged in March to the highest level since 2016, driven by weakened domestic demand amid the country's property crisis, prompting traders to seek more profitable markets. This trend underscores concerns raised by US Treasury Secretary Janet Yellen about Chinese overcapacity across emerging industries, with steel exports helping to offset declining domestic demand and affecting global steel markets.

- Efforts by the US to persuade the Netherlands and Japan to further restrict Chinese access to semiconductor technology faced resistance this week, as both countries sought more time to assess existing limits and awaited the outcome of the US presidential election. The impasse highlights the uncertainty surrounding President Joe Biden's reelection prospects and his administration's attempts to hinder China's technological advancement, particularly in light of potential policy shifts depending on the election outcome.

- Looking ahead, New Home Prices, GDP, Industrial Production & Retail Sales all expected tomorrow.

ASIA PAC EQUITIES: Equities Head Lower As Geopol Tensions Persist, EM Currencies Weaken

Regional Asian equities have pulled back on Monday as worries about potentially escalating tensions in the Middle East rattled financial markets, pushing investors to look for safer places for their money. U.S. futures rose and oil prices fell despite tensions roiling the Middle East where an attack late Saturday marked the first time Iran had ever launched a military assault on Israel. Regional Asian FX is lower, with TWD & KRW near multi-year lows. The economic data calendar is light on today with just Japan Machine Orders which surged in Feb, while New Zealand has PSI data which dropped below 50, to 47.5 in Mar and net migration jumped to 7,630 in Feb from a revised 3,650 in Jan.

- Japan equities equities are lower today tension in the middle east is seen as the major catalyst for the move. The yen has just broken the Friday lows and is now trading above 153.50, traders will be alert for yen intervention. Earlier Core Machine Orders were well above estimates coming in at 7.7% vs 0.8% expectation signifying a robust recovery and potential expansion in Japan's manufacturing and production sectors, positioning the country for further economic growth and development. The Topix is down 0.24%, while the Nikkei 225 is down 1.09%

- South Korean equities dropped as much as 1.5% in early morning trading and hit the lowest since March 7, erasing its year-to-date gain amid increased geopolitical risks after Iran launched an attack on Israel. The KRW has gapped lower this morning, after weakening on Friday with the currency now down 2.56% over the past 5 days. The Kospi has recovered majority of the earlier losses to trade down just 0.45%.

- Taiwan equities are lower today, there has been little in the way of local market headlines or economic data for the region with the next major data released not until Apr 22 when Unemployment and Export Orders are due out. Similar to the KRW, the TWD has weakened recently trading at 32.362 and now eyes multi year lows at 32.50. The Taiex has continued to trade off throughout the session and now down 1.02%

- Australian equities are lower today following global markets lower as risk assets track lower. Mining stocks have bucked the trend as commodity prices rise. The ASX200 is down 0.42%

- Elsewhere in SEA, New Zealand Equities are down 0.45%, Singapore equities are down 1.08%, Malaysian equities are 0.42% lower, while Philippines equities continue their drop down another 1.24% and now off 5.60% from recent highs made Apr 2nd.

ASIA EQUITY FLOW: Flows Negative As Risk-Off Sentiment Sees Investors Sell Asia Stock

- China equities saw their largest outflow via northbound connect since Jan 17th, with an outflow of 7.4b yuan, equities were lower although they did outperform Hong Kong equities by about 1%. Poor economic data was the catalyst for the sell-off with Exports down 7.5% vs -1.9% expected, while imports were -1.9% vs 1.0% expected. While The CSI 300 Index has failed to convincingly climb above 3,600 in recent weeks. Shortly we have the MLP 1-year rate, which is expected to on hold at 2.5%. The 5-day average is -2.29b, below both the 20-day average at 0.24b and the 100-day average at 0.29b yuan.

- Taiwan equities saw another day of outflows with a -$231m outflow on Friday, equity markets were largely unchanged for the 2nd day in a row. There has been very little in the way of market headlines or economic data with another quiet week on that front coming up, flows will largely be driven by US corporate earnings over the next week. The 5-day average is now -$84, the 20-day average is -$233, well below the longer term 100-day average at $162m.

- South Korea equities were lower on Friday, largely following the other regional markets lower on risk-off sentiment. The Unemployment rate increased although inline with expectations coming in at 2.8% while the BOK base rate was unchanged at 3.50%. Equity flows were largely flat with just a small $6.5m outflow, taking the 5-day average to $167m, the 20-day average to $273m and the 100-day average to $186m.

- Philippines equities broke below the 6,800 mark Apr 5th, a level that had acted at support for the prior month or so, the PSEi is now off 5.82% from its highs made on Apr 2nd, the next level of support would be 6,600 area, Feb 1st lows / 200-day EMA. Equity flows have been negative for 6 straight days for a total of -$61m. The 5-day average is -$10m, the 20-day average is -$6.16m, while the $1.67m.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | -7.4 | -11.5 | 52.9 |

| South Korea (USDmn) | -7 | 839 | 14336 |

| Taiwan (USDmn) | -231 | -423 | 4144 |

| India (USDmn)** | 388 | 1374 | 2678 |

| Indonesia (USDmn) *** | 0 | -377 | 1102 |

| Thailand (USDmn) *** | 0 | 252 | -1666 |

| Malaysia (USDmn) ** | 0 | -60 | -292 |

| Philippines (USDmn) | -10 | -49.7 | 123 |

| Total (Ex China USDmn) | 140 | 1554 | 20425 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To Apr 10th | |||

| *** Close for Public Holiday |

OIL: Crude Eases As Markets Don’t Expect An Escalation In The Middle East

After a short-lived spike at the start of the session, oil prices are moderately lower today as fears of an escalation in the Middle East fade and a risk premium is also priced in. Energy markets are likely to continue to watch development closely though. WTI is down 0.3% to $85.45/bbl after a low of $84.88, and Brent -0.2% to $90.30 after falling briefly below $90 earlier to a low of $89.77. The USD index is slightly lower.

