-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI US OPEN - PBOC Makes First Major Policy Tweak Since 2011

MNI BRIEF: China Passenger Car Sales Up In November Y/Y

MNI EUROPEAN MARKETS ANALYSIS: US Cash Yields Re-Open Higher, USD Mostly Firmer

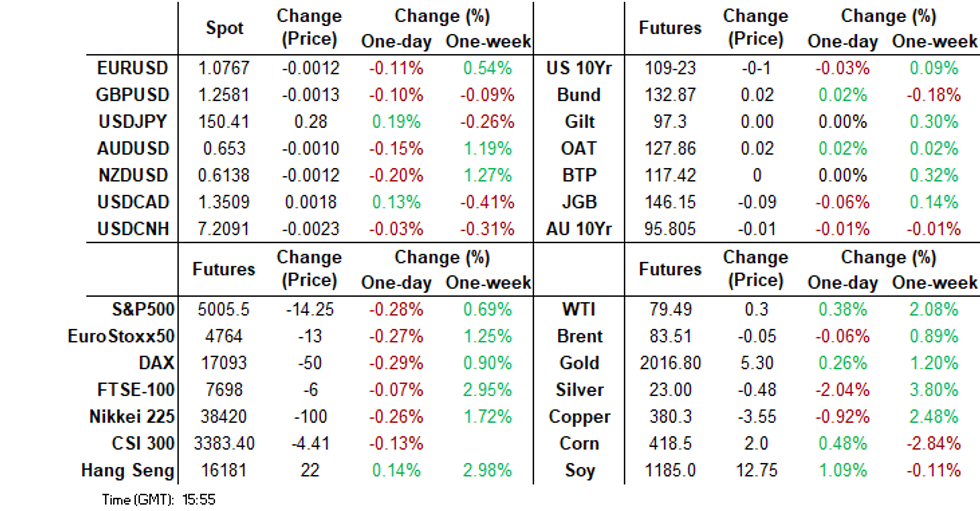

- US Mar'24 10Y futures have been trading in a tight range in Asia, with lows of 109-17, and highs of 109-24 where we currently trade heading into the Asia break. Cash yields opened with the curves 1-4bps higher this morning, and as the day as progress we have reversed most of that move to trade just 0-2bps higher in yield terms. The USD has generally traded on a positive footing against the G10 and Asia FX.

- ACGBs (YM +1.0 & XM -1.0) are mixed after the release of the RBA Minutes for the February meeting. The RBA Board discussed leaving rates at 4.35% and a 25bp increase but decided on the former as it best balanced its objectives of price stability and full employment.

- China surprised markets with a larger than expected 25bps cut in the 5yr LPR. The 1yr was left unchanged. Still, this hasn't positively impacted sentiment. Iron ore prices remain under pressure, while onshore equities are in the red at this stage.

- Looking ahead, the BoE’s Bailey appears. There are also January Canadian CPI data and US Philly Fed non-manufacturing and leading indices.

MARKETS

US TSYS: Treasury Futures Erase Early Moves To Trade Unchanged

TYH4 is currently trading at 109-24, unchanged from New York closing levels.

Treasury futures have traded in a very tight range today, with little in the way of market headlines, as we await the US to come back from President's Day

- Mar'24 10Y futures have been trading in a tight range in Asia, with lows of 109-17, and highs of 109-24 where we currently trade heading into the Asia break.

- Cash yields opened with the curves 1-4bps higher this morning, and as the day as progress we have reversed most of that move to trade just 0-2bps higher in yield terms. The 2Y yield is unchanged today at 4.642%, the 10Y is +1.6bps higher at 4.395% while the 2y10y is +1.574 at -34.879

- Looking ahead later today, Philadelphia Fed Non-Manufacturing Activity & Leading Index Data is due out.

JGBS: Twist-Flattened After 20Y Supply Goes Well

JGB futures have weakened and are currently trading near the mid-range of today’s session, -4 from settlement levels. With a light domestic calendar, local participants were primarily focused in the morning session on a Reuters report suggesting the BoJ’s consideration to end negative interest rates in the upcoming months, despite the country's recession, as well as the resumption of trading for cash US tsys after yesterday’s holiday. In the afternoon session, attention shifted to the results of today’s 20-year supply.

