-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: US Yields Drift Lower, But Dollar Firms Ahead Of FOMC

- JGB's slumped in early trade, as the BoJ Summary Of Opinions (from the Jan meeting) struck a hawkish tone, with lots of discussion around exiting negative rates. Futures are up from earlier lows (last -.19), likewise for USD/JPY, amid broader USD gains.

- The AUD has underperformed post the Q4 CPI miss, while a slight downside miss on the China manufacturing PMI didn't help either. RBA-dated OIS pricing is 5-13bps softer for meetings beyond March, with a cumulative 56bps of easing priced by year-end.

- US yields grinded lower, but this didn't hurt USD sentiment. US equity futures are notably weaker, owing to some late tech related earnings disappointment in the US from Tuesday's session.

- The focus of today will be the Fed decision out later; no change in rates is expected (see MNI Fed Preview here). There are also January US ADP employment & MNI Chicago PMI, and Q4 employment cost index. German & French preliminary CPIs also print.

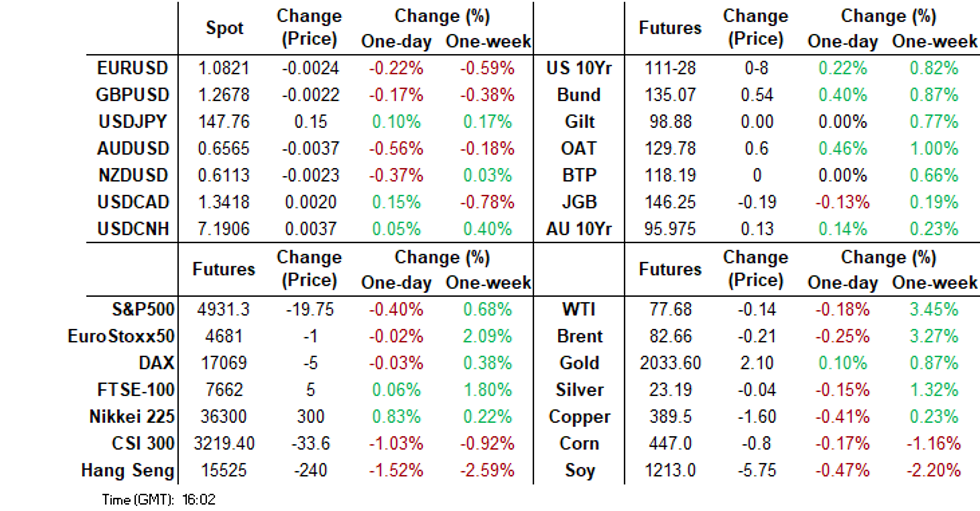

MARKETS

US TSYS: Yields Grind Lower, FOMC Tonight

TYH4 is trading at 111-29+, + 09 from NY closing levels.

Yields have been griding lower all day, front end slightly outperforming after underperforming overnight. China manufacturing PMI data miss, while US equity futures trend lower, potentially aiding the move.

- Cash yields moving lower, the 2y trade 1.9bps lower to 4.316%, while the 10y yield is 1.5bp lower trading at 4.017%.

- US 10Y Tsy futures broke out higher earlier, above yesterdays highs of 111-27+ and have held onto that move and remaining rangebound for the afternoon, trading back to Jan 17th levels of 111-28+.

- TYH4 are still trading within resistance levels of 112-01+ and from the highs of Jan 17th, while support remains back at 110-26 from Jan 19th

- Busy night for Data: Mortgage Applications, ADP Employment, MNI Chicago PMI and finally FOMC rate decision.

JGBS: Futures Sharply Weaker After BoJ Board Actively Discusses An Exit Policy

JGB futures are holding sharply lower, -27 compared to settlement levels, after the release of a relatively hawkish BoJ Summary Of Opinions for the January policy meeting. The session low for JBH4 has been 145.96, -48 versus settlement levels.

