-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS:US CPI In View

- The greenback was marginally pressured in Asia today, however moves have a little follow through thus far as US CPI print comes into view.

- Consensus puts core CPI inflation at 0.3% M/M in April but with sizeable skew to the upside, full MNI preview is here.

- Oil has more than unwound yesterday’s gains falling 0.7% during APAC trading after US crude stocks rose sharply last week. WTI is trading around $73.22/bbl and Brent $76.94, both just off intraday lows of $73.10 and $76.80 respectively.

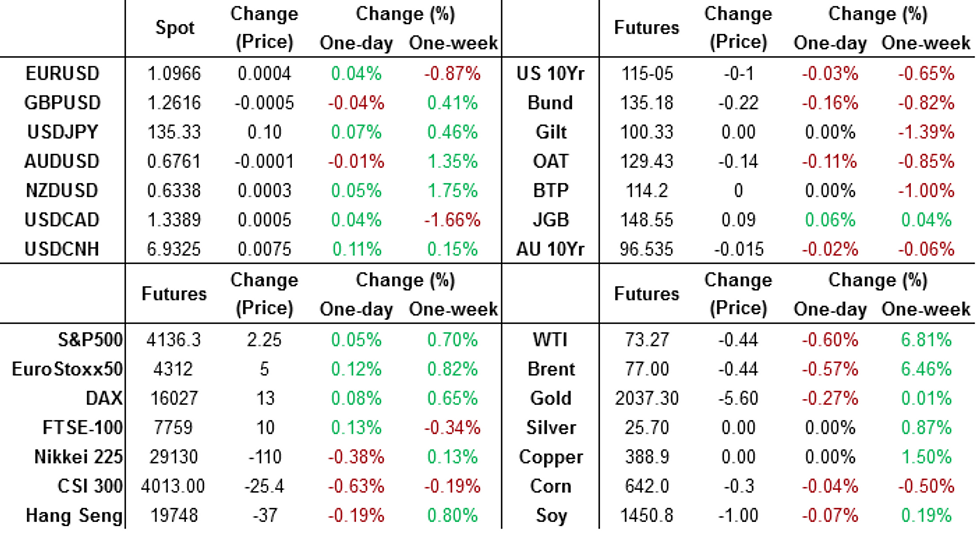

MARKETS

US TSYS: Narrow Ranges Ahead Of US CPI

TYM3 deals at 115-06+, +0-00+, with a 0-03+ range observed on volume of ~42k.

- Cash tsys sit 1bp cheaper to 1bp richer across the major benchmarks, the curve has twist flattened pivoting on 7s.

- Tsys were marginally richer in early dealing as Asia-Pac participants have continued the move seen in the NY session post the latest 3 Year auction.

- There was little follow through on the move and no meaningful macro news flow crossed. Tsys ticked away from session highs.

- The latest talks on the US debt ceiling did not produce any movement. House Leader McCarthy said congressional leaders will meet with President Biden again on Friday.

- There is a thin docket in Asia-Pac today. Further out the highlight today is Apr CPI print, the MNI preview is here. We also have the latest 10-Year supply.

JGBs: Futures Hold Uptick, Tight Range, Awaits US CPI

JGB futures sit slightly firmer in Tokyo’s afternoon session, +7 compared to settlement levels.

- Without meaningful domestic drivers, local participants have been on headline watch ahead of US CPI later today.

- BoJ Governor Ueda, in today’s appearance in Parliament, said it was premature to talk about specifics on what to do with holdings of ETFs since it would take more time to achieve the stable and sustainable 2% price target.

- The preliminary Leading Indicator for March came in slightly lower than expected at 97.5, while the Coincident Indicator was in line with expectations at 98.7.

- JBM3 is currently trading at 148.53, which is within the range of 147.92 (the upper limit of April's trading range) and 149.53 (the high point of March 22). This range has continued throughout May so far.

- Cash JGBs are richer across the curve, except in the 1-year zone which is 0.6bp cheaper. Yields are 0.2-0.9bp lower with the cash curve flatter. The benchmark 10-year yield is 0.6bp lower at 0.42%, below the BoJ's YCC limit of 0.50%.

- Swap rates are 0.5-0.8bp lower across the curve with the 10-year zone outperforming. Swap spreads tighter out to the 10-year zone and wider beyond.

- The local calendar sees the release of Trade Balance (Mar) and MoF’s Investment Flows (May 5) data along with 30-year JGB supply.

AUSSIE BONDS: Holding Weaker, Awaits US CPI

ACGBs are holding weaker (YM -3.0 & XM -1.0), but off session lows after trading in a relatively tight range in the Sydney session. There have been few local headlines outside those related to the Federal Budget.

- The Australian Budget presented improved fiscal metrics than in October, thanks to favourable developments in commodity prices, inflation, and the labour market. A small surplus for FY23 is expected with smaller projected deficits in the out years.

