-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI BRIEF: Trudeau To Keep Working As Opposition Seeks Ouster

MNI EUROPEAN MARKETS ANALYSIS: US Yields & Oil Hold Close To Weekly Lows

- US Tsys observed narrow ranges for the most part on Friday (post CPI highs remain intact), ticking higher due to a bid in JGBs spillover as BOJ's Ueda reiterated recent policy comments. JGB futures spiked to fresh multi month highs, but sit lower in recent dealings. G10 FX trends were relatively muted.

- Oil largely held Thursday losses. Hong Kong equities tracked sharply lower, which limited CNH upside. Other Asia FX performed better, aided by lower oil prices.

- The final read of Eurozone CPI headlines in Europe, further out we have Housing Starts and Fedpeak from Chicago Fed President Goolsbee, Boston Fed President Collins and San Francisco Fed President Daly.

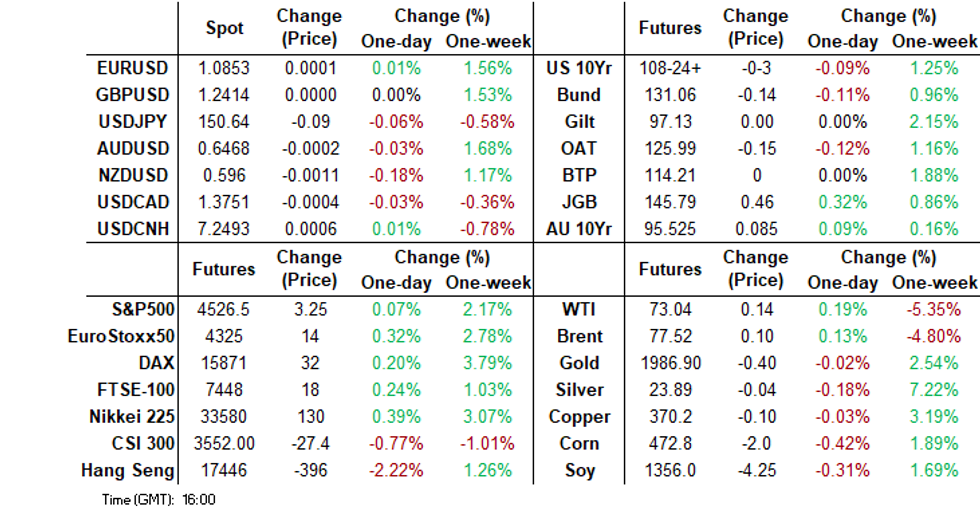

MARKETS

US TSYS: Marginally Cheaper, Post CPI Highs Intact

TYZ3 deals at 108-26+, -0-01, a 0-05 range has been observed on volume of ~68k.

- Cash tsys sit ~1bp cheaper across the major benchmarks.

- Tsys observed narrow ranges for the most part on Friday, ticking higher as a bid in JGBs spillover as BOJ's Ueda reiterated recent policy comments.

- The move higher didn't follow through as Tsys ticked away from session highs through the second half of the Asian session.

- Post CPI highs remain intact for TY, short term bullish conditions remain intact. Immediate focus for bulls is the post CPI high (108-31) a break through here opens 109-20 high from Sep 19. Support comes in at 107-00, low from Nov 13.

- The final read of Eurozone CPI headlines in Europe, further out we have Housing Starts and Fedpeak from Chicago Fed President Goolsbee, Boston Fed President Collins and San Francisco Fed President Daly.

JGBS: Futures Back To Mid September Levels, 10yr Yield Fall To 0.72%

JGB futures have pierced the 146.00 level in afternoon trade. Last 146.03, +.70 (highs at 146.06). This is fresh highs back to the first half of September. The Sep 4 high at 146.41 and bull trigger is now within sight.

- BoJ Governor Ueda has appeared before parliament today, largely reiterating the status quo from a policy outlook standpoint. Confidence in achieving the 2% inflation target sustainably is not yet high enough to warrant a meaningful policy shift. The wage-inflation cycle is the key watch point.

