-

Policy

Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM POLICY: -

EM Policy

EM Policy

Exclusive interviews with leading policymakers that convey the true policy message that impacts markets.

LATEST FROM EM POLICY: -

G10 Markets

G10 Markets

Real-time insight on key fixed income and fx markets.

Launch MNI PodcastsFixed IncomeFI Markets AnalysisCentral Bank PreviewsFI PiFixed Income Technical AnalysisUS$ Credit Supply PipelineGilt Week AheadGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance CalendarsEZ/UK Bond Auction CalendarEZ/UK T-bill Auction CalendarUS Treasury Auction CalendarPolitical RiskMNI Political Risk AnalysisMNI Political Risk - US Daily BriefMNI Political Risk - The week AheadElection Previews -

Emerging Markets

Emerging Markets

Real-time insight of emerging markets in CEMEA, Asia and LatAm region

-

Commodities

-

Credit

Credit

Real time insight of credit markets

-

Data

-

Global Macro

Global Macro

Actionable insight on monetary policy, balance sheet and inflation with focus on global issuance. Analysis on key political risk impacting the global markets.

Global MacroDM Central Bank PreviewsDM Central Bank ReviewsEM Central Bank PreviewsEM Central Bank ReviewsBalance Sheet AnalysisData AnalysisEurozone DataUK DataUS DataAPAC DataInflation InsightEmployment InsightGlobal IssuanceEurozoneUKUSDeep DiveGlobal Issuance Calendars EZ/UK Bond Auction Calendar EZ/UK T-bill Auction Calendar US Treasury Auction Calendar Global Macro Weekly -

About Us

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.

Real-time Actionable Insight

Get the latest on Central Bank Policy and FX & FI Markets to help inform both your strategic and tactical decision-making.

Free AccessMNI: BOJ Tankan: Key Sentiment Rises, Solid Capex Plans

MNI ASIA OPEN: Weak 30Y Reopen, ECB Forward Guidance Weighing

MNI ASIA MARKETS ANALYSIS: Tsys Reverse Early Data Driven Gain

MNI EUROPEAN MARKETS ANALYSIS: USD & Rates Relatively Steady Ahead Of Key Central Bank Meetings

- Dollar and US rate trends were steady for the most part of Monday Asia Pac trade. We had better than expected China industrial production and fixed asset investment data, but consumption softened and property activity remained weak. Regional equities are higher, while US futures have firmed, allowing some modest outperformance of high beta G10 FX plays.

- Much of the focus rests on the key central bank meetings this week, with the BoJ and RBA due tomorrow. With respect to the BoJ, the primary question revolves around whether the central bank will immediately terminate its negative interest rate policy (NIRP) or postpone such action for another month and a half. While a move in March is not set in stone, we anticipate the BoJ to announce the attainment of its 2% price stability target and exit NIRP.

- For the RBA, we expect no change, but some form of tightening bias to be retained in March as the data since the last meeting has been broadly in line with the RBA’s projections, while the significant uncertainties discussed last month have not dissipated and the risks are still “broadly balanced”.

- The key data release later is euro area February CPI but there are also US NY Fed services and NAHB housing. The ECB’s Buch speaks.

MARKETS

US TSYS: Treasury Futures Unchanged, Trade In Tight Ranges

- Jun'24 10Y futures briefly traded below the lows from Friday of 109-31 touching 109-30+, before reversing course to make new highs for the day of 110-04+, ranges have remained well within Friday's as we trade at 110-03 unchanged from NY closing levels.

- Looking at technical levels, initial support is 109-25+ (Feb 23 and the bear trigger), below here 109-14+ (Nov 28 low). While to the upside, initial resistance is 110-30+ (Mar 14 high) above here 111-03+( 50-day EMA).

- Treasury curve is flatter today, after initially opening 1-2bps higher yields now trade flat to 1bps lower across the curve. The 2Y is -0.8bp to 4.719%, 10Y -0.6bp to 4.300, while the 2y10y is +0.253 at -42.086 .

