-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: South Korea Trade Data Offers Some Hope For The Global Outlook

- JGB futures are holding richer at 148.64, +11 versus settlement levels, after trading in a narrow range in the Tokyo session. The BoJ Minutes for the April Meeting and a speech from BoJ Board Member Seiji Adachi didn't suggest a YCC shift at the July meeting was a strong likelihood at this stage.

- Elsewhere, regional equities are mostly weaker so far in the Wednesday session. Weakness is evident in HK and China equities, as recent gains on stimulus hopes are unwound further. Calls for further stimulus continues from various China officials, including some linked closely to President Xi Jinping

- South Korea's first 20-days of trade data for June suggests it is not all doom and gloom for the global outlook though.

- Looking ahead, the UK's CPI report headlines in Europe today. Further out we have Mortgage Applications and Fed Chair Powell's semi-annual testimony to the House Services Panel. Also due to cross is Fedspeak from Chicago Fed President Goolsbee, and we have the latest 20-Year supply.

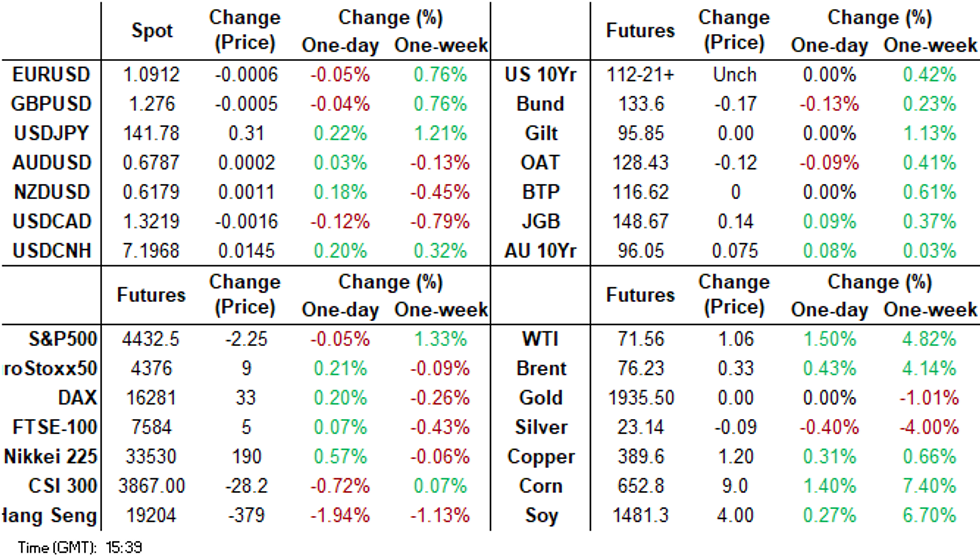

MARKETS

US TSYS: Marginally Cheaper In Asia

TYU3 deals at 113-07, -0-03, a touch off the bottom of the observed 0-06 range on volume of ~43k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Asia-Pac participants faded yesterday's richening, perhaps focusing on Tuesday US housing data in early dealing.

- A brief bid in the USD saw Tsys marginally extended losses however there was little follow through on the moves and narrow ranges persisted for the remainder of the session.

- Little meaningful macro news flow crossed.

- The UK's CPI report headlines in Europe today. Further out we have Mortgage Applications and Fed Chair Powell's semi-annual testimony to the House Services Panel. Also due to cross is Fedspeak from Chicago Fed President Goolsbee, and we have the latest 20-Year supply.

JGBS: Futures Stronger, Narrow Range, 5-Year Supply & BoJ Speak Tomorrow

JGB futures are holding richer at 148.64, +11 versus settlement levels, after trading in a narrow range in the Tokyo session.

- There hasn’t been much in the way of domestic drivers to flag, outside of the previously outlined BoJ Minutes for the April Meeting and a speech from BoJ Board Member Seiji Adachi.

- According to the MNI technicals team, JGBs continue to operate above support at 147.34, the May 26 low. The contract pierced 148.41, the May 12 high, on Friday. A clear break would strengthen a bullish case and signal scope for a climb towards the next key resistance at 149.21/53, this year's highs from May and March. Clearance of these levels would highlight an important break. To the downside, a breach of 147.34 would signal a stronger reversal and open 146.11, the Feb 22 low.