- Bloomberg also note possible short covering flows as a catalyst for today's move (see this link).

- JGBs have notably outperformed a fairly steady TYZ back drop, with US futures holding beneath post CPI highs (last 108-27+). The US-JP 10yr government bond yield differential has recovered ground, back to +372bps.

- The cash 10yr JGB yield has fallen 7bps to 0.72%, with similar yield losses up to the 40yr tenor. 10yr swap rates are back to 0.90%, -5bps lower for the session.

- Next week 20-yr supply will be in focus (on the 21st of Nov), while next Friday delivers national CPI data.

AUSSIE BONDS: ACGBs Richen On Friday

ACGBs marginally extended gains through the Asian session, spillover from JGBs which firmed after the BOJs Ueda reiterated previous policy comments supported the space.

- ACGBs sit ~9bps richer across the major benchmarks. XM and YM and both ticked ~0.1% higher today.

- RBA dated futures are steady pricing a terminal rate of 4.40% with ~20bps of cuts by Dec 24.

- There was little meaningful domestic news flow today.

- Looking ahead, the docket is thin next week with just the RBA's minutes of the November meeting and flash PMIs due. On the supply side A$800mn of 3.5% 2034 bonds are due for auction on Tuesday.

NZGBS: Kiwi Bonds Extend Early Gains

NZGBs have extended early gains through the Asian session today, the support from US Tsys rally on Thursday extended through the session as RBNZ rate cut expectations ticked higher through the session. We sit 5-11bps richer across the major benchmarks, the belly leads the bid.

- There are now ~50bps of cuts priced by Oct 24. ANZ updated their view and now do not expect a rate rise in February, seeing the OCR held steady until early 2025.

- A reminder that early in the session we had Q3 PPI, the Output component rose to 0.8% Q/Q from 0.2% Q/Q. The Input component also ticked higher to 1.2% Q/Q from -0.2% Q/Q.

- Looking ahead the NZ docket is empty until Tuesday when Oct Trade Balance crosses.

EQUITIES: HK Falters Due To Alibaba Weakness, Mixed Trends Elsewhere

Asia Pac equities are mixed. Hong Kong shares are down sharply due to weakness in Alibaba. Trends are mixed elsewhere, although those markets posting gains are up only modestly at this stage. US equity futures aren't far away from flat. Eminis, +0.1%, last near 4528.10, while Nasdaq futures are close to unchanged.

- The HSI is off 2.17% at the break, with Alibaba down 10%, after the company scraped spinning off its cloud unit (see this BBG link for more details). This reportedly follows US export restrictions to China in terms of semiconductors. The HS China Enterprise Index is off by 2.34% at this stage.

- For mainland shares, losses are evident, but are much more muted. At the break the CSI 300 is off 0.32%. The real estate sub index continues to weaken, down a further 0.87%. In index terms we aren't too far away from earlier 2023 lows just under 4000.

- Elsewhere, the Topix is modestly higher, last near +0.40%. The Taiex is +0.25% firmer in Taiwan, continuing a positive run on the back of broader tech gains.

- South Korean shares have faltered though, the Kospi off 0.75%. Offshore investors have sold $212.7mn of shares today, curbing week to date inflows. Institutional investors have also been net sellers.

- The ASX 200 is close to flat, with energy plays down on oil price weakness. Mining names rose though.

FOREX: Narrow Ranges Across G-10 In Asia

There have been narrow ranges in early dealing across G-10 FX with little follow through on moves in Asia on Friday. Cross asset flows are muted, US Tsys are little changed as are e-minis. The data docket was empty in Asia today.

- Kiwi is the weakest performer in the G-10 space as post-CPI gains continue to be trimmed. NZD/USD is down ~0.2%, sitting a touch below Thursday's lows. On the downside bears look to target the 20-Day EMA ($0.5926), which opens the low from 14 Nov at $0.5864.

- Yen has marginally firmed alongside a bid in JGBs seen after BOJ's Ueda reiterated recent policy comments. USD/JPY is down ~0.1% and remains well within recent ranges.