- Looking ahead the US calendar is empty today, with Building Permits & Housing starts on Tuesday main focus this week will be on the FOMC on Thursday

JGBS: Futures Sharply Higher Ahead Of BoJ Policy Decision Tomorrow

JGB futures are sharply higher and at session highs, +31 compared to settlement levels, ahead of the BoJ Policy Decision Tomorrow.

- There hasn’t been much in the way of domestic data drivers to flag, outside of the previously outlined Core Machine Orders.

- (Bloomberg) What the End of Japan’s Negative Interest Rates Means: QuickTake (See link)

- (Bloomberg) Investors who have piled into JGB shorts this year could be forgiven for some nerves as the BoJ’s ¥3t of repo liquidity underscores the central bank’s determination to avoid sharp bond-market losses. (See link)

- Regarding the decision tomorrow the primary question revolves around whether the central bank will immediately terminate its negative interest rate policy (NIRP) or postpone such action for another month and a half. While a move in March is not set in stone, we anticipate the BoJ to announce the attainment of its 2% price stability target and exit NIRP. (See MNI BoJ Preview here)

- The cash JGB curve has bull-flattened beyond the 1-year (2.8bps cheaper), with yields 1-3bps lower. The benchmark 10-year yield is 2.5bps lower at 0.761% versus the year’s high of 0.801% set on Friday.

- The swaps curve has also bull-flattened, with rates 1-5bps. Swap spreads are tighter.

BOJ: MNI BoJ Preview - March 2024: Policy Normalisation Is Here

EXECUTIVE SUMMARY

- Regarding the decision this week the primary question revolves around whether the central bank will immediately terminate its negative interest rate policy (NIRP) or postpone such action for another month and a half.

- While a move in March is not set in stone, we anticipate the BoJ to announce the attainment of its 2% price stability target and exit NIRP.

- This decision is likely to have been ‘green-lighted’ by the technical recession in 2H-23 being revised away, recent wage negotiations indicating a significant increase, and the BoJ’s preferred inflation measure expected to remain above 2% this year.

- Despite the debate in the markets over March versus April, the key takeaway from tomorrow’s meeting is that the BoJ seems to have made up its mind to act by the end of spring.

- Therefore, even if the BoJ opts to hold off in March, it would be expected to provide a clear indication that it is contemplating action at its next policy meeting scheduled for April 25th-26th

- Full preview here:

AUSSIE BONDS: Little Changed Ahead Of RBA Policy Decision Tomorrow

ACGBs (YM -0.4 & XM +1.0) sit little changed and near Sydney session highs. With the domestic calendar light today, local participants have been content to sit on the sidelines ahead of the RBA Policy Decision tomorrow.

- The RBA is unanimously expected to leave rates at 4.35%. We expect some form of tightening bias to be retained as the data since the last meeting has been broadly in line with the RBA’s projections, while the significant uncertainties discussed last month have not dissipated and the risks are still “broadly balanced”. Thus, the meeting statement will probably be little changed compared with February.

- Cash ACGBs are flat to 1bp richer with the AU-US 10-year yield differential 3bps lower at -18bps.

- The swaps curve has twist-flattened, with rates 1bp higher to 1bp lower.

- The bills strip has slightly bear-steepened, with pricing flat to -2.

- RBA-dated OIS pricing is little changed across meetings. Despite this stability, the market still reflects expectations of a total easing of 35bps by year-end. This projection has, however, been reduced from nearly 50bps of anticipated easing recorded just a week ago.

- The shift follows a notable recalibration of easing expectations for the FOMC during the same period following unexpectedly high February US CPI and PPI data.

RBA: MNI RBA Preview - March 2024: No Reason To Pivot In March

- The RBA meets on March 19, six weeks since the last meeting, and is unanimously expected to leave rates at 4.35%. We expect some form of tightening bias to be retained in March as the data since the last meeting has been broadly in line with the RBA’s projections, while the significant uncertainties discussed last month have not dissipated and the risks are still “broadly balanced”. Thus the meeting statement will probably be little changed compared with February.

- It is unlikely that this month the Board will feel confident enough that inflation will return sustainably to target to shift to neutral. A change now may signal that the inflation fight is won and result in easier financial conditions and may encourage the government to provide additional stimulus in its May budget at a time when inflation is still domestically driven and above the band.

