MNI EUROPEAN MARKETS ANALYSIS: Steady USD & Yields

- Broader market moves have been limited in the first part of Friday trade. Relief that we are unlikely to see reciprocal tariffs in the near term (with an early April date touted), hasn't weighed much further on the USD, although dollar indices are down comfortably for the week.

- US Tsy futures have been relatively steady, while JGB futures are stronger, +4 compared to settlement levels, but well off the session’s best levels. NZ data was stronger, but isn't seen shifting the near term RBNZ easing outlook.

- Hong Kong equities continue to outperform, led by the tech side, but spill over elsewhere hasn't been evident.

- Looking ahead, we have EU GDP, while in the USD retail sales is likely to be the main focus point. We also hear from the Fed's Logan.

MARKETS

- Not too much to mention for tsys during Asia today, the curve has steepened slightly, with the 2s10s roughly +1bps at 22.632. Volumes in tsys futures are well below recent averages, TU is +00⅜ at 102-21⅝, the only contract in the green, while TY is -01+ at 108-29+

- The 10yr is unchanged at 4.529%, the 10yr has slightly out-performed the 5-30yrs part of the curve over the past week. BBG have reported that MLIV survey participants expect the 10yr to rise to 4.80% over the coming 6 months, the 10yr last reached this level in early Jan.

- January retail sales are expected to soften due to harsh weather that dampened vehicle sales and shopping activity, despite strong labor market and inflation data. Headline retail sales are expected to have fallen 0.4%, while core sales (excluding autos and gas) likely to have risen 0.2%. Rebuilding efforts from natural disasters may have boosted sales of building materials, though small-business data and consumer sentiment suggest downside risks. Despite this, robust Q4 consumer spending—driven by higher wages and front-running of tariff hikes—is expected to continue supporting demand, particularly for durable goods.

- • Projected rate cuts through mid-2025 steady to slightly firmer vs. Thursday (*) as follows: Mar'25 steady at -0.5bp, May'25 steady at -3.9bp, Jun'25 at -11.1bp (-9.8bp), Jul'25 at -15.1bp (-13.6bp).

- The market is still pricing in the first rate cut in October, after briefly pushing out the first cut expectation to December following CPI on Wednesday, note there is no meeting in November

- Focus now turns to Retail Sales later tonight, followed by Industrial Production later in the session

STIR: $-Bloc Markets Firmer Over the Past Week, Except For NZ

In the $-bloc, rate expectations through December 2025 are mostly firmer over the past week, except for New Zealand. Canada’s year-end expectations firmed 17bps over the past week, with the US +12bps and Australia +8bps. New Zealand was unchanged.

- In the US, sequential price pressures in the January CPI report exceeded all expectations, but the hawkish impact was blunted 24 hours later by relatively benign PPI details.

- Following the data, Fed Chair Powell cautioned in his congressional testimony that while CPI “was above almost every forecast”, it would be “wise” to wait for the PPI report which would help fill in the gaps for PCE which is as he said “a better measure of inflation”.

- And while the January PPI aggregates came in above expected the broad array of individual price categories that feed into PCE came in significantly softer than most had anticipated, spurring analysts to downwardly revise their core PCE estimates to well below the CPI equivalent – if still too high for comfort.

- Looking ahead to December 2025, the projected official rates and cumulative easing across the $-bloc are as follows: US (FOMC): 4.01%, -32bps; Canada (BOC): 2.53%, -47bps; Australia (RBA): 3.56%, -78bps; and New Zealand (RBNZ): 3.04%, -121bps.

Figure 1: $-Bloc STIR (%)

Source: MNI – Market News / Bloomberg

JGBS: Subdued Session, Rice Prices Surge, Q4 GP On Monday

JGB futures are stronger, +4 compared to settlement levels, but well off the session’s best levels.

- Given that today’s 5-year auction was offering a yield approximately 10-15bps higher than last month, marking a cyclical peak, mixed demand metrics were viewed as somewhat disappointing.

- Outside of the previously outlined International Investment Flow data, there hasn't been much by way of domestic drivers to flag.

- Japan will sell 210,000 tons of rice from its emergency stockpiles as households are paying record prices for the grain. The average retail price for 5 kilograms of rice surged 82% to 3,688 yen ($24) in the week of Jan. 27th compared with a year ago, according to the Ministry of Agriculture, Forestry and Fisheries. (per BBG)

- Cash US tsys are little changed in today’s Asia-Pac session after yesterday’s solid rally which took yields back to pre-CPI levels from Wednesday. Details of January's PPI offered some hope for easing price pressures in the PCE Deflator

- Cash JGBs are little changed across benchmarks out to the 10-year and 1-2bps richer beyond.