- AUD/USD is little changed today and has observed a $0.6460/75 range. Technically the bull cycle remains in play, resistance comes in $0.6542 (high from Nov 15) and $0.6582 50.0% retracement of the Jul-Oct bear leg. Support is at the 50-Day EMA ($0.6415).

- Elsewhere across G-10 there has been little moves of note thus far today.

- The final read of Eurozone CPI and UK Retail Sales headline in Europe, otherwise the data docket is fairly light today.

OIL: Down For the 4th Straight Week, OPEC Meeting On Nov 25-26 Coming Into Focus

Brent crude sits a touch above Thursday NY closing levels, last near $77.50/bbl. We have largely tracked sideways in Friday trade to date, (narrow $77.28-$77.75/bbl range). This leaves us comfortably lower for the week, down ~4.8% at this stage. This is fourth straight weekly loss for Brent. WTI was last near $73/bbl, following a similar trajectory to Brent today.

- Goldman Sachs analysts noted earlier that the driver of the crude slump has been stronger non-OPEC supply (see this BBG link for more details). This was from the US but also economies like Iran.

- Elsewhere, per BBG the US government stated that all Venezuela sanctions are on the table if path to fairer elections by the end of November does not become clearer . This would include revoking oil and gas export licenses (see this BBG link for more details).

- Looking ahead, next weekend's OPEC meeting (starting on Nov 25) will be a focus point.

- In terms of levels, Thursday's low in Brent was $76.60/bbl, a break sub this level opens up $75.51 (76.4% retracement of May 4 – Sep 28 bull run).

- For WTI, next up lies $69.96 (76.4% retrace of the May 4 – Sep 28 bull run).

GOLD: Tracking Comfortably Higher For The Week, As Dollar Sentiment Falters

Gold has added to Thursday gains in the first part of Friday dealing. We last tracked at $1986.75, a further 0.30% gain, after Thursday's +1.07% rise. Intra-session highs from Thursday at $1988 aren't too far away, with support evident ahead of $1980 in early trade today.

- Gold is tracking nicely higher for the week, +2.4% at this stage, thanks to the combined effects of lower US yields and a pull back in USD sentiment.

- The technical set up looks positive, recent gains fulfil a bullish trend set-up, clearing $1978.4 (Nov 7 high) to next open a bull trigger at $2009.4 (Oct 27 high).

ASIA FX: HK Equity Losses Curbs CNH Gains, THB & PHP Hit Multi Month Highs

USD/Asia pairs are mixed. CNH has been steady, with HK equities down sharply helping to curb gains against the USD. THB and PHP have both gained ground, hitting fresh multi month highs for both currencies. TWD is also firmer, threatening a test of 100-day EMA support. USD/HKD is below the mid-point of the peg band. The early focus next Monday will be on 1yr (3.45% currently) and 5yr (4.20% currently) LPR decisions from China, although no change is expected. Thailand Q3 GDP is also out Monday.

- USD/CNH has tracked a tight range today. The pair last near 7.2500, little changed for the session (range has been 7.2441 to 7.2551). weaker HK equities, due to Alibaba weakness, as the company has canceled plans to spin off its cloud business due to US export retractions has weighed. Comments crossed earlier today from Xi around steps to attract foreign investment flows into China and make it easier to do business in China (BBG).

- Spot USD/HKD is through the mid-point of the HKMA peg band. The pair last near 7.7965, fresh lows back to the start of August (lows at 7.7926). Beyond that, December lows from last year rest near 7.7600. On the topside, recent highs come in at 7.8107, while the 20-day EMA is around 7.8130.• We continue to see downside in relative yield spreads, aiding HKD sentiment. The US-HK 3 month spread is now back to -4bps, also near early August lows.