- Treasurer Chalmers claimed on Budget night that the government’s policies would reduce inflation by 0.75% for 2023-24. Economist Richardson estimates that each A$6bn the government puts into the economy equates to another 25bp rate hike. The budget has added a net A$12bn over the coming year (The Australian).

- Cash ACGBs are flat to 1bp cheaper with the 3/10 curve 1bp flatter and the AU-US 10-year yield differential -2bp at -6bp.

- Swap rates are flat to 1bp higher with EFPs 1bp tighter.

- Bills pricing is flat to -1.

- RBA dated OIS pricing is 1bp softer to 2bp firmer across meetings.

- The local calendar is light tomorrow with May MI Inflation Expectations as the highlight.

- Until then, all eyes will be on the US CPI for April later today.

NZGBS: At Bests, Outperforms $-Bloc

NZGBs ended the session on a high note, with the 2-year and 10-year benchmarks gaining 3bp and 2bp, respectively. Without meaningful domestic drivers, the local market followed the modest strengthening in US tsys in Asia-Pac trade. However, NZGBs performed better, with the NZ/US 10-year yield differential tightening by 3bp to +64bp.

- Meanwhile, the NZ/AU 10-year yield differential narrowed by 1bp to +69bp, marking close to the narrowest gap since mid-March when the NZ current account deficit significantly exceeded expectations. This is noteworthy because it has occurred despite the divergent paths of NZ and Australia's external and fiscal accounts, with the latter in a more favourable position.

- Swap rates closed 1-3bp lower with the 2s10s curve 2bp steeper.

- RBNZ dated OIS closed little changed across meetings with 25bp of tightening for the upcoming May 24 meeting.

- April Food Prices and REINZ House Prices are slated for tomorrow.

- Until then, all eyes will be on the US CPI for April later today.

- The NZ Treasury announced that they plan to sell NZ$200mn of the 0.25% 15 May 2028 bond, NZ$150mn of the 3.50% 14 April 2033 bond and NZ$50mn of the 2.75% 15 May 2051 bond tomorrow.

FOREX: USD Marginally Pressured In Asia

The greenback is marginally pressured in Asia today, however moves have a little follow through thus far as US CPI print comes into view.

- NZD/USD is ~0.2% firmer, last printing at $0.6345/50. The pair continues to consolidate recent gains and sits at the top of today's narrow range.

- AUD/USD sits at $0.6765/70 ~0.1% higher. Bulls look to target $0.6806 high from Apr 14 and key resistance. Support comes in at $0.6711 the 50-Day EMA.

- Yen is little changed from yesterday's closing levels, there has been little follow through on moves with a narrow ~30 pip range observed in Asia.

- Elsewhere in G-10 SEK is the strongest performer in the G-10 space at the margins, however liquidity is poor for the currency in Asia-Pac hours.

- Cross asset wise, e-minis are up ~0.1% and the US Treasury Yield curve is a touch steeper. BBDXY is ~0.1% lower.

- There is a thin docket in Europe today. Further out the highlight today is US Apr CPI print, the MNI preview is here.

OIL: Prices Down On Lower Risk Sentiment & Higher Stocks, Focus On US CPI

Oil has more than unwound yesterday’s gains falling 0.7% during APAC trading after US crude stocks rose sharply last week. WTI is trading around $73.22/bbl and Brent $76.94, both just off intraday lows of $73.10 and $76.80 respectively. The USD index is almost unchanged ahead of the US CPI data. Risk appetite has deteriorated ahead of the release too.

- A lower than expected US inflation print could see oil rally towards this level as a Fed pause gets priced in, thus supporting the demand outlook. If it is higher than projected then it increases the chance of more hikes and thus the risk of a recession, which would be negative for crude.

- On Tuesday the US announced that the planned sale of crude from the SPR would be cancelled and that refilling would begin later in the year. Also on the demand side, Indian diesel consumption surged in April to a record level at a time when refiners in the region were concerned about falling Asian demand.

- The focus of the day is the US April CPI data which is forecast to rise by 0.4% m/m with headline remaining at 5% y/y and core easing 0.1pp to 5.5%. Real average weekly earnings for April and the April budget statement are also released. The official EIA US inventory data are due later.

GOLD: Bullion In Holding Pattern Ahead Of US CPI Data

Gold is treading water ahead of the US April CPI data, which is expected to give guidance on the next Fed move. It is down 0.2% to $2031.43/oz, close to the intraday low of $2030.55, after rising 0.7% on Tuesday to $2034.53 on the back of lower US yields. The USD index is 0.1% lower ahead of the data.

- Resistance is at $2063, the May 4 high, but prices are still some way off this but a lower than expected US inflation print could see bullion rally towards this level as a Fed pause is priced in. If it is higher than projected then it increases the chance of more hikes and thus the risk of a recession, which could also be positive for gold.

- Bullion continues to benefit from safe-haven flows driven by the US debt-ceiling impasse, which didn’t find a resolution after talks on Tuesday. See Another Debt Ceiling Meeting On Friday.