- The cash JGBs curve twist flattens with the 10-year zone (-1.2bp lower) leading. The benchmark 10-year yield is at 0.381%, below the BoJ's YCC limit of 0.50%.

- Swap spreads are generally narrower out to the 20-year zone and wider beyond.

- The local calendar tomorrow sees Weekly Investment Flow data (June 16) ahead of 5-year supply. BoJ Board Member Noguchi is also scheduled to give a speech in Okinawa.

AUSSIE BONDS: Richer, Narrow Range, Focus On Chair Powell's Testimony

ACGBs sit richer (YM +6.0 & XM +6.5) but at session cheaps as overnight strength in US tsys is faded ahead of Fed Chairman Powell's semi-annual testimony to House Services Panel later today. Chair Powell is not expected to deviate from last week's policy messaging.

- US tsys are holding cheaper through the Asia-Pac session, but ranges are narrow given the lack of meaningful news flow.

- Cash ACGBs are 5-6bp richer on the day with the AU/US 10-year yield differential +1bp at +23bp, the highest level since September of last year. The 10-year differential had traded within a range of -30bp to +20bp since November. The recent shift in the 10-year yield differential can be attributed to the divergent expected rate paths of the US Fed and the RBA. (See link)

- Swap rates are 5-6bp lower with EFPs slightly wider.

- The bills strip bull steepens with pricing +2 to +4.

- RBA-dated OIS pricing is 2-5bp softer across meetings with Feb’24 leading.

- The local calendar is light tomorrow.

- TCV has priced an A$2.75 billion increase to the 2.25% 20 November 2034 benchmark bond via syndication, taking outstanding volume to A$8.708bn. The bond priced with a re-offer spread of +95 basis points over the 10-year futures contract, equivalent to +90.5 basis points over the ACGB 3.5% 21 December 2034.

AU RATES: AU/US 10-Year Yield Differential Widening Consistent With Policy Outlook

The AU/US 10-year cash yield differential remains unchanged today at +23bp, sitting at its highest level since September of last year. The 10-year differential had traded within a range of -30bp to +20bp since November.

- The recent shift in the 10-year yield differential can be attributed to the divergent expected rate paths of the US Fed and the RBA. The RBA is in the process of catching up to the rate hikes that have already been implemented by the Fed. Currently, the RBA's cash rate stands at 4.10%, while the US Fed funds rate is at 5.0-5.25%

- This idea is strengthened by the observation that a basic regression analysis of the AU/US cash 10-year yield differential and the AU/US 1Y3M swap differential throughout the current tightening cycle indicates that the 10-year yield differential is currently in line with its fair value.

Figure 1: AU/US 10-Year Yield Differential (%, Y-Axis) Vs. AU/US 1y3m Swap Spread (%, X-Axis)

Source: MNI – Market News / Bloomberg

AUSTRALIAN DATA: Labour Market Indicators Clearly Pointing To Tight Labour Market

On Tuesday RBA Deputy Governor Bullock spoke about the labour market and achieving full employment. She said that while the NAIRU is difficult to estimate, Australia is currently below it and so labour demand exceeds supply and they need to be back in balance to return inflation to target (see RBA Aiming To Return Unemployment To Neutral To Contain Prices). She showed some indicators that the RBA is monitoring to gauge the degree of labour market tightness. The charts below show a number of them.

- The indicators that the RBA are looking at are still clearly pointing to a very tight labour market. The unemployment rate continues to hover around its series low of 3.4% and we are yet to see a material rise in this indicator. It remains around 1pp below the RBA’s 4.5% estimate of the NAIRU.

- The underemployment rate, those who would like to work more, is another measure the RBA is watching and while it has risen 0.6pp, it also remains historically low.

- Vacancies are off their peak but remain elevated and there are still job openings for 85% of the unemployed. And job churning also remains high.

Source: MNI - Market News/ABS

Australia vacancies to unemployment %

Source: MNI - Market News/Refinitiv

*Q2 vacancies estimated from monthly data, unemployment Apr/May average

NZGBS: Closed Cheaper, US Tsys Weaken Ahead Of Chair Powell's Address

NZGBs closed 2bp cheaper, but well off session bests set in early local session trading. The limited local calendar activity suggests that the upward movement from yield lows can largely be attributed to softer US tsy yields in Asia-Pac trading. However, the range for cash tsys has been relatively narrow given the absence of significant macroeconomic news flow.