- Q1 CPI data prints on April 24 and the next meeting on May 7 will include a new set of projections. So, if there was to be a change in tone or shift to neutral, it can wait until that meeting, but it will be highly dependent on the quarterly CPI results.

- See full preview here.

AU STIR: RBA Dated OIS Steady Ahead Of RBA Policy Decision Tomorrow, 35bps Of Easing Priced By End-24

RBA-dated OIS pricing has shown minimal movement across meetings today ahead of tomorrow’s RBA Policy Decision.

- Despite this stability, the market still reflects expectations of a total easing of 35bps by year-end. This projection has, however, been reduced from nearly 50bps of anticipated easing recorded just a week ago.

- The shift follows a notable recalibration of easing expectations for the FOMC during the same period. This adjustment was prompted by the unexpectedly high February US CPI and PPI data.

- In line with the unanimous consensus among Bloomberg analysts expecting a status quo decision, the current market sentiment suggests a 0% probability of a 25bp hike or cut occurring tomorrow.

Figure 1: RBA-Dated OIS Expected End-24 Easing Expectations Versus Cash Rate

Source: MNI – Market News / Bloomberg

NZGBS: Closed On A Strong Note, PM Downbeat On NZ Economy

NZGBs closed with a bull-steepening despite the negative lead from US tsy dealings on Friday. Benchmark NZGBs closed at the session’s best levels, with yields 1-3bps lower.

- With the domestic calendar fairly light (Performance Services Index and Non-Resident Bond Holdings), today’s move appears more likely linked to downbeat comments on the NZ economy from PM Luxon. “What we see is a deteriorating set of economic conditions in New Zealand. We’ve got inflation, we’ve got high interest rates, we’ve got a slowing economy, we’ll see GDP numbers out later this week, and we’ve obviously got a risk of rising unemployment. That’s the situation we’ve inherited.” It is however worth noting that the comments were similar to those made by the Finance Minister on Friday. (See link)

- US tsys are dealing little changed in today’s Asia-Pac session. The US calendar is empty today.

- Swap rates closed little changed.

- RBNZ dated OIS pricing closed is unchanged across meetings. A cumulative 57bps of easing is priced by year-end.

- Tomorrow, the local calendar is empty.

- In Australia, the RBA hands down its Policy Decision. Consensus among Bloomberg analysts is unanimous in expecting a status quo decision.

FOREX: Dollar Steady Ahead Of Key Central Bank Meetings

It has been a fairly muted start for G10 FX markets in Monday trade to date. Of course we have key central bank meetings tomorrow in terms of the BoJ and the RBA. Later in the week is the Fed.

- The BBDXY sits unchanged, last at 1235.70. Earlier highs (close to 1236.50) weren't sustained with UST yields slightly lower. This has likely curbed USD upside to a degree. US equity futures have firmed as well, which has likely aided higher beta FX performance as well.

- NZD and AUD sit modestly higher, with regional equities mostly higher. China activity figures were slightly better than forecast, although property indicators remained weak. AUD/USD was last near 0.6570, with iron ore back above $100/ton.

- NZD/USD is slightly outperforming, last back close to 0.6095. NZ PM Luxon presented a downbeat view of the economy and NZ front end rates have not risen in line with the US over the past few sessions. Still the better equity tone has likely provided some offset to these headwinds.

- USD/JYP dips sub 149.00 have been supported. The pair was last near 149.10. Earlier highs were at 149.33, which came after the BoJ announced an unscheduled repo operation. The flurry of media articles post last Friday's stronger than expected wages outcome points to a BoJ shift tomorrow.

- Still a tightening cycle which is unlikely to be aggressive, coupled with reports of continued BoJ bond buying, is likely dampening any sentiment this is a dramatic game changer for yen.

- Looking ahead it is a fairly quiet start to the week data wise, with the NAHB index printing in the US, the main data print of note.