- (MNI) BoJ board members actively discussed an exit policy and a post-exit monetary policy at the Jan 22-23 meeting, the summary of opinions released on Wednesday showed. One BOJ board member said the conditions to terminate the negative interest rate policy are being met. While the other board members did not share the same view, some admitted conditions had elevated the probability of Japan's economy hitting the bank’s 2% price target, leaving the door open for the possible removal of the negative interest rate policy in future. (See link)

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined Industrial Production and Retail Sales. Consumer Confidence and Housing Starts are due later today.

- Cash JGBs are cheaper out to the 20-year, with the 10-year underperforming. The benchmark 10-year yield is 2.5bps higher at 0.742% versus the Nov-Dec rally low of 0.555%.

- Swaps are also cheaper, with swap spreads tighter out to the 20-year and wider beyond.

- Tomorrow, the local calendar sees Weekly International Investment Flows and Jibun Bank PMI Mfg data, along with 10-year supply.

AUSSIE BONDS: Sharply Higher After Q4 CPI Undershoot, Focus Turns To FOMC Decision

ACGBs (YM +10.0 & XM +9.0) sit 6-7bps richer than pre-CPI data levels.

- ICYMI, Q4 CPI undershot market expectations printing +0.6% q/q (4.1% y/y) for Headline and +0.8% q/q (4.2% y/y) for Trimmed Mean versus expectations of +0.8% q/q and 4.3% y/y for Headline and +0.9% q/q and 4.3% y/y for Trimmed Mean.

- The moderation was driven by goods and tradeables though with services and non-tradeables both rising in line with Q3. The data is likely to mean that the RBA is on hold in February, dependent on revised staff projections, but maintains its tightening bias given the sticky nature of domestic price pressures.

- An extension of overnight strength in US tsys in today’s Asia-Pac session also likely assisted the local bid. Ahead of the FOMC decision later today, US tsys are 1-2bps richer across benchmarks.

- Cash ACGBs are 9-11bps richer on the day, with the AU-US 10-year yield differential 6bps tighter at +3bps.

- Swap rates are 9-10bps lower, with EFPs little changed.

- The bills strip has bull-flattened, with pricing +3 to +13.

- RBA-dated OIS pricing is 5-13bps softer for meetings beyond March, with a cumulative 56bps of easing priced by year-end.

- Tomorrow, the local calendar sees CoreLogic House Prices, Judo Bank PMI Mfg, Q4 Terms of Trade, Q4 NAB Business Confidence and Building Approvals data.

AUSTRALIAN DATA: Persistent Domestic Inflation Likely To Keep RBA Wary

Q4 CPI came in below expectations and RBA forecasts with headline rising 0.6% q/q and easing to 4.1% y/y from 5.4%. The trimmed mean measure rose 0.8% q/ and moderated to 4.2% from 5.1%. Quarterly inflation rates slowed but favourable base effects also helped to bring annual inflation down. The moderation was driven by goods and tradeables though with services and non-tradeables both rising in line with Q3. The data is likely to mean that the RBA is on hold in February, dependent on revised staff projections, but maintains its tightening bias given the sticky nature of domestic price pressures.

Australia CPI y/y% approaches RBA's target band

Source: MNI - Market News/Refinitiv

- Rent assistance contributed to the quarterly easing in inflation as rents rose only 0.9% q/q after 2.2% in Q3 and would have been +2.2% without the measure. New dwelling construction rose 1.5% q/q, insurance +3.8% and tobacco +7% due to excise indexation.

- The moderation in inflation was driven by tradeables inflation falling 0.7% q/q, the lowest since Q2 2020. Whereas domestically-driven non-tradeables rose 1.3% q/q, in line with Q3, bringing the annual rate to 5.4% from 6.2% due to base effects. This series remains elevated.

- While goods prices rose only 0.4% q/q, services rose 1% q/q (Q3 1%) with core services up 1.1% down from 1.3% in Q3 (data is non-seasonally adjusted). Base effects brought annual inflation down to 4.6% y/y and 4.5% respectively from 5.8% and 6.2%. The quarterly rates are above the 2000-2019 averages and imply that services prices remain sticky.