- 20-year supply displayed strong demand metrics. The low price beat dealer expectations, the cover ratio increased to 3.852x from 3.126x at last month’s auction and the auction tail shortened materially.

- After the lunch break, JGB futures exhibited a notable uptick, reaching new session lows, and the 20-year JGB witnessed a 3bps richening in post-auction trading. Although JGB futures retraced some of their initial gains, the 20-year bond sustained its rally.

- Cash US tsys are dealing flat 2bps cheaper in today’s Asia-Pac session.

- Cash JGBs have twist-flattened, pivoting at the 7s, with yields 0.6bp higher to 3.4bps lower (20-year). The 20-year yield is currently 1.482% versus this morning’s high of 1.528%.

- The swaps curve has bull-flattened.

- Tomorrow, the local calendar sees Trade Balance and Machine Tool Orders data, along with BoJ Rinban operations covering 1-10-year JGBs.

AUSSIE BONDS: Slightly Mixed, RBA Minutes Have Minimal Impact, Wages Data Tomorrow

ACGBs (YM +1.0 & XM -1.0) are mixed after the release of the RBA Minutes for the February meeting.

- The RBA Board discussed leaving rates at 4.35% and a 25bp increase but decided on the former as it best balanced its objectives of price stability and full employment.

- However, the tightening bias was retained given that inflation was still high and it would take time for it to feel confident inflation was returning to target.

- The Board is prepared to respond to the data, risks and changes in the outlook but the minutes suggest that for now, it is on hold.

- US tsys are dealing flat to 2bps cheaper in today’s Asia-PAC session.

- Cash ACGB movements are bounded by +/- 1bp, with the curve steeper.

- Swap rates are -1bp lower to 1bp higher.

- Bills strip pricing is flat to +2.

- RBA-dated OIS pricing is little changed across meetings.

- Tomorrow, the local calendar sees the Wage Price Index (WPI). The Q4 WPI is expected to rise 0.9% q/q with the annual rate rising to 4.1% y/y from 4.0% in Q3. The RBA said in its February meeting statement that the WPI “remains consistent with the inflation target” assuming productivity growth improves.

- Tomorrow, the AOFM plans to sell A$800mn of 3.75% Apr-37 bond.

RBA MINUTES: Hike & Pause Discussed, RBA Seems On Hold For Now

The RBA Board discussed leaving rates at 4.35% and a 25bp increase but decided on the former as it best balanced its objectives of price stability and full employment. But the tightening bias was retained given that inflation was still high, costly and it would take time for it to feel confident inflation was returning to target, and there were still considerable uncertainties. The Board is prepared to respond to the data, risks and changes in the outlook but the minutes suggest that for now it is on hold.

- The tone of the discussion around inflation remained hawkish with concerns that most of the work in bringing it down had been done by goods prices and any further slowing was “likely to be modest”, whereas services “remained high and had declined only a little”, largely reflecting excess demand.

- The risk that inflation wouldn’t return to target in a “reasonable timeframe” had “eased” though and the updated forecasts had that occurring assuming no change in rates.

- Data had come in weaker-than-expected, including consumption. Risks to the outlook are balanced though but there is a risk that household spending “weakens more sharply”.

- The case for further tightening was centred on the return to the mid-point of the band being still two years away and a hike would reduce the risk of inflation not “returning to target in an acceptable timeframe”. It commented that another hike wouldn’t prevent it from easing if the economy weakened “more sharply”.

- The key risks that the Board is concerned about are inflation not returning to target as expected, productivity growth not recovering and consumption being materially weaker than forecast. Scenarios were considered where inflation expectations rose gradually and consumption was weaker.