ASIA STOCKS: China & Hong Kong Equities Push Higher, Property Lags As Sales Drop

Hong Kong and China equities opened mixed today, however are mostly higher now. China mainland equities are outperforming after earlier data showed industrial production rose to 7.0% y/y vs 5.2% expected, fixed assets rose to 4.2% y/y vs 3.2% expected, although retail sales slightly missed, coming in at 5.5% vs 5.6% expected. The Property space continues to under-perform after Longfor reported a drop in sales by 60% from a year earlier, while Yuexiu Property pulled their bond issuance.

- In Hong Kong, equities are mixed today, with property names being the worst-performing sector. The Mainland Property Index is down 1.88% as property investment fell to 9% vs 8% expected. The HSTech Index is up 1.00%, while the Biotech Index is now unchanged for the day after being down as much as 2.2% earlier, the wider HSI is up 0.20%. In China, equities are faring a bit better, the CSI300 is up 0.75%, small cap and growth stocks are the top performing with the CSI1000 up 0.90%, while the ChiNext is 2.00% higher.

- China Northbound flows were 10.32 billion yuan on Friday, with the 5-day average at 6.56 billion, while the 20-day average sits at 3.19 billion yuan.

- In the Property space, Longfor Group shares fell over 4% after Feb contracted sales fell by more than 60% from a year earlier. Yuexiu Property shares also fell over 4% after their parent company Guangzhou Yuexiu canceled the issuance of 500m 10yr and 500m 15yr bonds blaming recent significant market fluctuations.

- China's bank loans expanded at a historically slow pace in February, with yuan loans growing 9.7% year-on-year, the lowest since 2003, indicating weak borrowing demand despite central bank efforts to ease policy. Sluggish borrowing demand poses challenges for Beijing's economic growth target of around 5%, compounded by weak or negative price growth across the economy and signals from policymakers to align credit growth with growth and inflation targets.

- The CSRC plans to tighten listing requirements and increase scrutiny on publicly traded firms to restore confidence in the stock market, amidst recent declines attributed to various economic factors and regulatory concerns. The measures include re-evaluating listing standards, enhancing oversight of IPO processes, and cracking down on financial fraud, which may further slow IPO activity in a market already impacted by regulatory scrutiny and economic challenges, with IPO proceeds dropping significantly compared to previous years.

- Looking ahead, Hong Kong has unemployment data due out later today, while next up in China is the Loan Prime Rates on Wednesday

ASIA PAC EQUITIES: Asian Equities Push Higher Ahead Of A Busy Central Bank Week

Regional Asian equities are higher today, with Japanese equities being the best-performing region, while tech is the top performing sector, the Bloomberg APAC Index is up 1.27%. Eyes will be on central banks this week, with the BoJ being the major focus as the likelihood of a rate rise increased again after the Rengo wages results showed an increase of over 5% compared to 3.8% the year prior. The RBA also meets on Tuesday; however, it is widely expected to keep rates on hold while Taiwan's central Bank meets on Thursday.

- Japanese equities rose as a weak yen supported exporters, fueled by speculation that the Bank of Japan would lift its key interest rate for the first time in 17 years during its two-day meeting, following reports of strong wage deals and reduced uncertainty, leading to expectations of higher stock prices, particularly in defensive sectors such as electric power and gas, land transportation, materials, non-ferrous metals, and steel. The Nikkei 225 is up 2.41%%, while the Topix is 1.80% higher.

- South Korean equities snapped a three-day winning streak on Friday as foreign investors sold equities at the largest rate since March 2023. The market gapped lower right on the close Friday, and we now trade at the levels prior to that late move. Tech names are the top-performing sector today. The Kospi is up 0.50%.

- Taiwanese equities have opened higher, while Taiwanese officials are growing increasingly concerned about the surging equity market, indicating that regulators may look into ways to control the market. Later this week we have the Central Bank rate decision, expected to remain unchanged at 1.1875%. Currently, the Taiex is up 0.35%.

- Australian equities have recovered earlier loses to trade mostly unchanged for the day real estate names have been the worst-performing sector offsetting gains in financials and mining names. The major focus this week will be on the RBA tomorrow; however, it's widely expected to keep rates on hold. The ASX200 closed Monday up 0.06%.

