-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI China Daily Summary: Monday, December 9

MNI EUROPEAN MARKETS ANALYSIS: Tech Equity Gains Aids Risk Appetite, NZD FX Outperforms

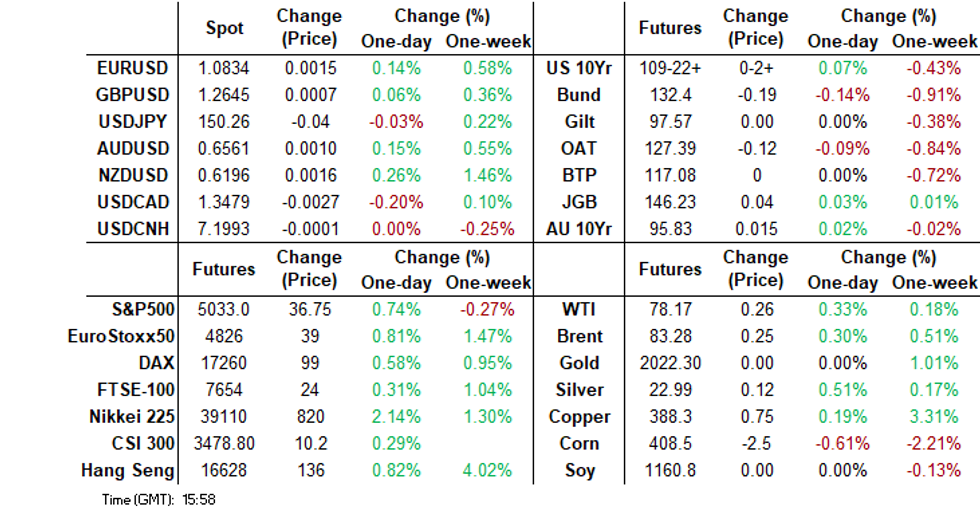

- Early focus was on tech/AI bellwether Nvidia's earning results. They surprised on the upside, which has seen Nasdaq futures surge. We are up nearly 1.5%, while positive spill over to Japan's Nikkei-225 has seen it hit fresh all time highs.

- These trends boosted the FX risk mood, with NZD continuing to outperform. The AUD/NZD cross hit fresh lows, while yen has lagged, although comments to parliament from BoJ Governor Ueda, helped drag JGB futures lower. US yields have softened a touch but have largely been on the sidelines.

- It has been a quieter day for China and Hong Kong equities, but the post lunch time trend has been positive. In Asia FX, KRW has outperformed, aided by tech trends.

- Looking ahead, the Fed’s Jefferson, Harker, Cook and Kashkari speak later. Also, the ECB’s Tuominen and Fernandez-Bollo appear and the January meeting accounts are published. In terms of data, US/Europe preliminary February PMIs are released, as well as US jobless claims, Chicago Fed index, US existing home sales, final January euro area CPI and Canadian retail sales.

MARKETS

US TSYS: Treasury Yields Lower, Remain Rangebound Ahead of US Data

TYH4 is currently trading at 109-22+, up - 02 + from New York closing levels

Treasury futures have traded in a tight range today, currently just off daily highs as we head into the Asia lunch break, while yields are 1-3bps lower in yield terms.

- Mar'24 10Y futures are trading in tight range today, currently 109-22+ sitting just below daily highs of 109-24, while daily lows are 109-18+. Initial technical support holds at 109-17/16+ (50.0% of Oct 19 - Dec 27 climb / Low Feb 14), a break here will open up 109-05+ Low Nov 28, while to the upside initial technical resistance sits at 110-17.5 (Feb 15 high).

- Yield curves are slightly steeper, curve trades 1-2bps lower in yield terms. Currently the 2Y yield is -2.1bps lower at 4.645%, 10Y yield is -1.4bp lower at 4.305%, while the 2s10s +0.759 at -34.193.

- Biden stated earlier that he would support a 28% minimum tax for corporations.