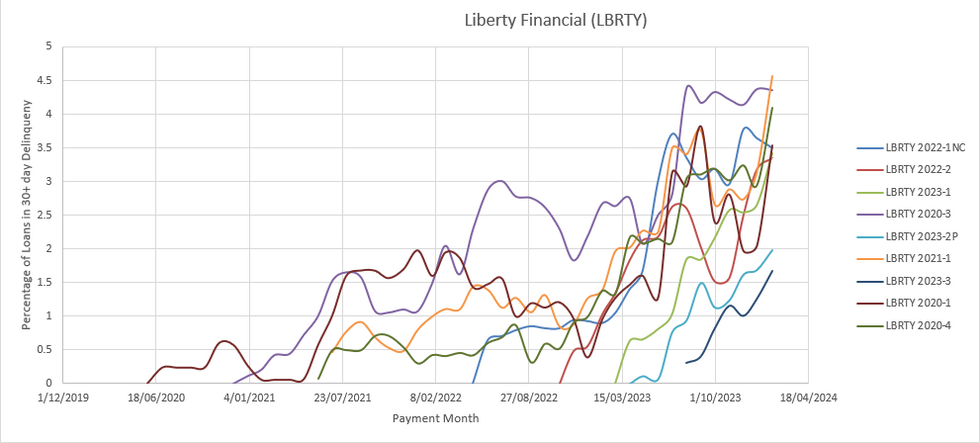

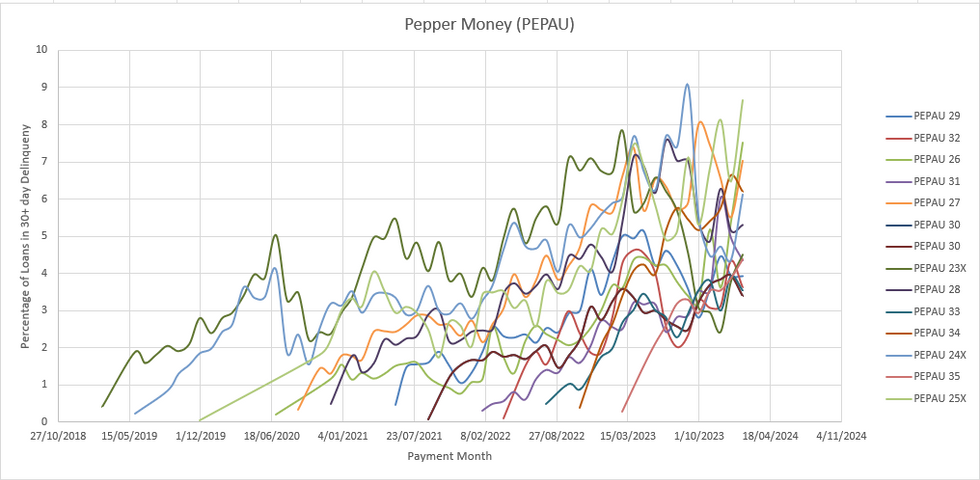

AUSTRALIA: Australian Mortgage Stress Increases As Delinquencies Rise

The combination of high interest rates and inflation has materially reduced Australia’s household savings ratio to the lowest level since 2008 of 1.1%, which is weakening the ability of financially vulnerable borrowers to meet mortgage repayments. It's important to note though that savings in borrowers outset accounts has surprised many as they had increased toward the end of 2023.

- Cracks have been starting to appear in the Aussie Mortgage sector as delinquencies and arrears start to pick up. Tracking delinquency rates of non-conforming loans from some of Australia's largest Non-ADI RMBS issuers and it is clear that a trend is emerging, looking at seasoned Liberty Financial RMBS deals issued back between 2020-2022 the rate of 30+ day Delinquencies sits above 4% of all loans outstanding (Figure 1. Lbrty), while Pepper Money's (who have been seen to issue slightly riskier loans) 30+ day delinquency rates for similar issues RMBS deals sit between 4-9% of all loans outstanding (Figure 1. Pepau).

Figure 1. Liberty Financial Non-Conforming RMBS

Source: MNI - Market News / BBG

Figure 1. Pepper Money Non-Conforming RMBS

Source: MNI - Market News / BBG

- Australian RMBS deals are well structured with plenty of support built in, so the risk of any of these deals facing trouble is a while off yet, however what it does clearly show are delinquencies are growing and growing at a faster rate than before. Trouble will follow if these 30+ day arrears, turn into 90+ day in arrears. It's important to note that currently 90+ day arrears currently sit between 1-2% of all loans outstanding for both Liberty and Pepper Money deals.