Source: MNI - Market News/Refinitiv

- December inflation moderated to below 4% for the first time in 2 years. It came in at 3.4% helped by a 0.1% m/m drop and December 2022 rising 0.9% m/m. Base effects will be less favourable going foreward. Trimmed mean moderated to 4.1% from 4.8% y/y and ex volatile items & holiday travel to 4.2% from 4.8%. 6-month annualised rates for services and non-tradeables remain elevated at 8% and 10.1% respectively.

NZGBS: Closed On A Strong Note, FOMC Decision Later Today

NZGBs closed on a strong note, with benchmark yields 1-6bps lower, despite a mixed set of economic data releases.

- ANZ sentiment readings printed Business Confidence at 36.6 vs 33.2 prior, and Activity Outlook at 25.6 vs 29.3 prev.

- Job Ads fell 6.9% q/q in December, registering a sixth straight quarter decline.

- An extension of overnight strength in US tsys in today’s Asia-Pac session also likely assisted the local bid. Ahead of the FOMC decision later today, US tsys are ~1bp richer across benchmarks.

- Bloomberg reported that Finance Minister Willis commented in parliament that “the economy is at or near the bottom of the economic cycle”.

- The swaps curve has bull-flattened, with rates flat to 7bps lower.

- RBNZ dated OIS pricing flat to 4bps firmer across meetings, with August leading.

- RBNZ Governor Adrian Orr is scheduled to deliver a keynote speech on 16 February at the NZ Economics Forum. Mr Orr will speak about the changing drivers of inflation over the past couple of years and the shift from transitory to more stubborn underlying inflation.

- Tomorrow, the local calendar sees CoreLogic House Prices.

- Tomorrow, the NZ Treasury plans to sell NZ$250mn of the 4.5% May-30 bond, NZ$175mn of the 3.5% Apr-33 bond and NZ$75mn of the 2.75% May-51 bond.

RBNZ: Governor Orr To Speak On Feb 16

The RBNZ notes: "Governor Adrian Orr is scheduled to deliver a keynote speech at 7.40am, Friday 16 February 2024, at the New Zealand Economics Forum hosted by the University of Waikato."

- "Mr Orr will speak about the changing drivers of inflation over the past couple of years and the shift from transitory to more stubborn underlying inflation. He will also discuss why – despite these challenging years – the Reserve Bank continues to believe that a flexible inflation target centred on 2% still makes sense.

Mr Orr will also talk about the year ahead for the Reserve Bank. As a full-service central bank, the RBNZ has a wide mandate that spans monetary policy, financial stability, cash operations, and financial markets infrastructure."

FOREX: USD Firmer, Weaker Equity Tone Helps, AUD Holding Losses Post CPI Miss

The USD has mostly traded on a positive footing as the FOMC comes into view. The BBDXY was last near 1237.35, slightly off session highs (1237.74). A weaker tone to US equity futures (Nasdaq off more than 0.8%), has aided the USD at the margins, as earnings disappointment from tech bellwethers weighed on sentiment. US yields sit down around 1-2bps across the benchmarks.

- AUD has been the weakest performer, off 0.45% in recent dealings near the 0.6570 level (lows were at 0.6559). We had a weaker than expected Q4 CPI print, which has weighed on local yields and market pricing for the RBA outlook.

- The slight downside miss on the China manufacturing PMI also hasn't helped the A$. Metal commodities are down for copper and iron ore.

- NZD/USD has been dragged down by AUD weakness, and broader risk off trends. The pair last new 0.6115 around 0.35% weaker versus end NY levels from Tuesday.

- USD/JPY sunk in early trade, dipping under 147.20, as the BoJ Summary Of Opinions from the Jan policy meeting struck a hawkish tone around exiting negative rates. Our Japan policy team provided its latest insight, "While the April 25-26 meeting remains the most likely timing for policy adjustment, there is still an outside chance the Bank of Japan could look to end its negative rates policy in March 18-19 due to strong wage and prices data, MNI understands (see this link)."