- Swap rates are 1-2bps higher. Swap spreads are wider.

- On Monday, the local calendar will see Q4 GDP (P) and December IP (F).

JAPAN DATA: Local Investors Buy Offshore Bonds In Size, But Dump Global Equities

The highlight of last week's offshore investment flows for Japan, was a surge in purchases of offshore bonds. The ¥1753bn in net purchases was the largest weekly flow since mid September last year. This marks the fourth out of the last five weeks that we have seen positive flows from Japan investors to offshore bonds. This fits with an improved global bond return backdrop, as US yields have stabilized, although such returns remain below 2024 highs.

- In contrast, on the equity side, we saw sharp net selling of offshore equities by local investors. This ended a run of 8 weeks of consecutive buying by local investors. Cumulative outflows are still positive YTD for 2025, despite last week's strong net selling.

- In terms of offshore investor inflows into Japan, aggregate moves were moderate last week, but we saw net selling of both local bonds and stocks. For bonds this ended a run of three straight weeks of inflows. For stocks, cumulative offshore inflows in 2025 to date are close to flat.

Table 1: Japan Offshore Weekly Investment Flows

| Billion Yen | Week ending Feb 7 | Prior Week |

| Foreign Buying Japan Stocks | -384.4 | -315.2 |

| Foreign Buying Japan Bonds | -187.2 | 724.5 |

| Japan Buying Foreign Bonds | 1752.9 | -1458.4 |

| Japan Buying Foreign Stocks | -1267.4 | 199.2 |

Source: MNI - Market News/Bloomberg

AUSSIE BONDS: Richer But Off Bests, RBA Decision On Tuesday With At 85% Priced

ACGBs (YM +4.0 & XM +6.0) sit stronger but off the session’s best levels on a local data-light session.

- Cash ACGBs are 4-5bps richer with the AU-US 10-year yield differential at -11bps.

- Swap rates are 3-5bps lower, with the 3s10s curve flatter.

- The bills strip has bull-flattened, with pricing +1 to +5.

- “The Reserve Bank of Australia is on track to lower interest rates for the first time in the current global easing cycle, but the outcome of next week's policy meeting is more finely balanced than what is implied by pricing in money markets, according to Jonathan Kearns, a former senior manager at the central bank.” (per DJ via BBG)

- Reuters Poll shows 40 out of 43 economists expect the RBA to cut the cash rate to 4.10% on February 18, while three predict no change.

- RBA-dated OIS pricing is flat to 3bps softer across meetings today. A 25bp rate cut is more than fully priced for April (119%), with the probability of a February cut at 84% (based on an effective cash rate of 4.34%).

- The local calendar is empty until the RBA Policy Decision next Tuesday.

- Next week, AOFM plans to sell A$800mn of the 2.75% 21 June 2035 bond on Wednesday and A$700mn of the 2.50% 21 May 2030 bond on Friday.

BONDS: NZGBS: Closed Near Cheaps But Held Bull-Flattener

NZGBs closed near session cheaps. Nevertheless, the market showed a bull-flattener, with benchmark yields 1-5bps lower. The NZ-US 10-year yield differential rose 2bps to -2bps, with the NZ-AU differential unchanged at +9bps.

- “NZ Treasury Secretary Iain Rennie says the country needs to address its high cost of capital, which is a key driver of its poor productivity growth. Renni identifies "relatively high tax rates on businesses" as part of a policy landscape that discourages investment and the inflow of foreign capital, and suggests focus on four areas to lift productivity growth.” (per BBG)

- Food prices in NZ rose 1.9% m/m in January, a leap from the 0.1% uptick in December 2024 to mark the highest increase since July 2022. "The proportion of the food basket that increased by over 5% in price was the highest in five years,": StatsNZ

- Swap rates closed flat to 3bps lower, with the 2s10s curve flatter.

- RBNZ dated OIS pricing closed slightly softer across meetings today.

- Notably, OIS pricing is 2–14bps firmer than pre-Q4 Labour Market data levels from February 4. Nevertheless, 48bps of easing is priced for February, with a cumulative 116bps by November 2025.

- On Monday, the local calendar will see the Performance Services Index and Net Migration data.

