-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

Commodities

Real-time insight of oil & gas markets

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Chart Packs -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI EUROPEAN MARKETS ANALYSIS: USD/JPY Testing Y110

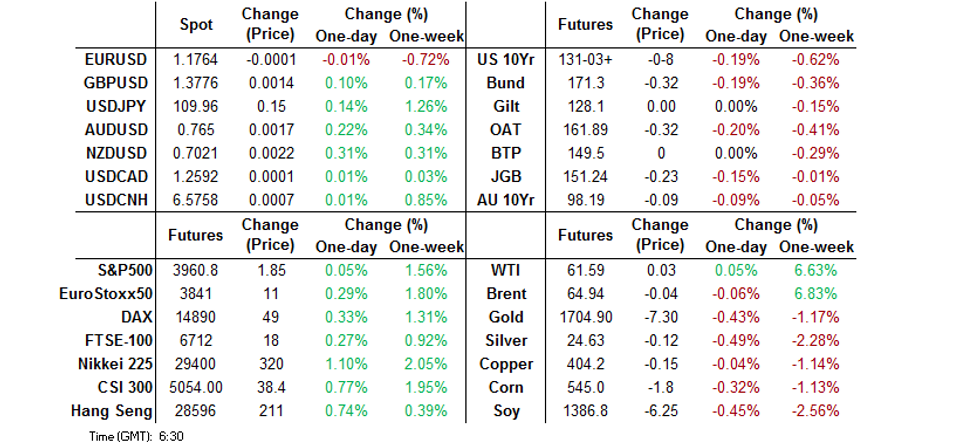

- The potential for an upsized fiscal impulse in the U.S., along with the country's vaccine drive, weighed on U.S. Tsys in in Asia, while USD/JPY tests Y110.00.

- Turkish President Erdogan removes a Deputy Governor at the central bank.

- Matters surrounding the Archegos liquidation remain under the spotlight.

BOND SUMMARY: U.S. Fiscal Impulse Pressures Bonds

Tsys worked their way lower in Asia-Pac hours, with focus on the potential for an upsizing of U.S. fiscal & infrastructure support spilling over from the latter part of the NY session. This took 10-Year yields to within touching distance of the recent cycle highs, last printing at ~1.742%. The March 18 high resides at 1.7526%. A break would allow bond bears to switch focus to the nearby 50% retracement of the move from the '18 high to the '20 low, located at 1.7866%. On the flow side a 3.0K block seller FVM1 provided the highlight, as 5s printed above 0.900% in yield terms for the first time since Mar '20. T-Notes last -0-07 at 131-04+. 7+-Year Tsys sit ~3.5bp cheaper on the day. Consumer confidence data and Fedspeak from Williams & Quarles headline locally on Tuesday.

- JGB futures have extended on their overnight weakness during the Tokyo afternoon, playing catch up to the aforementioned round of U.S. Tsy weakness, to last print -23 on the day. The 4- to 5-Year zone of the cash curve has richened a little on the day, while the remainder of the curve sits up to 1.5bp cheaper, with the 7- to 10-Year sector underperforming. Better than expected local monthly retail sales data had little in the way of tangible impact on the space, with the same holding true for the virtually in line with expectations labour market report. The low price at the latest 2-Year JGB auction came in below broader dealer expectations (100.260 per the BBG dealer poll), with the cover ratio sliding and tail widening. Looks like the proximity to FY end may mean that Japanese investors chose to keep at least some of their powder dry, which could stem from the allure of the yield of some foreign core global bonds in FX-hedged terms. We also saw the Philippines price Y55bn of 3-Year Samurai paper. BoJ Governor Kuroda's latest round of rhetoric revealed nothing in the way of fresh information.