- WSJ's Nick Timiraos was out earlier today writing about the Fed minutes where he mentioned that Federal Reserve officials, in the January meeting, expressed concerns about cutting interest rates too quickly and allowing inflation pressures to persist. Despite prior expectations of rate cuts, economic data showing job growth and higher-than-expected inflation has shifted the outlook, with the Fed now more cautious about immediate rate reductions. (WSJ)

- Looking ahead: Chicago Fed Nat Activity Index, Jobless Claims, S&P Global US PMI & Existing Home Sales

GLOBAL: Early 2024 Global Factors No Longer Disinflationary For Goods, Now Neutral

Global developments so far this year are unlikely to add upward pressure on goods inflation as a whole but they are also unlikely to continue driving inflation lower as they have done. At best they are neutral in aggregate. RBA February meeting minutes noted that “any further slowing in this component was likely to be modest”. Sticky services inflation remains a problem for a number of central banks.

- Oil prices and shipping costs are likely to add to price pressures but non-oil commodity prices, including metals and gas, and food should continue to be disinflationary, while supply-chain pressures are probably neutral. G20 disinflation stalled when the supply chain index and oil prices troughed.

- Container rates began trending higher in Q4 last year but have risen sharply this year driven by attacks in the Red Sea but they have eased in recent weeks. The global FBX rate is up around 15% m/m in February following a 124% m/m jump but the Baltic Dry Index is down 4.5% m/m after -32.6%.

Source: MNI - Market News/Refinitiv

- Geopolitical developments especially in the Middle East have driven oil prices higher with Brent rising 2% m/m in January and another 3% so far this month. This is being seen in higher fuel prices. An expected market surplus in 2024 should put downward pressure on prices eventually.

- Supply chain pressures remain subdued with the NY Fed index remaining slightly negative in January.

Source: MNI - Market News/Refinitiv

- Food prices are subdued falling 1% m/m to be down 10.4% y/y in January driven by cereals and meat. Processed rice prices are down this year but rough rice is higher, while wheat is around 10% lower.

- Other commodities have been weak at the start of 2024 with LME metal prices down moderately, iron ore 8% lower and wool -3.1%.

JGBS: Ueda Comments Help Drive Futures Off Highs, Onshore Markets Closed Tomorrow

JGB volatility has continued post the lunch time break. We were last 146.17, -.02. Earlier highs rested at 146.45. We remain above lows that were seen close to the open of 146.06.

- BoJ Governor Ueda is before parliament at the moment and is generally giving upbeat comments around Japan's inflation and growth backdrop. The economy is expected to strengthen, and that Japan is experiencing inflation. This has likely weighed on futures to a degree.

- Ueda also noted companies are becoming more active in terms of wage hikes, which is consistent with recent BBG reports from automakers, which granted larger rises this year compared to last year.

- In the cash JGB space, we are firmer in yield terms, but only modestly and for the most part remain sub earlier highs. The 10yr was last near 0.73%. For swap rates, the 10yr was last just above 0.89%.

- Tomorrow onshore markets are closed for the Emperor's Birthday holiday.

RBA: Governor Has Requested Continuity On New RBA Board

The senate is currently asking officials questions on the RBA review ahead of legislation being presented. The focus is on how board members will be appointed and if the central bank’s independence needs to be strengthened. Governor Bullock believes that the current level of independence is sufficient and that continuity on the Board is vital in the “new world”.

- Governor Bullock has emphasised to the Treasurer that the continuity between the old and new monetary policy boards is extremely important and he assured her that he understands and will provide continuity when making the appointments.

- The bill allows for current members to continue their terms on the new boards. They will be given the choice given their experience may mean they shift to one of the new boards, such as governance, and that there will be additional responsibilities. But all appointments will still be made by Treasurer Chalmers.

- Bullock said that there are always interpretation risks and so that is a possibility when Board members make their legislated one appearance per year, but she said that the meeting statement is now from the Board and so members will talk to that statement.

- The RBA review has recommended the removal of section 11 of the RBA Act that allows the Treasurer to override a decision if the RBA and government can’t resolve their differences. This provision has never been used.