NZGBS: Closed Strongly, PPI Data Tomorrow

NZGBs closed 1-2bps richer after trading in relatively narrow ranges in today’s session. With the domestic calendar empty, local participants appear to have been content to sit on the sidelines as cash US tsys resumed dealings after yesterday’s holiday. US tsys are dealing flat to 2bps cheaper in today’s Asia-PAC session, with a steepening bias in place.

- Swap rates closed 1-4bps richer, with the 2s10s curve flatter.

- Long-dated implied swap spreads are tighter, possibly aided by the NZDM's announcement of the launch of a new May 2054 bond. The scheduled February 22 bond auction has been cancelled. The NZDM expects to issue at least NZ$2bn of the new bond via syndication, with a cap of NZ$4bn. Pricing will be on February 21, with guidance at -1 to +6 over May 2051 yield.

- RBNZ dated OIS pricing closed 1-3bps firmer across meetings. A cumulative 39bps of easing is priced by year-end.

- NZ’s economic slowdown continued into early 2024, the NZ Treasury said in Fortnightly Economic Update. “In an economy buffeted by big opposing forces, the downdraft from high-interest rates appears to be dominating the updrafts coming from net migration and still-strong employment and wage growth”

- Tomorrow, the local calendar will see PPI data.

FOREX: USD Firms, But Off Best Levels

The USD index sits close to 1245 in recent dealings, up around 0.1% for the session so far, but down slightly from session highs (1245.60).

- Initial support for the USD was evident as US cash Tsys resumed trading after the long weekend. Yields opened higher, particularly at the back end. Still, we are away from highs in yield terms, with the 10yr last near 4.29%. This has like tempered US demand at the margins.

- US equity futures sit lower, off by around 0.30%, another potential USD support point. Regional equities have mostly tracked lower in Asia, although are away from lows. The larger than expected cut in China's 5yr LPR (-25bps to 3.95%) hasn't materially impacted sentiment.

- The RBA minutes stated the central bank considered a hike, but this only saw a modest recovery in AUD sentiment. AUD/USD sits near 0.6530 in latest dealings, -0.15% for the session. Iron ore prices have continued to correct lower.

- NZD/USD is off by a similar amount, last near 0.6140. The AUD/NZD cross is up from earlier lows at 1.0625, last near 1.0635.

- USD/JPY has firmed a touch, last near 150.30/35, but overall moves have been modest.

- Looking ahead, the BoE’s Bailey appears. There are also January Canadian CPI data and US Philly Fed non-manufacturing and leading indices.

IRON ORE: Slips To Multi Month Lows

Iron ore prices remain on the back foot. The active contract in Singapore is back to the low $124/ton region, off a further 2.5%. This puts us back to lowest levels since Nov last year. Early Jan highs rested just above $140/ton.

- Weakness has been particularly pronounced since onshore China markets re-opened on Monday (we ended last Friday near $131.30/ton).

- As to the drivers of the move, familiar worries appear to be in play. Lack of demand from the property sector is a key factor highlighted from analysts, with still depressed sales activity in the new segment of the market evident during the LNY period.

- Sentiment hasn't been aided much by the larger than expected cut in the 5yr LPR (by 25bps) today, which should flow through to mortgage rates and aid housing/consumer sentiment all else equal. We are up from earlier lows for the session though ($123.20/ton).

- Note on Friday we get an update on China iron ore inventories.

Fig 1: Singapore Iron Ore

Source: MNI - Market News/Bloomberg

CHINA/HONG KONG EQUITIES: Hong Kong and China Equities Lower As Market Concerns Persist

Hong Kong and China equities are lower today as we head in the lunch break, earlier Chinese banks cut the 5-year loan prime rate by 25bps to 3.95%, marking the most substantial reduction on record and surpassing expectations. However, concerns persist among investors that recent policy announcements and market headlines may not be sufficient to halt the sell-off in Chinese and Hong Kong equities that has occurred over the past few months.

- Hong Kong equities opened higher but swiftly erased gains, pushed lower by tech names with the HS Tech Index is down 1.20%, while the HSI is down 0.30%. Meanwhile, the Mainland Property Index, which initially opened 2% higher, now trades down 0.43%.

- Chinese equities face similar challenges, with the 5-year loan prime rate reduction offering limited support. CSI300 is down 0.18%, ChiNext is down 0.60%, and the CSI1000 is down 0.70%.