NEW ZEALAND: Food Prices Surge In January, But We May See Some Payback

New Zealand food prices rose 1.9%m/m in Jan, versus a 0.1% m/m gain in Dec. This is the highest rise since mid 2022 in m/m terms. We tend to see higher prices at the start of the year, so we may see some downside payback as Q1 unfolds, see the chart below

- Stats NZ noted "Higher prices for grocery food contributed the most to the January 2025 increase, with higher prices for boxed chocolates, milk, and chocolate blocks." It also stated: "Higher prices for fruit and vegetables, up 2.8 percent, also contributed to the monthly increase in food prices. When adjusted for seasonal effects, fruit and vegetable prices were down 0.6 percent."

- An excise tax on tobacco, also took effect from Jan 1 of this year. This segment rose 2.4% m/m.

- In terms of the other detail, petrol (up 4% m/m) and diesel prices rose, but air travel fell. Accommodation services gained 1.9%m/m, only partially reversing Dec's -4.6% decline.

- In y/y terms, food prices rose 2.3%y/y, while petrol rose to 1.2%y/y ending a run of negative prints for this segment.

Fig 1: NZ Food Prices M/M

Source: MNI - Market News/Bloomberg

FOREX: A$ & NZD Near Important Resistance Levels, USD Lower For The Week

The USD BBDXY index sits little changed in the first part of Friday dealing, last near 1292.4. We have seen slight outperformance from NZD and AUD, but aggregate moves are modest at this stage.

- The BBDXY index is comfortably down for the week, with EUR and EU related currencies outperforming. Ukraine peace hopes, coupled with no fresh tariffs in the near term, is weighing on USD sentiment.

- For today, NZD/USD is up a little over 0.20%, last near 0.5690. This brings us back within striking distance of the 50-day EMA (near 0.5700), which also coincides with early Feb highs.

- Earlier we had a surge in the NZ PMI back above 50.0, while Jan NZ food prices were also very strong. This comes ahead of next week's RBNZ meeting. A 50bps cut is expected. Today's data outcomes may have more influence on the RBNZ outlook beyond next week's meeting.

- NZ-US 2yr swap spreads also remain within recent ranges, last near -78bps, so we may need more upside on this front to sustain higher NZD levels.

- AUD/USD has edged up, but at 0.6320 is still short of key resistance at 0.6331 (the Jan 24 high). Iron ore prices are higher, amid supply fears due to weather conditions in Western Australia

- We have seen a continued rally in Hong Kong equities, while China markets are also higher today. Tech optimism continues to fuel gains.

- US equity futures are up a touch, while US yields are little changed.

- USD/JPY is near 152.80, unchanged for the session, but yen has been a notable underperformer the past week, particularly against EU currencies.

- Looking ahead, we have EU GDP, while in the USD retail sales is likely to be the main focus point. Will also hear from the Fed's Logan.

ASIA STOCKS: China & Hong Kong Equities Trade Higher, Tech Surges

- Hong Kong and Chinese equities extended their rallies on Friday, driven by optimism over AI advancements and a measured U.S. approach to tariffs. The Hang Seng Index surged 2.3%, heading for its fifth consecutive weekly gain, while the Hang Seng Tech Index jumped 3.2%, surpassing its October highs. Chinese offshore tech stocks rallied, with Alibaba (+2.3%), Tencent (+4%), and Meituan (+4.4%) leading gains, supported by investor enthusiasm over AI startup DeepSeek and its impact on China's AI sector.

- On the mainland, the CSI 300 Index rose 0.8%, while the Shanghai Composite added 0.1%. Sentiment was further lifted by reports of a potential state-backed National Data Group, consolidating key industry data, driving stocks like Beijing E-Hualu (+15%) and Beijing Topnew Info&Tech (+20%) higher.

- While some remain cautious about the sustainability of the AI rally, hedge fund flows into Chinese stocks have accelerated, with China's growing tech momentum, as per BBG

- Investors now turn their focus to March's Two Sessions meetings for potential policy support to sustain the rally.

ASIA STOCKS: Asian Equities Higher Following Positive Tariff News

Asian equities are higher today as investors reacted positively to the prospect that reciprocal US tariffs may take weeks to materialize, raising hopes for negotiations that could soften their impact. The MSCI Asia Pacific rose for the third consecutive day, supported by Wall Street's rally, where the S&P 500 neared a record high. The South Korean won gained, while the yen fluctuated. Optimism around China’s artificial intelligence sector further fueled gains, with Hong Kong-listed Chinese tech stocks performing strongly. Meanwhile, US tsys yields fell overnight, helping risk sentiment, and the AUD hit a two-month high against the USD.