- The pair has recovered though to be back at 147.65, little changed for the session, albeit outperforming the other majors.

- EUR/USD sits near 1.0825, off around 0.25% for the session so far.

- The focus of today will be the Fed decision out later; no change in rates is expected (see MNI Fed Preview here). There are also January US ADP employment & MNI Chicago PMI, and Q4 employment cost index. German & French preliminary CPIs also print.

EQUITIES: ASX Hits New Highs, Tech Earnings Weigh On Indices

Asia equities have opened mostly lower today, but have recovered some of the early losses, Australia remains the standout in the region. US Equities futures are also lower today after being pulled down by tech names, with the Nasdaq 0.80% lower following disappointing earnings from Microsoft and Alphabet earlier, while Eminis trade 0.40% lower

- Japan equity indices are mixed today, after recovering most of this mornings sell off, with the Nikkei falling as much as 1% in early morning trading, we currently trade just 0.10% lower for the day, while the Topix is now higher by 0.25%. The majority of the weakness in Equities today is coming from the Tech names, which could be attributed to weak tech earnings in the US earlier. Also, it's important to note earlier this morning BoJ Summary of opinions were out, with a hawkish tone attached, contributing to weaker equity prices, as the JPY moved higher, and JGB futures had a sharp drop.

- Hong Kong & China indices are lower again today, market sentiment is still poor following the ordered liquidation of China Evergrande, while China data isn't helping with the manufacturing PMI missing slightly, and a lack of details surrounding the market-stabilization program announced last week. Currently the Hang Seng is 1 % lower, while poor tech earnings weigh on Heng Seng tech index, down by 1.25%. Note the China Mainland Property Index is 1.85% lower, while CSI 300 is 0.2% lower

- South Korea is slightly lower today, as Samsung's profit fall again weighing on the Kospi, currently trading 0.15% lower.

- In Taiwan, the Taiex is being pulled lower by tech names, currently trading 0.75% lower

- Australia equities hitting fresh new all time highs, as inflation expectation cools, with the market now pricing in a 70% chance of a rate cut in June, up from a 50% chance yesterday. The ASX200 currently trading up 1.00%.

- In SEA, the Philippines bourse is the standout, up over 1.25%, with a Q4 GDP beat helping at the margins.

OIL: Crude Lower Ahead Of Fed, Geopolitics Remain In Focus

Oil prices are moderately weaker ahead of the Fed decision later today. Brent has held above $82 during APAC trading and is currently down 0.4% to $82.18/bbl. WTI is also 0.4% lower at $77.52. Geopolitical tensions have supported crude this month and it looks set to rise around 7%. The USD index is up 0.2%.

- US President Biden said that he did not want a war with Iran after 3 US troops were killed following a drone attack by Iranian-backed militants, which has weighed on oil today. Concern that the conflict in the Middle East could spread to Iran following the incident had supported crude, and as a result attention will remain on the US’ response to the strike.

- Bloomberg reported that US inventories fell a larger-than-expected 2.49mn barrels last week after 6.67mn, according to people familiar with the API data. Gasoline stocks rose 584k but distillate fell 2.13mn. The official EIA data is out later today.

- The focus of today will be the Fed decision out later; no change in rates is expected (see MNI Fed Preview here). There are also January US ADP employment & MNI Chicago PMI, and Q4 employment cost index. German & French preliminary CPIs also print.

GOLD: Holding Pattern Ahead Of FOMC Meeting

Gold is slightly lower in the Asia-Pac session, after closing 0.2% higher at $2037 on Tuesday.

- Bullion, like most markets, remains in a holding pattern ahead of today’s FOMC policy meeting, which may steer on when the US central bank will start easing policy.

- Fed speakers have been in a blackout ahead of this week’s FOMC meeting.

- The market is currently assigning around a 40% chance to a 25bp rate cut in March. This compares to the near 70% chance seen a couple of weeks ago.

- Lower interest rates are typically positive for non-interest-bearing gold.