- Elsewhere in SEA, New Zealand equities closed down 0.33% after the NZ Institute of Economic Research published forecasts showing lower expected GDP growth, while Prime Minister Luxon made comments about the deteriorating economic conditions. Singapore equities are unchanged after with Non-oil Domestic Exports fell to -0.1% in Feb from 4.7% in Jan, Philippines equities are 1.60% higher and Indonesian equities up 0.14%.

ASIA EQUITY FLOWS: China Equities Continue See Inflows, Regional Markets Lose Momentum

- China equities were higher on Friday, outperforming HK equities. China’s market regulator vowed to tighten listing requirements onshore and beef up checks on publicly traded firms, in its latest effort to inject confidence. Based on equity flows, investors do seem to be growing more confident in the market with the past six days of net inflows, while short-term equity flow momentum continues to grow with the five-day average at 6.5 billion yuan, versus 20-day at 3.19 billion yuan, both well above the longer-term 100-day average of just 0.24 billion yuan.

- South Korean equities saw their largest outflow since March 2023 with a net outflow of $831 million while the Kospi was down almost 2%. Chances of an early Fed rate cut continue to weaken, which has been a major contributor to equity weakness especially in the tech space. Samsung C&T's shareholders rejected activist funds’ proposals on a dividend increase and share buyback at a closely watched annual general meeting. The five-day average is -$154.2 million, while the 20-day is $70.8 million. The longer-term trend is still a healthy $135 million.

- Taiwan equities saw their largest net outflow since January 17 with -$523 million in net outflows, higher US yields, and a weakened chance of an early Fed rate cut being the main drivers, while Taiwan expects higher inflation due to an increase in power prices. The five-day average is now -$99 million on the back of two days of outflows, while the 20-day average is $180 million, roughly in line with the 100-day average at $175 million.

- Thailand equities flows turned negative again on Friday with -$60 million in net outflows. There wasn't much in the way of market drivers other than higher yields, the SET was down 0.65% while the five-day average is now -$0.1 million, versus the 20-day at $0.5 million and the longer-term 100-day average at -$16 million.

- Indonesian equities were also negative on Friday with their largest outflow since October 18th, 2023, although this was on the back of the largest inflow since April 2022. Equities markets were down 1.42%. The five-day average is $117 million, the 20-day is $33 million, while the longer-term 100-day average is $16 million.

- Philippine equity markets saw their largest outflow since September 2023, the PSEi was down 2.09% with higher yields weighing on the market. Overseas cash remittances also missed estimates, coming in at 2.7% versus 2.8% expected. The PSEi briefly traded below 6800, a level it has been able to hold above since early Feb, a break and hold below could signal further weakness. The five-day average now sits at $1.39 million versus the 20-day at -$11 million.

Table 1: EM Asia Equity Flows

| Yesterday | Past 5 Trading Days | 2024 To Date | |

| China (Yuan bn)* | 10.3 | 32.8 | 70.6 |

| South Korea (USDmn) | -832 | -771 | 8036 |

| Taiwan (USDmn) | -524 | -497 | 8027 |

| India (USDmn)** | -14 | 3488 | 1750 |

| Indonesia (USDmn) | -97 | 586 | 1674 |

| Thailand (USDmn) | -61 | 0 | -884 |

| Malaysia (USDmn) *** | -23 | -72 | 5 |

| Philippines (USDmn) | -77 | -55.5 | 196 |

| Total (Ex China USDmn) | -1627 | 2677 | 18803 |

| * Northbound Stock Connect Flows | |||

| ** Data Up To March 14 |

OIL: Crude Continues To Climb As Market Tightens & Geopolitical Risks Persist

Oil prices have rallied around 0.5% during APAC trading as risk appetite has improved and China’s IP and fixed asset investment rose more than expected in January-February. WTI is up 0.4% to $81.39/bbl, close to the intraday high, and Brent +0.4% to $85.65/bbl breaking above resistance at $85.53 opening up $86.52. The USD index is flat.

- The market remains nervous re attacks on energy infrastructure in key producing countries. Last week the Ukraine struck a major Russian refining facility and over the weekend Russia’s defence ministry said it had destroyed drones targeting refineries in a number of regions, but according to Bloomberg a number were hit. These strikes are putting upward pressure on diesel prices.