- Aussie bonds were also dragged lower by U.S. Tsys, YM -5.0, XM -10.0 at typing. The 12-Year point represented the softest area on the cash curve. The local labour market continued to reveal positive news. Alongside the latest round of payrolls data, the ABS noted that "after a seasonal peak and fall across the summer months, payroll jobs at mid-March 2021 were slightly above the levels of a year earlier. By mid-March 2021, most state and territory payroll jobs had either reached or passed levels of a year ago. Tasmania and Victoria were the exceptions." Elsewhere, Volkswagen Financial Services launched a 3- & 5-Year A$ senior unsecured benchmark transaction, which is set to price today.

FOREX: Risk-On Flows Push USD/JPY Toward Y110 Mark

USD/JPY punched through resistance from Y109.85, which capped gains on Jun 5, Mar 26 & Mar 29, as a broader risk-on orientation inspired across-the-board yen sales. USD/JPY found itself within touching distance from the psychological Y110.00 level, which has remained intact for a year.

- The Antipodean currencies outperformed in the G10 basket, as broader sentiment improved after the latest round of U.S. Pres Biden's upbeat comments re: local vaccine rollout. A BBG trader source flagged leveraged buy stops above $0.7018 as a kiwi-supportive factor.

- The PBOC fixed its USD/CNY mid-point at CNY6.5641, 2 pips below sell side estimates. USD/CNH slipped after failing to take out yesterday's high.

- Selling pressure hit TRY as Turkish Pres Erdogan sacked CBRT Dep Gov Cetinkaya and replaced him with Mustafa Duman, a former Morgan Stanley executive.