- The focus of the day is the US April CPI data which is forecast to rise by 0.4% m/m with headline remaining at 5% y/y and core easing 0.1pp to 5.5%. Real average weekly earnings for April and the April budget statement are also released.

RBA: Lower 2023 Growth & CPI Forecasts Reduce Rate Estimates

In its latest Statement on Monetary Policy the RBA revised down its 2023 growth and inflation projections. We have fed these into our RBA cash rate model as well as updated CPI, lending rate and house price data. The equation is now indicating that economic fundamentals are pointing to the cash rate at 4% by the end of 2023 and then probably staying there in H1 2024. Unlike market pricing, it is not yet signalling any rate cuts as the inflation gap remains positive.

- The RBA’s new forecasts result in the output gap closing in H1 2024 and it is then slightly negative for the rest of the forecast horizon. While the inflation gap narrows it doesn’t close we use the mid-point of the target band). The revised forecasts have resulted in model rate estimates being around 75bp lower by Q1 2024 at 4.06% compared to 4.82% calculated at the end of March.

- Both equations with and without house prices are estimating Q2 & Q3 2023 rates below the current quarterly average of 3.77. But without considering house prices, an additional 40bp of tightening by Q1 2024 is still in the model’s estimates, which is above AUD OIS market pricing. According to the equation, economics are suggesting a slower pace of tightening in H1 2023 than has occurred.

- When CoreLogic house prices are included and assumed to rise at the April pace going forward, then rates at 3.5% in Q2 2023 are consistent with economic fundamentals with only another 25bp of tightening to 3.75% estimated by Q1 2024, which is down about 25bp on the previous estimate and on the model excluding housing.

- Econometric estimates are only estimates and not projections.

Source: MNI - Market News/Bloomberg/Refinitiv

Budget Forecasts: Policy Measures Have Net Positive Economic Effect

Treasury’s updated economic forecasts were published with the fiscal outlook yesterday. They show the first budget surplus in 15 years but with both growth and the fiscal position deteriorating while inflation returns to target in 2024-25. There is the risk that the measures announced will add to inflation and the pressure for the RBA to hike.

- The budget is projected to be in surplus by $4.2bn in the current financial year worth 0.2% of GDP. It will return to a deficit in 2023-24 of $13.9bn or 0.5% of GDP and then reach 1.3% the following year. In October, the deficit was forecast to peak at 2%. Spending as a share of the economy is to rise to a peak of 26.8% of GDP in 2024-25 up from 24.8% this FY while receipts peak at 25.9% in 2023-24.

- The risk to the budget’s bottom line is from the stage 3 tax cuts which are worth $69bn over 5 years and haven’t been included in the budget estimates as won’t be implemented until the 2024-25 FY.

- The impact on the underlying cash balance from policy decisions in this budget is projected to be 0.5% of GDP in 2023-24 and 0.2% in 2024-25. Thus it is not surprising that economists have been sceptical that the budget’s measures wouldn’t be inflationary, as the government is claiming.

- Treasury expects inflation to ease over the forecast horizon. It should be 3.25% in 2023-24 and then in the RBA’s target band at 2.75% in 2024-25 and falling further to 2.5% in 2025-26. The 2024-25 forecast is more optimistic than the RBA’s, which has an average 3.1% with 3% in June 2025.

- Growth forecasts are little changed with growth troughing in 2023-24 at 1.5%, which is more optimistic than the RBA’s 1.3%, and then recovering to 2.75% by 2025-26.

- The gross debt ratio is expected to remain low compared to other OECD countries but still trending gradually higher over the forecast horizon reaching 36.5% in 2025-26 from 34.9% this FY, lower than expected in October.

Source: MNI - Market News/Commonwealth of Australia

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 10/05/2023 | 0600/0800 | *** |  | DE | HICP (f) |

| 10/05/2023 | 0600/0800 | * |  | NO | CPI Norway |

| 10/05/2023 | 0600/0800 | ** |  | SE | Private Sector Production |

| 10/05/2023 | 0800/1000 | * |  | IT | Industrial Production |

| 10/05/2023 | 0900/1000 | ** |  | UK | Gilt Outright Auction Result |

| 10/05/2023 | 1100/0700 | ** |  | US | MBA Weekly Applications Index |

| 10/05/2023 | - | *** |  | CN | Money Supply |

| 10/05/2023 | - | *** |  | CN | New Loans |

| 10/05/2023 | - | *** |  | CN | Social Financing |

| 10/05/2023 | 1230/0830 | * |  | CA | Building Permits |

| 10/05/2023 | 1230/0830 | *** |  | US | CPI |

| 10/05/2023 | 1430/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 10/05/2023 | 1700/1300 | ** |  | US | US Note 10 Year Treasury Auction Result |

| 10/05/2023 | 1800/1400 | ** |  | US | Treasury Budget |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.