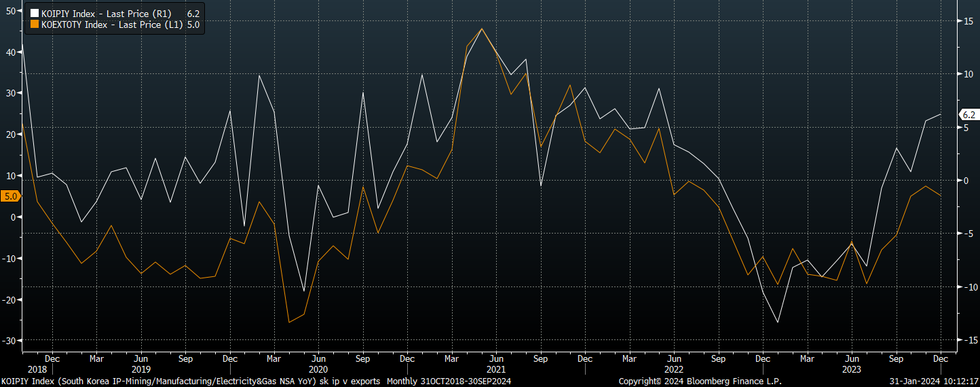

SOUTH KOREA DATA: Dec IP Above Expectations On Chip Rebound, Jan Trade Data Due Tomorrow

South Korea industrial production was stronger than expected in Dec. We rose 0.6% m/m, after a revised 3.6% gain in Nov. In y/y terms we rose 6.2%, also above the 5.3% projected. The y/y pace is now back to Q2 2022 levels.

- A source of strength was chip production up 8.5% m/m, following Nov's 13.2% rise. This bought the y/y pace to a heady +53.3% for this segment, the firmest since 2016. Vehicles were another area of strength, but other segments were less upbeat though.

- Other data showed retail sales down 0.8% m/m. Services sector output was modestly positive at +0.3% m/m.

- The chart below overlays y/y IP against export growth. Note tomorrow we get full month export data for Jan. The consensus looks for +17.6% y/y export growth (+5.0% prior), with imports forecast at -8.1%.

Fig 1: South Korean IP & Export Growth Y/Y

Source: MNI - Market News/Bloomberg

IDR: Political Uncertainty Adding To IDR Weakness, BI Hoping To Cut In H2

In two weeks, Indonesians vote for a new President, Senate and House of Representatives. Polls have consistently had defence minister Prabowo in the lead but it is too tight to determine whether he can avoid a run-off in June and most expect that it will occur. Ahead of the election USDIDR has risen despite Bank Indonesia (BI) intervention last week on concerns that the finance minister may resign. The pair is now up 2.7% this month and over 1% this last week.

- Today BI governor Warjiyo said that monetary policy will ensure rupiah and price stability, demonstrating that the focus of the central bank remains on FX stabilisation. Resolution of the political uncertainty should help with this, given economic fundamentals are supportive. BI is hoping to be able to cut rates in H2 2024 as the currency should have strengthened by then.

- The average of the four polls taken over the second half of January gives Prabowo 50.4% support, Anies 22.6% and Ganjar 20.1%. Prabowo received over 50% support in 3 of the last 5 polls. He will not only need above 50% of the vote to avoid a runoff but also at least 20% in over half of the provinces. At this stage it looks like a runoff would be between him and Anies.

- The popular President Jokowi has supported Prabowo even though his party’s candidate is Ganjar, but his son is running as the former’s VP. Some within his cabinet are unhappy about this and that has added to uncertainties surrounding the current government. There is also talk that there is some dissent regarding social assistance. The finance minister is well respected given her success in achieving fiscal targets.

THAILAND DATA: Manufacturing Sector Contraction Worsens, January PMI Tomorrow

December industrial data showed that Thailand’s manufacturing sector remains depressed and that the January S&P Global manufacturing PMI, released February 1, is likely to print below 50 for the sixth consecutive month. December manufacturing production deteriorated further declining 6.3% y/y after -4.7% the previous month, when an improvement to -3% y/y was expected. The 3-month average travelled around -5% y/y for 2023 and the industry minister expects it to expand 2-3% in 2024. Capacity utilisation fell around 2.5points to 55.25. Last week the IMF noted that Thailand is underperforming ASEAN and needs to focus on structural reforms to improve competitiveness. It also warned there were numerous external and domestic risks to the outlook.