- The NZ/US 10-year yield differential has widened by 8bp, currently standing at +74bp. In addition, NZGBs have shown weaker performance compared to ACGBs, with the NZ/AU 10-year yield differential increasing by 7bp to +50bp, after reaching a five-week low yesterday.

- The 2s10s swap curve twist flattened with rates +3bp to flat.

- RBNZ dated OIS pricing closed 1-3bp firmer across meetings with terminal OCR expectations at 5.60%.

- The local calendar is slated to release May trade balance data tomorrow. The underlying balance is slowly improving as imports soften.

- Before then, the focus turns to Fed Chairman Powell's semi-annual testimony to the House Services Panel later today, though it's unlikely Chair Powell will deviate from last week's policy messaging.

- The NZ Treasury announced that they plan to sell NZ$200mn of the 4.50% 15 May 2030 bond, NZ$150mn of the 3.50% 14 April 2033 bond and NZ$50mn of the 2.75% 15 April 2037 bond tomorrow.

FOREX: Muted Asian Session On Wednesday

Its been a muted Asian session for G-10 FX, moves have been limited with little follow through and ranges have been narrow.

- AUD/USD is ~0.1% dealing in a narrow range below the $0.68 handle. The May Westpac Leading Index printed at -0.27%, the prior read was -0.03%.

- Kiwi is a touch firmer however NZD/USD has observed a 15 pip range for the most part of todays Asian session.

- Yen is marginally pressured, USD/JPY is up ~0.1% however the pair remains well within recent ranges.

- Elsewhere in G-10 EUR and GBP are a touch lower than Tuesday's closing levels.

- Cross asset wise; BBDXY is ~0.1% firmer and US Treasury Yields are ~2bps firmer across the curve. E-minis are little changed.

- The May CPI report from the UK headlines todays data docket. Headline CPI is expected to tick lower to 0.5% M/M from 1.2% M/M in April.

EQUITIES: HSI Threatening Move Back Sub 200-day MA

Regional equities are mostly weaker so far in the Wednesday session. Weakness is evident in HK and China equities, as recent gains on stimulus hopes are unwound further. Other bourses are tracking higher though, most notably Japan, but gains are modest at this stage. Following US/EU equity losses from Tuesday, futures for both markets are tracking a touch higher at this stage, although more so for the EU.

- The HSI is slightly above session lows at the break, down 1.90%, which puts the index just below its 200-day MA (19263.35). Tech index losses are weighing, the sub-index down a further 2.2%, the third straight session of losses. The Golden Dragon index fell nearly 5% in US trade on Tuesday.

- China's CSI 300 is back sub 3900, off 0.62% at the break. Calls for further stimulus continues from various China officials, including some linked closely to President Xi Jinping (see this link for more details). Per Reuters reports, US President Biden referred to China President Xi Jinping as a dictator, at a campaign rally in California.

- The Kospi and Taiex are tracking lower, more so the Kospi (-0.70%) as recent tech gains in global indices unwind gains. Reasonable offshore selling is also evident for Korean shares (-$303.2mn at this stage).

- Japan stocks are doing better, the Nikkei 225, +0.55% firmer.

- In SEA Thai stocks are off by 0.70%, but Singapore and Malaysian stocks are higher, while Indian stocks have started positively.

OIL: Crude Moves Higher Ahead Of Fed Chair Powell’s Appearance

Oil prices are up slightly during APAC trading ahead of Fed Chair Powell’s appearance later but are still down around 0.6% on the week. WTI is 0.4% higher to $71.49/bbl, close to the intraday high of $71.58. Brent is up 0.3% to $76.16, also near the high of $76.29. The USD index is slightly higher.

- China’s recent measures to support the economy appear to have helped provide a floor to oil prices today, but the market remains sensitive to demand indicators and is likely to look through stimulus if the data continue to disappoint. China National Petroleum Corp reduced its 2023 oil demand growth expectations to +3.5% from +5.1%.

- Later Fed Chairman Powell appears before the House Financial Services Panel, which should help frame the rate outlook, and Fed’s Goolsbee will also speak. On the data front UK May CPI and US mortgage applications are published.

GOLD: Lowest Close Since March

Gold is slightly higher in the Asia-Pac session, after closing 0.7% lower at 1936.42 on Tuesday, its lowest close since late-March.

- Firmer than expected US housing market data, coupled with the related move in the broader USD and US Tsys, saw spot gold shed ~$15/oz in fairly short order, with a fresh NY session low registered during the process.