- The arguments for s.11’s removal include shifting Australia’s central bank in line with international best practice, and to strengthen and “future proof” its independence. It would also lift the bar for the government to intervene as parliament would have to legislate rather than just a government override. Bullock has said she is “agnostic” on whether it is removed and can work with whatever the government decides.

AUSTRALIAN DATA: PMI Shows Rising Labour Demand And Price Pressures

Australia’s Judo Bank preliminary composite PMI for February returned to growth territory driven by the services sector. It came in at 51.8 up from 49.0 in January with services recovering to 52.8 from 49.1. Manufacturing activity contracted at 47.7 down from 50.1. Composite selling prices picked up in Q1 2024 after easing in Q4 2023, signalling that early 2024 inflation may look more persistent around 4-5%, according to Judo Bank, suggesting RBA easing is some way off.

- The quarterly average PMI has oscillated around the breakeven-50 mark since Q3 2022. The Q1 2024 average is in line with that implying the continuation of sluggish but positive growth.

- Business confidence declined in February on rate and inflation concerns but it remains positive. Rising costs continue to weigh on sentiment.

- Services printed at their highest since April driven by stronger new business which drove higher employment and output growth. But that meant firms had the pricing power to pass on higher labour and input costs to customers. Selling price inflation picked up at an above-average pace. Sticky services inflation remains a problem and the RBA has said it needs to come down so that it can meet its inflation target.

- Judo Bank notes that the positive employment index indicates rising labour demand and so February employment is likely to jump after the weak January result.

- Manufacturing activity contracted at a rate in line with Q4’s due to a drop in new orders driving production down at its fastest rate since the pandemic. The sector is being impacted by higher rates and low demand, including from overseas, and cut employment in response. Higher raw material and transport prices drove overall costs higher.

- Manufacturers reported delays due to attacks on shipping in the Red Sea and recent industrial disputes in Australian ports.

- See Judo Bank report here.

Source: MNI - Market News/Refinitv/Bloomberg

AUSSIE BONDS: Early Yield Gains Not Sustained, AU-US 10yr Spread Sits At Multi-Month Lows

Back end Aussie bond yields sit comfortably off earlier highs. The 10yr last tracked at 4.15% (against an earlier high of near 4.215%. This keeps us comfortably within ranges for Feb for the 10yr yield. The shorter end has proven to be stickier from a yield standpoint, with the 2 and 3 yr holding +1bps firmer, albeit down from earlier highs.

- This is similar trends to NZ and leaves the yield curve flatter. In the futures space, XM sit +.02, well up from earlier lows. YM is still softer at -.02.

- Support has been evident from firmer US TSYs. The AU-US 10yr spread sits at -15bps, fresh lows back to late Oct last year.

- On the macro front, Governor Bullock has emphasised to the Treasurer that the continuity between the old and new monetary policy boards is extremely important and he assured her that he understands and will provide continuity when making the appointments (this was before a Senate hearing).

- On the data front, Australia’s Judo Bank preliminary composite PMI for February returned to growth territory driven by the services sector. It came in at 51.8 up from 49.0 in January with services recovering to 52.8 from 49.1. Manufacturing activity contracted at 47.7 down from 50.1. Composite selling prices picked up in Q1 2024 after easing in Q4 2023, signalling that early 2024 inflation may look more persistent around 4-5%, according to Judo Bank, suggesting RBA easing is some way off.

- The data calendar is empty tomorrow.

NZGBS: Yields Off Highs, Retail Sales Volumes Tomorrow, RBNZ Next Week

NZ yields finished away from best levels, albeit more so at the back end. The 10yr yield finished near 4.775%, down from intra-session highs above 4.79%. The 2yr year yield was stickier, holding close to 4.92% (earlier highs were above 4.93%). This left the 2/10s curve slightly flatter at around -14bps.

- NZ bonds saw support from a firmer US Tsy backdrop. TYH4 is +03 firmer versus opening levels. Outside of buoyant Nvidia earnings news, macro news flow has been light.

- In the swap space, the 2yr sits off earlier highs, last near 5.11%, while the 10yr rate is down around 2.5bps to 4.59%. Both benchmarks have followed the equivalent NZGB yield trajectory to large extent.

- We had early data on Jan trade, with a wider deficit relative to Dec, but this didn't impact sentiment. Tomorrow we have Q4 retail sales volumes.

- Next Wednesday the RBNZ outcome is due. OIS pricing has a rough 30% pricing of a hike, with rate cuts expected towards the end of the year.

NZ DATA: Annual Deficit Improves As Imports Weaken Sharply

NZ’s trade deficit widened in January to $976mn from $368mn but the 12 month YTD sum narrowed to $12.5bn from $13.6bn, the best in 18 months. Export and import growth are both weak with shipments to major destinations contracting.

- Merchandise export growth improved moderately to -7.1% y/y from -9.6% in December this still outpaced import growth which deteriorated 22.6% y/y after -10.3%. The level of imports was its lowest since September 2021, signalling weak domestic demand but helping the 12-month deficit to improve. Consumer goods imports fell 6.7% y/y.

- Goods exports to China are down 2.8% y/y, -5.6% y/y to the US and -17% y/y to Australia. Lower shipments of dairy and meat products and wine are weighing on NZ’s trade position.

- There were sharp drops in imports of petroleum (-50% y/y), vehicles (-20% y/y), ships & boats (-90% y/y) and machinery & equipment (-12% y/y), which probably also reflect the unwinding of Covid-related pent up demand.

Source: MNI - Market News/Refinitiv

NZ DATA: Household Inflation Expectations Concerning

Q1 RBNZ household survey expectations were mixed and are likely to worry the RBNZ, but at least business ones moderated. In recent research, the central bank found that mean 1-year household expectations had the closest fit with underlying inflation. This was one of the measures in the report that eased, falling to 5.1% from 5.5%. The median was steady at 5% though. Median current inflation perceptions rose 0.1pp to 7.1%, 2-years ahead by 0.2pp to 3.2% and 5-years by 1pp to 3%. The RBNZ meets on February 28 and while we expect them to leave rates unchanged, they are likely to sound cautious and increase expectations of a prolonged hold.

NZ Inflation y/y%

Source: MNI - Market News/Refinitiv

FOREX: NZD/JPY Hits Fresh Multi-Year Highs As Risk Mood Buoyed By Nvidia Earnings

The BBDXY sits down modestly, versus end Wednesday levels, last near 1241.4. US equity futures have surged, driven by the Nasdaq (+1.45%) post Nvidia's positive earnings beat and guidance. This drove a risk-on theme to markets early, although we didn't see much follow through.

- NZD/USD continues to see a positive beta with respect to equity risk moves. The pair got close to 0.6200 but couldn't breach the level (we were last in the 0.6190/95 region). Initial technical resistance holds at 0.6206 the Jan 16 high, while support sits at 0.6163 (lows from Feb 21)

- AUD/USD has lagged, the pair last near 0.6555. AUD/NZD broke below 1.060 earlier making fresh yearly lows of 1.0586, before quickly reversing however the pair was unable to break back above 1.060 and currently hovers above the new yearly lows at 1.0588, technical support holds at 1.0560 the lows from May 2023.

- Both NZD and AUD saw sensitivity to HK/China equity moves, coming off highs as these markets soften. They are firmer at the Asia lunch time break though, which has helped push both currencies back into positive territory.

- USD/JPY was higher in early trade, as risk on flows boosted yen crosses. However, we sit back unchanged now at 150.30/35. A slight US yield pull back today, likely helping yen. NZD/JPY got to fresh highs of 93.215 earlier, but we sit back at 93.10 in latest dealings.

- Looking ahead, the Fed’s Jefferson, Harker, Cook and Kashkari speak later. Also, the ECB’s Tuominen and Fernandez-Bollo appear and the January meeting accounts are published. In terms of data, US/Europe preliminary February PMIs are released, as well as US jobless claims, Chicago Fed index, US existing home sales, final January euro area CPI and Canadian retail sales.

CHINA/HONG KONG EQUITIES: Hong Kong & China Equities Grind Higher

Hong Kong & China equity markets are slightly higher today heading into the Asia break. The ban on institutional investors selling stock in the first 30 minute of trading didn't seem to have too much of an impact, as stocks moved higher for the first hour of trading, while China northbound flows turn positive.

It has been a relatively subdued day for HK and China equities today, with little in the way of headlines, or data.

- Hong Kong Equities have see-sawed today, the HSI is currently 0.15% higher after being down 0.50% at one stage, HSTech down 0.27% while Mainland property is down 1.05%

- China mainland equities are slightly outperforming HK equities today. Currently the CSI300 is up 0.28%, while the Shanghai Composite is 0.50% higher.

- China Coal stock have benefited from a crack down on coal miners exceeding permitted output quotas.

- Elsewhere, it has been reported that China will continue to roll out a series of regulations on Quant funds one by one aimed the reducing the amount of illegal quantitative transactions on the market

- Looking ahead Hong Kong has CPI Composite data out at 4.30pm Local time

ASIA PAC EQUITIES: Asia Equities Higher As Tech Leads The Way, Nikkei 225 Makes New ATHs

Regional Asian Equities are higher today with markets in the region getting a boost from strong earning results from Nvidia.

- Japan equities are higher today, tech names lead the way. The Nikkei 225 up 1.67%, and made fresh all time highs earlier, we sit just off those levels now. Japanese export names are also seeing support as the yen stayed weaker, currently at 150.29, while foreigners bought a net of ¥382b of Japanese stocks for the week ended Feb 16, marking the 7th straight week of net buying. The Topix is lagging the Nikkei 225 today, up about 1.00%.

- Taiwan Equities are pushing higher today mostly due to higher Tech stocks, with TMSC leading the way up 1.47%. Yesterday Taiwan saw -$466m in foreign equity outflow and -$843m for the week, expect this to change as investors look to get back into semiconductor names now that Nvidia has reported earnings. Taiex is up 0.84%

- South Korean equities are also higher today, again largely due to strength in the semiconductor space. Similar to Taiwan, SK saw net selling by foreigners yesterday as -$133m left the market. Currently the Kospi is 0.38% higher

- Australian Equities are flat today, weakness in the financials sectors was offset by strength in Health Care and Construction sector. Currently the ASX200 is 0.03% higher

- Elsewhere in SEA, New Zealand Equities trade 0.86% higher, Thailand up 0.20% while Indonesia, India Singapore and Malaysian Equities trade off 0.40-0.50%

JAPAN DATA: Mixed Weekly Investment Flows, But Offshore Buying Of Local Equities Continues

Japan weekly investment flows were mixed last week. In terms of offshore buying of local equities, we saw continued inflows, see the table below. ¥382bn of net inflows were recorded in this space, which was the 7th straight week of positive flow momentum. Each week since the start of this year we have seen positive inflows.

- Offshore investors sold local Japan bonds, more than offsetting the modest buying pace seen in the week prior.

- In terms of Japan investors, in the bond space, local investors were net sellers last week, in line with the offered tone in global fixed income markets led by the US. This only partially reversed the strong inflows seen in the prior week though.

- Japan investors picked up the pace of offshore equity purchases to ¥359.9bn.

Table 1: Japan Weekly Investment Flows

| Billion Yen | Week ending Feb 16 | Prior Week |

| Foreign Buying Japan Stocks | 382.0 | 621.2 |

| Foreign Buying Japan Bonds | -521.6 | 176.1 |

| Japan Buying Foreign Bonds | -560.8 | 1495.1 |

| Japan Buying Foreign Stocks | 359.9 | 22.1 |

Source: MNI - Market News/Bloomberg

OIL: Crude Steady, EIA Data & Fed Speakers Later May Give It Some Direction

Oil is little changed during APAC trading today after rising around a percent on Wednesday and is finding support from generally positive equities. Brent is up 0.1% to $83.11 having dipped briefly below $83 earlier and WTI is 0.1% higher at $78.02 after a low of $77.87. Crude may find direction later from the EIA data and Fed speakers. The USD is slightly lower.

- Demand concerns persist with China’s consumption outlook uncertain and the Fed minutes signalling that FOMC members are concerned regarding easing too soon.

- Bloomberg reported a US crude inventory build of 7.168mn last week after 8.52mn previously, according to people familiar with the API data, whereas market prompt spreads are pointing to tight supplies. Distillate stocks fell 2.91mn while gasoline rose 415k. The data reflect shortages of refined products which have increased refining margins. The official EIA data is out later today.

- The Fed’s Jefferson, Harker, Cook and Kashkari speak later. Also the ECB’s Tuominen and Fernandez-Bollo appear and the January meeting accounts are published. In terms of data, US/Europe preliminary February PMIs are released, as well as US jobless claims, Chicago Fed index, US existing home sales, final January euro area CPI and Canadian retail sales.

GOLD: Bullion Steady, Upcoming Fed Speakers May Give Some Direction

Gold continues to trade around $2026/oz, where it closed on Wednesday and around the mid-point of its range this year. With the USD little changed and few major data releases, there is not much to drive bullion. Fed speakers coming up later today may give it some direction. It is currently at $2026.59.

- Gold is moving well below resistance at $2065.50, February 1 high, and it needs to clear this level in order for the bullish theme to be reinstated. It is currently just below its 50-day simple moving average.

- Increasing “high-for-longer” Fed views have stalled gold prices. There are a number of Fed speakers later but the focus is likely to be on Fed Governor Waller as he is speaking on the economic outlook and he’s on the FOMC. He has said that he’s cautious re easing.

- The Fed’s Waller, Jefferson, Harker, Cook and Kashkari speak later. In terms of data, US/Europe preliminary February PMIs are released, as well as US jobless claims, Chicago Fed index, US existing home sales, final January euro area CPI and Canadian retail sales.

BOK: A Rate Cut In H1 Unlikely, May Data Key For Rate Cut View In H2

The BoK held policy rates steady at 3.50%, as widely expected. The central bank also kept its 2024 and 2025 inflation and GDP forecasts unchanged (relative to the Nov BoK update, mostly in the 2-2.5% range for both series). The 2024 core inflation forecast is projected to be slightly below the Nov estimate.

- The decision to hold rates steady was unanimous. 5 out of 6 board members saw the policy rate at 3.50% in 3 months time, while one board member was open to a cut. This reflected a weaker consumption backdrop.

- Governor Rhee stated that a rate cut was unlikely in the first half. A rate in H2 would be dependent upon economic data outcomes in May. Note we get Apr CPI on May 2, which will likely be a key input to the second half outlook. The BoK meeting in May is on the 23rd.

- The April inflation period may be a key reference point as Governor Rhee stated that near term inflation may pick up before trending down again. Presumably by the April print we should know if this trend is correct, which in turn may pave the way for easier policy settings in H2.

- The BoK statement and the Governor reiterated that policy would be held restrictive long enough to ensure a return to the inflation target. The BoK stated it was premature to be confident that inflation will return to the target level.

- The market reaction today's announcement hasn't been large. A second half easing does align with the rough sell-side consensus.

ASIA FX: Won Outperforms, Aided By Tech Equity Gains, CNH Steady

USD/Asia pairs are mostly lower, albeit with fairly modest moves overall. The won is the best performer, up around 0.30% at the stage (1 month NDF). Better tech sentiment is likely aiding the move. CNH has largely held steady, not drifting far from the 7.2000 level. More modest gains have been seen elsewhere. The equity tone in SEA has been more cautious relative to NEA, which tend to have more tech plays. Tomorrow, we have China new house prices for Jan, Thailand customs trade data, Malaysia CPI and Singapore inflation as well.