- Given oil’s move higher on the back of continued geopolitical issues and the IEA’s upward revision to global demand, Morgan Stanley has revised up its Q3 Brent forecast by $10 to $90/bbl. Brent’s timespread has widened signalling further tightening of the market.

- The focus of the week for oil markets will be Wednesday’s Fed meeting. There is also the CERAWeek conference in Houston, comments from speakers will be watched closely.

- The key data release later is euro area February CPI but there are also US NY Fed services and NAHB housing. The ECB’s Buch speaks.

GOLD: Weaker Ahead Of This Week’s FOMC Meeting

Gold is 0.4% lower in the Asia-Pac session, after closing 0.3% lower at $2155.90 on Friday.

- Friday’s move left the yellow metal 1.0% lower on the week, the first weekly decline in four.

- US bonds and equities had another heavy session on Friday ahead of this week’s FOMC meeting. The 2-year US Treasury yield finished 3bps higher at 4.73% while the 10-year yield ended up 2bps at 4.31%. These yields now stand over 20bps higher than their levels at the beginning of last week, driven by concerns surrounding persistent inflation. These inflationary pressures have raised questions about the extent of potential monetary easing that policymakers might signal at the forthcoming FOMC meeting.

- According to MNI’s technicals team, the trend condition is still bullish despite the recent pullback from its all-time high of $2195.15. The break above resistance at $2135.4, the Dec 4 high, signals scope for $2206.6 next, a Fibonacci projection. Firm support is at $2108.4, the 20-day EMA.

IRON ORE: Back Above $100/ton, Highter IP A Positive, But inventory Levels Still Rising

Active Singapore futures in Iron ore have stabilized somewhat. We last just above $101/ton. Lows from late last week came in under $98/ton. We haven't been at these levels since August last year.

- China's better than expected activity figures in terms of strong industrial production, coupled with higher fixed asset investment, has likely helped sentiment at the margins.

- Property indicators still look weak, although with infrastructure spending up 6.3% ytd y/y, and state-owned enterprise investment spending rising, it is not all one way to the downside in terms of China data outcomes.

- At the end of last week though we still had inventories at China ports climb further. This continued the weekly run of increases going back to Nov last year. Until this rolls over we may see the upside on prices limited to a degree.

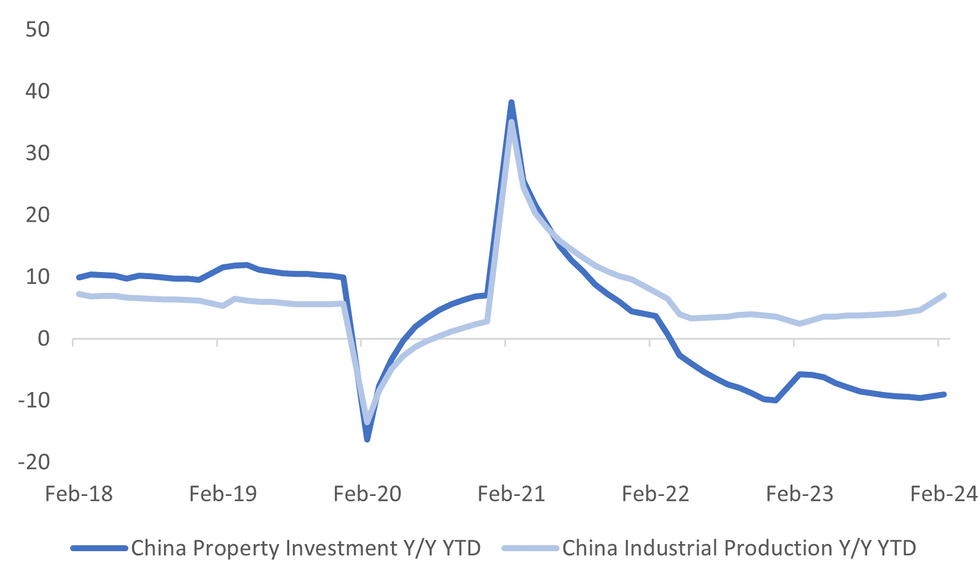

CHINA DATA: Mixed Activity Outcomes, Weaker Property Still Evident

China Feb activity data was better than expected, with upside surprises recorded in terms of industrial production and fixed asset investment growth. Retail sales and property investment were slightly weaker than forecast, while the unemployment rate ticked higher.