- Iran said it has achieved its objective and also doesn’t want an escalation particularly with the US. The US has apparently warned Israel privately not to retaliate but war cabinet minister Gantz has said that it will “exact a price” when the time is right.

- Shipping risks in the Middle East have risen with Iran seizing an Israeli cargo vessel in the Strait of Hormuz. The closure of the Strait is a key concern.

- Geopolitical risks in the Middle East and Russia, key oil-producing regions, plus signs of increased demand in the US and China in addition to OPEC’s continued output cuts are driving consideration that crude will reach $100/bbl. Any second round effects from higher energy prices will be monitored closely by central banks.

- Later the Fed’s Logan and Williams appear and March retail sales and April Empire manufacturing are released. The ECB’s Lane and BoE’s Breeden speak, and euro area February IP is released.

GOLD: Higher After Friday’s Spike Reversal

Gold is 0.6% higher at $2357.66 in the Asia-Pac session, after Iran’s military launched drones and missiles against Israel over the weekend, in a significant escalation of hostilities.

- Interestingly, US tsys aree dealing weaker today after Friday’s rally.

- Today’s move comes after bullion surged to a fresh record high of $2431.52 on Friday before the gains were pared.

- The underlying safe-haven demand for the US dollar exerted itself in the latter half of Friday’s session, prompting a significant reversal lower for the precious metal.

- (Bloomberg) Gold is in an “unshakeable bull market,” according to Goldman Sachs Group Inc., which raised its year-end forecast for the precious metal to $2,700/oz. (See link)

- According to MNI’s technicals team, the next objective is $2376.5, a Fibonacci projection.

CNH: USD/CNH Lower, But USD/CNY Holding Steady, Q1 GDP & Mar Activity Data Out Tomorrow

USD/CNH sits close to session lows in recent dealings, the pair near 7.2575/80. Local equities have started the week off better than the rest of the region, although more so the CSI 300 than Shanghai Composite. Late news on Friday around fresh stock regulations is aiding sentiment (see this link for more details).

- For USD/CNH post US CPI lows on Thursday came just under 7.2500, which could be a downside target. Note the 20-day EMA, which has drifted higher, was last near 7.2440. Recent highs close to 7.2700 are the upside focus point.

- Still, spot USD/CNY is unmoved last near 7.2380, which still suggests some pent up USD demand onshore. The CNH-CNY basis has generally stayed positive in recent months, so lack of downside in USD/CNY spot may stabilize USD/CNH to a degree.

- Onshore media is also upbeat on the near term economic outlook. This comes ahead of tomorrow's Q1 GDP data. The market expects q/q growth at 1.5% (prior 1.0%), while y/y growth is forecast at 4.8% (prior was 5.2%). Also out is March activity figures.

PHILIPPINES: Philippines Sov Debt Curve Steepens, Cash Remittances Beat

- Curve has bear-steepened today, yields are 2-3bps higher with the 2Y yield is 1.5bps higher at 5.02%, 5Y yield is 1bps higher at 5.235%, 10Y yield is 2bp higher at 5.31%, while 5yr CDS is 1bp higher to 66.5bps.

- The Philip to US Treasury spread has move just off its tightest levels, with the the 2y 9bps (+3.5bp), the 5yr is 65bps (+3bps), while the 10yr is 75.5bps (+1.5bp).

- Cross-asset moves: the USD/PHP is up 0.43% at 56.781, PSEi Index is down 1.26% Corporate Credit curve is 10-14bps higher over the week with the front-end selling off, while US Tsys yields are 2-4bps lower as the curve steepens.

- In February, the Philippines experienced a higher-than-expected increase in overseas cash remittances, rising by 3.0% year-on-year compared to economists' estimates of 2.4%. Despite the decline from January's figure of $2.836 billion to $2.646 billion, the cumulative remittances for January to February totaled $5.481 billion, reflecting a 2.8% year-on-year increase.

- (Bloomberg) Philippines's Consumer Sentiment Index Improves in Q1, Outlook Drops for Q2 (See link)

- Looking Ahead, Balance Of Payments Overall on Friday

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 15/04/2024 | 0630/0230 |  | US | Dallas Fed's Lorie Logan | |

| 15/04/2024 | 0900/1100 | ** |  | EU | Industrial Production |

| 15/04/2024 | 1115/1215 |  | UK | BoEs Breeden on Payments Innovation | |

| 15/04/2024 | 1230/0830 | ** |  | CA | Monthly Survey of Manufacturing |

| 15/04/2024 | 1230/0830 | ** |  | CA | Wholesale Trade |

| 15/04/2024 | 1230/0830 | *** |  | US | Retail Sales |

| 15/04/2024 | 1230/0830 | ** |  | US | Empire State Manufacturing Survey |

| 15/04/2024 | 1400/1000 | * |  | US | Business Inventories |

| 15/04/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 15/04/2024 | 1415/1615 |  | EU | ECB's Lagarde Speaks On ECB Podcast | |

| 15/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 15/04/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |