-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: Robust Labour Market Data Supports NZD & Local Yields

- The early focus was on NZ Q4 jobs data. We saw positive surprises across all the indicators, which aided NZD, although follow through above 0.6100 has been limited. RBNZ dated OIS pricing 8-16bps firmer for meetings beyond April. A cumulative 73bps of easing is priced by year-end compared to 96bps last Friday.

- Elsewhere, HK and China equity market gains have cooled. The market may be awaiting more details around support/rescue plans. In tandem USD/CNH downside has stalled.

- US Tsys yields drifted lower in early trade, but there was no follow through. JGB futures are holding an uptick, +4 compared to settlement levels, after dealing in a relatively tight range in the Tokyo session.

- Looking ahead, before industrial production and Swiss currency reserves are out. US and Canadian trade balance data also crosses, as well as further Fed Speak, with expected comments from Fed’s Kugler, Collins, Barkin and Bowman all due.

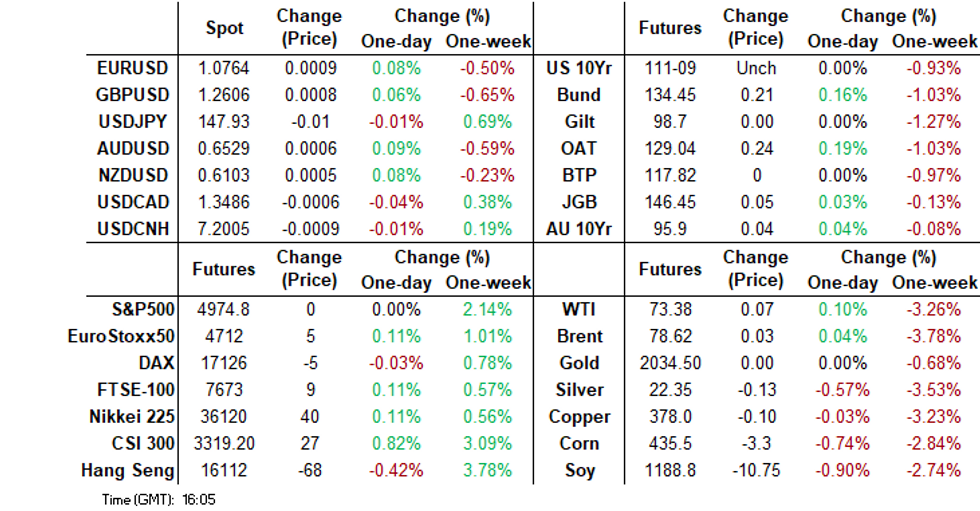

MARKETS

US TSYS: Tsys Hold Steady Ahead Of 10Y Auction Later

TYH4 is currently trading at 110-10+, + 01 from New York closing levels.

A slow day in Asia as cash yields move 1-2bps lower across the curve in early morning trading and have held there throughout the day.

- Mar'24 10Y futures tested the highs from the US session of 111-11+ early, to then settle in a very tight range throughout the rest of the session, currently holding just below at 111-10.

- Cash yields are 1-2bps lower, the 2y now trading at 4.393%, 1bp lower, while the 10Y is 1.3bps lower at 4.086% to trade just above Tuesday lows of 4.080%.

- Pimco see multiple BOJ rate hikes coming as soon as March (BBG). Fed speak from Harker noted: “While inflation does remain above target, real progress is being made,” Harker said in prepared remarks that made no reference to possible rate cuts (MNI).

- Tonight's data focus includes ongoing attention to Fed speakers, Mortgage Applications, Trade Balance, and the 10-year Treasury sale.

JGBS: Richer After 30Y Supply, BoJ Rinban Operations Tomorrow

JGB futures are holding an uptick, +4 compared to settlement levels, after dealing in a relatively tight range in the Tokyo session.

- With the domestic calendar light today, Leading and Coincident Indices for December (Preliminary) are due later, the local market’s focus was likely on today’s 30-year supply.

- The auction showed solid demand metrics, with the low price meeting dealer expectations, the cover ratio increasing to 3.181x and the tail shortening.

- Today's auction result fell in line with last week’s 10-year supply, which bucked recent trends and showed solid demand metrics.

- As highlighted in the MNI Preview, today’s auction took place with an outright yield that was 15bps higher than the early January offering. Moreover, the 2/30 yield curve was 15bps steeper and the 10/30 curve was 5bps steeper than the levels observed in early January.

- US tsys are 1-2bps richer in today’s Asia-Pac session after finishing richer on Tuesday.

- Cash JGBs are dealing richer across the curve, with the 20-40-year zone leading (1.4-1.8bps richer). The benchmark 10-year yield is 1.3% lower at 0.710% versus the Nov-Dec rally low of 0.555%.

- The swaps curve has bull-flattened, with rates flat to 1.9bps lower. Swap spreads are generally wider.

- Tomorrow, the local calendar sees weekly International Investment Flows, BoP Current Account Balance, Bank Lending and Tokyo Avg Office Vacancies data, along with BoJ Rinban Operations covering 1-25-year JGBs.

AUSSIE BONDS: Richer, Mid-Range, Year-End Easing Expectations Back To 43bps

ACGBs (YM +3.0 & XM +3.0) are richer and sit in the middle of the Sydney session’s ranges. With the domestic calendar light today, local participants have been focused on US tsys after yesterday’s bounce back after two heavy days of selling. US tsys are ~1bps richer in today’s Asia-Pac session after finishing 4-7bps richer across benchmarks on Tuesday.

- The local market's movement today is also likely to have reflected the continuing digestion of yesterday’s less dovish RBA statement and a possible spillover from the sharp sell-off in NZGBs following stronger-than-expected Q4 Employment and Wages data.

- Cash ACGBs are 3bps richer, with the AU-US 10-year yield differential 1bp wider at +1bp.

- The latest round of ACGB Nov-28 supply saw the weighted average yield print 1.53bp through prevailing mids (per Yieldbroker), extending the recent trend of firm pricing at ACGB auctions.

- Swap rates are 2bps lower.

- The bills strip has slightly bull-flattened, with pricing flat to +3.

- RBA-dated OIS pricing is dealing mixed across meetings, with a cumulative 43bps of easing priced by year-end compared to 48bps going into yesterday’s decision.

- Nevertheless, terminal rate expectations have softened to 4.30% versus the prevailing effective cash rate of 4.32%.

- Tomorrow, the local calendar is empty.

AU STIR: RBA Dated OIS Scale Back Easing Expectations Post-RBA

RBA-dated OIS pricing is dealing mixed across meetings today after yesterday’s RBA Policy Decision. A cumulative 43bps of easing is priced by year-end compared to 48bps going into yesterday’s decision.

- With the market having indicated a 0% likelihood of a 25bp hike or cut transpiring yesterday, it was the tone of the RBA statement that caused the market to scale back easing expectations.

- Nevertheless, terminal rate expectations have softened to 4.30% versus the prevailing effective cash rate of 4.32%. Any prospect of further tightening was eliminated in early December following the October CPI Monthly release in late November.

Figure 1: RBA-Dated OIS Terminal Rate Expectations Versus Cash Rate

Source: Bloomberg / MNI - Market News

RBA: MNI RBA Review – February 2024: Time Needed To See Job Done

- The RBA kept rates at 4.35% at its February meeting as expected. It also maintained its tightening bias and caution regarding services inflation and the labour market. A prolonged hold seems the most likely scenario for now.

- Governor Bullock said in her first press conference that the Board is “not ruling in or out anything” and that the risks are “broadly balanced”. In other words, the Board is keeping its options open as there remain significant uncertainties and they want to be confident that inflation will “sustainably” return to the target band. It is too early to speak of rate cuts and the message is that currently the chance of a hike is just as likely.

- A period of unchanged rates gives them the time to assess economic developments, risks and the outlook. Thus, when they do move it is likely to coincide with new quarterly CPI data and updated forecasts. The August meeting is a possibility if Q2 inflation falls below the RBA’s 3.3% forecast, but it is more likely to be in November if a return to the top of the band is still projected for Q2 2025.

- See full review here.

NZGBS: Closed At Session Cheaps After Stronger Than Expected Employment & Wages Data

NZGBs closed on a weak note, with benchmark yields 8-13bps higher and the 2/10 curve flatter, after Q4 employment and wages data printed stronger-than-expected across the board: Employment Change 2.4% q/q vs 2.1% est. and an upwardly revised 2.7% prior, Unemployment Rate 4.0% vs 4.3% est. and 3.9% prior and Private Wages Including Overtime 1.0% q/q vs 0.8% est and 0.9% prior.

- Ahead of the data drop, NZGBs were little changed, ignoring the strength in US tsys overnight. US tsys have slightly extended the overnight rally, with yields ~1bp lower in today’s Asia-Pac session after yesterday’s 4-8bps drop across benchmarks.

- Swap rates are 8-12bps higher on the day, with the 2s10s curve flatter.

- RBNZ dated OIS pricing 8-16bps firmer for meetings beyond April. A cumulative 73bps of easing is priced by year-end compared to 96bps last Friday.

- Tomorrow, the local calendar is empty.

- Tomorrow, the NZ Treasury plans to sell NZ$275mn of the 1.5% May-31 bond, NZ$150mn of the 3.5% Apr-33 bond and NZ$75mn of the 2.75% Apr-37 bond.

NZ DATA: Robust Labour Market & Elevated Wages Mean Prolonged RBNZ Hold

Employment data for Q4 came in stronger than expected with the unemployment rate only rising 0.1pp to 4.0% and new jobs up 0.4% q/q to be up 2.4% y/y, which was still a slowdown from Q3’s upwardly revised 2.7% y/y. While the labour market is gradually easing, it remains tight and wage pressures persist and so the RBNZ is on hold for the foreseeable future while it monitors developments.

- Working age population grew 3% y/y compared with 2.4% for employment and so the unemployment rate was 0.6pp higher than a year ago and 0.8pp from the trough but remains well below the historical average.

Source: MNI - Market News/Refinitiv

- Full-time employment growth remains robust rising 0.7% q/q and 2.2% y/y in Q4 with part-time easing 0.3% q/q to be up 3.4% y/y. Both are off their peaks but remain solid.

Source: MNI - Market News/Refinitiv

- The underutilisation rate continued trending higher at 10.7% up 0.3pp q/q and +1.4pp y/y. This increase has been driven by rising underemployment. Statistics NZ reported that there were 8k more people underemployed in Q4 while the number of unemployed rose by less (+3k).

- Labour costs remained elevated rising 1% q/q and 4.3% y/y, where it has now been for four quarters. Private sector wages have eased to 6.6% y/y, stronger than expected, after peaking at 8.6%, whereas the public sector saw an increase of 7.4%, the highest in almost 18 years. The continued strength in wages will worry the RBNZ and means easing is unlikely until later in the year at the earliest.

FOREX: USD Close To Unchanged, NZD Aided By Jobs Data

The USD is relatively steady in Wednesday trade to date. The BBDXY last near 1240.80, down a touch from end Tuesdya levels in NY. Cross asset moves have been muted, with US yields a touch lower, while US equity futures have shown some volatility but since unchanged this afternoon.

- Early focus was on NZ Q4 employment data, which came out stronger than expected across all the indicators. NZD/USD rose to 0.6107 but had little follow through, we eventually got to 0.6112 but sit back closer to 0.6100 in recent dealings.

- Positive HK/China equity sentiment aided NZD and AUD gains, but markets are away from best levels this afternoon.