- According to MNI's technicals team, the bear cycle in gold remains intact. The yellow metal is trading below trendline support drawn from Nov 3 2022 low - the trendline intersects at $1971.2. The break of this line reinforces bearish conditions and marks a resumption of the downtrend. The focus is on $1903.5, 61.8% of the Feb 28 - May 4 bull cycle. Initial firm resistance is $1985.3, the May 24 high. Clearance of this resistance would signal a short-term reversal instead.

INDONESIA: MNI BI Preview - June 2023: On Hold, Easing Talk Not Yet

- Bank Indonesia (BI) has been on hold at 5.75% since February and are unanimously expected to stay there at the June 22 meeting. The discussion is now around when it is likely to begin easing given that inflation has returned to the target band sooner than expected.

- It is unlikely that BI will begin to signal a pivot at the June meeting due to some IDR weakening and clear indications from the Fed this month that it was not yet done. Watch the meeting press release for any further changes in tone.

- A marked deterioration in growth, a stable Fed, further fall in inflation with the IDR holding below its March peak of 15400 are likely needed to drive the onset of an easing bias.

- See full preview here.

PHILIPPINES: MNI BSP Preview- June 2023: On Hold Again

- None of the 25 economists surveyed by Bloomberg expect a change from the BSP tomorrow, with the policy rate forecast to hold steady at 6.25%. This is also our bias heading into the meeting.

- The authorities appear confident of a further down move in headline inflation pressures as we progress through the remainder of 2023. The baseline view is that, by year end, inflation is expected to be back sub the top end of the target band (2-4%), before reaching the 3% mid point in 2024.

- Focus may inevitably shift to when the BSP will cut rates. Finance Secretary Diokno noted Q1 2024 was a possibility if the inflation impulse fell strongly enough. A lot is likely to ride on how the Fed outlook unfolds as we progress through H2 of 2023.

- Click to view the full preview here:

ASIA FX: USD/CNH Breaches 7.2000, IDR Extends Rebound

Most USD/Asia pairs are trading with a firmer tone, as USD/CNH briefly traded to fresh highs above 7.2000. The won also continued to unwind some its recent outperformance. IDR was a clear outperformer though, likely aided by the pull back in core yields from Tuesday's session. Tomorrow the focus will be on the BI and BSP decisions, with no change expected from either central bank.

- USD/CNH breached 7.2000 not long after we had a slightly weaker CNY fixing and further HK,/China mainland equity market weakness. Highs were at 7.2007 and we currently track close to 7.1970/80. Calls for further policy remain strong across the board, from a local media standpoint.

- Spot USD/KRW is up nearly 1% so far in Wednesday trade. This puts the pair back in the 1292/93 region. This is highs back to earlier parts of June. Regional equity markets are mostly weaker, with the Kospi off by 0.65% so far today, putting the index back sub the 2600 level. Offshore investors have sold just over $300mn of local shares, bringing week to date outflows close to $1bn. Higher USD/CNH levels (the breach of 7.2000) may also be having an impact.

- The rupiah is bucking the broader trend of firmer USD levels within Asia Pac trade today. After printing fresh highs above 15050 yesterday we sit back around 14955/60 in latest dealings. Spot IDR recovered sharply ahead of yesterday's onshore close, so we are only modestly firmer so far today in terms of spot gains. The 1 month NDF sits just under 14980. Lower core yields through Tuesday's session have likely aided the IDR recovery, although there doesn't appear to be many other cross asset supports.

- The ringgit has weakened in early dealing as broader USD/Asia trends continue to dominate flows. USD/MYR has printed a fresh year to date high last printing at 4.6490/4.6505. The pair is ~0.2% higher today. Malaysia's Economy Minister Rafizi Ramli noted that the government hasn't discussed directly intervening in markets to support the nations currency. Looking ahead, Jun 15 Foreign Reserves cross tomorrow before May CPI on Friday.

- The SGD NEER (per Goldman Sachs estimates) is marginally firmer in early dealing, the measure remains well within recent ranges. We now sit ~0.5% below the upper end of the band. USD/SGD is consolidating recent gains, dealing in a narrow range above the $1.34 handle. The pair last prints at $1.3430/40. Singapore's Energy Market Authority plans to more aggressively regulate electricity markets as price jumps intensify. A reminder that the local docket is empty until Friday's CPI print. Headline CPI is expected to fall to 5.4% Y/Y from 5.7%, and Core CPI is also expected to tick lower to 4.6% Y/Y from 5.0%.