- USD/CNH sits a touch below 7.2000, having largely been on the sidelines today. Equity sentiment has been mixed as markets digest recent support measures and regulatory shifts. We are tracking firmer in the afternoon session though, with potential positive spill over from tech related gains in Japan and US Nasdaq futures (post Nvidia's result).

- 1 month USD/KRW has tracked lower, albeit modestly. The pair last around 1327, +0.30% firmer in won terms. Onshore equities are modestly higher, but tech sentiment will be lending some support, based off the above news. Earlier the BOK held rates steady at 3.50% as expected. The BoK Governor doesn't see a rate cut in H1, while scope for H2 cuts will depend on how data in may evolves.

- USD/TWD has firmed a touch, last to 31.54, the Taiwan currency not enjoying positive spill over from tech moves at this stage. The Taiex has risen around 0.90%.

- In SEA, the IDR is up modestly, last near 15610, up 0.15% for spot rupiah. Better equity trends globally will be aiding risk appetite (although local stocks are around flat). USD/INR is back to 82.90/95, but remains within recent ranges. The simple 200-day MA is near 82.84 and we haven't been meaningfully below this level since July last year. PMI prints suggested a continued firm growth backdrop.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 22/02/2024 | 0630/0630 |  | UK | BOE's Greene, Kroll South Africa breakfast | |

| 22/02/2024 | 0745/0845 | ** |  | FR | Manufacturing Sentiment |

| 22/02/2024 | 0815/0915 | ** |  | FR | S&P Global Services PMI (p) |

| 22/02/2024 | 0815/0915 | ** |  | FR | S&P Global Manufacturing PMI (p) |

| 22/02/2024 | 0830/0930 | ** |  | DE | S&P Global Services PMI (p) |

| 22/02/2024 | 0830/0930 | ** |  | DE | S&P Global Manufacturing PMI (p) |

| 22/02/2024 | 0900/1000 | ** |  | IT | Italy Final HICP |

| 22/02/2024 | 0900/1000 | ** |  | EU | S&P Global Services PMI (p) |

| 22/02/2024 | 0900/1000 | ** |  | EU | S&P Global Manufacturing PMI (p) |

| 22/02/2024 | 0900/1000 | ** |  | EU | S&P Global Composite PMI (p) |

| 22/02/2024 | 0930/0930 | *** |  | UK | S&P Global Manufacturing PMI flash |

| 22/02/2024 | 0930/0930 | *** |  | UK | S&P Global Services PMI flash |

| 22/02/2024 | 0930/0930 | *** |  | UK | S&P Global Composite PMI flash |

| 22/02/2024 | 1000/1100 | *** |  | EU | HICP (f) |

| 22/02/2024 | 1100/0600 | *** |  | TR | Turkey Benchmark Rate |

| 22/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 22/02/2024 | 1330/0830 | ** |  | CA | Retail Trade |

| 22/02/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (flash) |

| 22/02/2024 | 1445/0945 | *** |  | US | S&P Global Services Index (flash) |

| 22/02/2024 | 1500/1000 | *** |  | US | NAR existing home sales |

| 22/02/2024 | 1500/1000 | * |  | US | Services Revenues |

| 22/02/2024 | 1500/1000 |  | US | Fed Vice Chair Philip Jefferson | |

| 22/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

| 22/02/2024 | 1600/1100 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 22/02/2024 | 1600/1100 | ** |  | US | Kansas City Fed Manufacturing Index |

| 22/02/2024 | 1630/1130 | * |  | US | US Bill 08 Week Treasury Auction Result |

| 22/02/2024 | 1630/1130 | ** |  | US | US Bill 04 Week Treasury Auction Result |

| 22/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for TIPS 30 Year Bond |

| 22/02/2024 | 2015/1515 |  | US | Philly Fed's Pat Harker | |

| 22/02/2024 | 2200/1700 |  | US | Minneapolis Fed's Neel Kashkari | |

| 22/02/2024 | 2200/1700 |  | US | Fed Governor Lisa Cook |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.