- USD/TWD spot sits sub 31.90 in latest dealings, fresh lows back to mid September for the pair. We are close to 100-day EMA (near 31.87), a support level we haven't breached since the first half of 2023. The TWD has benefited from a sharp rise in offshore equity inflows this past week, nearly $3.5bn. Inflows have been supported by lower US real yields, which has aided tech related equity sentiment more broadly. Sentiment has also been aided post yesterday's Xi-Biden leaders summit, where the China leader dialled back concerns around China military action against Taiwan.

- The SGD NEER (per Goldman Sachs estimates) has ticked lower this morning, the measure printed a fresh cycle high yesterday as US Tsy Yields ticked lower. We are ~0.3% below the top of the band. On Thursday USD/SGD printed its lowest level since early August as the aforementioned downtick in US Tsy Yields weighed. The pair is holding below the $1.35 handle this morning last printing at $1.3480/85. A reminder that early in today's session October Export data crossed. Non-Oil Domestic Export rose 3.4% M/M, a touch firmer than the estimated 2.0%. Electronic Exports fell 5.6% Y/Y.

- The Ringgit has opened dealing a touch above yesterday's closing levels, ranges remain narrow in a steady start to Friday's dealing. Thursday's fall in US Tsy Yields is marginally weighing on USD/MYR. USD/MYR prints at 4.6840/60, ~0.1% lower today.

- The Rupee has opened dealing little changed from yesterday's closing levels in a steady start to Friday's dealing. USD/INR sits at 82.27/28. The RBI has asked Indian banks to increase buffers for some consumer loans as it looks to limit a rise in risky debt (BBG). Risk weights on consumer credit will be raised by 25 percentage points to 125%, the RBI said in a statement Thursday. The decision excludes mortgages, loans for education and cars, and debt backed by gold. RBI's Das noted that unsecured loans are rising almost twice as fast as overall credit.

- USD/THB has fallen sharply in the first part of Friday trade, the pair down nearly 1.0% to 35.10/15. This is lows in the pair back to early September. We sit slightly higher now 35.17. A break sub 35.00 could see late August lows at 34.835 targeted. Baht looks to be broadly following dollar trends, in line with the pullback in US yields. However, baht has outperformed over the past week (THB +2%, BBDXY -1.25%). The sharp pull back in oil prices is likely being seen as a positive for THB. The Citi THB terms of trade index is at multi month highs, albeit still in negative territory.

- USD/PHP has broken down to fresh lows back to early August. The pair last near 55.64. We are sub all key EMAS, with the 200-day nearest to current spot levels at 55.94. Today's spot move has also pierced the simple 200-day MA (55.69). Note early August lows were sub the 55.00 level. Yesterdays on hold BSP outcome hasn't impact PHP sentiment negatively. The softer tone to US yields, coupled with lower oil prices, remain clear PHP positives.

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 17/11/2023 | 0700/0700 | *** |  | UK | Retail Sales |

| 17/11/2023 | 0700/0800 | ** |  | SE | Unemployment |

| 17/11/2023 | 0830/0930 |  | EU | ECB Lagarde Keynote Speech at Banking Conference | |

| 17/11/2023 | 0900/1000 | ** |  | EU | EZ Current Account |

| 17/11/2023 | 1000/1100 | *** |  | EU | HICP (f) |

| 17/11/2023 | 1310/1310 |  | UK | BOE's Ramsden keynote speech at Conference | |

| 17/11/2023 | 1330/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 17/11/2023 | 1330/0830 | * |  | CA | International Canadian Transaction in Securities |

| 17/11/2023 | 1330/0830 | *** |  | US | Housing Starts |

| 17/11/2023 | 1345/0845 |  | US | Fed Vice Chair Michael Barr | |

| 17/11/2023 | 1430/0930 |  | US | San Francisco Fed's Mary Daly | |

| 17/11/2023 | 1445/0945 |  | US | Chicago Fed's Austan Goolsbee | |

| 17/11/2023 | 1500/1000 | * |  | US | Services Revenues |

| 17/11/2023 | 1500/1600 |  | EU | ECB's Cipollone participates in digital euro round table | |

| 17/11/2023 | 1800/1300 | ** |  | US | Baker Hughes Rig Count Overview - Weekly |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.