- China margin debt bounced by 1.1% on Monday as traders return from LNY, marking the biggest increase since Sept.

- China's Communist Party aims to have a bigger role in the technology sector, planning a refined mechanism for top decision-makers on the Central Committee to steer technological work. This move signals Beijing's intent to exert more control, particularly in critical areas like semiconductors and artificial intelligence, amid a technological race with the US, causing concern among investors and experts about the potential impact on innovation.

ASIA PAC EQUITIES: Asia Equities Mixed Ahead of US Reopening

Asian Equities have a largely uneventful day, with most regions trading lower.- Japan Equities are lower today, as the Nikkei 225 comes ever so close to making new all-time highs down 0.22% today, while the Topix trades 0.34% lower. There has been little in the way of market news for Japan today, other than Tokyo Condominiums for sale data coming in at 56.6% from 3.8% prior.

- Taiwan equities are the outperformer in the region today, led by the semiconductor sector as TSMC contributed most of the gains up 1.18%. Currently the Taiex is 0.52% higher. While Monday saw the highest net selling of Taiwan Equities by foreign investors for a month with -$477m of outflows.

- South Korea is the worst performer in the region today as foreign buying of SK stocks lose momentum, the 5-day moving average of net foreign inflows decreased to $133.8m, falling below the 20-day average of $297.7m with -$58m of outflows occuring today. Currently the Kospi is down 1.23%.

- Australian Equities are lower today, as weakness in the mining and energy space weigh on the market. In other news ANZ were able to overturn the block to buy Suncorp, pathing the way for the purchase to go ahead, Suncorp equity up 5.79%, while ANZ stock trades 2.4% lower. The ASX 200 currently trades 0.10% lower for the day.

- Elsewhere in SEA, Indonesian, Philippines & Malaysian equities are up 0.50-0.70%, while New Zealand Equities are 0.70% lower.

OIL: Crude Little Changed, Talk Of Further Sanctions On Russia

Oil prices are currently little changed during today’s APAC session but are off their intraday lows. Weak supply-demand fundamentals continue to be offset by geopolitical tensions and threats to Red Sea shipping. Brent is down 0.1% to $83.46/bbl after falling to $83.23 early in trading and WTI is also 0.1% lower at $78.36 rising from $78.02. The USD index is 0.1% higher.

- OPEC quota compliance has been lax and Iraq has said that it will try and improve after it has done a review of its estimated output. OPEC+ meets in early March to decide if it will extend production cuts into Q2.

- Sanctions on Russia are in focus again and stricter measures are expected from the EU on its oil and gas, including against Indian and Chinese firms that have contributed to Russia’s defence industry. The US is also looking at improving enforcement. The death on the weekend of opposition leader Navalny and Ukraine’s loss of Avdiivka have put pressure on NATO countries to increase sanctions.

- G7 transport ministers are going to hold an online meeting to discuss the situation in the Red Sea.

- US inventory data has been volatile since a cold snap disrupted oil output and refining. Data for the latest week is released by API later today.

- Later the BoE’s Bailey appears. There are also January Canadian CPI data and US Philly Fed non-manufacturing and leading indices.

GOLD: Slightly Higher On Light Volumes

Gold is unchanged in the Asia-Pac session, after closing 0.2% higher at $2017.21 on Monday.

- Bullion’s nudge higher extended the recovery above the $2,000/oz mark and further ate into the US CPI-inspired decline on February 13.

- With the US out for the Presidents Day holiday, volumes were relatively subdued despite a boost from China’s reopening following a week-long break.

- The market’s focus is now likely tuned to the release of the Federal Reserve minutes of its recent meeting midweek.

- A handful of Fed speakers are also scheduled to speak this week. Among them, Minneapolis Fed chief Neel Kashkari will address economic trends and the outlook on Thursday.

INDONESIA: MNI BI Preview – February 2024: No Reason To Shift Rates

- Bank Indonesia (BI) is unanimously expected to leave rates at 6.0% at its meeting on February 21. The accompanying meeting statement is likely to be scrutinised for any dovish changes or downward revisions to forecasts. Currently with inflation around the mid-point of the band, growth robust and the IDR still at weak levels, there is no reason to change rates.