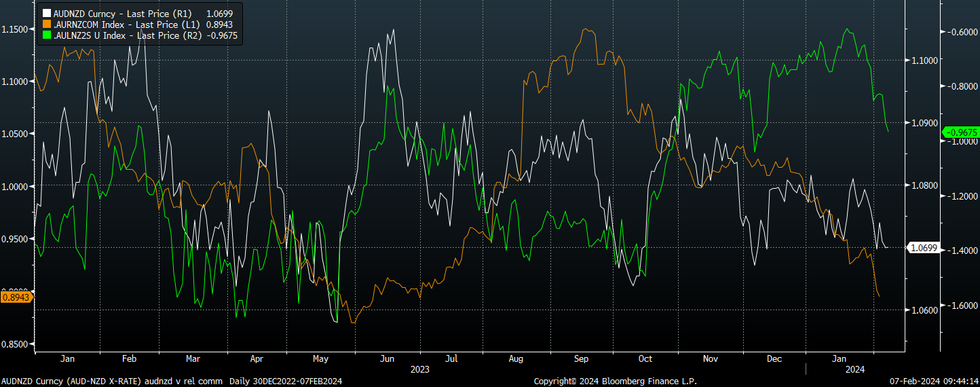

- AUD/USD sits near 0.6530 this afternoon against earlier highs of 0.6540. AUD/NZD has seen dips towards 1.0690 supported, the pair last near 1.0705. Sentiment is skewed lower in the pair given relative yield differentials and relative commodity prices, as we noted earlier (see this link).

- USD/JPY sits near 147.90 little changed for the session and having tracked a tight range overall (less than 30pips).

- Looking ahead, before industrial production and Swiss currency reserves are out. US and Canadian trade balance data also crosses, as well as further Fed Speak, with expected comments from Fed’s Kugler, Collins, Barkin and Bowman all due.

AUD/NZD: Macro Drivers Pointing South

Macro drivers for AUD/NZD have been skewed lower in recent weeks. The chart below plots the spot AUD/NZD cross against the 2yr AU-NZ swap spread (the green line on the chart) and the ratio of AU to NZ commodity prices (the orange line), proxied by a DB Australian series and a ASB series for NZ.

- The 2yr swap spread has fallen sharply in recent week, back close to -100bps, versus -60bps in mid Jan. Hawkish RBNZ rhetoric (from the Chief Economist) and positive data surprises have aided the move in NZD's favor. AU data outcomes have been slightly more mixed, although the RBA hasn't ruled out tightening further.

- On the relative commodity front, the skew has also been in NZ's favor as well. Overnight we had another solid rise in while milk powder prices at the GDT auction (see this link). The trend in dairy prices has been positive for a number of month and Westpac has revised higher its 2023-24 milk price forecast this morning.

- On the AU commodity price side, softer China sentiment and a resurgent USD since the start of the year (which has had an impact on base metal prices) has hurt sentiment. The focus is likely to be on China efforts to aid the local equity market backdrop and the broader economy. If successful, this is likely to benefit the AUD more so than NZD.

- Technically, spot AUD/NZD sits near 1.0700 in current dealings. A clean break sub this level could see Dec 2023 lows at 1.0656 targeted. Oct lows were at 1.0624. On the topside, the 20-day EMA is back near 1.0740, while the 200-day sits close to 1.0800.

Fig 1: AUD/NZD Versus AU-NZ 2yr Swap Differential & AU/NZ Commodity Prices

Source: DB/ABS/MNI - Market News/Bloomberg

CHINA EQUITIES: Equity Rally Runs Out of Steam, Share Buy-Backs Reach Record High

After a strong start to trading in Asia today, Chinese and Hong Kong equities seem to have run out of steam, as tech names weigh on performance, this could be somewhat attributed to poor earning from SNAP late in the US session. Hong Kong equities trade in negative territory, while mainland China stock still hold onto gains for the day.

- As trading got underway in Asia, equity markets again ripped higher, HSI was at one point 2.4% higher but the gain were short lived and we quickly reversed the HSI is currently trading flat, while HS Tech is lower by 0.80% and mainland property index is 2.36% lower. China Mainland indices are faring slightly better today, with CSI 300 still holding onto gains to be 0.46% higher.

- Chinese companies have been ramping up their share buybacks after government authorities have pushed for companies to help support the slumping market, Chinese and Hong Kong listed companies spent 14b yuan repurchasing shares last month, the highest on record (BBG)

- In sector specific news, property names see further support after another government funding push, as the financial regulators call for a prompt implantation of financing coordination mechanism (BBG). While Chinese Vice Commerce minister held calls with US officials around concerns about US semiconductor control measures. This follows the meeting between China Vice Premier He Lifeng and US Treasury officials in Beijing on Tuesday (BBG). The talks included industrial policies and US concerns around over capacity

Asia Pac Equities: Equities Trade Higher, As Yields Trend Lower

Regional Asia Equities are mostly higher this afternoon, following on from the US trading session as yields moved lower and continued that trend in Asia trading, there has been little in way on news flow today.