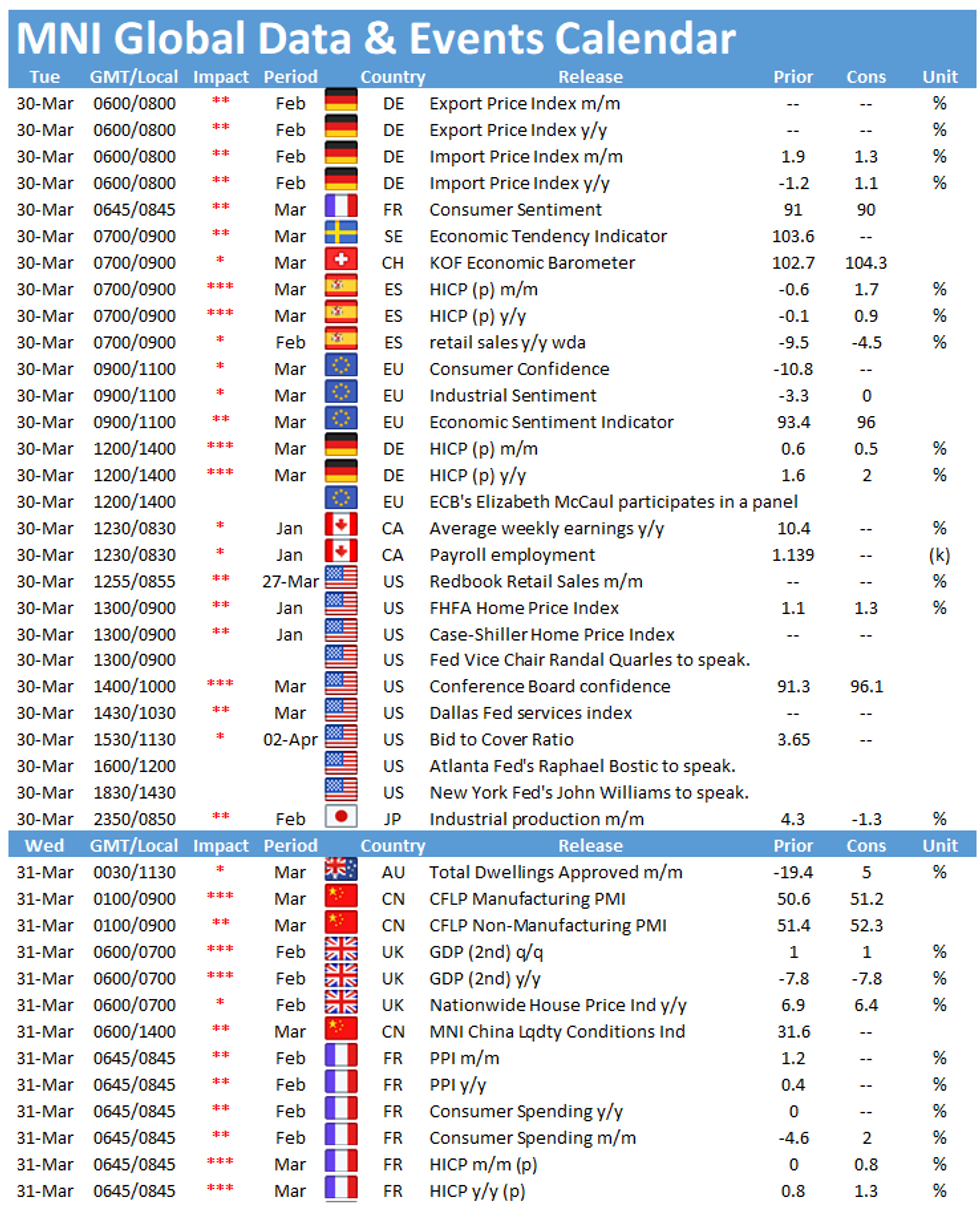

- U.S. Conf. Board Consumer Confidence, flash German CPI, EZ sentiment gauges as well as speeches from Fed's Williams & Quarles, ECB's Centeno & Riksbank's Ingves take focus today.

FOREX OPTIONS: Expiries for Mar30 NY cut 1000ET (Source DTCC)

- EUR/USD: $1.1740(E693mln), $1.1800(E503mln), $1.2000(E745mln)

- USD/JPY: Y109.00($700mln), Y109.75($495mln)

- GBP/USD: $1.3910(Gbp530mln)

- EUR/NOK: Nok10.07(E570mln-EUR puts), Nok10.10(E440mln-EUR puts)

- AUD/USD: $0.7640(A$839mln-AUD puts), $0.7700(A$810mln-AUD puts), $0.7960(A$1.1bln)

- AUD/JPY: Y82.60-70(A$598mln-AUD puts), Y84.35(A$453mln-AUD puts)

- USD/CAD: C$1.2475-85($595mln), C$1.2500-15($712mln)

ASIA FX: Mixed As Markets Await Catalysts

A mixed day for Asia EM FX amid a lack of fresh catalysts while the greenback spent the session treading water.

- CNH: Offshore yuan is stronger, but spent most of the session in negative territory, gaining after the PBOC fixed USD/CNY stronger than expected. USD/CNH yesterday hit the highest since late November 2020.

- SGD: Singapore dollar is flat, but has spent most of the session in minor negative territory, USD/SGD has strong resistance at the 200-day moving average at 1.3523, last trades at 1.3480.

- TWD: Taiwan dollar is stronger for a second session, arresting a two-week decline. USD/TWD last down 0.021 at 28.521. The rate is seeing some support at 28.50, after also failing to breach the level yesterday.

- KRW: The won is weaker in sluggish trade, South Korea says Covax's AstraZeneca vaccine delivery, which was scheduled on March 31, will be delayed to the third week of April. A number of data releases await later in the week.

- IDR: The rupiah is lower, with little to write home on local news flow. Bullish focus falls on Mar 19 cycle high of IDR14,470 and a break here would open up the upper 2.0% Bollinger band at IDR14,498. Conversely, losses past Mar 23 low of IDR14,395 would expose Mar 18 low/200-DMA at IDR14,369/14,362.

- MYR: Ringgit is weaker, Malaysian Science Min Khairy noted that just 2mn out of 9mn targeted people registered for the second phase of the vaccine rollout, so some of participants of phase three will be able to receive their vaccinations ahead of schedule. Separately, the King publicly reiterated his call on Malaysians to take part in vaccinations.