- BI Governor Warjiyo said that the window to begin easing is H2 2024, but a material and sustainable appreciation in the rupiah and the start of Fed rate cuts are probably going to be needed first, unless growth slows sharply and inflation with it.

- February has seen some rupiah strengthening but FX stability is likely to remain BI's focus. Recent depreciation has put pressure on import prices, which the central bank is monitoring closely.

- See full preview here.

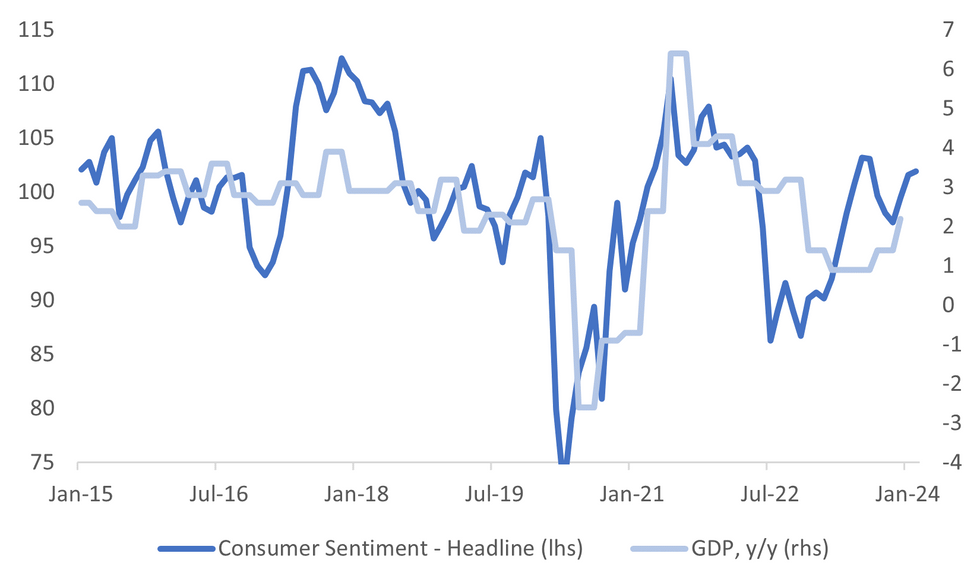

SOUTH KOREA: Consumer Sentiment Edges Higher, Inflation Expectations Steady

South Korean Feb consumer sentiment continued to tick up in terms of the headline result. We are now at 101.9, from 101.6 in Jan. We are comfortably above mid 2022 lows. The first chart below overlays this headline series against GDP y/y growth. Current consumer sentiment readings are consistent with a resilient GDP backdrop.

- In terms of the detail, it was mixed. Expectations around the domestic economic situation and employment ticked down slightly. The current situation though ticked higher. Spending plans were either unchanged from Jan or ticked down slightly.