Thailand manufacturing sector

Source: MNI - Market News/Refinitiv/Bloomberg

PHILIPPINES DATA: Q4 GDP Slightly Better Than expected, Although Full Yr 2023 Growth Below Govt Target

Earlier Q4 Philippines Q4 GDP data printed stronger than expected. Q/Q growth was 2.1%, versus 1.7% expected (prior was 3.8%, also firmer than the initial 3.3% estimate). Y/Y momentum was 5.6% versus 5.2% forecast, albeit down slightly from the 6.0% Q3 Y/Y pace. 2023 growth as a whole stood at 5.6% (versus 7.6% in 2022).

- In terms of expenditure details, government consumption (-1.8% y/y) and exports (-2.6% y/y) were the main drags. Private consumption and investment added to growth. By sector there were no negative y/y prints, although manufacturing continued to ease, back to 0.6% (from 1.8%), construction slowed from Q3, back to 8.5% y/y.

- Philippines NEDA Secretary Balisacan spoke and stated that infrastructure spending will accelerate. Concerns were highlighted around food consumption, while risks come from El nino and external developments. Balisacan added that moderating interest rates can boost consumption.

- The full year growth figure (5.6%) was below the government's 6-7% target. Balisacan stated the government was sticking with its 6.5-7.5% growth target for 2024.

- Overall, the data is unlikely to concern the BSP too much and warrant a near term dovish shift.

- Equity sentiment is positive today, the PCOMP up 1.3%, to fresh highs since May last year.

- USD/PHP is relatively steady though, last tracking slightly stronger in PHP terms, near the 56.36 level.

ASIA FX: Asian FX Mostly Lower Ahead Of FOMC

USD/Asia pairs are mostly higher, albeit with INR and IDR and PHP showing some resilience. The mostly weaker regional equity tone and firmer USD against the majors have been headwinds today for Asia FX. Still ranges are mostly tight ahead of the FOMC later. Still to come in the region today, is Thailand trade figures, as well as Taiwan and Hong Kong Q4 GDP. Tomorrow the South Korea Jan trade update is out, as well as the China Caixin manufacturing PMI and other regional PMIs.

- USD/CNH has held tight ranges for Wednesday trade to date. The pair last near 7.1900, well within recent ranges. The official Jan PMIs were mixed, although manufacturing staying wedged closed to 49.0 still suggests more can be done to boost momentum. Local equities are in the red, with familiar drivers still at play.

- 1 month USD/KRW has firmed back to 1333/34 around 0.50% weaker in won terms for the session so far. A weaker tech equity lead is weighing. Still, the pair remains comfortably within recent ranges. Dec IP figures were stronger than expected earlier on rebounding chip production. Tomorrow the focus will be on full month Jan trade figures.

- Spot USD/IDR was above 15800 in earlier trade, but now sits back below this level (last 15780). This may indicate moves above this figure level is drawing an intervention response from the authorities. Today BI governor Warjiyo said that monetary policy will ensure rupiah and price stability, demonstrating that the focus of the central bank remains on FX stabilisation. Resolution of the political uncertainty should help with this, given economic fundamentals are supportive. BI is hoping to be able to cut rates in H2 2024 as the currency should have strengthened by then.

- USD/INR is down slightly, but continues to exhibit very low volatility. The pair was last near 83.05/10, so slightly outperforming the firmer USD trend elsewhere.