- USD/INR is little changed in early dealing on Wednesday, consolidating above 82 in a narrow range. Foreign investors' inflows into Indian equities continued with $214.26mn on Monday bringing the total in June to date to $1.762bn. A reminder that the data calendar is light with just Q1 BoP Current Account Balance on the wires which is due between today and month end.

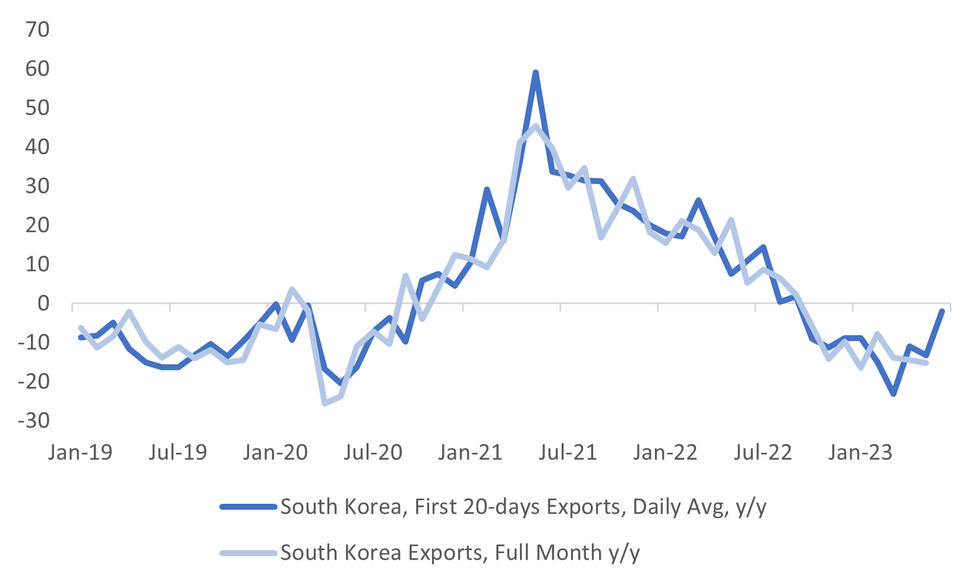

SOUTH KOREA DATA: Better Exports, Lower Trade Deficit In First 20-days Of June

The first 20-days of June trade data showed an improving trend in terms of the headline export print. We printed at +5.3%y/y, the first gain since August last year. It also compares with -16.1% y/y last month, although base effects have been at play over the past 2 months.

- The daily average export number was -2% y/y, so less positive than the headline result, but the trend is improving. This metric troughed at -23.1% y/y in March of this year. As the chart below suggests this points to improving trends in the full month y/y figure, although the relationship is by no means perfect between the two series.

- Chip exports were still down -23.5% y/y, but this is an improvement on the May read of -35.5% (for the first 20 days of that month).

- Exports to China were down -12.5% y/y, but again showing an improvement, while exports to the US bounced to +18.4% y/y.

- On the import side, we were down -11.2% y/y, with momentum slightly better compared to the first 20-days of May (-15.3%).

- The trade deficit was -$1.607bn, versus -$4.3bn for the equivalent period in May. This is the best result (for the 20-day period) since late 2021.