- Japan equities indices opened weaker this morning as tech names weighed on the market, after SNAP missed earnings and plunged 20% in late US trading, the tech heavy Nikkei trades 0.20% lower today, recovering some of its early losses, while the Topix is 0.35% higher. In other news, Toyota's market value breaks ¥50 trillion for the first time, while Mitsubishi shares surged after they announced a monster share buy-back program to repurchase up to 10% of their shares.

- Australia Equities are higher today, after falling for the past two days. Lower US yields are supporting the move higher so far, as the market brushed of the hawkish rate talk from the RBA yesterday. Financials and Mining names are led the move higher today, with the ASX 200 closing 0.45% better. In stock specific news the potential merger between Woodside and Santos has been called off causing Santos equity to fall over 6%.

- South Korea stocks are higher today, snapping a two-day losing streak. Data out earlier showed SK Dec Current account surplus widen to $7.415B, currently the Kospi is trading 1.00% higher. South Korean equities have seen $220.7mn in offshore inflows in Wednesday trading to date.

- Elsewhere in SEA, it has been a strong start to trading with most markets trading 0.25-1.00% higher.

OIL: Crude Little Changed As More Red Sea Trouble Offset By Higher US Inventories

Oil prices are only up moderately during APAC trading today rising almost a percent on Tuesday as geopolitical tensions persist. But a pickup in US crude inventories has kept a lid on prices. WTI is 0.2% higher at $73.47/bbl after an intraday high of $73.72 earlier. Brent has been trending lower since its high at $78.69 and is now up 0.2% to $78.71. The USD index is moderately lower.

- US Central Command reported that six missiles were fired by Houthis at shipping yesterday in the Gulf of Aden and the southern Red Sea. MV Star Nasia was hit but there was only minor damage. With no end in sight for these attacks, more ships are taking the longer route around southern Africa. This has provided support to oil prices amid concerns of excess supply.

- A ceasefire deal in Gaza would likely drive crude lower. Qatar said that a draft has been presented to Hamas and the response so far was “positive”.

- Bloomberg reported that US crude inventories rose 674k barrels, less than expected, according to people familiar with the API data. While gasoline stocks rose 3.652mn, distillate saw a drawdown of 3.7mn. The official EIA data is out later today.

- Later the Fed’s Harker, Kugler, Collins, Barkin, Bowman, Remache and Nordstrom all speak. On the data front there is December US trade and consumer credit and German IP.

GOLD: Gains Ground As Fed Rhetoric Softens

Gold is little changed in the Asia-Pac session, after closing 0.5% higher at $2036.14 on Tuesday.

- Bullion’s performance on Tuesday reflected a weaker USD and lower US Treasury yields as Fedspeak softened its rhetoric. Cash US Treasuries are dealing ~1bp richer in today’s Asia-Pac session after finishing 4-8bps richer across benchmarks on Tuesday.

- There was a muted initial reaction to Fed Mester economic outlook comments, which were largely in line with Chairman Powell's comments. However, Mester later reiterated the likelihood of three rate cuts in 2024. Fed President Kashkari also sounded more placative of late.

- Projected Fed rate cut pricing gained slightly by Tuesday's close: March 2024 chance of 25bp rate cut at 20% vs. 17% prior. May 2024 at a cumulative -20bps at 5.12%, while June 2024 back to -43bp at 4.90%.

- Yesterday’s increase moved gold away from support at $2015.0 but it remains some way off resistance at $2065.5 (Feb 1 high).

RBI: MNI RBI Preview - February 2024: On Hold, But Scope To Shift To Neutral

- The consensus and our own strong bias is for no change at tomorrow's RBI policy meeting. There will be more focus on the central bank's policy stance. We see a risk they shift to neutral from 'withdrawal of accommodation', although this will be a close call, with risks the RBI maintains the status quo.