- USD/PHP spot is close to unchanged last just under 56.40. We had Q4 GDP stronger than expected earlier, albeit still below the government's full year growth target. Onshore calls for easier policy settings to boost domestic consumption were evident. Local equities are up strongly so far today, the PCOMP last +1.10%.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 31/01/2024 | 0700/0800 | ** |  | DE | Import/Export Prices |

| 31/01/2024 | 0700/0800 | ** |  | DE | Retail Sales |

| 31/01/2024 | 0700/1500 | ** |  | CN | MNI China Liquidity Index (CLI) |

| 31/01/2024 | 0730/0830 | ** |  | CH | Retail Sales |

| 31/01/2024 | 0745/0845 | *** |  | FR | HICP (p) |

| 31/01/2024 | 0745/0845 | ** |  | FR | PPI |

| 31/01/2024 | 0855/0955 | ** |  | DE | Unemployment |

| 31/01/2024 | 0900/1000 | *** |  | DE | North Rhine Westphalia CPI |

| 31/01/2024 | 0900/1000 | *** |  | DE | Bavaria CPI |

| 31/01/2024 | 1200/0700 | ** |  | US | MBA Weekly Applications Index |

| 31/01/2024 | 1300/1400 | *** |  | DE | HICP (p) |

| 31/01/2024 | 1315/0815 | *** |  | US | ADP Employment Report |

| 31/01/2024 | 1330/0830 | *** |  | CA | Gross Domestic Product by Industry |

| 31/01/2024 | 1330/0830 | ** |  | US | Employment Cost Index |

| 31/01/2024 | 1330/0830 | ** |  | US | Treasury Quarterly Refunding |

| 31/01/2024 | 1445/0945 | *** |  | US | MNI Chicago PMI |

| 31/01/2024 | 1530/1030 | ** |  | US | DOE Weekly Crude Oil Stocks |

| 31/01/2024 | 1900/1400 | *** |  | US | FOMC Statement |

| 01/02/2024 | 2200/0900 | ** |  | AU | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0030/1130 | * |  | AU | Building Approvals |

| 01/02/2024 | 0030/1130 | ** |  | AU | Trade price indexes |

| 01/02/2024 | 0030/0930 | ** |  | JP | IHS Markit Final Japan Manufacturing PMI |

| 01/02/2024 | 0145/0945 | ** |  | CN | IHS Markit Final China Manufacturing PMI |

| 01/02/2024 | 0815/0915 | ** |  | ES | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0830/0930 | *** |  | SE | Riksbank Interest Rate Decison |

| 01/02/2024 | 0845/0945 | ** |  | IT | S&P Global Manufacturing PMI (f) |

| 01/02/2024 | 0850/0950 | ** |  | FR | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0855/0955 | ** |  | DE | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0900/1000 | ** |  | EU | IHS Markit Manufacturing PMI (f) |

| 01/02/2024 | 0930/0930 | ** |  | UK | S&P Global Manufacturing PMI (Final) |

| 01/02/2024 | 1000/1100 | *** |  | EU | HICP (p) |

| 01/02/2024 | 1000/1100 | ** |  | EU | Unemployment |

| 01/02/2024 | 1000/1100 | *** |  | IT | HICP (p) |

| 01/02/2024 | 1130/1230 |  | EU | ECB's Lane remarks at EIEF | |

| 01/02/2024 | 1200/1200 | *** |  | UK | Bank Of England Interest Rate |

| 01/02/2024 | 1230/1230 |  | UK | BoE Press Conference | |

| 01/02/2024 | - | *** |  | US | Domestic-Made Vehicle Sales |

| 01/02/2024 | 1330/0830 | *** |  | US | Jobless Claims |

| 01/02/2024 | 1330/0830 | ** |  | US | WASDE Weekly Import/Export |

| 01/02/2024 | 1330/0830 | ** |  | US | Preliminary Non-Farm Productivity |

| 01/02/2024 | 1400/1400 |  | UK | DMP Data | |

| 01/02/2024 | 1445/0945 | *** |  | US | IHS Markit Manufacturing Index (final) |

| 01/02/2024 | 1500/1000 | *** |  | US | ISM Manufacturing Index |

| 01/02/2024 | 1500/1000 | * |  | US | Construction Spending |

| 01/02/2024 | 1530/1030 | ** |  | US | Natural Gas Stocks |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.