Fig 1: South Korea Export Trend Showing Slightly Better Trends

Source: MNI - Market News/Bloomberg

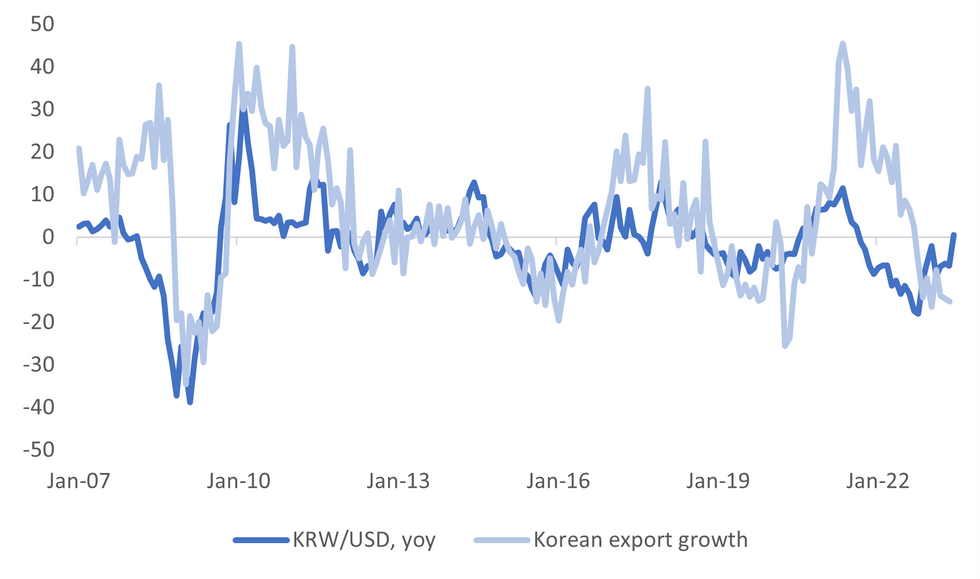

KRW FX: Further Unwinding Of Recent Outperformance

Spot USD/KRW is up nearly 1% so far in Wednesday trade. This puts the pair back in the 1292/93 region. This is highs back to earlier parts of June. Just above the 1300 level sits the 50-day MA around 1302.50. On the downside recent dips come in under 1270.

- Earlier today we had the first 20-days of trade data for June, which showed tentative signs of a less adverse export backdrop. Why hasn't this benefited the won? Regional equity markets are mostly weaker, with the Kospi off by 0.65% so far today, putting the index back sub the 2600 level.

- Offshore investors have sold just over $300mn of local shares, bringing week to date outflows close to $1bn. Higher USD/CNH levels (the breach of 7.2000) may also be having an impact.

- Even after today's correction, the won is still the best EM Asia FX performer in June to date (+2.6%, with PHP next best at ~1%).

- In this sense a better export backdrop may already be priced by the won to some degree. The chart below plots y/y KRW/USD changes against export growth, assuming current spot KRW levels hold to end June. Note the export line is for full month exports, not the 20-day update released earlier today, so is only up to date for May figures.

Fig 1: South Korea Export Growth & KRW/USD Y/Y Changes

Source: MNI - Market News/Bloomberg

SOUTH KOREA: Highlights From Local News Wires

Below is a collection of news wires reports from English versions of South Korean Newspapers and some other major news outlets from the past day or so.

INFLATION: S. Korea to freeze Q3 electricity rates amid mounting public burdens (link)

BOK: Higher rates, economic slowdown, slump in real estate market pose risks to financial system: BOK report (link)

TRADE: Exports up 5.3% during first 20 days of June (link)

TECH: Korean chipmakers ask US to extend exemption on export controls (link)

FX: Koreans Snap up Weak Yen (link)

FLOWS: S. Korea's overseas investment dips 41.6 pct in Q1 (link)

DEBT: Mounting national debt erodes S. Korea's competitiveness: report (link)

GEOPOLITICS: Yoon asks Macron to help ensure EU trade laws do not harm S. Korean businesses (link)

GEOPOLITICS: S. Korea completes environmental assessment of U.S. THAAD missile defense base (link)

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 21/06/2023 | 0600/0700 | *** |  | UK | Public Sector Finances |

| 21/06/2023 | 0600/0700 | *** |  | UK | Producer Prices |

| 21/06/2023 | 0600/0700 | *** |  | UK | Consumer inflation report |

| 21/06/2023 | 0600/0800 | ** |  | SE | Unemployment |

| 21/06/2023 | 0830/0930 | * |  | UK | ONS House Price Index |

| 21/06/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 21/06/2023 | 1230/0830 | ** |  | CA | Retail Trade |

| 21/06/2023 | 1255/0855 | ** |  | US | Redbook Retail Sales Index |

| 21/06/2023 | 1345/1545 |  | EU | ECB Schnabel Panels Discussion at Landesvertretung Hessen | |

| 21/06/2023 | 1400/1000 |  | US | Senate Hearing on Fed Nominees | |

| 21/06/2023 | 1400/1000 |  | US | Fed Chair Jerome Powell | |

| 21/06/2023 | 1625/1225 |  | US | Chicago Fed's Austan Goolsbee | |

| 21/06/2023 | 1700/1300 | ** |  | US | US Treasury Auction Result for 20 Year Bond |

| 21/06/2023 | 1730/1330 |  | CA | BOC minutes from last rate meeting |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.