- Hong Kong’s HSI jumped 2.3%, continuing its recent rally driven by strong gains in Chinese technology stocks. Tencent, Xiaomi, and Meituan all surged over 4%, supported by renewed investor interest in the sector following DeepSeek’s AI breakthrough. Optimism around China’s broader AI capabilities and a wave of new AI model releases from firms such as Alibaba and Baidu further boosted sentiment. Mainland China equities are higher, however are again underperforming HK listed stocks, The Shanghai Composite edged up 0.25%, while the CSI 300 is trading 0.75% higher.

- Japan’s Nikkei 225 slipped 0.65%, despite the broader rally in Asian equities. Selling pressure was evident as investors weighed Trump’s comments targeting Japan for potential reciprocal tariffs. Meanwhile, JX Advanced Metals Corp. set an indicative share price for its IPO, marking Japan’s largest such deal since 2018. The semiconductor sector was in focus, with sentiment dampened by questions over the benefits of TSMC’s reported partnership with Intel.

- South Korea’s KOSPI climbed 0.90%, benefiting from broader risk-on sentiment and a stronger won. Tech stocks were a key driver, mirroring gains in the Chinese sector. However, South Korea remains under scrutiny after being singled out by Trump for potential reciprocal tariffs, which could impact trade-sensitive industries.

- Taiwan's TAIEX has struggled today with the index down 1%, as TSMC dropped 2.30%.

- Australia's ASX 200 hit a fresh record, rising 0.30% and marking its third record high this week, with the index briefly trading above 8,600 before pulling back, with strong gains in utilities and mining offsetting losses in financials and healthcare. Origin Energy surged 2.8%, leading the utilities sector, while BHP, Fortescue, and Rio Tinto all advanced. However, Cochlear slumped 13% after issuing a cautious profit outlook, and AMP plunged 13.7% following a disappointing earnings report.

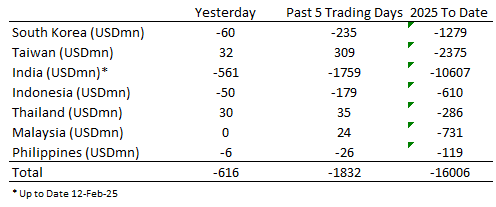

ASIA STOCKS: Asian Equity Flows Mixed As India Continues To See Heavy Selling

Muted flows on Thursday, Indonesia saw a slight increase in outflows above the recent averages, while India continues to see heavy outflows, with $10.6b of selling ytd.

- South Korea: Recorded -$60m in outflows yesterday, bringing the 5-day total to -$235m. YTD flows remain negative at -$1.28b. The 5-day average is -$47m, worse than the 20-day average of -$102m and the 100-day average of -$126m.

- Taiwan: Posted +$32m in inflows yesterday, bringing the 5-day total to +$309m. YTD flows remain negative at -$2.38b. The 5-day average is +$62m, better than the 20-day average of -$184m and the 100-day average of -$55m.

- India: Recorded -$561m in outflows Wednesday, bringing the 5-day total to -$1.76b. YTD outflows remain significant at -$10.61b. The 5-day average is -$352m, worse than the 20-day average of -$329m and the 100-day average of -$202m.

- Indonesia: Posted -$50m in outflows yesterday, bringing the 5-day total to -$179m. YTD flows are negative at -$610m. The 5-day average is -$36m, worse than the 20-day average of -$20m and the 100-day average of -$28m.

- Thailand: Saw +$30m in inflows yesterday, bringing the 5-day total to +$35m. YTD flows remain negative at -$286m. The 5-day average is +$7m, better than the 20-day average of -$8m and the 100-day average of -$17m.

- Malaysia: Registered $0m in inflows yesterday, bringing the 5-day total to +$24m. YTD flows are negative at -$731m. The 5-day average is +$5m, better than the 20-day average of -$26m, but in line with the 100-day average of -$26m.

- Philippines: Recorded -$6m in outflows yesterday, bringing the 5-day total to -$26m. YTD flows remain negative at -$119m. The 5-day average is -$5m, in line with the 20-day average of -$3m and the 100-day average of -$3m.

Table 1: EM Asia Equity Flows

Oil Set for Weekly Gain as Tariffs Take Centre Stage.

- Oil markets are on track for a weekly gain, following three successive weeks of losses.