- PHP: Peso has weakened, Philippines' unemployment rate registered at 8.8% in Feb after printing at 8.7% in Jan, while the total number of unemployed persons increased to 4.2mn from 4.0mn. Elsewhere, several provinces will be subjected to stricter quarantine.

- THB: Baht is lower for the seventh straight day, Thai tourism operators called for including Bangkok in the gov't's upcoming scheme of re-opening quarantine-free travel into several selected locations, starting with Phuket, for vaccinated foreigners.

ASIA RATES: Bonds Sell Off Globally

Bond yields mostly higher on global inflation fears, China bucks the trend on inclusion in the WGBI index.

- INDIA: Yields higher across the curve, following the trend of bonds globally, while higher equity markets in India have accelerated the sell off. Downside is tempered by the announcement from FTSE Russel that India will be placed on the watch list for potential reclassification of its market accessibility level, and will be considered for inclusion in the FTSE Emerging Markets Government Bond Index.

- INDONESIA: Yields higher across the curve, some steepening seen, 2-/30-year spread 3.3bps wider. Markets await the results of an IDR 30tn target auction. The market is wary of supply risks when it comes to Indonesian bonds, the government have been reliant on the greenshoe option to fill requirements at desired yields.

- CHINA: The PBOC matched maturities with injections again today, the seventeenth straight day of matching maturities, while the bank hasn't injected funds since February 25. The market appears sanguine about liquidity, the overnight repo rate is last at 1.8081%, from around ~2.00% last week while the 7-day repo rate last at 2.1897%, below the prevailing PBOC repo rate of 2.20%. Futures are higher, building on gains from yesterday after inclusion in the FTSE Russel WGBI index.

- SOUTH KOREA: Bond futures in South Korea are lower, giving back yesterday's gains. 10-Year contract last down 75 ticks at 126.25 as equity markets move higher. Cash space has seen the curve steepen, 10-year yield up 1.1bps at 1.994%, while 2-year yield falls 0.1bps to 0.919%. South Korea says Covax's AstraZeneca vaccine delivery, which was scheduled on March 31, will be delayed to the third week of April.

EQUITIES: Mixed Picture

A mixed session for Asia-Pac equities, investors still contemplating worries about a hedge fund default and who could be impacted next, while a fresh wave of concerns about inflation have seen bond yields move higher.

- In Japan the Nikkei 225 lost around 1% before paring back to neutral levels. Nomura weighed on the index after saying it was too early to estimate the loss tied to Archegos Capital Management. Australian markets dropped to their lowest in a week after an uptick in COVID-19 cases and a snap lockdown in Greater Brisbane. Hong Kong, China, Taiwan and South Korea all saw gains, supported by the tech sector.

- Futures in the US were earlier in positive territory after US President Biden said 90% of US citizens would be eligible for the COVID-19 vaccine In April, however they have edged down into minor negative territory on concerns of further exposure to Archegos Capital Management positions. The Dow Jones is the exception, futures clinging on to minor gains on hopes for Biden's stimulus plan due to be announced on Wednesday.

GOLD: Consolidating After Monday's Downtick

Gold trades $5/oz or so lower on the day, last dealing at $1,707/oz, with the latest uptick in U.S. real yields and selling pressure on the back of the break out of the narrow recent range weighing on bullion since the start of Monday's European trading session. Technically, bears are now targeting the Mar 12 low at $1,699.3/oz.

OIL: Little Changed

WTI & Brent sit at virtually unchanged kevels.

- Markets are looking ahead to this week's OPEC+ meeting, the group are expected to maintain output cuts given signs in the last few weeks of the fragility of the oil rally. There are reports that Saudi Arabia has not yet decided its position on oil production quotas.

- Salvagers managed to refloat the Ever Given, the ship that was blocking the Suez Canal, yesterday. Markets now watch for signs of a return to normalcy for the major shipping route, some analysts estimate it could take weeks for the back log to subside.

UP TODAY (Times GMT/Local)

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.