Fig 1: South Korean Consumer Sentiment Versus GDP Y/Y

Source: MNI - Market News/Bloomberg

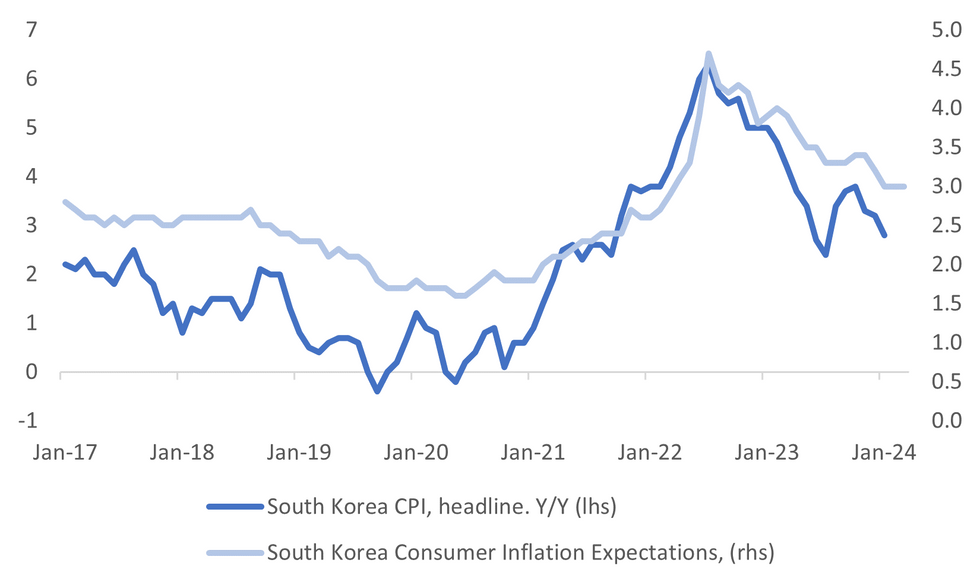

- In terms of prices, the expected inflation level was unchanged at 3%. The chart below overlays this series against headline CPI in y/y terms.

- We are comfortably off cyclical highs, albeit arguably not back to levels consistent with the inflation target for the BoK. The authorities have warned headline inflation pressures may stabilize somewhat in coming months. This would also be consistent with less favorable base effects.

- The BoK meets this Thursday but is widely expected to remain on hold (current policy rate is 3.50%).

Fig 2: South Korean Consumer Inflation Expectations Versus CPI Y/Y

Source: MNI - Market News/Bloomberg

ASIA FX: USD/Asia Pairs Higher, But CNH Steady

USD/Asia pairs are mostly higher in the first part of Tuesday trade. A firmer US yield backdrop and weaker regional equity sentiment have been headwinds, although these have faded as the session progressed. The cut in China's 5yr LPR by a record 25bps hasn't shifted sentiment positively either. CNH has outperformed at the margins, with headlines of intervention crossing post the LPR cut. Tomorrow, we have South Korea PPI and business confidence early, then the first 20-days of Feb trade data prints. Later on, the BI decision is due, no change expected.

- USD/CNH spiked on the announcement of the larger than expected cut to 5yr LPR rate. We got to highs of 7.2185, but quick fell back below 7.2100. We last tracked near 7.2100. Reuters reported that onshore banks had been selling USDs to curb the yuan weakness. Note onshore spot has remained sub 7.2000. This was designed limit fallout for the yuan post the LPR cut. Local equities are still struggling for positive traction, not inspired by the cut at this stage.

- 1 month USD/KRW has climbed, albeit while remaining in recent ranges. We are were last near 1336, around 0.25% weaker in won terms for the session. Local equities have seen a sharp pull back of -1.2%, perhaps on profit taking flows given the recent strength. Offshore investors have sold -$66.3mn of local shares so far today. Earlier we had Feb consumer sentiment print, with the headline rising, while consumer inflation expectations were steady at 3%.

- USD/THB got close to fresh YTD highs earlier, getting to 36.185. We sit slightly lower now, last near 36.15, still down by 0.35% in THB terms. Early comments from PM Srettha, calling for an unscheduled BoT meeting to cut rates has clearly weighed on sentiment. A break above 36.20 could see 36.33 (early Nov 2023 highs) targeted.

- The USD is modestly firmer elsewhere. Spot USD/IDR has drifted higher, last near 15660, around 0.20% weaker in spot IDR terms. Tomorrow's BI decisions is expected to see rates left on hold. BI Governor Warjiyo said that the window to begin easing is H2 2024, but a material and sustainable appreciation in the rupiah and the start of Fed rate cuts are probably going to be needed first, unless growth slows sharply and inflation with it.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 20/02/2024 | 0900/1000 | ** |  | EU | Current Account |

| 20/02/2024 | 1000/1100 | ** |  | EU | Construction Production |

| 20/02/2024 | 1000/1000 | ** |  | UK | Gilt Outright Auction Result |

| 20/02/2024 | 1015/1015 |  | UK | BOE's Bailey et al at TSC to discuss MPR | |

| 20/02/2024 | 1330/0830 | *** |  | CA | CPI |

| 20/02/2024 | 1330/0830 | ** |  | US | Philadelphia Fed Nonmanufacturing Index |

| 20/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 20/02/2024 | 1630/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

| 20/02/2024 | 1800/1300 | * |  | US | US Treasury Auction Result for Cash Management Bill |

| 20/02/2024 | 1800/1300 | ** |  | US | US Treasury Auction Result for 52 Week Bill |

| 21/02/2024 | 2350/0850 | ** |  | JP | Trade |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.