- As President Trump signed a measure proposing reciprocal tariffs on numerous trading partners, assessing tariffs on a country by country basis, markets realized that tariffs are not imminent and turned positive.

- WTI opened the day at US$71.52 bbl and trended marginally higher throughout the day to $71.40.

- WTI is enjoying a positive week and on track to be +0.55% higher.

- Brent opened at $75.02 and rose modestly throughout to reach $75.20.

- Brent too is on track for a positive week up +0.70%

- The International Energy Agency had reduced its forecasts for oil surplus in 2025.

- The IEA reduced their forecasts for output from Russia and Iran, given the focus from the US on halting their shipments and imposition of sanctions, and revising up their assumptions for demand in Asia.

- In signs that the focus on Russia is working, ship tracking data shows that over 50% of the oil tank listers blacklisted by the Biden administration are currently not shipping oil (as per BBG).

Gold Delivers Seventh Straight Week of Gains.

- President Trump has issued a directive that tariffs must be assessed on a country-by-country basis, a move which may delay time for them to be imposed whilst driving uncertainty.

- The move raises the possibility of an all out global trade war, driving demand for safe haven assets like gold and contributing to it rising more than 10% this year.

- Starting the day at US$2,927.79 gold’s ascent throughout the day was modest as it rose towards a new high of $2,933.89 before moderating to $2,923.58.

- In a move that could have serious implications for gold markets, the Trump government is looking at not only mark to marking the US gold reserves, but even selling them.

- A move to mark-to-market the gold reserves could have up to a $700 billion impact on the valuation of the holdings, creating a windfall for the Trump administration.

- This could have major implications for the funding requirements of the government going forward.

SOUTH KOREA: Korean Employment Data Strong.

- South Korea’s unemployment rate for January came in much lower than forecast.

- Following December’s rate at +3.7%, the market had expected an improving trend and forecast January’s result to be +3.2%

- January saw more than 130,000 jobs created and the unemployment rate falling to 2.9% with manufacturing improving from -2.2% in December to -1.2% in January, business/personal services up to 2.8%, from 1.4%

- This a significant turnaround from December when data showed a 52,000 net contraction in jobs for the first contraction in almost four years.

- This will naturally feed into the decision-making process for the Bank of Korea’s meeting on February 25.

- At the last meeting the Governor indicated that the BOK is in a ‘rate cutting phase’, driving bond yields lower.

- Since then, the Governor has moderated his approach and pushed back on the government indicating that the need for a fiscal response is compelling.

- Additionally, the US has seen higher than expected inflation and the Federal Reserve Chairman indicating that they are intending to be patient in their approach.

- All of this adds up making the decision on rates for the BOK much more balanced.

US: Modi’s Visit: Trade Imbalances in Focus.

- As the press conference concludes between Trump and Modi’s meetings, some key takeaways have come from the meeting.

- The key areas they have agreed of further opportunities are energy and infrastructure, artificial intelligence and semi-conductors, rare earth mining and the pharmaceutical sector.

- As the leader of one of the world’s largest economies, Mr. Modi’s visit, in the midst of President Trump threatening tariffs, was dominated by the issue.

- President Trump saying openly that “India has the highest level of tariffs of any of the US trading partners.” Going on to note “I had discussions with India in the first term about the fact that their tariffs were very high, and I was unable to get a concession,” Trump adding, “ So we’re just going to do it the easy way. And we’re just going to say: ‘Whatever you charge, we charge.'”

- During the press conference Trump then said that he welcomes a recent decision by India to reduce tariffs, as a start.

- The President then spoke to the trade deficit that the US has with India and that the talks were the start of more, aimed at strengthening the trade alliance and balancing it more in the US's favour.

- In that context the President indicated that military ties with India are to be strengthened via the increase of military sales.

- The focus on the value of the trade deficit should be a warning to other countries in Asia where significant imbalances rest.

- India generally runs a trade deficit whilst several of its key regional peers run huge surpluses, risking the ire of President Trump.

MALAYSIA: Final 2024 GDP Confirms Stellar Year for Malaysia.

- Malaysia’s final 2024 GDP was released today confirming that the South East Asian nation’s growth rate is among the best of its regional peers.

- The final 2024 GDP growth rate was 5.1%, up from 3.6% in 2023 and within the forecast for a GDP expansion of +4.8-5.3% for 2024 by the Central Bank.

- The forecast range from the BNM for 2025 is currently at +4.5 – 5.5%.

- Malaysia’s fourth quarter GDP result was ahead of expectations at 5.0%, from 4.8% in Q3.