- The sharp drop in core inflation pressures, the domestic liquidity deficit and fiscal consolidation, point to a more neutral RBI outlook. If the RBI doesn't shift its policy stance at this meeting, we suspect it will do so at the next (most likely in April).

- Full preview here:

ASIA FX: Most USD/Asia Pairs Lower, CNH Gains Slow As Equities Stabilize

Dips in USD/CNH and USD/KRW have been supported so far today. The better HK/China trend has stalled somewhat today curbing yuan gains. The USD is generally weaker though against the SEA currencies, with THB, PHP and IDR the better performers in spot and NDF terms. Still to come is the BoT decision, with no change expected. Tomorrow, we have China Jan inflation data, along with the RBI decision. We expect the RBI to be on hold.

- USD/CNH broke under 7.1900 in early trade, aided by a firmer equity open, particularly in Hong Kong. The PBoCs announcement of yuan debt sales in HK later in Feb likely aided CNH at the margins as well. However, this marked the low for the session (7.1888), as we climbed back to 7.2050 this afternoon. The equity rebound has run out steam with for HK and mainland shares, with the market potentially waiting for more details around support policies/rescue plans.

- 1 month USD/KRW was heavy in early trade, with won sentiment aided by broader USD weakness and onshore equity market gains. Offshore investors have purchased over $200mn of local shares today. However, after getting to lows of 1320.70 we have turned back higher, back to 1325/26, little changed for the session. Higher USD/CNH levels likely seeing some spill over to CNH.

- USD/THB gaped lower at the open, getting to lows of 35.45, but there hasn't been much follow through as markets await the BoT meeting outcome later. The pair was last near 35.50, still around 0.50% stronger in baht terms for the session largely thanks to weaker USD trends more broadly. For USD/THB, the 20-day EMA isn't too far from current spot levels (last around 35.42). The 200-day sits further south at 35.24. On the topside, recent highs rest at 35.83.• The upcoming BoT meeting will be eyed both for the outcome (no change is expected from us or the consensus) and the BoT tone and forecast outlook.

- USD/IDR sits lower, back under 15700, while the 1 month NDF is near 15695, both benchmarks around 0.30% stronger in rupiah terms for the session so far. This keeps us within recent ranges. Recent lows in USD/IDR spot came in at 15644. Some calmness to the US yield backdrop has likely aided IDR sentiment, while regional equity gains have mostly been positive.

- It has been a similar backdrop for USD/PHP, which sits back near 56.00 and around 0.35% stronger in PHP terms. We aren't too far off the simple 200-day MA (near 55.96).

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 07/02/2024 | 0645/0745 | ** |  | CH | Unemployment |

| 07/02/2024 | 0700/0800 | ** |  | DE | Industrial Production |

| 07/02/2024 | 0745/0845 | * |  | FR | Foreign Trade |

| 07/02/2024 | 0800/0900 | ** |  | ES | Industrial Production |

| 07/02/2024 | 0840/0840 |  | UK | BoE's Breeden Speaks At Women In Economics Event | |

| 07/02/2024 | 0900/1000 | * |  | IT | Retail Sales |

| 07/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 07/02/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 07/02/2024 | 1215/1215 |  | UK | BOE's Woods et al : Treasury Select Committee 'work of the PRA' | |

| 07/02/2024 | 1330/0830 | ** |  | CA | International Merchandise Trade (Trade Balance) |

| 07/02/2024 | 1330/0830 | ** |  | US | Trade Balance |

| 07/02/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 07/02/2024 | 1600/1100 |  | US | Fed Governor Adriana Kugler | |

| 07/02/2024 | 1630/1130 |  | US | Boston Fed's Susan Collins | |

| 07/02/2024 | 1800/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 07/02/2024 | 1830/1330 |  | CA | BOC Minutes (Summary of Deliberations) | |

| 07/02/2024 | 1900/1400 |  | US | Fed Governor Michelle Bowman | |

| 07/02/2024 | 2000/1500 | * |  | US | Consumer Credit |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.