- IP growth was 7.0% in ytd y/y terms, against a 5.2% forecast. Strength was notable in manufacturing and utilities (with mining weaker). Still parts of metals were strong, as were tech /computers. Auto production eased to 9.8% from 20.0%.

- It was a similar story across the fixed asset investment space. State-owned enterprises continued to outperform, up 7.3% ytd y/y, but private enterprises recorded much more modest growth of 0.4%, albeit out of negative territory where we spent much of 2023. Infrastructure spending rose 6.3%, so still a source of support for aggregate growth.

- Property indicators remain weak. Aggregate investment was down -9.0% ytd y/y, against a forecast of -8.0%. Under construction (-11% ytd y/y) and new construction (-29.7% ytd y/y) weakened further against Dec outcomes. Funds for property development were also down to -21.1% ytd y/y (versus -13.6% in Dec).

- Retail sales was close to expectations at 5.5% ytd y/y, versus 5.6% forecast. The detail was mixed, with a clear slowing in restaurant and catering to 12.5% ytd y/y, but last year's bounce reflected emerging from lockdown. Spending on household electronics and automobiles rose in ytd y/y terms for Feb.

- The unemployment rate edged up to 5.3% from 5.1% in Dec last year.

Fig 1: China IP & Property Investment YTD Y/Y

Source: MNI - Market News/Bloomberg

ASIA FX: Most USD/Asia Pairs Higher, CNH Steady - Aided By Better Activity Data

USD/Asia pairs are mostly higher, in line with upbeat dollar index levels. CNH is steady though, aided at the margin by better than expected Feb activity figures. Equity sentiment is mostly positive around the region, likely helping cap upside dollar gains. The data calendar tomorrow is very light tomorrow, with just Philippines BoP data on tap. The BI decision follows on Wednesday.

- USD/CNH has had a low beta with respect to USD moves so far today. The pair was last near 7.2050, little changed for the session, while onshore spot remains under 7.2000. Onshore equities are higher by around 0.50% at this stage. Aiding sentiment, albeit at the margins, was better IP and FAI prints, with higher infrastructure spending a support point. Still, property indicators remain downbeat.

- 1 month USD/KRW has probed higher, getting close to 1332, but hasn't seen any follow through the pair last near 1331. Onshore equities are higher, while alter this week we get first 20-days trade data for March. Earlier headlines crossed around fresh North Korean missile launches, which appeared to coincide with US Secretary of State Blinken's visit to Seoul. There wasn't an impact on market sentiment though.

- USD/THB is just off earlier highs (35.965), sitting near 35.95 in latest dealings. We are still down nearly 0.50% for the session in spot terms. We sit comfortably above all the key EMAs (with the 20-day near 35.74), the closest on the downside. Topside focus will be on test above 36.00, note Feb highs in the pair came in around 36.20. Sell-side analysts are also highlighting negative seasonality for THB. Dividend outflows are expected to be 81bn baht this year, up from 72bn baht last per onshore analysis, per BBG. The majority of outflows are expected to hit in mind to late April.

- USD/IDR spot has pushed back to earlier March levels, back at 15665. The 1 month NDF is also higher, back to 15685. Dips in the pair sub 15600 remain supported, particularly with US yields firming through the second half of last week. Portfolio flows remain negative in the debt space, although are more positive in equities (at least for last week). Looking ahead, the BI decision on Wednesday is expected to see rates held steady.

- USD/MYR sentiment continues to grind higher, the pair last above 4.7200. Recent sessions have seen reduced USD weakness at the opens, which may suggest repatriation inflows to boost the ringgit have eased. On the data front, Feb trade figures saw expect growth slip back into negative territory (-0.8% y/y, versus +8.7% prior). The trade surplus was also slightly weaker than forecast.

INDONESIA: Indon Sov Debt Yields Push1-3bps Higher, Foreign Investors Sell Bonds

Indonesian USD sovereign debt curve bear steepened the past week with yields 7-15bps higher, significantly out-performing the moves in US Treasuries, which finished the week 20-30bps wider. Palm Oil prices hit new multi-year highs earlier, although we trade unchanged for the day now.

- To start the week off curves are flatten with yields 1-3bps higher continuing their trend from last week, the 2Y yield is 1bp higher at 4.97%, 5Y yield is 2.5bps higher at 4.995%, the 10Y yield is 2.5bps higher at 5.09%, while the 5-year CDS is up 0.5bp to 69bps.

- The INDON to UST spread difference has closed over the past week, with the front-end INDON curve out-performing although it has lagged the moves tighter made by the PHILIP curve the 2yr is 25bps, 5yr is 68bps, while the 10yr is 78bps.

- In cross-asset moves, the USD/IDR is 0.47% higher, the JCI is 0.25% higher, Palm Oil is up 0.05%, while US Tsys yields are mostly unchanged

- Foreign Investors continue to sell Indonesian debt with Thursday marking the 6th consecutive day of selling. The 5-day average is now -$137m, while the 20-day average is $64m while the longer term 200-day average now sits at just $0.005m

- Looking ahead: Wednesday BI Rate decision, expected to hold steady at 6.00%

PHILIPPINES: Philippines Sov Debt Curves Steepens, Outperforms US Yields

The Philippines USD sovereign debt curve bear steepened last week with yields 7-15bps higher, significantly out-performing the moves in US treasury which finished the week 20-30bps wider. Overseas cash remittances were slightly below expectation coming in at 2.7% vs 2.8%.

- To start the week off yields are continuing their trend from last week with yields 1-3bps higher. The 2Y yield is 1bp higher at 4.85%, 5Y yield is 2bp higher at 5.01% the 10Y yield is 2bp higher at 5.10%, while 5yr CDS is up 1bp to 60bps

- The PHILIP to UST spread difference has significantly tightened over the past week the 2y is 12bps now tightest levels since July 2023, the 5yr is 68bps from 88bps and YTD wide on from March 6th, while the 10yr is 80bps from 93.5bps on march 6th.

- Cross-asset moves: the USD/PHP is 0.21% higher, PSEi Index is up 1.13%, Corporate Credit curve is 5-9bps higher over the past week with better selling in the long-end, while US Tsys yields are mostly unchanged.

- Looking Ahead: Philippines to sell PHP15b total of 91, 182 & 364 day Bills at 4.15 AEST, while Balance of Payment data due on Tuesday

UP TODAY (TIMES GMT/LOCAL)

| Date | GMT/Local | Impact | Flag | Country | Event |

| 18/03/2024 | 0700/0800 | ** |  | NO | Norway GDP |

| 18/03/2024 | 1000/1100 | *** |  | EU | HICP (f) |

| 18/03/2024 | 1000/1100 | * |  | EU | Trade Balance |

| 18/03/2024 | 1230/0830 | * |  | CA | Industrial Product and Raw Material Price Index |

| 18/03/2024 | 1300/0900 | * |  | CA | CREA Existing Home Sales |

| 18/03/2024 | 1400/1000 | ** |  | US | NAHB Home Builder Index |

| 18/03/2024 | 1530/1530 |  | UK | DMO Quarterly Investor/GEMM Consultation Meetings | |

| 18/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 26 Week Bill |

| 18/03/2024 | 1530/1130 | * |  | US | US Treasury Auction Result for 13 Week Bill |

To read the full story

Sign up now for free trial access to this content.

Please enter your details below.

Why MNI

MNI is the leading provider

of intelligence and analysis on the Global Fixed Income, Foreign Exchange and Energy markets. We use an innovative combination of real-time analysis, deep fundamental research and journalism to provide unique and actionable insights for traders and investors. Our "All signal, no noise" approach drives an intelligence service that is succinct and timely, which is highly regarded by our time constrained client base.Our Head Office is in London with offices in Chicago, Washington and Beijing, as well as an on the ground presence in other major financial centres across the world.