- Recently Prime Minster Anwar boasted that Malaysia had tamed inflation, reduced unemployment and stabilized the economy and the focus on chips and data centres will support Malaysia’s growth outlook in 2025.

- The BNM next meets on March 6 and based on today’s result, there seems little pressure to cut rates.

CNY Basket Down For 6th Straight Week, CNH-CNY Basis Back To Zero

USD/CNH has spent most of the Friday session recovering ground (off around 0.20% in latest dealings), although near 7.2840/50, we are still comfortably sub highs this week near 7.3250. CNH is tracking a little over 0.20% firmer versus the USD over the past week, around a third of the broader USD index loss over the same period (for the BBDXY index).

- Against the majors, CNH has lost ground EUR and the EU related currencies, but rebounded against the yen. The CNY CFETS basket tracker is down, last near 100.06 (per BBG).

- Indeed, this index has fallen in each of the last 6 weeks, see the chart below. The other line is the USD BBDXY index, note the strong directional correlation between the two series. The yuan has been outperforming during bullish USD periods and underperforming during USD bearish periods.

- In the current context, the authorities arguably won't mind softer NEER conditions, given still challenging domestic growth conditions and a good degree of uncertainty facing this year's trade outlook.

- Spot USD/CNY onshore is little change (close to 7.2850), with earlier dips under 7.2800 supported. This leaves little basis between offshore and onshore spot. The average basis between USD/CNH and USD/CNY has been just over 100pips in the past 12 months.

Fig 1: CNY CFETS Basket & USD BBDXY Index

Source: MNI - Market News/Bloomberg

CHINA: Country Wrap: Alibaba to Partner with Apple.

- China's central bank will utilize a variety of monetary policy tools and adjust the intensity and timing of policies as appropriate (source: Xinhua).

- Alibaba Group Holding has confirmed that it will partner with Apple to develop artificial intelligence tailored for iPhones in China. (source: Yicai)

- China’s major equity bourses rejoiced at the idea of a delay in tariffs and rose strongly with the Hang Seng up +2.3%, CSI 300 +0.70%, Shanghai +.29%, Shenzhen +0.79%. This will cap off a strong week the the Hang Seng delivering +5.6% gain, CSI 300 +1.00%, Shanghai +1.17% and Shenzhen +1.89%.

- CNY: Yuan Reference Rate at 7.1706 Per USD; Estimate 7.2769

- Bonds: a modest move higher in yields today with the CGB 10YR at 1.64% (+1bps)

INDONESIA: Country Wrap: Indonesia Launches SWF.

- President Prabowo addressed the World Government’s Summit yesterday and spoke of Indonesia’s development of a new sovereign wealth fund, mandated to invest in infrastructure, renewable energy, advanced manufacturing and food production to support his goal of annualized GDP growth of 8%. (source: BBG).

- According to the Plantation Fund Management Agency, Indonesia collected IDR25 tn in levies and is expecting an increase in the government levy in 2025 (source: BBG).

- The Jakarta Composite’s week was poor again, down -1.7% for the week, despite modest gains today of +.14%. Despite a very strong Wednesday the index has been under constant downward pressure with data showing foreign investors selling.

- IDR: the rupiah’s strong day today (gaining +0.54%) was enough to bring the currency to flat for the week.

- Bonds: bonds rallied across the curve today, lower by 1-5bps. INGDOGB 10YR fell 4bps to 6.79%.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Country | Event |

| 14/02/2025 | 0800/0900 | *** | HICP (f) | |

| 14/02/2025 | 1000/1100 | *** | GDP (p) | |

| 14/02/2025 | - | *** | Money Supply | |

| 14/02/2025 | - | *** | New Loans | |

| 14/02/2025 | - | *** | Social Financing | |

| 14/02/2025 | 1330/0830 | ** | Monthly Survey of Manufacturing | |

| 14/02/2025 | 1330/0830 | ** | Wholesale Trade | |

| 14/02/2025 | 1330/0830 | *** | Retail Sales | |

| 14/02/2025 | 1330/0830 | ** | Import/Export Price Index | |

| 14/02/2025 | 1415/0915 | *** | Industrial Production | |

| 14/02/2025 | 1500/1000 | * | Business Inventories | |

| 14/02/2025 | 1800/1300 | ** | Baker Hughes Rig Count Overview - Weekly | |

| 14/02/2025 | 2000/1500 | Dallas Fed's Lorie Logan |